-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Markets Look Through China COVID Angst

EXECUTIVE SUMMARY

- PELOSI OPENS DOOR TO MORE VIRUS AID (BBG)

- ECB’S SCHNABEL: ECB MAY NEED TO ACT IF ENERGY PRICE RISES MORE PERSISTENT: SCHNABEL (RTRS)

- COMPULSORY COVID TESTING UNDERWAY IN CHINA’S TIANJIN

- CHINA AIMS TO ACCELERATE M&A AMONG DEBT-RIDDEN REAL ESTATE FIRMS TO ADDRESS RISKS (GLOBAL TIMES)

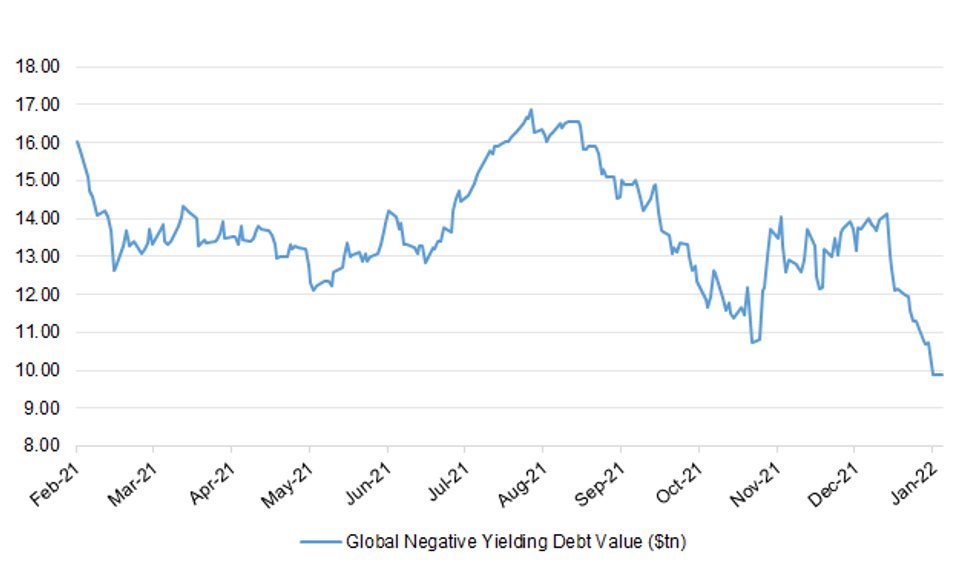

Fig. 1: Global Negative Yielding Debt Value ($tn)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: The capital "may have passed or be at the peak" of its latest wave of infections, according to the city's public regional health director. Professor Kevin Fenton said the peak may have occurred around the New Year period, based on the latest Office for National Statistics (ONS) data. He said the city is seeing reductions in overall case rates, although infection levels remain "very, very high" with one in 10 Londoners infected with COVID. "We are not yet out of this critical phase but we are past the peak," he said. (Sky)

CORONAVIRUS: Most hospitals are getting through Omicron without tipping into crisis, NHS chiefs believe, as confidence grows among ministers that further Covid restrictions will be avoided. (The Times)

CORONAVIRUS: There is no need for a fourth dose of vaccine against Covid-19, government advisers have said, as data on boosters shows they still work well after three months. Protection against hospital admission in over-65s remains at about 90 per cent three months after a third jab, new analysis from the UK Health Security Agency shows. The Joint Committee on Vaccination and Immunisation (JCVI) said that as a result there was “no immediate need to introduce a second booster dose” for the most vulnerable, although the option remains under review. (The Times)

CORONAVIRUS: The Chancellor is among Cabinet ministers backing calls to cut the Covid isolation period to five days amid growing pressure for the UK to shift to living with the virus. Rishi Sunak and ministers from the main economic ministries believe cutting isolation from seven days could help reduce staffing shortages caused by the omicron variant, the Telegraph understands. One government source suggested 60 per cent of the Cabinet were in favour of the move, although they stressed that such a move would have to be sanctioned as safe by scientists. (Telegraph)

CORONAVIRUS: Cutting the self-isolation period to five days would be "helpful", the UK's former vaccines minister has said. People who test positive for Covid are required to self-isolate for seven days, but several sectors are experiencing staffing pressure. Education Secretary Nadhim Zahawi said the country is "witnessing the transition of the virus from pandemic to endemic", reports the Sunday Times. (BBC)

ECONOMY: Absenteeism caused by Covid-19 isolation and staff shortages could result in a £35 billion loss in output over January and February — equivalent to 8.8 per cent of gross domestic product (GDP) for those two months. The analysis for The Sunday Times by the Centre for Economics and Business Research (CEBR) is based on government planning assumptions of a 25 per cent absenteeism rate. A more conservative estimate of 8 per cent — three times the seasonal average — would result in loss in output across January and February of £10.2 billion, or 2.6 per cent of GDP, the CEBR said. “Even with only a peak of 8 per cent, there will be an economic cost,” said Pushpin Singh, economist at the CEBR. (Sunday Times)

ECONOMY: British manufacturers are optimistic that business conditions and productivity will improve this year despite most saying they have been hurt by Brexit and rising costs, according to an industry survey published on Monday. Trade body Make UK and accountants PwC said 73% of manufacturers believed conditions for the sector would improve and 78% foresaw at least a moderate increase in productivity in 2022. But two thirds of companies said Brexit had hampered their business in the nearly two years since Britain left the EU, while retaining staff and rising input costs linked to inflation also presented a challenge. (RTRS)

ECONOMY: Major British companies plan a surge in investment in 2022 to meet strong demand and respond to climate change against a backdrop of growing labour shortages, according to a survey from accountants Deloitte. Some 37% of chief financial officers viewed higher capital spending as a priority for 2022, the most since the quarterly survey started in 2009 and up from 20% at the start of 2021. If the plans translate into action, they could help ease long-standing problems with weak productivity in Britain, which many economists blame on lower rates of business investment than in other rich nations. "CFOs seem to be looking past Omicron and plan to focus their businesses on growth in 2022," said Ian Stewart, chief economist at Deloitte. (RTRS)

ECONOMY: A slightly more downbeat assessment of the business environment came from BDO, the accountancy and business advisory firm. Its monthly indicators of business optimism and output fell in December amid the wave of Omicron infections although both indicators were still higher than their average levels. Kaley Crossthwaite, a partner at BDO, said the drop in optimism in December stemmed from “ongoing uncertainty” concerning Omicron, supply chain disruption and inflationary pressures. She added: “While the health of the jobs market continues to be a glimmer of hope for employees and the government, it also demonstrates the difficulties that businesses are having recruiting and retaining staff.” (FT)

INFLATION: Inflation could rise to about 7 per cent if ministers fail to cap an increase in energy bills due in April, internal government estimates suggest, risking a multibillion-pound hole in public finances. (The Times)

FISCAL/ENERGY: Labour has called for business rates to be scrapped to help firms struggling to cope with rising energy prices. The party also urged the government to introduce a windfall tax on North Sea gas and oil producers to create a £600m fund to support companies. (BBC)

FISCAL/ENERGY: A third of voters expect their energy bills to become unaffordable this year, increasing the pressure on Boris Johnson to protect against the rising cost of living. Most people want taxpayer money used to offset rises in gas and electricity bills but the government is being urged by Labour to scrap VAT on fuel. (The Times)

BREXIT: Foreign Secretary Liz Truss says she will not accept a deal which means goods from Britain being checked as they enter Northern Ireland. Ms Truss, now the UK's lead negotiator with the EU in post-Brexit talks, was writing in the Sunday Telegraph. In 2019 the prime minister agreed a deal, known as the protocol, which means some goods are checked as they enter from Great Britain. For the last six months the UK has been attempting to renegotiate that deal. Next week Mrs Truss is due to hold two days of talks with her European Union counterpart Maros Sefcovic. "I will not sign up to anything which sees the people of Northern Ireland unable to benefit from the same decisions on taxation and spending as the rest of the UK, or which still sees goods moving within our own country being subject to checks," she said. (BBC)

BREXIT: The European Union has hit back at Liz Truss, saying Brussels is unimpressed with the foreign secretary’s threats of unilateral action to suspend the post-Brexit agreement on Northern Ireland. Joao Vale de Almeida, the EU ambassador to the UK, said it was “not very helpful” to be talking about emergency action before talks this week on the Northern Ireland protocol. Vale de Almeida said Brussels was willing to show a “certain degree of flexibility” in the application of border checks and wanted to find compromises to make the agreement work. He urged Britain to find “concrete and practical solutions” and insisted it was a “huge opportunity” for Northern Ireland to have access to both Great Britain and the EU single market. (The Times)

POLITICS: Boris Johnson has been urged by an influential Conservative MP to end all Covid-19 restrictions in England by the end of this month, or face a massive revolt within his party and the prospect of a leadership challenge later this year. Mark Harper, chair of the lockdown-sceptic Tory Covid Recovery Group, said Johnson should announce by January 26 — when most current rules expire — that he will end them and never bring them back. The former Tory chief whip told the Financial Times that Johnson could face a leadership challenge after May’s local elections unless he changes the way he operates and proves he is still an electoral asset. Harper said that upon the expiry of existing plan B rules — notably work from home guidance, mask-wearing in public places and Covid passes -Johnson should vow they will never return, even if new variants emerge. (FT)

POLITICS: An investigation into allegations of COVID lockdown-busting parties in Number 10 has been widened after former top Downing Street aide Dominic Cummings made a fresh claim. In his latest blog post, the prime minister's ex-chief adviser confirmed that he was present in a photo of an alleged wine and cheese gathering in Number 10's garden on 15 May 2020, which was published by the Guardian last month. (Sky)

POLITICS: A top civil servant who runs Boris Johnson's private office is being lined up to become the 'fall guy' for the No 10 Partygate row, senior sources have said. Martin Reynolds, the Prime Minister's principal private secretary, is expected to be moved after the Cabinet Office concludes its investigation into whether rules were broken at a series of No 10 gatherings during Covid lockdowns. One option being explored is to hand Mr Reynolds a senior diplomatic role, possibly at ambassador level. (Mail On Sunday)

POLITICS: A cost of living crisis is “driving angst” among Conservative MPs about spring’s local elections, senior party figures are warning, as an overwhelming majority of voters in a survey reported that they had seen their costs rise faster than their income. With the Treasury examining an expansion of a scheme designed to help the poorest with their energy bills, influential Tories are already saying that the plan will be too narrow and that the party will suffer big losses in May’s elections. (Observer)

POLITICS: Almost half of all Tory members now believe that Rishi Sunak would make a better leader and could win more seats at the next election than Boris Johnson, an exclusive poll for Sky News has found. A third of the Tory membership now think Mr Johnson should stand down as Tory leader. Almost four in 10 say they think he is doing a bad job. Both findings mark a substantial increase in disaffection amongst members of the Conservative Party compared to the early stage of the pandemic. The results come in a YouGov poll of 1,005 Tory members for Sky News conducted between 30 December and 6 January, the first such survey since July 2020. (Sky)

PROPERTY: Michael Gove is expected to declare today that there is no hiding place for property developers he blames for the cladding scandal in the wake of the Grenfell Tower disaster. He will announce a series of reforms designed to end the agony of three million flat owners trapped in unsafe or unsellable homes after the 2017 blaze, which killed 72. Campaigners gave a cautious welcome but have demanded immediate action to protect leaseholders and new laws to force the building companies to pay for the work. (The Times)

EUROPE

ECB: Rising energy prices may force the European Central Bank to stop "looking through" high inflation and act to temper price growth, particularly if the green transition proves inflationary, ECB board member Isabel Schnabel said on Saturday. (RTRS)

GERMANY: German government departments are stepping up efforts to help consumers affected by runaway wholesale energy prices which are beginning to hurt low-income households, two policymakers told Reuters at the weekend. Like many countries, Germany has seen historically high prices of energy and related European carbon emissions permits which were triggered by the lifting of COVID-19 restrictions and resulting demand on depleted gas stocks. "We are working flat out on solutions for households that are now facing difficulties," said the general secretary of the centre-left Social Democratic Party (SPD), Kevin Kuehnert in remarks authorised for publication on Sunday. (RTRS)

FRANCE: French authorities say more than 105,000 people have taken part in protests across the country against the introduction of a new coronavirus pass. A new draft law would in effect ban unvaccinated people from public life. Demonstrators in the capital, Paris, held placards emblazoned with phrases like “no to vaccine passes”. (BBC)

ITALY: Italy will only allow people showing a so-called reinforced green pass to board trains, planes, boats and to access to hotels, open air restaurants, swimming pools from Jan. 10. The reinforced certification, which can only be obtained with the vaccine or after recovering from Covid, is already mandatory in the country for many leisure activities, including eating inside restaurants, and going to theaters, cinemas, sporting and other public events. (BBG)

ITALY: The Italian government is preparing new support measures to be approved next week to help companies whose business is being hit by a surge in coronavirus infections, two sources familiar with the matter told Reuters. The main beneficiaries of the measures, worth some 2 billion euros ($2.27 billion), will be the tourist and leisure sector, with discos and trade fairs among businesses affected by government COVID curbs. The package will not weigh on public accounts because some other spending items already budgeted for by the Treasury are proving less costly than anticipated, the sources said. (RTRS)

ITALY: Italy plans to sell EU6.5 billion ($7.38 billion) of bills due Jan. 13, 2023 in an auction on Jan. 12. (BBG)

PORTUGAL: Portuguese Prime Minister Antonio Costa’s Socialist Party saw its lead over center-right opposition party PSD narrow to 6 percentage points in an opinion poll, broadcaster RTP reported on its website. Costa, who is halfway through a second four-year term, will face an early election on Jan. 30 after parliament rejected his minority Socialist government’s 2022 budget on Oct. 27. The Socialists took 36% of the vote in the 2019 election. (BBG)

FINLAND: Prime Minister Sanna Marin’s cabinet said students in Finland should return to classrooms for in-person learning, overruling a Health Ministry proposal for remote learning as many schools prepare to reopen next week after a holiday break. (BBG)

U.S.

FED: San Francisco Federal Reserve Bank President Mary Daly on Friday weighed into the debate at the Fed on when to begin shrinking its massive balance sheet, saying she could see doing so soon after the Fed has raised rates once or twice. (RTRS)

FED: With US inflation high and the Federal Reserve expected to hike interest rates within months, President Joe Biden said on Friday he had faith in the central bank's ability to manage price increases while ensuring that businesses keep hiring. "I want to be clear: I'm confident the Federal Reserve will act to achieve their dual goals of full employment and stable prices and make sure the price increases do not become entrenched over a long term, with the independence that they need," the president said at the White House. (AFP)

ECONOMY: U.S. consumer credit soared by $40 billion in November, more than double expectations and compared with a $16 billion gain in October, according to Federal Reserve data released Friday. That translated into an 11% annual gain — the largest move in a single month in 20 years. Economists had been expecting a $20 billion gain, according to the Wall Street Journal forecast. Revolving credit, such as credit cards, rose at a 23.4% rate after a 7.8% gain in October. That’s the highest rate since April 1998. Total revolving credit is still below its pre-COVID peak. (MarketWatch)

FISCAL: The week before Christmas, Sen. Joe Manchin III sent the White House a $1.8 trillion counteroffer to President Biden’s Build Back Better agenda that included substantial funds for climate, health-care and education initiatives. About four weeks later, the West Virginia Democrat has made clear that he does not currently support advancing even that offer following a breakdown in negotiations between Manchin and the White House right before Christmas, three people with knowledge of the matter said. Manchin said publicly this week that he was no longer involved in talks with the White House over the economic package. Privately, he has also made clear that he is not interested in approving legislation resembling Biden’s Build Back Better package and that Democrats should fundamentally rethink their approach. Senior Democrats say they do not believe Manchin would support his offer even if the White House tried adopting it in full — at least not at the moment — following the fallout in mid-December. The people spoke on the condition of anonymity to discuss private conversations. (Washington Post)

FISCAL: House Speaker Nancy Pelosi said there’s an “opportunity” to add federal coronavirus relief aid to a package of legislation funding the government as a February deadline looms. “It is clear from the opportunity that is there and the challenge that is there,” Pelosi said in an interview on CBS’s “Face the Nation,” noting that President Joe Biden’s administration “has not made a formal request for more funding.” (BBG)

CORONAVIRUS: President Joe Biden said surging cases won’t be the “new normal,” though the virus is likely to endure and can be managed with newly developed tools. “Covid -- as we’re dealing with it now -- is not here to stay,” Biden said to reporters at the White House on Friday. “Having Covid in the environment here and in the world is probably here to stay.” The U.S. Supreme Court cast doubt on President Joe Biden’s push to vaccinate millions of workers amid a Covid-19 surge, questioning whether the Occupational Safety and Health Administration had authority to require that 80 million workers get shots or regular tests. (BBG)

CORONAVIRUS: The Food and Drug Administration on Friday authorized adults 18 and older who are vaccinated with Moderna to get a booster shot five months after their second dose, shortening the waiting period by a month. (CNBC)

CORONAVIRUS: New York will become the first state in the U.S. to require a Covid-19 booster shot for its health-care workers, Governor Kathy Hochul said on Friday. While the state will allow medical exceptions, there will be no test-out option. Health-care employees will be required to get a booster shot within two weeks of when they are eligible. The governor still needs approval from the state’s health planning council but expects “swift approval,” Hochul said during a Friday briefing. (BBG)

CORONAVIRUS: New York City Mayor Eric Adams said he’s considering whether to follow California’s lead and mandate vaccines for the city’s schoolchildren. Adams, talking on CNN’s “State of the Union,” noted that the U.S. already vaccinates children for smallpox, measles and other diseases, and he will work to educate parents about the importance of vaccination against Covid-19. “We’re going to sit down and determine if we’re going to roll that out as well,” the mayor said, adding that he is now discussing the issue with his health advisers. (BBG)

CORONAVIRUS: Governor Gavin Newsom said he has activated the California National Guard to add testing facilities and capacity with the surge in cases. (BBG)

OTHER

GLOBAL TRADE: Some trucking supply routes are at risk of failing because of the impending wave of infections, German logistics association BGL said. “Omicron has the potential to increase supply bottlenecks,” BGL President Dirk Engelhardt told newspaper Bild am Sonntag. (BBG)

GLOBAL TRADE: The Port of New York and New Jersey is working to clear a small but rare bottleneck of container ships anchored off the coast of Long Island. Hundreds of dockworkers are ill with Covid-19, or quarantining, while cargo volumes remain unusually high because of a pandemic-led surge in imports. (BBG)

GLOBAL TRADE: Canadian Prime Minister Justin Trudeau is pushing ahead with a vaccine mandate for international truckers despite increasing pressure from critics who say it will exacerbate driver shortages and drive up the price of goods imported from the United States. (RTRS)

GLOBAL TRADE: Apple Inc supplier Foxconn will reopen its shuttered iPhone manufacturing facility in southern India on Jan. 12, government officials and a legislator in the region where the plant is located told Reuters. (RTRS)

GLOBAL TRADE: UK financial regulators are preparing to step up their scrutiny of cloud computing providers amid growing fears that an outage or hack of their services could severely disrupt a banking system increasingly reliant on them. The Prudential Regulation Authority is exploring ways to access more data from cloud providers Amazon, Microsoft and Google, including on the operational resilience of their services, according to people familiar with the matter. The trio dominate cloud computing, a global market that has boomed as more companies transfer data and IT services to third-party servers run by Big Tech. (FT)

GEOPOLITICS: Kazakh forces, backed by Russian-led troops, are pressing ahead with operations to restore control after crushing the biggest protests in the central Asian nation in decades. Almost 6,000 people, including foreigners, have been detained since the demonstrations erupted, and security services are carrying out raids throughout the country, the Kazakh presidential administration said on its website Sunday. The official death toll stands at 164 people, according to state television, while the real number is thought to be higher. (BBG)

CORONAVIRUS: A strain of Covid-19 that combines delta and omicron was found in Cyprus, according to Leondios Kostrikis, professor of biological sciences at the University of Cyprus and head of the Laboratory of Biotechnology and Molecular Virology. “There are currently omicron and delta co-infections and we found this strain that is a combination of these two,” Kostrikis said in an interview with Sigma TV Friday. The discovery was named “deltacron” due to the identification of omicron-like genetic signatures within the delta genomes, he said. (BBG)

BOJ: The Bank of Japan may increase its forecast for inflation to reflect higher material costs when the board meets later this month, the Yomiuri newspaper reported, without saying where it got the information. The central bank’s outlook for price trends for the fiscal 2022, currently at 0.9%, will be raised to 1% or higher, according to the report. The board is scheduled to hold a policy meeting on Jan. 17 and 18, when it is expected to its review quarterly guidance on prices. The possible revision is due mainly to the supply-chain disruptions triggered by the Covid-19 pandemic, the paper said. Energy prices to produce and ship food, and gas and raw materials are rising, while import costs have also been hit the recent weakness in the Japanese currency. (BBG)

AUSTRALIA: Prime Minister Scott Morrison says he wants to “maximise the workforce”, with state leaders to tick off on new guidelines that will allow close contacts to avoid having to isolate if they work in a wider range of critical industries. Mr Morrison also rejected accusations from Opposition Leader Anthony Albanese and some health experts that he had “let the virus rip”, saying it was a comparison that did not stack up because a raft of public health measures remained in place. “I don’t accept that analysis because that’s not the approach that the government is taking at a Commonwealth level or in the states and territories,” Mr Morrison said. “If Mr Albanese thinks that the answer is to put Australia back into lockdown, then I don’t agree with you.” But Mr Albanese said Australia was now in the third year of the pandemic and Mr Morrison “still thinks it isn’t a race”. (Australian Financial Review)

AUSTRALIA: A vaccine mandate applying to some Victorian workers has been expanded, meaning those in some sectors must get a third dose of a COVID vaccine to continue working on site. The changes, due to come into effect at 11:59pm on Wednesday, will apply to workers in the healthcare, aged care, disability, emergency services, corrections, quarantine accommodation and food distribution industries. Other measures being introduced from Wednesday evening include the closure of indoor dancefloors, tightening restrictions for visitors to aged care and hospital facilities and changing close contact requirements for those working in the food distribution system. (ABC)

AUSTRALIA: Australia’s New South Wales will treat some Covid-19 patients in private hospitals starting Monday to alleviate pressure on the government-run system, according to Susan Pearce, the health deputy secretary of the country’s biggest state. Calling it a “planned exercise,” she said the measure was “pre-emptive and protective” and shouldn’t be “seen as a failure of the public hospital system.” The issue is not hospital bed availability but staffing. (BBG)

BOK: Experts remain divided over whether Korea’s central bank will carry out a rate hike at its first rate-setting meeting of the year set to be held Friday. The upcoming monetary policy board meeting comes as the Korean economy continues to struggle with high inflationary pressure and the US Federal Reserve’s recent signal of a sooner-than-expected rate hike. A majority of experts see a rate hike coming Friday or next month and the Bank of Korea is expected to raise its benchmark interest rate at least once more for the rest of the year, they say. (Korea Herald)

SOUTH KOREA: The latest Realmeter survey of 3,042 adults shows that the ruling Democratic Party (DP) presidential candidate Lee Jae-myung is leading the main opposition People Power Party (PPP) candidate Yoon Suk-yeol by 6 percentage points. The poll puts Lee on 40.1%, with Yoon on 34.1%, as support for the PPP candidate fell 5pp from the previous poll. The most recent survey covered a period when Yoon dissolved his campaign team in a bid to start afresh just two months ahead of the election. The betting markets (as indicated by data from PredictIt & Smarkets) clearly favour Lee at the moment, even as Yoon held a comfortable lead earlier in the campaign. This turn of events is due to a notable decline in the support for the main opposition candidate since around mid-December. The steady erosion in support for Yoon has been driven by an internal strife within PPP, which culminated in the aforementioned replacement of his campaign committee. Some have also pointed to negative publicity surrounding Yoon's poor showing in a widely circulated Christmas Day YouTube interview, as well as a scandal involving his wife, who allegedly lied on her CV. (MNI)

MEXICO: Two of Mexico’s most vocal central bank board members took to Twitter on Friday to air their differences over monetary policy, with one saying high inflation was easing and the other insisting quickening core prices looked like a “grave” problem. In almost a dozen tweets, Jonathan Heath sounded the alarm over accelerating core inflation, saying its persistence may signal a structural problem. Fellow board member Gerardo Esquivel tweeted a few hours later that inflation had peaked in late November and would continue to subside in coming months. Heath then countered that price increases had only decelerated due to slowing non-core inflation, which he said was “almost irrelevant” because that component is so volatile and doesn’t respond to monetary policy action. While both are vocal about their inflation views on Twitter, it may be the first time they so openly sparred on social media. (BBG)

MEXICO: Mexico’s government said it had slashed Petroleos Mexicanos’ debt burden by $3.2 billion through a refinancing operation. The government swapped debt that was expiring soon for a new bond with a maturity of 10 years, while also refinancing some medium maturity debt that was cheap, according to a statement from the Finance Ministry. The operation will reduce the “financial pressure” on Pemex by $10.5 billion between 2024 and 2030, the ministry said, adding that the refinancing wouldn’t reduce the fiscal budget. The government contributed $3.5 billion to the operation, which helped narrow the spread to sovereign bonds by 50 basis points, reducing Pemex’s annual financial costs by $180 million. (BBG)

BRAZIL: Brazil’s central bank head Roberto Campos Neto has tested positive for Covid as a new wave of infections sweeps through the country. Campos Neto, who’s doubly vaccinated, is asymptomatic and will isolate at home, the central bank said in a message Saturday. The policy maker, 52, returns to the job on Monday remotely following year-end vacations. (BBG)

RUSSIA: Secretary of State Antony Blinken says he doesn't expect to see any breakthroughs in the meetings with Russia this week, reiterating that while the US is prepared to listen to Moscow's concerns, it will be hard to achieve any progress unless Russia de-escalates tensions on the border with Ukraine. "It's hard to see making actual progress, as opposed to talking, in an atmosphere of escalation with a gun to Ukraine's head. So, if we're actually going to make progress, we're going to have to see de-escalation, Russia pulling back from the threat that it currently poses to Ukraine," he said on CNN's "State of the Union" on Sunday. (CNN)

RUSSIA: U.S. Deputy Secretary of State Wendy Sherman met with Russian Deputy Foreign Minister Sergei Ryabkov in Geneva on Sunday, ahead of three days of talks this week as Russia presses for security concessions from the NATO alliance amid a crisis over Ukraine. Sherman "stressed the United States' commitment to the international principles of sovereignty, territorial integrity, and the freedom of sovereign nations to choose their own alliances," the State Department said in a statement. (RTRS)

RUSSIA: The Biden administration is heading into next week’s talks with Russia still unsure whether Moscow is serious about negotiations, but if so U.S. officials are ready to propose discussions on scaling back U.S. and Russian troop deployments and military exercises in Eastern Europe, a current administration official and two former U.S. national security officials familiar with the planning told NBC News. The discussions could potentially address the scope of military drills held by both powers, the number of U.S. troops stationed in the Baltic states and Poland, advance notice about the movement of forces, and Russia’s nuclear-capable Iskander missiles in the Russian territory of Kaliningrad between Poland and Lithuania, the sources said. (NBC)

RUSSIA: The Biden administration and U.S. allies are discussing possible export controls on Russia, including curbs on sensitive technology and electronics, to be imposed if President Vladimir Putin seizes more of Ukraine, a person familiar with the discussions said. While no decisions have been made, the trade restrictions could apply to exports from the U.S. to Russia and possibly to some foreign-made products, according to the person. Also being considered are measures to deprive Russia of microelectronics made with or based on U.S. software or technology, the person said. (BBG)

RUSSIA: Concern among some big European nations about economic fallout raises the risk of a split with the U.S. on how strongly to hit Russia with fresh sanctions if it invades Ukraine, according to people familiar with the matter. Western allies are united in their desire to prevent a war as they enter high-stakes talks this week aimed at defusing tensions with Russia, warning it faces massive penalties for any incursion. Actions that have been discussed include export controls, curbing Russia’s access to technology, and even cutting it out of the global system for financial payments. But while the major Western European members of the European Union remain committed in principle to a significant response, some have also aired worries with the U.S. about the potential for damage to their own economies, the people said. (BBG)

RUSSIA: A group of Russia experts urged U.S. national security adviser Jake Sullivan to send more arms to the Ukrainians when he spoke with them before this week’s high-stakes diplomatic meetings with Russian officials, participants told Axios' Hans Nichols and Zachary Basu. By soliciting advice from the hawkish pockets in the foreign policy establishment, including those who served under Trump, the Biden administration is considering all options while weighing how to discourage Russian President Vladimir Putin from invading Ukraine — and punish him if he does. (Axios)

RUSSIA: Nato has warned Moscow to abandon its belligerent foreign policy and co-operate with the west or face a military alliance steeled for conflict, on the eve of a week of intense diplomacy aimed at averting a Russian assault on Ukraine. Jens Stoltenberg, Nato secretary-general, said the US-led defence pact was prepared for “a new armed conflict in Europe” should negotiations fail, as western officials readied for potential discussions with Moscow on reducing the size of military exercises, arms control and a pledge not to deploy US missiles in Ukraine. “I am aware of Russia’s history. For centuries they have experienced conflict with neighbours,” he told the Financial Times. “[But] Russia has an alternative: to co-operate, to work with Nato.” (FT)

RUSSIA: Nato’s secretary-general has ruled out creating “second-class” members of the military alliance to appease Moscow, ahead of a week of high-stakes diplomacy between the Kremlin and western powers that aims to avoid a feared Russian invasion of Ukraine. (FT)

SOUTH AFRICA: South Africa must finalize a policy on vaccine mandates for certain settings and activities as it seeks to fully reopen its virus-battered economy, the nation’s ruling party said. "The success of our economic recovery depends to a large measure on our ability to effectively manage Covid-19, as this virus is likely to remain part of our lives for the foreseeable future,” President Cyril Ramaphosa, who heads the African National Congress, said at a rally on Saturday. The government started offering Covid-19 booster shots in December, even with only about 45% of adults fully vaccinated. (BBG)

IMF: Emerging economies must prepare for U.S. interest rate hikes, the International Monetary Fund said, warning that faster than expected Federal Reserve moves could rattle financial markets and trigger capital outflows and currency depreciation abroad. In a blog published Monday, the IMF said it expected robust U.S. growth to continue, with inflation likely to moderate later in the year. The global lender is due to release fresh global economic forecasts on Jan. 25. It said a gradual, well-telegraphed tightening of U.S. monetary policy would likely have little impact on emerging markets, with foreign demand offsetting the impact of rising financing costs. But broad-based U.S. wage inflation or sustained supply bottlenecks could boost prices more than anticipated and fuel expectations for more rapid inflation, triggering faster rate hikes by the U.S. central bank. "Emerging economies should prepare for potential bouts of economic turbulence," the IMF said, citing the risks posed by faster-than-expected Fed rate hikes and the resurgent pandemic. (RTRS)

OIL: Libya’s crude production rose to 900,000 barrels a day after maintenance work on a major crude pipeline was completed, the North African country’s oil minister said. The production boost followed completion of last week’s works on the pipeline linking the eastern Samah and Dhuhra fields to the country’s biggest export terminal, Es Sider, Mohamed Oun said Sunday. The operations had stopped output of 200,000 barrels a day. That, combined with the forced shutdown of the nation’s biggest oilfield and some other deposits in the west, had led production to falter to the lowest in more than a year. (BBG)

OIL: Kazakhstan's largest oil venture Tengizchevroil is gradually increasing production to reach normal rates at the Tengiz field after protests limited output there in recent days, operator Chevron said on Sunday. (RTRS)

CHINA

POLICY: China's Central Commission for Discipline Inspection (CCDI) has placed Wang Bin, the chairman of China Life Insurance Co Ltd, under investigation, the bureau said on Saturday (Jan 8). Wang is "suspected of serious violations of discipline and law, and is currently undergoing disciplinary review and investigation", the anti-graft watchdog wrote in a statement. (CNA)

POLICY: China should prepare its macro policies before the Federal Reserve’s upcoming “steeper-than-previously-expected” monetary tightening, the 21st Century Business Herald reported citing a speech by Yu Xuejun, a former official of the China Banking and Insurance Regulatory Commission. The Fed may start hiking interest rates as early as in March, possibly by 25 bps, followed by another three hikes over the year, ex-Minister of Finance Zhu Guangyao told another state-owned newspaper the China Securities Journal. (MNI)

INFLATION: China’s consumer price index may have decelerated to below 2% y/y in December from 2.3% in November as the prices of vegetables and pork dropped on ample supply, the Economic Information Daily reported citing analysts. Domestic fuel costs also declined as international crude oil prices fell, while the resurgence of the pandemic hindered the rebound of service prices, the newspaper said citing Li Chao, chief economist of Zheshang Securities. China is set to release its latest CPI data on Wednesday. (MNI)

CORONAVIRUS: China vowed to ensure continuous food supply at stable prices after an outcry over shortages of produce in the coronavirus hotspot of Xi’an city in Shaanxi province, officials said at the State Council’s press conference on Saturday, while reiterating the government’s zero Covid policy. (BBG)

CORONAVIRUS: China reported its first community-spread omicron cases on Sunday, with two people confirmed with the variant in the northern city of Tianjin, according to a report by state broadcaster CCTV on Sunday. The cases were confirmed as being omicron by the Chinese Center for Disease Control and Prevention, after its local branch completed the genome sequencing, CCTV reported. The two new cases were found to be from the same transmission chain but officials have yet to establish if the strain is the same as imported omicron cases reported earlier in the city, according to the report. The city announced that it will start mass testing from 7 a.m. Sunday, in order to “effectively prevent the further spread of the omicron variant,” state news agency Xinhua reported. (BBG)

CORONAVIRUS: China's speed is again on display in Zhengzhou city, capital of central China's Henan Province, in the latest mass nucleic acid testing which started on Friday. Reports say Zhengzhou has completed the sampling of 12.6 million residents in just 6 hours -- 2.1 million people per hour or 583 residents per second. Observers say this is a swifter response than that of Xi'an's, a city that has reported more than 1,900 cases so far as it has fought the latest COVID-19 flare-up. It shows that Zhengzhou city has obviously learnt a lesson from Xi'an, where some local health officials have been punished for negligence. (Global Times)

PROPERTY: The People's Government of South China's Guangdong Province has held meetings with a number of property enterprises, likely paving the way for state-owned real estate enterprises to carry out merger and acquisition (M&A) deals with troubled property firms, financial news site cls.cn reported. The meeting came after media reports said that loan limits for debt-financed acquisitions will be removed, as a measure to accelerate the M&A of debt-ridden property firms, an analyst said. The loan rules for builders, known as "three red lines," define thresholds on debt and were introduced by Chinese regulators in 2020. (Global Times)

PROPERTY: Shimao Group Holdings has put on sale all of its real estate projects, including both residential and commercial properties, as the cash-strapped Chinese property developer accelerates asset disposals, Caixin reported. Shimao, which defaulted on a trust loan last week, has asked agents since late December to help seek buyers for its properties, Caixin reported over the weekend. The company didn't immediately respond to a request for comment. (RTRS)

PROPERTY: Shares of Chinese developer Modern Land plunged nearly 40% to all-time lows on resumption of trade on Monday after it said it has been in talks with noteholders on a restructuring plan for its $1.3 billion of offshore bonds. Modern Land said in a filing on Monday it has received notices from certain noteholders demanding early repayment of their senior notes, after the firm missed payment for its 12.85% notes due Oct 25, 2021. The shares, which have been suspended since Oct. 21, sank nearly 40% in Asia opening hours to HK$0.23, a historical low. (RTRS)

HUAWEI: Chinese telecom giant Huawei is taking actions ranging from issuing debts to a management overhaul, as the company continues to cope with lingering challenges such as the US' crackdown and the ongoing COVID-19 pandemic. However, such moves are not proof that the Chinese company is in serious financial trouble or face other problems, as its business has stabilized in general despite external blows, analysts said. Huawei disclosed recently that it would issue a three-year note of 4 billion yuan ($627 million), according to a statement on the Shanghai Clearing House. (Global Times)

OVERNIGHT DATA

AUSTRALIA NOV BUILDING APPROVALS +3.6% M/M; MEDIAN +3.0%; OCT -13.6%

AUSTRALIA NOV PRIVATE SECTOR HOUSES +1.4% M/M; OCT +3.5%

AUSTRALIA DEC MELBOURNE INSTITUTE INFLATION +2.8% Y/Y; NOV +3.1%

AUSTRALIA DEC MELBOURNE INSTITUTE INFLATION +0.2% M/M; NOV +0.3%

AUSTRALIA DEC FOREIGN RESERVES A$80.8BN; NOV A$80.8BN

CHINA MARKETS

PBOC NET INJECTS CNY10BN VIA OMOS MONDAY

The People's Bank of China (PBOC) injected CNY10 billion via seven-day reverse repos with the rate unchanged at 2.2% on Monday. This operation has injected net CNY10 billion as no reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The seven-day weighted average interbank repo rate for depository institutions rose to 2.1485% at 09:44 am local time from the close of 2.0483% on Friday.

- The CFETS-NEX money-market sentiment index closed at 47 on Friday vs 46 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3653 MON VS 6.3742

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3653 on Monday, compared with 6.3742 set on Friday.

MARKETS

SNAPSHOT: Markets Look Through China COVID Angst

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 is closed

- ASX 200 down 6.245 points at 7447.1

- Shanghai Comp. up 12.092 points at 3591.635

- JGBs are closed

- Aussie 10-Yr future down 6.5 ticks at 98.050, yield up 6.4bp at 1.919%

- U.S. 10-Yr future -0-07+ at 128-02, cash Tsys are closed

- WTI crude up $0.06 at $78.97, Gold down $3.26 at $1793.26

- USD/JPY up 25 pips at Y115.81

- PELOSI OPENS DOOR TO MORE VIRUS AID (BBG)

- ECB’S SCHNABEL: ECB MAY NEED TO ACT IF ENERGY PRICE RISES MORE PERSISTENT: SCHNABEL (RTRS)

- COMPULSORY COVID TESTING UNDERWAY IN CHINA’S TIANJIN

- CHINA AIMS TO ACCELERATE M&A AMONG DEBT-RIDDEN REAL ESTATE FIRMS TO ADDRESS RISKS (GLOBAL TIMES)

BOND SUMMARY: Lower Tsy Futures Drive Broader Price Action

Tsy futures were pressured from the off in Asia-Pac trade (cash markets are closed until the London open owing to a Japanese holiday), as Asia reacted to Friday’s post-NFP moves and greater chances of further fiscal stimulus in the U.S. This outweighed China-related COVID worry and reports out of Cyprus pointing to several cases of a combination of the Delta & Omicron COVID strains. The latter had little lasting impact on broader risk appetite, with the scientist that flagged the developments having to downplay speculation that the combination came about on the back of contamination in the testing lab. TYH2 -0-07+ at 128-02 as of typing, after the contract threatened to test the psychological 128-00 at one point overnight. On the sell side, Goldman Sachs frontloaded their Fed rate hike view (now looking for 4 25bp hikes in ’22 vs. 3 previously), while they rolled forward their call re: the start of B/S normlisation on the part of the central bank. A screen seller of the EDH4/M4/U4 butterfly {~5K) headlined on the flow front. There isn’t much of note on the U.S. docket on Monday, which may mean that any rumblings from the Russia-related discussions in Geneva may receive higher scrutiny vs. the norm.

- The Aussie bond space traded at the whim of the broader Tsy-driven impetus, leaving YM -2.0 & XM -6.5 at settlement, as the weakness observed in the final overnight session of last week extended. The 10- to 12-Year zone provided the weak point on the cash ACGB curve. In local news, Australian PM Morrison tipped his hat to the already known dampening of consumer demand, while stressing that it is too early to make predictions re: the economic impact of Omicron. We also saw the RBA return to ACGB buying operations, as scheduled. A$IG supply continues to tick over, with CBA & the AIIB providing the deals of note after flagging the potential for such issuance last week.

EQUITIES: U.S. Fiscal Hope & Chinese Tech Uptick Counter Early Pressure

Worry re: the prospect of speedier rate hikes and/or swifter balance sheet reduction at the Federal Reserve made for a cautious start to Asia-Pac trade on Monday, with a market holiday in Japan thinning out broader liquidity. Reports out of Cyprus pointing to a combination of the Delta & Omicron COVID strains had little lasting impact on broader risk appetite, with the scientist that flagged the developments having to downplay speculation that the combination came about on the back of contamination in the testing lab.

- The COVID situation in China provided another source of concern in early trade, although growing speculation surrounding the potential for fresh U.S. fiscal stimulus helped counter that.

- Volatile trade continued when it came to the Chinese property developer sphere, with troubles for some individual names mixed in with signs that Guangdong is looking to promote activity that would strengthen the sector (via M&A, supported by SOEs).

- Elsewhere, the Hang Seng Tech index is on course to register its third consecutive day of gains after tagging a fresh all-time low last week (some dipping their toe into the beaten down space).

- This made for outperformance in the Hang Seng, while the Shanghai Composite is on course to lodge its first positive session for calendar ’22.

- The strength in Chinese tech and U.S. fiscal speculation left e-minis little changed to 0.4% higher, with the NASDAQ 100 leading gains there.

OIL: Crude Unwinds Early Losses

WTI & Brent crude futures sit ~$0.10 higher on the day, unwinding early Asia-Pac weakness which likely stemmed from the latest round of COVID worry re: China (with compulsory testing observed in the port city of Tianjin after new cases were detected there) and the partial resumption of previously halted crude production in both Libya & Kazakhstan. There wasn’t much in the way of overt triggers re: the recovery from lows, outside of the potential for spill over from the weakness observed in the U.S. Tsy futures space, which may be linked to the increased likelihood of fresh fiscal stimulus in the U.S. (which we have flagged elsewhere).

GOLD: Bullion Under Modest Pressure To Start The Week

Spot gold has held to a ~$5/oz range during Asia-Pac hours, last trading a handful of dollars lower at $1,792.4/oz, as U.S. Tsy futures come under fresh selling pressure (cash Tsys are closed until London hours owing to a Japanese holiday).

- To recap, our weighted U.S. real yield monitor tested Thursday’s highs in the wake of Friday’s U.S. NFP release (solid prints in the supplementary metric outweighed a miss in the headline print), before backing off. The initial impulse allowed gold to challenge the channel base drawn off the Aug 9 low, bottoming at $1,782.8/oz, which held & continues to provide initial technical support.

- Wednesday’s U.S. CPI print is front and centre when it comes to the focus of market participants.

FOREX: Aussie Dollar Takes Lead, Japanese Holiday Saps Liquidity

The Aussie dollar clawed back its opening losses and climbed to the top of the G10 scoreboard, even as Australia's daily Covid-19 cases topped 100k for the first time on record, while iron ore futures retreated on fears surrounding demand from China in light of the community outbreak of Omicron there. A beat in Australian building permits helped the local currency extend gains, while a BBG trader source pointed to additional support from exporter demand. AUD/USD rose past Friday's peak but struggled to take out the $0.7200 mark.

- The broader high-beta FX space traded on a firmer footing amid an apparent improvement in sentiment, with participants still trying to forecast the Fed tightening path. The monthly CPI report, due out of the U.S. on Wednesday, may provide a notable data input.

- Liquidity was thinned out and market activity was limited by a public holiday in Japan. The yen weakened, with USD/JPY recouping the bulk of losses registered last Friday.

- Spot USD/CNH edged lower, even as Tianjin reported China's first community transmission of the Omicron coronavirus variant, while the PBOC set their yuan reference rate 14 pips above sell-side estimate.

- EZ unemployment, Norwegian CPI & final U.S. wholesale inventories headline the thin global data docket today. The central bank speaker slate is virtually empty.

FOREX OPTIONS: Expiries for Jan10 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1275-80(E1.1bln), $1.1350(E501mln), $1.1390-10(E552mln)

- USD/JPY: Y114.00($1.1bln), Y116.00($600mln), Y116.50($1.2bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/01/2022 | 0830/0930 | ** |  | SE | Private Sector Production |

| 10/01/2022 | 1000/1100 | ** |  | EU | Unemployment |

| 10/01/2022 | 1500/1000 | ** |  | US | Wholesale Trade |

| 10/01/2022 | 1600/1100 | ** |  | US | NY Fed Survey Of Consumer Expectations |

| 10/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result For 13 Week Bill |

| 10/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result For 26 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.