-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Familiar Central Bank Tones Evident Overnight

EXECUTIVE SUMMARY

- ECB’S VILLEROY: ECB WILL DO WHAT IS NEEDED TO MEET 2% INFLATION TARGET (RTRS)

- FED'S DALY: U.S. INFLATION COULD GET WORSE BEFORE IT GETS BETTER (RTRS)

- BOJ’S NAKAMURA: WILL CONTINUE WITH MONETARY EASING PERSISTENTLY (BBG)

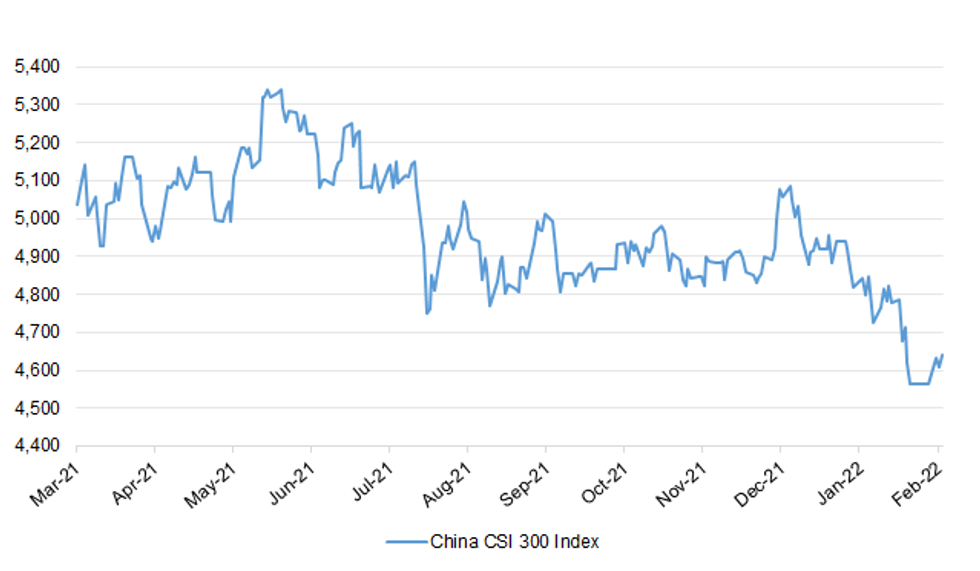

Fig. 1: China CSI 300 Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: Boris Johnson is planning a full reshuffle this summer as he tries to fend off an attempt by Conservative MPs to remove him from office. The prime minister mounted a “defensive” mini-reshuffle yesterday in which he moved arch-loyalists within cabinet to shore up support on the right of the party. Jacob Rees-Mogg was moved from the role of leader of the Commons to take responsibility for the government’s post-Brexit agenda, including civil service reform. Mark Spencer was moved from chief whip to succeed Rees-Mogg while Chris Heaton-Harris, a Brexiteer, replaced Spencer. The prime minister did not sack anyone, although there was uncertainty surrounding the appointment of Chris Pincher as deputy chief whip after the announcement was delayed for five hours. (The Times)

POLITICS: Senior Scottish Tories want a vote of no confidence in Boris Johnson as soon as possible amid fears that voter anger over "partygate" will become "normalised" if he clings on. (Telegraph)

BREXIT: Higher costs, more paperwork and border delays have been "the only detectable impact so far" of Brexit for British businesses, according to a new report by MPs. Trade volumes have been suppressed since the end of the transition period in December 2020 - though the COVID-19 pandemic and wider global issues were also key factors, the report said. But the Commons public accounts committee (PAC) said it was clear that Brexit has had an impact and called for the government to calculate the additional costs that firms face. (Sky)

EUROPE

ECB: The European Central Bank will do everything necessary to steer inflation back to its 2% target over time, Bank of France Governor Francois Villeroy de Galhau said on Tuesday. Euro zone inflation rose to a record of 5.1% year-on-year in January, adding to doubts that price pressures are not as mild and temporary as the ECB had so far expected. (RTRS)

ECB: Deutsche Bank Chief Executive Officer Christian Sewing on Tuesday said that the European Central Bank will need to raise interest rates to stem inflation expectations. Sewing, who has long been pushing for a change in ECB policy, said that inflation levels mean that the ECB “will have to follow suit” after the U.S. Federal Reserve raises rates in March, as widely expected. (RTRS)

EU: “A very comprehensive transformation of the architecture of the economic and monetary union seems like something to me that wouldn’t be embraced by the majority,” German Finance Minister Christian Lindner tells reporters after meeting with Italy’s Finance Minister Daniele Franco in Rome. “We should make possible whatever is needed within the current treaties and current rules,” while also sending sign to markets that governments understand responsibility to reduce debt. “Inflation developments show that public finances must be sustainable, solid, and healthy.” Says they discussed EU fiscal rules, further steps on banking union, recovery fund. (BBG)

FRANCE: French economic growth will slow in the first quarter of the year in the face of a wave of coronavirus infections caused by the Omicron variant before picking up by mid year, the national statistics agency forecast on Tuesday. INSEE forecast that the European Union's second-biggest economy would grow 0.3% in the current quarter from the previous three months when it expanded 0.7%. The growth rate was then seen doubling to 0.6% in the second quarter as household spending rebounded in line with an expected improvement in the health situation. (RTRS)

ITALY/BTPS: Italy plans to sell up to EU3 billion ($3.43 billion) of 0% bonds due Dec. 15, 2024 in an auction on Feb. 11. The sale is a reopening of previously issued securities with EU7.448 billion outstanding. Currently the securities are being quoted at a price to yield of 0.644%. Italy plans to sell up to EU3 billion ($3.43 billion) of 0.45% bonds due Feb. 15, 2029 in an auction on Feb. 11. The sale is a reopening of previously issued securities with EU7.95 billion outstanding. Currently the securities are being quoted at a price to yield of 1.445%. Italy plans to sell up to EU1.75 billion ($2 billion) of 1.8% bonds due March 1, 2041 in an auction on Feb. 11. The sale is a reopening of previously issued securities with EU14.5 billion outstanding. Currently the securities are being quoted at a price to yield of 2.243%. (BBG)

PORTUGAL: Portuguese President Marcelo Rebelo de Sousa will swear in Prime Minister Antonio Costa’s new government on Feb. 23, Expresso reports on its website, citing Rebelo de Sousa’s comments to reporters. Costa, who leads the nation’s center-left Socialist Party, won Portugal’s general election on Jan. 30 with enough votes to secure an absolute majority in parliament. (BBG)

U.S.

FED: High U.S. inflation may get even higher before subsiding in the face of Federal Reserve action and as supply chain strains recede, San Francisco Federal Reserve Bank President Mary Daly said on Tuesday. "We could have it be worse before it gets better but it is definitely going to get better," Daly told CNN, adding that even so she doesn't expect inflation to have fallen to 2% by the end of the year. Consumer prices rose 7% last year, eating into American paychecks. The Fed is expected to begin raising interest rates from near-zero levels next month, a move Daly said she supports. When it does, Daly said, the Fed should do neither too little nor be "overly aggressive," mindful that the Fed alone cannot cure inflation that's caused in large part by ongoing pandemic disruption. (RTRS)

INFLATION: U.S. President Joe Biden plans to host company executives at the White House on Wednesday, press secretary Jen Psaki said on Tuesday, to discuss how his stalled social spending and climate change package could help lower energy costs. (RTRS)

INFLATION: U.S. Senator Elizabeth Warren, a Democrat who has argued for the breakup of tech giants like Amazon, Google and Facebook, has urged the Justice Department to be more aggressive in fighting price-fixing and to stop making deals with corporate wrongdoers that defer prosecution in exchange for good behavior. "The nation is dealing with inflation at its highest level in decades, much of it driven by corporate greed and anticompetitive behavior, and the federal government must use every tool available to prevent price gouging and reduce prices for Americans," Warren wrote in a letter dated Monday and sent to Attorney General Merrick Garland and his deputy, Lisa Monaco. (RTRS)

FISCAL: The House of Representatives voted Tuesday to pass a short-term government funding bill to avert a shutdown at the end of next week. Funding is currently set to expire on February 18, but the measure the House approved would extend funding through March 11. (CNN)

CORONAVIRUS: Pfizer CEO Albert Bourla on Tuesday said he believes the Food and Drug Administration will authorize the company’s Covid vaccine for children under 5 years old under a fast-track process that allows the agency to review the data as soon as researchers compile it in real time. “I think the chances are very high for FDA to approve it,” Bourla told CNBC’s Meg Tirrell, while noting that the regulatory process still has to play out. “I think that they will be pleased with the data and they will approve,” he said. (CNBC)

CORONAVIRUS: Plans for a demonstration by truckers in the U.S. similar to the one in Canada appear to be gaining momentum, aided by online supporters, the New York Times reported. The route and timing of the demonstration, meant to protest pandemic restrictions in the U.S., was set to be announced on Tuesday evening, said Brian Brase, a trucker who is organizing the American effort. (BBG)

CORONAVIRUS: Illinois Governor J.B. Pritzker will lay out a plan on Wednesday to phase out the mask mandate for the state residents in most indoor settings, Chicago Sun Times reported, citing people it didn’t identify. Pritzker teased the rollback Tuesday, telling residents to “stay tuned” for an update on the policy. While the governor will wind down the mask mandate for the public at large, state officials are expected to continue waging the legal battle to keep masks on in schools, which Pritzker says present a different challenge in the fight to curb the spread of the virus, the report said. (BBG)

EQUITIES: Senate Majority Leader Chuck Schumer gave public support on Tuesday to his colleagues' growing efforts to rein in their fellow lawmakers' trades of individual stocks after he previously dodged questions on whether he would support such a ban. "I believe in it," Schumer told reporters in response to a question about his position. "I have asked our members to get together to try to come up with one bill. I would like to see it done." (Business Insider)

OTHER

GLOBAL TRADE: Countries in Asia-Pacific have strengthened their regional integration during the pandemic, which helped to insulate their economies as supply-chain bottlenecks and restrictions to restrain the virus choked trade elsewhere. “Asia supply chains have been more resilient compared to those in advanced countries,” ADB Principal Economist Jong Woo Kang told Bloomberg Television on Wednesday. This has helped keep any widespread inflation pressures at bay in the region, save for sporadic spikes in food prices, he said. (BBG)

U.S./CHINA: President Biden tweeted the following on Tuesday, “China has been leading the electric vehicle race, but that’s about to change. We’re building a convenient, reliable, equitable national public charging network. It’ll make America more economically competitive and help us tackle the climate crisis at the same time.” (MNI)

U.S./CHINA: Feuding investors in a California plane startup are firing off allegations against each other while the company is in the midst of a U.S. national security review, a risky tactic during the secretive process. Icon Aircraft Inc. makes a small, amphibious plane with foldable wings that is marketed for recreational use. A group of American shareholders fell out with Chinese investors who hold a dominant stake in Icon, alleging they are improperly transferring the company’s technology to China. The Chinese investors have said in legal filings that they are pursuing a normal technology licensing agreement. They and Icon deny any improper dealing. (WSJ)

U.S./CHINA/TAIWAN: China is firmly opposed to the U.S.’s plan to sell about $100m of missile defense system equipment and services to Taiwan, the Defense Ministry said in a statement. China urges U.S. to cancel the plan and terminate military ties with the island. The Chinese military will use “all necessary” measures to defeat external intervention and attempts to seek Taiwan independence. (BBG)

CORONAVIRUS: The World Health Organization expects a more transmissible version of omicron to increase in circulation around the world, though it’s not yet clear if the subvariant can reinfect people who caught an earlier version of the omicron strain. Maria Van Kerkhove, the WHO’s Covid-19 technical lead, said Tuesday the global health agency is tracking four different versions of omicron. Van Kerkhove said the BA.2 subvariant, which is more contagious than the currently dominant BA.1 version, will likely become more common. (CNBC)

JAPAN: Board Member Toyoaki Nakamura says the Bank of Japan will persist in its easing policy to reache the bank’s 2% inflation target. BOJ’s easing will help raise Japan’s growth potential and contribute to achieving the price goal, Nakamura says in an online speech to local business leaders in Yamanashi. Says a pickup in Japan’s economy has become evident. Expects consumer price gains to increase. Companies may pass their costs onto consumers more frequently than expected, he says. (BBG)

JAPAN: Tokyo and 12 other prefectures currently under a COVID-19 quasi-state of emergency have requested an extension to the measure set to end this weekend, the prefectural governments said Tuesday. (Kyodo)

BOK: South Korean presidential office has begun the process to review candidates to head Bank of Korea as current Governor Lee Ju-yeol’s term ends on March 31, Yonhap News reports, citing an unidentified Blue House official. Even though the process has started, actual nomination likely to be announced after March 9 presidential election, Yonhap says without citing anyone. (BBG)

CANADA: The busiest land crossing from the United States to Canada remained shut on Tuesday after Canadian truckers blocked lanes on Monday to protest their government's pandemic control measures. While traffic in both directions was initially blocked, U.S.-bound lanes have since reopened, Windsor Police tweeted. (RTRS)

TURKEY: Finance Minister Nureddin Nebati told investors in London that Turkey's high inflation was temporary while providing them with "comprehensive information" about the country's economic model, his ministry said on Tuesday. Nebati held two days of talks in London and pitched Ankara's unorthodox economic policy to investors, as Turkey grapples with soaring inflation after the lira currency lost 44% of its value last year. In a statement, the finance ministry said Nebati held talks with some 100 senior officials, as well as representatives from dozens of banks, firms, and funds, and added they had exchanged views on the outlook for the Turkish economy and beyond. Nebati emphasised that Turkey "is a developing star country with significant potential" in its region and globally, and that it had a dynamic production capacity, strong growth performance, healthy public finances and a solid banking sector, it said. (RTRS)

RUSSIA: U.S. lawmakers negotiating a Russia sanctions bill were getting "closer and closer" to an agreement, Senate Democratic leader Chuck Schumer said on Tuesday. Russia has amassed troops and equipment along its border with Ukraine, stoking fears of an invasion. Washington has threatened Moscow with sanctions should it attack Ukraine. "It is moving along but there are still a couple of areas of disagreement, but they're bridging the gap. They're getting closer and closer," Schumer said of the sanctions bill. (RTRS)

RUSSIA: Germany, France and Poland are "united" in working to keep the peace in Europe in the face of the Ukraine crisis, German Chancellor Olaf Scholz said Tuesday at a meeting of the three countries' leaders. "We are united by the goal of maintaining peace in Europe through diplomacy and clear messages and the shared will to act in unison," Scholz told reporters flanked by French President Emmanuel Macron and Poland's Andrzej Duda. (AFP)

RUSSIA: Finance Minister Christian Lindner said on Tuesday that Germany was very clear that Russia would face harsh consequences if it invades Ukraine. Asked about the Nord Stream 2 pipeline, Lindner said he would not speculate about any specific individual sanctions. (RTRS)

RUSSIA: The European Central Bank is preparing banks for a possible Russian-sponsored cyber attack as tensions with Ukraine mount, two people with knowledge of the matter said, as the region braces for the financial fallout of any conflict. The stand-off between Russia and Ukraine has rattled Europe's political and business leaders, who fear an invasion that would inflict damage on the entire region. Earlier this week, French President Emmanuel Macron shuttled from Moscow to Kyiv in a bid to act as a mediator after Russia massed troops near Ukraine. (RTRS)

MIDDLE EAST: Syrian air defences on Wednesday shot down a number of "Israeli aggression's missiles" around Damascus, the capital, state TV said. State television also reported earlier that Syrian air defences confronted "hostile targets" over Damascus. There was no immediate information on damages or casualties. (RTRS)

PERU: Peruvian President Pedro Castillo swore in his fourth cabinet in just six months in office on Tuesday, picking a loyalist as prime minister, in a bid to end his administration's recurring crises. (RTRS)

IRON ORE: More on the earlier headlines: China's market regulator and the state planner recently talked to iron ore information providers, urging related companies not to publish false price information and pledged to pay close attention to market movements. The authorities would take further measures to ensure iron ore price stability and strictly crack down on irregularities such as fabricating information or driving up prices, the State Administration for Market Regulation said in a statement on Wednesday. (RTRS)

ENERGY: The Japanese government has solidified a plan to divert some liquefied natural gas to Europe amid ratcheting tension in Ukraine that threatens to disrupt supply to the continent, according to a public broadcaster. Japan will seek cooperation from its companies that have stakes in overseas LNG export plants, and will ensure enough domestic supply before redirecting shipments, NHK reported on Wednesday citing an unidentified person. The move appears to be symbolic, as the volumes would likely do little to solve a shortage in Europe in the event of a shutdown in Russian supplies. (BBG)

OIL: White House spokeswoman Jen Psaki said on Tuesday that all options are on the table to respond to high oil prices, including talking to allies, when asked if there could be future cooperative oil releases. In November, the United States announced plans to release 50 million barrels of crude from the U.S. Strategic Petroleum Reserve to help cool oil prices, but prices now are just below seven-year highs. (RTRS)

OIL: U.S. crude oil output is expected to rise 770,000 barrels per day to 11.97 million bpd in 2022, the government said in a monthly forecast on Tuesday. U.S. crude output is expected to rise 630,000 bpd to 12.60 million bpd in 2023, according to the same monthly report from the Energy Information Administration. U.S. total petroleum consumption is due to rise 880,000 bpd to 20.66 million bpd in 2022. (RTRS)

CHINA

PROPERTY: China’s banking regulators on Tuesday further eased restrictions on rental housing development, a move set to spur more developers applying for loans, the China Securities Journal reported. In a directive published yesterday, the PBOC and the banking commission excluded guaranteed rental property projects from its centralized management system, essentially encouraging banks to freely lend to developers of these projects without quota restrictions. At the end of November, loans to rental housing development rose five times faster than the average rate of growth of all lending, the newspaper said. (MNI)

CAPITAL FLOW: China won’t see a capital outflow even as the U.S. Federal Reserve is more likely to raise interest rates starting in March, the Economic Information Daily said citing analyst Liang Si with Bank of China. The yuan has stayed strong and the higher interest rate offered by China and lower inflation will prevent an exodus of foreign capital, Liang was cited saying. Yuan assets are still attractive as they are more independent from other global markets, offering investors an option to diversify risks, the newspaper said. China’s higher economic growth and supply chain advantage as well as the financial market opening will help keep capital movement stable, the daily said citing spokeswoman Wang Chunying of the State Administration of Foreign Exchange. (MNI)

MARKETS: A senior Chinese central bank official blasted the nation’s brokers for providing “illegal” cross-border securities trading services to mainland investors, just three months after he questioned the legitimacy of some online trading apps. Offshore units of some brokers are working with overseas branches of Chinese banks to help individual mainland investors wire their money across the border, often under false claims that the foreign exchange is used for personal travel, Sun Tianqi, head of the financial stability bureau at People’s Bank of China, wrote in an article published Tuesday in the central bank’s bi-weekly China Finance magazine. (BBG)

EQUITIES: China’s domestic security firms raised CNY113 billion in initial public offerings from the start of this year through Feb. 8, 229% more than the same period a year ago, the China Securities Journal said. The increase in capital raised contrasts with a smaller number of IPO applications approved, which numbered 33 out of 36 submitted, compared with 76 out of 83 last year, indicating tighter regulatory scrutiny, the newspaper said. Citic Securities led with CNY34.9 billion underwritten, followed by CICC’s CNY27.6 billion, the journal said. China is expected to fully implement the so-called stock registration system reform on its mainboards this year, the journal said. The new system, more in line with other mature capital markets, will allow more companies to meet the listing criteria and boost the overall IPO market. (MNI)

OVERNIGHT DATA

JAPAN JAN, P MACHINE TOOL ORDERS +61.4% Y/Y; DEC +40.6%

JAPAN JAN M2 MONEY STOCK +3.6% Y/Y; MEDIAN +3.6%; DEC +3.7%

JAPAN JAN M3 MONEY STOCK +3.3% Y/Y; MEDIAN +3.3%; DEC +3.4%

AUSTRALIA FEB WESTPAC CONSUMER CONFIDENCE 100.8; JAN 102.2

AUSTRALIA FEB WESTPAC CONSUMER CONFIDENCE -1.3% M/M; -2.0%

Given that the health disruptions from the Omicron variant have eased and the labour market has strengthened it is surprising that we did not see some improvement in the Index in February. Virus developments do look to have seen an improved assessment of the economy, as measured by the components of the Index that relate to the economic outlook, and confidence in the jobs market (see below). The ‘economy, next 12 months’ sub-index increased by 2.4% and the ‘economy, next 5 years’ sub-index was up by 1.5%. However, this was more than offset by increased pressure on family finances. Both components of the Index that measure respondents’ assessments of their finances deteriorated. The ‘finances vs a year ago’ sub-index slumped by 9.2% (more than reversing the surprise 7.5% lift in January) while the ‘finances, next 12 months’ sub-index fell by 1.5% to be down by 4.3% since December. The most likely explanations for these elevated pressures on finances relate to: Omicron-related disruptions to activity and earnings at the start of the year; the rising cost of living; and the prospect of rising interest rates. (Westpac)

NEW ZEALAND JAN ANZ TRUCKOMETER HEAVY -0.5% M/M; DEC -0.4%

January brought relatively steady traffic flows versus December (seasonally adjusted). The Light Traffic Index lifted 0.9% after bouncing 16% in December as the Auckland border opened, while the Heavy Traffic Index eased 0.5%. The Heavy Traffic index has largely made back its Delta fall, while light traffic hasn’t yet, sitting around 2018-19 levels. COVID restrictions including regional boundaries have lessened the usefulness of light traffic in particular as an economic indicator. The looming Omicron outbreak is likely to disrupt things further. The Heavy Traffic Index may be more a reflection of infection levels amongst truck drivers than anything else over the next couple of months. As for the Light Traffic Index, its six-month lead on the economy has been battered by lockdowns. Heavy traffic has been the more useful indicator recently. It suggests a solid increase in Q4 GDP following the lockdown-induced 3.7% fall in GDP in Q3. (ANZ)

CHINA MARKETS

PBOC DRAINS NET CNY130 BILLION VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) injected CNY20 billion via 7-day reverse repos with the rate unchanged at 2.10% on Wednesday. The operation has led to a net drain of CNY130 billion after offsetting the maturity of CNY150 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0878% at 09:20 am local time from the close of 2.0656% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 41 on Tuesday vs 43 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3653 WEDS VS 6.3569

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.3653 on Wednesday, compared with 6.3569 set on Tuesday.

MARKETS

SNAPSHOT: Familiar Central Bank Tones Evident Overnight

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 319.49 points at 27604.05

- ASX 200 up 81.411 points at 7268.1

- Shanghai Comp. up 23.027 points at 3474.464

- JGB 10-Yr future down 1 tick at 150.13, yield down 0.7bp at 0.210%

- Aussie 10-Yr future up 1.5 ticks at 97.880, yield down 1.5bp at 2.105%

- U.S. 10-Yr future +0-03+ at 126-22, yield down 2.55bp at 1.938%

- WTI crude up $0.22 at $89.58, Gold up $2.49 at $1828.41

- USD/JPY down 7 pips at Y115.48

- ECB’S VILLEROY: ECB WILL DO WHAT IS NEEDED TO MEET 2% INFLATION TARGET (RTRS)

- FED'S DALY: U.S. INFLATION COULD GET WORSE BEFORE IT GETS BETTER (RTRS)

- BOJ’S NAKAMURA: WILL CONTINUE WITH MONETARY EASING PERSISTENTLY (BBG)

BOND SUMMARY: Better Bid Overnight

Core FI markets moved away from worst levels in Asia-Pac hours, with bears unable to force a meaningful extension of the recent weakness. There wasn’t much in the way of notable macro news flow.

- The more notable market flows tried to fade the Asia-Pac uptick in the Tsy space, with a couple of 2K+ screen sellers of TYH2 futures hitting, while 10K of block lifts in TYJ2 126.00 puts headlined broader overnight flow. TYH2 last +0-03+ at 126-22, 0-01 off session highs, while cash Tsys run 1-3bp richer across the curve, with bull flattening in play. Looking ahead, Wednesday’s NY docket is headlined by Fedspeak from Bowman & Mester, in addition to 10-Year Tsy supply.

- The super-long end led the JGB rally, with the major cash JGB benchmarks little changed to ~3.0bp richer, bull flattening in the process. Long dated swap spread tightening also pointed to receiver flows in swaps aiding the rally. JGB futures were +6 at the bell, with overnight losses more than reversed. The broader core FI bid and expectations re: the BoJ’s defence of the upper bound of its permitted 10-Year JGB yield trading band (0.25%) on any test of the level (if not pre-emptively) seemed to be the major supportive factors for the space. BoJ Rinban operations covering 1- to 10-Year JGBs saw little movement vs. prev in offer/cover terms. In local news, BoJ board member Nakamura stuck to the BoJ’s well-trodden central views in his latest address. Meanwhile, Tokyo and other prefectures requested an extension of the quasi COVID-19 state of emergency that they are currently observing, in line with press reports that have hit in recent days.

- Aussie bonds benefited from the broader uptick in core FI markets and the passage of supply-related pressure, with ACGB Nov’32 and semi-government issuance now behind us. YM +1.0 & XM +1.5 at the close, a touch shy of best levels of the day.

JGBS AUCTION: Japanese MOF sells Y2.7565tn 6-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y2.7565tn 6-Month Bills:

- Average Yield -0.0907% (prev. -0.0907%)

- Average Price 100.045 (prev. 100.045)

- High Yield: -0.0866% (prev. -0.0866%)

- Low Price 100.043 (prev. 100.043)

- % Allotted At High Yield: 27.7941% (prev. 28.7513%)

- Bid/Cover: 3.547x (prev. 4.416x)

AUSSIE BONDS: The AOFM sells A$1.0bn of the 1.75% 21 Nov ‘32 Bond, issue #TB165:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 1.75% 21 November 2032 Bond, issue #TB165:

- Average Yield: 2.1435% (prev. 1.8898%)

- High Yield: 2.1450% (prev. 1.8925%)

- Bid/Cover: 3.2250x (prev. 3.6550x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 65.3% (prev. 4.9%)

- Bidders 45 (prev. 48), successful 20 (prev. 26), allocated in full 12 (prev. 15)

EQUITIES: Asia-Pac Higher On Wall St. Lead, Chinese Mega Cap Rally

The major Asia-Pac equity indices trade 0.3% to 2.0% higher, on the back of a positive lead from U.S. equities.

- The Hang Seng leads the gains, driven by a rally in Chinese mega cap tech names such as Alibaba, following a rise in their U.S. ADRs on Tuesday. The Hang Seng Tech index gained 3.1%, after a 3.9% rise in the Nasdaq Golden Dragon China index during the U.S. session.

- The CSI300 brings up the rear amongst regional peers, adding 0.3%. A broad rally in Chinese property developer shares (on the back of the latest unwind of tightening measures hampering the sector) was countered by weakness in high-beta equities, with the tech-heavy ChiNext and STAR50 unchanged to a touch lower at typing. Note that offshore investors haven’t showed much in the way of interest when it comes to following Tuesday’s reported “National Team” buying of mainland Chinese equities, at least when it comes to observable Northbound Hong Kong-China Stock Connect flows. This morning’s cumulative net northbound flows via the Stock Connect channels sit at a relatively paltry ~CNY2bn of purchases.

- The ASX 200 closed 1.1% higher, shrugging off a decline in the Australian Westpac-Melbourne Institute Index of Consumer Sentiment, with the latter pulling back to near-neutral levels.

- E-mini futures trade at the top of their Asia range at typing, 0.4% to 0.5% above their respective settlement levels.

OIL: A Marginal Uptick In Asia

WTI and Brent futures are ~$0.40 better off at typing, consolidating above Tuesday's worst levels aided by an uptick in U.S. e-mini equity futures. Crude specific news has also been supportive, with the latest round of weekly U.S. API crude inventory figures reportedly revealing drawdowns in crude, gasoline, and distillate inventories.

- A reminder that hope surrounding the Iranian nuclear talks in Vienna pressured crude prices on Tuesday, leaving WTI & Brent futures ~$2.00 lower on the day come settlement. EU foreign policy chief Josep Borrell noted that parties to the talks were “reaching the last steps” of negotiations, although the discussions still rely on intermediaries from third party nations when it comes to facilitating U.S.-Iran communique.

- Tuesday also saw the EIA revise its 2022 U.S. shale production forecasts into positive territory i.e. projecting growth vs. ’21 levels, but this is unlikely to assuage broader fears re: tight oil markets, at least in isolation.

- WTI & Brent have breached technical support (which came in the form of their respective 4 Feb lows), with bears now switching focus to the Jan 31 low in WTI ($86.34) and the Jan 24 low in Brent ($87.05).

- U.S. EIA oil inventory data is due later Wednesday, with the median estimate of those surveyed by Platts looking for a 100K build in headline crude stocks.

GOLD: Range Trading

Spot remains hemmed in its recently observed range, leaving well-defined technical parameters intact, as participants zero in on Thursday’s U.S. CPI release (with the well-documented global fears re: inflation and recent hawkish turns from the likes of the ECB & BoE front & centre). Tuesday’s pullback from best levels for both our U.S. real yield monitor and the DXY allowed gold to register fresh session highs into Tuesday’s NY close, with bullion finishing just below best levels. Tuesday’s peak has held in narrow Asia-Pac dealing, with spot little changed, just shy of $1,830/oz.

FOREX: Greenback Struggles Amid Risk-On Flows, Softer U.S. Tsy Yields

A key gauge of broader greenback strength (DXY) lost altitude in tandem with U.S. Tsy yields, with participants looking to the release of U.S. CPI data on Thursday. Dollar weakness may have been exacerbated by a pullback in USD/JPY after the pair rejected resistance from Y115.68, the high print of Jan 28. The move shielded the yen from the impact of reduced demand for safe haven currencies, with both USD and CHF faltering amid a decent showing from the equity markets.

- The Antipodean currencies benefited from greater appetite for risk proxies. Australian Westpac-Melbourne Institute Index of Consumer Sentiment fell to a near-neutral level, with breakdown data playing into the hands of RBA hawks, as consumers' expectations of an increase in mortgage rates rose markedly.

- Today's data docket is fairly empty, which turns focus to central bank speak. Comments are due from Fed's Bowman & Mester, ECB's Schnabel, BoJ's Nakamura, BoE's Pill & BoC's Macklem.

FOREX OPTIONS: Expiries for Feb09 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1300-20(E1.0bln)

- USD/JPY: Y113.80-00($964mln), Y114.50-55($840mln), Y115.00($725mln), Y115.50-60($822mln), Y115.70-90($1.1bln)

- AUD/USD: $0.7150-70(A$1.0bln)

- USD/CAD: C$1.2720-30($740mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/02/2022 | 0700/0800 | ** |  | DE | Trade Balance |

| 09/02/2022 | 0900/1000 | * |  | IT | Industrial Production |

| 09/02/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 09/02/2022 | 1310/1310 |  | UK | BOE Pill at UK Monetary Policy outlook conference | |

| 09/02/2022 | 1500/1000 | ** |  | US | Wholesale Trade |

| 09/02/2022 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 09/02/2022 | 1530/1030 |  | US | Fed Governor Michelle Bowman | |

| 09/02/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 09/02/2022 | 1700/1200 |  | CA | BOC Governor Macklem speaks to Chamber of Commerce | |

| 09/02/2022 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 09/02/2022 | 1700/1200 |  | US | Cleveland Fed's Loretta Mester | |

| 09/02/2022 | 1800/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.