-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Core FI Markets Cheapen Further Overnight, NFPs Await

- Core FI markets cheapen further overnight, with JGBs leading the way.

- The latest rounds of BoJ & RBA rhetroic failed to move the needle.

- Friday's focal points include: U.S. jobs data, the Canadian labour market report, Eurozone retail sales & German factory orders. The central bank speaker slate features BoE's Bailey, Broadbent & Pill as well as ECB's Villeroy. Elsewhere, the Norwegian FinMin will name the new Norges Bank Governor.

US DATA PREVIEW: Primary Dealer NFP Estimates

| Primary Dealer | Estimate | Primary Dealer | Estimate |

|---|---|---|---|

| HSBC | +225K | Credit Suisse | +200K |

| Daiwa | +200K | Mizuho | +200K |

| Amherst Pierpoint | +170K | Societe Generale | +155K |

| BNP Paribas | +150K | Deutsche Bank | +150K |

| J.P.Morgan | +150K | RBC | +150K |

| BMO | +100K | Citi | +70K |

| Barclays | +50K | UBS | +50K |

| Nomura | -50K | Scotiabank | -100K |

| Wells Fargo | -100K | Bank of America | -150K |

| Jefferies | -200K | TD Securities | -200K |

| Morgan Stanley | -215K | Goldman Sachs | -250K |

| NatWest | -350K | -- | -- |

| Dealer Median | +70K | BBG Whisper Number | +22K |

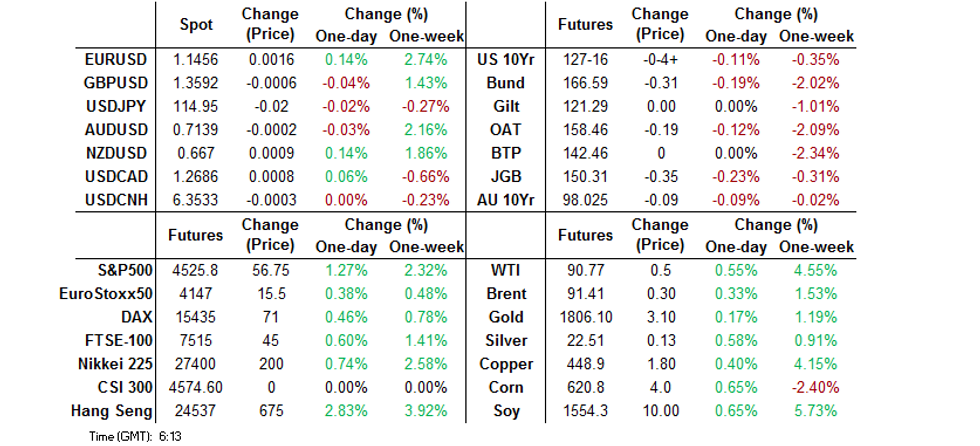

BOND SUMMARY: Core FI Markets Cheapen Further In Asia

U.S. Tsys edged lower in Asia, with regional reaction to Thursday’s price action & related-JGB weakness applying pressure, keeping a lid on any buying interest at the same time. TYH2 last -0-05 at 127-15+, 0-01 off the base of a 0-06 range, while cash Tsys run ~1.0-2.5bp cheaper across the curve, bear flattening. The latest labour market report headlines the U.S. docket on Friday (BBG median looks for +125K in headline NFPs, current BBG whisper number is +22K, although there is plenty of speculation re: the potential for a negative print).

- Japanese participants pressured JGBs lower from the off, reacting to Thursday’s core FI market dynamic. This saw JGB futures print through their ’21 low, with that contract -32 come the bell, back from worst levels of the day. Meanwhile, 5-Year JGB yields topped 0% and 10-Year yields printed 0.20% for the first time since ‘16, with the latter moving closer to the peak of the BoJ’s permitted -/+0.25% trading range. Cash JGBs sit 0.5-3.5-bp cheaper across the curve, with 7s leading the weakness, pointing to the futures-driven nature of the move. Elsewhere, the majority of the major swap spreads widened, applying a further source of pressure to the space.

- Aussie bonds were also subjected to the aforementioned major sources of pressure, which pushed bond futures through their overnight session lows, leaving YM -8.0 & XM -9.0 at the bell. Meanwhile, the Bill strip bear steepened, ending 2-11 ticks lower on the day. Next week’s AOFM issuance slate includes an extra A$500mn of nominal ACGB issuance vs. the “standard” A$2.0bn of generic weekly ACGB supply (a reminder that next week represents the final week of RBA ACGB purchases under its QE scheme).

JGBS AUCTION: Japanese MOF sells Y4.0532tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y4.0532tn 3-Month Bills:

- Average Yield -0.0968% (prev. -0.0923%)

- Average Price 100.0260 (prev. 100.0248)

- High Yield: -0.0930% (prev. -0.0893%)

- Low Price 100.0250 (prev. 100.0240)

- % Allotted At High Yield: 1.3166% (prev. 16.1165%)

- Bid/Cover: 3.252x (prev. 3.755x)

AUSSIE BONDS: The AOFM sells A$1.0bn of the 0.25% 21 Nov '25 Bond, issue #TB161:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 0.25% 21 November 2025 Bond, issue #TB161:

- Average Yield: 1.5056% (prev. 1.3250%)

- High Yield: 1.5075% (prev. 1.3275%)

- Bid/Cover: 4.3400x (prev. 5.2800x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 32.1% (prev. 40.5%)

- Bidders 42 (prev. 44), successful 11 (prev. 17), allocated in full 5 (prev. 11)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Monday 7 February it plans to sell A$500mn of the 1.75% 21 November 2032 Bond.

- On Tuesday 8 February it plans to sell A$150mn of the 1.25% 21 August 2040 Indexed Bond.

- On Wednesday 9 February it plans to sell A$1.0bn of the 1.75% 21 November 2032 Bond.

- On Thursday 10 February it plans to sell A$1.0bn of the 13 May 2022 Note & A$1.0bn of the 10 June 2022 Note.

- On Friday 11 February it plans to sell A$1.0bn of the 0.25% 21 November 2024 Bond.

FOREX: Greenback Remains Under Pressure, Kiwi Takes Lead

Most G10 currency pairs meandered within fairly tight ranges in muted pre-NFP trade, with all eyes on the widely watched U.S. labour market report. Modest risk-on flows materialised in early trade, as solid earnings reports from Amazon, Snapchat and Pinterest allowed U.S. tech equities to catch a breath in the wake of yesterday's sell-off. That being said, the spillover into FX space was marginal at best.

- The dollar index (DXY) extended its rout and is poised to mark a fifth day of losses, as the greenback underperformed all of its major peers. The index descended onto its 100-DMA, which limited losses in mid-Jan. The USD may have faced some further pressure from continued EUR purchases, following a relatively hawkish post-MonPol press conference with Pres Lagarde held Thursday.

- The kiwi dollar outperformed despite the absence of notable headlines. Some linked NZD strength to optimistic comments from PM Ardern, who pointed to a fairly slow spread of the Omicron variant across New Zealand. Meanwhile, government data showed that NZ job ads rose about 1.0% Q/Q in the final quarter of 2021, accelerating after an upward revised 0.8% gain recorded in Q3.

- Apart from U.S. jobs data, today's data highlights include Canadian labour market report, EZ retail sales & German factory orders. Central bank speaker slate features BoE's Bailey, Broadbent & Pill as well as ECB's Villeroy. Elsewhere, Norwegian FinMin will name the new Norges Bank Governor.

FOREX OPTIONS: Expiries for Feb04 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1200(E2.2bln), $1.1225-35(E514mln), $1.1300(E724mln), $1.1350(E656mln), $1.1400(E1.1bln)

- USD/JPY: Y113.80-00($1.3bln)

- GBP/USD: $1.3750(Gbp961mln)

- AUD/USD: $0.7100(A$701mln), $0.7195-00(A$549mln), $0.7300(A$1.1bln)

- USD/CAD: C$1.2500($1.6bln), C$1.2600-10($891mln), C$1.2695-10($1.5bln), C$1.2740($635mln), C$1.2940($2.5bln)

ASIA FX: USD/Asia Falter On Post-ECB Greenback Weakness, Inflation Data Take Focus

Residual greenback weakness after Thursday's dose of freshly hawkish ECB speak weighed on USD/Asia in early trade, while a number of regional economies reported domestic CPI data for the month of January.

- CNH: Spot USD/CNH held a tight range, with onshore Chinese markets still shut for the Lunar New Year holiday. They will re-open on Monday.

- KRW: The won outperformed in the Asia EM basket, as South Korea's headline consumer price growth printed above median estimate, while the acceleration in underlying inflation was larger than forecast. The data raised the prospect of further tightening action from the BoK going forward.

- IDR: The rupiah held a narrow range, as a potential impact from overnight greenback sales was offset by lingering concern over a spike in Indonesia's daily Covid-19 cases. The 50-DMA and 200-DMA of spot USD/IDR formed a golden cross.

- MYR: The ringgit garnered some strength amid little in the way of domestic catalysts. Local headline flow was dominated by further signs of tensions within the federal coalition, although the frictions between UMNO and Bersatu parties are nothing new.

- PHP: The peso remained stable within this week's range. The Philippines' January CPI inflation printed at +3.0% Y/Y, overshooting the median estimate of +2.8%, with the previous reading revised lower to +3.2%. Note that the data was affected by a base-year shift and adjustments to the CPI basket. BSP Gov Diokno said after the release that the central bank has space to remain accommodative.

- THB: Spot USD/THB extended losses after January data showed that headline inflation accelerated to +3.23% Y/Y (highest level since Apr 2021), beating the consensus forecast of +2.47%. The Commerce Ministry cited oil and fresh food prices as main drivers. Reminder that the BoT are set to hold a monetary policy meeting next week.

EQUITIES: Tech-Driven Bid In Wake Of Amazon & Snapchat Earnings

Post-market earnings from Amazon & Snapchat allowed the U.S. tech space to erase a portion of Thursday’s losses, with the NASDAQ 100 e-mini contract last +~2% (after the cash version of the index shed ~4.2% on Thursday). The S&P 500 e-mini is +1.2% last, while the Dow contract trades ~0.6% above settlement levels (with the varied performance owing to relative sensitives to the tech space).

- Meanwhile, the Hang Seng benefitted from the relative stabilisation in broader equity indices in recent sessions as Hong Kong markets re-opened after the LNY holiday. While its large tech exposure allowed the index to benefit from the aforementioned uptick in NASDAQ e-minis. The Hang Seng is +3.1% last.

GOLD: Softer USD Offsets Hawkish CBs, NFPs eyed

Thursday’s hawkish takeaways re: the latest BoE & ECB monetary policy decisions only provided fairly limited & brief downside impetus for bullion, with spot quickly reclaiming the $1,800/oz. Gold then stuck to a tight range during Asia-Pac trade, last dealing a touch above $1,805/oz, little changed on the day. It would seem that the weakness in the broader USD (qs measured by the DXY) offset the uptick in U.S. real yields on Thursday. Familiar technical parameters remain intact ahead of Friday’s U.S. NFP release.

OIL: Fresh Cycle Highs For WTI

WTI & Brent crude futures have added ~$0.60 & ~$0.40 vs. their respective settlement levels, aided by the uptick in e-mini futures, weakness in broader core global FI markets and the impulse from fresh cycle highs in WTI on Thursday (which have been extended on overnight, with $91.00 now within touching distance). Note that WTI futures are on track for a seventh consecutive weekly gain, with questions continuing to do the rounds re: the ability of certain OPEC+ production pact participants to act on their increased output quotas.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/02/2022 | 0700/0800 | ** |  | DE | Manufacturing Orders |

| 04/02/2022 | 0745/0845 | * |  | FR | Industrial Production |

| 04/02/2022 | 0830/0930 | ** |  | EU | IHS Markit Eurozone Construction PMI |

| 04/02/2022 | 0900/1000 |  | EU | ECB Survey of Professional Forecasters | |

| 04/02/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 04/02/2022 | 1000/1100 | ** |  | EU | Retail Sales |

| 04/02/2022 | 1215/1215 |  | UK | BOE Broadbent & Pill Monetary Policy Briefing | |

| 04/02/2022 | 1330/0830 | *** |  | US | Employment Report |

| 04/02/2022 | 1330/0830 | *** |  | CA | Labour Force Survey |

| 04/02/2022 | 1500/1000 | * |  | CA | Ivey PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.