-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Xi-Biden Summit Eyed

EXECUTIVE SUMMARY

- BIDEN-XI VIRTUAL SUMMIT SET FOR MONDAY EVENING AMID RISING CHINA TENSIONS (CNBC)

- FED'S KASHKARI SAYS POLICY SHOULDN'T OVERREACT TO INFLATION (BBG)

- CHINESE ECONOMIC ACTIVITY DATA BEATS, HOUSE PRICES SOFTEN FURTHER

- EUROPEAN COVID RESTRICTIONS DEEPEN

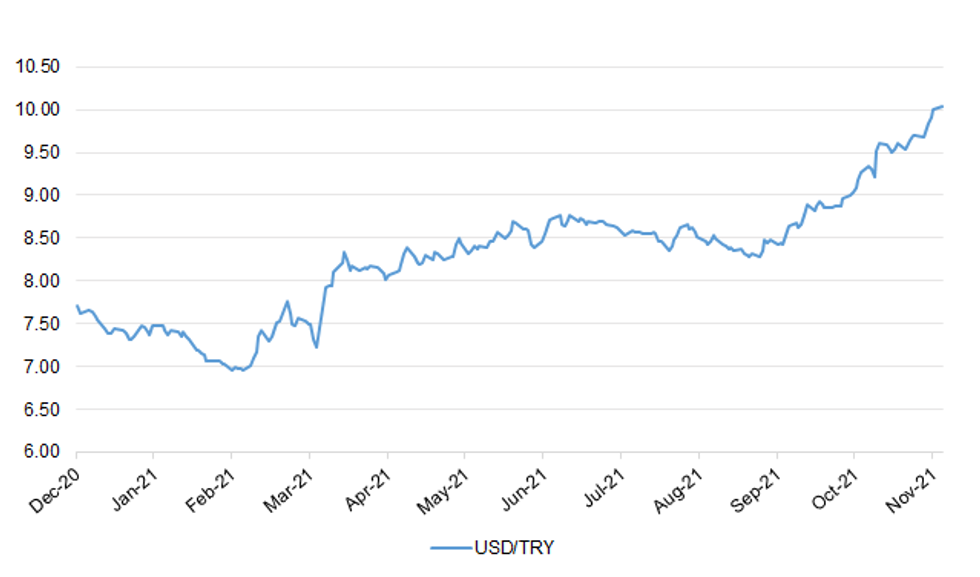

Fig.1: USD/TRY

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Boris Johnson has warned the rise in COVID cases in Europe could be seen in the UK if people do not get their booster jabs fast enough. (Sky)

CORONAVIRUS: The booster programme will be extended to under-50s in an attempt to increase the nation's immunity to coronavirus over the winter, the government is expected to announce today. Scientists believe that rolling out booster jabs to younger people could drive down transmission of the virus, keep middle-aged people out of hospital and limit the risk of another wave. (The Times)

ECONOMY: UK ministers will this week announce a new £1tn a year export target by 2030, although previous Conservative governments failed to achieve the same figure by 2020. The restated overseas sales target is part of Prime Minister Boris Johnson's plan to overhaul Britain's post-Brexit export strategy, which will be launched in London during international trade and investment week. The trade event, which starts on Monday, is the first since the UK left the EU's single market, giving it extra significance, say executives involved in the preparations. Johnson is under pressure to show the benefits of leaving the EU, which will allow Britain to strike free trade deals directly with other countries. Many companies complain they will be exposed to extra costs and red tape because of leaving the bloc, rather than seeing any practical benefits. (FT)

ECONOMY: Consumers are likely to draw only gradually on savings accumulated during the pandemic, dampening hopes of a sustained and consumer-led recovery, a new report says. People are not displaying much inclination to spend any extra income, with wealthier households more likely to put additional income into savings and poorer households to use it to pay off debt, an analysis by the Institute for Fiscal Studies has found. (The Times)

ECONOMY: British private-sector employers expect to raise staff pay by an average of 2.5% over the next 12 months, well below the likely rate of inflation, according to a survey that could ease worries at the Bank of England about the risk of a wage-price spiral. The quarterly figures from the Chartered Institute of Personnel and Development (CIPD) suggested companies were taking only cautious steps to battle growing recruitment difficulties. The CIPD said the median annual pay settlement which private-sector employers plan to offer between September 2021 and the same month next year had risen to 2.5% from 2.2% in its previous quarterly survey, its highest since the summer of 2019. (RTRS)

ECONOMY: Uptake of the UK's voluntary living wage has surged over the past year, as employers seek to secure staff loyalty against a backdrop of worsening labour shortages. Nine thousand employers, including more than half the FTSE 100, are now committed to paying all employees and contractors in their supply chain at a hourly rate that is significantly higher than the statutory minimum and calculated to reflect rising living costs, according to the Living Wage Foundation, a charity that offers accreditation. A third of these employers had signed up since the start of the pandemic, the foundation said, the fastest rate of increase in the 10 years it had been operating. It cited research by Cardiff Business School that found one in 13 employees now worked for a living-wage employer, with 300,000 benefiting directly. (FT)

POLITICS: Labour has recorded its first poll lead over the Conservatives for almost a year in the wake of the row over Tory sleaze and second jobs, according to the latest Opinium poll for the Observer. Keir Starmer's party recorded 37% support, a single point ahead of the Tories. It is the first Labour lead with Opinium since January, when the UK was in the grips of a covid peak and the government had imposed emergency restrictions over Christmas. The Lib Dems are on 9%, Greens 7% and SNP 5%. (Observer)

POLITICS: Two thirds of voters now see the Tories as "very sleazy" as Boris Johnson's ratings fall behind Sir Keir Starmer's for the first time since the January lockdown. Concerns about Tory sleaze are back to levels last seen in the 1990s, with twice as many voters seeing the Conservatives as disreputable as say the same about Labour. The Conservatives have also lost their poll lead, with the two main parties neck and neck on 35 per cent of the vote, according to a YouGov survey carried on Tuesday and Wednesday this week. (The Times)

POLITICS: Boris Johnson has insisted sleaze allegations levelled at the Conservatives will not affect voters' choice in upcoming by-elections. The prime minister visited Sidcup on Friday afternoon ahead of a vote next month to replace former minister James Brokenshire who died of cancer last month. (Sky)

POLITICS: Two MPs have admitted using their parliamentary offices as part of a paid meeting. Liberal Democrat foreign affairs spokesperson Layla Moran and senior Conservative backbencher Crispin Blunt both took part in a panel event for Bindmans legal firm regarding the treatment of detainees in Saudi Arabia. (Sky)

M&A: Ministers are poised to pull the trigger on a full-blown investigation into the sale of ARM, Britain's biggest technology company, in a move that threatens to scupper the controversial $40 billion (£30 billion) deal. Nadine Dorries, digital and culture secretary, will this week order a "phase 2" probe into US chip giant Nvidia's acquisition of the Cambridge-based semiconductor design company from Japan's SoftBank. She will instruct the competition watchdog to carry out an in-depth inquiry into antitrust concerns, as well as scrutinise national security fears raised by the takeover, which was agreed in September 2020. (The Times)

RATINGS: Sovereign rating reviews of note from Friday include:

- DBRS Morningstar confirmed the United Kingdom at AA (high), Stable Trend

EUROPE

GERMANY: Due to a recent surge in covid cases, the three parties negotiating to form Germany's next government plan to require companies to allow office workers to work from home where possible, Handelsblatt newspaper reported. (BBG)

GERMANY: Germany is being battered by a fourth Covid wave, with low vaccination rates in its eastern states a big reason the virus has regained a foothold. The four regions registering the lowest vaccination rates -- Saxony, Thuringia, Brandenburg, and Saxony-Anhalt -- are all in the formerly communist East. No state in eastern Germany has an inoculation level that exceeds the nationwide rate of 67.5% fully vaccinated, with the exception of once-divided Berlin, according to health ministry data. Germany's military will put as many as 12,000 troops on standby to help overburdened health clinics and to speed the rollout of booster vaccines, Der Spiegel reported Saturday. At the previous critical points in the pandemic as many as 10,000 soldiers were deployed. (BBG)

ITALY/BTPS: Italy's latest BTP Futura bond aimed at funding coronavirus-related spending proved to be less attractive than the previous three issues as retail investors grew wary of high interest rate volatility, market observers said. The November 2033 maturity drew total bids of 3.27 billion euros ($3.74 billion) at the end of a five-day offer, bourse data showed on Friday. In April, Rome raised a total of 5.48 billion euros with a BTP Futura maturing in April 2037. The Treasury will adjust both the maturity and the loyalty premium scheme of the next BTP Futura bond issuance in order to better meet market conditions, the head of the debt department Davide Iacovoni told Reuters on Friday. (RTRS)

NETHERLANDS: The Netherlands will return to a partial lockdown from Saturday after the government ordered restaurants and shops to close early and barred spectators from major sporting events in an effort to contain a rapid surge in COVID-19 cases. Caretaker Prime Minister Mark Rutte said restrictions that the Dutch people had thought had ended for good were being re-imposed for three weeks. (RTRS)

AUSTRIA: The Austrian government has ordered a nationwide lockdown for unvaccinated people starting at midnight Sunday to combat rising coronavirus infections and deaths. The move prohibits unvaccinated people 12 and older from leaving their homes except for basic activities such as working, grocery shopping, going for a walk — or getting vaccinated. (AP)

SWITZERLAND: A third vaccination will have to be extended to the general population in the near future, Swiss President Guy Parmelin said in an interview with local paper NZZ am Sonntag. Switzerland currently recommends booster shots for people over 65 years old. (BBG)

RATINGS: Sovereign rating reviews of note from Friday include:

- DBRS Morningstar confirmed the United Kingdom at AA (high), Stable Trend

U.S.

FED: Higher inflation does not affect all households equally, with people on fixed incomes taking a bigger hit, New York Federal Reserve Bank President John Williams said Friday. "There are definitely segments ... of our labor force and economy that are more protected against inflation and there others who are less so," Williams said during a webinar organized by the New York Fed. "People on fixed incomes are obviously less protected against surprisingly high inflation." (RTRS)

FED: Federal Reserve Bank of Minneapolis President Neel Kashkari said the U.S. central bank shouldn't overreact to elevated inflation even as it causes pain for Americans, because it is likely to prove temporary. "The high prices that families are paying, those are real and people are experiencing that pain right now," Kashkari said Sunday on CBS' "Face the Nation." (BBG)

ECONOMY: U.S. President Joe Biden's economic advisers defended his policies on Sunday amid rising inflation that they said was a global issue related to the COVID-19 pandemic, not a result of the administration's programs. (RTRS)

ECONOMY: US Treasury secretary Janet Yellen said controlling Covid-19 was key to taming inflation, as Joe Biden's administration tries to stop rising prices derailing the US economic recovery and the president's legislative agenda. "The pandemic has been calling the shots for the economy and for inflation," Yellen said, speaking on CBS's Face the Nation programme. "And if we want to get inflation down, I think continuing to make progress against the pandemic is the most important thing we can do." (FT)

FISCAL: A CNN reporter tweeted the following on Friday: "While Democrats are uncertain where Manchin will come down, they are far more reassured that Arizona Sen. Kyrsten Sinema will ultimately back the Build Back Better bill, based on her public and private statements." (MNI)

CORONAVIRUS: A federal appeals court has called President Joe Biden's vaccine and testing requirements for private businesses "fatally flawed" and "staggeringly overbroad," arguing that the requirements likely exceed the authority of the federal government and raise "serious constitutional concerns." The U.S. Court of Appeals for the Fifth Circuit, in an opinion issued Friday evening, reaffirmed its decision to press pause on the implementation of the requirements, in another sign that they may not survive judicial scrutiny. (CNBC)

CORONAVIRUS: Idaho's Republican-controlled legislature is coming out of recess on Monday to consider bills seeking to blunt federal vaccine mandates. Possible actions include a defense fund for businesses fighting mandates and exemptions to vaccine or mask rules, the Idaho Statesman reported. (BBG)

POLITICS: Republican congressional candidates currently hold their largest lead in midterm election vote preferences in ABC News/Washington Post polls dating back 40 years, underscoring profound challenges for Democrats hoping to retain their slim majorities in Congress next year. While a year is a lifetime in politics, the Democratic Party's difficulties are deep; they include soaring economic discontent, a president who's fallen 12 percentage points underwater in job approval and a broad sense that the party is out of touch with the concerns of most Americans -- 62% say so. (ABC)

EQUITIES: Elon Musk is trolling again on Twitter, and this time his target is Sen. Bernie Sanders. "I keep forgetting you're still alive," Musk tweeted Sunday morning, in response to Sanders tweeting that the extremely wealthy should pay their fair share of taxes. CNN Business has reached out to Sanders for comment. "Want me to sell more stock, Bernie? Just say the words..." Musk tweeted an hour later. (CNN)

OTHER

GLOBAL TRADE: The Biden administration spurned a plan by Intel Corp. to increase production in China over security concerns, dealing a setback to an idea pitched as a fix for U.S. chip shortages, according to people familiar with the deliberations. Intel, the world's largest chipmaker, has proposed using a factory in Chengdu, China, to manufacture silicon wafers, said the people, who asked not to be identified because the discussions were private. That production could have been online by the end of 2022, helping ease a global supply crunch. But at the same time, it's been seeking federal assistance to ramp up research and production in the U.S. (BBG)

GLOBAL TRADE: The Biden administration is moving to ease import tariffs on Japanese steel and aluminum, in the latest step by the White House to reset trade relations with allies. The U.S. and Japan will begin talks to address bilateral concerns over steel and aluminum issues, including the tariffs imposed by the Trump administration, U.S. trade and commerce officials said in a joint statement Friday. (WSJ)

GLOBAL TRADE: The logjam of container ships outside the California ports of Los Angeles and Long Beach swelled to another record as stepped-up efforts to clear cargo off the docks failed to prevent the average wait for vessels from reaching nearly 17 days. The queue, both at anchor and in a holding zone, rose to 83 ships as of late Friday, four more than Wednesday and topping the previous high of 81 set earlier in the week, according to officials who monitor marine traffic in San Pedro Bay. The average wait increased to 16.9 days, double the level from two months ago, according to L.A.'s Wabtec Port Optimizer. (BBG)

U.S./CHINA: President Joe Biden will hold a highly anticipated virtual summit with Chinese President Xi Jinping on Monday evening, CNBC has confirmed. Biden and Xi have held two phone calls since Biden took office in January, the most recently on September 9. But Monday's summit will be the first time in Biden's term that they have communicated face-to-face in a formal summit format. Traditionally, world leader to leader summits are carefully choreographed to produce some kind of tangible outcome. But senior White House officials said the Biden-Xi summit will not be like that. "This is not about seeking specific deliverables or outcomes," said one administration official, who requested anonymity to discuss an agenda that was still being finalized on Friday. "This is about setting the terms of an effective competition where we are in the position to defend our values and interests and those of our allies and partners," the official said. "We believe when such terms—or guardrails—are established, we can sustain a vigorous competition." (CNBC)

U.S./CHINA: U.S. Secretary of State Antony Blinken expressed concerns over China's continued military, diplomatic, and economic pressure on Taiwan in a phone conversation with Foreign Minister Wang Yi on Nov. 12. Blinken urged Beijing "to engage in meaningful dialogue" to resolve Taiwan Strait issues "peacefully and in a manner consistent with the wishes and best interests of the people on Taiwan," U.S. Department of State spokesperson Ned Price said in a statement Saturday. The two officials also discussed preparations for President Joe Biden's upcoming virtual meeting with President Xi Jinping. The summit is set for Monday evening Washington time, which is Tuesday morning in Beijing. (BBG)

U.S./CHINA: Senior Chinese diplomat Wang Yi told U.S. Secretary of State Antony Blinken not to "send wrong signals" to Taiwan pro-independence forces, China's foreign ministry said in a statement on Saturday. Both men also spoke about the virtual meeting that Chinese President Xi Jinping and U.S. President Joe Biden would have on Tuesday Asia time. (RTRS)

U.S./CHINA: China has been pushing U.S. executives, companies and business groups in recent weeks to fight against China-related bills in the U.S. Congress, four sources familiar with the initiative told Reuters, in letters to and meetings with a wide range of actors in the business community. (RTRS)

U.S./CHINA/HONG KONG: The Economist magazine said Hong Kong immigration authorities declined to renew the employment visa of one of its journalists and didn't provide a reason for the rejection. Sue-Lin Wong, the China correspondent for the magazine, isn't currently in Hong Kong, according to a statement on the media outlet's website. Wong previously worked at the Financial Times and Reuters, according to her Twitter profile. (BBG)

GEOPOLITICS: Belarus's authoritarian leader Alexander Lukashenko said that he wanted Russia's Iskander missile system stationed in his country, amid mounting tensions over the migrant crisis on the Belarusian-Polish border. (FT)

GEOPOLITICS: The EU will tighten sanctions on the Belarus regime by targeting those closest to its authoritarian leader, the union's top diplomat has said, as ministers prepare to step up their response to what Brussels terms a "hybrid attack" at its eastern border. Thousands of people have travelled from the Middle East via Minsk to Belarus's borders with Poland, Lithuania and Latvia in recent months in the hope of entering the EU. European officials say the surge is being orchestrated by Minsk in retaliation for the bloc's support for the Belarusian opposition. Josep Borrell, head of the European External Action Service, the EU's security and diplomatic arm, said foreign ministers meeting on Monday will give the green light to a widening of the legal framework governing sanctions on Belarus, as part of measures to press authoritarian leader Alexander Lukashenko to stop the flow of migrants to Europe's borders. (FT)

JAPAN: The government plans to resume the Go To Travel subsidy program to stimulate demand for domestic travel as early as mid-January 2022, Nikkei has learned. (Nikkei)

JAPAN: Japan's ruling Liberal Democratic Party aims to accelerate discussions to amend the nation's constitution with an eye on giving more power to the government at a time of emergency, Secretary General Toshimitsu Motegi told the Yomiuri newspaper. Japan's constitution has never been amended. During the pandemic, Japan has largely relied on voluntary measures to contain the spread of the coronavirus. Nonetheless, it has seen by far the fewest deaths of countries in the G-7. (BBG)

JAPAN: Japan's health ministry is making preparations to shorten the period after second Covid vaccine shots in which booster inoculations will be available to 6 months from 8 months, NHK reports. (BBG)

JAPAN: MNI: Govt Aide Warns Q4 Downside Risks On Supply Gaps

- Japan's economy faces downside risks in the fourth quarter from prolonged supply chain disruptions and private consumption is not expected to rebound in line with more upbeat sentiment on pandemic recovery, a senior official at the Cabinet Office said Monday. "Consumer sentiment recovered to a high level and it showed consumers' positive stance. But the recovery of sentiment was mainly based on strong (rebound) expectations," the official told reporters. "How private consumption evolves in the fourth quarter is a vital issue (for us) to predict the future economy," the official said - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

JAPAN: Japan Cabinet approval falls 1ppt to 48% in Mainichi poll. (BBG)

JAPAN: Japan Kishida cabinet approval rating 63.2% in FNN poll. (BBG)

BOJ: Bank of Japan Governor Haruhiko Kuroda says there's a need for persistent powerful monetary easing since the country has no immediate prospect of reaching the BOJ's inflation target, even as some other central banks are changing direction. Japan's consumer prices are likely to increase moderately for the time being reflecting a rise in energy prices, Kuroda tells local business leaders in Nagoya. The CPI is likely to increase gradually to about 1% around mid-2022 as the output gap turns positive. Financial stress due to Covid-19 seems limited to some industries and small companies. (BBG)

AUSTRALIA: APRA chairman Wayne Byres said a request for banks to make sure they can measure loans being made to high-risk borrowers points to additional tools the regulator could deploy if it grows more concerned about rising mortgage debt. The Australian Prudential Regulation Authority set out different "macroprudential" responses to limit bank lending for housing in an information paper published last Thursday. (AFR)

AUSTRALIA: Australia could begin its rollout of Covid-19 vaccines for children ages 5-11 in January, the Sydney Morning Herald reported. (BBG)

AUSTRALIA/CHINA: It would be "inconceivable" for Australia not to join the United States should Washington take action to defend Taiwan, Australian Defence Minister Peter Dutton said on Saturday. (RTRS)

AUSTRALIA/CHINA: The Editor in Chief of the Global Times tweeted the following on Saturday: "If Australian troops come to fight in the Taiwan Straits, it is unimaginable that China won't carry out a heavy attack on them and the Australian military facilities that support them. So Australia better be prepared to sacrifice for Taiwan island and the US." (MNI)

RBNZ: The Reserve Bank's Head of Economics and Chief Economist, Yuong Ha, who is also an inaugural member of the Monetary Policy Committee will leave next year after 25 years with RBNZ. Mr Ha, who has been with the RBNZ since 1997, and is an internal member of the Monetary Policy Committee, will leave both roles next year. He will depart after the February 2022 Monetary Policy Statement. (RBNZ)

RUSSIA: Ukrainian President Volodymyr Zelenskiy has said there are nearly 100,000 Russian soldiers near Ukraine's border and that Western countries had shared information about active Russian troop movements with Kyiv. (RTRS)

RUSSIA: Western intelligence suggests a "high probability of destabilisation" of Ukraine by Russia as soon as this winter after Moscow massed more than 90,000 troops at its border, according to Kyiv's deputy defence minister. Hanna Maliar told the FT at the weekend that while interpretations of western intelligence "need further discussion", they underlined "the high probability of escalation of the situation". When asked if the risk of a Russian military aggression was higher than during the past years, she said: "Information of our [military intelligence services] coincides with the information of partner countries about the high probability of destabilisation of the situation in Ukraine this winter." Maliar added that allies' conclusions were "based not only on information about the number of Russian troops along the Ukrainian border", suggesting Washington had additional intelligence about Russian leader Vladimir Putin's intentions. (FT)

RUSSIA: Russia sent paratroopers to Belarus on Friday, in a show of support for its ally amid tensions over migrants and refugees amassing on the Belarus-Poland border, but two of the Russian soldiers were killed in a parachute accident. The Russian Defense Ministry said that as part of joint war games, about 250 Russian paratroopers jumped from heavylift Il-76 transport planes into the Grodno region of Belarus, which borders Poland. The ministry said in a statement later that the two paratroopers' parachutes collided in a gust of wind and deflated. It noted that one of the soldiers tried to use a reserve chute but the altitude was too low for it to deploy. Both died of their injuries in a hospital. (WAPO)

RUSSIA: Russia's foreign minister Sergei Lavrov said on Friday after talks with French counterparts that they had discussed an increased presence of NATO naval forces in the Black Sea, RIA news agency reported. He accused the military alliance of being aggressive towards Russia recently. Lavrov said relations between Moscow and the European Union had reached a dead end and the Russian delegation proposed to look for a way out. (RTRS)

TURKEY: An Israeli couple and a Turkish national were arrested Friday on espionage charges after being detained for taking pictures of President Recep Tayyip Erdogan's residence from a tower in Istanbul. The three face charges of political and military espionage, according to Turkey's state-run Anadolu Agency. Israel's foreign ministry refuted the claims and said the couple "do not work for any Israeli agency." (BBG)

TURKEY: President Recep Tayyip Erdogan vowed to consolidate security lines on Turkey's southern border with Syria, his latest hint of a potential offensive against American-backed Kurdish forces there. "Turkey will defend its rights in the Aegean and Mediterranean seas, will build the Istanbul Canal, and will merge its security lines across border," Erdogan said Saturday in the western province of Canakkale. Turkey aims to capture land inside war-torn Syria, just across its border, to control an area that can be used to keep back YPG militants. (BBG)

COP26: Negotiators from nearly 200 countries at the COP26 summit on Saturday reached an agreement to try to prevent progressively worse and potentially irreversible climate impacts. The announcement comes several hours after the scheduled Friday evening deadline. Delegates had struggled to resolve major sticking points, such as phasing out coal, fossil fuel subsidies and financial support to low-income countries. India, among the world's biggest burners of coal, raised a last-minute change of fossil fuel language in the pact, going from a "phase out" of coal to a "phase down." After initial objections, opposing countries ultimately conceded. (CNBC)

ENERGY: Russian President Vladimir Putin said that he'll talk to Alexander Lukashenko about gas flows to the European Union after the Belarusian leader threatened to interrupt supplies to the energy-strapped continent in the face of more EU sanctions. Any disruption in gas supplies would threaten the countries' relationship as transit partners, Putin said. Pipelines crossing Belarus are owned by Russia's Gazprom PJSC, which lessens the risk of any shutdowns. (BBG)

OIL: White House press secretary Jen Psaki on Friday declined to specify how the Biden administration plans to tackle soaring gas prices, despite assurances from the president that addressing the matter is a "top priority." Asked during the daily press briefing whether President Biden would take a slate of different actions to address rising gas prices – including releasing barrels from the nation's emergency oil stockpile or reinstating a ban on U.S. oil exports – Psaki demurred. "We're not just closely and directly monitoring the situation, which of course we've been doing," she said. "We're looking at every tool in our arsenal. You mentioned some of them. While I don't have anything to preview today, the president is quite focused on this, as is the economic team." (Fox Business)

OIL: U.S. President Joe Biden said in a memo to the U.S. State Department on Friday that there were sufficient supplies of petroleum so other countries can reduce what they buy from Iran. (RTRS)

OIL: Senate Majority Leader Charles Schumer urged President Joe Biden to tap the U.S. government's reserves of emergency fuel to help lower gasoline prices. "Consumers need immediate relief at the gas pump, and so I am urging the administration to approve fuel sales from the nation's Strategic Petroleum Reserve," Schumer, a Democrat who is New York's senior senator, said at a news conference Sunday. (BBG)

CHINA

PBOC: China should be mindful of the pace and intensity of its curbs on the property market, as well as the combined effects of different policies on the financing of developers, a former central bank official said. "The liquidity risks that real-estate companies currently face is not a problem of policy direction, but is reflective of the intensity and pace of policy implementation and the combined impact of policies," Sheng Songcheng, a former official of the People's Bank of China, said at the annual Caixin summit Saturday. "The tone and direction of China's real-estate market regulation are correct," he said. While marginal easing in the curbs is needed to satisfy reasonable financing needs of developers, the general direction of real-estate tightening will not change and China will not return to the old path of relying on the property market to stimulate growth, he said. "Developers shouldn't have such illusions," according to Sheng. (BBG)

PBOC: MNI BRIEF: PBOC Should Consider Buying Green Bonds: Advisor

- The People's Bank of China should consider directly buying green bonds and help create sufficient liquidity that helps local authorities raise green bonds, said Wang Xin, director-general of PBOC's Research Bureau on Saturday. The central bank should also recognize municipal green bonds as qualified collaterals for monetary tools to encourage credit expansion, Wang said during the 12th Caixin Summit. "These are measures that can be studied in-depth and introduced accordingly," said Wang. Central banks of some countries will use foreign exchange reserves, or employee pensions to invest in green bonds, Wang added. The PBOC should formulate the standards of green bonds, strengthen information disclosure, as well as evaluate financial institutions on their underwriting of green bonds, according to Wang - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

PBOC: Chinese regulators have "absolutely" loosened policies against the property sectors and some Chinese banks have relaxed mortgage lending quotas since October, ordering branches to boost sales to customers with high standing, the Economic Observer reported citing an executive at a lender in central China. The newspaper reported after property stocks jumped last week and as real estate bonds also recovered. However, lenders remain cautious about loans to developers, assessing based on the cities and locations of the projects, and they are particularly careful with those developers that have run into liquidity challenges, the newspaper said citing the bank official. Local governments have also called for meetings with local banks fearing worsening crisis without adequate bank credit, the newspaper said. (MNI)

PBOC: The carbon credit tools introduced by the PBOC to boost green lending should not be seen as a rate cut in disguise, but as serving to guide the financial industry to recognize the significance of transition toward a green economy, the Economic Daily said in a commentary. Some observers estimated as much as CNY1 trillion to be released by these tools, equivalent to a full-scale RRR reduction, which would be a misinterpretation, the official newspaper said. The carbon-reduction tools have not set a funding quantity limit but will "accurately" target emerging industries with large potential for cutting emissions, it said. The credit will support operations with clear due dates and require disclosure, it said. (MNI)

INFLATION: MNI BRIEF: China's Consumer Prices To Stay Moderate:

- China's consumer prices will maintain a moderate rise and the economy is expected to continue to recover steadily, said Fu Linghui, spokesman of the National Bureau of Statistics at a briefing on Monday, when asked if the government is worried about the risk of so-called "quasi-stagflation" given and economic downturn and rising prices - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: State-owned developers are rushing to the rescue of cash-strapped local governments in China by stepping to the fore at land auctions previously dominated by private sector groups. Over the past three months state developers have bought three-quarters of residential land sold at auctions in 22 big cities by value, according to a Financial Times analysis of public records. They had previously purchased only about 45 per cent of land plots sold at auctions, which is the biggest source of income for local governments. (FT)

PROPERTY: China must prevent real estate bubbles and the financialization of the property industry, maintain prudent monetary policies, support consumption recovery, and prevent fast inflation, according to a report by Wind Information summing separate meetings of the People's Bank of China and other financial regulators held on Nov. 12.. Authorities must stabilize prices of land and homes, keep market expectations stable and balance pro-growth and risk-prevention goals, the regulators said according to Wind. (MNI)

CORONAVIRUS: China covid tsar Liang Wannian reiterated the need to aggressively quash domestic Covid-19 infections and limit severe cases. The nation's strict measures have not hindered its economy, Xinhua cited him as saying. (BBG)

CORONAVIRUS: Tens of thousands of university students are under lockdown on their campuses in the northeastern Chinese city of Dalian, which is battling the biggest flareup in the country's current outbreak, according to newspaper Dushikuaibao. Two universities in Zhuanghe in Dalian have imposed the curbs since the port city discovered Covid cases on Nov. 4, the report said, citing university students. Students are having online classes from their dormitories, the paper said. (BBG)

CORONAVIRUS: China's National Medical Products Administration is likely to approve the first locally-produced Covid drug based on antibodies with conditions by Dec., state-run Science and Technology Daily reports, without citing anyone. Application for the drug was submitted Oct. 9, report says, without naming the applicant. (BBG)

EQUITIES: The Cyberspace Administration of China released draft rules on Sunday that would require firms to undergo a cyber security review before going public in Hong Kong if it implicates national security, threatening a recent shift as internet companies seek to list in the territory. (FT)

OVERNIGHT DATA

CHINA OCT RETAIL SALES +4.9% Y/Y, MEDIAN +3.7%; SEP +4.4%

CHINA OCT RETAIL SALES YTD +14.9% Y/Y; MEDIAN +14.7%; SEP +16.4%

CHINA OCT INDUSTRIAL PRODUCTION +3.5% Y/Y; MEDIAN +3.0%; SEP +3.1%

CHINA OCT INDUSTRIAL PRODUCTION YTD +10.9% Y/Y; MEDIAN +10.8%; SEP +11.8%

CHINA OCT FIXED ASSETS EX RURAL YTD +6.1% Y/Y; MEDIAN +6.2%; SEP +7.3%

CHINA OCT SURVEYED JOBLESS RATE 4.9%; MEDIAN 4.9%; SEP 4.9%

CHINA OCT NEW HOME PRICES -0.25% M/M; SEP -0.08%

JAPAN Q3, P GDP SA -0.8% Q/Q; MEDIAN -0.2%; Q2 +0.4%

JAPAN Q3, P GDP ANNUALIZED SA -3.0% Q/Q; MEDIAN -0.7%; Q2 +1.5%

JAPAN Q3, P GDP NOMINAL SA -0.6% Q/Q; MEDIAN -0.3%; Q2 -0.2%

JAPAN Q3, P GDP DEFLATOR -1.1% Y/Y; MEDIAN -1.2%; Q2 -1.1%

JAPAN Q3, P GDP PRIVATE CONSUMPTION -1.1% Q/Q; MEDIAN -0.5%; Q2 +0.9%

JAPAN Q3, P GDP BUSINESS SPENDING -3.8% Q/Q; MEDIAN -0.6%; Q2 +2.2%

JAPAN Q3, P INVENTORY CONTRIBUTION % GDP +0.3%; MEDIAN +0.1%; Q2 -0.3%

JAPAN Q3, P NET EXPORTS CONTRIBUTION % GDP +0.1%; MEDIAN 0.0%; Q2 -0.3%

JAPAN: MNI BRIEF: Japan's Q3 GDP Contracts More Than Expected

Japan's economy posted the first contraction in two quarters in the July-September period, weighed down by weak private consumption and capital investment, preliminary GDP data released by the Cabinet Office Monday showed.

NEW ZEALAND OCT PERFORMANCE PSI 44.6; SEP 46.5

New Zealand's services sector stepped further into contraction during October, according to the BNZ - BusinessNZ Performance of Services Index (PSI). The PSI for October was 44.6 (A PSI reading above 50.0 indicates that the service sector is generally expanding; below 50.0 that it is declining). This was down 1.9 points from September, reversing some of the 11.1 point increase from August to September. BusinessNZ chief executive Kirk Hope said that it was disappointing that the gains in September did not also flow through to October. "The key sub-indexes of Activity/Sales (43.7) and New Orders/Business (46.4) still clearly remain in contraction, while Employment (50.0) remains unchanged. With Auckland taking another recent step towards opening up, this will hopefully provide greater ability for a number of service sector businesses in New Zealand's largest city to lift their activity levels and prepare more fully for the Xmas period ahead." BNZ Senior Economist Doug Steel said that "the ongoing weakness in services overall – in contrast to the improvement we saw in last week's Performance of Manufacturing Index – fits with our thinking that any bounce in Q4 GDP will be modest, especially in comparison to the decline in Q3." (BusinessNZ)

NEW ZEALAND SEP NET MIGRATION SA +653; AUG +211

UK NOV RIGHTMOVE HOUSE PRICES -0.6% M/M; OCT +1.8%

UK NOV RIGHTMOVE HOUSE PRICES +6.3% Y/Y; OCT +6.5%

CHINA MARKETS

MNI: PBOC NET DRAINED CNY90 BILLION VIA OMOS MON, CNY1 TRILLION MLF MATCHES UPCOMING EXPRIATIONS

The People's Bank of China (PBOC) injected CNY1 trillion via 1-year medium-term lending facility and CNY10 billion via 7-day reverse repos with the rates unchanged at 2.95% and 2.2%, respectively, on Monday. The operation has led to a net drain of CNY90 billion after offsetting the maturity of CNY1 trillion MLF and CNY100 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.2000% at 09:30 am local time from the close of 2.0897% on Friday.

- The CFETS-NEX money-market sentiment index closed at 43 on Friday, compared with the close of 40 on Thursday.

CHINA SETS YUAN CENTRAL PARITY AT 6.3896 MON VS 6.4065 FRI

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3896 on Monday, compared with the 6.4065 set on Friday.

MARKETS

SNAPSHOT: Xi-Biden Summit Eyed

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 166.83 points at 29776.8

- ASX 200 up 27.054 points at 7470.1

- Shanghai Comp. down 2.163 points at 3536.937

- JGB 10-Yr future up 11 ticks at 151.76, yield down 1bp at 0.066%

- Aussie 10-Yr future up 2.5 ticks at 98.210, yield down 2.9bp at 1.766%

- U.S. 10-Yr future up 0-08 at 130-25, yield down 1.2bp at 1.5493%

- WTI crude down $0.51 at $80.28, Gold down $5.87 at $1859.11

- USDJPY down 7 pips at 113.82

- BIDEN-XI VIRTUAL SUMMIT SET FOR MONDAY EVENING AMID RISING CHINA TENSIONS (CNBC)

- FED'S KASHKARI SAYS POLICY SHOULDN'T OVERREACT TO INFLATION (BBG)

- CHINESE ECONOMIC ACTIVITY DATA BEATS, HOUSE PRICES SOFTEN FURTHER

- EUROPEAN COVID RESTRICTIONS DEEPEN

BOND SUMMARY: Core FI A Touch Firmer On The Day

The very light overnight bid in U.S. Tsys has been driven by the front end of the curve, with the belly leading, richening by ~1.5bp on the session, while the longer end of the curve is little changed on the day. The only round of major macro headline flow has centred on the Chinese liquidity situation, which saw the PBoC inject CNY1tn of MLF, matching the amount of MLF that was set to roll off in November (this may have supported broader core global FI). TYZ1 last +0-07+ at 130-24+. The space also looked through the latest round of Chinese economic activity data (which was firmer than exp.). Empire manufacturing data presents the highlight of a very limited domestic docket on Monday. Focus is already on the late Monday call between U.S. President Biden & Chinese counterpart Xi, although a White House official has told CNBC that the meeting "is about setting the terms of an effective competition where we are in the position to defend our values and interests and those of our allies and partners." As a result, most see little room for any real positive developments.

- The belly of the JGB curve has outperformed, richening by as much as ~2bp on the back of the softer than expected GDP print (business capex and consumer spending data both disappointed) and broader impulse in the core global FI space. Meanwhile, 20+-Year paper sits flat to 1bp cheaper on the back of issuance worries in the wake of the previously flagged Nikkei report which pointed to the potential for a larger than expected fiscal support package in Japan, resulting in some twist steepening on the curve. Futures +8 as a result of the firmer belly outlined above.

- In addition to the broader bid in the core FI space evident on Monday (perhaps linked to the previously outlined Chinese liquidity dynamic), several desks have pointed to international value hunting as a driver behind the outperformance in ACGBs, with the compression of the Australia/U.S. 10-Year yield spread adding further weight to that argument. Market pricing re: the RBA's rate path remains aggressive vs. the Bank's own forward guidance, while the negative RBA purchase adjusted net ACGB supply dynamic and record levels of excess liquidity in the Australian banking system continue to facilitate demand. YM +6.5 & XM +2.0 at the close, with the 3- to 5-Year zone leading in cash ACGB trade. Note that the RBA's overnight cash rate settled at 0.04% today, after months of printing at 0.03%., potentially on a lack of "traded" activity and expert judgement.

EQUITIES: Mixed Performance In Asia

Equity markets lacked clear direction in Asia-Pac trade, with positive inputs in the form of Chinese liquidity management and firmer than expected Chinese economic activity data at least partially countered by softer Chinese house price data (a headwind for the troubled property sector). Elsewhere, China's newest equity exchange, focused on SMEs, saw several of the new listings go limit up. The major regional indices trade either side of unchanged in Asia, while U.S. e-mini futures ticked away from their early Asia highs, to last print little changed.

OIL: SPR, Will They Or Won't They?

Continued focus on the U.S. ability to release holdings from its SPR facility continue to draw focus, applying some modest pressure to WTI & Brent futures early this week, with both metrics running ~$0.70 below Friday settlement levels at typing. The Biden administration has noted that the SPR is one of several tools that it has at its disposal, but higher gas prices have started to weigh on the President's approval rating.

GOLD: Resistance Defined

Gold was capped by the Nov 10 high back on Friday, when a lower DXY and dip in our weighted U.S. real yield metric supported bullion, although spot has drifted away from the resistance zone established last week ($1,868.7/oz), last dealing a handful of dollars lower at $1,858/oz. A break through $1,868.7/oz would expose the June 14 high ($1,877.7/oz). Initial support comes in at the Nov 10 low ($1,822.4/oz). Market-based U.S. inflation dynamics and Fedspeak will likely drive bullion throughout this week.

FOREX: DXY Marginally Lower Overnight

There was a distinct lack of notable headline catalysts observed in Asia-Pac hours, with a very modest downtick in U.S. Tsy yields helping the DXY away from its early session high, leaving the USD at the bottom of the G10 FX table.

- The latest round of monthly Chinese economic activity data beat expectations, although house price data came in on the softer side, offering an offset (and a deepening headwind for the troubled property developer sector). There was no direct reaction to the PBoC's move to inject CNY1tn via MLF, as it matched the amount of MLF that will mature this month (such a move was widely expected), although that may have aided the modest bid in the U.S. Tsy space. USD/CNH was pretty steady, with the CFETS RMB measure grinding towards its all-time high, while the PBoC's USD/CNY mid-point fixing was in line with broader expectations.

- USD/TRY registered another fresh all-time high after crossing above the TRY10.00 mark on Friday, with the potential for heightened cross-border tensions between Turkey & Syria, as well as continued worry re: looser CBRT policy, weighing on the TRY.

- Participants are already rolling their focus to the late Monday call between U.S. President Biden & Chinese counterpart Xi, although a White House official has told CNBC that the meeting "is about setting the terms of an effective competition where we are in the position to defend our values and interests and those of our allies and partners." As a result, most see little room for any real positive developments. Further afield BoE comments (Bailey & Haskel) & ECB speak (de Guindos) will draw attention on Monday.

FOREX OPTIONS: Expiries for Nov15 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1375(E553mln), $1.1580-00(E1.3bln)

- USD/JPY: Y113.95-00($519mln), Y114.75($570mln)

- AUD/USD: $0.7267-80(A$600mln)

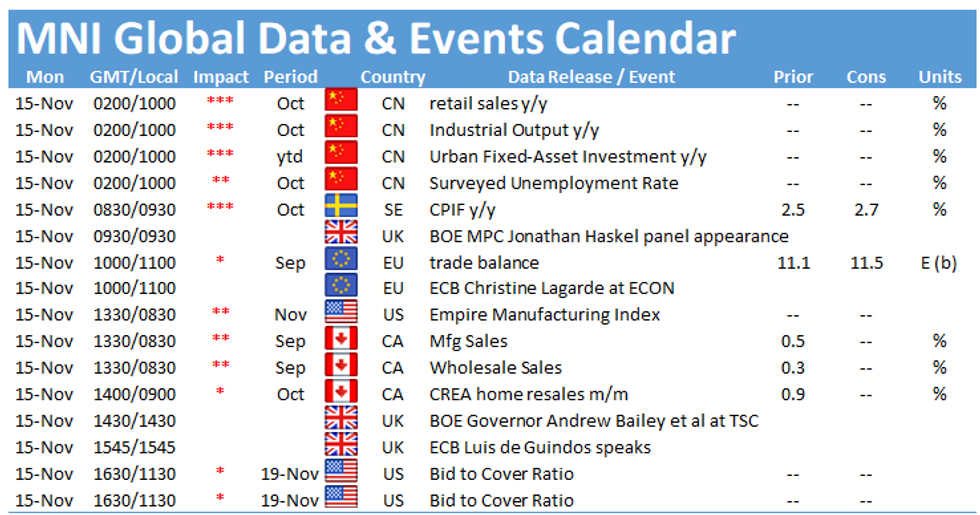

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.