-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Fed Outlines Taper Plan, BoE Due

EXECUTIVE SUMMARY

- FED TAPERS AMID LESS TRANSITORY INFLATION (MNI)

- ECB'S LAGARDE: DON'T SEE RATE HIKES TAKING PLACE IN 2022 (BBG)

- XI: CHINA TO DEEPEN GLOBAL COOPERATION ON SHIPPING (CCTV)

- HOYER SAYS POSSIBLE HOUSE VOTES ON BIDEN AGENDA BILLS THURSDAY (BBG)

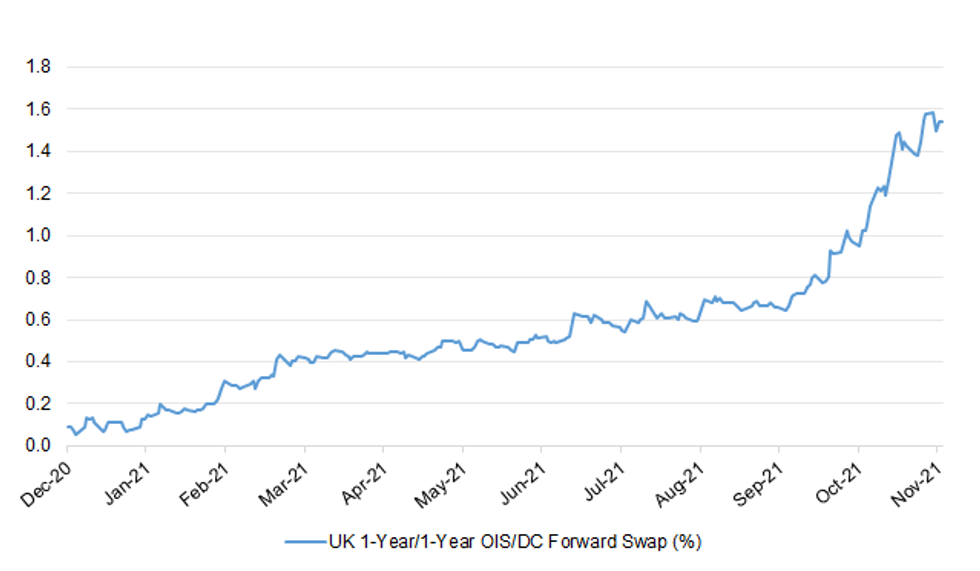

Fig. 1: UK 1-Year/1-Year OIS/DC Forward Swap (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

EUROPE

ECB: "I certainly don't see any interest rate taking place in the next year -- 2022 is off the chart in that respect," European Central Bank President Christine Lagarde says in interview with Portuguese television station TVI. "I would suggest that at the moment and in the foreseeable future, with the monetary policy measures that we take, interest rates, meaning favorable conditions, will continue to be available." (BBG)

FISCAL: MNI: Talks On EU Debt Rule Overhaul To Gain Momentum In March

- Eurozone finance ministers will set out radically differing proposals for overhauling European Union rules on public borrowing in Brussels on Monday, in what is set to be the first of a long series of monthly meetings which should gain by momentum by March and which even optimists expect to yield no more than agreement on common principles for reform by the end of next year, officials told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

PORTUGAL: A majority of members of Portugal's Council of State gave a favorable opinion on President Marcelo Rebelo de Sousa's proposal to dissolve parliament, the presidency said in a statement late on Wednesday. Parliament on Oct. 27 rejected the 2022 budget presented by Prime Minister Antonio Costa's minority Socialist government. The president had already said that parliament would be dissolved if lawmakers were to reject the budget, likely leading to early elections as soon as January. President Rebelo de Sousa has said he'll make a speech on Thursday. The Council of State is an advisory body for the president that must be consulted before dissolving parliament. (BBG)

GREECE: Greece has already decided to raise the minimum wage by 2% on Jan. 1st and "I am determined to have a second increase in the minimum wage" in 2022, Greek Prime Minister Kyriakos Mitsotakis says in an interview with Mega TV. "We don't want to reach to a point that people will feel that GDP's increase doesn't concern them," Mitsotakis says. (BBG)

U.S.

FED: MNI STATE OF PLAY: Fed Tapers Amid Less Transitory Inflation

- The Federal Reserve on Wednesday initiated tapering pandemic-era bond purchases and moved closer to raising interest rates if unexpectedly strong inflation persists next year, while Chair Jay Powell urged patience to allow the labor market to recover from Covid. The USD15 billion per month wind-down of the USD120 billion monthly asset purchase program came "earlier and faster" than markets had expected at the start of the year, "partly because we see inflation coming in higher," Powell told reporters after the November FOMC meeting. "The risk is skewed for now, it appears to be skewed toward higher inflation. We need to be in a position to act if in case it becomes appropriate to do so," he said. "It's appropriate to be patient," he added. "It's appropriate for us to see what the labor market and what the economy look like when they heal further" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY: MNI INTERVIEW: U.S. Service Price Gains Aren't Transitory - ISM

- U.S. service costs jumped again to a record high in October and will remain elevated until well into next year, pressures that Fed policy makers are underestimating, ISM survey chair Anthony Nieves told MNI Wednesday. "I don't want to contradict the Fed but I think that this is definitely longer than what they even anticipated," Nieves said in an interview - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: House Majority Leader Steny Hoyer's office says votes on the $1.75 trillion tax-and-spending bill and the bipartisan infrastructure bill are possible on Thursday. (BBG)

FISCAL: Speaker Nancy Pelosi is pushing the House toward a vote on President Joe Biden's economic agenda with a few key issues still unresolved and without the full support of Senate Democrats. Pelosi on Wednesday told fellow Democrats during a private meeting to anticipate voting on an updated version of the tax and spending bill even though changes will likely be made in the Senate, according to a person in the room, who asked for anonymity because the discussion wasn't public. (BBG)

FISCAL: A key House panel was set Wednesday to review the latest version of President Joe Biden's social safety net and climate plan as Democratic leaders try to contend with small groups of holdouts. Speaker Nancy Pelosi can only afford to lose three members of her caucus if she hopes to pass the spending bill on a party-line vote. (CNBC)

FISCAL: House Democrats have proposed increasing the federal deduction for state and local taxes to $72,500 from $10,000, according to a draft of the bill released by the Rules Committee, and the new limit would apply through 2031. The $10,000 SALT cap has become a bargaining chip in the Democrats' $1.75 trillion spending plan among certain lawmakers from high-tax states such as New York and New Jersey. Another proposal, a five-year repeal from 2021 through 2025 with a reinstatement from 2026 through 2031, has received pushback from lawmakers on both sides of the aisle, including Sen. Bernie Sanders, I-Vt. (CNBC)

CORONAVIRUS: President Joe Biden said Wednesday that Covid vaccinations for kids and booster shots for adults will speed up the pandemic's end date in the U.S. Covid cases and hospitalizations in the U.S. are down more than 50% since early September, with both falling in 40 states over the past two weeks, Biden said. "Vaccines for children ages 5 to 11 and boosters that provide additional protection for seniors and others are two major steps forward that are going to accelerate our path out of this pandemic," he said from the White House. (CNBC)

POLITICS: New Jersey Gov. Phil Murphy has become the first Democratic governor in more than four decades to win reelection in the Garden State, CNN projects Wednesday, narrowly surviving a closer-than-expected race that dragged well past Election Day. (CNN)

OTHER

GLOBAL TRADE: President Xi Jinping says that China is willing to work with other nations to resume and ensure smooth global supply chain, State broadcaster CCTV reports. Xi comments in a congratulatory letter to a shipping forum that starts Thursday in Shanghai. (BBG)

U.S./CHINA/TAIWAN: China is not signaling to the public that an imminent war on Taiwan is about to start when the commerce ministry urged local authorities to ensure supply and stable prices of daily necessities, Hu Xijin, the editor-in-chief of government-run Global Times, wrote in a column. The situation across the Taiwan Straits has not escalated to "urgency," and the public may have overinterpreted the ministry's statement, wrote Hu, who comments on a host of issues in the tabloid-sized newspaper owned by the People's Daily, the Communist Party's official mouthpiece. The commerce ministry also encouraged families to store daily necessities, which Hu said is not an indication that they are in shortage. MNI noted that shares of food producers surged by the daily limit on Wednesday as some consumers reportedly began hoarding food and other staples after the ministry's statement on Monday. (MNI)

GEOPOLITICS: China plans to quadruple its nuclear stockpile by 2030, according to a Pentagon assessment that points to a shift in Chinese policy with big implications for the balance of military power. The US defence department said China could have 700 deliverable nuclear warheads by 2027 and would boost its stockpile — currently estimated in the low 200s — to at least 1,000 warheads by the end of the decade. The US has 3,800 warheads, according to the Nuclear Information Project at the Federation of American Scientists. The projection marked a dramatic increase from last year's estimate when the Pentagon said China was on course to double its stockpile. (FT)

JAPAN: An easing of Japan's border controls may start as soon as November 8. (Mainichi)

BOJ: Bank of Japan Governor Haruhiko Kuroda said he confirmed with Prime Minister Fumio Kishida that the central bank will keep aiming for 2% inflation, following a meeting that further shores up the government and BOJ's commitment to the goal. "We have continued our monetary easing program in order to bring about stable 2% inflation," Kuroda told reporters in Tokyo on Thursday after the first regular meeting between the prime minister and central bank governor since Kishida became leader. (BBG)

SOUTH KOREA: South Korea will conduct emergency govt bond buyback tomorrow focused on 5-10 year bonds, Vice Finance Minister Lee Eog-weon says in meeting. Govt will preemptively take steps to stabilize bond market via coordination with BOK if volatility rises again. Sees limited impact from FOMC results on domestic financial markets. To closely monitor Fed tapering, major countries' monetary policies, global economic trend; to be ready to take steps for market stabilization if needed. Separately, Bank of Korea says it'll strengthen market monitoring and take market stabilization measures including government bond purchase if needed. (BBG)

TURKEY: Turkey says claims on social media that it has taken Russian S-400 missile defense batteries to Incirlik Air Base are not true, according a statement from defense ministry. (BBG)

MEXICO: Mexican authorities have taken former Pemex Chief Executive Officer Emilio Lozoya into custody in a corruption case that reaches the highest levels of power, after the nation's president pressed prosecutors to speed up the drawn-out investigation. At a hearing on Wednesday, the judge granted a request by federal prosecutors to have him put into pre-trial detention. Prosecutors argued that Lozoya, who is accused of corruption but became a protected witness and avoided prison, is now a flight risk.

MEXICO: The U.S. has "serious concerns" about the nationalist electricity reform proposed by Mexico's president, ambassador Ken Salazar said, echoing increasing congressional criticism of the nation's treatment of private companies. "I want to learn more about the impetus for the proposed constitutional reform," Salazar said in a Tweet late Wednesday. Mexico's carbon emissions risk soaring by as much as 65% and electricity costs could jump if the changes to the constitution are adopted, according to a draft of a report by the U.S. Energy Department's National Renewable Energy Laboratory seen by Bloomberg News. (BBG)

BRAZIL: The Chamber of Deputies approved, in the first round, at dawn this Thursday (4), by 312 votes to 144, the basic text of the Proposal for Amendment to the Constitution (PEC) of the Precatório. To be approved, the PEC needs the support of 308 deputies in two rounds of voting, and now it will be voted a second time by parliamentarians. (CNN)

BRAZIL: Brazil isn't looking to subsidize motor fuels even amid a rapid price increase that is stoking inflation and causing a political backlash in Latin America's largest economy. Brazil could look at reducing taxes and creating compensation programs to ease the impact of rising gasoline and diesel prices, Mines and Energy Minister Bento Albuquerque said in a Bloomberg TV interview. "We have to manage this using our taxes. We cannot reduce the price of the commodity. It's impossible," he said. "we don't want to subsidize fossil fuels." (BBG)

SOUTH AFRICA: South Africa's coal-dependent power utility Eskom Holdings SOC Ltd. will rely on government and development finance for "the important" funding for a transition to cleaner sources of energy, according to its top official. The concessional lending will allow the company, which provides almost all of South Africa's power, to accelerate a move away from the fossil fuel, Eskom Chief Executive Officer Andre de Ruyter said in an interview on Bloomberg Television. (BBG)

IRAN: Stalled Iran nuclear negotiations will resume at the end of November, nearly five months since signatories of the 2015 deal held the last round of talks, the State Department announced Wednesday. The U.S. special envoy for Iran, Robert Malley, will lead the U.S. delegation in the seventh round of talks on Nov. 29, State Department spokesman Ned Price said during a press briefing. Price added that the U.S. remains hopeful that all participants can achieve a mutual return to compliance with the deal. (CNBC)

ENERGY: Russia's Gazprom is committed to meeting European gas demand and is keen on reaching a balanced, predictable market, the company's export chief said on Wednesday. (RTRS)

OIL: U.S. shale producers' decision this year to resist pumping more oil even as prices surge could be nearing an end, according to company executives. Several major oil companies, including BP Plc, Chevron Corp and Exxon Mobil Corp, are planning to pushed crude oil prices above $80 a barrel as global demand for fuel rebounded more swiftly than many anticipated. (RTRS)

CHINA

PBOC: The PBOC intended to keep the market from worrying about tightening liquidity when it on Wednesday ramped up the size of the 7-day repo purchases by CNY40 billion from a day ago to CNY50 billion, the Shanghai Securities Journal reported. Concerns for liquidity shortage were based on the incoming maturities of CNY1 trillion MLF and another CNY1 trillion reverse repos, the newspaper said. The central bank will use MLF and OMOs to offset the short-term liquidity gap, the newspaper cited analysts as saying. Increasing fiscal expansion will release CNY1.89 trillion and CNY3.81 trillion in November and December, which can fully absorb the remaining CNY1.79 trillion of government bonds to be issued, the Journal said citing Shen Xinfeng, the chief analyst at Northeast Securities. (MNI)

FISCAL: Local governments in China are lowering the thresholds of land auctions by reducing margin ratios and dividing them into smaller parcels, a turnaround from the crackdown against the industry seen earlier this year, the 21st Century Business Herald reported. However, many developers remain too cash-strapped to participate, the newspaper said. In a recent land auction in Wuxi city, developers were required to pay only 50% of the total land transfer fees by year-end, the newspaper said citing the China Index Academy. The top 21 Chines cities sold only 52% of their planned land offering this year, the newspaper said. MNI noted that land sale revenues accounted for about 30% of local governments' fiscal incomes. (MNI)

EVERGRANDE: A China Evergrande financing company has used the mortgages it provided to about 100 flats in its Hong Kong residential project as collateral for a loan from a financial firm, HK01 reports Thursday. Apartment owners' combined mortgages in the Evergrande project reached as much as HK$400 million ($51 million); Evergrande's loan from the other finance company isn't disclosed. (BBG)

EVERGRANDE: China Evergrande Group's automotive unit is nearing a sale of U.K. startup Protean Electric to e-mobility company Bedeo, people with knowledge of the matter said. The divestment by China Evergrande New Energy Vehicle Group Ltd. could be announced as soon as Thursday, according to the people, who asked not to be identified because the information is private. The deal would help Europe-focused Bedeo, which supplies light commercial vehicles and technology for zero emissions transport, expand into Asia and the U.S. The transaction value couldn't be immediately learned. (BBG)

ENERGY: China's National Development & Reform Commission has told Futures Daily not to fabricate news about the coal market, the economic planner says in a statement on its Wechat account late on Wednesday. The NDRC demanded that the newspaper strictly abide by the principles of truth, objectivity and fairness, and forbid the fabrication and dissemination of false information about coal: statement. The authority vows to punish violators. (BBG)

OVERNIGHT DATA

JAPAN OCT, F JIBUN BANK SERVICES PMI 50.7; FLASH 50.7

JAPAN OCT, F JIBUN BANK COMPOSITE PMI 50.7; FLASH 50.7

Japanese service sector firms reported that activity returned to expansion territory for the first time in nearly two years as the country lifted restrictions in light of falling COVID-19 infections. While marginal, the upturn in business activity was the first since January 2020, while new business saw just a fractional reduction in October. Moreover, firms continued to build capacity in anticipation of a gradual recovery in demand, despite the rate of job creation easing to a three-month low. Service providers also noted stronger optimism that business conditions would improve over the year ahead, with confidence rising to the highest for eight-anda-half years. Overall private sector activity increased at the start of the fourth quarter, the first in six months. A renewed expansion in services activity was coupled with a reversal of the decline in manufacturing output from the previous survey period. Concerns surrounding intensifying price pressures remained elevated, with aggregate input prices rising at the fastest pace in over 13 years in October. This contributed to the quickest rise in prices charged for goods and services for over three years. Yet, private sector firms reported record levels of optimism regarding the year-ahead outlook, as firms expected the pandemic would further recede and demand would recover in line with a further easing in restrictions, notably internationally. As a result, IHS Markit estimates the Japanese economy will expand by 2.3% in 2021. (IHS Markit)

AUSTRALIA Q3 RETAIL SALES EX INFLATION -4.4% Q/Q; MEDIAN -5.0%; Q2 +0.8%

AUSTRALIA SEP TRADE BALANCE +A$12.243BN; MEDIAN +$12.375BN; AUG +A$14.739BN

NEW ZEALAND OCT ANZ COMMODITY PRICE INDEX +2.1% M/M; SEP +1.5%

CHINA MARKETS

PBOC NET DRAINS CNY150BN VIA OMOS THURSDAY

The People's Bank of China (PBOC) injected CNY50 billion via 7-day reverse repos with the rates unchanged at 2.2% on Thursday. The operation led to a net drain of CNY150 billion after offsetting the maturity of CNY200 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.2000% at 09:29 am local time from the close of 2.1163% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 45 on Wednesday vs 42 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3943 THURS VS 6.4079

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3943 on Thursday, compared with the 6.4079 set on Wednesday.

MARKETS

SNAPSHOT: Fed Outlines Taper Plan, BoE Due

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 220.12 points at 29740.99

- ASX 200 up 35.273 points at 7428

- Shanghai Comp. up 27.292 points at 3526.858

- JGB 10-Yr future up 5 ticks at 151.61, yield down 0.2bp at 0.076%

- Aussie 10-Yr future up 2.0 ticks at 98.145, yield down 1.9bp at 1.832%

- U.S. 10-Yr future -0-03+ at 130-21, yield down 0.7bp at 1.596%

- WTI crude down $0.76 at $80.08, Gold up $5.01 at $1774.93

- USD/JPY up 15 pips at Y114.16

- FED TAPERS AMID LESS TRANSITORY INFLATION (MNI)

- ECB'S LAGARDE: DON'T SEE RATE HIKES TAKING PLACE IN 2022 (BBG)

- XI: CHINA TO DEEPEN GLOBAL COOPERATION ON SHIPPING (CCTV)

- HOYER SAYS POSSIBLE HOUSE VOTES ON BIDEN AGENDA BILLS THURSDAY (BBG)

BOND SUMMARY: Stuck Between FOMC & NFPs

TYZ1 was hemmed in a 0-05 range overnight, last -0-03+ at 130-21, while cash Tsys are little changed across the curve (-/+0.5bp vs. settlement). There has been a couple of spurts of activity, but markets have failed to latch onto anything in an Asia-Pac session that has been bereft of headline flow and further hampered by lower liquidity on the back of the observance a national holiday in Singapore and the proximity to Friday's NFP. This came after the post-Fed bear steepening into the NY close. To recap, the FOMC confirmed its initial $15bn/month tapering plan ($10bn Tsys & $5bn MBS), which will get underway this month. The central bank stressed that "similar reductions in the pace of net asset purchases will likely be appropriate each month, but it is prepared to adjust the pace of purchases if warranted by changes in the economic outlook." Chair Powell was quick to reiterate that the Fed's tapering move does not put an imminent rate hike on the table, which facilitated the aforementioned steepening. On inflation, the Fed noted that "inflation is elevated, largely reflecting factors that are expected to be transitory," a tweak from the previously employed "inflation is elevated, largely reflecting transitory factors." Weekly jobless claims, challenger job cuts and unit labour cost data headline the local docket on Thursday. Note that House Majority Leader Hoyer has suggested that the House could vote on the well-documented fiscal spending initiatives as soon as Thursday.

- After unwinding the gains registered in the pre-holiday overnight session, JGB futures regained some poise as the Nikkei 225 pulled back from early highs, last +5, while the major cash benchmarks run little changed to ~1bp richer across the JGB curve. The proximity to the recent multi-year year highs for 10-Year breakevens promoted a smooth enough JGBi auction, with the cover ratio moving up from the multi-year low seen at the previous offering. Still, the fact that Japan continues to experience benign inflationary pressures (at best) will have provided a cap when it comes to broader demand. Elsewhere, discussions between PM Kishida & BoJ Governor Kuroda provided no fresh information.

- The Aussie bond curve was subjected to twist flattening pressure on Thursday, YM -6.0 and XM +2.0, with futures finishing off of worst levels after selling accelerated in the wake of a break of the overnight lows for both contracts (albeit with a lack of overt headline flow to drive the move).

JGBS AUCTIONS: Japanese MOF sells Y199.7bn 10-Year JGBis:

The Japanese Ministry of Finance (MOF) sells Y199.7bn 10-Year JGBis:

- High Yield: -0.357% (prev. -0.174%)

- Low Price 103.50 (prev. 101.75)

- % Allotted At High Yield: 23.9819% (prev. 79.0909%)

- Bid/Cover: 3.314x (prev. 2.878x)

EQUITIES: Regional Equity Benchmarks Higher On Thursday

The major regional equity indices ticked higher during Thursday's Asia-Pac session, following the positive lead from Wall St. and no surprises from the Federal Reserve as it outlined its initial tapering plans re: asset purchases. The Nikkei 225 benefitted from the recent uptick in USD/JPY as Tokyo markets returned from their mid-week holiday, while the continued withdrawal of month-end liquidity provisions from the PBoC limited Chinese markets once again (note the PBoC has introduced higher gross reverse repo injections over the last couple of sessions). E-minis trade either side of unchanged, with the NASDAQ 100 contract experiencing some light outperformance.

OIL: Softer Ahead Of OPEC+

WTI & Brent crude futures trade the best part of $1.00 lower on the day at typing, a touch off their respective Asia-Pac lows, after both contracts threatened to make a clean break below Wednesday's trough.

- Spill over from Wednesday's U.S. DoE inventory release, which revealed a larger than expected build in headline crude stocks, alongside a surprise build in distillate stocks and a larger than expected uptick in refinery run rates, was evident.

- The formal announcement that Iran is set to resume talks with the U.S. re: the revival of the Iran nuclear deal at the end of the month provided another source of pressure.

- Thursday will be headlined by the latest OPEC+ gathering, with the group set to lift production by another 400K bpd in December, even with questions surrounding the ability of some participants when it comes to meeting the upper limit of higher permitted production quotas.

GOLD: Nowhere Near Challenging Key Technical Parameters In Wake Of FOMC

Spot gold last deals a handful of dollars higher on the day at $1,775/oz.

- A lack of meaningful net movement in the DXY and our weighted U.S. real yield monitor leaves gold little changed over the last 24 hours, with the brief show lower witnessed on Wednesday mostly unwound given that both of the aforementioned metrics operate off of their respective Wednesday highs.

- Wednesday's FOMC decision provided no real surprises for markets, delivering the expected tapering plan, stressing that interest rate hikes are some way off and providing general reassurance re: patience when it comes to unwinding the stimulus that it employed in the wake of the COVID outbreak.

- From a technical perspective, bullion made a very brief and limited showing below its Oct 8 low on Wednesday but got nowhere near challenging medium-term support in the form of the October 6 low ($1,746.0/oz).

FOREX: Risk-On Disposition Lingers Post-FOMC

The Asia-Pacific jumped on the risk-on bandwagon, set off by the Fed's declaration of patience on raising interest rates. The yen went offered as Japanese markets reopened after a public holiday, with demand for safe haven currencies reduced by post-FOMC impetus.

- AUD led high-beta FX higher, as the space drew support from risk-on flows. AUD/NZD moved away from a fresh five-week low printed yesterday.

- In light of the observance of a national holiday in Singapore, liquidity in the region may have been thinner today.

- The yuan defied PBOC signalling and traded on a marginally firmer footing, despite another softer than anticipated fixing of the central USD/CNY mid-point.

- Central bank activity picks up today, with the BoE and Norges Bank set to deliver monetary policy decisions. This will be complemented by speeches from BoE's Cunliffe, Norges Bank's Bach & several ECB members including Pres Lagarde.

- Data highlights include U.S. trade balance & weekly jobless claims, German factory orders, Canadian trade balance & a suite of Services PMIs from across the globe.

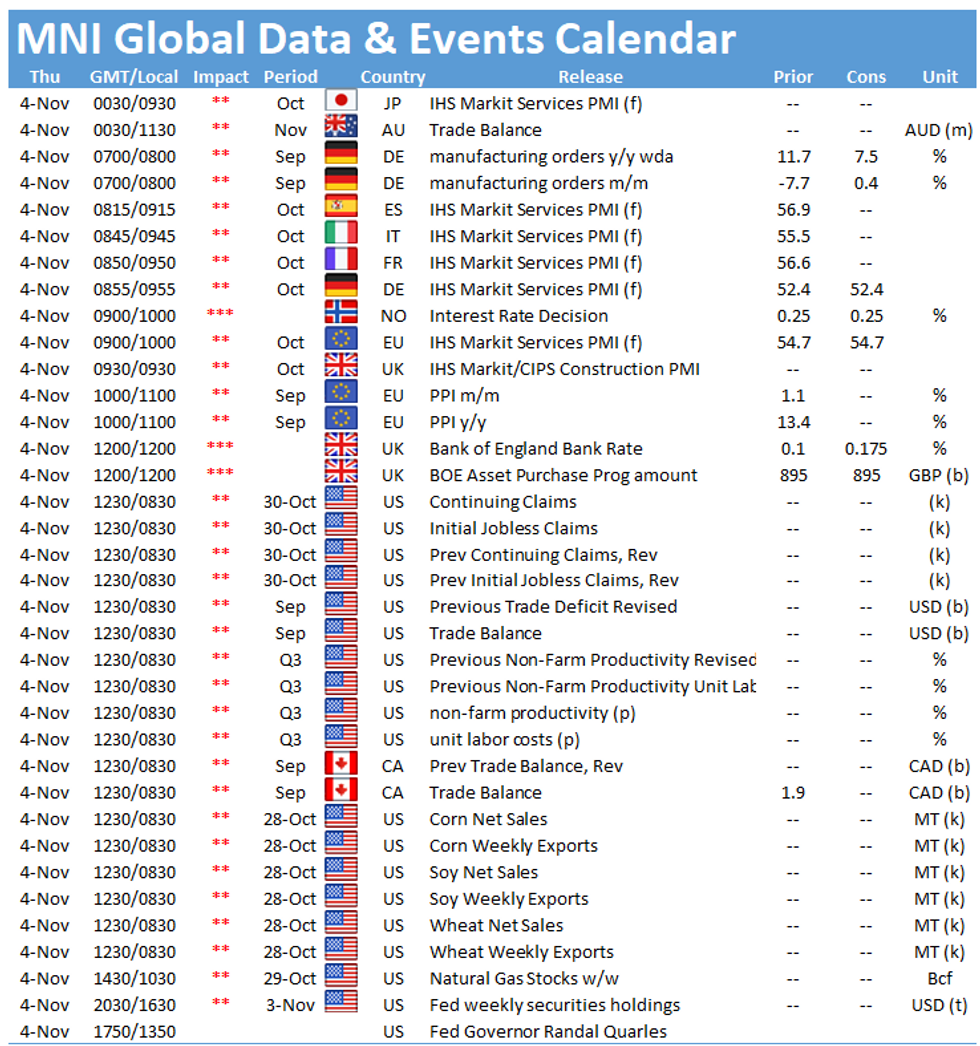

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.