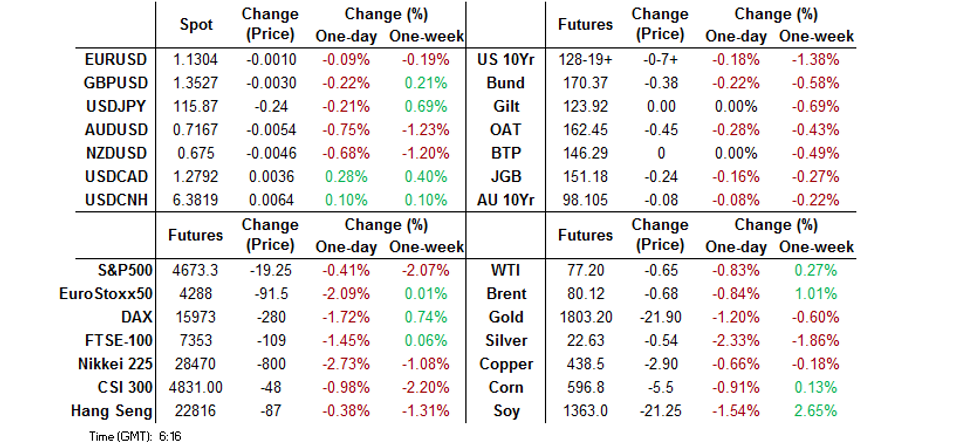

-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Equities Lower & U.S. Tsys Cheapen Further Overnight

- Asia trade was driven by spill over from the release of the FOMC's Dec meeting minutes. To recap, the minutes pointed to the potential for swifter than expected rate liftoff and a more aggressive, earlier balance sheet reduction.

- This allowed Tsys to extend on Wednesday's weakness, while the JPY sat atop the G10 FX table and equities sold off.

- On the data front, focus turns to German factory orders as well as U.S. ISM Services, trade balance & weekly jobless claims. Speeches are due from Fed's Bullard & Daly.

BOND SUMMARY: Tsys Drag Core FI Lower As Post-FOMC Mins Move Extends

TYH2 -0-08+ at 128-18+, at the base of the 0-13+ Asia range, running on nearly 200K lots. This came as Tsys extended on their post-Dec FOMC meeting minute weakness during Asia-Pac hours as the curve bear flattened, with the major cash Tsy benchmarks running 1.5-3.0bp cheaper into European hours. All of the major U.S. Tsy yield benchmarks have moved above their respective Wednesday peaks. Headline flow remained light, with regional follow through from the release of the FOMC minutes outweighing early dip buying & support from lower equity markets (with the resumption of the cheapening move in Tsys eventually fuelling further equity weakness). Regional COVID worry failed to facilitate meaningful support (participants are more at ease, given the apparent diminished severity that the Omicron strain offers), while stronger than expected Caixin services PMI data didn’t seem to provide any notable market reaction. On the flow side, a burst of TY screen selling added to the broader weakness, while downside exposure was sought via a block buy of TYG2 128.50 puts (+5K). The ISM services survey tops the NY docket. Thursday’s Fedspeak will consist of addresses from St. Louis Fed President Bullard (’22 voter) & San Francisco Fed President Daly (’24 voter).

- The second burst of Tsy weakness weighed on JGB futures, after the weakness in the Nikkei 225 provided some relief. That allowed the contract to take out its early Tokyo lows, ending the day at worst levels, -30. The major cash JGB benchmarks are flat to ~2bp cheaper at typing, with the 7- to 20-Year zone leading the weakness. Cash 10-Year JGB yields have moved above 0.10%, printing at the highest level since early November in the process (0.121% provides the next point of technical resistance on that front). The BoJ continued to administer JGB repo operations as it looks to manage cash and collateral levels in the system. The latest round of BoJ Rinban operations drew the following offer/cover ratios: 1- to 3-Year: 2.41x (prev. 3.01x), 3- to 5-Year: 3.28x (prev. 2.10x), 10- to 25-Year: 3.19x (prev. 3.27x).

- The Aussie bond space remained happy to track broader gyrations, with a lack of meaningful domestic news flow evident. YM was 5.5 cheaper, with XM 8.0 worse off come the bell. The 7- to 12-Year zone provided the weak point on the cash ACGB curve.

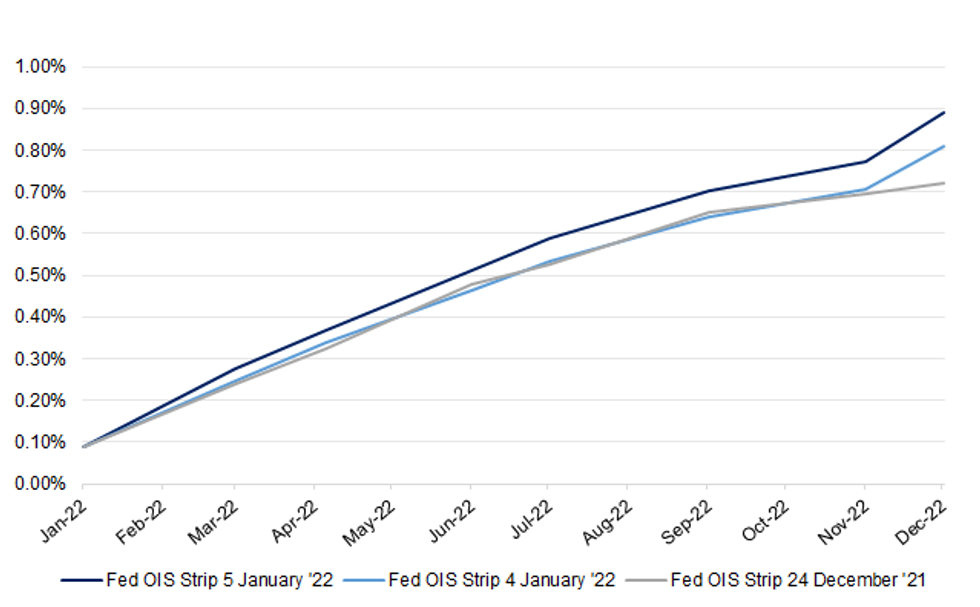

STIR: OIS Strip Steeper In Wake Of FOMC Dec Meeting Minutes

The release of the FOMC’S December meeting minutes has allowed the OIS strip to steepen, with just under ~20bp of tightening now priced for central bank’s March meeting. Further out the strip, ~80bp of tightening is now priced come the end of the Fed’s December meeting, 8bp more than was priced as of Tuesday’s close, with ~17bp of extra tightening priced over that horizon when compared to the 24 December close.

- Outside of the potential for a brisker pace of rate hikes, the potential for swifter, more aggressive balance sheet normalisation has also become more apparent.

Fig. 1: Fed Meeting Dated OIS Strip Pricing

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

| Fed Meeting | Fed OIS Strip 5 January '22 | Fed OIS Strip 4 January '22 | Fed OIS Strip 24 December '21 |

|---|---|---|---|

| Jan-22 | 0.089% | 0.087% | 0.090% |

| Mar-22 | 0.277% | 0.247% | 0.241% |

| Apr-22 | 0.368% | 0.340% | 0.324% |

| Jun-22 | 0.510% | 0.463% | 0.478% |

| Jul-22 | 0.588% | 0.534% | 0.525% |

| Sep-22 | 0.702% | 0.642% | 0.653% |

| Nov-22 | 0.772% | 0.705% | 0.694% |

| Dec-22 | 0.890% | 0.810% | 0.722% |

JGBS AUCTION: Japanese MOF sells Y2.8068tn 6-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y2.8068tn 6-Month Bills:

- Average Yield -0.1068% (prev. -0.1082%)

- Average Price 100.053 (prev. 100.054)

- High Yield: -0.0987% (prev. -0.1062%)

- Low Price 100.049 (prev. 100.053)

- % Allotted At High Yield: 2.0426% (prev. 6.7449%)

- Bid/Cover: 3.733x (prev. 4.562x)

FOREX: Market Sentiment Sours As FOMC Minutes Send Reverberations Through Asia

Risk appetite turned sour as the Asia-Pacific woke up to the relatively hawkish FOMC minutes released Wednesday, which fuelled expectations of an earlier, faster policy tightening by the Fed. The defensive feel was reflected in price action across G10 FX space.

- Risk aversion was a boon for the yen which topped the G10 pile. USD/JPY moved away from a cycle high printed on Tuesday. Reports suggesting that the BoJ might raise their FY2022 inflation outlook at their monetary policy meeting this month were doing the rounds, while BBG noted that policymakers could debate ditching the view that price risks are skewed downward.

- The Antipodeans led commodity-tied currencies lower, with both AUD/USD and NZD/USD printing two-week lows. Weaker oil prices added pressure to the space.

- China's services sector unexpectedly expanded at a faster pace in December, according to the latest Caixin PMI report, but the yuan was unfazed. Broader USD strength drove spot USD/CNH above its 50-DMA.

- On the data front, focus turns to German factory orders as well as U.S. ISM Services, trade balance & weekly jobless claims. Speeches are due from Fed's Bullard & Daly.

FOREX OPTIONS: Expiries for Jan06 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1210-25(E2.1bln), $1.1265-75(E1.9bln), $1.1300(E1.4bln), $1.1330-50(E1.0bln), $1.1425(E598mln)

- USD/JPY: Y113.45-55($1.8bln), Y114.75-00($1.3bln), Y115.50-65($1.1bln)

- AUD/USD: $0.7200-20(A$639mln)

- USD/CAD: C$1.2780-90($796mln)

- USD/CNY: Cny6.40($651mln)

ASIA FX: FOMC Minutes Provide Headwind For Asia EM FX, Baht Lags Amid Omicron Worry

Asia EM FX went offered as participants assessed the minutes from the most recent FOMC monetary policy meeting. The document signalled potential for a sooner, more aggressive policy tightening by the Fed.

- CNH: Spot USD/CNH crossed above its 50-DMA despite an above-forecast December reading of China's Caixin Services PMI. Headline index printed at the highest level since May 2021 albeit Caixin flagged a deterioration in business confidence.

- KRW: Spot USD/KRW re-opened higher and had a look above the psychological KRW1,200.00 figure and topped out at levels not seen since Jul 2020. Geopolitical matters helped push the cross higher, as North Korean state media said that Pyongyang successfully test-launched a "hypersonic" missile on Wednesday.

- IDR: Spot USD/IDR advanced amid subdued domestic headline flow, with impetus generated by the FOMC minutes in the driving seat. The rate touched its strongest levels in more than two weeks, approaching resistance from Dec 21 high of IDR14,400.

- MYR: The ringgit faltered along its regional peers. Malaysian headline flow offered nothing to mitigate the impact of aforementioned Fed musings.

- PHP: Spot USD/PHP crept higher, clawing back the bulk of losses registered on Wednesday. Yesterday's move in the peso was somewhat puzzling, given a miss in CPI inflation reported by the Philippine Statistics Authority, but BSP Gov Diokno said that the central bank did not intervene in FX markets.

- THB: The Thai baht was the worst performer in the region amid continued spread of Omicron across the Southeast Asian nation and the gov't's moves to curb soaring pork prices. The Health Ministry raised the Covid-19 alert by one notch to the second-highest level, with officials due to decide on new restrictions tomorrow.

EQUITIES: Higher U.S. Yields Weigh In Asia

The continuation of the recent uptick in U.S. Tsy yields, with the latest leg stemming from the release of the FOMC’s Dec meeting minutes, weighed on the major regional equities and e-mini futures during Asia-Pac dealing, after Wall St. provided a negative lead.

- Tech names continue to come under pressure, with a higher U.S. real yield environment and the increased regulatory burden for the Chinese tech sphere headlining on that front in recent days.

- Firmer than expected Caixin services PMI data did little to nothing for broader risk appetite, with Chinese government guidance to limit travel over the upcoming lunar new year period garnering more attention.

- It was the ASX 200 that spearheaded losses amongst the major regional equity indices, as it shed ~2.75%. U.S. e-minis sit 0.2-0.6% below settlement levels, with the NASDAQ 100 leading losses there.

GOLD: Fed Minutes Facilitate Pullback After Test Of Resistance, Tight Asia Trade Observed

Gold has stuck to a narrow range during Asia-Pac hours, with spot hovering just above $1,805/oz, a handful of dollars softer on the day. A reminder that the minutes from the FOMC’s Dec meeting provided a hawkish market reaction (with the potential for a faster rate liftoff and swifter, more aggressive round of balance sheet normalisation at the fore). This supported the DXY and U.S. real yields, which allowed bullion to fully unwind the gains registered in pre-Fed minute dealing, moving into negative territory come the bell. Familiar technical parameters remain in play after the early Wednesday rally failed to break key near-term resistance ($1,831.9/oz).

OIL: A Touch Weaker

Pressure on the broader equity sphere (in the wake of the release of the FOMC’s Dec meeting minutes) has applied pressure to crude since Wednesday’s settlement, leaving WTI & Brent futures ~$1.00 softer on the day at typing.

- A reminder that firmer than expected U.S. ADP employment data had provided some support for crude in early NY trade on Wednesday, while the latest round of weekly DoE inventory data failed to meaningfully impact the space. The DoE data was broadly inline with the picture sketched out by the weekly API inventory estimate (drawdown in headline crude stocks, alongside a notable build in distillates & gasoline, with the latter potentially driven by the Omicron effect). Rocket launches on a U.S. military installation in Iraq also provided some support for crude, before the benchmarks pulled away from best levels into yesterday’s settlement in the wake of the aforementioned release of the FOMC’s Dec meeting minutes.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/01/2022 | 0700/0800 | ** |  | DE | Manufacturing Orders |

| 06/01/2022 | 0830/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/01/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Services PMI (Final) |

| 06/01/2022 | 1000/1100 | ** |  | EU | PPI |

| 06/01/2022 | 1300/1400 | *** |  | DE | HICP (p) |

| 06/01/2022 | 1330/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 06/01/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 06/01/2022 | 1330/0830 | ** |  | US | Trade Balance |

| 06/01/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 06/01/2022 | 1500/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 06/01/2022 | 1500/1000 | ** |  | US | Factory New Orders |

| 06/01/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 06/01/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 06/01/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 06/01/2022 | 1630/1130 |  | US | San Francisco Fed's Mary Daly | |

| 06/01/2022 | 1815/1315 |  | US | St. Louis Fed's James Bullard |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.