-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - Le Pen’s RN Wins First Round of French Parliamentary Election

EXECUTIVE SUMMARY:

- RN WINS 1ST ROUND PLURALITY, ATTENTION TURNS TO RUN-OFF CONTESTS

- BIDEN LOYALISTS DISMISS CALLS TO QUIT IN FRENETIC WEEKEND BLITZ

- PBOC TO BORROW CGBS IN RESPONSE TO MARKET SITUATION

- REGIONAL PRINTS POINT TO DOWNSIDE RISKS TO NATIONAL GERMAN CPI

Figure 1: French Parliamentary Election vote share, % (2022 results in lighter shaded column)

NEWS

FRANCE (MNI): Attention Turns to Run-Off Contests After RN Wins 1st Round Plurality

The first round of the French parliamentary election on 30 June delivered a result largely in line with opinion polling as the right-wing nationalist Rassemblement National (National Rally, RN) secured a plurality of the vote. Attention now turns to the second round on 7 July, where President Emmanuel Macron - after a poor third-placed finish for his centrist Ensemble alliance - is calling for a 'republican front' of the centre and left to join together to stop RN securing a majority. Projections from pollster Ifop expect the RN to win between 240 and 270 seats based on these vote shares, short of the 289 required for a majority.

US (BBG): Biden Loyalists Dismiss Calls to Quit in Frenetic Weekend Blitz

President Joe Biden’s campaign is going on the attack against a chorus of donors, consultants, officials and media voices calling on him to drop out of the 2024 race after his devastating debate performance. The strategy will be remembered as a display of either remarkable foresight or incredible hubris. Aides spent the weekend publicly dismissing suggestions that Biden reconsider his candidacy or take dramatic steps to overhaul his operation. They angrily denounced the suggestion Biden and his family might entertain a discussion of leaving the race as they traveled to Camp David for a private getaway.

CHINA (BBG): Chinese Mutual Funds Ask Bond Brokers to Lower Trading Fees

Some of China’s biggest mutual funds are asking bond brokers to lower their trading fees, according to people familiar with the matter. The funds used to pass those fees to investors, said the people, who asked not to be identified as the matter is private, but a rule from the China Securities Regulatory Commission taking effect in July has put a stop to the practice. The funds are looking for a cut in the fees of as much as 70%, according to one person. The brokers have agreed to provide the services for free starting Monday until the parties reach an agreement, the people said.

ISRAEL/MIDDLE EAST (BBG): Hezbollah Drone Wounds 18 Israeli Troops as Clashes Escalate

A drone attack by Hezbollah militants on Sunday injured 18 Israeli soldiers, one of them seriously, according to Israel’s military. The assault in the northern Golan Heights came as Israel and Hezbollah, based in Lebanon, move closer to a full-scale war after trading fire since the start of the Israel-Hamas war in October. The attack targeted a command center and was a response to Israel firing on houses in south Lebanon, Hezbollah said. Israel’s military responded by striking Hezbollah targets in Lebanon — including an observation post and a rocket-launch site — but didn’t imply the Iran-backed militant group’s latest actions were serious enough to be a cause for war.

CHINA (MNI): PBOC to Borrow CGBs in Response to Market Situation

MNI (Beijing) The People’s Bank of China will borrow treasury bonds in the secondary market, according to a statement on the PBOC’s website on Wednesday. The PBOC “has decided to conduct treasury bond borrowing operations with selected primary dealers of open market operations in the near future” in a bid to “maintain the stable operation of the bond market” the statement said, noting the decision was made “based on a prudent observation and assessment of the current market situation”.

N.KOREA (BBG): North Korea Fires Missiles to Show Force After Putin Visit

North Korea shot off at least two suspected ballistic missiles Monday, days after firing a rocket to test a new multiple warhead system for delivering a nuclear strike. The missiles were launched at about 5:05 a.m. and 5:15 a.m. from a province southwest of Pyongyang and headed toward the northeast, South Korea’s Joint Chiefs of Staff said in a dispatch sent to reporters. The launch was the second in less than a week. North Korea typically doesn’t comment on its launches until the following day.

SOUTH AFRICA (BBG): South African Rand Rallies as Godongwana Retains Finance Post

South Africa’s rand extended a post-election rally after President Cyril Ramaphosa announced a new cabinet that he said would prioritize rapid and sustainable growth. Ramaphosa also included members of the Democratic Alliance — considered business-friendly by investors — in his cabinet, with leader John Steenhuisen named agriculture minister. The coalition government was formed after the African National Congress lost its parliamentary majority

DATA

GERMANY DATA (MNI): MNI Projects 2.2-2.3% Y/Y National CPI, Core CPI Around 2.9%

- GERMANY BAVARIA JUN CPI +0.2% M/M, +2.7% Y/Y (MNI)

- GERMANY NRW JUN CPI +0.1% M/M, +2.2% Y/Y (MNI)

- GERMANY SAXONY JUN CPI +0.1% M/M, +2.8% Y/Y (BBG)

- GERMANY BRANDENBURG JUN CPI +0.1% M/M, +2.6% Y/Y (BBG)

- GERMANY HESSE JUN CPI +0.1% M/M, +1.8% Y/Y (BBG)

From state-level data that equates to 89.1% weighting of the national June flash German CPI print (due at 13:00 BST/14:00 CET), MNI estimates that national CPI (non-HICP print) rose by around 0.1% M/M (May 0.1%) and 2.2-2.3% Y/Y (May 2.4%). Analyst consensus currently stands at 2.3% Y/Y and 0.2% M/M, so there are some downside risks here. Current tracking of core CPI (ex-energy and food, based on 50% of the national index) implies around 2.9% Y/Y (3.0% in May) and 0.2% M/M (0.3% in May).

GERMAN DATA: Services Inflation Potentially A Touch Softer; Food Prices Jump

Looking a bit closer at this morning's German state level flash June inflation data, food inflation seems to have jumped up, while services inflation might have softened slightly, and the core goods categories painted a mixed picture.

- MNI estimates services inflation slightly lower than in May, at 3.8%-3.9% Y/Y (3.9% May) based on 49.7% weighting of the national print. This is driven by deceleration centred around a couple of individual categories: We track transport prices at 1.6-1.7% Y/Y (2.6% May) and the recreation and culture category at 1.4-1.5% Y/Y (1.8% May).

- Meanwhile, healthcare and restaurants/hotels inflation appear to have accelerated, to around 2.9% Y/Y (2.7% May) and 6.5% Y/Y (6.3% May), and inflation in the communication, education, and other goods and services categories seems to have kept a relatively steady pace in June.

- Food prices appear to have seen a jump looking at the yearly rate, at 2.4-2.5% Y/Y (1.2% May), which was driven by a firm sequential 1.1-1.2% M/M.

- Core goods seem to paint a more mixed picture this month after disinflating recently. We estimate clothing and footwear broadly around 3.1% Y/Y (2.8% May) and furnishings and household equipment at 0.4% Y/Y (vs 0.8% May).

SPAIN DATA (MNI): Competition Limits Input Cost Passthrough

- SPAIN JUNE MANUFACTURING PMI 52.3 (52.9 F'CAST, 54.0 MAY)

The Spanish manufacturing PMI remained in expansionary territory in June at 52.3, but was slightly weaker than consensus (52.9) and May's reading (54.0). Although input costs accelerated in June, competition amongst manufacturers limited passthrough. Additionally, the report notes that political uncertainty (likely from neighbouring France), served to limit some new business.

ITALY DATA (MNI): Firms Tighten Profit Margins to Absorb Higher Costs

- ITALY JUNE MANUFACTURING PMI 45.7 (44.3 F'CAST; 45.6 MAY)

The Italian manufacturing PMI was stronger than expected at 45.7 (vs 44.3 cons, 45.6 prior), but marked the third consecutive month in contractionary territory. Similar to Spain, rises in input cost inflation were not passed onto consumers, with firms tightening profit margins to absorb cost increases. Key notes from the release: "Amid reports of unfavourable market conditions, panellists linked the downturn to client hesitancy".

EUROZONE JUNE MANUFACTURING PMI 45.8 (45.6 FLASH; 45.6 MAY) (MNI)

GERMANY FINAL JUNE MANUFACTURING PMI 43.5 (43.4 FLASH; 45.4 MAY) (MNI)

FRANCE FINAL JUNE MANUFACTURING PMI 45.4 (45.3 FLASH; 46.4 MAY) (MNI)

CHINA DATA (MNI): Caixin June Manufacturing PMI Hits Three-Year High

- CHINA JUNE CAIXIN MANUFACTURING PMI 51.8 VS 51.7 IN MAY

MNI (Beijing) China's Caixin manufacturing PMI registered 51.8 in June, up 0.1 points from May, marking eight consecutive months above the 50 mark and hitting the highest level since June 2021, the financial publisher said on Monday. The production sub-index rose within the expansion range for five consecutive months, with significant growth in consumer goods. The new orders sub-index fell slightly but remained above 50. However, the new export orders sub-index dropped to its lowest in nearly six months, indicating a weakening in overseas demand.

CHINA DATA (MNI): China June PMI Contracts for 2nd Straight Month

MNI (Beijing) China's Manufacturing Purchasing Managers Index shrank for a second straight month in June, registering 49.5, flat from May's reading, while non-manufacturing PMI slowed to the lowest level this year, data from the National Bureau of Statistics showed Sunday. The production sub-index fell 0.2 points to 50.6, still above the 50 mark. However, the new orders sub-index fell by 0.1 points to 49.5 as enterprises reported insufficient effective demand.

JAPAN DATA (MNI): Sentiment Rises, Solid Capex Plans, Backs BOJ

- BOJ JUNE TANKAN LARGE MFG INDEX +13; MAR +11; MEDIAN +11

- BOJ TANKAN LARGE NON-MFG INDEX +33; MAR +34; MEDIAN +33

Japanese benchmark business sentiment rose from three months ago, the first rise in two quarters as manufacturers succeeded in transferring higher costs to retail prices, although non-manufacturers were hit by higher costs caused by the weak yen, the Bank of Japan’s June Tankan business sentiment survey released Monday showed. Major and smaller firms’ capital investment plans remained firm and above average historical levels, supporting the BOJ's view that the beneficial cycle from income to spending continues.

JAPAN DATA (MNI): Japan Q1 GDP Revised Lower on Public Investment

Japan's Q1 economy contracted at a faster pace than previously estimated as public investment was revised lower, updated data released by the Cabinet Office showed on Monday. The economy contracted 0.7% q/q, or annualized -2.9%, compared previous estimates of -0.5% q/q and an annualized -1.8%.Public investment fell 1.9% q/q, revised down from +3.0%, whilst the GDP contribution from public investment was revised to -0.1 pp from +0.2 pp.

FOREX: EUR/USD Marked Higher on French First Round

- French politics remains a market focus - results from the first round showed the right-wing RN winning plurality, meaning attention now turns to the second round this weekend. While RN put in a strong showing, polling numbers show no overall majority in the assembly, helping underpin the EUR today, which is firmer against most others in G10.

- EUR/USD has been marked higher to trade back above 1.0750, but resistance at the 1.0777 50-dma has contained the rally so far. Nonetheless, the pair has traded the best levels since Jun13, aided by the rally in core French banking shares.

- AUD/JPY trades a higher high for a tenth consecutive session. Such a streak has only occured a handful of times since the Global Financial Crisis and another higher high tomorrow would be the longest winning streak for the cross since 2011. Price has cleared 107.50 to touch the highest level since 2007 today.

- German national CPI is set to come in alongside consensus, with core CPI tracking at 2.9% for today's release - as per this morning's regional numbers which have provided few surprises. The June Manufacturing ISM is the data highlight, with markets watching for whether the ISM will follow Chicago PMI's strong showing from last Friday.

- The speaker slate is euro-centric this week, with the formal kick-off of the ECB's central banking forum in Sintra. Nagel and Lagarde are both set to speak today but the agenda picks up later in the week, with appearances from Fed members also due. BoE speak remains quiet, however, as MPC members remain inside their pre-election quiet period.

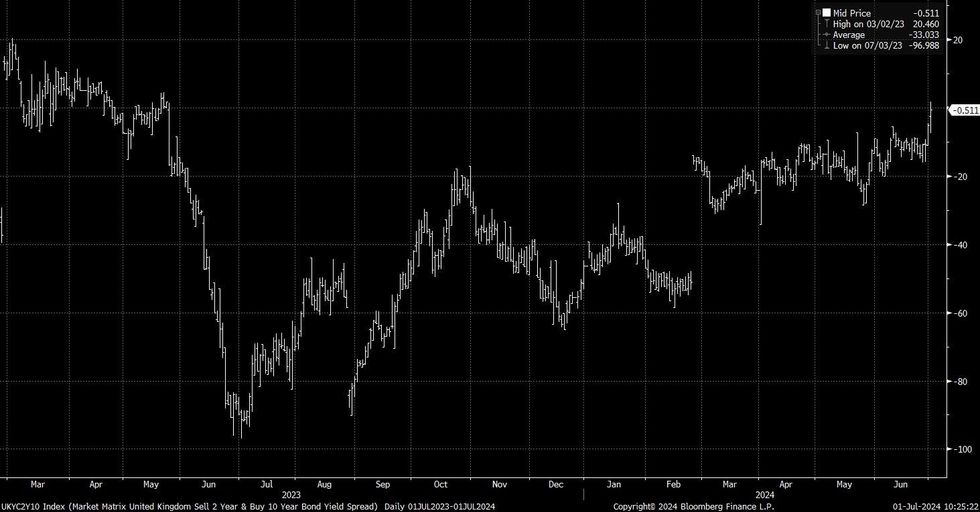

GILTS: Under Pressure, 2s10s Tests 0bp

Gilts have sold off alongside wider core global FI markets following the first round of the French legislative elections.

- Futures trade as low as 97.07.

- Support at the trendline drawn from the May 29 low & the Jun 28 low (97.60/54) have been broken.

- Bears now eye the June 12 low (96.84).

- Cash gilt yields are 1-6bp higher, with the curve steepening.

- Multi-month ranges are comfortably intact across all major benchmarks.

- BBG benchmark 2s10s printed above 0 for the first time since May ’23.

- Modest hawkish adjustments are seen in most GBP STIRs.

- BoE-dated OIS shows ~14bp of cuts for August and ~42bp easing through year end.

- SONIA futures are +0.25 to -5.0

- GBP650mn of long-dated BoE APF sales are due this afternoon.

- The general election will be held on Thursday. We should have a good indication of the outcome early on Friday morning. Given the picture provided by opinion polls, focus is set to fall on the scale of the likely Labour majority.

- Expect our political risk team’s full preview of that event in the coming days.

Fig. 1: Gilts 2s/10s Curve (bp)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

Under Pressure After Initial Unwind Of Political Risk Premia

After unwinding some of the political risk premium that was priced in ahead of Sunday’s French election, core/semi-core EGBs have come under broad-based pressure.

- The results from first round French election voting were in line with expectations, with the far-right RN winning the most seats but likely falling short of an absolute majority.

- OAT and BTP futures thus began the week on a positive note, before reversing course over the past 2 hours.

- After reaching a multi-year wide at 85bps last week, the 10-year OAT/Bund spread tightened to ~72bps at the open but has since widened back to ~75bps.

- German state-level inflation data pointed to modest downside risks to the 2.3% Y/Y national consensus (due 1300BST), but the lack of a larger downward surprise provided little support to EGBs.

- Final June manufacturing PMIs were not market moving.

- Alongside French election developments, broader regional focus is on tomorrow’s Eurozone-wide flash PMI release and the ECB’s Sintra conference, which begins this evening.

EQUITIES: Trend Conditions in E-Mini S&P Unchanged and Bullish

The trend condition in Eurostoxx 50 futures remains bullish. The recovery from the Jun 14 low appears to be an early reversal of the May 16 - Jun 14 correction. Attention is on 5039.84, a Fibonacci retracement. A break of this level would be a positive development. For bears, a reversal lower would signal a resumption of the bearish corrective cycle and open 4846.00, the Apr 19 low and a key support. The trend condition in S&P E-Minis is unchanged and signals remain bullish. Resistance at 5430.75, the May 23 high and bull trigger, has recently been cleared. This break confirmed a resumption of the primary uptrend. Note that moving average studies are in a bull-mode position and this continues to highlight positive sentiment. Sights are on 5594.66, a Fibonacci projection. Support to watch is 5484..21, the 20-day EMA.

- Japan's NIKKEI closed higher by 47.98 pts or +0.12% at 39631.06 and the TOPIX ended 14.65 pts higher or +0.52% at 2824.28.

- Across Europe, Germany's DAX trades higher by 108.55 pts or +0.6% at 18344.52, FTSE 100 higher by 41.01 pts or +0.5% at 8204.78, CAC 40 up 131.21 pts or +1.75% at 7610.61 and Euro Stoxx 50 up 57.39 pts or +1.17% at 4951.41.

- Dow Jones mini up 58 pts or +0.15% at 39527, S&P 500 mini up 8.5 pts or +0.15% at 5530, NASDAQ mini up 30.5 pts or +0.15% at 19958.5.

COMMODITIES: Bullish WTI Futures Trading Close to Last Week's Highs

A bull cycle in WTI futures remains in play and the contract traded higher last week. The recent breach of $80.11, the May 29 high and a key resistance, strengthened a bullish theme. Note too that $82.24, 76.4% of the Apr 12 - Jun 4 bear leg, has been pierced. A clear break would open $85.24, the Apr 12 high and a bull trigger. Initial firm support to watch is $78.86, the 50-day EMA. A break would be seen as a potential reversal signal. A bear threat in Gold remains present and the yellow metal continues to trade closer to its recent lows. The sell-off on Jun 7 reinforced a short-term bearish theme. Price has pierced the 50-day EMA, at 2318.4. A clear break of this EMA would confirm a resumption of the reversal from May 20 and open $2277.4, the May 3 low. Clearance of this price point would also strengthen a bearish theme. Initial firm resistance is $2387.8, the Jun 7 high.

- WTI Crude up $0.54 or +0.66% at $82.16

- Natural Gas down $0.03 or -0.96% at $2.575

- Gold spot down $2.35 or -0.1% at $2324.28

- Copper up $0.5 or +0.11% at $439.85

- Silver up $0.05 or +0.16% at $29.188

- Platinum down $3.53 or -0.35% at $992.48

| Date | GMT/Local | Impact | Country | Event |

| 01/07/2024 | 1200/1400 | *** | HICP (p) | |

| 01/07/2024 | 1345/0945 | *** | S&P Global Manufacturing Index (final) | |

| 01/07/2024 | 1400/1000 | *** | ISM Manufacturing Index | |

| 01/07/2024 | 1400/1000 | * | Construction Spending | |

| 01/07/2024 | 1530/1130 | * | US Treasury Auction Result for 26 Week Bill | |

| 01/07/2024 | 1530/1130 | * | US Treasury Auction Result for 13 Week Bill | |

| 01/07/2024 | 1900/2100 | ECB's Lagarde speech at ECB forum on Central Banking | ||

| 02/07/2024 | 2301/0001 | * | BRC Monthly Shop Price Index | |

| 02/07/2024 | 0130/1130 | RBA Minutes | ||

| 02/07/2024 | 0730/0930 | ECB's De Guindos chairing session on inflation | ||

| 02/07/2024 | 0830/1030 | ECB's Elderson chairs session on biodiversity | ||

| 02/07/2024 | 0900/1100 | *** | HICP (p) | |

| 02/07/2024 | 0900/1100 | ** | Unemployment | |

| 02/07/2024 | 0900/1000 | ** | Gilt Outright Auction Result | |

| 02/07/2024 | 1030/1230 | ECB's Schnabel chairing panel on Geopolitical shock and inflation | ||

| 02/07/2024 | - | *** | Domestic-Made Vehicle Sales | |

| 02/07/2024 | 1255/0855 | ** | Redbook Retail Sales Index | |

| 02/07/2024 | 1330/1530 | ECB's Lagarde in policy panel at ECB forum | ||

| 02/07/2024 | 1330/0930 | Fed Chair Jerome Powell | ||

| 02/07/2024 | 1400/1000 | *** | JOLTS jobs opening level | |

| 02/07/2024 | 1400/1000 | *** | JOLTS quits Rate | |

| 02/07/2024 | 1530/1130 | * | US Treasury Auction Result for Cash Management Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.