-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US CPI Preview: Setting The Tone For 2025

MNI ASIA MARKETS OPEN: NY Fed Inflation Expectations Gaining

MNI ASIA MARKETS ANALYSIS: Tsy Ylds Drift Higher Ahead CPI/PPI

MNI EUROPEAN MARKETS ANALYSIS: Fresh Multi-Year Lows For USD/CNH

- Most of the major equity indices moved higher in Asia, save the Hang Seng, which struggled on the back of worry re: a clampdown on offshore financing for Chinese tech startups.

- USD/CNH printed fresh multi-year lows.

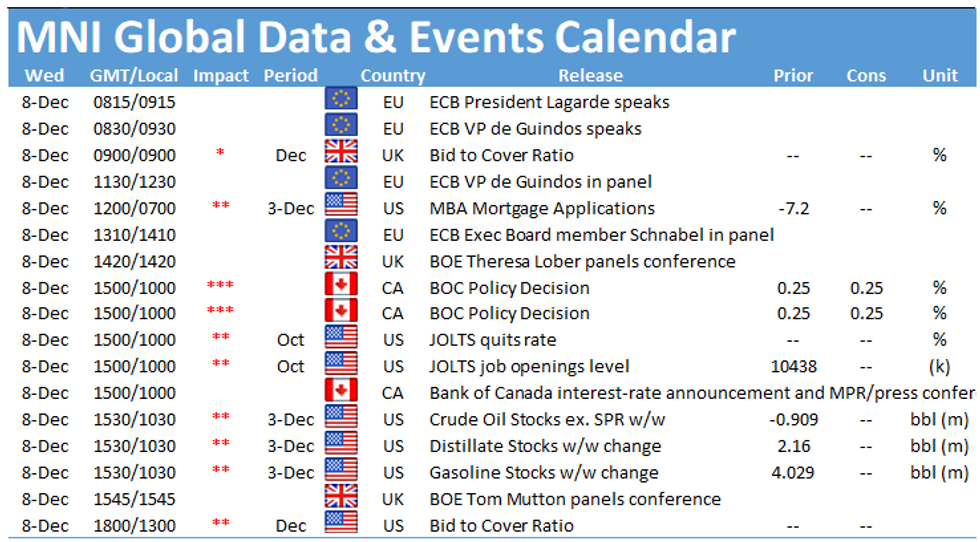

- The BoC will deliver their monetary policy decision today, while speeches are due from ECB's Lagarde, de Guindos & Schnabel.

BONDS: Core FI Firms A Little In Asia

U.S. Tsys garnered an early, modest bid in Asia-Pac trade, aided by Australia declaring a political boycott of the Beijing Winter Olympics & some cross-market spill over from strong ACGB supply. Still, firmer regional equities & e-minis tempered the bid (on hopes re: the severity of omicron and the Chinese policy easing dynamic). That leaves TYH2 +0-02+ at 130-13, off the peak of its 0-06+ overnight range. Cash Tsys run 0.5-1.5bp richer across the curve. 10-Year Tsy supply headlines the U.S. docket on Wednesday, with JOLTS job data also due.

- JGB futures hit the bell +3. The contract showed lower at the re-open on the broader impulse witnessed in U.S. Tsys overnight (JGB futures once again experienced a relative degree of resilience in overnight trade), before edging away from worst levels. Cash JGBs were flat to 1.0bp richer when compared to yesterday’s closing levels, with 5s lagging ahead of tomorrow’s 5-Year JGB auction. Local news flow has been limited in the grander scheme of things, with comments from Cabinet Secretary Matsuno and BoJ Deputy Governor Amamiya pointing to continued caution re: the omicron COVID strain, with a lack of notable, fresh information evident re: their respective policy areas. BoJ Rinban operations saw the following offer/cover ratios: 1- to 3-Year: 3.60x (prev. 3.36x), 5- to 10-Year: 1.62x (prev. 2.80x).

- Aussie bond futures moved away from their early Sydney lows through the day, aided by the aforementioned Australian diplomatic boycott of the Chinese winter Olympics and well-received ACGB supply. Today’s ACGB Nov-31 auction saw the weighted average yield price 0.85bp through prevailing mids (per Yieldbroker), while the cover ratio printed at a more than solid 4.48x. This was a firm auction by recent standards. The former was supported by well-known background matters (negative RBA-adjusted net supply, international relative value appeal and record levels of excess liquidity in the domestic banking system), while the latter was likely boosted by the fact that this is the final AOFM ACGB auction of calendar ’21. A quick reminder that this line showed up as borrowed via the RBA’s SLF earlier this week (~A$220mn), although this retreated back to A$0 as of Tuesday. A widening collateral shortage may have boosted demand. Elsewhere, the Christmas issuance hiatus will result in a deepening of the negative RBA purchase-adjusted dynamic (see auction preview bullet for more on that). This may have provided another source of demand at the auction. A spike higher in futures was observed later in the session (no headline flow apparent), with the contracts going out near late Sydney highs as the curve twist flattened, YM -0.5 & XM +2.5. Some bad execution in the IB strip skewed the optics re: RBA rate hike pricing (see earlier bullet for more on that), while the bid in bonds dragged the IR strip off lows. A reminder that STIRS & YM saw overnight/early Sydney pressure on the back of the previously flagged hawkish article from RBA watcher Terry McCrann.

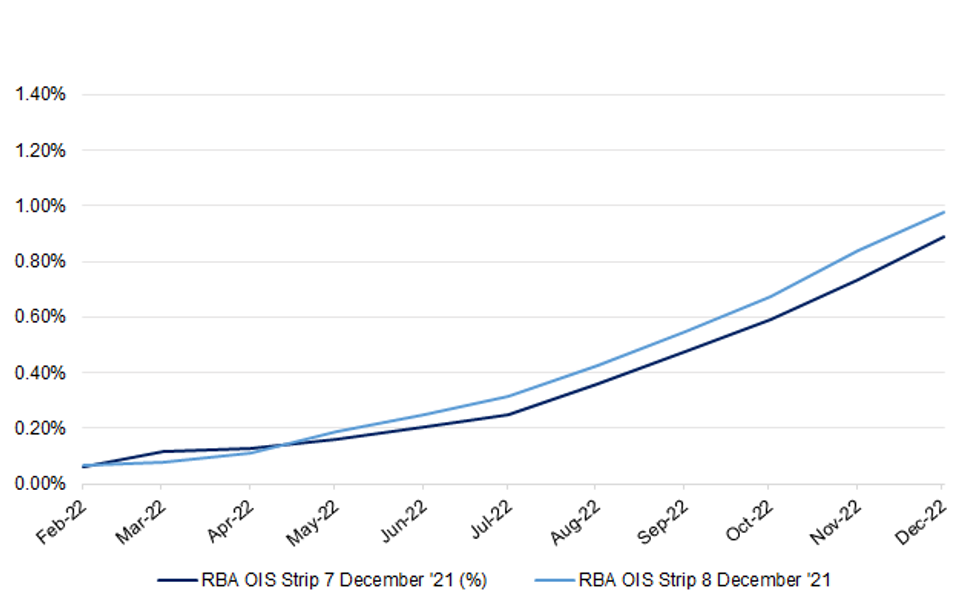

STIRS: Bad Execution Explains Odd IBG2 Print

A couple of questions have been received re: IBG2 contract activity this morning, with the contract last trading at 99.835. That looks like bad execution in a thin market shortly after the re-open. The bid/offer spread was 10bp wide at the time, with 1 lot trading there. The market has been quoted 99.925/99.935 for ~5 hours. A price of 99.835 implies an effective cash rate of 16.5bp come the end of February, a full 12.5bp above current levels, which would almost fully price a 15bp cash rate hike at the RBA’s February meeting. A reminder that the IB strip has softened a touch on the back of the previously flagged Terry McCrann article, which suggested that “after the latest RBA board meeting it is clear Australia is moving closer to a rate rise, not just potentially in 2023 but possibly even relatively early next year. Note that the OIS strip now prices ~15bp of tightening come the end of the Bank’s May ’22 decision, with McCrann’s article helping push OIS rates higher from May ’22 to further out the strip (albeit only incrementally for the May decision).

RBA OIS Strip Pricing 7 December ’21 Vs. 8 December ‘21

Source: MNI - Market News/ASX/Bloomberg

Source: MNI - Market News/ASX/Bloomberg

FOREX: Greenback Softens, Yuan Rallies In Risk-Positive Environment

Offshore yuan surged to its best levels since 2018 on the back of expectations of further policy easing out of China and improving global risk environment. Fresh headline flow failed to provide much in the way of notable catalysts in Asia-Pac hours, with familiar risk-on factors taking centre stage as a result.

- The DXY retreated as the greenback underperformed all of its G10 peers. Cash U.S. Tsy yields fell across the curve amid improving market sentiment.

- AUD and NOK gained some ground, while NZD and CAD struggled. The Antipodean cross AUD/NZD printed its best levels since Oct 29.

- The BoC will deliver their monetary policy decision today, while speeches are due from ECB's Lagarde, de Guindos & Schnabel.

FOREX OPTIONS: Expiries for Dec08 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1290-05(E522mln), $1.1350-60(E572mln)

- USD/JPY: Y113.00-05($563mln), Y113.80($524mln), Y114.25($550mln)

- USD/CNY: Cny6.3300($910mln), Cny6.4000-10($1.2bln)

ASIA FX: Baht Leads Gains, Yuan Hits Best Levels Since 2018

Further moderation in concern over the Omicron coronavirus variant and the prospect of more supportive measures from China's policymakers underpinned a risk-on environment, applying pressure to most USD/Asia crosses.

- CNH: Offshore yuan went bid and surged to its best levels since 2018, as aforementioned risk-on factors overshadowed the latest goings-on surrounding China's troubled real estate sector and the escalating diplomatic boycott of 2022 Beijing Olympics.

- KRW: Easing sense of concern about the Omicron variant outweighed the deterioration in the local Covid-19 situation. The won was in demand, even as South Korea's daily cases surpassed 7,000 for the first time, while critical cases hit another record high.

- IDR: Spot USD/IDR retreated, with broader market sentiment in the driving seat. Indonesia's official consumer confidence index rose to the highest point since Jan 2020.

- MYR: USD/MYR retreated in tandem with most USD/Asia crosses. Domestic news coverage focused on the announcement from Malaysia's Court of Appeals, which upheld the guilty verdict against former PM Najib in 1MDB case.

- THB: The baht led gains in Asia EM space on dissipating Omicron angst. PM Prayuth played down potential for another lockdown, allowing the local business community to breathe a sigh of relief.

- PHP: Philippine markets were shut in observance of a public holiday.

EQUITIES: Mostly Bid In Asia

Regional equity indices & U.S. e-mini futures have mostly traded higher, as the impact of reduced worry re: the mortality threat posed by omicron and the combination of realised/potential for further policy easing in China continues to filter through into markets. A positive lead from Wall St. also helped set the tone for Asia-Pac trade, with the Nikkei 225, CSI 300 & ASX 200 all adding over 1%. The exception to the broader rule was the Hang Seng, which logged incremental losses as reports pointed to the impending tightening of restrictions when it comes to offshore financing for new Chinese tech firms (note that this isn’t a new concept). U.S. e-mini futures added 0.2-0.4%.

GOLD: Jobbing The Range

Spot last deals a handful of dollars higher at $1,790/oz, sticking to a tight range in Asia-Pac hours. Gold has firmed at the margin over the last 24 hours or so, with our weighted U.S. real yield monitor moving a little lower over that horizon (within the confines of the recent range), while the DXY’s move away from Tuesday’s peak allowed gold to build a base. Familiar technical parameters remain in place, with broader focus on Friday’s U.S. CPI reading.

OIL: Tight In In Asia

A tight range for WTI & Brent crude futures in Asia-Pac hours, with both operating ~$0.25 below their respective settlement prices after pulling back from best levels during Tuesday’s NY session.

- There wasn’t much, if any, trading impulse in the wake of the weekly API inventory estimates. The release reportedly revealed a larger than expected drawdown in headline crude stocks, alongside a build in stocks at the Cushing hub, a larger than expected build in gasoline stocks and a shallower than expected build in distillate stocks.

- Matters surrounding the omicron COVID strain remain in the driving seat when it comes to intraday price movements.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.