-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI EUROPEAN OPEN: False Flag Fears Dominate In Asia

EXECUTIVE SUMMARY

- UKRAINIAN ARMED FORCES FIRE MORTAR SHELLS, GRENADES ON 4 LPR LOCALITIES (SPUTNIK)

- CONTINUED WESTERN SPECULATION RE: INCREASE IN RUSSIAN PRESENCE AROUND UKRAINIAN BORDER

- FED SEES FASTER TIGHTENING IF INFLATION PERSISTS (MNI)

- FED’S KASHKARI: AGGRESSIVE HIKES MAY BRING RECESSION (MNI)

- IRAN'S TOP NUCLEAR NEGOTIATOR BAGHERI: WE ARE CLOSER THAN EVER TO AN AGREEMENT' (RTRS)

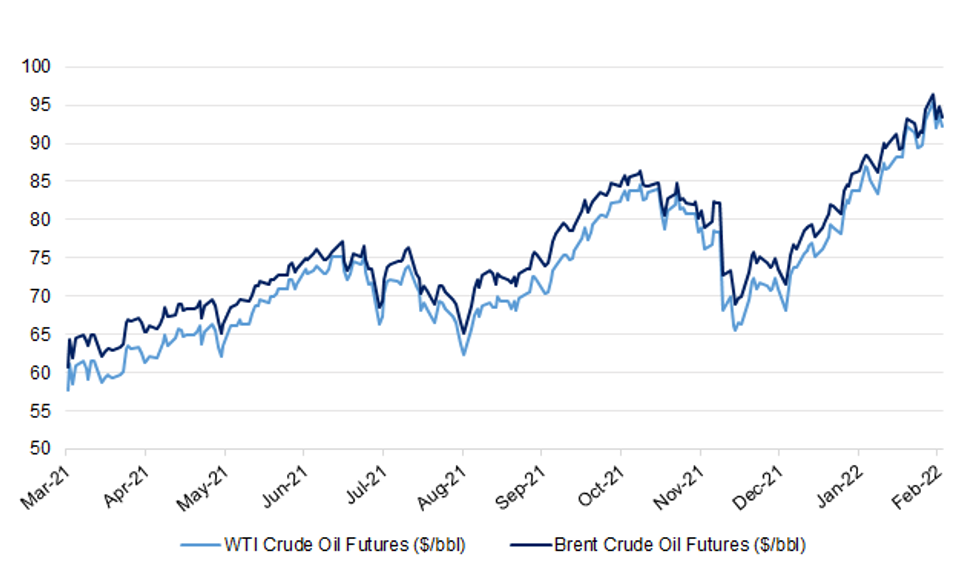

Fig. 1: WTI & Brent Crude Oil Futures ($/bbl)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

ECONOMY: Business confidence has fallen from a record high amid a shortage of skilled workers, concerns about tax rises, and an expectation that salaries will increase at their sharpest rate for 13 years in the next year, a survey has found. The quarterly business monitor from the Institute of Chartered Accountants in England and Wales found that confidence, which reached a record high in 2021, had declined for the second consecutive quarter to average levels not seen since 2014. (The Times)

CORONAVIRUS: Children age 5 to 11 in England will be offered Covid-19 vaccinations to widen protection for the population as the government moves to scrap remaining pandemic restrictions. The National Health Service will make shots available to children across that age group starting in April, so “parents can, if they want, take up the offer to increase protection against potential future waves of Covid-19,” U.K. Health Secretary Sajid Javid said in a statement Wednesday. (BBG)

EUROPE

FISCAL: MNI: Inflation Prompts Fresh Calls For EU Budget Discipline

- EU finance ministers are set for a difficult discussion on inflation when they meet in Paris on Feb. 25-26, with fiscally frugal ministers calling for the bloc to move towards more prudent budget policies in response to the surge in prices, officials told MNI. Others will argue that higher inflation is the result of transient phenomena, such as the spike in gas prices and geopolitical tensions, in a key meeting ahead of the European Commission’s March 2 fiscal guidance, expected to confirm that the escape clause from the Stability and Growth Pact will be deactivated as of 2023.

GREECE: Greece will begin easing some key coronavirus measures following a recommendation by the government’s advisory committee, Health Minister Athanasios Plevris said in a written statement as he currently has the virus. From Feb, 19, the ban on standing at entertainment venues will be lifted while the permitted capacity at stadiums will be increased to 50% from 10% now. Other measures include a lowering of the number of staff required to work at home in both the private and public sectors to 20% from 50% of the workforce. School trips will also be allowed to resume. (BBG)

U.S.

FED: MNI BRIEF: Fed Sees Faster Tightening If Inflation Persists

- Federal Reserve officials considered sharper interest-rate hikes than previously anticipated and "significant" reduction in the USD8.7 trillion balance sheet amid a prolonged bout of inflation, minutes from the January meeting showed. "Most participants noted that, if inflation does not move down as they expect, it would be appropriate for the Committee to remove policy accommodation at a faster pace than they currently anticipate," the FOMC minutes said. The U.S. consumer price index hit a 40-year high of 7.5% in January. "Participants agreed that uncertainty regarding the path of inflation was elevated and that risks to inflation were weighted to the upside," the report said - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

FED: MNI BRIEF: Kashkari Says Aggressive Hikes May Bring Recession

- Minneapolis Federal Reserve President Neel Kashkari on Wednesday warned against tightening monetary policy too fast to bring down an inflation rate that will naturally slow this year as the economy rebalances following the pandemic downturn. Inflation will ease in 2022 while remaining above the Fed's 2% target, he said during an online talk, though it will take time for the squeeze on labor force participation and supply chains to unwind - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

FED: San Francisco Federal Reserve Bank President Mary Daly on Thursday repeated her view, shared by her fellow U.S. central bankers, that the Fed should raise interest rates in March, and then consider next steps based on the data. “We’ve already seen financial conditions tighten somewhat as the Fed has started talking about our path of raising interest rates and I’d like to see continued tightening up of some financial conditions so that we’re right sizing the amount of accommodation we’re giving to the economy, to the economy’s ability to run and sustain on its own,” Daly told SiriusXM Business Radio in an interview, according to a transcript. (RTRS)

INFLATION: Soaring inflation is unacceptable but health of U.S. economy is sound, Treasury Sec. Janet Yellen tells AFP in interview. Yellen says she’s confident Fed will act in appropriate way to combat inflation. Yellen says Treasury working to prepare sanctions package against Russia if it invades Ukraine. (BBG)

FED: MNI BRIEF: Top Republican Ponders Reform At Regional Fed Banks

- The top Republican on the Senate Banking Committee said Wednesday Congress should weigh an overhaul of the Federal Reserve Regional Bank system. While Senator Pat Toomey, a Republican of Pennsylvania, said he is not ready to formally release any proposals, he also ruled out ideas that he would seek to eliminate the central bank's regional branches. "I have not advocated that we eliminate them and I don't have a specific list of reforms. But I have raised the issue that if the regional Feds continued to wander ever further from what I think is their mission, then Congress will inevitably and should think about whether this is the right model," he said in response to a question from MNI - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

CORONAVIRUS: New York City Mayor Eric Adams told leaders of major companies in the city it was time to get their workers back in offices, emphasizing that empty buildings are holding back the city’s pandemic recovery. (BBG)

OTHER

GLOBAL TRADE: The cabinet approves amendments to tighten rules to prevent critical technologies from being leaked to China, according to a statement from the cabinet. Individuals or groups with critical technical knowledge that receive government commissions or subsidies above a certain level within three years are required to seek permission before traveling to China, according to a statement from Mainland Affairs Council. (BBG)

AUSTRALIA: Australia’s second-most-populous state, Victoria, will scrap Covid-19 density restrictions on venues and reduced hotel quarantine periods, Premier Daniel Andrews announced on Thursday, as the number of hospitalizations and new infections fell. (BBG)

RBNZ: MNI INTERVIEW: Ex-RBNZ Chair Calls For 75bps Hike, Bond Sales

A former senior Reserve Bank of New Zealand official has called for a rate hike of as much as 75 basis points at the meeting next week and for the bank to begin selling some of the NZD50 billion in bonds purchased as part of the recent pandemic programme of Quantitative Easing. Arthur Grimes, a former RBNZ Chairman and chief economist, who is now a senior fellow at consultancy Motu Economic and Public Policy Research, told MNI in an interview that he had been urging the RBNZ to tighten policy for around 18 months, and that he considered current policy settings to be “ludicrous.”

BOC: MNI: BOC Says It Can Be 'Forceful' Against Inflation If Needed

- Bank of Canada Deputy Governor Tim Lane said Wednesday that the pandemic could still bring fresh surprises and policymakers can be "forceful" if needed against the potential for more persistent inflation. “While we now expect supply disruptions to ease and inflation to come down quickly in the second half of this year, we are alert to the risk that inflation may again prove more persistent," Lane said in the text of a speech. "We will be nimble -- and if necessary, forceful -- in using our monetary policy tools to address whatever situation arises, as we have done throughout these turbulent times.”

CANADA: Canada's main oil-producing province of Alberta looks set to return to a budget surplus this coming fiscal year, ending seven years of deficit, as surging oil prices swell provincial royalty revenues and provide a boost to Premier Jason Kenney ahead of a spring leadership review. (RTRS)

MEXICO: Mexico supports security measures offered by the state of Michoacan to resolve the U.S. Department of Agriculture’s concerns regarding the avocado trade, according to a govt statement. Mexico’s Interior Ministry has been attentive to conversations held this morning between Michoacan Governor Alfredo Ramirez Bedolla and U.S. Embassy security officers to restart avocado exports to the U.S. Agriculture Ministry reported that it continues to verify the work plan signed with the USDA Animal and Plant Health Inspection Service for avocados is punctually fulfilled. (BBG)

TURKEY: Govt is working on measures that should reduce citizens’ electricity and natural gas bills, including raising threshold for lower power costs from 210kw per month, President Recep Tayyip Erdogan says in Ankara, speaking after a cabinet meeting.. Turkey price increases “transitory”. Citizens will start to see inflation decelerating every month. Turkey at “final curve” to rank among world’s top 10 economies. Work underway on a new “social support” package of 15b liras ($1.1b). Erdogan announces support and incentives package for wind and solar energy investors. (BBG)

BRAZIL: Brazil's government is considering a tax exemption for foreigners investing in domestic corporate bonds, the Economy Ministry said in a statement to Reuters on Wednesday, in an effort to lower financing costs for local firms amid climbing interest rates. According to the statement, the ministry is drafting regulations aimed at "expanding the access of Brazilian companies to foreign capital" by aligning the tax treatment given to corporate bonds with the one already applied to equity investments by non-residents. Foreigners currently pay a 15% tax on capital gains from local private-sector bonds, but are exempt from the tax when they invest in Brazil's stock market and public debt. Brazilians pay a 15-22.5% income tax rate on returns from corporate bonds, depending how long they are held. (RTRS)

RUSSIA: The Ukrainian military fired mortar shells and grenades at four localities in the self-proclaimed Lugansk People's Republic at 2:30 a.m. GTM on Thursday, according to the Joint Centre for Control and Coordination. "Ukraine's armed units grossly violated the ceasefire regime, using weapons that, in accordance with the Minsk agreements, should be withdrawn", an officer of the LPR mission to the JCCC noted. (Sputnik)

RUSSIA: Ukrainians defied pressure from Moscow with a national show of flag-waving unity Wednesday, while the U.S. warned that Russia had added as many as 7,000 troops near Ukraine’s borders despite Kremlin declarations that forces were being pulled back from the region. (AFP)

RUSSIA: The latest Ukrainian intelligence report compiled on Wednesday shows no evidence of Russia pulling back its forces from near Ukraine’s borders, Defence Minister Oleksii Reznikov told Reuters in an interview. Ukraine will only believe Russia is serious about defusing the current crisis if it withdraws its troops, military hardware and weapons, including forces deployed in Belarus for drills that are due to end on Feb. 20, he said. According to the Ukrainian military, about 140,000 combined Russian military and pro-Russian separatist forces are currently massed near Ukraine, including 125,000 ground troops. There are 9,000 Russian troops in Belarus alone, he said. By way of comparison, Reznikov said Ukraine has around 35,000 troops in its eastern Donbass region, where Kyiv has been battling a Russian-backed separatist insurgency since 2014. (RTRS)

RUSSIA: "Over the past several weeks, we've also seen Russian officials and Russian media plant numerous stories in the press, any one of which could be elevated to serve as a pretext for an invasion," Price told reporters. Those claims, which have spread on social media, include genocide, mass graves and the potential of the Ukrainian government to use chemical weapons against the people of Donbass. "There is no basis of truth to any of these allegations," Price said. "These are false narratives that Russia is developing for use as a pretext for military action against Ukraine." (France 24)

RUSSIA: US Treasury Secretary Janet Yellen says "global fallout" would be inevitable if the West moves ahead with the punishing, coordinated sanctions threatened against Russia, should it attack Ukraine. If the penalties are imposed, "Of course, we want the largest cost to fall on Russia" Yellen said in an interview. "But we recognize that there will be some global fallout from sanctions," she told AFP. (AFP)

RUSSIA: U.S. President Joe Biden and German Chancellor Olaf Scholz discussed Russia's military build-up near Ukraine in a phone call Wednesday and underscored the importance of reinforcing NATO's eastern flank if Moscow invades, the White House said. A German government spokesperson said the two leaders agreed the situation in Ukraine must be assessed as "extremely serious" as there is still a risk of further Russian military aggression. (RTRS)

RUSSIA: France has called for a revamp of Europe’s security framework, warning that it has become “nearly obsolete” and risks allowing Russia to become a permanent threat on the continent even if Vladimir Putin does not invade Ukraine. Jean-Yves Le Drian, France’s foreign minister, said in an interview that there were “no more rules” governing European security and stability because arms control pacts covering everything from intermediate-range nuclear missiles to transparency on military force movements had become “nearly obsolete or irrelevant”. He said that Russia had to recognise that the EU had its own security concerns, given that Putin wanted to exercise an unacceptable form of “partial sovereignty” over its neighbours, and that agreement was needed to restore long-term stability. (FT)

RUSSIA: Russia is preparing to "test the mettle" of the West by dragging out the stand-off at the Ukrainian border for months, Liz Truss has warned. In an article for The Telegraph, the Foreign Secretary cautioned against being lulled into a "false sense of security" by Russia's claims that it is withdrawing troops. Ms Truss echoed warnings from the US and Nato that there was no evidence of any pullback and that the Russian troop build-up on Ukraine's border may actually be increasing despite Kremlin claims to the contrary. (Telegraph)

RUSSIA: Britain will double the size of the British force in Estonia as part of a NATO deployment and will send equipment, including tanks and armoured fighting vehicles, to the country amid fears of a Russian invasion of Ukraine. (RTRS)

RUSSIA: U.S. and Russian military aircraft flew dangerously close to each other in three separate weekend incidents over the Mediterranean Sea, including one in which the planes passed within 5 feet, Pentagon officials said Wednesday. The incidents, which occurred in international airspace Friday and Saturday, involved Russian Su-35 jet fighters crossing into the flight paths of U.S. Navy P-8A surveillance aircraft, the officials said. (WSJ)

RUSSIA: A series of cyberattacks on Tuesday knocked the websites of the Ukrainian army, the defense ministry and major banks offline, Ukrainian authorities said, as tensions persisted over the threat of a possible Russian invasion. Still, there was no indication the relatively low-level, distributed-denial-of-service attacks might be a smokescreen for more serious and damaging cyber mischief. At least 10 Ukrainian websites were unreachable due to the attacks, including the defense, foreign and culture ministries and Ukraine’s two largest state banks. In such attacks, websites are barraged with a flood of junk data packets, rendering them unreachable. “We don’t have any information of other disruptive actions that (could) be hidden by this DDoS attack,” said Victor Zhora, a top Ukrainian cyberdefense official. He said emergency response teams were working to cut off the attackers and recover services. (AP)

RUSSIA: U.S. officials said Wednesday that Russian state-backed hackers have been targeting U.S. defense contractors for the last two years, acquiring “sensitive” information, including about weapons development. The hackers have used “common but effective tactics,” including the harvesting of user credentials and spearphishing attacks, to gain access to large and small defense contractors, according to a statement from the National Security Agency, the Federal Bureau of Investigation and the Department of Homeland Security’s Cybersecurity and Infrastructure Security Agency. The hackers have managed to maintain access to the companies, sometimes for as long as six months, by using legitimate credentials as well as a variety of malicious software, according to the agencies. In instances where attackers successfully gained access to companies, U.S. officials said there was “regular and recurring exfiltration of emails and data.” The alert did not identify the affected firms by name. (BBG)

RUSSIA: Ukraine has asked the U.N. Security Council to discuss a bid by Russia's parliament to recognize self-proclaimed separatists in eastern Ukraine when the body meets on Thursday. (RTRS)

IRAN: Iran's top nuclear negotiator, Ali Bagheri Kani said on Twitter on Wednesday that "after weeks of intensive talks, we are closer than ever to an agreement; nothing is agreed until everything is agreed, though." (RTRS)

IRAN: The United States is in "the midst of the very final stages" of indirect talks with Iran aimed at salvaging a 2015 deal limiting Tehran's nuclear activities, State Department spokesperson Ned Price said on Wednesday. (RTRS)

CHINA

YUAN: The yuan has sufficient strength to allow China to pursue independent monetary easing, the Securities Times reported citing analysts. Even as the Federal Reserve's expected rate hike may weaken the Chinese currency, the depreciation will be manageable, as the current strong yuan matches the economic fundamentals, the newspaper said citing Zhang Yu, chief analyst of Huachuang Securities. The yuan is expected to reach 6.35 against the U.S. dollar by the end of December and 6.1 by 2023 yearend, supported by a high current account surplus of about USD380 billion per year and increasing holdings of yuan assets, the newspaper said citing Xiong Yi, chief economist of Deutsche Bank China. (MNI)

INFLATION: China's low reported January inflation has given the People’s Bank of China space to further ease its monetary policy and stimulate economic growth, the Shanghai Securities News reported citing analysts. CPI in January eased to 0.9% y/y, down 0.6 pp from December, while PPI's gain narrowed by 1.2 pp to 9.1%, official stats on Wednesday showed. The PBOC may consider an RRR cut to ensure ample liquidity, as the total amount of infrastructure-back special bonds may increase significantly from last year, requiring better credit and social financing support, the newspaper said citing Lian Ping, the chief economist of Zhixin Investment Research Institute. The PBOC may be constrained once the U.S. starts its rate hikes, but the central bank is expected to keep market rates stable by using short-term money market tools, the newspaper cited Lian as saying. (MNI)

ECONOMY: China’s overall debt-to-GDP ratio may increase in the next few years as the government borrows to stimulate the economy while GDP growth fails to keep pace, Yicai.com reported citing a report by the Chinese Academy of Social Sciences. The so-called macro leverage ratio may rise to 268% in 2022 from the current 263.1%, the report said. The leverage ratio of Chinese residents has risen the fastest among the sectors, from less than 5% in 2000 to the current 62.2%, which has surpassed Germany and is closer to that of Japan, said the report. It warned that excessive debt of the U.S. households had led to the 2008 Great Financial Crisis. (MNI)

OVERNIGHT DATA

CHINA JAN SWIFT GLOBAL PAYMENTS CNY 3.20%; DEC 2.70%

JAPAN JAN TRADE BALANCE -Y2,191.1BN; MEDIAN -Y1,600.0BN; DEC -Y583.3BN

JAPAN JAN TRADE BALANCE ADJUSTED -Y932.6BN; MEDIAN -Y398.3BN; DEC -Y435.3BN

JAPAN JAN EXPORTS +9.6% Y/Y; MEDIAN +17.1%; DEC +17.5%

JAPAN JAN IMPORTS +39.6% Y/Y; MEDIAN +37.1%; DEC +41.1%

JAPAN DEC CORE MACHINE ORDERS +5.1% Y/Y; MEDIAN +0.9%; NOV +11.6%

JAPAN DEC CORE MACHINE ORDERS +3.6% M/M; MEDIAN -2.0%; NOV +3.4%

AUSTRALIA JAN UNEMPLOYMENT RATE 4.2%; MEDIAN 4.2%; DEC 4.2%

AUSTRALIA JAN EMPLOYMENT CHANGE +12.9K; MEDIAN 0.0K; DEC +64.8K

AUSTRALIA JAN FULL-TIME EMPLOYMENT CHANGE -17.0K; DEC +41.5K

AUSTRALIA JAN PART-TIME EMPLOYMENT CHANGE +30.0K; DEC +23.3K

AUSTRALIA JAN PARTICIPATION RATE 66.2%; MEDIAN 66.1%; DEC 66.1%

AUSTRALIA JAN RBA FX TRANSACTIONS GOV’T -A$949MN; DEC -A$1,983MN

AUSTRALIA JAN RBA FX TRANSACTIONS MARKET A$904MN; DEC A$1,940MN

AUSTRALIA JAN RBA FX TRANSACTIONS OTHER -A$1,919MN; DEC A$768MN

NEW ZEALAND JAN NON RESIDENT BOND HOLDINGS 58.2%; DEC 57.9%

SOUTH KOREA DEC MONEY SUPPLY L +0.5%; NOV +1.0%

SOUTH KOREA DEC MONEY SUPPLY M2 +0.7%; NOV +1.1%

CHINA MARKETS

PBOC DRAINS NET CNY10 BILLION VIA OMOS THURSDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.10% on Thursday. The operation has led to a net drain of CNY10 billion after offsetting the maturity of CNY20 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0967% at 09:26 am local time from the close of 2.0296% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 43 on Wednesday vs 42 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3321 THURS VS 6.3463

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3321 on Thursday, compared with 6.3463 set on Wednesday. Today's parity is the lowest since Jan 26.

MARKETS

SNAPSHOT: False Flag Fears Dominate In Asia

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 210.15 points at 27250.95

- ASX 200 up 11.268 points at 7296.2

- Shanghai Comp. up 9.407 points at 3475.34

- JGB 10-Yr future up 2 ticks at 149.92, yield up 1.0bp at 0.226%

- Aussie 10-Yr future up 2.5 ticks at 97.780, yield down 2.5bp at 2.207%

- U.S. 10-Yr future +0-14 at 126-08, yield down 5.06bp at 1.988%

- WTI crude down $1.52 at $92.11, Gold up $6.55 at $1876.26

- USD/JPY down 34 pips at Y115.18

- UKRAINIAN ARMED FORCES FIRE MORTAR SHELLS, GRENADES ON 4 LPR LOCALITIES (SPUTNIK)

- CONTINUED WESTERN SPECULATION RE: INCREASE IN RUSSIAN PRESENCE AROUND UKRAINIAN BORDER

- FED SEES FASTER TIGHTENING IF INFLATION PERSISTS (MNI)

- FED’S KASHKARI: AGGRESSIVE HIKES MAY BRING RECESSION (MNI)

- IRAN'S TOP NUCLEAR NEGOTIATOR BAGHERI: WE ARE CLOSER THAN EVER TO AN AGREEMENT' (RTRS)

BOND SUMMARY: Russian Reports Of Ukraine Mortar Attack On Luhansk Supports Core FI

Asia-Pac trade saw core FI markets draw a bid from unverified Russian reports which pointed to Ukraine conducting mortar and grenade attacks on the separatist region of Luhansk, as false flag fears intensified. Note that the issue has only been covered by Russian state media, with scepticism surrounding the source of the reports resulting in the paring of a chunk of the initial risk-off moves in the wider cross-asset space. Note that early Asia-Pac dealing saw U.S. officials point to a further 7K Russian troops gathering near the Ukrainian border in recent days (contrary to Russian rhetoric on the matter).

- TYH2 +0-14 at 126-08, 0-07+ off the overnight peak, with the contract operating in a 0-22+ range on a more than healthy and comfortably above average ~290K lots. Cash Tsys run 4-6bp richer on the day, with the belly leading on the curve. Looking ahead, weekly jobless claims, housing starts, building permits and Philly Fed activity data headline In NY hours. We will also get Fedspeak from Bullard & Mester, as well as 30-Year TIPS supply

- Prior to the broader risk-off move, JGB futures rebounded on the back of solid takedown of 20-Year JGB supply, after this morning’s concession-driven cheapening & steepening provided enough enticement for buyers to dip their toe into the water. Futures finished +3 after registering fresh cycle lows during the Tokyo morning. The smooth auction came against a backdrop of multi-year steeps on the curve, as well as appeal on the 10-/20-/30-Year JGB fly, in the wake of the recent buyers’ hiatus when it comes to super-long paper. Still, the cash JGB curve is steeper on the day (benchmarks sit little changed to 5bp cheaper), with the super-long end drifting back towards morning cheaps after the impulse of the auction and wider risk-off flows faded. Optically, the 1.00% yield level in 30s held firm, for now. Crucially 10-Year JGB yields didn’t top 23bp (the level which triggered the recent round of BoJ intervention).

- Aussie bond futures ticked higher on the back of the broader risk aversion, with YM finishing +4.0, while XM was 2.5 better off come the bell. Note that local labour market data provided little impetus for markets, with the unemployment rate meeting exp., headline employment beating expectations (the uptick was driven solely by part-time hiring), while hours worked tumbled on COVID cases and annual leave usage.

JGBS AUCTION: Japanese MOF sells Y971.0bn 20-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y971.0bn 20-Year JGBs:

- Average Yield 0.736% (prev. 0.532%)

- Average Price 95.91 (prev. 99.41)

- High Yield: 0.739% (prev. 0.536%)

- Low Price 95.85 (prev. 99.35)

- % Allotted At High Yield: 67.1546% (prev. 94.8003%)

- Bid/Cover: 3.392x (prev. 3.179x)

JGBS AUCTION: Japanese MOF sells Y2.9377tn 1-Year Bills:

The Japanese Ministry of Finance (MOF) sells Y2.9377tn 1-Year Bills:

- Average Yield -0.0551% (prev. -0.0909%)

- Average Price 100.055 (prev. 100.091)

- High Yield: -0.0491% (prev. -0.0879%)

- Low Price 100.049 (prev. 100.088)

- % Allotted At High Yield: 46.1531% (prev. 5.5750%)

- Bid/Cover: 2.732x (prev. 3.164x)

EQUITIES: Mixed As Japanese Equities Lag

Unverified Russian reports of a Ukrainian mortar & grenade attack on the separatist region of Luhansk saw the major regional equity benchmarks move back from best levels, with the news story having varying degrees of impact on the space, as worries of a Russian false flag did the rounds.

- Chinese and Korean equity indices outperformed their major regional peers, while Australian, Japanese, and Hong Kong equities are flat to lower.

- The CSI300 is 0.4% firmer, aided by gains in new energy and metals sub-indices. On the other hand, the sub-index tracking real estate developers leads losses, as COVID–19 outbreaks in Hong Kong and some Chinese cities (e.g. Suzhou) weigh on sentiment.

- The Nikkei 225 leads regional losses, sitting 1.0% weaker, with heavily favoured names such as Recruit Holdings and NTT Data feeling the brunt of the wider risk-off pressure. Re-opening plays e.g. railways and airlines, were more fortunate, with expectations surrounding an impending announcement from Japanese PM Kishida re: the loosening of border restrictions providing tailwinds.

- E-minis sit 0.4-0.6% lower, having pared some of the Ukraine-related losses as questions re: the validity of the source of the reports allowed some of the initial risk-off move to fade.

OIL: Lower Than Settlement, But Paring Losses Overnight

WTI is ~-$0.60 and Brent is ~-$0.70 from settlement at typing, recovering from session lows to print $94.20 and $92.95, respectively.

- A sharp rally came on the back of unconfirmed reports (from Russian media outfits Ria and Sputnik) of a mortar and grenade attack by Ukrainian armed forces on Luhansk (recently recognised by Russia as a sovereign state). A reminder that western powers have warned of Russia possibly creating “false narratives” to justify military intervention in Ukraine.

- To recap, WTI traded as low as $90.0 on Wednesday, while Brent troughed at $91.1, tumbling in post-settlement trade as the Iranian nuclear talks in Vienna were seemingly moving in a positive direction. French Foreign Minister Le Drian suggested that “it is a question of days” when it comes to concrete developments on the matter. Optimism for a nuclear deal received a further boost when Iran’s top nuclear negotiator tweeted: “After weeks of intensive talks, we are closer than ever to an agreement.” However, he did caution that “nothing is agreed until everything is agreed, though. Our negotiating partners need to be realistic, avoid intransigence and heed lessons of past 4yrs. Time for their serious decisions.”

- That was before the aforementioned worry re: Russia boosted geopolitical risk premium overnight.

- Looking to technical levels, support for WTI and Brent remain intact at $88.41 (Feb 9 low) and $89.93 (Feb 8 low) respectively, while resistance is seen at Feb 14 highs ($95.82 for WTI and $96.78 for Brent).

GOLD: Modest Bid Overnight

Gold added a handful of dollars overnight, trading at $1,875/oz ahead of European hours, with (unverified) Russian reports of a Ukrainian mortar & grenade attack on the separatist region of Luhansk weighing on broader risk-appetite (with false flag worry elevated).

- The precious metal sits just below the recently recorded multi-month highs.

- To recap, continued western questions/apprehension re: the Russian claims of at least a partial troop pullback from the Ukrainian border remained evident on Wednesday. This fed into yesterday’s price action, as bullion added ~$15/oz in spot trade, given the continued line of questioning from western powers. A lack of fresh, hawkish developments in the Fed minutes covering the central bank’s most recent monetary policy meeting also supported gold on Wednesday.

- On the technical front, bulls now look to resistance at $1,881.6/oz (1.00 projection of Dec 15-Jan 25-28 price swing), while initial support is defined at $1,844.7/oz (Feb 15 low).

FOREX: Growing Drumbeat Of Ukraine Conflict Escalation Inspires Risk Aversion

Headlines from Russian state media pointing to alleged shelling of targets in Luhansk and Donetsk People's Republics by Ukrainian security forces in breach of the Minsk agreements inspired a round of risk-off flows in G10 FX space. While the initial story was circulated by Sputnik, a portal often described as the Kremlin's propaganda outlet, it was quickly picked up by other Russian outlets.

- Reports of rising tensions in the Donbas came on the heels of comments from a senior U.S. official, who said that Russia's claims that it was reducing military presence near Ukraine were "false" and Moscow has instead added 7,000 troops along the border. There was a modest risk-off reaction to those remarks but it was promptly unwound, albeit markets were left on the alert for further developments.

- The prospect of military escalation in east Ukraine inspired a flight to safety, putting a bid into JPY and CHF. Major safe haven currencies gained at the expense of their riskier peers (save for NZD), with Scandie FX coming under particular pressure. The SEK landed at the bottom of the G10 pile owing to its sensitivity to the Ukraine crisis. The Russian rouble retreated as Moscow trading re-opened, but weekly lows remain some way off.

- The Aussie dollar was unfazed by domestic labour market data, as political risk headlines took precedence. Part-time jobs drove a surprise overall gain in employment in January, which absorbed marginally wider participation to generate an unchanged headline unemployment rate.

- U.S. housing starts & weekly jobless claims headline the global data docket today. Central bank speaker slate includes Fed's Bullard & Mester, ECB's Lane & de Cos, Norges Bank's Olsen & Riksbank's Breman.

FOREX OPTIONS: Expiries for Feb17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1390-00(E522mln), $1.1435-50(E1.7bln), $1.1500-20(E1.1bln)

- USD/JPY: Y115.00($1.3bln), Y115.75($860mln), Y116.00($1.5bln)

- GBP/USD: $1.3400(Gbp1.0bln), $1.3500(Gbp1.0bln)

- EUR/GBP: Gbp0.8390(E583mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/02/2022 | 0700/0800 |  | EU | ECB Schnabel discussion with SPD | |

| 17/02/2022 | 1100/0600 | * |  | TR | Turkey Benchmark Rate |

| 17/02/2022 | - |  | EU | ECB Lagarde at G20 CB Governors Meeting | |

| 17/02/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 17/02/2022 | 1330/0830 | *** |  | US | Housing Starts |

| 17/02/2022 | 1330/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 17/02/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 17/02/2022 | 1400/1500 |  | EU | ECB Lane on MNI Webcast on ECB Policy | |

| 17/02/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 17/02/2022 | 1600/1100 |  | US | St. Louis Fed's James Bullard | |

| 17/02/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 17/02/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 17/02/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for TIPS 30 Year Bond |

| 17/02/2022 | 2200/1700 |  | US | Cleveland Fed's Loretta Mester | |

| 18/02/2022 | 2330/0830 | *** |  | JP | CPI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.