-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Fed's Bostic Flags Potential For Faster Taper

EXECUTIVE SUMMARY

- FED'S BOSTIC: FASTER TAPER WOULD GIVE FED OPTION FOR EARLIER HIKES (BBG)

- YELLEN SEES MONTHLY INFLATION BACK IN 0.2% RANGE LATER IN 2022 (BBG)

- CHINA IS LESS LIKELY TO CUT MLF RATE WITHIN THIS YEAR (DAILY)

- LORD FROST: MOVING AWAY FROM EU RULES IS 'NATIONAL NECESSITY' & UK MUST REDUCE TAXES (SKY)

- DELEGATES: OPEC+ MAY ADJUST PLANS IF STATE OIL STOCKS RELEASED (BBG)

Fig. 1: Spot Gold ($/oz)

Source: MNI – Market News/Deutsche Bank/Bloomberg

Source: MNI – Market News/Deutsche Bank/Bloomberg

UK

BREXIT: Moving away from EU rules is a "national necessity" and the UK must strive towards lower taxes to be successful, Brexit minister Lord Frost has said. The Conservative peer warned the UK "cannot carry on as before" and urged the country to "step up and compete at a global level" after leaving the European Union. n a speech at a Centre for Policy Studies conference on global trade, Lord Frost looked beyond his immediate post-Brexit task of easing tensions over border arrangements for Northern Ireland. He spoke of the importance of Britain's "divergence" from Brussels, warned against copying the "European social model", and also pointedly praised Chancellor Rishi Sunak's vision of lower taxes. (Sky)

BREXIT: Boris Johnson's Brexit negotiating strategy over Northern Ireland has been thrown into confusion after a cabinet minister ruled out a full scale confrontation with the EU before Christmas. Anne-Marie Trevelyan, the UK's international trade secretary, said it was "absolutely not" Britain's intention to trigger the Article 16 process, which overrides post-Brexit trade arrangements in Northern Ireland, in the coming weeks. Her comments confirmed an FT report last week that ministers wanted a Christmas "truce" to give UK and EU negotiators time to try to strike a compromise over the border arrangements in Northern Ireland. (FT)

POLITICS: Boris Johnson is facing calls from senior Tories to shake up his Downing Street team after a rambling speech at the CBI annual conference intensified concerns about policy missteps and deteriorating relations with MPs. The prime minister's disjointed address to business leaders on Monday stoked fears among Conservative MPs that he is struggling to cope with his workload and may require a stronger support network in Number 10. Johnson lost his place for about 30 seconds during his speech in South Shields, referenced the children's cartoon character Peppa Pig and imitated a petrol car. The Labour party described the speech as "shambolic". (FT)

EUROPE

ECB: The current spike in inflation is no reason for the European Central Bank (ECB) to rethink its interest rate policy, as inflation is still expected to slow towards the end of next year, ECB policymaker Klaas Knot said on Monday. "Interest rates will rise once inflation continues to exceed expectations in the time to come. But at the moment we have no reason to believe this will be the case", Knot said in an interview with Dutch TV programme Nieuwsuur. (RTRS)

GERMANY: Germany recorded a total of 45,326 new cases compared with 30,643 the day before, according to the country's public health authority RKI. (BBG)

FRANCE: French Prime Minister Jean Castex tested positive for Covid-19 in a breakthrough case, Agence France-Presse reported, citing his office. Castex, who met Belgian counterpart Alexander De Croo in Brussels Monday, will isolate for 10 days. (BBG)

FRANCE: Emmanuel Macron's approval rate is up 4 percentage points to 44% in comparison to a poll published Oct. 26, Odoxa says. 56% answered question if Macron is a good president with "no." It's Macron's highest approval rating in the poll since June 2018. Approval rate of Prime Minister Jean Castex is also up 4 ppts to 41% vs 58% disapproving, 1% not knowing. (BBG)

ITALY/BTPS: Italy plans to sell up to EU2.25 billion ($2.53 billion) of 0% bonds due Jan. 30, 2024 in an auction on Nov. 25. Italy plans to sell up to EU1 billion ($1.13 billion) of 0.4% inflation-linked bonds due May 15, 2030 in an auction on Nov. 25. (BBG)

U.S.

FED: Federal Reserve Bank of Atlanta President Raphael Bostic said the central bank may need to speed up its removal of monetary stimulus in response to strong employment gains and surging inflation, allowing for an earlier-than-planned increase in interest rates. "A faster taper would certainly give us more optionality as we move into 2022 and see sort of where the data takes us," Bostic said Monday in a Bloomberg Television interview with Kathleen Hays. "I definitely think it is appropriate for us to be talking about the pace of tapering and being open to a faster one." (BBG)

FED: MNI BRIEF: Powell - Committed to Fed's Jobs, Inflation Mandates

- Federal Reserve Chair Jerome Powell, during brief remarks following his appointment to a second term at the central bank's helm, said he's committed to both keeping inflation in check and bringing the economy to full employment. "We know that high inflation takes a toll on families, especially those less able to meet the cost of essentials," Powell said. "We will use our tools both to support the economy and a strong labor market and to prevent inflation from becoming entrenched" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: MNI BRIEF: Biden - Bipartisanship Played Role in Powell Pick

- U.S. President Joe Biden said Monday his decision to reappoint Republican Jerome Powell for a second term as chair was driven in part by a desire for continuity and stability and to avoid the impression of political bickering over the central bank. "I believe having Fed leadership with broad bipartisan support is important, especially now in a politically divided nation," Biden said in a speech announcing Powell's renomination along with the appointment of Governor Lael Brainard as the Fed's new vice chair - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: Brainard added she too was committed to putting working Americans at the centre of her agenda. "This means getting inflation down at a time when people are focused on their jobs and how far their paychecks will go," Brainard said. (RTRS)

FED: The U.S. Federal Reserve will have an important role to play over the longer term to ensure that inflation does not become "endemic," U.S. Treasury Secretary Janet Yellen told CNBC on Monday. Yellen acknowledged that most Americans are concerned about rising prices, but said she still believed most of the increase was due to pandemic-related logjams in supply chains, and expressed confidence that the surge in prices would subside. (RTRS)

FED: A Punchbowl reporter tweeted the following on Monday: "MCCONNELL is expected to support Powell's nomination, an aide told me." (MNI)

FED: Senator Elizabeth Warren said she'll vote against Jerome Powell's re-appointment to chair the Federal Reserve, but that she'll support Lael Brainard, whom President Joe Biden nominated for the central bank's No. 2 slot. "It's no secret I oppose Chair Jerome Powell's renomination, and I will vote against him. I will support the president's nomination of Lael Brainard as Vice Chair," the Massachusetts Democrat said in a statement Monday. (BBG)

FED: There are three vacancies on the Fed board that Biden has yet to fill. None of the board's current members are nonwhite, and just two -- Brainard and Michelle Bowman -- are women. Biden promised that "my additions will bring new diversity to the Fed, which is much needed and long overdue in my view," he said. One of the people the White House has vetted for a seat is William Spriggs, the chief economist for the AFL-CIO, according to two people familiar with the matter. Spriggs is Black. White House Press Secretary Jen Psaki told reporters the administration is "hoping to make decisions soon" on the three vacancies. (BBG)

ECONOMY: President Joe Biden is expected to discuss gas prices in the coming days, White House economic adviser Brian Deese says on Bloomberg TV. (BBG)

ECONOMY: Treasury Secretary Janet Yellen expects inflation to subside in the latter part of next year as more Americans get back to work, consumer demand shifts toward services and supply-chain issues abate. "I would expect monthly inflation rates to move down to levels consistent with 2% or thereabouts," Yellen said late Monday, participating virtually in a Greater Providence Chamber of Commerce event. She said she expects monthly gains in the consumer price index to come in around 0.2% or 0.3% in the second half of 2022. That would be a fraction of the 0.9% month-on-month surge recorded in October, when the annual rate hit 6.2% -- the fastest since 1990. Yellen said that's a result of the pandemic, and that she's confident in the newly appointed Federal Reserve team of Jerome Powell and Lael Brainaird to avert any return to 1970s type inflation. (BBG)

ECONOMY: Federal contractors will be guaranteed an hourly minimum wage of at least $15 in all new contracts with government agencies beginning on Jan. 30, 2022, the U.S. Department of Labor announced on Monday. President Joe Biden had signed the executive order lifting the hourly rate for federal contractors from $10.95 in April. The change is expected to impact some 327,000 workers, including food-service employees and nursing assistants who currently make less than $15 an hour. (CNBC)

CORONAVIRUS: The United States does not need to impose a lockdown or shut down its economy to curb the spread of Covid-19 and will rely on other tools, White House Covid-19 response coordinator Jeff Zients said on Monday (Nov 22). "We are not headed in that direction. We have the tools to accelerate the path out of this pandemic; widely available vaccinations, booster shots, kid shots, therapeutics," Mr Zients told reporters at a White House briefing. "We can curb the spread of the virus without having to in any way shut down our economy." (RTRS)

CORONAVIRUS: Over 90% of the more than 3.5 million federal workers covered by President Joe Biden's Covid vaccine mandate will have received at least one dose by the government's deadline, a senior administration official told CNBC on Monday. (CNBC)

CORONAVIRUS: New York City plans to be more aggressive in pushing vaccinations as the weather turns colder and people gather indoors. The city will have a "heavy, heavy focus on vaccination, heavy focus on youth vaccination, heavy focus on boosters," Mayor Bill de Blasio said Monday at a briefing. "If we keep doing that, we can protect the people of the city, we can make sure that we save lives, we can make sure that our hospitals are going to be OK." New York City hospitalizations for Covid-19 haven't seen the recent surges taking place in other parts of the state. (BBG)

CORONAVIRUS: Schools in New Jersey are seeing an increase Covid-19 cases in students K-12 and staff since the second week of November, according to Governor Phil Murphy and Health Commissioner Judy Persichilli. This surge in cases comes as the statewide transmission rate increases to 1.23, signaling an outbreak. More than 87,000 of children ages 5 through 11 are now vaccinated. In the last reporting period, schools reported 85.2% of staff were fully vaccinated, Persichilli said. "We are concerned about cases in students and staff and among the general public increasing with gatherings for Thanksgiving and the upcoming holidays," said Persichilli. (BBG)

OTHER

CENTRAL BANKS: MNI INTERVIEW: Smaller Central Banks Like BOE To Tighten Faster

- Smaller, open economies like the UK and Canada will tighten policy much more sharply than the Federal Reserve and European Central Bank, which are both years from raising interest rates, a former senior forecaster at the Bank of England and the Bank of Canada told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

GLOBAL TRADE: More than 20 House lawmakers are calling on the Biden administration to pursue a digital trade deal in the Indo-Pacific region, contending the initiative would help "expand American economic leadership and improve lives." (World Trade Online)

U.S./CHINA/TAIWAN: U.S. 7th Fleet destroyer USS Milius conducted a routine Taiwan Strait transit Nov. 23 local time through international waters, according to a statement from the U.S. 7th Fleet. The operation was in accordance with international law, demonstrating the U.S. commitment to a free and open Indo-Pacific. (BBG)

AUSTRALIA: The Resolve Political Monitor, conducted for The Sydney Morning Herald and The Age, showed that the net performance rating of Prime Minister Morrison fell 4pp to -9%, amid a deterioration in his key personal measures, despite a small uptick in the primary vote for the Coalition. Morrison's lead as the preferred Prime Minister over his chief rival and Labour leader Anthony Albanese narrowed to 11pp from 18pp in the previous survey. The gap between Prime Minister Morrison and Mr Albanese has halved since the launch of the Resolve Political Monitor in April, while Morrison's net performance rating sits at its lowest point since the survey began. The Coalition saw a marginal 1pp uptick in its primary vote to 39%, which coincided with a fall in Labour's primary vote to 32% from 34%. The change in support for the Coalition was a function of a recovery in the Nationals' support coupled with a slight decline in the Liberals' primary vote. According to Resolve director Jim Reed, "the Nationals lost some support in October around the time they were prevaricating about net zero, but that's bounced back to them very quickly as soon as they got their house in order." (MNI)

RBA: Australia's central bank will closely monitor risk premiums to judge whether asset prices appear "sensibly valued," especially at a time of record low interest rates, said Marion Kohler, head of the domestic markets department. "Asset prices increase when risk-free rates are low, and this is part of the monetary transmission mechanism," Kohler said in the text of a speech Tuesday. "While bank bond spreads are around their lowest level in over a decade, it's difficult to know whether this is not aligned with fundamentals." She also noted that measures of equity risk premiums were within their "typical range." (BBG)

RBNZ: In a new consultation paper on debt serviceability restrictions, the Reserve Bank assesses the impacts of introducing a debt-to-income (DTI) cap for borrowers of six or seven and a test interest rate floor for bank lenders of 7% or 8%, but stresses these are illustrative models and might not necessarily be where it would set such restrictions. The Reserve Bank is seeking feedback by 5pm on February 28 on the merits and design features of debt serviceability restrictions on residential mortgage lending. "We are not proposing to implement debt serviceability restrictions at this time, but we want to prepare for implementing them in case financial stability risks warrant it," Reserve Bank Deputy Governor Geoff Bascand says. (Interest NZ)

SOUTH KOREA: South Korea plans to chart out around 12.7 trillion won (US$10.7 billion) worth of support measures for pandemic-hit small merchants and vulnerable people with excess tax revenue and the state budget, the country's finance minister said Tuesday. The government will unveil a package of measures to support small merchants, including low interest rate loans and cuts in electricity bills, according to Finance Minister Hong Nam-ki. The measures will also include ways to stabilize inflation and back quarantine efforts. The country plans to spend 9.4 trillion won to support people working in sectors that have not been covered by a state compensation scheme. South Korea has launched a scheme to compensate small merchants for their losses that have been incurred by tough virus restrictions. But businesses like travel agencies and accommodations did not receive such financial support. (Yonhap)

SOUTH KOREA: Prime Minister Kim Boo-kyum has ruled out the possibility of a Cabinet reshuffle in the final months of the current administration amid rumors some Cabinet members could quit to run in next year's local elections. "It makes no sense," Kim said during his press meeting Monday in the central city of Sejong. "There are only six months left of this government's term, so how can we do a reshuffle?" Rumors have been circulating recently that Finance Minister Hong Nam-ki may run for Gangwon Province governor, while Education Minister Yoo Eun-hae is looking at the gubernatorial post of Gyeonggi Province in the local elections slated for June 2022. Kim also strongly denied rumors of him replacing Lee Jae-myung as the ruling Democratic Party's presidential nominee in the March presidential election if the candidate drops out of the race, saying it would be an "insult" to people. (Yonhap)

BOK: South Korea's central bank will raise interest rates on Thursday and carry a tightening cycle into next year as it tries to curb rising inflation and soaring home prices that have households piling on ever more debt, a Reuters poll found. Inflation in Asia's fourth-largest economy accelerated to nearly the highest in a decade in October, reinforcing the need for the Bank of Korea (BOK) to act now to prevent it from accelerating further. All but one of 30 economists in a Nov. 15-22 Reuters poll predicted the BOK would raise its base rate by 25 basis points to 1.00% at its Nov. 25 policy meeting. (RTRS)

MEXICO: Mexico's inflation is expected to reach 7% in December, a 20-year high that more than doubles the central bank's target, according to a Citibanamex survey of economists. Inflation has accelerated faster than expected, remaining around twice the central bank's 3% target, pressuring policy makers to increase borrowing costs even amid sluggish economic growth. Central bank board member Jonathan Heath said last week inflation is becoming a serious problem and that it would end the year between 7.1% and 7.3%, higher than the central bank's 6.8% forecast. (BBG)

BRAZIL: Brazil's fiscal deficit estimate for 2021 was reduced due to the country's growing expenses, Economy Ministry said said. Govt now sees fiscal deficit at 1.1% of estimate GDP for 2021, down from 1.6% previously. Gross debt seen at 81.9% of 2021 GDP and at 81.7% of 2022 GDP if Congress approves the court-ordered payments bill known as Precatorios. (BBG)

BRAZIL: Brazil's political party known as PSDB decided to conclude voting on the presidential primaries between Sao Paulo's governor Joao Doria and Rio Grande do Sul's Eduardo Leite by Sunday, Nov. 28, Folha de S.Paulonewspaper, citing a statement disclosed after the party's meeting with the two campaigns. (BBG)

RUSSIA: The U.S. imposed sanctions on a ship involved in completing the Nord Stream 2 gas pipeline as the Biden administration looks to exert more pressure on Russia while not antagonizing German leaders who are determined to see the project through. In a report sent to Congress on Monday, the administration designated Transadria Ltd., a Cyprus-based entity believed to be a Russian shell company, over pipeline work done by one of its ships, the Marlin, according to a statement from Secretary of State Antony Blinken. Another vessel, known as Blue Ship, was cited for its work on the almost-complete pipeline but not sanctioned because it belongs to an entity affiliated with the German government, according to a U.S. official who asked not to be identified. (BBG)

RUSSIA: The Biden administration is weighing sending military advisers and new equipment including weaponry to Ukraine as Russia builds up forces near the border and US officials prepare allies for the possibility of another Russian invasion, multiple sources familiar with the deliberations tell CNN. The discussions about the proposed lethal aid package are happening as Ukraine has begun to warn publicly that an invasion could happen as soon as January. The package could include new Javelin anti-tank and anti-armor missiles as well as mortars, the sources said. (CNN)

SOUTH AFRICA: South Africa's ruling African National Congress lost control of the nation's richest city as parties backed Mpho Phalatse from the main opposition Democratic Alliance as mayor of Johannesburg on Monday. The parties installed Phalatse after the ANC failed to secure an outright majority in the city, tallying 33.60% in the Nov. 1 local government elections. More than 60 local councils including major urban metropolitans did not have an outright winner. The DA won 26.1% and newly formed ActionSA, led by Herman Mashaba and hailed as a "king-maker" after its maiden election, got 16.1%. Mashaba, 62, was the mayor of Johannesburg from August 2016 to November 2019 when he was a DA member. (BBG)

SOUTH AFRICA: The Eskom Pension and Provident Fund's (EPPF's) chief investment officer is stepping down to pursue other interests. The EPPF said in a statement on Monday that Ndabezinhle Mkhize, who joined the state utility's pension fund in 2014, was stepping down at the end of November. Mkhize's contract will be coming to an end and he has elected to pursue interests outside the state utility's pension fund, the EPPF said. (Business Day)

MIDDLE EAST: The Saudi-led coalition in Yemen said on Tuesday it is launching air raids on "legitimate" Houthi military targets in the capital Sanaa, asking civilians not to gather around or approach potential targets, the state TV reported. The Houthis have repeatedly launched cross-border attacks on Saudi Arabia using drones and missiles since the coalition intervened in Yemen in March 2015 after the movement ousted the Saudi-backed government from the capital. (RTRS)

METALS: Iron ore climbed again on optimism easing curbs for China's troubled property sector will boost demand, while steel mills' profits are surging. Prices in Singapore have climbed about 17% in the three days after a string of announcements in China, from potential economic easing measures to expectations of more support for its property sector, buoyed sentiment. The country's central bank signaled possible easing measures to aid the economic recovery after a sharp downturn, while authorities are also looking to ease fund-raising rules for its beleaguered developers. "The market has higher expectations for steel production to resume," due to announcements regarding the property sector and a rebound in steel-mill margins, Huatai Futures Co. wrote in a note. Property is a key source of steel demand. (BBG)

OIL: OPEC+ officials warned they're likely to respond to plans by the world's largest oil consumers to release oil from their strategic stockpiles, setting up a fight for control of the global energy market. President Joe Biden is set to announce a plan to release reserves from the Strategic Petroleum Reserve on Tuesday in tandem with China, India, Japan and South Korea, according to officials briefed on the matter. The move, weeks in the planning, is designed to ease this year rise in fuel prices for drivers and businesses. OPEC+ delegates said the release of millions of barrels from the inventories of their biggest customers is unjustified by current market conditions and the group may have to reconsider plans to add more oil production when they meet next week. (BBG)

OIL: President Joe Biden is preparing to announce a release of oil from the nation's Strategic Petroleum Reserve in concert with several other countries as soon as Tuesday, according to people familiar with the plan. The move, likely in conjunction with India, Japan and South Korea, would be an unprecedented effort by major oil consumers to tame prices after OPEC+ countries rebuffed U.S. calls to significantly boost production. China said it's working to release some oil from its strategic reserves, days after the U.S. invited it to participate in a joint sale. The situation remains in flux and the plans could change but the U.S. is considering a release of more than 35 million barrels over time, according to two of the people. The pending announcement was described by people who requested anonymity prior to official statements. (BBG)

OIL: Nine House Democrats urge President Joe Biden to ban U.S. oil exports to combat rising fuel prices, CNN reports. "We must use all tools at our disposal to bring down gasoline prices in the short term," say the lawmakers, led by California Representative Ro Khanna, in letter to Biden. "A ban on US crude oil exports will boost domestic supply and put downward pressure on prices for American families." (BBG)

OIL: Nigeria's oil production outlook is under tremendous pressure, as technical and operational issues along with mounting security concerns are likely to persist over the short term, industry sources and analysts said Nov. 22. (Platts)

CHINA

PBOC: China's loan interest rate has limited downward room as the central bank kept the benchmark Loan Prime Rate unchanged for 19 consecutive months on Monday, the Shanghai Securities News reported citing analysts. The PBOC left out wording of "promoting a further reduction in actual loan interest rates" in its Q3 monetary policy report published last week, which may indicate that it is satisfied with the current interest level. That means it may work on facilitating finance channels to reduce financing costs instead of sharply cutting rates, the newspaper said citing Ming Ming, deputy research head of CITIC Securities. Though analyst Wang Qing with Golden Credit Rating said the interest rate of one-year LPR can still be cut by 0.05 to 0.1 percentage point should the central bank implement another RRR cut by the end of this year to encourage banks to boost lending, the newspaper said. (MNI)

ECONOMY: China's economic growth may slow to 3.9% in Q4, possibly followed by a 5.1% rebound in Q1 2022, given sporadic Covid-19 outbreaks, increased commodity prices, a power crunch, declined auto production and sales amid chip shortages, and other factors, the 21st Century Business Herald reported citing Liu Yuanchun, vice president of Renmin University. Liu expects the downward pressure will be greatly eased next year with the repositioning of macro policies and the full implementation of the 14th Five Year Plan. He expects 2022 GDP may register 5.5%, slightly higher than the country's potential growth rate, the newspaper said. Liu also noted that the full liberalization of epidemic controls in Western countries next year may lead to supply chain readjustment and largely impact China's imports and exports, while the Fed's gradual monetary tightening will also bring uncertainties, the newspaper said. (MNI)

FISCAL: Sales of local government bonds in China this year will exceed CNY7 trillion to set a record, compared to the previous high of CNY6.44 trillion in 2020 amid a great fiscal expansion to offset the pandemic impact, the 21st Century Business Herald reported, also noting that the local government debt ratio has reached 100%. The local debt expansion this year is mainly due to the large increase in refinancing bonds which rose by 53% y/y to CNY2.9 trillion, aiming to help resolve local governments' off-balance-sheet debts and roll over matured government bonds, the newspaper said. Meanwhile, local governments are intensively reporting new infrastructure projects for 2022, and the central government may front-load some of next year's special bond quota to help promote these projects so to stabilize economic growth, the newspaper said citing insiders. (MNI)

PROPERTY: Kaisa Group says the company repaid wealth management products due in October and November 2021 on Monday, according to a Wechat statement late Monday. Payment was made under its installment plan outlined earlier. Kaisa paid the interest and principal of Jinheng wealth management products in order by maturity and installment Kaisa plans to pay 10% of principal and interest in the month of maturity and to pay 10% of them every three months. Interest will not be paid before the maturity of principal. Co. will make the payment on the 20th of the month. Kaisa is actively selling its assets to repay the WMPs. (BBG)

POLICY: China's cyberspace regulator said on Tuesday it will more tightly regulate the online information of celebrities, including the publishing of their personal details and the placements of their advertisements on internet sites. (RTRS)

MARKETS: China is tightening approvals for quantitative hedge funds in the latest sign that officials are concerned about the potential market impact of trading driven by algorithms after a year of rapid asset expansion. (BBG)

OVERNIGHT DATA

AUSTRALIA NOV, P MARKIT MANUFACTURING PMI 58.5; OCT 58.2

AUSTRALIA NOV, P MARKIT SERVICES PMI 55.0; OCT 51.8

AUSTRALIA NOV, P MARKIT COMPOSITE PMI 55.0; OCT 52.1

The Australian economy grew at a faster pace in November, according to the IHS Markit Flash Australia Composite PMI, and this is reflective of the positive effects from the continued easing of COVID-19 restrictions and decline in new cases. The rate of expansion picked up to a five-month high, indicating that the Australian economy continued to enjoy the strengthening of growth momentum. That said, supply chain issues featured strongly in the Australian PMI survey as delivery times lengthened, widespread shortages were reported and price increases continued to be seen. While some of these can be attributed to the presence of pent-up demand that was reported, it will be worth watching if the constraints clear over time. Overall business confidence improved in the latest survey and this was a very positive sign. Private sector firms were also more willing to expand their workforce capacity, though instances of labour shortages had continued to surface. (IHS Markit)

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 107.4; PREV. 106.0

Consumer confidence rose 1.3% last week as the nation inched closer to normalcy, with Victoria easing all COVID restrictions for the fully vaccinated. Close to 85% of those aged 16 and above across Australia had been fully vaccinated by last week. Confidence increased 4.9% in Victoria, 2.0% in Western Australia and 1.7% in Queensland, while it dropped -1.1% in New South Wales and -0.5% in South Australia. Inflation expectations decreased 0.4ppt to 4.6% last week despite petrol prices hovering around record highs. This indicator can be volatile from week-to-week, so we are cautious about overreacting to one survey reading. If the fall in inflation expectations is sustained, however, it may be an important signal for wages growth. (ANZ)

NEW ZEALAND Q3 RETAIL SALES EX INFLATION -8.1% Q/Q; MEDIAN -10.5%; Q2 +3.3%

SOUTH KOREA NOV CONSUMER CONFIDENCE 107.6; OCT 106.8

SOUTH KOREA Q3 HOUSEHOLD CREDIT KRW1,844.9TN; Q2 KRW1,808.2TN

CHINA MARKETS

PBOC INJECTS CNY50BN VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY50 billion via 7-day reverse repos with the rate unchanged at 2.2% on Tuesday. This keeps the liquidity unchanged after offsetting the maturity of CNY50 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1545% at 09:45 am local time from the close of 2.0962% on Monday.

- The CFETS-NEX money-market sentiment index closed at 60 on Monday vs 44 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3929 TUES VS 6.3952

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3929 on Tuesday, compared with 6.3952 set on Monday.

MARKETS

SNAPSHOT: Fed's Bostic Flags Potential For Faster Taper

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 is closed

- ASX 200 up 57.522 points at 7410.6

- Shanghai Comp. up 10.369 points at 3592.955

- JGBs are closed

- Aussie 10-Yr future down 7.5 ticks at 98.115, yield up 7.5bp at 1.867%

- U.S. 10-Yr future -0-04 at 129-28, cash Tsys are closed

- WTI crude down $0.74 at $76.02, Gold up $3.58 at $1808.14

- USD/JPY up 21 pips at Y115.10

- FED'S BOSTIC: FASTER TAPER WOULD GIVE FED OPTION FOR EARLIER HIKES (BBG)

- YELLEN SEES MONTHLY INFLATION BACK IN 0.2% RANGE LATER IN 2022 (BBG)

- CHINA IS LESS LIKELY TO CUT MLF RATE WITHIN THIS YEAR (DAILY)

- LORD FROST: MOVING AWAY FROM EU RULES IS 'NATIONAL NECESSITY' & UK MUST REDUCE TAXES (SKY)

- DELEGATES: OPEC+ MAY ADJUST PLANS IF STATE OIL STOCKS RELEASED (BBG)

BOND SUMMARY: TYZ1 Through Tech Support As Bostic Flags Potential For Quicker Taper

Comments from Atlanta Fed President Bostic ('21 FOMC voter) hit during the NY-Asia crossover. Bostic pointed to the potential for a faster tapering process (the latest Fed official to sing from that hymn sheet), which he noted would afford the central bank wider optionality. Still, Bostic flagged that further progress on the labour market front would add to the case for a faster taper, while highlighting the lingering risks stemming from COVID. Bostic's comments seemingly applied some delayed pressure to Tsy futures, although the lack of cash Tsy trade until London hours, owing to a Japanese holiday, may have limited broader activity/the scope of the move. TYZ1 last -0-04+ at 129-27+, 0-02 off the lower boundary of its 0-07 overnight range, with the pressure pushing the contract through the bear trigger (Oct 21 low of 129-31), which allows bears to switch focus to the 50% retracement of the Oct '18 to Mar '20 bull cycle (129-03). Broader macro headline flow was light at best. Flash PMIs from across the globe will headline ahead of NY hours, while the Thanksgiving-related front-loaded supply will continue, with 7-Year Tsy & 2-Year FRN supply due.

- JGBs were closed as Japan observed a national holiday.

- The dip in U.S. Tsy futures failed to provide any notable pressure to the Aussie bond space, with bears unable to force a retest of the early Sydney lows which came on the back of local reaction to the U.S. Tsy-driven overnight session weakness. YM closed -5.0, while XM closed -7.5. The 7- to 12-Year zone of the cash ACGB curve presented the weak point. There hasn't been anything in the way of notable idiosyncratic news flow to digest today.

AUSSIE BONDS: The AOFM sells A$150mn of the 0.25% 21 Nov ‘32 I/L Bond, issue #CAIN416:

The Australian Office of Financial Management (AOFM) sells A$150mn of the 0.25% 21 November 2032 I/L Bond, issue #CAIN416:

- Average Yield: -0.1892%

- High Yield: -0.1700%

- Bid/Cover: 1.5333x

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 88.9%

- Bidders 23, successful 19, allocated in full 17

EQUITIES: Mixed Fortunes

E-minis stabilised overnight after the impulse from higher U.S. real rates pressured the space into the close on Monday. The Hang Seng was the biggest mover, shedding ~1%, as fallout from Monday's tech-led weakness in the U.S. equity space, coupled with the potential for greater tax burdens for Chinese online platforms (per comments from state-owned media outlets), weighed on the tech space. The ASX 200 benefitted from strength in energy and material names, with M&A activity surrounding BHP Billiton & Woodside supporting the former, while a rebound in iron ore prices (on hopes for looser restrictions and support for the Chinese property sector) supported the latter. Japanese markets were closed as Japan observed a national holiday.

OIL: A Little Softer In Asia

WTI & Brent crude futures sit ~$0.50 below their respective settlement levels, with the spectre of a multilateral inventory release from some of the major oil consuming nations, led by the U.S., weighing overnight (note that BBG has suggested that a formal announcement of such a move could come as soon as today). Monday saw the space make incremental gains, aided by a BBG sources piece, which cited OPEC+ delegates, who "warned they're likely to respond to plans by the world's largest oil consumers to release oil from their strategic stockpiles." Further afield, the weekly API inventory estimate will provide interest after hours on Tuesday.

GOLD: Biden's Powell Pick Applies Pressure

A narrow Asia-Pac session for spot gold sees the benchmark trade a handful of dollars higher on the day, last printing just above $1,805/oz. To recap, Monday saw U.S. President Biden offer Fed Chair Powell the chance to serve a second term atop the central bank, triggering broader USD strength and a rally for our weighted U.S. real yield monitor, which weighed on gold (note that Powell was deemed the more hawkish when compared to his main challenger, Lael Brainard). Spot gold threatened to test $1,800/oz on Monday, but never quite got there. After moving through near-term support levels, a break through yesterday's low ($1,802.4/oz) would expose key support in the form of the Nov 3 low ($1,759.0/oz). Bulls need to reclaim yesterday's high ($1,849.1/oz) to regain some control.

FOREX: USD/JPY Pierces Y115.00 Amid Holiday-Thinned Liquidity, Iron Ore Rally Aids AUD

The break lower in U.S. Tsy futures lent some further support to the USD, which coincided with a leg higher in USD/JPY. The pair pierced the Y115.00 figure for the first time since '17 as a result. Many have been linking these moves to the comments from Atlanta Fed Pres Bostic, who became the latest Fed member to flag the potential for a quicker pace of tapering. Worth mentioning that Japanese markets were closed in observance of a public holiday, which means that JPY crosses were subject to thinner liquidity.

- NZD/USD retreated to a fresh multi-week low, as the kiwi dollar showed some broad-based weakness, even as the contraction in New Zealand's retail sales was shallower than expected. The proximity of the RBNZ's monetary policy decision likely played a role here, as participants prepared for tomorrow's announcement. NZD/USD overnight implied volatility leapt to its highest point since Oct 5.

- AUD/USD recouped a dip driven by aforementioned greenback strength, as a surge in iron ore futures, which were aided by optimism surrounding Chinese demand. Antipodean divergence continued to unfold and AUD/NZD advanced towards its 50-DMA.

- Today's yuan fixing was softer than expected, with the central USD/CNY mid-point set 25 pips above sell-side estimate. Offshore yuan was unfazed and traded on a slightly firmer footing.

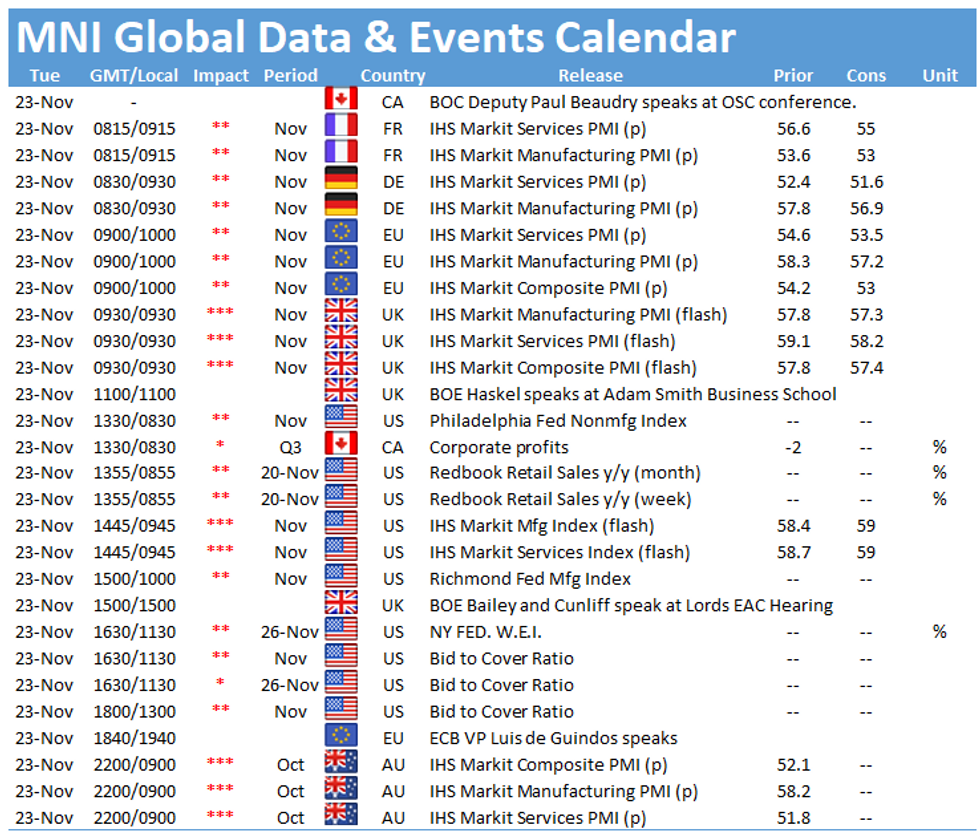

- A flurry of PMI readings from across the globe headline today's data docket. Speeches are due from BoE's Bailey, Cunliffe & Haskel, ECB's Makhlouf & de Guindos as well as BoC's Beaudry.

FOREX OPTIONS: Expiries for Nov23 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1220(E767mln), $1.1340-55(E914mln), $1.1595-00(E1.7bln)

- USD/JPY: Y114.20($840mln)

- AUD/USD: $0.7310-25(A$622mln), $0.7350-60(A$651mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.