-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: PBoC Provides Upside Surprise In USD/CNY Fixing

EXECUTIVE SUMMARY

- ECB’S KNOT SEES INTEREST-RATE HIKE AS EARLY AS OCTOBER (BBG)

- PBOC RETURNS FROM LNY BREAK & FIXES USD/CNY SHARPLY ABOVE EXP.

- CHINA PREDICTS LOW INFLATION BASED ON WESTERN MONETARY MOVES (BBG)

- UK PM JOHNSON RESHUFFLES TEAM, BUT HEADWINDS REMAIN

- BIDEN SECURITY ADVISOR SULLIVAN: RUSSIAN INVASION COULD COME ‘ANY DAY NOW’ (CNBC)

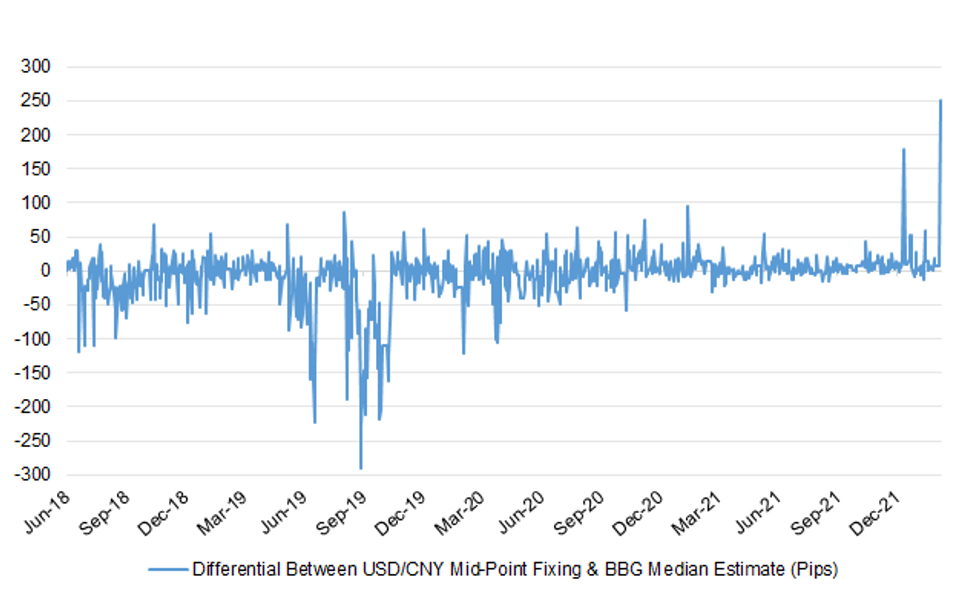

Fig. 1: Differential Between USD/CNY Mid-Point Fixing & BBG Median Estimate (Pips)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

INFLATION: The worst of rising food prices is "yet to come" with a potential 5% surge in spring, the chairman of Tesco has warned. It is the latest bad news amid a growing cost of living crisis driven by rocketing energy prices and tax increases the government will introduce in April. (Sky)

ENERGY/FISCAL/INFLATION: The business secretary has again ruled out the prospect of the government cutting VAT on energy bills to provide further support as the cost of living continues to rise. Kwasi Kwarteng told Sky News the move would be "quite regressive" because "rich people will benefit just as much as people on lower incomes". "That's not something which the Conservative Party or the chancellor want to do, they want to have more progressive taxes so that people who need the money are the ones who get it," he told Trevor Phillips on Sunday. (Sky)

POLITICS: Boris Johnson has told allies that he is determined to cling on to power as he prepares to face a confidence vote as soon as this week. Friends say the prime minister is determined to stay in No 10. “He’s making very clear that they’ll have to send a Panzer division to get him out of there,” one senior adviser said. Downing Street believes the prime minister is in “the danger zone” and that the threshold for calling a vote — letters from 54 MPs to the chairman of the 1922 Committee — could soon be reached. (Sunday Times)

POLITICS: Boris Johnson has announced two new appointments to his backroom staff following a wave of resignations. Cabinet Office minister Steve Barclay will become the PM's chief of staff. And Guto Harri, a former BBC correspondent and adviser to Mr Johnson when he was mayor of London, will become director of communications. Mr Johnson said the moves would "improve how No 10 operates". The PM is understood to be considering further changes to his top team. (BBC)

POLITICS: Boris Johnson’s desperate efforts to save his premiership were undermined on Saturday as one of his most loyal backbench supporters said it was now “inevitable” that Tory MPs would remove him from office over the “partygate” scandal. In an interview with the Observer, Sir Charles Walker, a former vice-chairman of the 1922 Committee of backbench Conservative MPs, implored the prime minister to go of his own accord in the national interest, and likened events in the Tory party to a Greek tragedy. (Observer)

POLITICS: A former minister has become the 14th Conservative MP to publicly call for Boris Johnson to resign as prime minister. Writing in The Daily Telegraph, Nick Gibb declared "we need to change the prime minister" and confirmed he has submitted a letter of no confidence to the 1922 Committee. (Sky)

POLITICS: Another aide has left Number 10, taking the total number of departures in less than 24 hours to five. Number 10 Policy Unit member Elena Narozanski is the latest aide to leave Boris Johnson's Downing Street operation amid the continuing fallout from the partygate allegations. (Sky)

POLITICS: Boris Johnson still has control of Downing Street after a string of close aides quit their jobs, his official spokesman has insisted. Mr Johnson quoted The Lion King as he attempted to rally remaining staff, telling them "change is good". His spokesman said No 10 was "not currently" expecting more resignations in the coming hours. But a former minister has become the latest Conservative MP to submit a letter of no confidence in Mr Johnson. Writing in the Telegraph, Nick Gibb said his constituents were "furious about the double standards" and said Mr Johnson had been "inaccurate" during statements in the Commons. (BBC)

POLITICS: Downing Street has refused to comment on reports a picture of Boris Johnson holding a beer at a birthday party in Number 10 during lockdown has been handed to the Metropolitan Police's investigation. According to the Daily Mirror, the photo shows the prime minister standing next to Chancellor Rishi Sunak, who is holding a soft drink, in Number 10's cabinet room. (Sky)

POLITICS: The cabinet descended into rancour over Boris Johnson’s future last night after both Sajid Javid and Rishi Sunak rebuked the prime minister. One cabinet minister called for Johnson to dismiss Sunak, and two others accused the chancellor of being “on manoeuvres” after he criticised the prime minister for a personal attack on Sir Keir Starmer. (The Times)

POLITICS: Cabinet ministers have turned on Rishi Sunak, accusing him of plotting against the prime minister. Three members of the cabinet have said the chancellor should be sacked for disloyalty as Boris Johnson fights to save his premiership. The prime minister could face a confidence vote as early as this week. "Rishi has been far too blatant this week,” one said. “He’s a bit like a five-year-old boy who tells the girl he likes to ‘please, please’ not kiss him. He appears to be trying to hasten the PM’s departure before things get properly shit with the economy.” (Sunday Times)

POLITICS/FISCAL: A multi-billion pound plan to tackle the NHS backlog has been delayed after the Treasury blocked an announcement due to be made on Monday. The National Recovery Plan for the health service had been the subject of detailed discussions over the past week involving Number 10, the Treasury, the Department of Health and the NHS. Health officials were expecting it to be announced by Boris Johnson and Sajid Javid, the Health Secretary, on Monday as evidence of the Government’s determination to tackle delays in treatment owing to the Covid pandemic, which have left a record six million patients on waiting lists. However, it has emerged that the Treasury refused to sign off the plans, with sources citing concerns over value for money after deadlines for hitting treatment targets slipped as a result of the omicron surge. It comes amid reports of growing tensions between Downing Street and the Treasury. (Telegraph)

POLITICS: The proportion of people unlikely to vote Conservative if Boris Johnson raises taxes has risen sharply, a poll for The Telegraph reveals. (Telegraph)

CORONAVIRUS: The Covid booster campaign has stalled, and declining trust in the prime minister is part of the problem, say scientists. (Guardian)

FISCAL: Workers across the country will be hit twice by Boris Johnson’s tax increase, according to a bombshell official assessment, as leading businessmen and Tory donors condemned the “unconservative” rise and a former minister separately warned that Britain risked becoming “Brussels on Thames”. (Telegraph)

INFRASTRUCTURE: Downing Street is in talks with Macquarie Group, the Australian lender, to secure a headline-grabbing £10bn investment in British infrastructure that would represent one of the largest-ever such commitments by an overseas company. Sky News has learnt that officials at Number 10 have been negotiating with executives at the bank about the plan - which would be earmarked for energy and digital infrastructure projects - for a number of weeks. Sky News has learnt that officials at Number 10 have been negotiating with executives at the bank about the plan - which would be earmarked for energy and digital infrastructure projects - for a number of weeks. An announcement was expected to be made during a state visit to Australia by the prime minister, which had been tentatively scheduled for the middle of this month. (Sky)

NORTHERN IRELAND: The DUP leader has urged Boris Johnson to "do what other prime ministers did" and prioritise Northern Ireland, instead of being distracted by controversies in Downing Street. Sir Jeffrey Donaldson MP has urged Boris Johnson to prioritise the political crisis in Northern Ireland over controversies in Downing Street. (Sky)

EUROPE

ECB: European Central Bank Governing Council Member Klaas Knot said he expects an interest-rate increase as early as in the fourth quarter. Borrowing costs are typically tightened in 25 basis-point steps and “I don’t have reason to think differently this time,” he said in a Buitenhof interview on Sunday. Knot said a second hike can then take place in the spring of 2023. (BBG)

SPAIN: Wealthy Spaniards are rushing to pull their money from a 29 billion-euro ($33 billion) investment vehicle industry as the government shuts down a tax loophole. Wealth managers from Banco Santander SA to UBS Group AG have been busy in recent weeks informing Spain’s market regulator of their intention to close down the products, known as sicavs. (BBG)

SWITZERLAND: Swiss President Ignazio Cassis called Sunday for "calm and creativity" to fix Switzerland's thorny relations with the European Union. Ties between Brussels and Bern have been strained since non-EU member Switzerland suddenly decided in May 2021 to end years of discussion towards a broad cooperation agreement with the bloc. Cassis said that in sorting out Bern's future relationship with Brussels, Switzerland must get away from "purely technical and institutional questions" and instead focus on matters of content. "It is only when we have enriched the content, when politics and society recognise the material gains that Switzerland can expect, that an institutional rapprochement will be accepted," he told the SonntagsZeitung newspaper. The situation needs "a little calm and creativity", he added. (AFP)

RATINGS: Sovereign rating reviews of note from Friday include:

- DBRS Morningstar confirmed Luxembourg at AAA, Stable Trend

- DBRS Morningstar confirmed Sweden at AAA, Stable Trend

ENERGY: Brussels is examining how to shield consumers from a potential energy crisis as part of plans to protect Europe’s households, businesses and borders from the fallout from a Russian military escalation in Ukraine. Diplomats have told the Financial Times that the EU is discussing contingency measures to deal with risks from surging gas prices, a possible migratory crisis and cyber security threats if Russia invades Ukraine. The priority of EU emergency planning is to cope with any reduction in gas flows from Russia, which as Europe’s largest supplier accounts for about 40 per cent of imports. (BBG)

U.S.

FED: MNI: Powell Re-Designated Fed Chair Pending Confirmation

- Jerome Powell will become chair pro tempore of the Federal Reserve after his term expires Saturday and while he awaits a Senate confirmation vote, the Fed said Friday. All three Fed governors voted for the action, and Powell abstained "to avoid even the potential appearance of a conflict of interest," the Fed said. The Senate Banking Committee is expected to vote on Powell and four other Fed governor nominees on Feb. 15, before sending the names to the full Senate. Powell is expected to be confirmed easily. The Fed last appointed a chair pro tempore in 1996, when Alan Greenspan was awaiting his renomination confirmation - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

ECONOMY: The U.S. economy has finally broken free of the sharp ups and downs of Covid, President Joe Biden said Friday, citing January’s unexpectedly big jobs gains. The president also cited upward revisions to November and December’s employment data that show the economy remained strong throughout a dramatic spike in Covid cases. “Our country is taking everything that Covid has to throw at us, and we’ve come back stronger,” Biden said in remarks at the White House. (CNBC)

FISCAL: Janet Yellen, President Joe Biden’s surprise pick as Treasury secretary in the wake of his 2020 election victory, says there’s too much unfinished business to think about departing the role after just over a year on the job. The biggest win of her tenure -- an historic global agreement on corporate taxes that Yellen engineered through careful international diplomacy -- remains incomplete, with the U.S. Congress yet to endorse it. The administration’s “Build Back Better” package of social investments is also in legislative limbo. Meantime, high inflation is marring assessments of the $1.9 trillion aid bill enacted last March. "We still have a huge amount of important work to do,” Yellen, 75, said last week in a statement to Bloomberg News following a wide-ranging interview marking her first year in office. “I have no plans to leave Treasury anytime soon." (BBG)

CORONAVIRUS: U.S. President Joe Biden called for a fresh vaccination push after the country passed a “tragic milestone” of 900,000 deaths from Covid-19. “We can save even more lives -- and spare countless families from the deepest pain imaginable -- if everybody does their part. I urge all Americans: get vaccinated, get your kids vaccinated, and get your booster shot if you are eligible.” (BBG)

EQUITIES: The Justice Department is collecting a trove of information on dozens of investment firms and researchers engaged in short selling as part of a sweeping U.S. hunt for potential trading abuses, according to people with knowledge of the matter. The Federal Bureau of Investigation seized computers from the home of prominent short seller Andrew Left, the founder of Citron Research, in early 2021, some of the people said. In more recent months, the Justice Department subpoenaed certain market participants seeking communications, calendars and other records relating to almost 30 investment and research firms, as well as three dozen individuals associated with them, the people said, asking not to be identified discussing confidential inquiries. (BBG)

OTHER

GLOBAL TRADE: A U.S. extension of tariffs on solar products distorts international trade and hinders the development of clean, low-emission energy, China’s commerce ministry said on Saturday. President Joe Biden on Friday extended Trump-era tariffs on imported solar energy equipment for four years, though he eased the terms to exclude bifacial panels that generate power on both sides, which are dominant among big U.S. projects. Donald Trump imposed the tariffs on solar imports in 2018, using authority under section 201 of a 1974 trade law. The levies started at 30% and declined to 15%. (RTRS)

GLOBAL TRADE: Ford Motor plans to suspend or cut production at eight of its factories in the United States, Mexico and Canada throughout next week because of chip supply constraints, a spokeswoman told Reuters on Friday. (RTRS)

U.S./CHINA: The U.S. House of Representatives on Friday narrowly passed a multibillion-dollar bill aimed at increasing American competitiveness with China and boosting U.S. semiconductor manufacturing, despite Republican opposition. (RTRS)

U.S./CHINA: U.S. Commerce Secretary Gina Raimondo on Friday urged Congress to move swiftly to agree on legislation to increase American competitiveness with China after the U.S. House of Representatives narrowly passed its version of the bill. Raimondo told reporters during a briefing there was no reason negotiations between the House and Senate should drag on for months, adding that $52 billion in appropriations to boost the U.S. semiconductor industry was the most urgent part of the legislation. (RTRS)

U.S./CHINA: U.S. officials called on Monday for "concrete action" from China to make good on its commitment to purchase $200 billion in additional U.S. goods and services in 2020 and 2021 under the "Phase 1" trade deal signed by former President Donald Trump. The officials said Washington was losing patience with Beijing, which had "not shown real signs" in recent months that it would close the gap in the two-year purchase commitments that expired at the end of 2021. The comments come a day before the U.S. government is due to release full-year trade data that analysts expect to show a significant shortfall in China's pledge to increase purchases of U.S. farm and manufactured goods, energy and services. (RTRS)

JAPAN: The Japanese government is making final arrangements to extend Covid-19 quasi-state of emergency in Tokyo and 12 other prefectures due to expire on Feb. 13, the Asahi reports, citing several unidentified officials. Considers extending the measures by ~3 weeks. Areas affected include Tokyo’s neighboring prefectures of Saitama, Kanagawa and Chiba, as well as Aichi and Kumamoto. Formal decision to come by Thurs. The government remains cautious about declaring a state of emergency for Tokyo. (BBG)

AUSTRALIA: Australia will fully reopen its borders to all vaccinated visa holders from Feb 21, Prime Minister Scott Morrison said on Monday (Feb 7), after nearly two years since he shut it to non-citizens to mitigate the threat of the new coronavirus. "If you're double vaccinated, we look forward to welcoming you back to Australia," Morrison said during a media briefing. (CNA)

NORTH KOREA: North Korea stayed mum on a much-anticipated meeting of the country's rubber-stamp parliament Monday, a day after it was supposed to take place, spawning speculation the event might have been delayed. (Yonhap)

NORTH KOREA: North Korea continued to develop its nuclear and ballistic missile programs during the past year and cyberattacks on cryptocurrency exchanges were an important revenue source for Pyongyang, according to an excerpt of a confidential United Nations report seen on Saturday by Reuters. The annual report by independent sanctions monitors was submitted on Friday evening to the U.N. Security Council North Korea sanctions committee. “Although no nuclear tests or launches of ICBMs (intercontinental ballistic missiles) were reported, DPRK continued to develop its capability for production of nuclear fissile materials,” the experts wrote.” (WSJ)

CANADA: The ongoing truckers' protest in the Canadian capital is "out of control," the Ottawa mayor said Sunday, announcing a state of emergency as the city center remained blocked by opponents of anti-Covid measures. (AFP)

CANADA: Protests that started in Ottawa last week have spread to major cities across Canada this weekend, as demonstrators call for an end to pandemic restrictions and say they’re ready to continue blocking streets for weeks or even months until their demands are met. On Saturday, many of the demonstrations were met with direct opposition. Counter-protesters in Ottawa called for an end to protest-related disruptions to daily life in the city’s core, including road closures and frequent blasts from truck horns. In Toronto, counter-protesters said they wanted to protect the well-being of health care workers. (Globe & Mail)

TURKEY: Turkish President Recep Tayyip Erdogan said in a Twitter post that he and his wife tested positive for coronavirus. (BBG)

RUSSIA: A Russian invasion of Ukraine could be imminent, White House national security adviser Jake Sullivan warned on Sunday. “We are in the window,” Sullivan said in an interview on “Fox News Sunday.” “Any day now, Russia could take military action against Ukraine or it could be a couple of weeks from now, or Russia could choose to take the diplomatic path instead.” Sullivan appeared on several morning news programs to discuss the ongoing situation in Eastern Europe. (CNBC)

RUSSIA: German Chancellor Olaf Scholz will meet U.S. President Joe Biden on Feb. 7 at the White House to discuss tensions between Russia and Ukraine, Washington said on Thursday. The leaders would "discuss their shared commitment to both ongoing diplomacy and joint efforts to deter further Russian aggression against Ukraine," White House press secretary Jen Psaki said. "They will also discuss the importance of continued close cooperation on a range of common challenges, including ending the COVID-19 pandemic, addressing the threat of climate change, and promoting economic prosperity and international security." (RTRS)

SOUTH AFRICA: Eskom Holdings SOC Ltd. said it’s suspending power rationing, known locally as load shedding, after its mostly coal-fired power plants’ capacity to generate more electricity improved. South Africa’s state-owned power utility resumed power cuts last week to prevent a total collapse of the grid after breakdowns at its power-generating plants. (BBG)

IRAN: The Biden administration is waiving sanctions on some of Iran’s civilian nuclear activities as it seeks to close a deal with Iran on returning to the 2015 nuclear pact. The U.S. will once again allow foreign companies and officials to work on certain non-weapons Iranian nuclear facilities, reversing a Trump administration decision in 2020 to sanction that work, which froze this activity, according to documents reviewed by The Wall Street Journal. (WSJ)

IRAN: Israeli Prime Minister Naftali Bennett said on Sunday he spoke with U.S. President Joe Biden and discussed ways to halt Iran's nuclear program. (RTRS)

PERU: Peruvian Prime Minister Hector Valer confirmed on Saturday that he is departing just four days after being named to the post, following allegations that he beat his daughter and late wife, creating a new leadership vacuum in the Andean nation. (RTRS)

OIL: Saudi Aramco has raised prices for all crude grades it sells to Asia in March from February, in line with market expectations. The world's top oil exporter increased its March price for its Arab Light crude grade for Asian customers by 60 cents a barrel versus February to a premium of $2.80 a barrel to the Oman/Dubai average, Aramco said on Saturday. March Arab Light crude to the United States was raised by 30 cents a barrel versus February to a premium of $2.45 a barrel versus ASCI (Argus Sour Crude Index). Prices to Northwestern Europe for the same grade were set at a discount of 10 cents a barrel versus ICE Brent, an increase of $1.70 a barrel compared to February. The producer had been expected to raise the March price for the flagship grade to Asia by 60 cents a barrel, according to a Reuters survey of seven refining sources in late January. The price hikes reflected firm demand in Asia and stronger margins for gasoil and jet fuel. (RTRS)

OIL: The state-owned Libyan National Oil Corporation (NOC) announced on Friday that the country's daily oil production has dropped by 100,000 barrels per day due to its inability to maintain oil tanks damaged by armed conflicts. "The National Oil Corporation expresses deep concern about having to reduce daily oil production as a result of the inability to carry out maintenance of tanks damaged by wars, as well as the disruption of some emergency projects," the NOC said in a statement. Currently, 11 out of the 19 oil tanks are out of service, making it impossible to maintain oil production, according to NOC Chairman Mustafa Sanalla. (Xinhua)

CHINA

INFLATION: Inflation in China will remain modest in 2022, the nation’s top economic planner said a statement Sunday, if shifting monetary policies elsewhere weaken the rally in global commodities. The National Development and Reform Commission expects China’s inflation risks will fall this year, as the adverse impacts of Covid and global supply shortages grow less severe. It forecasts the consumer price index to rise this year, after retreating in December from 15-month high, according to the official statement. The full-year 0.9% average increase was lower than previous years. (BBG)

PBOC: The People’s Bank of China will continue to promote credit growth to ensure monetary supply and social financing grow in line with nominal GDP, as well as boost lending to small businesses, innovation and green development, the Financial News, run by the central bank, said in a commentary on Sunday. The central bank is likely to continue keeping ample liquidity through flexible open market operations following a series of loosening measures in the last month, the newspaper said citing analysts. China is likely to introduce several more pro-growth policies in Q1, the newspaper said. (MNI)

YUAN: The yuan may continue to show strength this year after gaining almost 9% in the past two years supported by China's low inflation, its active fiscal policy, its wider global acceptance and China's strong exports advantage, Caixin reported on Monday citing Gao Zhanjun, a senior researcher with the National Institution for Finance Development. However, the currency also faces uncertainties stemming from how the U.S. approaches the pace of easing and inflation. which impacts the dollar's strength, Gao said. (MNI)

ECONOMY: The pandemic and China’s restrictions to control it are still damaging domestic spending, with travel and consumption during the just-ended Lunar New Year break down from 2021’s already low level. People in China made 251 million trips during the seven-day holiday, down 2% from last year and a 26% drop from the pre-pandemic level in 2019. Travel spending was even worse, with tourism revenue of 289 billion yuan ($45.4 billion), 4% below last year and 44% under the 2019 level, the Ministry of Culture and Tourism said in a statement Sunday. (BBG)

PROPERTY: China’s property market has “more space” to develop in the future given the growing urban population, the China Central Television reported citing Wang Yiming, a member of the central bank’s monetary policy committee. Wang was one of several government advisors interviewed by the state television. Urban long-term residents rose by 12 million at the end of last year given that the urbanization rate rose to 64.7% of the population, Wang said. The property market has turned more “rational” as the risks in the property sector had been “orderly rooted out,” CCTV said. China should “fully satisfy” people's housing needs and provide the capital needed for real estate development, CCTV said citing Liu Yuanchun, the President of Renmin University. (MNI)

CORONAVIRUS: China has no plans to adjust its zero-Covid-tolerance policy for the time being, Wu Zunyou, chief epidemiologist with the Chinese Center for Disease Control and Prevention, told the Global Times in an interview. “We previously thought Covid-19 could be basically contained through vaccines, but now it seems that there’s no simple method to control it except with comprehensive measures, although vaccines are the most important weapon,” Wu said. (BBG)

OVERNIGHT DATA

CHINA JAN CAIXIN SERVICES PMI 51.4; MEDIAN 50.5; DEC 53.1

CHINA JAN CAIXIN COMPOSITE PMI 50.1; DEC 53.0

The Caixin China General Services Business Activity Index came in at 51.4 in January, down from 53.1 the previous month. The expansion of activity in the services sector slowed due to recent Covid-19 flareups in many regions across China. Both supply and demand in the services sector expanded in January, but at a slower pace. The gauges for business activity and total new orders remained in expansionary territory for five straight months, but each was more than one point lower than the previous month. External demand fell into contractionary territory in January amid the pandemic following three consecutive months of expansion. The gauge for new export orders in January was the lowest since October 2020. The job market for services shrank. The measure for employment fell into contractionary territory for the first time in five months. Market demand was weak. New hiring for vacant positions was insufficient. The labor market was subdued. Outstanding business increased marginally in January from the previous month, as tightening epidemic control measures impacted production of the services sector. Input costs and prices charged increased, and service providers were under greater cost pressure. Neither gauge changed much from the previous month, but the gauge for input costs was apparently higher than the one for prices charged. Surveyed companies said high labor and raw material costs were the primary causes. Tightening epidemic control measures also increased service providers’ operational costs. Businesses grew less optimistic. The gauge for future output expectations fell to its lowest in 16 months in January, though the figure remained in positive territory. That indicated that service enterprises remained concerned about the ongoing epidemic in China. (Caixin)

JAPAN DEC, P LEADING INDEX 104.3; MEDIAN 103.7; NOV 103.9

JAPAN DEC, P COINCIDENT INDEX 92.6; MEDIAN 92.6; NOV 92.8

AUSTRALIA Q4 RETAIL SALES EX INFLATION +8.2% Q/Q; MEDIAN +7.8%; Q3 -4.4%

AUSTRALIA JAN ANZ JOB ADVERTISEMENTS -0.3% M/M; DEC -5.8%

Although ANZ Job Ads fell by 0.3% in January, they rose steeply on a weekly basis through the month, as is usual following the seasonal Christmas/New Year low. This was despite the large number of Omicron cases in the community, reflecting the resilience in labour demand and the widespread view that Omicron would only be a temporary setback. (ANZ)

AUSTRALIA JAN FOREIGN RESERVES A$81.1BN; DEC A$80.8BN

SOUTH KOREA JAN FOREIGN RESERVES $461.53BN; DEC $463.12BN

CHINA MARKETS

PBOC DRAINS NET CNY130 BILLION VIA OMOS MONDAY

The People's Bank of China (PBOC) injected CNY20 billion via 7-day reverse repos with the rate unchanged at 2.10% on Monday. The operation has led to a net drain of CNY130 billion after offsetting the maturity of CNY150 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1000% at 09:26 am local time from the close of 2.3056% before Chinese New Year holiday.

- The CFETS-NEX money-market sentiment index closed at 58 on Friday vs 43 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3580 MON VS 6.3746

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3580 on Monday, compared with 6.3746 set before Chinese New Year holiday.

MARKETS

SNAPSHOT: PBoC Provides Upside Surprise In USD/CNY Fixing

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 220.96 points at 27219.03

- ASX 200 down 9.411 points at 7110.8

- Shanghai Comp. up 67.331 points at 3428.771

- JGB 10-Yr future down 6 ticks at 150.28, yield up 0.3bp at 0.201%

- Aussie 10-Yr future down 3.5 ticks at 97.990, yield up 3.5bp at 1.995%

- U.S. 10-Yr future +0-05+ at 126-30, yield down 1.09bp at 1.898%

- WTI crude down $0.19 at $92.12, Gold up $2.35 at $1810.68

- USD/JPY up 9 pips at Y115.35

- ECB’S KNOT SEES INTEREST-RATE HIKE AS EARLY AS OCTOBER (BBG)

- PBOC RETURNS FROM LNY BREAK & FIXES USD/CNY SHARPLY ABOVE EXP.

- CHINA PREDICTS LOW INFLATION BASED ON WESTERN MONETARY MOVES (BBG)

- UK PM JOHNSON RESHUFFLES TEAM, BUT HEADWINDS REMAIN

- BIDEN SECURITY ADVISOR SULLIVAN: RUSSIAN INVASION COULD COME ‘ANY DAY NOW’ (CNBC)

BOND SUMMARY: Latest Leg Of Cheapening Seemingly Results In Some Regional Demand In Asia

Friday’s post-NFP cheapening in global core FI markets seemed to draw money from the sidelines, resulting in a bid during early Tsy future and JGB dealing.

- Cash Tsys run little changed to 2bp richer across the curve as a result, bull flattening, with TYH2 last +0-06 at 126-30+, 0-01 off the peak of the contract’s 0-09 Asia range. The contract did register an incremental fresh multi-year low at the re-open, before the aforementioned demand supported the space. TYH2 operates on solid volume of over 130K. Note that flow was headlined by 20K of block sales in FVH2 118.75 put options vs. 14K of block lifts in FVJ2 117.50 puts, in what looked to be some profit taking coupled with rolling down & out. Looking ahead, the NY docket is virtually empty.

- JGB futures benefited from the broader core FI bid and expectations that the BoJ will act to defend the 0.25% upper boundary of its permitted 10-Year JGB yield trading range (perhaps pre-emptively), if required. This left JGB futures -2 at the bell, with most of the overnight session losses unwound. The super-long end led the richening, which pointed to Japanese lifer-driven demand given their already expressed preference for that zone of the curve. Major benchmarks across the curve were little changed to ~3bp richer on the day, as the bull flattening.

- Outside of the wider spread gyrations in core global FI markets, Aussie bonds looked to have a modest, delayed downtick on the back of the formalisation of the Australian international border re-opening (which will kick in on 21 February, for the double vaccinated), after weekend press reports pointed to an imminent announcement re: the matter. YM -7.0 and XM -3.5 come the bell, off worst levels after the space sold off post-NFP.

AUSSIE BONDS: The AOFM sells A$500mn of the 2.75% 21 May ‘41 Bond, issue #TB156:

The Australian Office of Financial Management (AOFM) sells A$500mn of the 2.75% 21 May 2041 Bond, issue #TB156:

- Average Yield: 2.4864% (prev. 2.0511%)

- High Yield: 2.4900% (prev. 2.0575%)

- Bid/Cover: 2.1440x (prev. 2.8500x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 23.4% (prev. 53.3%)

- Bidders 69 (prev. 59), successful 35 (prev. 24), allocated in full 25 (prev. 19)

EQUITIES: China Plays Catchup Following LNY Holiday

The CSI 300 trades 1.6% better off at midday, moving higher as mainland China returns from the LNY holiday, playing catchup to gyrations witnessed in broader equity markets over the last week.

- Meanwhile, the remainder of the regional benchmark indices, namely the Nikkei 255 (-0.7%) and the Hang Seng (-0.3%), ticked lower. E-minis are little changed on the day, paring early losses.

- The post-holiday rally in the CSI 300 is a little more subdued than that seen on the Hang Seng’s first day back (the Hang Seng added 3.2% on Friday), with continued worry re: the Chinese economy perhaps limiting the upside impetus (the latest instance of such worry came in the form of LNY tourism and spending figures).

- The ASX 200 was little changed at the close, recovering from worst levels following PM Morrison’s formal announcement re: Australia’s border re-opening to double-vaccinated international travellers (as of 21 Feb).

OIL: Lacking Clear Direction In Asia

WTI is -$0.40, while Brent is +$0.10 at typing. The benchmarks have traded either side of unchanged during Asia-Pac dealing.

- Crude markets were subjected to conflicting signals during Asia hours, with weight from lower U.S. e-mini equity futures at least partially offset by the familiar stories of tightness in crude supply, cold weather snaps and questions re: the ability of some OPEC+ members to raise production to meet their new quotas.

- In oil-specific news, the weekend saw Saudi Aramco raise its March prices for customers in Asia, the U.S., and Europe by $0.30-$2.30 per barrel (within wider expectations).

- Elsewhere, Libyan state operators disclosed a 100K bpd reduction in oil production on Friday (Platts estimated Libyan oil production of 1.11mn bpd in 2021) due to reduced storage capacity surrounding damaged oil tanks.

- WTI futures remain in backwardation with front month futures trading at a ~$1.60 premium to the second contract at writing, with that dynamic aided by supply uncertainty and familiar geopolitical risks e.g. Ukraine/Russia matters and Middle Eastern tensions.

GOLD: Intraday Vol., But No Range Breaks

A narrow round of Asia-Pac trade sees spot gold deal little changed, hovering around ~$1,810/oz. To recap, Friday’s firmer than expected U.S. NFP release provide a second consecutive day of volatility for bullion, but spot failed to break out of the recently observed range, in a session that looked very much like Thursday in terms of price action. A pullback from intraday highs in both U.S. real yields (as proxied by our weighted monitor) and the USD (as measured by the DXY) allowed bullion to stabilise and then recover pre-NFP losses, with well-trodden technical parameters remaining untouched.

- Thursday's U.S. CPI print presents the major event risk for participants this week.

FOREX: AUD Gains With Australia Set To Ease Border Rules, PBOC Signals Preference For Softer Yuan

High-beta G10 currencies showed resilience against the familiar combination of global monetary policy tightening/geopolitical tensions. The Aussie dollar was among the best performers, drawing further support from the announcement that Australia will re-open its international border to vaccinated visa holders within two weeks. Appetite for the AUD may have been fuelled by a record-breaking Q4 retail sales print, although the initial reaction was limited.

- The Eurozone's single currency traded on a softer footing, despite hawkish comments from ECB Governing Council Member Knot, who said he expected an interest-rate hike in Q4 this year. The geopolitical tension surrounding Russia's military build-up on the Ukrainian border may have sapped some strength from the EUR.

- Upon return from Lunar New Year holiday, the PBOC reached for its daily fixing of yuan reference rate to knock the redback on its head. China's central bank set the mid-point of the permitted USD/CNY band at CNY6.3580, 252 pips above consensus estimate, which represents the widest miss since June 2018. Spot USD/CNH posted a leg higher after the fixing, but eventually pulled back toward neutral levels.

- Worth noting that while markets in China and Taiwan re-opened after Lunar New Year holidays, those in New Zealand were shut in observance of the Waitangi Day.

- German industrial output & comments from ECB Pres Lagarde take focus from here.

FOREX OPTIONS: Expiries for Feb07 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1500(E633mln)

- USD/JPY: Y115.00($568mln)

- GBP/USD: $1.3400(Gbp591mln)

- AUD/NZD: N$1.0600(A$1.4bln)

- USD/CAD: C$1.2730-50($560mln)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.