-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Evergrande Avoids Default, Again

EXECUTIVE SUMMARY

- EVERGRANDE PAYS DELAYED INTEREST, SET TO AVERT DEFAULT AGAIN (BBG)

- CHINA WEIGHS MODERATING PROPERTY CURBS TO HELP TROUBLED DEVELOPERS UNLOAD ASSETS (WSJ)

- CHINA STATE MEDIA STOKE SPECULATION PROPERTY CRACKDOWN MAY EASE (BBG)

- HOLZMANN: ALL ECB BOND PURCHASES COULD END NEXT FALL (BBG)

- ANALYSTS LOOK THROUGH SOFT AUSTRALIAN EMPLOYMENT DATA, POINT TO BETTER TIMES AHEAD

Fig. 1: U.S. 5-Year/30-Year Treasury Yield Spread (bp)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BREXIT: MNI BRIEF: EU Ambassadors Not To Close The Door On

- EU ambassadors agreed Wednesday to stay calm and united and to give the ongoing talks between the EU Commission and the UK government a full chance of securing agreement based on the package of measures recently published by the EU, MNI understands on MNI MainWire and email now, for more details please contact sales@marketnews.com.

POLITICS: Boris Johnson has hit back at sleaze allegations, insisting the UK is not "remotely a corrupt country". The prime minister said MPs faced "tough" scrutiny - and those who broke the rules should be punished. He was speaking to the world's media at the COP26 climate summit in Glasgow. It comes amid controversy over Conservative MPs with second jobs - and an investigation into Sir Geoffrey Cox doing paid outside work in his House of Commons office. This, as well as paid lobbying - attempting to influence government policy in return for money - is banned under MPs' rules. (BBC)

EUROPE

ECB: The European Central Bank could stop buying bonds as early as next September if inflation looks to have sustainably returned to the official target, Governing Council member Robert Holzmann said. Introduced in 2015, the bank's asset purchase program, or APP, was designed to get consumer-price growth back to 2%, according to Holzmann, who heads Austria's central bank. "So the elimination of the condition and therefore the end of the program could -- depending on the inflation development -- happen in September or at the end of the year," he told an event Wednesday in London. (BBG)

INFLATION: The new European Commission economic forecasts are set to see euro-area inflation at 2.4% this year and 2.2% in 2022, according to a draft seen by Bloomberg. The rate will then slow to 1.4% in 2023, the document showed. The predictions are set to be published by the European Union executive on Thursday. Inflation in the 19-member currency block has been running at the fastest level since 2008, complicating the challenge for policy makers in the region. Most central bankers still claim that price pressures will ease next year as special factors start to fade, but nervousness around the outlook has grown. (BBG)

FISCAL: MNI: Positive Start To EU Debt Reform Talks, Long Haul Ahead

- Eurogroup Chairman Paschal Donohoe hopes to build on a constructive initial meeting by eurozone finance ministers on reforming European Union rules on public borrowing by drawing together common themes from statements next month ahead of draft national budgets, officials told MNI. Looking to build consensus in what are expected to be drawn-out talks on revising the Stability and Growth Pact, Donohue will seek to identify early areas of agreement on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: MNI: Draghi To Drive Through Projects For NextGenEU Cash

- Italian Prime Minister Mario Draghi plans to simplify rules for awarding infrastructure projects and allow the government to directly appoint key officials as it accelerates preparations for spending tens of billions of euros of European Covid aid after delays which risked a public warning from Brussels, a source close to the matter told MNI on MNI MainWire and email now, for more details please contact sales@marketnews.com.

SWEDEN: Sweden's PES unemployment rate fell to 3.6% in October from 3.7% in September, according to The Public Employment Service. (BBG)

U.S.

FED: Federal Reserve Bank of San Francisco President Mary Daly said she is monitoring "eye-popping" inflation but it is too soon to judge if the central bank should accelerate its pace of policy tightening. "Right now it would be premature to start changing our calculations about raising rates," Daly, one of the central bank's most dovish officials, said Wednesday during an interview on Bloomberg Television with Michael McKee. "Right now, uncertainty requires us to wait and watch with vigilance." Fed officials are facing the sharpest acceleration in inflation in 30 years, even as millions of Americans remains out of work compared with pre-pandemic employment levels. U.S. consumer prices rose 6.2% last month, the fastest annual pace since 1990, cementing high inflation as a hallmark of the pandemic recovery. (BBG)

FED: MNI: Fed's December Dots To Signal 2022 Hike, Ex-Staffers Say

- The Federal Reserve's December "dot plot" interest rate forecasts will likely show most officials seeing at least one hike next year and perhaps several others preferring two or three increases, ex-Fed staff economists told MNI. "The dots need to move higher; possibly a lot higher," said Dean Croushore, an ex-Philadelphia Fed economist now at University of Richmond. "The Fed is way behind the curve at this point" on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: If President Joe Biden chooses Lael Brainard to replace Fed Chairman Jerome Powell, her confirmation -- like so much else in Washington -- could turn on whether she can win over Senator Joe Manchin, the leading Democratic critic of the Fed's monetary policy and a supporter of fossil fuels. While Brainard would likely win confirmation, she wouldn't get the slam dunk bipartisan vote the White House could expect for Powell. She'd either have to appease Manchin -- who has been aggressively warning about inflation and represents a coal-producing state -- or win Republican votes, which are far from assured in the 50-50, highly partisan Senate. (BBG)

ECONOMY: President Joe Biden's first trip to celebrate a long-sought congressional victory on infrastructure was clouded by new data showing inflation rose to a level not seen for more than 30 years. Biden, who ran on his ability to whip COVID-19 and revive the economy that the pandemic left in tatters, now faces rising political pressure over shortages of goods and rising prices as society comes back to life. "Consumer prices remain too high," Biden said at the Port of Baltimore. "We still face challenges we have to tackle head on." On Wednesday, Biden described reversing inflation as "a top priority for me." (RTRS)

ECONOMY: President Joe Biden said on Wednesday that the chief executives of major U.S. retailers had assured him that store shelves would be stocked in time for the holidays. Speaking at the Port of Baltimore, Biden said billions of dollars included in a $1 trillion infrastructure bill would help unclog the nation's ports, ease shortages and combat inflation. Biden spoke Tuesday with the CEOs of Walmart Inc, United Parcel Service Inc, FedEx Corp and Target Corp to discuss speeding up deliveries and lowering prices for consumers. (RTRS)

FISCAL: The White House announced Wednesday that President Joe Biden will on Monday sign into law the largest federal investment in infrastructure in more than a decade. In a statement, the administration said Biden will be joined in a signing ceremony by members of Congress who helped write the $1 trillion piece of legislation to improve the nation's roads, bridges and waterways. "The President will highlight how he is following through on his commitment to rebuild the middle class and the historic benefits the Bipartisan Infrastructure Deal will deliver for American families," the White House said in a press release. (CNBC)

FISCAL: Red-hot inflation data validates the instinct of Sen. Joe Manchin (D-W.Va.) to punt President Biden's Build Back Better agenda until next year — potentially killing a quick deal on the $1.75 trillion package, people familiar with the matter tell Axios' Hans Nichols. (Axios)

FISCAL: The U.S. government on Wednesday posted a $165 billion budget deficit for October, 42% lower than the $284 billion shortfall a year earlier as personal and corporate income tax receipts surged on the back of the rebounding economy. The October deficit was $14 billion below the median estimate among economists polled by Reuters of $179 billion. Receipts for the first month of the federal government's fiscal year totaled $284 billion, up 19% and a record for the month of October. Individual tax receipts rose 18% to $214 billion, and corporate taxes rose 39% to $21 billion. A Treasury official said the increases stem from the improvement in the economy after last year's widespread shutdowns from the COVID-19 pandemic, which triggered a short but sharp recession. Rebounding employment is driving the increased individual taxes, while improved corporate earnings are fueling the rise in business tax receipts. (RTRS)

CORONAVIRUS: At least 900,000 U.S. kids age 5 to 11 have received one shot of Pfizer's vaccine out of about 28 million in the age group, White House coronavirus response coordinator Jeff Zients said in a briefing. The pace of immunizations in children is expected to increase over the next several days as more than 20,000 sites across the country will provide them, Zients said. (BBG)

CORONAVIRUS: National industry groups representing retail, truckers and independent businesses sued the Biden administration on Wednesday over its vaccine and testing requirements for private companies, claiming they would cause "irreparable harm." The National Retail Federation, the National Federation of Independent Business and the American Trucking Associations, told the U.S. Court of Appeals for the 5th Circuit in their lawsuit that businesses would lose employees, incur "unrecoverable compliance costs" and face deteriorating conditions in "already fragile supply chains and labor markets." (CNBC)

CORONAVIRUS: A federal judge blocked Texas Governor Greg Abbott's edict banning school mask mandates. U.S. District Judge Lee Yeakel sided Wednesday with some Texas parents who fear their medically vulnerable children will catch -- and potentially die from -- Covid-19 transmitted by unmasked classmates and teachers. The parents said their children could safely access the benefits of in-person instruction if others would wear masks around them. "The spread of Covid-19 poses an even greater risk for children with special health needs. Children with certain underlying conditions who contract Covid-19 are more likely to experience severe acute biological effects and to require admission to a hospital and the hospital's intensive-care unit," Yeakel wrote. (BBG)

EQUITIES: Tesla Inc. Chief Executive Officer Elon Musk unloaded $5 billion of stock in the electric car-maker, shortly after holding a poll on Twitter over whether he should sell 10% of his massive stake in the company. The world's richest person so far has disposed of more than 4.5 million shares this week, according to regulatory filings Wednesday -- his first sales in more than five years. On Monday, he offloaded about $1.1 billion worth of stock to pay income taxes on equity options that he also exercised that day, two of the filings showed. Those transactions were made based on a pre- arranged trading plan adopted in mid-September. On Tuesday and Wednesday, Musk carried out the remaining sales. The filings detailing those disposals didn't indicate that they were pre- Planned. (BBG)

OTHER

GLOBAL TRADE: The Biden administration is getting traction with China in talks over Beijing's compliance with a Trump-era trade deal, U.S. Trade Representative Katherine Tai said on Wednesday, but she declined to predict an outcome while discussions continue. (RTRS)

GLOBAL TRADE: Draft landmark EU rules requiring U.S. tech giants to share information with rivals could put at risk companies' intellectual property and trade secrets, the United States government warned in a document seen by Reuters. The paper said requiring gatekeepers - companies that control data and access to their platforms - to change their business practices and the design of their software may have implications for security and consumer protection. (RTRS)

U.S./CHINA: The much-anticipated virtual summit between President Joe Biden and Chinese President Xi Jinping is tentatively scheduled for the evening of Nov. 15, a U.S. official told POLITICO on Wednesday. A second non-administration source familiar with the summit's planning also confirmed the date. The two leaders telegraphed their intent Tuesday to establish a positive tone for the summit via letters of congratulations both leaders sent to the National Committee on United States-China Relations to mark its 55th anniversary. Xi's letter, read by China's ambassador to the U.S., Qin Gang, at Tuesday's NCUSCR black-tie gala dinner, stated that "China stands ready to work with the United States to enhance exchanges and cooperation across the board ... so as to bring China-U.S. relations back to the right track of sound and steady development." The letter's messaging intent was underscored by its wide reporting Wednesday in Chinese state media. (POLITICO)

U.S./CHINA: The United States and China, the world's two largest emitters of carbon dioxide, unveiled a deal to ramp up cooperation tackling climate change, including by reducing methane emissions, protecting forests and phasing out coal. (RTRS)

GEOPOLITICS: Japan's new foreign minister said on Thursday it was important to build constructive and stable ties with China while calling for responsible behaviour from its giant neighbour. (RTRS)

GEOPOLITICS: Vice President Kamala Harris announced U.S. efforts to work more closely with France to combat cyber threats and to cooperate on space exploration and commercial development. The initiatives followed Harris's meeting with French President Emmanuel Macron on the second day of a visit to Paris that's aimed at raising the vice president's international profile. Harris announced that the U.S. would support the Paris Call for Trust and Security in Cyberspace, which the White House described as "a voluntary commitment to work with the international community to advance cybersecurity and preserve the open, interoperable, secure, and reliable internet." (BBG)

JAPAN: The Japanese government plans to resume its "Go To" travel subsidy program in Jan. or later, Mainichi reports, without attribution. Program began in July but was suspended in Dec. amid surging coronavirus cases. Government sees need to have Covid treatments in place before resumption. Jiji reports separately the government is planning to resume the program around Feb., which will subsidize 30% of travel expenses with a cap of 10,000 yen per night; will offer 3,000 yen shopping voucher for weekday users and 1,000 voucher for weekend users. (BBG)

JAPAN: Hit by a weaker yen, a slim majority of Japanese firms plan to pass on or have passed on climbing commodity costs to customers, a Reuters poll showed - a sign that inflationary pressures may be increasing in the world's third-biggest economy. Underscoring Japan Inc's decades-long struggle to completely shake off a deflationary mindset in which companies have found it difficult to pass on costs to a population worried about low wage rises and financial security, only 14% of firms said they have already passed along those costs. But another 40% plan to sometime in the future, according to the Reuters corporate survey which was conducted Oct. 26-Nov. 5. (RTRS)

NEW ZEALAND: Support for New Zealand's ruling Labour Party has taken a hit amid a prolonged lockdown in Auckland and questions surrounding the government's handling of the latest outbreak of Covid-19 Delta variant. A survey commissioned by right-leaning lobby group the Taxpayers' Union and conducted by Curia Market Research showed that support for Labour dipped 6pp to 39.3%. The main opposition National Party rose 3.7pp to 26.2%. Support for ACT was stable at 15.9%, while the Greens gained 2.2pp and were backed by 8.6% of respondents. Jacinda Ardern remains by far the most preferred Prime Minister, but the share of people who named her as their favourite candidate shrank by 13.2pp to 34%. In addition, the assessment of the direction in which the country is headed turned net negative. Separately, NZ Herald reported that leaked results of Talbot Mills Research poll showed that support for Labour fell 5pp to 41%, the lowest level since before the pandemic reached New Zealand. Support for Ardern as the preferred Prime Minister fell 4pp to 47%. Furthermore, the approval rate of the government's handling of Covid-19 fell from 60% last month to 46%. (BBG)

BOK: South Korea's economy remains on a recovery path driven by robust exports but faces an expanded "unknowable uncertainty" associated with global supply chain disruptions and concerns over inflation, the country's central bank chief said Thursday. Bank of Korea Gov. Lee Ju-yeol made the remarks in a meeting with economic experts from major think tanks, adding that next year will be an "important turning point" toward a "new balance" after a prolonged fight against the coronavirus pandemic. "Backed up by robust exports and fast-recovering consumption thanks to the change in antivirus measures to the living with COVID-19 scheme, the economy is moving within our earlier expectations," Lee said at the start of the meeting. (Yonhap)

CANADA: MNI: Canada Says Hot Housing Mkt Needs "Supply, Supply, Supply"

- Canada's Finance Minister Chrystia Freeland said Wednesday one of her top priorities is increasing affordable housing, the third top policy maker in recent days shifting emphasis from years of unsuccessful efforts to restrain demand as households took big mortgages and sent prices soaring on MNI MainWire and email now, for more details please contact sales@marketnews.com.

RUSSIA: Secretary of State Antony Blinken voiced growing U.S. alarm over Russian troop movements near its border with Ukraine, saying on Wednesday that the American commitment to Kyiv is "ironclad." The U.S. still doesn't "have clarity into Moscow's intentions," Blinken said at a news conference in Washington alongside his Ukrainian counterpart, Dmytro Kuleba, after Russia moved military forces to a training ground near Voronezh. He said the U.S. would be on the watch for a repeat of 2014, when Russia claimed it was provoked into annexing Crimea and stoking tensions in eastern Ukraine, a conflict that continues to this day. "The playbook that we've seen in the past is to proclaim some provocation as a rationale for doing what it's intended and planned to do all along, which is why we're looking at this very carefully," Blinken said. (BBG)

ENERGY: The United States is watching for signs that Russia may be using energy as a political tool in Europe's energy crunch, Secretary of State Antony Blinken said on Wednesday, adding that Washington was committed to take appropriate action, along with Germany, if Moscow were to take that path. (RTRS)

OIL: Kuwait Petroleum set the official selling price of Kuwait Export Crude at a premium of $2.15/bbl to Oman-Dubai benchmark for Dec. sales, according to a price list seen by Bloomberg. Other OSPs to Asia for Dec. to Oman-Dubai: Kuwait Super Light at +$3.80/bbl, Khafji at +$1/bbl, Hout at +$2.51/bbl. (BBG)

OIL: National Iranian Oil Co. set the official selling price of Iranian Light crude at a $2.50/bbl premium to the Oman-Dubai benchmark to Asia for December sales, according to a co. official who asked not to be identified. That compares with +$1.10/bbl for November OSPs of other Iranian grades to Asia for Dec. to Oman-Dubai: Iranian Heavy at +$1.45/bbl, Forozan Blend at +$1.50/bbl, Soroosh at -$2.60/bbl. (BBG)

CHINA

EVERGRANDE: China Evergrande Group looks set to avert another default in its biggest test since the property developer's debt crisis began. Customers of international clearing firm Clearstream received overdue interest payments on three U.S. dollar bonds issued by Evergrande, a spokesperson for Clearstream said. Two investors that hold two of the bonds confirmed that they received the payments, asking not to be identified because they weren't authorized to speak publicly. Investors had been waiting to see if the embattled developer would make the coupon payments totaling $148.1 million before the end of 30-day grace periods on Wednesday. Evergrande missed the initial interest deadlines last month, Bloomberg-compiled data show. (BBG)

INFLATION: China's CPI and PPI may stay elevated through the year end, though further surges are also not likely, the 21st Century Business Herald reported citing analysts. Food prices may gain by rebounding pork prices, while higher raw material costs may lift consumer product prices and service prices may moderately recover, the newspaper said citing Wen Bin, chief researcher of Minsheng Bank. The surge in PPI may be tamed in the next two months as policies to stabilize commodity prices kick in and the global supply chain gradually improves, the newspaper said analysts. CPI snapped declines in the past four months to rise 1.5% y/y in October, while PPI rose to over 26-year-high of 13.5%, with the CPI-PPI gap further expanding to a new record high of 12%. (MNI)

PROPERTY: China's bank lending to property developers rose sharply in October and the momentum is expected to extend into November, the country's flagship securities newspapers reported, adding to signs that credit conditions may be easing for the battered real estate industry. The China Securities Journal, Shanghai Securities News and Securities Times all carried similar reports Thursday on their front pages, which elaborated on October credit data released by the People's Bank of China Wednesday afternoon. Mortgages also picked up in the month, the central bank said in a separate report, releasing rare monthly data in an apparent attempt to calm concerns. (BBG)

PROPERTY: Chinese regulators, wary of financial risks spreading as a result of their crackdown on property lending, are considering easing the rules to let struggling developers sell off assets to avoid defaults and hits to the broader economy. Currently, rules put in place late last year to restrict how much property firms can borrow, dubbed the "three red lines" on leverage ratios, are so strict that they have hurt the ability of developers like China Evergrande Group to sell assets to repay debts. (WSJ)

PROPERTY: China should consider relaxing home purchase limits in some areas and lowering mortgage interest rates to first-time homebuyers, so as to gradually restore market confidence, as a sudden drop in prices threatens the financial system, the 21st Century Business Herald reported citing comments made by unidentified bank presidents in internal meetings. By Oct. 31, the balance of housing loans was CNY37.7 trillion, up by CNY348.1 billion from September, and the incremental gain was CNY101.3 billion more than September's, the newspaper said citing housing loan data that was separately disclosed for the first time, which the newspaper said was a strong signal by the central bank. The improvement indicated residents' willingness to buy houses has grown following the marginal easing of lending policy in some cities, the newspaper cited analysts as saying. (MNI)

PROPERTY: A think-tank of China's state council met a local property association and financial institutions in the southern city of Guangzhou, Chinese media outlet Cailianshe said on Thursday. (RTRS)

BONDS: China's Ministry of Finance will sell additional yuan sovereign bonds in Hong Kong on Nov. 17, according to HKMA's statement. It's selling additional 3b yuan of 2.41% bonds due 2023, 2b yuan of 2.5% bonds due 2026 and 1b yuan of 4.15% bonds due 2031. Bank of Communications is the issuing and lodging agent. (BBG)

CORONAVIRUS: Beijing closed at least one major hospital and shopping mall in central Dongcheng district after the city reported seven infections in the past day. Authorities in the Chinese capital have closed off residential compounds where the patients live as well as some surrounding areas, and conducted mass-testing overnight. (BBG)

GREEN POLICY: China will promote "comprehensive green transformation" and implement strategies responding to climate change, and reach its carbon-peak and carbon-neutrality goals on schedule, President Xi Jinping told the APEC business leaders forum on Thursday. China will promote reform and opening, and provide better assurance for global businesses investing in China, Xi said. The APEC region should not return to confrontation and division as seen in the Cold War era, said Xi. (MNI)

OVERNIGHT DATA

JAPAN OCT PPI +8.0% Y/Y; MEDIAN +7.0%; SEP +6.3%

JAPAN OCT PPI +1.2% M/M; MEDIAN +0.4%; SEP +0.3%

JAPAN OCT TOKYO AVG OFFICE VACANCIES 6.47; SEP 6.43

AUSTRALIA NOV CONSUMER INFLATION EXPECTATION +4.6%; OCT +3.6%

AUSTRALIA OCT EMPLOYMENT CHANGE -46.3K; MEDIAN 50.0K; SEP -138.0K

AUSTRALIA OCT UNEMPLOYMENT RATE +5.2%; MEDIAN +4.8%; SEP +4.6%

AUSTRALIA OCT FULL TIME EMPLOYMENT CHANGE -40.4K; SEP 26.7k

AUSTRALIA OCT PART TIME EMPLOYMENT CHANGE -5.9K; SEP -164.7K

AUSTRALIA OCT PARTICIPATION RATE +64.7%; MEDIAN +64.8%; SEP +64.5%

NEW ZEALAND OCT REINZ HOUSE SALES -21.7% Y/Y; SEP -37.9%

NEW ZEALAND OCT FOOD PRICES -0.9% M/M; SEP +0.5%

SOUTH KOREA SEP MONEY SUPPLY L SA +0.2% M/M; AUG +0.9%

SOUTH KOREA SEP MONEY SUPPLY M2 SA +0.5% M/M; AUG +1.5%

UK OCT RICS HOUSE PRICE BALANCE +70%; MEDIAN +65%; SEP +68%

CHINA MARKETS

PBOC NET INJECTS CNY50BN VIA OMOS THURSDAY

The People's Bank of China (PBOC) injected CNY100 billion via 7-day reverse repos with the rates unchanged at 2.2% on Thursday. The operation led to a net injection of CNY50 billion after offsetting the maturity of CNY50billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1909% at 09:26 am local time from the close of 2.1051% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 40 on Wednesday, flat from the close on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4145 THURS VS 6.3948

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4145 on Thursday, compared with the 6.3948 set on Wednesday.

MARKETS

SNAPSHOT: Evergrande Avoids Default, Again

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 166.71 points at 29273.44

- ASX 200 down 42.006 points at 7381.9

- Shanghai Comp. up 28.499 points at 3520.428

- JGB 10-Yr future down 13 ticks at 151.79, yield up 0.8bp at 0.071%

- Aussie 10-Yr future down 8.0 ticks at 98.165, yield up 8.1bp at 1.813%

- U.S. 10-Yr future -0-02 at 130-21+, cash Tsys are closed

- WTI crude up $0.25 at $81.59, Gold up $3.97 at $1853.45

- USD/JPY up 3 pips at Y113.94

- EVERGRANDE PAYS DELAYED INTEREST, SET TO AVERT DEFAULT AGAIN (BBG)

- CHINA WEIGHS MODERATING PROPERTY CURBS TO HELP TROUBLED DEVELOPERS UNLOAD ASSETS (WSJ)

- CHINA STATE MEDIA STOKE SPECULATION PROPERTY CRACKDOWN MAY EASE (BBG)

- HOLZMANN: ALL ECB BOND PURCHASES COULD END NEXT FALL (BBG)

- ANALYSTS LOOK THROUGH SOFT AUSTRALIAN EMPLOYMENT DATA, POINT TO BETTER TIMES AHEAD

BOND SUMMARY: Core FI Off Lows In Asia, Cash Tsys Closed

TYZ1 had a look through Wednesday's low before recovering, last -0-02+ at 130-21+ vs. worst levels of 130-15. Initially, the spill over from the U.S. session, an uptick in Chinese equities and second round weakness in the ACGB space weighed. Cash Tsys will not trade on Thursday owing to the observance of the Veterans Day holiday. Downside interest has headlined on the flow side in the STIR space, with screen buying of 0EX1 99.00 puts seen (~15K lots lifted in total thus far).

- JGB futures saw a marginal extension of their overnight weakness as U.S. Tsy futures came under some pressure, before recovering, last dealing 13 ticks below settlement levels. Cash JGBs ran little changed to 1bp cheaper across the curve. Note that much firmer than expected domestic PPI data was witnessed, although there wasn't much in the way of tangible reaction post-release.

- Aussie bond futures rallied on the surprise fall in headline employment and larger than expected uptick in the unemployment rate in the latest domestic labour market report. However, the rally was capped as the report wasn't quite as bad as the headline figures suggested, with the space drifting back to cheaps as a result, before recovering later in the day. The uptick in the unemployment rate was partially driven by an uptick in the participation rate, which reflected more people looking for work as COVID restrictions in NSW were about to wind down. Job ads data, the subsequent removal of COVID restrictions in NSW & Victoria (after the sample period covering the data release) and the latest ABS payrolls print had most pointing to the potential for positive readings in the coming months (albeit with the potential for volatility). YM -12.5 & XM -8.0 at the bell, with bear flattening the theme throughout the day.

JGBS AUCTION: Japanese MOF sells Y498.8bn of 5-15.5 Year JGBs in liquidity enhancement auction:

The Japanese Ministry of Finance (MOF) sells Y498.8bn of 5-15.5 Year JGBs in a liquidity enhancement auction:

- Average Spread: +0.011% (prev. -0.007%)

- High Spread: +0.013% (prev. -0.007%)

- % Allotted At High Spread: 70.8029% (prev. 96.3700%)

- Bid/Cover: 3.176x (prev. 3.948x)

EQUITIES: Little Changed On Thursday

The major Asia-Pac equity indices trade either side of unchanged, although they all sit within 1% of Wednesday's closing levels. China's CSI 300 was the outperformer as mainland property developers benefitted from reports that pointed to Evergrande making a previously missed round of bond coupon payments late on Wednesday, before the grace period re: the payments elapsed. The sector gained a further round of tailwinds from a WSJ report which suggested that "Chinese regulators, wary of financial risks spreading as a result of their crackdown on property lending, are considering easing the rules to let struggling developers sell off assets to avoid defaults and hits to the broader economy." U.S. e-mini futures flatlined, with Tesla CEO Musk once again stealing the headlines as he revealed that he has shed ~$5bn worth of his holdings in the company (~$1bn of which covered tax obligations re: options under a pre-announced plan, with the remaining amount seemingly coming on the back of the well-discussed weekend Twitter poll that he ran on the matter).

OIL: Modestly Higher

WTI & Brent futures sit ~$0.30 above settlement levels.

- There is continued focus on the debate surrounding the potential for the U.S. to release some of its SPR holdings. Citi were the latest to weigh in on that particular matter, pointing to the potential for as much as 60mn bbl being released from the SPR.

- A reminder that the two major benchmarks shed over $2.00 apiece on Wednesday, with the move lower aided by a headline build in crude stocks in the latest weekly DoE inventory data, which went against the headline crude drawdown seen in the API estimates. Elsewhere, a firmer USD applied some weight. We also saw U.S. Sec. of State Blinken suggest that Russia could and should alleviate some of the pressure re: the well-documented energy crunch.

GOLD: Flat In Asia After Break Higher

Spot gold is little changed, dealing around $1,850/oz. A reminder that bullion surged on Wednesday, as participants reacted to a firmer than expected round of U.S. CPI data, with a technical bull trigger broken in the process. Real yields did recover from session lows, which meant that gold peaked just below $1,870/oz (a firmer USD also helped bullion away from highs). The next level of technical resistance is located at the June 14 high ($1,877.7/oz).

FOREX: Caution Dominates Amid Reflection On Inflation Dynamics, Aussie Jobs Data

The AUD reversed initial gains after the release of Australia's most recent jobs market report. The unemployment rate climbed more than expected, as full-time job losses resulted in a surprise contraction in total employment. Market reaction may have been limited by the fact that the uptick in the unemployment rate was partly driven by wider participation, as lockdown restrictions were eased across Australia.

- The greenback was in demand, following the release of U.S. CPI data on Wednesday, which showed that inflation accelerated to the fastest pace in more than two decades. The DXY extended gains to best levels since Jul 23, 2020, but rejected the 95.00 figure.

- Inflation worry translated into a broader cautious feel, which became evident even as regional headline flow was relatively subdued. High-beta G10 FX traded on a softer footing as a result.

- Cable probed the water below the $1.3400 figure for the first time since Dec 2020, ahead of the release of preliminary Q3 GDP report and monthly economic activity indicators out of the UK.

- Apart from aforementioned UK data, speeches from ECB's Makhlouf, Lane, Schnabel & de Cos as well as BoE's Mann take focus from here. The U.S. observes a public holiday.

FOREX OPTIONS: Expiries for Nov11 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1550-70(E1.6bln), $1.1580(E566mln), $1.1650(E605mln)

- USD/JPY: Y113.00-20($1.8bln), Y113.25-45($1.5bln), Y113.50-60($1.7bln), Y113.70($1.5bln)

- AUD/USD: $0.7330-40(A$845mln)

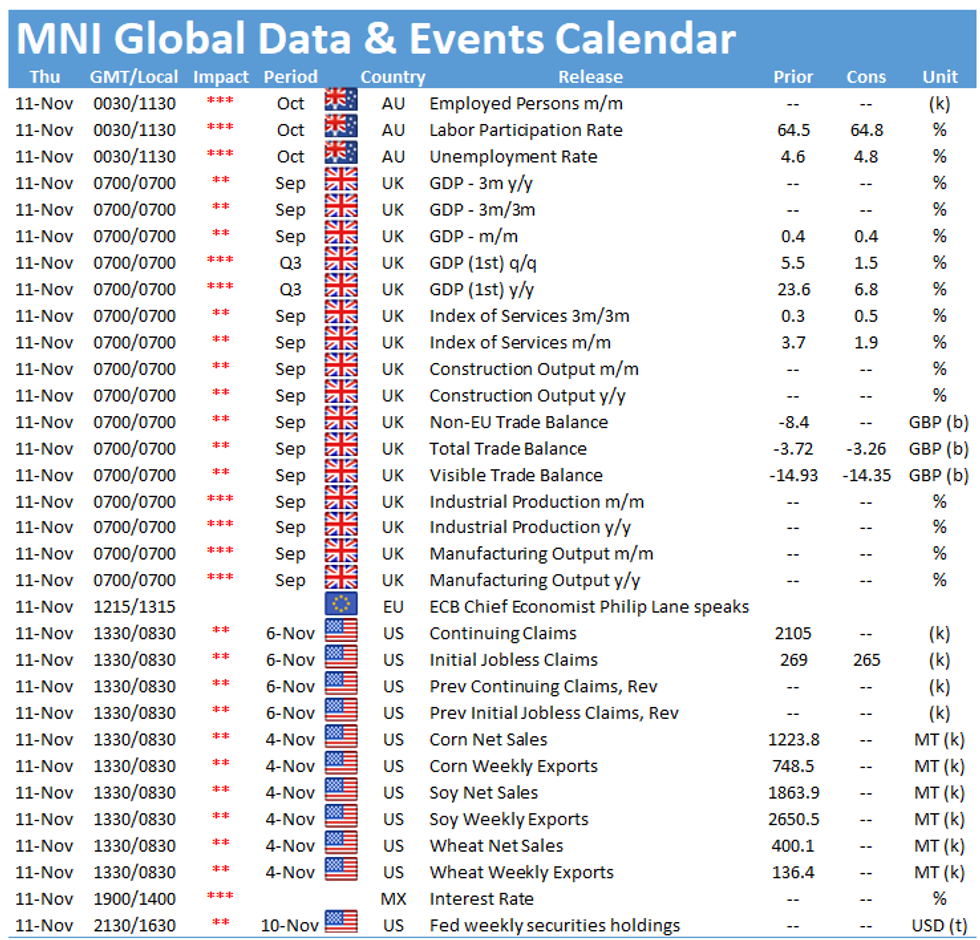

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.