-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Russian Special Operation In Ukraine Underway

EXECUTIVE SUMMARY

- RUSSIA LAUNCHES SPECIAL MILITARY OPERATION TO DEMILITARIZE UKRAINE, BIDEN POINTS TO INCOMING SEVERE SANCTIONS

- FED'S DALY: NEED MORE 'URGENCY' ON POLICY TIGHTENING (RTRS)

- ECB’S LANE: DATA SIGNAL INFLATION MAY NEAR MEDIUM-TERM GOAL (FAZ)

- DE COS: ECB SHOULD ONLY RAISE RATES AFTER STIMULUS PLAN END (BBG)

- BANK OF KOREA FLAGS COMMODITY, INFLATION RISKS OF UKRAINE CRISIS (BBG)

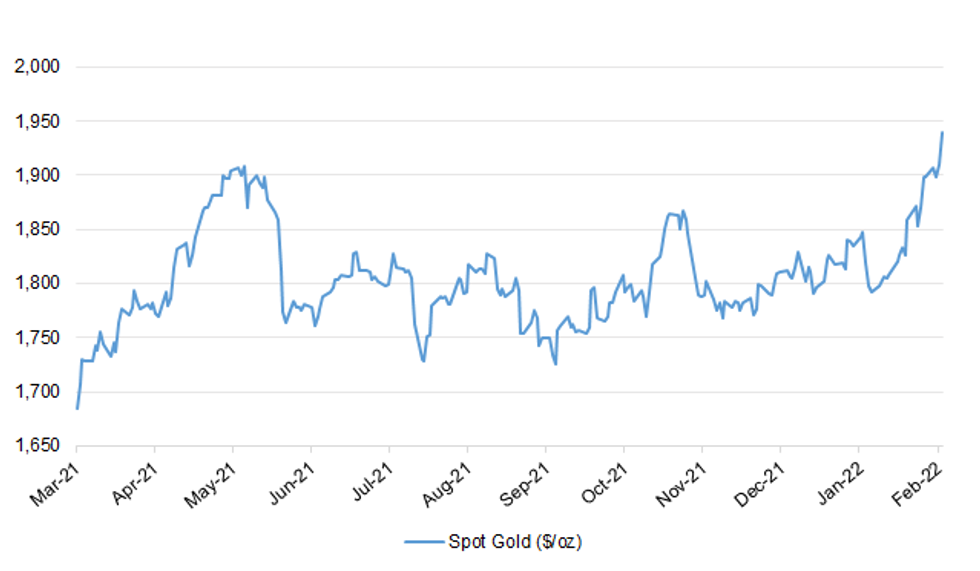

Fig.1: Spot Gold ($/oz)

Source: MNI - Market News

Source: MNI - Market News

UK

BOE: Bank of England policy maker Silvana Tenreyro said “only a small amount of policy tightening” is needed, warning about the trade-offs that central banks face in moving too quickly to curb inflation. The most dovish member of the BOE’s monetary policy committee said price rises had proved more persistent than expected but there was too much uncertainty to know how the path of tightening will evolve. Tenreyro voted for an increase in rates to 0.5% from 0.25% in February but was the lone dissenter when others on the nine-member panel first opted to raise rates in December. The remarks suggest that while she may back another increase in the coming months, she’s reluctant to move as aggressively as investors anticipate.(BBG)

FISCAL: Chancellor Rishi Sunak will pledge to "deliver a low tax, higher growth economy" amid criticism from MPs over rises to National Insurance. Mr Sunak will tell an audience at the Bayes Business School on Thursday that he will cut taxes "sustainably". It comes as National Insurance rates are set to rise from 1 April to help fund health and social care. The rise means employees, employers and the self-employed will all pay 1.25p more in the pound. "I am going to deliver a lower tax economy but I am going to do so in a responsible way, and in a way that tackles our long term challenges," Mr Sunak will say in his speech. "I firmly believe in lower taxes." However, the chancellor will also argue that taxes should not be cut if spending plans are unfunded. (BBC)

IMF: The International Monetary Fund has said that the UK government should bring forward tax rises on the rich to ease inflation and support growth in poorer regions of the country. In its annual review, the IMF said the chancellor should impose income and wealth taxes on rich households now to avoid the need for tougher action to tackle inflation in the coming months. The fund added that the central bank should not increase interest rates rapidly or it could risk pushing the economy into a recession. Inflation, now at 5.5 per cent, is expected to peak at more than 7 per cent in April, according to the Bank of England’s forecasts. Its target is 2 per cent. (The Times)

EUROPE

ECB: The European Central Bank will adjust its monetary policy if inflation rates move toward the 2% goal in the medium term, “which is more likely now,” Chief Economist Philip Lane tells Frankfurter Allgemeine Zeitung in an interview. Strong economic recovery can be expected, inflation will remain higher for longer than initially thought. ECB continues to expect inflation rates to fall in course of year “but it’s uncertain how quickly and how much”. Geopolitical tensions are currently a “very significant risk factor, particularly for Europe”. (BBG)

ECB: The European Central Bank should stick to its plan to raise interest rates only after ending its net asset purchases and tread carefully in the path to normalize monetary policy, said Governing Council member Pablo Hernandez de Cos. “We will not raise interest rates until the end of the net asset purchases under the PPP,” de Cos, who heads the Spanish central bank, said Wednesday in a webinar organized by Barcelona-based Esade business school. Any normalization should be done gradually, he said. (BBG)

FISCAL: The European Commission will ask EU governments next week to start withdrawing in 2023 generous fiscal support they provided during the pandemic because the economy has recovered and is growing strongly, Executive Vice President Valdis Dombrovskis said. This move on March 2 will be the first time the Commission will call for a clear reduction in fiscal support since the start of the pandemic. Its recommendation for 2022, issued in November, was for a still "moderately supportive fiscal stance". The Commission will issue this fiscal guidance to EU governments because normal EU fiscal rules that limit government borrowing to support the euro have been suspended since early 2020 to create room to fight the pandemic. "It's time to start to moderate and start thinking about withdrawing fiscal support," Dombrovskis told Reuters in an interview. "Its time to move towards normalization of fiscal policy and we have been always emphasizing that the fiscal support, which we are providing now, should be temporary and targeted," he said. (RTRS)

GERMANY: Germany's coalition parties agreed on Wednesday a roughly 13 billion euro package of measures to help households cope with surging energy prices, including scrapping a surcharge levied on electricity bills to support green power. Energy prices in Germany have soared in the last year, and fears of an escalation of the crisis between Ukraine and gas supplier Russia are set to push them higher still. Germany's ruling parties, the Social Democrats (SPD), ecologist Greens and pro-business Free Democrats (FDP), said the steps were designed to help households with the greatest need. "We are all seeing how rising prices are hitting many people very hard, especially the situation abroad with Russia is fuelling that," said Greens co-leader Ricarda Lang. The parties agreed to abolish the renewable energy surcharge in July, some six months earlier than planned. It is expected to save an average household about 150 euros a year. Finance Minister Christian Lindner said it was worth a total of 6.6 billion euros. (RTRS)

ITALY: Italy’s government plans not to extend the Covid emergency state after March 31, Prime Minister Mario Draghi said on Wednesday in Florence. At the end of next month Italy’s three-tier system, which defines restrictions for each region, will no longer exist, all schools will stay open, and other restrictions will be gradually phased out, Draghi said. The emergency state has been introduced in the country at the end of January 2020. (BBG)

U.S.

FED: San Francisco Federal Reserve Bank President Mary Daly said on Wednesday she expects the U.S. central bank will need to raise rates at least four times this year, and likely more, to stop high inflation from getting worse. "There is broad agreement that inflation is too high and the policy rate is too low," Daly said at the Los Angeles World Affairs Council & Town Hall, given that the economy is adding jobs and growing strong. The geopolitical situation with Ukraine and Russia adds to uncertainty, she said, but does not disrupt the Fed's plans to lift off in March. (RTRS)

FED: MNI: Fed's Daly Says 50BP Hike Is Possible At Some Point

- San Francisco Fed President Mary Daly said Wednesday that while a 25bp rate hike is the most likely option with liftoff starting in March, a 50bp move may still be needed at some point. “It’s too early to call that we would move at 50 basis points or not,” she said on a media call when asked about going faster. “All of our possibilities are on the table, but my modal outlook, the one that I expect to engage is a 25 basis point increase.” Daly said she can examine “whether 50 basis point adjustments down the road are necessary." Research suggests that front-loading rate increases isn’t “materially impactful on the economy,” she said. Daly had downplayed the chance of a 50bp rate hike in a Feb. 10 interview with MNI, where she also said she saw at least three rate increases. Earlier on Wednesday she said at least four are now needed to curb the fastest inflation in decades - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

FED: MNI: Fed SEP To Show 5 Or More Hikes For 2022

- The Federal Reserve's upcoming quarterly economic forecasts are likely to show an increase in the number of rate hikes officials are penciling in for this year to at least five, up from three in December, several former central bank staffers told MNI. “The dots will show a median expectation of five 25-basis-point rate increases for 2022, but with some skew towards the upside,” said Peter Ireland, a former Richmond Fed staffer and now a consultant at Boston College - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

CORONAVIRUS: New York City Mayor Eric Adams said that he wants the city to move in coming weeks toward phasing out rules that require people to show proof of vaccination at restaurants, bars and other indoor spaces. Adams said he doesn’t want to act prematurely but is also eager to move the city back toward normalcy. “I can’t wait to get it done,” he said, when asked about phasing out the requirement. The policy, under which residents must show proof of at least one Covid shot for most indoor activities, was put in place last fall. (BBG)

OTHER

U.S./CHINA: The Justice Department said on Wednesday that it was ending a contentious Trump-era effort to fight Chinese national security threats that critics said unfairly targeted professors of Asian descent. A top Justice Department official, Matthew G. Olsen, said in remarks at George Mason University’s National Security Institute that the agency would instead introduce a broader strategy meant to counter threats from hostile nations, which would extend beyond China to include countries like Russia, Iran and North Korea. “By grouping cases under the China Initiative rubric,” Mr. Olsen said, “we helped give rise to a harmful perception that the department applies a lower standard to investigate and prosecute criminal conduct related to that country or that we in some way view people with racial, ethnic or familial ties to China differently.” (NYT)

RBNZ: The Reserve Bank of New Zealand (RBNZ) Governor Adrian Orr said on Thursday that more monetary policy tightening will be needed to counter rising inflation, and said rates will be north of neutral rates of about 2% in a year. RBNZ’s rate hike on Wednesday was hawkish, and signals more hikes, Governor Orr told a parliamentary committee. “The markets are saying the reserve bank is incredibly worried about inflation and are signalling higher interest rates...that is correct,” he told a parliamentary committee. “We have got a very clear path of interest rate rises outlined ahead of us,” he added. He also said the current level of inflation was undoubtedly too high. (RTRS)

NEW ZEALAND: New Zealand Covid Response Minister Chris Hipkins says nation moves to next phase of omicron response at midnight tonight. Phase 3 means only confirmed cases and their household contacts are required to isolate. All other contacts now asked to monitor symptoms but do not have to isolate. Rapid Antigen Tests (RATs) will become the primary form of testing in the community with availability from thousands of sites around the country including pharmacies and GP practices over coming days. (BBG)

NEW ZEALAND: Fonterra has lifted its forecast milk payment to farmers for this season to a new record high, which it expects will inject more than $14 billion of cash into the economy. The co-operative on Thursday lifted its forecast for the 2021/22 season a fourth time, and is now expecting to pay its farmer suppliers between $9.30 and $9.90 per kilogram of milk solids. That’s up from its forecast a month ago of between $8.90 and $9.50 per kgMS. The midpoint of the range, which farmers are paid off, increased by 40 cents to $9.60 per kgMS which would be the highest level since Fonterra was formed in 2001. The co-operative paid farmers $7.54 per kgMS last season, and its previous record was $8.40 per kgMS in the 2013/14 season. Global dairy prices hit their highest level in almost nine years at auction last week, as tight milk supply stokes demand for New Zealand’s biggest export commodity. Prices have been supported this season by weaker milk production in New Zealand and overseas, hindered by poor weather and higher feed costs. (Stuff NZ)

BOK: Bank of Korea Governor Lee Ju-yeol flagged the risk of the Ukraine crisis impacting global commodities markets and fueling inflation if there is a further escalation, following an earlier decision by the central bank to keep policy on hold. “Even though we’re not assuming a full-scale war, such a situation would inevitably have a big impact,” Lee said. Since both Russia and Ukraine are major players in the global commodity market, an all-out escalation of the crisis will cause immediate supply and demand imbalances in raw materials, Lee said. It would also have a big impact on inflation, he added. (BBG)

CANADA: Canada is ending rarely used special measures invoked nine days ago to tackle weeks-long protests that shut some border crossings and paralyzed Ottawa since late-January, Prime Minister Justin Trudeau said on Wednesday. "The situation is no longer an emergency. Therefore, the federal government will be ending the use of the Emergencies Act," Trudeau told a news conference. "We are confident that existing laws and bylaws are now sufficient to keep people safe," he said. Trudeau said the emergency measures would formally be revoked in the coming hours, when Canada's governor general signs the proclamation. (RTRS)

RUSSIA: President Vladimir Putin authorised a special military operation against Ukraine in the early hours of Thursday morning to eliminate what he said was a serious threat against his country, saying his aim was to de-militarise Russia's southern neighbour. In a special televised address on state TV, Putin told the Ukrainian military to lay down its weapons and go home. "I urge you to immediately lay down your weapons and go home. All servicemen of the Ukrainian army who fulfil this demand will be able to freely leave the combat zone and return to their families," said Putin. The Russian leader said Moscow has been left with no choice but to launch the operation, the scope of which was not immediately clear. "I have decided to conduct a special military operation," said Putin. "Its goal is to protect people who have been subjected to bullying and genocide... for the last eight years. And for this we will strive for the demilitarisation and denazification of Ukraine. "And to bring to court those who committed numerous bloody crimes against civilians, including against citizens of the Russian Federation." RTRS)

RUSSIA: Ukraine accused President Vladimir Putin of carrying out a full-scale invasion after the Russian president said he ordered a special military operation to “protect” the Donbas region of eastern Ukraine. Ukrainian Foreign Minister Dmytro Kuleba said on Twitter that cities in the country were being hit by airstrikes. The U.S. and its allies have for weeks warned of the potential for an attack, including on the capital, Kyiv, estimating Putin had massed 150,000 troops on the border. (BBG)

RUSSIA: The United States and its allies will respond in a united and decisive way to "an unprovoked and unjustified attack by Russian military forces" on Ukraine, U.S. President Joe Biden said after blasts were heard in the Ukrainian capital of Kyiv. "President (Vladimir) Putin has chosen a premeditated war that will bring a catastrophic loss of life and human suffering," Biden said in a statement issued late on Wednesday. "Russia alone is responsible for the death and destruction this attack will bring. The world will hold Russia accountable." Biden said he would announce on Thursday further measures to be imposed on Russia by the United States and its allies. The White House said Biden would speak in the early afternoon. (RTRS)

RUSSIA: UN chief Antonio Guterres on Wednesday urged Russia to end aggressions in Ukraine after Moscow announced a military operation against its neighbor. "President Putin, in the name of humanity bring your troops back to Russia," the secretary-general said after an emergency meeting of the UN Security Council over the crisis. "In the name of humanity do not allow to start in Europe what could be the worst war since the beginning of the century," he said, adding the conflict "must stop now." (AFP)

SOUTH AFRICA: South Africa’s government plans to restructure state power utility Eskom Holdings SOC Ltd.’s debt before elections in 2024, and will only provide additional support if the company sells assets and cuts jobs, Finance Minister Enoch Godongwana said. Eskom, which supplies almost all of South Africa’s power, has 392 billion rand ($26 billion) of debt. The utility has said the liabilities need to be cut to 200 billion rand for it to be sustainable and accept support pledged by rich nations to help reduce South Africa’s dependence on coal and cut carbon emissions. While local authorities are discussing whether the state should assume all or part of its debt, government support hinges on Eskom getting its “house in order,” Godongwana said Wednesday in an interview in Cape Town. (BBG)

IRAN: Nearly a year after they began, success or failure in negotiations over a renewed Iran nuclear deal is now expected within the next several days. Iran’s chief negotiator, Ali Bagheri Kani, left the Vienna talks Wednesday for consultations in Tehran following a flurry of last-minute sessions with his counterparts from Europe, Russia and China. The U.S. delegations and others remained in place awaiting his return, possibly as early as Friday. “We are nearing the end,” Enrique Mora, the European Union representative to the talks, said on Twitter. Mikhail Ulyanov, who heads Russia’s delegation, tweeted that negotiators are “about to cross the finish line.” State Department spokesman Ned Price said Wednesday that “there has been significant progress” in recent days but cautioned that no agreement has been finalized. (WSJ)

IRAN: Iran on Wednesday urged Western powers to be "realistic" in talks to revive a 2015 nuclear deal and said its top negotiator was returning to Tehran for consultations, suggesting a breakthrough in its discussions is not imminent. (RTRS)

MIDDLE EAST: The United States on Wednesday sanctioned a sprawling international network run by Iran’s Islamic Revolutionary Guard Corps and a Houthi financier that provided tens of millions of dollars to Yemen’s Houthi rebels, the U.S. Treasury said. (RTRS)

OIL: The Biden administration is considering tapping its emergency supply of oil again in coordination with allies to counter a surge in prices brought on by Russia’s moves against Ukraine, according to two people familiar with the matter. While no decision has been made, “robust conversations” within the administration are underway, including on potential price point triggers and how to coordinate a release from the reserve with other nations, said the people, who asked not to be identified discussing non-public government deliberations. Modeling is being done to ascertain size and scope of any potential release, they said. (BBG)

CHINA

PBOC: China's interbank liquidity will likely be loose in March, as monetary injection and fiscal deposits at commercial banks rise and banks are inclined to boost credit, the China Securities Journal reported citing Zhou Maohua, a researcher with Everbright Bank. There will be relatively less maturing tools that drain liquidity next month, including CNY300 billion reverse repos and CNY100 MLF, the newspaper said. The PBOC will flexibly use various tools to keep the movement of market interest rates around policy rates, Zhou was cited as saying. The central bank injected net CNY280 billion on Tuesday and Wednesday to keep month-end liquidity stable, the newspaper said. (MNI)

YUAN: The strengthening yuan against the U.S. dollar could see a sudden reversal following the accelerating monetary tightening by the Federal Reserve, and China should anticipate the impact of sudden money outflow on the country's financial market, the Securities Times reported citing analysts. Some offshore "hot money" has long positions in yuan and increased the holdings of China Government Bonds in 2021 amid rising global inflation risk. Should it try to flee if the yuan drops, it could shock both the forex and interest rate markets, the newspaper said citing research by Bank of China. On Wednesday, offshore yuan continued to rise near 6.3 against the dollar, touching 6.3036, the highest since April 2018, the newspaper said. (MNI)

PROPERTY: China will keep stable operations of the property market: Housing Minister Wang Menghui says. Plans to build 2.4m units of new affordable rental housing this year. China will satisfy reasonable demand for housing upgrade: Wang. China sees huge potential in domestic demand as urbanization continues. (BBG)

PROPERTY: China won’t use property market as short-term stimulus for the economy, Ni Hong, vice minister of Ministry of Housing and Urban-Rural Development, says at a press conference in Beijing. Will maintain continuity and stability in housing market controls and aim for better coordinated and more targeted policies. China will “firmly” deal with risks of overdue housing project delivery caused by debt defaults of some developers. (BBG)

BANKS: China's commercial banks are expected to issue about CNY2.02 trillion secondary capital and perpetual bonds to supplement capital this year, exceeding the scale in 2021, the 21st Century Business Herald reported citing analysts. Banks are also expected to issue more financial bonds to support small and micro enterprises, green development, agriculture and rural areas as policies require, the newspaper said citing analyst Li Qian with Golden Credit Rating. (MNI)

EQUITIES: Ride-hailing firms and online trucking platforms in China will have to set reasonable caps on their fees and make their pricing rules public this year, according to Wang Xiuchun, a senior official at the Ministry of Transportation. The plan to rein in commissions and offer more transparency was signaled in guidelines issued in November by several government agencies and mirrors Friday’s request for food-delivery services to also cut fees. President Xi Jinping’s “common prosperity” agenda has prioritized helping small businesses and individual operators, such as ride-hailing drivers, to navigate the challenges of the pandemic, which has increasingly come at the cost of big internet service operators. (BBG)

OVERNIGHT DATA

JAPAN JAN NATIONWIDE DEPT STORE SALES +15.6% Y/Y; DEC +8.8%

JAPAN JAN TOKYO DEPT STORE SALES +23.9% Y/Y; DEC +11.1%

AUSTRALIA Q4 PRIVATE CAPITAL EXPENDITURE +1.1% Q/Q; MEDIAN +2.5%; Q3 -1.1%

SOUTH KOREA JAN PPI +8.7% Y/Y; DEC +9.0%

CHINA MARKETS

PBOC NET INJECTED CNY190 BLN VIA OMOS THURSDAY

The People's Bank of China (PBOC) injected CNY200 billion via 7-day reverse repos with the rates unchanged at 2.10% on Thursday. The operation has led to a net injection of CNY190 billion after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to maintain stable liquidity at month-end, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.1000% at 09:30 am local time from the close of 2.1919% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 54 on Wednesday vs 46 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3280 THU VS 6.3313

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3280 on Thursday, compared with 6.3313 set on Wednesday.

MARKETS

SNAPSHOT: Russian Special Operation In Ukraine Underway

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 503.19 points at 25946.42

- ASX 200 down 215.085 points at 6990.6

- Shanghai Comp. down 52.174 points at 3436.972

- JGB 10-Yr future up 13 ticks at 150.47, yield down 0.7bp at 0.190%

- Aussie 10-Yr future up 11.5 ticks at 97.835, yield down 11.2bp at 2.158%

- U.S. 10-Yr future +0-28 at 127-05, yield down 11.45bp at 1.877%

- WTI crude up $4.84 at $96.94, Gold up $28.19 at $1937.2

- USD/JPY down 42 pips at Y114.59

- RUSSIA LAUNCHES SPECIAL MILITARY OPERATION TO DEMILITARIZE UKRAINE, BIDEN POINTS TO INCOMING SEVERE SANCTIONS

- FED'S DALY: NEED MORE 'URGENCY' ON POLICY TIGHTENING (RTRS)

- ECB’S LANE: DATA SIGNAL INFLATION MAY NEAR MEDIUM-TERM GOAL (FAZ)

- DE COS: ECB SHOULD ONLY RAISE RATES AFTER STIMULUS PLAN END (BBG)

- BANK OF KOREA FLAGS COMMODITY, INFLATION RISKS OF UKRAINE CRISIS (BBG)

BOND SUMMARY: Russian Special Military Operation In Ukraine Supports Bonds

Russian President Putin announced a special operation to demilitarise Ukraine overnight. Russian troops advanced within the LPR & DPR separatist regions, while wider spread missile and air-based attacks on Ukrainian military installations across the country were noted. U.S. President Biden has flagged impending severe sanctions on Russia, with U.S. allies also set to move to implement similar sanctions.

- This shunted core global fixed income markets higher, with TYH2 through initial resistance levels to last print +0-30 on the day, sitting at 127-07, 0-10+ back from best levels of the day. TYH2 volume has topped 500K (90K of which was roll related). Cash Tsys run 8-12bp richer on the session, with 7s leading the bid. Looking ahead, regional Fed activity indices, weekly claims data, updated Q4 GDP prints and new home sales will hit. We will also hare from Fed’s Barkin, Bostic, Daly & Mester. On the supply front, Tsy will come to market with 7s.

- The JGB curve twist steepened today, with the long end leading the weakening observed during the Tokyo morning (on the back of the post-holiday catch up), while super-long paper failed to return to neutral territory during the Tokyo afternoon, even with clear, widespread risk-off price action in play. JGB futures have moved into positive territory, more than paring early losses, to close +10. Local headline flow saw BoJ Governor Kuroda reaffirm the Bank’s on hold stance (as he has done on many occasions in recent weeks), while the latest round of BoJ Rinban operations (covering 3- to 10-Year JGBs and JGBis) saw offer/cover ratios in the low 2s (upticks for cover in the conventional JGB ops conducted today, but still holding at low levels, and a moderation in JGBi cover).

- Aussie bonds traded at the whim of broader risk sentiment, looking through local Capex data. That left YM +9.5 & XM +11.5 come the bell, with shift in the 7+-Year zone of the cash ACGB curve being fairly parallel in nature. The IB strip also richened, with a 15bp RBA rate hike now not fully priced until July.

JGBS AUCTION: Japanese MOF sells Y2.7566tn 6-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y2.7566tn 6-Month Bills:

- Average Yield -0.0766% (prev. -0.0907%)

- Average Price 100.038 (prev. 100.045)

- High Yield: -0.0766% (prev. -0.0866%)

- Low Price 100.038 (prev. 100.043)

- % Allotted At High Yield: 71.6600% (prev. 27.7941%)

- Bid/Cover: 4.087x (prev. 3.547x)

EQUITIES: Sharp Declines In Asia As War Breaks In Ukraine

Most major Asia-Pac equity indices are over 2% softer at typing, while similar declines were observed in regional EM equity indices. The broad move lower was facilitated by a sharp deterioration in the Russia-Ukraine situation during Asian trading hours, culminating in Russian President Putin announcing the commencement of a “special military operation” into separatist regions of Ukraine. There have since been reports of Russian incursions into Ukraine and explosions being heard across several Ukrainian cities, although the Russian military continues to emphasize that they are avoiding civilian targets in an effort to demilitarise Ukraine.

- The Hang Seng brings up the rear among regional peers, sitting 3.4% lower at typing. More granularly, the Hang Seng Tech Index leads losses being 4.0% worse off, as worry over China-based tech company performance mounts ahead of Alibaba’s earnings call later on Thursday (the company is widely expected to report a ~60% decline in earnings following a continued crackdown on Chinese internet companies throughout 2021).

- U.S. e-mini equity index futures trade 2.1-2.3% lower at typing.

OIL: Brent Breaches $100

WTI and Brent trade over $4.00 above their respective settlement levels, ~$1.00 shy of their session peak, with Brent futures now comfortably above $100.00bbl.

- The move higher was catalysed by Russian President Putin announcing military operations in the Donbas to “demilitarise” Ukraine, while stating that conflict between both countries was “inevitable” and a “question of time”. A statement in response from U.S. President Biden that the “world will hold Russia accountable” also fed into the bid.

- From a technical perspective, the uptrend has extended. The earlier rally has seen WTI and Brent clear resistance at $95.38 (2.764 proj. of the Dec 2-9-20 price swing) and $101.49 (3.00 proj of the Dec 2-9-20 price swing) respectively, with $97.91 (3.00 proj. Of the Dec 2-9-20 price swing) for WTI and $104.04 (3.236 proj. of the Dec 2-9-20 price swing) for Brent now in focus.

GOLD: Higher In Asia On Russia-Ukraine Escalation

Gold has caught a bid from an ongoing deterioration in the Russia-Ukraine situation, dealing ~$25/oz firmer to print ~$1,935.0/oz at typing (back from fresh cycle highs of $1,949.0/oz). Russian President Putin announced a special military operation re: the LPR and DPR separatist regions of Ukraine, supporting the separatists. Note that explosions have been heard across many Ukrainian cities in the wake of the announcement, with the Russian army pointing to a surgical strike on Ukrainian military facilities, playing down any threat to civilians.

- Looking to technical levels, gold has broken through key resistance and the top of the bull channel drawn from the Aug 9 ’21 low, with bulls now focused on $1,959.4, the Jan 6 ‘21 high.

FOREX: Risk Gets Battered On Russian Invasion

Risk sentiment crumbled as Russia launched a full-scale invasion of Ukraine, with multiple cities across the country coming under heavy missile fire amid reports that Russian ground troops were crossing the borders from several directions. Ukraine confirmed that the Russian forces struck a number of its military targets, while Belarussian troops and Donbas separatists joint the attack. When this summary is being written, reports are doing the rounds of Russian strikes at targets as far west as near the city of Lutsk, with Ukraine's air force picking up the fight.

- The announcement of a military strike against Ukraine by Russian President was preceded by reports of explosions in several locations across Ukraine, with Russia implementing a ban on all civilian flights in airspace across its border with Ukraine.

- Heavy buying of safe haven currencies commenced as President Putin went live with his pre-recorded announcement of invasion. The yen outperformed in G10 FX space, closely followed by USD and CHF.

- Selling pressure hit Scandi FX owing to their exposure to the Russo-Ukrainian conflict. The Antipodeans lost ground on the broader flight to safety. CAD suffered the least severe wounds among high-beta currencies as crude oil prices surged.

- The Russian rouble collapsed and printed an all-time low against the greenback as Western leaders rushed to pledge announcements of a powerful barrage of sanctions. Interfax reported that trading in the rouble, stocks and futures was virtually halted after quote hit trading band limits.

- The second reading of U.S. GDP, local jobless claims and new home sales headline the data docket today. Comments are due from Fed's Daly, Mester, Bostic & Barkin, BoE's Bailey, Broadbent & Pill, ECB's Schnabel & Riksbank's Jansson.

FOREX OPTIONS: Expiries for Feb24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1200-15(E1.8bln), $1.1225(E627mln), $1.1245-55(E1.5bln), $1.1265(E548mln), $1.1290-00(E3.4bln), $1.1315-35(E2.3bln), $1.1345-50(E752mln), $1.1385-00(E1.4bln), $1.1425-35(E1.0bln)

- USD/JPY: Y113.50($715mln), Y114.30-50($592mln), Y115.25-30($781mln), Y116.40($1.4bln)

- EUR/GBP: Gbp0.8335-55(E807mln)

- EUR/JPY: Y128.65-70(E591mln)

- AUD/USD: $0.7225-35(A$2.7bln), $0.7270(A$541mln)

- USD/CAD: C$1.2645-50($1.5bln), C$1.2695-10($827mln), C$1.2800-10($849mln)

- USD/CNY: Cny6.3700($675mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/02/2022 | 0700/0800 | ** |  | SE | Unemployment |

| 24/02/2022 | 0745/0845 | ** |  | FR | Consumer Sentiment |

| 24/02/2022 | 0900/1000 | * |  | IT | industrial orders |

| 24/02/2022 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 24/02/2022 | 1315/1315 |  | UK | BOE Bailey Intro at BEAR Research Conference | |

| 24/02/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 24/02/2022 | 1330/0830 | *** |  | US | GDP (2nd) |

| 24/02/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 24/02/2022 | 1330/0830 | * |  | CA | Payroll employment |

| 24/02/2022 | 1500/1000 | *** |  | US | new home sales |

| 24/02/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 24/02/2022 | 1600/1100 | ** |  | US | DOE weekly crude oil stocks |

| 24/02/2022 | 1600/1700 |  | EU | ECB Schnabel panels BOE BEAR conference on Unwinding QE | |

| 24/02/2022 | 1600/1600 |  | UK | BOE Broadbent moderates panel at BEAR Conference on QE | |

| 24/02/2022 | 1600/1100 |  | US | San Francisco Fed's Mary Daly | |

| 24/02/2022 | 1610/1110 |  | US | Atlanta Fed's Raphael Bostic | |

| 24/02/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 24/02/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 24/02/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 24/02/2022 | 1700/1200 |  | US | Cleveland Fed's Loretta Mester | |

| 24/02/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 25/02/2022 | 2330/0830 | ** |  | JP | Tokyo CPI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.