-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Fresh YtD Highs For The DXY

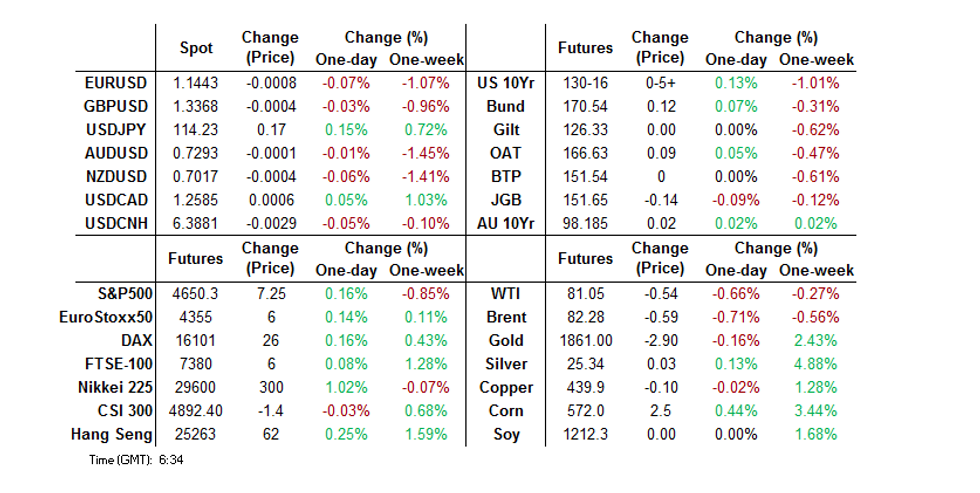

- The DXY nudged higher overnight, registering an incremental, fresh YtD high.

- The Nikkei 225 outperformed in equity trade, benefitting from the latest round of pressure on the JPY.

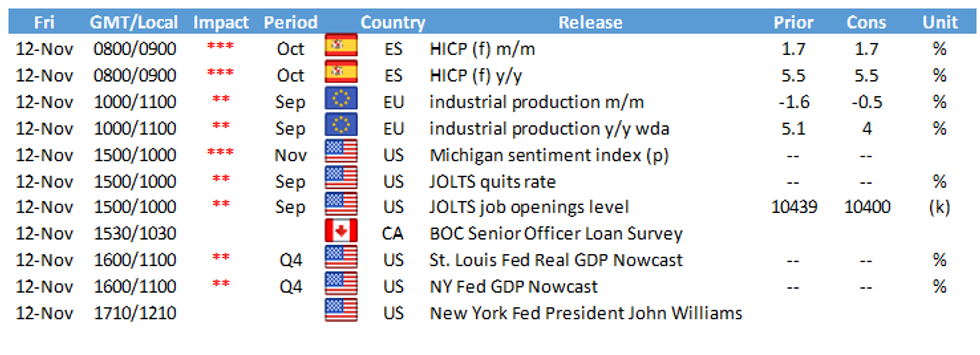

- The U.S. UoM sentiment survey & Eurozone industrial production data provide Friday's highlights (granted, it is a very thin data calendar).

BOND SUMMARY: Tsys Away From Early Asia Lows

5-Year cash Tsy yields printed at the highest level witnessed since the onset of the COVID outbreak at the re-open, as participants reacted to the continued drift lower in futures on Thursday (when cash markets were closed owing to the observance of the Veterans Day holiday). The space then retraced from intraday cheaps, with little in the way of meaningful headline flow observed. That left cash Tsys little changed to 2.5bp cheaper across the curve, with the impetus from post-CPI repricing of Fed expectations continuing to weigh on the belly of the curve, which provided the weak point. TYZ1 last +0-07 at 130-17+, representing best levels of the day. JOLTS job openings data and the latest UoM sentiment survey provide the focal points of Friday's domestic docket, while the latest round of comments from NY Fed President Williams will hit (topic: heterogeneity in macroeconomics).

- JGB futures struggled to gather any upward impetus, even as Tsys recovered from worst levels, perhaps owing to the bid in domestic equity markets on the latest leg of JPY weakness. That leaves futures 14 ticks softer ahead of the close. Cash JGBs were mixed across the curve, with no notable deviation from Thursday's closing levels.

- ACGBs showed no reaction to a nominal uptick in the amount of ACGB issuance on offer next week, given the fact that an uptick of a cumulative A$500mn notional on offer across the two ACGB auctions will be more than digestible in DV01 terms (see earlier bullet for more detail on next week's AOFM issuance plans). Fairly sedate trade was witnessed in Sydney, with nothing in the way of notable macro headline flow observed. YM -2.0 & XM +2.0 at the close as a result. The longer end of the cash ACGB curve was ~7bp firmer on the day, with the bid in the longer end developing into the close, aided by the uptick from lows in U.S. Tsys (although there was some clear outperformance for long Aussie paper here, without clear reasoning). EFPs were a little wider on the day.

FOREX: Another Fresh YtD High For The DXY

The USD bid extended a touch in the final Asia-Pac trading session of the week, with the DXY registering a fresh YtD high in the process, as the fallout from Wednesday's firmer than expected U.S. CPI readings continued to permeate. U.S. Tsy yields moved higher after the Veterans Day holiday closure on Thursday, although now operate back from best levels.

- JPY struggled, as you would expect under such a backdrop. USD/JPY prints at Y114.25 as we move towards London trade, a handful of pips shy of best levels and 20 pips firmer on the day. Bulls need to take out key resistance in the form of the October 20 high (Y114.70) after a bullish engulfing candle (formed Wednesday) helped tip the scales in their favour from a technical perspective. Still a $2.2bn cluster of options with strikes of Y113.90-114.00 are set to roll off at today's 10AM NY cut, which may provide a degree of magnetism if further upward traction is not forthcoming before then.

- The commodity dollar bloc also struggled, with oil on the defensive. It was the NZD that found itself at the bottom of the G10 pile as the NZD/USD cross looked below $0.7000 for the first time since mid-October.

- USD/CNH was steady, with nothing in the way of market moving information divulged in the post-CCP plenum press briefing. The USD/CNY mid-point fixing was bang in line with broader market expectations.

- There isn't much in the way of notable risk events on Friday's docket. Eurozone industrial production and the latest UoM sentiment survey from the U.S. headline, while NY Fed President Williams is set to speak (topic: heterogeneity in macroeconomics).

FOREX OPTIONS: Expiries for Nov12 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1320-25(E934mln), $1.1460(E1.2bln), $1.1485-00(E1.0bln), $1.1540-50(E2.0bln)

- USD/JPY: Y112.95-00($750mln), Y113.90-00($2.2bln)

- GBP/USD: $1.3320(Gbp690mln)

- AUD/USD: $0.7370-85(A$1.4bln)

- NZD/USD: $0.6780(N$1.1bln)

- USD/CAD: C$1.2450-65($1.2bln), C$1.2490($1.3bln), C$1.2510-15($1.1bln), C$1.2620-25($507mln)

EQUITIES: Major Indices Mostly Higher In Asia

Most of the major Asia-Pac equity indices traded higher during the final session of the week, with U.S. e-mini futures also ticking up in overnight trade. Japanese equities benefitted from the latest uptick in JPY crosses, which would have helped exporters (the Nikkei 225 is ~1% higher on the day as a result). Meanwhile, in China, a continued feeling that the worst may be behind us when it comes to the regulatory crackdown, coupled with record Singles Day sales for Alibaba (which actually missed analyst exp.) & JD.com provided some support for the tech space, resulting in a minor uptick for the Hang Seng, although the CSI 300 edged lower. A quick reminder that Goldman Sachs have raised their offshore China equity recommendation to overweight (after lowering it to marketweight in July), while they remain overweight China A shares to start 2022. The press conference in the wake of the latest CPC plenum in China failed to provide anything that was truly risk negative.

GOLD: Consolidating

Gold has hugged a narrow range during Asia-Pac hours, after spot failed to challenge its Wednesday highs over the last 24 hours, with the impact of a stronger USD nullifying at least some of the upward impetus created by worries re: inflation. That leaves spot bullion a handful of dollars lower on the day, last printing $1,855/oz with the previously outlined technical overlay remaining in play. The resumption of cash Tsy & TIPS trade on Friday (after Thursday's market closure), alongside the inflation expectation component of the latest UoM sentiment survey, will provide the focal points ahead of the weekend.

OIL: A Touch Lower In Asia

WTI & Brent crude futures run ~$0.60 below their respective settlement levels at typing, a little above worst levels of the session. This comes after a firmer dollar and a downtick in OPEC's world oil demand growth projections for the current calendar year capped the upward impetus that came on the back of several Gulf states lifting crude prices to Asia buyers on Thursday. It also seemed that the COVID situation in some of the major European nations created some worries re: the demand side of the equation, while localised restrictions in the Chinese capital of Beijing also caught the eye. In broader index news, S&P have recently noted that Brent crude oil has seen the largest percentage weight increase for '22 when it comes to the S&P-Goldman Sachs commodities index, while WTI crude has retained its largest weight status. Broader focus continues to fall on the potential release of U.S. SPR holdings, given the well-documented upward pressure on gasoline prices.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.