-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Biden's Fed Pick Could Hit Over The Weekend

EXECUTIVE SUMMARY

- BIDEN HINTS AT FED CHAIR PICK SOON AS SENATORS RUSH TO REACT (BBG)

- YELLEN: U.S. COULD HIT DEBT LIMIT ON DEC. 15 (CNBC)

- MANCHIN HAS 'A LOT OF CONCERNS' OVER TIMING OF BIDEN SPENDING PLAN (THE HILL)

- SECRETIVE CHINESE COMMITTEE DRAWS UP LIST TO REPLACE U.S. TECH (BBG)

- US ASKS CHINA TO RELEASE OIL RESERVES (SCMP)

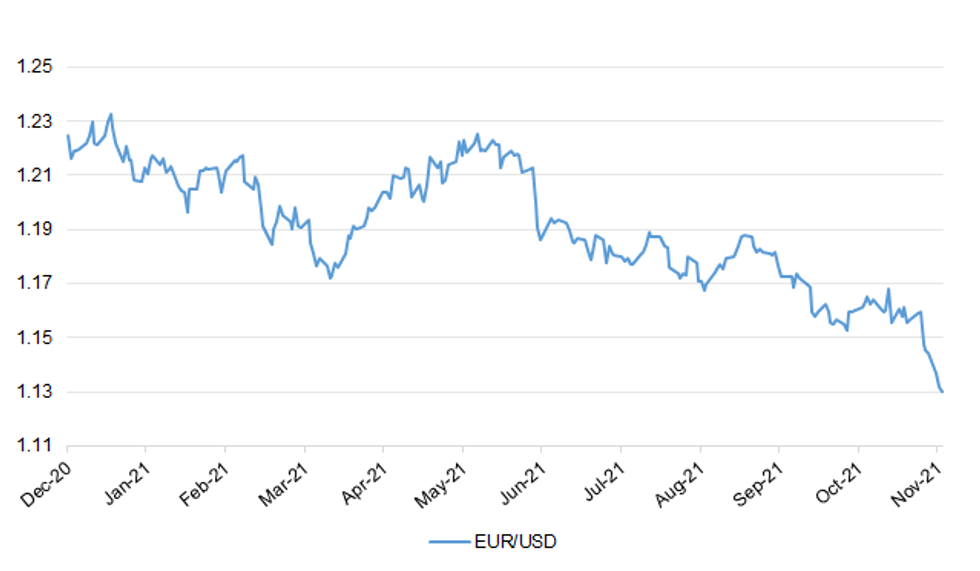

Fig. 1: EUR/USD

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Mandatory Covid vaccine passports could become enforceable in Northern Ireland from 13 December under proposals from the health minister, BBC News NI understands. Robin Swann will bring a paper to Wednesday's executive meeting and ask ministers to agree to recommendations. It is understood his plan would see the regulations take effect on 29 November. However there would be a 14-day grace period before fixed penalty notices can be issued. (BBC)

BREXIT: MPs and peers will not get a vote on whether to trigger Article 16 before it is used, under government plans to take the move if Brexit talks fail. (Telegraph)

BREXIT: The taoiseach (Irish prime minister) has said there has been a change of tone in the the EU-UK negotiations on the Northern Ireland Protocol. Mícheál Martin told the Dáil (Irish parliament) that he felt UK negotiators had indicated they want a resolution. The taoiseach said he believed political parties in NI want to remain part of the European Single Market. His comments came as the Irish foreign minister said protocol issues could be resolved "before Christmas". Simon Coveney said that was the EU's hope but "we'll see" by the weekend if that's "realistic or not". (BBC)

POLITICS: Boris Johnson will face a raft of questions across Parliament later as a row about MPs' second jobs continues to engulf Westminster. The spotlight has been shone on the additional roles held by MPs since Tory Owen Paterson was found to have broken lobbying rules as a paid consultant. The PM announced plans on Tuesday to ban MPs from holding that type of job. But Labour claimed the government was "watering down" its own proposals, due to be debated on Wednesday. (BBC)

POLITICS: Boris Johnson faces a confrontation with his backbenchers today as he pushes for MPs to be banned from taking on second jobs as consultants. The prime minister gave in yesterday to pressure over sleaze by proposing that MPs be barred from acting as paid political consultants. He also called for a limit on the amount of time MPs can spend on outside interests. (The Times)

EUROPE

EU: Italian and French leaders Mario Draghi and Emmanuel Macron will sign a deal next week to try to tilt the balance of power in Europe after the departure of German Chancellor Angela Merkel a government source said. (RTRS)

IRELAND: Ireland has reintroduced some Covid-19 restrictions as it grapples with surging infections and a rising number of hospitalizations. Starting Thursday, people should work from home where possible, Prime Minister Micheal Martin said in a national address, while bars and restaurants must close by midnight. Cinemas and theaters will now require proof of vaccination, he said. (BBG)

U.S.

FED: Federal Reserve officials said on Tuesday they are vigilant of the ways that higher inflation can affect U.S. households and dampen consumer sentiment and want to get it under control. While wages are rising for some workers, consumer sentiment is down to a "level that you might associate with a recession," said Richmond Fed President Thomas Barkin, citing the consumer sentiment survey from the University of Michigan. "I think that's very much because of the impact that prices have on people," including those who spend a significant part of their pay on food and gas, Barkin said during a virtual panel organized by the Fed. (RTRS)

FED: MNI: Fed's Daly Says Against Preemptive Rate Hikes

- The Federal Reserve should gain more clarity about the inflation outlook before raising interest rates rather than acting preemptively on fears around lasting price pressures, San Francisco Fed President Mary Daly said Tuesday - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: President Joe Biden is still deciding whether to reappoint Federal Reserve Chair Jerome Powell or replace him with Fed governor Lael Brainard, as key senators wade in with their views on the choice. Biden told reporters on Tuesday to expect the announcement of a nominee for Fed chair in "the next four days." The president has ruled out other possible contenders for the job, said a person familiar with the matter, cautioning that the announcement may slip until next week. Biden considers them both strong options and respects them both, the person said. (BBG)

FED: Senate Banking Committee Chairman Sherrod Brown said Tuesday he has no doubt the Senate would confirm either Federal Reserve Chair Jerome Powell to a second term or his possible successor, Fed Governor Lael Brainard. "I am certain we would confirm either of them," the Ohio Democrat said, adding that either could rely on broad Democratic support and might draw some GOP backing. "I am absolutely certain." (BBG)

FED: Ohio Republican Senator Rob Portman, meanwhile, one of just four sitting Republicans to confirm Brainard for her current post, said in a hallway interview Tuesday that he urged Biden directly to choose Powell over Brainard. "I think she's more dovish than him, and I think for those of us concerned about the balance sheet of the Fed and inflation, he's a better pick," Portman said, though he declined to say when the conversation took place. (BBG)

FED: Senator Joe Manchin said he plans to meet with Federal Reserve Chair Jerome Powell in the next few days as President Joe Biden weighs whether to give him a second term. Biden said earlier Tuesday that he would announce his decision on who would lead the Fed in the next four days. Manchin told Bloomberg News that he would meet with Powell "before then." (BBG)

FED: Powell's critics among Democrats include Elizabeth Warren, who continued to argue Tuesday that his support for deregulation is a risk to the economy, and Sheldon Whitehouse of Rhode Island, who wants a public commitment from Powell on climate change. Whitehouse said Tuesday that Brainard is "distinctly better" on that issue. (BBG)

FED: Senator Richard Shelby, an Alabama Republican, said he'd met with Powell earlier Tuesday and that he has no plans to see Brainard. Shelby said he has not decided whether to back Powell and said he was worried about rising prices. "My concern with the Fed is that they have missed the inflation issue and they could do irreparable damage to our economy," Shelby said. (BBG)

FISCAL: Treasury Secretary Janet Yellen on Tuesday told lawmakers that she now estimates that the U.S. will reach its debt limit on Dec. 15, almost two weeks later than her initial forecast of Dec. 3. Those additional 12 days would offer Congress more time to strike a deal on how to lift or suspend the debt ceiling. If lawmakers fail to do so before the so-called drop-dead date, the U.S. government would default for the first time ever. In a letter to House Speaker Nancy Pelosi, D-Calif., Yellen explained that her revised estimate is in part the result of President Joe Biden's enactment of the $1 trillion infrastructure plan earlier this week. "Yesterday, the President signed the Infrastructure Investment and Jobs Act, which appropriates $118 billion for the Highway Trust Fund," she wrote. "These funds must be transferred into the Highway Trust Fund within one month after the enactment of the legislation, and the transfer will be completed on December 15." (CNBC)

FISCAL: Sen. Joe Manchin (D-W.Va.) on Tuesday signaled he's not on board with Senate Majority Leader Charles Schumer's (D-N.Y.) plan to get President Biden's $1.75 trillion climate and social spending package passed into law by Christmas. Asked how he feels about the plan to speed the massive budget reconciliation bill, known as Build Back Better, through the Senate over the next month, Manchin said he has a "a lot of concerns," cupping his hands around his mouth for emphasis as he took an elevator up to the second floor of the Capitol to vote. (The Hill)

FISCAL: Senate Minority Leader Mitch McConnell predicted lawmakers will stave off worst-case outcomes for two of the top items on Congress' to-do list, even as the exact path forward remains unclear. (POLITICO)

CORONAVIRUS: Top U.S. infectious disease official Dr. Anthony Fauci said on Tuesday it is possible for COVID-19 to be reduced to an endemic illness from the current major health crisis next year if the country ramps up vaccination rates. Booster doses of the COVID-19 vaccines are vital for reaching that point, Fauci said in an interview during the Reuters Total Health conference, which runs virtually from Nov. 15-18. (RTRS)

CORONAVIRUS: Pfizer on Tuesday submitted its application to the Food and Drug Administration for emergency authorization of its Covid-19 treatment pill, saying it reduces hospitalization and death by 89% when administered with a common HIV drug. (CNBC)

CORONAVIRUS: The U.S. Food and Drug Administration plans to authorize booster shots of the Pfizer-BioNTech Covid-19 vaccine for all adults as early as Thursday, the New York Times reported, citing unidentified sources. (BBG)

CORONAVIRUS: New York Governor Kathy Hochul urged people who live in areas with high transmission rates to get the booster, as cases rise across the state. "We are heading into a vulnerable time," she said. "We are seeing the spikes go up." People should start avoiding large indoor gatherings, Hochul said at a briefing, adding that the state could implement harsher restrictions if cases continue to increase. "The warning is going out loud and clear today," she said. Five regions in the state have infection rates of more than 50 cases per 100,000 residents, up from one region a week ago, she said. The seven-day average positivity rate topped 8% in Western New York and the Finger Lakes. Hospitalizations have topped 2,000 statewide and are increasing. (BBG)

CORONAVIRUS: Louisiana and Texas filed separate suits seeking to block a federal vaccine mandate for employees at hospitals, hospices, skilled nursing facilities and home health agencies. The mandate is a "one-size-fits-all sledgehammer" that will force workers to choose between their jobs and "the jabs," according to the Louisiana complaint, which was joined by Montana, Arizona, Alabama, Georgia, Idaho, Indiana, Mississippi, Oklahoma, South Carolina, Utah and West Virginia. The requirement, issued by the Centers for Medicare and Medicaid Services, will worsen staffing concerns, especially in nursing homes and rural communities, Texas said.

CORONAVIRUS: Washington, D.C., will lift its indoor mask mandate Nov. 22, nearly four months after the order was imposed because of a spike in cases. "Instead of following a blanket mandate, residents, visitors and workers will be advised to follow risk-based guidance from D.C. Health that accounts for current health metrics and a person's vaccination status," Mayor Muriel Bowser said in a statement. Masks still will be required in some locations, such as schools, public transportation, nursing homes and district government facilities where there is direct interaction between employees and the public. (BBG)

EQUITIES: Elon Musk sold Tesla Inc. stock for a seventh consecutive trading day, bringing him almost halfway to his promise to unload 10% of his stake in the electric car-maker. The chief executive officer on Tuesday disposed of 934,091 shares worth about $973 million, according to regulatory filings. That follows $7.8 billion of sales he carried out since he asked his Twitter followers on Nov. 6 whether he should pare his stake. Musk also exercised another 2.1 million of equity options on Tuesday, and part of the share sales were to help pay taxes on that. To reach the 10% threshold affirmed by the poll, Musk would need to sell some 17 million Tesla shares, which is equal to about 1.7% of the company's outstanding stock. So far, he's gotten rid of about 8.2 million shares. If his exercisable options are included in the ownership, he'd need to sell even more. (BBG)

OTHER

GLOBAL TRADE: The U.S. intends to initiate a new economic framework for the Indo-Pacific in 2022, Commerce Secretary Gina Raimondo said, as the Biden administration aims to reinvigorate America's standing in the region. "We're likely to launch a more formal process in the beginning of next year which will culminate in a proper economic framework" in Asia, Raimondo said at the Bloomberg New Economy Forum in Singapore Wednesday. "I am here in the region beginning the discussions, laying the groundwork." (BBG)

GLOBAL TRADE: China is accelerating plans to replace American and foreign technology, quietly empowering a secretive government-backed organization to vet and approve local suppliers in sensitive areas from cloud to semiconductors, people familiar with the matter said. Formed in 2016 to advise the government, the Information Technology Application Innovation Working Committee has now been entrusted by Beijing to help set industry standards and train personnel to operate trusted software. The quasi-government body will devise and execute the so-called "IT Application Innovation" plan, better known as Xinchuang in Chinese. It will choose from a basket of suppliers vetted under the plan to provide technology for sensitive sectors from banking to data centers storing government data, a market that could be worth $125 billion by 2025. (BBG)

GLOBAL TRADE: The number of containers sitting on docks at the port of Los Angeles has declined 29%, CEO Gene Seroka says. Carriers have increased deployment of sweeper ships to reduce the backlog of empty containers; port averages about 350,000 empty container units that get exported back to Asia every month, about 30% more than a year earlier, Seroka says in virtual call with reporters. (BBG)

U.S./CHINA: U.S. President Joe Biden said on Tuesday he had a "good meeting" with Chinese President Xi Jinping and aides would follow up on a range of issues. (RTRS)

U.S./CHINA: The U.S. and China have agreed to ease Trump-era visa restrictions for journalists on a reciprocal basis, following a series of expulsions by both governments during heightened tensions last year, a State Department spokesperson confirmed to Axios. (Axios)

U.S./CHINA: The U.S. should implement the consensus spirit of the Xi-Biden virtual summit on Tuesday and relay the positive momentum from the talks to key areas of bilateral ties, the party's tabloid Global Times said in an Editorial. China-U.S. relations have come to a point where they must manage divergences and ease the tense atmosphere, and the two heads of state sent a positive signal by declaring they reject a new Cold War and could co-exist peacefully, the newspaper said. If either party violated this commitment they would be committing a sin, the Times said. (MNI)

U.S./CHINA/TAIWAN: President Joe Biden said that Taiwan "makes its own decisions," backing the island's leaders anew after a summit with Chinese President Xi Jinping intended to stabilize the tense relationship between the world's two largest economies. "We made very clear we support the Taiwan Act, and that's it," Biden told reporters Tuesday during a trip to New Hampshire, referring to the 1979 Taiwan Relations Act. (BBG)

U.S./CHINA: Joe Biden and Xi Jinping have agreed to hold talks aimed at reducing tensions, as US anxiety grows at China's expanding nuclear arsenal and its recent test of a hypersonic weapon. Jake Sullivan, US national security adviser, said the US and Chinese presidents had discussed the need for nuclear "strategic stability" talks in their virtual meeting on Monday. China has previously refused to hold nuclear talks, partly because the US has a much larger weapons arsenal. "The two leaders agreed that we would look to begin to carry forward discussions on strategic stability," Sullivan told an audience at the Brookings Institution in Washington. (FT)

GEOPOLITICS: Armenia and Azerbaijan agreed on Tuesday to a ceasefire at their border, the Armenian defence ministry said, after Russia urged them to step back from confrontation following the deadliest clash since a war last year. (RTRS)

GEOPOLITICS: Russian President Vladimir Putin and Armenian Prime Minister Nikol Pashinyan discussed the situation on the Armenia-Azerbaijan border during a phone call on Tuesday, the Kremlin said in a statement, without elaborating. (RTRS)

JAPAN: Jiji reports that Japan's government and the ruling Liberal Democratic Party will discuss strengthening financial income taxation from next year. According to the agency, the issue will named a "matter of consideration" in the tax reform outline for the next fiscal year. While raising the capital gains tax is a controversial issue and Fumio Kishida shelved it after becoming Premier, he may return to the idea as part of his attempt to fulfil a campaign pledge to reduce income disparities. (MNI)

AUSTRALIA: Australia's government banned travel to or from a remote region of the Northern Territory to help curb the spread of a Covid-19 outbreak among First Nations people in the area. The Northern Territory on Tuesday reported nine new cases -- all in Indigenous people. That took a cluster linked to the regional center of Katherine, 200 miles from the capital Darwin, and the isolated Robinson River settlement to 11. (BBG)

NEW ZEALAND: Pandemic restrictions will be further eased in New Zealand, Prime Minister Jacinda Ardern said, as Covid-19 vaccination rates increase and opinion polls show waning support for the government. Residents of the country's largest city, Auckland, will be able to travel to other parts of New Zealand from Dec. 15 after being in a lockdown since mid-August, Ms. Ardern said Wednesday. Eligibility for travel will require either vaccination or a negative Covid-19 test. Lockdowns, which along with a border closures have been the main tool for controlling the spread of Covid-19, will be replaced from the end of November with a traffic light system that relies on vaccination certificates. (MarketWatch)

NEW ZEALAND: Vaccine passes were made available for the more than 3.4 million New Zealanders who are fully vaccinated, Covid-19 Response Minister Chris Hipkins said. The pass can be downloaded to a phone or printed out. It can be used to attend hospitality settings, retail establishments, community and sporting events, religious gatherings and other functions. Vaccination status isn't required at supermarkets, pharmacies, health services and other essential establishments. (BBG)

BOC: MNI: BOC Sees Major Labor Slack And Calls Inflation Transitory

- Bank of Canada Deputy Governor Larry Schembri said Tuesday there is still a lot of job market slack and called recent elevated price gains transitory, saying the pandemic makes it tougher for policy makers to figure out relationships between the economy's full potential and inflation - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

BRAZIL: Roberto Campos Neto is sounding the alarm about Brazil's growth and debt outlooks as the central bank he leads aggressively raises interest rates to battle spiraling inflation just as economists see the economy nearly stalling next year. Lack of reforms and the possible erosion of Brazil's austerity laws put into question how much Latin America's largest economy can expand without inflation, with negative consequences for debt dynamics, Campos Neto said on Tuesday at an event in Lisbon, explaining why Brazil's risk premium has increased even as debt levels remain better than forecast. (BBG)

BRAZIL: Members of Brazil's economic team agreed to work for a wage increase for public employees during an election year, Folha de S.Paulo newspaper reported citing members of Economy Minister Paulo Guedes' team. Economic team warned that the measure will require cutting expenses in other areas. (BBG)

ENERGY: An environmental challenge over Russian's Nord Stream 2 pipeline was dismissed by German judges on Tuesday. The judges at a regional German court rejected a suit by environmental group DUH that was asking to order a regulator of the state of Mecklenburg-Vorpommern -- where the pipeline comes ashore -- to reevaluate the permit to operate it granted. In the suit, DUH had cited recent studies showing that gas pipelines have much graver leaks of climate-damaging methane emissions than previously assumed. The regulator already looked at the problem of methane leaks and had taken this issue into account when it issued the permit, Presiding Judge Klaus Sperlich said when delivering the ruling. Most parts of the pipeline aren't on German territory so they're beyond its jurisdiction, he added. (BBG)

OIL: U.S. House Majority Leader Steny Hoyer said he is not in agreement with Senate Majority Leader Chuck Schumer's call for tapping the strategic oil reserve to lower gas prices, saying he believed the reserve was there to be used if there is a collapse in supply in times of emergency. "I'm not in agreement with that. I think that the Strategic Petroleum Reserve is not for a raise in prices, it's for a collapse in supply at times of emergency, i.e. a conflagration in the Middle East which essentially shuts off supply," Hoyer told reporters when asked if he agreed with Schumer's comments. (RTRS)

OIL: The United States has asked China to release oil reserves to help stabilise soaring international crude oil prices as part of ongoing discussions on economic cooperation between the two countries. The US wants China to join the US in releasing crude oil reserves and the issue was raised during the virtual meeting between Chinese President Xi Jinping and US President Joe Biden on Tuesday, according to a person familiar with the matter. The issue was also broached during a phone conversation between Chinese foreign minister Wang Yi and US Secretary of State Antony Blinken two days earlier. "One of the pressing issues for both sides is energy supply," the person said, who requested anonymity as the information is not public. "Currently, the energy departments from both sides are negotiating the details," the person said, adding that China is open to the US request but has not committed to specific measures yet, citing the need to consider its domestic consumption needs. (SCMP)

OIL: A legal battle between Canadian company Enbridge Inc and the U.S. state of Michigan over Enbridge's Line 5 oil pipeline will be heard in federal court, a judge ruled on Tuesday, dismissing Michigan's motion to have the case sent back to state court. Line 5 ships 540,000 barrels per day of crude and refined products from Superior, Wisconsin, to Sarnia, Ontario, via the Straits of Mackinac in the Great Lakes. (RTRS)

CHINA

YUAN: More global asset management institutions and sovereign wealth funds are using the Chinese yuan to hedge against the risk of falling exchange rates of other countries and are actively increasing yuan assets, the 21st Century Business Herald reports. The yuan has continued to rise against a basket of currencies this year amid China's robust trade and steady economic growth, with the latest CFETS RMB index rising to 101.08, the highest level since Dec. 2015. The more than 6% rise in the CFETS is also encouraging more domestic and foreign companies to use the yuan for settlement in cross-border trade and investment, the newspaper said. Although the rising CFETS was partly due to the adjustment of lowering the weight of the U.S. dollar to 0.1879 from 0.2159 last year, strong exports and the large trade surplus are playing the leading role in driving up the index, even amid the sharp dollar rebound due to rising expectations of the Fed's QE taper, the newspaper added. (MNI)

POLICY: China and the world must work together to boost global economic growth, Vice President Wang Qishan said, vowing that Beijing will continue opening up more to foreign investment at a time when more countries are raising barriers over national security concerns. "China can not develop in isolation of the world and nor can the world develop without China," Wang said Wednesday at the Bloomberg New Economy Forum in Singapore. "China will not waver in its resolve to deepen reform and expand opening up." "Going forward, China will keep its arms wide open, provide more market investment and growth opportunities to the world," he added. "And to contribute its part to the building of a noble world economy and a community with a shared future for mankind." Wang, technically second-in-charge to President Xi Jinping, spoke a day after the Chinese leader held a virtual summit with U.S. President Joe Biden. The outcome was generally positive, with both sides agreeing to continue talking on a range of topics even as they continue to spar over issues like Taiwan. Wang said the U.S.-China relationship impacts "the future of the world," and said both sides should "act on the important common understandings reached between the two presidents, keep their focus on cooperation and manage and control differences." (BBG)

EVERGRANDE: China Evergrande Group Chairman Hui Ka Yan has injected over 7 billion yuan in cash to improve the developer's liquidity since July 1, China Business News reports, citing unidentified sources as saying. Hui raised the funds from disposal of personal assets and share pledges, report cites people close to Evergrande. The money was used to maintain basic operations of the company. (BBG)

EVERGRANDE: Evergrande aims to merge some departments and make personnel changes by Nov. 30 to meet the need of strategic development, Chinese news outlet Cailian reports, citing internal memo on Tuesday. Some regional management and supervision units will report to its real estate group. Evergrande did not immediately respond to request for comment by Bloomberg. (BBG)

EVERGRANDE: Evergrande's online home and car sales platform closed some local units due to funding issue and business contraction, Cailian reports, citing unidentified people close to Evergrande. Evergrande didn't immediately respond to Bloomberg's request for comments. (BBG)

PROPERTY: China plans to let property companies resume issuance of asset-backed securities, ending a three-month market freeze as authorities move to insulate higher-rated developers from an industrywide funding crunch. Financial regulators recently told Chinese exchanges that "high quality" developers can apply to issue new ABS to repay outstanding debt as soon as this month, people familiar with the matter said, asking not to be identified discussing private information. No developers have issued ABS since August after the government began tightening approvals in the second quarter, one of the people said. Developers had about 973 billion yuan ($152 billion) of outstanding ABS as of April, according to GF Securities Co. (BBG)

CORONAVIRUS: China reported eight Covid-19 infections on Wednesday, all in one province, as the country's new cases dropped to single digits for the first time in its latest delta outbreak. All of the locally transmitted cases were found in northeastern Liaoning province, according to the National Health Commission. The number of new infections has fallen for three consecutive days, after peaking at more than 100 daily during the broadest outbreak it's experienced since Covid first emerged two years ago. (BBG)

CORONAVIRUS: China sent its Covid-19 response czar Liang Wannian to the southwestern border town Ruili to oversee containment efforts. Ruili, which has suffered repeated lockdowns, came into spotlight last month after a former vice mayor of the city made a plea online for more support from the central government. While reiterating the goal of Covid Zero, Liang vowed to balance local Covid response with economic and social development and build out a new model for Covid containment for China's land ports. (BBG)

OVERNIGHT DATA

JAPAN OCT TRADE BALANCE -Y67.4BN; MEDIAN -Y320.0BN; SEP -Y624.1BN

JAPAN OCT TRADE BALANCE ADJ -Y444.7BN; MEDIAN -Y609.2BN; SEP -Y605.5BN

JAPAN OCT EXPORTS +9.4% Y/Y; MEDIAN +10.3%; SEP +13.0%

JAPAN OCT IMPORTS +26.7% Y/Y; MEDIAN +31.8%; SEP +38.2%

JAPAN SEP CORE MACHINE ORDERS +12.5% Y/Y; MEDIAN +17.6%; AUG +17.0%

JAPAN SEP CORE MACHINE ORDERS 0.0% M/M; MEDIAN +1.5%; AUG -2.4%

AUSTRALIA Q3 WAGE PRICE INDEX +2.2% Y/Y; MEDIAN +2.2%; Q2 +1.7%

AUSTRALIA Q3 WAGE PRICE INDEX +0.6% Q/Q; MEDIAN +0.6%; Q2 +0.4%

AUSTRALIA OCT WESTPAC LEADING INDEX +0.16% M/M; SEP -0.01%

The Index growth rate has now been in negative territory for two consecutive months. Given that our two major cities were locked down for most of the September quarter and into October the Index has held up quite well. One key consideration has been that despite these lockdowns the rest of the country has been operating above trend. The global backdrop has also been much more supportive with US industrial production continuing to drive a strong recovery – in stark contrast to the major negative impact this was having on the Index in the June quarter last year. Finally, while hours worked were a drag on the Index in September and October confidence measures and the sharemarket have held up well. (Westpac)

NEW ZEALAND Q3 PPI INPUT +1.6% Q/Q; Q2 +3.0%

NEW ZEALAND Q3 PPI OUTPUT +1.8% Q/Q; Q2 +2.6%

CHINA MARKETS

PBOC NET DRAINS CNY50BN VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) injected CNY50 billion via 7-day reverse repos with the rates unchanged at 2.2% on Wednesday. The operation has led to a net drain of CNY50 billion after offsetting the maturity of CNY100 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1801% at 09:45 am local time from the close of 2.0654% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 57 on Tuesday vs 48 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3935 WEDS VS 6.3924

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.3935 on Wednesday, compared with the 6.3924 set on Tuesday.

MARKETS

SNAPSHOT: Biden's Fed Pick Could Hit Over The Weekend

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 122.06 points at 29686.06

- ASX 200 down 50.537 points at 7369.9

- Shanghai Comp. up 10.668 points at 3532.455

- JGB 10-Yr future down 3 ticks at 151.63, yield down 0bp at 0.076%

- Aussie 10-Yr future down 2.5 ticks at 98.120, yield up 2.8bp at 1.860%

- U.S. 10-Yr future -0-01+ at 130-04, yield up 0.35bp at 1.637%

- WTI crude down $0.69 at $80.06, Gold up $2.32 at $1852.95

- USD/JPY up 9 pips at Y114.91

- BIDEN HINTS AT FED CHAIR PICK SOON AS SENATORS RUSH TO REACT (BBG)

- YELLEN: U.S. COULD HIT DEBT LIMIT ON DEC. 15 (CNBC)

- MANCHIN HAS 'A LOT OF CONCERNS' OVER TIMING OF BIDEN SPENDING PLAN (THE HILL)

- SECRETIVE CHINESE COMMITTEE DRAWS UP LIST TO REPLACE U.S. TECH (BBG)

- US ASKS CHINA TO RELEASE OIL RESERVES (SCMP)

BOND SUMMARY: Broader Based Moves

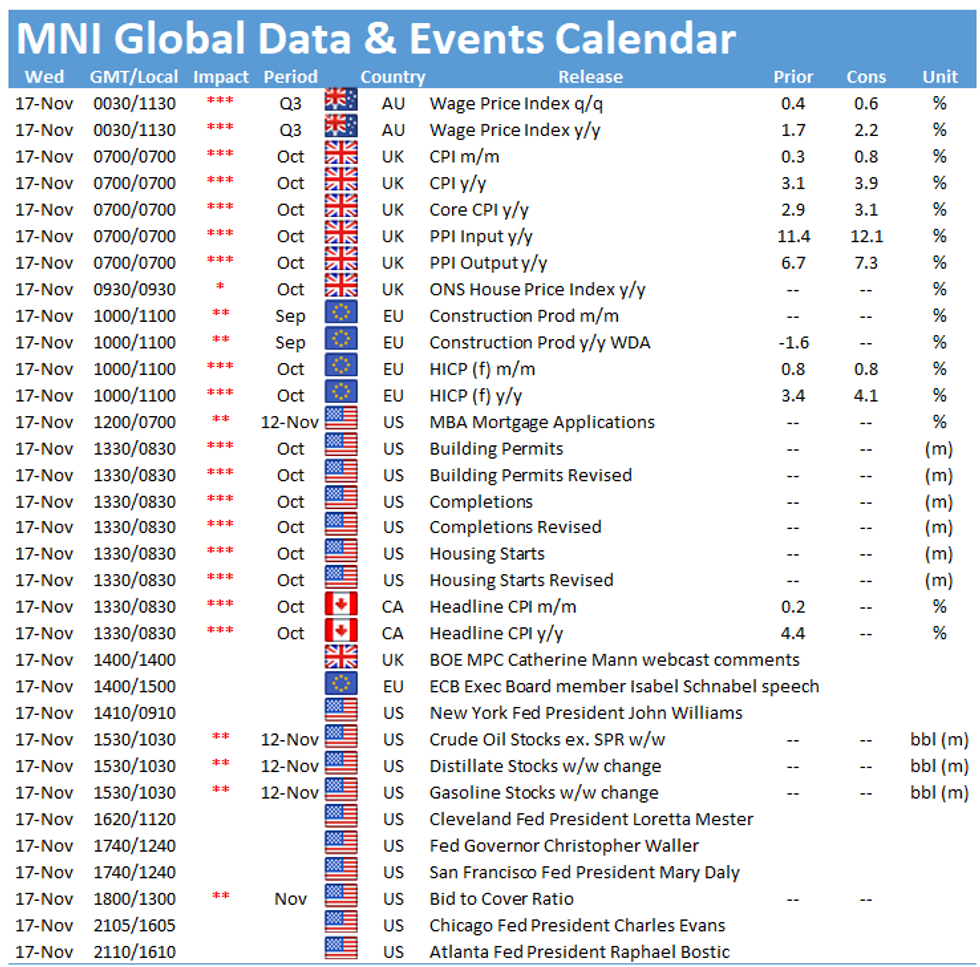

TYZ1 showed though Tuesday's low during Asia-Pac hours, before recovering from worst levels, to last print -0-01 at 130-04+, with the cash Tsy space running ~0.5bp cheaper across the curve at typing. An uptick in the USD helped to apply modest pressure. Macro headline flow was light overnight, with ACGB gyrations shaping early two-way price action. Wednesday's NY docket will see the release of housing starts and building permits data, 20-Year Tsy supply and Fedspeak from Williams, Bowman, Waller, Mester, Daly, Evans & Bostic.

- JGB futures tracked the broader impetus in core global FI markets, last -3. The major cash JGB benchmarks are -/+0.5bp on the day. The offer/cover ratios witnessed in the latest round of BoJ Rinban operations were as follows: 1- to 3-Year: 3.02x (prev. 2.83x), 5- to 10-Year: 1.84x (prev. 2.35x), 25+-Year: 4.15x (prev. 5.79x). This would have provided little, if any, trading impetus in the early part of the Tokyo afternoon.

- The ACGB space squeezed higher in the wake of Australia's Q3 wage price data, which failed to provide any upside surprise, printing in-line with broader expectations (+0.6% Q/Q, +2.2% Y/Y). The firming on the back of the in-line print was likely facilitated by the well-documented aggressive market positioning when it comes to the RBA hiking cycle (when compared to the Bank's own forward guidance). A reminder that the RBA has continually pointed to the likelihood that wages will need to rise by 3+% Y/Y to foster the inflationary outcome that it desires. The space eased away from highs as Tsys came under modest cheapening pressure and the impetus from the data release faded. The curve exhibited a twist steepening pattern, with YM +3.0 & XM -2.5. Pricing of A$700mn of 10-Year issuance from Australia Pacific Airports may have applied some pressure to XM.

BOJ: BoJ Makes Rinban Purchase Offers

The BoJ offers to buy a total of Y925bn of JGBs from the market:

- Y450bn worth of JGBs with 1-3 Years until maturity

- Y425bn worth of JGBs with 5-10 Years until maturity

- Y50bn worth of JGBs with 25+ Years until maturity

AUSSIE BONDS: The AOFM sells A$1.5bn of the 1.25% 21 May ‘32 Bond, issue #TB158:

The Australian Office of Financial Management (AOFM) sells A$1.5bn of the 1.25% 21 May 2032 Bond, issue #TB158:

- Average Yield: 1.9068% (prev. 1.7305%)

- High Yield: 1.9100% (prev. 1.7325%)

- Bid/Cover: 2.5033x (prev. 5.9000x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 7.5% (prev. 27.9%)

- Bidders 45 (prev. 48), successful 30 (prev. 18), allocated in full 21 (prev. 10)

EQUITIES: Asia-Pacific Equities Nudge Lower

The major Asia-Pac equity indices were little changed to modestly lower on Wednesday. Australia's ASX 200 was pressured by the banking sector after CBA's latest earnings report missed expectations. The latest uptick in U.S. Tsy yields will not have aided Asia-Pac equities. U.S. e-minis are little changed vs. settlement levels.

OIL: Crude A Little Softer In Asia, Joint Sino-U.S. Inventory Release Inbound?

A downtick in regional equities and a firmer USD combined to weigh on crude futures during Asia-Pac hours, leaving WTI & Brent ~$0.70 below their respective settlement levels. A shallower than expected build in headline crude stocks, per the latest API weekly estimate, provided no lasting impact on the space, with participants choosing to focus on the previously flagged headwinds, in addition to reports which pointed to the potential for a joint oil stockpile release between the U.S. and China (which the U.S. has seemingly pushed for, although China has not committed to such action, per the SCMP).

GOLD: Stagnant Overnight After Tuesday's Softening

Gold has looked through the latest leg of USD strength, which became evident in Asia-Pac hours, last dealing little changed, just above $1,850/oz.

- To recap, Tuesday saw a simultaneous uptick in the broader DXY and our weighted U.S. real yield monitor, which weighed on gold, dragging spot back from the fresh multi-month highs that were registered in the early part of the NY morning.

- Technical resistance remains intact at the June 14 high ($1,877.7/oz). A break there would expose the June 8 high ($1,903.8/oz). Initial support is seen at the Nov 10 low ($1,822.4/oz).

FOREX: Greenback Extends Gains, Aussie Gets Wounded By Wage Price Data

The DXY was on a tear, ripped through the 96.00 figure and printed a fresh 16-month high. The greenback was able to build on Tuesday's gains inspired by strong economic data released out of the U.S. Its most recent leg higher coincided with a dip in EUR/USD, which pierced the psychological $1.3000 level for the first time since mid-2020, with talk of the triggering of stop-loss orders doing the rounds.

- The AUD lagged behind all of its G10 peers after local Q3 wage price data failed to provide any upside surprise and matched consensus (+0.6% Q/Q & +2.2% Y/Y). The RBA had previously flagged that wages will need to rise at +3% Y/Y to generate the desired inflationary outcome.

- Across the Tasman, the NZD held firm as PM Ardern announced that the border around Auckland will be removed on Dec 15, in time for the Christmas period. 1-week implied volatilities of NZD crosses surged ahead of the RBNZ's monetary policy announcement scheduled for next Wednesday.

- Inflation data from the EZ, UK and Canada take focus from here. Central bank speaker slate features a slew of Fed, ECB, BoE & Norges Bank members.

FOREX OPTIONS: Expiries for Nov17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1390(E914mln), $1.1450-70(E735mln), $1.1490-05(E1.9bln)

- USD/JPY: Y115.00($558mln)

- EUR/GBP: Gbp0.8445(E839mln)

- AUD/USD: $0.7300(A$722mln)

- USD/CAD: C$1.2500($551mln), C$1.2540-50($905mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.