-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK-German Defence Stimulus: Analyst Views

MNI BRIEF: Canada Budget Office Says Trade War Cuts Output 2%

MNI POLITICAL RISK -Trump Notes Possible Tariff "Disturbances"

MNI EUROPEAN MARKETS ANALYSIS: No Catalysts Overnight, Although Some Small Moves Were Seen

- Asia seemed happy to sell into 20-Year auction-inspired Tsy strength.

- AUD NZD softened a little overnight.

- The broader docket is thin on Wednesday.

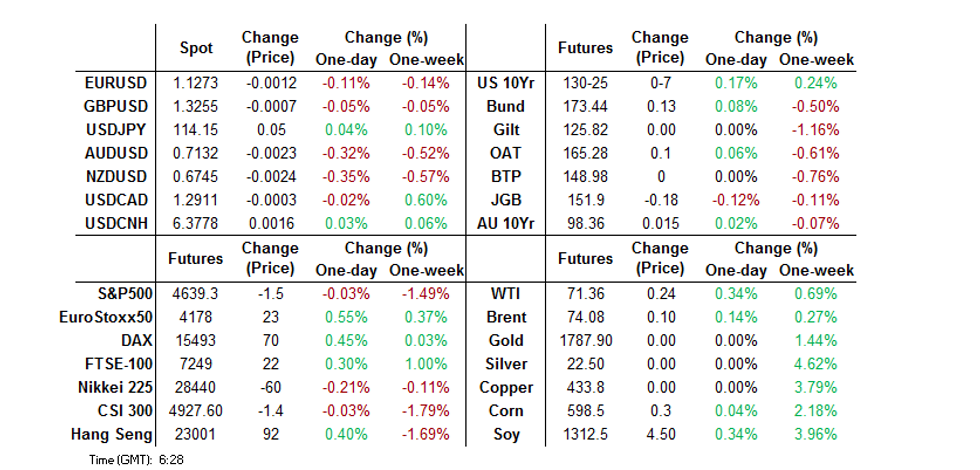

BONDS: Collateral Shortage Impacts AU Bonds, Tsys Fade From Best Levels

The early Asia Tsy bid has faded, leaving TYH2 +0-06 at 130-24, with cash Tsys dealing 0.5bp richer to 1.0bp cheaper across the major benchmarks, as the curve comes under some light twist steepening pressure. Headline flow remains light, Asia-Pac cash traders have seemingly been willing to sell into the late NY/early Asia 20-Year Tsy auction-inspired strength.

- In Australia, YM & XM finished at best levels, +7.5 & +1.5 respectively. The well-documented collateral shortage is seemingly impacting price action in YM as markets thin out ahead of Christmas, with the early twist steepening giving way to bull steepening. Some spill over from the U.S. Tsy space likely provided the initial impetus for the bid.

- JGB futures nudged higher at the Tokyo re-open, given the recovery from NY lows in U.S. Tsys, before pressure came back in as core fixed income markets softened. This pushed JGB futures below their overnight trough, hitting closing bell -18, a little above worst levels, while cash JGBs sit little changed to 1.5bp cheaper, with the belly leading the weakness, mimicking Tuesday’s developments on the U.S. Tsy curve and reflecting a bit of a futures driven move. Local headline flow has been modest, with stale minutes from the BoJ’s October meeting and familiar speculation re: the government’s GDP exp. & FY22 budget proposals doing the rounds.

FOREX: Antipodeans Bring Up The Rear In Asia

Participants continue to headline watch ahead of the Christmas break. There hasn’t been much in the way of notable news flow to decipher since Asia-Pac trade got underway, outside of Singapore tightening international access over the next month or so. The city state has noted that it will freeze all new ticket sales for flights and buses under its programme for quarantine-free travel.

- NZD & AUD have ticked downwards (AUD/USD & NZD/USD are ~20 pips lower on the day), with S&P 500 & NASDAQ 100 e-minis a touch lower on the session. Note that e-minis are off worst levels (which were printed ahead of the Singapore travel headlines), while AUD & NZD already traded lower pre-Singapore news, so we can’t really suggest that the headlines were a driver of the aforementioned moves.

- USD/JPY has traded either side of Y114.00, last +5 pips or so on the day, printing Y114.15. Note the rate was capped on Tuesday as long end U.S. Tsy yields topped out on the back of a well-received round of 20-Year U.S. Tsy supply, with subsequent spill over observed in early Asia dealing, before modest weakness crept back into Tsys, supporting the cross. The Dec 15 high (Y114.26) continues to present the initial technical resistance level, with the 61.8% & 76.4% retracements of the Nov 24-30 downleg (Y114.38 & Y114.81) layered in above there. Initial support comes in at the Dec 17 low (Y113.14). Our technical analyst notes that a break of the aforementioned Dec 15 high would allay developing bearish concerns. Wednesday’s Asia-Pac session is bereft of any notable tier 1 data release, which will leave headline flow at the fore.

- The USD is marginally firmer vs. the remainder of its G10 peers.

- There aren’t any tier 1 risk events on the broader docket on Wednesday.

FX OPTIONS: Expiries for Dec22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1190-05(E1.0bln), $1.1245-50(E939mln), $1.1280-00(E891mln), $1.1335-50(E1.3bln)

- GBP/USD: $1.3245(Gbp659mln), $1.3265-90(Gbp1.1bln)

- USD/JPY: Y113.00($638mln), Y113.45-50($870mln), Y113.70-85($711mln)

EQUITIES: Equities Little Changed

The major Asia-Pac regional equity indices sit flat to marginally higher at typing, aided by the positive lead from Wall St. Regional COVID worry e.g. further limitations surrounding entry to Singapore, have perhaps limited follow through after Tuesday’s Wall St. bid, with broader macro headline flow modest at best. U.S. e-minis are flat to a touch lower.

GOLD: Flat In Asia

Spot gold is flat, hovering around $1,790/oz at typing. Our weighted U.S. real yield monitor topped out ahead of Tuesday’s U.S. 20-Year Tsy auction, which allowed gold to form a base. The well received round of Tsy supply then allowed gold to nudge away from session lows. Note that spot traded in a ~$1,785-$1,800/oz range on Tuesday, with familiar technical parameters remaining untouched throughout. Thursday’s U.S. PCE release headlines the docket during the remainder of the week and may provide some impetus for bullion dealers.

OIL: Incrementally Higher In Asia

WTI & Brent crude futures sit ~$0.30 & ~$0.20 above their respective settlement levels at typing.

- This comes after the weekly API inventory estimates revealed a slightly deeper than expected drawdown in headline crude stocks, accompanied by a larger than expected build in gasoline stocks, a modest, surprise drawdown in distillate stocks and a build in stocks at the Cushing hub. The net immediate impact of the release was a very modest downtick for crude.

- A reminder, this comes after a turnaround Tuesday, in terms of risk appetite, which allowed the two benchmarks to add ~$2.50 come settlement time.

- Weekly DoE inventory data out of the U.S headlines on Wednesday.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/12/2021 | 0700/0700 | * |  | UK | Quarterly Current Account Balance |

| 22/12/2021 | 0700/0700 | *** |  | UK | GDP Second Estimate |

| 22/12/2021 | 0700/1500 | ** |  | CN | MNI China Liquidity Survey |

| 22/12/2021 | 0745/0845 | ** |  | FR | PPI |

| 22/12/2021 | 0800/0900 | ** |  | ES | PPI |

| 22/12/2021 | 0830/0930 | ** |  | SE | PPI |

| 22/12/2021 | 0830/0930 | ** |  | SE | Retail Sales |

| 22/12/2021 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 22/12/2021 | 1330/0830 | *** |  | US | GDP (3rd) |

| 22/12/2021 | 1500/1000 | *** |  | US | NAR Existing Home Sales |

| 22/12/2021 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 22/12/2021 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 22/12/2021 | 1800/1300 | ** |  | US | US Treasury Auction Result for TIPS 5 Year Note |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.