-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Ukraine Matters Continue To Dominate

EXECUTIVE SUMMARY

- IN NOD TO RUSSIA, UKRAINE SAYS NO LONGER INSISTING ON NATO MEMBERSHIP (AFP)

- U.S. & UK DEPLOY RUSSIAN OIL SANCTIONS

- RAIMONDO: CHINESE COMPANIES THAT AID RUSSIA COULD FACE U.S. REPERCUSSIONS

- AUSTRALIA RATE HIKE LATER THIS YEAR ‘PLAUSIBLE,’ LOWE SAYS (BBG)

- OPEC’S BARKINDO SAYS NO ‘PHYSICAL’ OIL SHORTAGE (BBG)

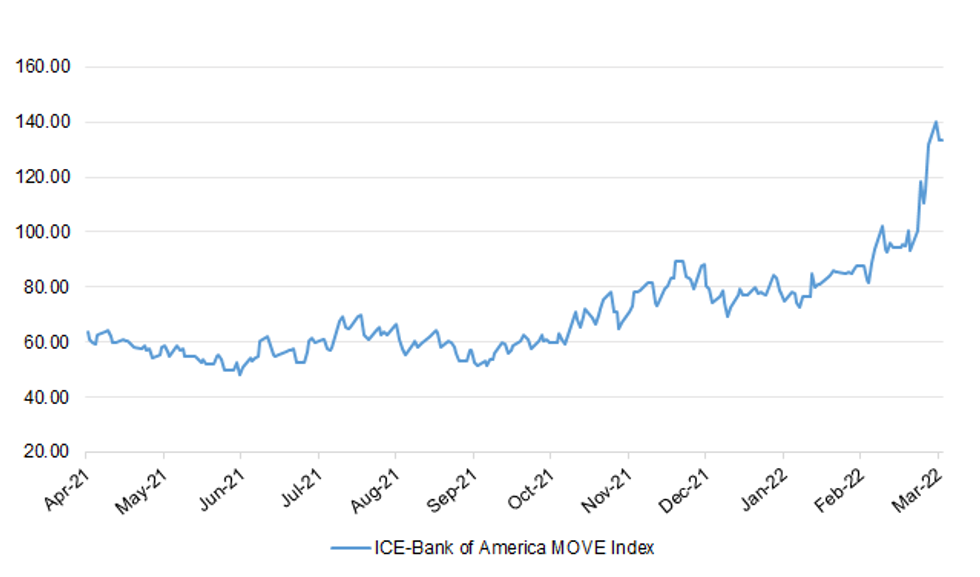

Fig. 1: ICE/Bank of America MOVE Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

EUROPE

ITALY/BTPS: Italy plans to sell up to EU2.75 billion ($2.99 billion) of 0% bonds due Dec. 15, 2024 in an auction on March 11. Italy plans to sell up to EU3 billion ($3.26 billion) of 0.45% bonds due Feb. 15, 2029 in an auction on March 11. Italy plans to sell up to EU2 billion ($2.18 billion) of 0.95% bonds due March 1, 2037 in an auction on March 11. (BBG)

PORTUGAL: The Portuguese government plans to reduce the fuel tax from Friday as it tries to contain rising energy costs. The government will reduce the fuel tax by the same amount as the potential increase in value-added tax revenue, Prime Minister Antonio Costa told reporters in Lisbon on Tuesday evening. “All scenarios indicate, unfortunately, that the price of diesel and gasoline will continue increasing,” Costa said. The government on March 4 also announced that Portugal plans to use 150 million euros ($164 million) of the extraordinary revenue its Environmental Fund is receiving to lower the electricity network access tariff. (BBG)

U.S.

FISCAL: The Senate voted 79-19 on Tuesday evening to pass a sweeping $107 billion plan to overhaul the U.S. Postal Service. Advocates argue that the bill will provide the beleaguered USPS with financial relief and help it modernize its operations, per the Washington Post. It will be the largest reform of the postal service in nearly two decades, the New York Times notes. The bill passed with large bipartisan support and now heads to President Biden's desk to be signed. (Axios)

RATINGS: S&P Affirmed The USA At AA+; Outlook Stable. (MNI)

OTHER

GLOBAL TRADE: A bipartisan group of 142 U.S. lawmakers write leaders of the House and Senate to urge action on the competition bill to secure $52 billion in semiconductor industry funding. “It is imperative that the United States rapidly expand domestic semiconductor manufacturing capacity,” lawmakers tell Senate Majority Leader Chuck Schumer, House Speaker Nancy Pelosi, Senate Republican leader Mitch McConnell, House Republican leader Kevin McCarthy. House Majority leader Steny Hoyer said earlier he is hopeful the competition bill will be finished in coming months. (BBG)

U.S./CHINA/RUSSIA: Gina Raimondo, the secretary of commerce, issued a stern warning Tuesday to Chinese companies that might defy U.S. restrictions against exporting to Russia, saying the United States would cut them off from American equipment and software they need to make their products. The Biden administration could “essentially shut” down Semiconductor Manufacturing International Corporation or any Chinese companies that defy U.S. sanctions by continuing to supply chips and other advanced technology to Russia, Ms. Raimondo said in an interview with The New York Times. (New York Times)

BOJ: Japan's economy is unlikely to slide into a "stagflation-like situation" where rising inflation and shrinking economic growth co-exist, a senior central bank official said on Wednesday. "Japan's consumer inflation is likely to clearly accelerate" as companies pass on rising energy and raw material costs, said Seiichi Shimizu, head of the Bank of Japan's monetary affairs department. "But we don't expect Japan to face a stagflation-like situation, defined as a combination of rising inflation and a contraction in economic growth," he told parliament. (RTRS)

RBA: An interest-rate increase in Australia this year is “plausible,” Reserve Bank Governor Philip Lowe said, as policy makers try to gauge whether a surge in prices driven by Russia’s invasion of Ukraine will result in a sustainable return of inflation to target. “We don’t have a plan that’s locked in,” Lowe said in response to a question Wednesday on whether the RBA will hike if inflation data released in April is very strong. “We are looking at, every month, the data that’s coming in.” (BBG)

AUSTRALIA: Australia will declare devastating floods along its east coast a national emergency on Wednesday, local media reported, after weeks of rains left authorities struggling to rush food and essential supplies to the worst-hit areas. (RTRS)

NEW ZEALAND: New Zealand will reduce the isolation period for Covid-19 cases and their household contacts to seven days in order to get more people back to work. The period will reduce from 10 days effective at 11:59 p.m. on Friday March 11 in Wellington, Minister for Covid Response Chris Hipkins said in a statement. “The most up to date public health advice is that there is a decline in infectiousness of omicron over time, and that in most cases transmission occurs within seven days,” he said. “Seven days isolation will break the vast majority of potential transmissions, while ensuring people can get back to work quicker and therefore reducing the impact on business operations.” (BBG)

HONG KONG: Hong Kong authorities will focus on a vaccination drive for elderly people living at care facilities, and increase the number of hospital beds to treat patients, Lam said. The pivot from in priorities from mass testing follows suggestions from Liang Wannian, the leader of China’s National Health Commission’s Covid response team who is visiting Hong Kong. It also shows the strain on the city’s health-care facilities, with hospitals overwhelmed and morgues unable to keep up with the growing number of deaths. (BBG)

CANADA: Ontario is set to drop most mask mandates including in shops, restaurants, elementary and secondary schools on March 21, Toronto Star reported. An announcement is expected Wednesday 11 am local time from Ontario’s chief medical officer of health Kieran Moore. (BBG)

RUSSIA: President Volodymyr Zelenskyy said he is no longer pressing for NATO membership for Ukraine, a delicate issue that was one of Russia's stated reasons for invading its pro-Western neighbour. In another apparent nod aimed at placating Moscow, Zelenskyy said he is open to "compromise" on the status of two breakaway pro-Russian territories that President Vladimir Putin recognised as independent just before unleashing the invasion on Feb 24. "I have cooled down regarding this question a long time ago after we understood that ... NATO is not prepared to accept Ukraine," Zelenskyy said in an interview aired Monday night on ABC News. "The alliance is afraid of controversial things, and confrontation with Russia," the president added. (AFP)

RUSSIA: Ukrainian President Volodymyr Zelenskyy vowed to "fight to the end" against Russia as he appealed for more help from the UK in a historic address to the House of Commons. Echoing Winston Churchill's "we shall fight on the beaches" speech to the same chamber in 1940, he vowed: "We will fight until the end, at sea, in the air. We will continue fighting for our land, whatever the cost. "We will fight in the forests, in the fields, on the shores, in the streets." And quoting Shakespeare, Mr Zelenskyy said the question for Ukraine is "to be, or not to be.. it's definitely yes, to be". It is the first time a foreign leader has directly addressed MPs in the Commons. (Sky)

RUSSIA: Russian armed forces have declared a "silence regime" and the opening of humanitarian corridors for the safe evacuation of civilians in Ukraine starting 10 a.m. Moscow time (0700 GMT) on Tuesday. "Humanitarian corridors from Kiev, Chernihiv, Sumy, Kharkov and Mariupol are being opened," local media reported, citing Russian Defense Ministry spokesperson Igor Konashenkov. (Xinhua)

RUSSIA: Ukrainian authorities were once again not able to evacuate civilians from the southern Ukrainain city of Mariupol on Tuesday, Deputy Prime Minister Iryna Vereshchuk said, describing the humanitarian situation in the besieged city as catastrophic. Humanitarian corridors from Mariupol offered by Russia that lead to Russian or Belarusian territory are unacceptable, she said in a televised briefing. (BBC)

RUSSIA: Russian President Vladimir Putin is likely to accelerate the Kremlin’s military campaign in Ukraine amid stalled progress after nearly two weeks at war, U.S. officials warned Tuesday. The intelligence chiefs, who had previously warned of Putin’s invasion of Ukraine, outlined a number of issues the Russian military is currently facing on the battlefield. “We assess Moscow underestimated the strength of Ukraine’s resistance and the degree of internal military challenges we are observing which include an ill-constructed plan, morale issues and considerable logistical issues,” Avril Haines, director of national intelligence, said before the House Intelligence Committee. U.S. intelligence analysts believe those setbacks won’t deter Putin, who “instead may escalate, essentially doubling down,” she said. (CNBC)

RUSSIA: At the Pentagon, a senior U.S. defense official separately said Tuesday that Russian forces are pursuing four different advances on Kyiv and are approximately 12 miles from the city center. The official, who spoke on the condition of anonymity in order to share new details of the Pentagon’s assessment, said that Russian troop movements deeper into Ukraine have slowed. “They still seem to be plagued by logistics and sustainment challenges,” explained the official, adding that the Russians are facing substantial fuel and food shortages. “We have every expectation that they will try to overcome those challenges,” the person said. The official added that almost all of the Russian forces once lined on Ukraine’s borders are now in Ukraine. (CNBC)

RUSSIA: The United States rejected a surprise offer by NATO ally Poland on Tuesday to transfer its Russian-made MiG-29 fighter jets to a U.S. base in Germany as a way to replenish Ukraine's air force in its defense against invading Russian forces. The United States has sought to speed weapons deliveries to Ukraine. But the prospect of flying combat aircraft from NATO territory into the war zone "raises serious concerns for the entire NATO alliance," the Pentagon said. "It is simply not clear to us that there is a substantive rationale for it," Pentagon spokesman John Kirby said of Poland's proposal. "We will continue to consult with Poland and our other NATO allies about this issue and the difficult logistical challenges it presents, but we do not believe Poland’s proposal is a tenable one." Separately, the U.S. military announced it would reposition two Patriot missile batteries to Poland to proactively "counter any potential threat to U.S. and Allied forces and NATO territory." (RTRS)

RUSSIA: Systems monitoring nuclear material at the radioactive waste facilities at Chernobyl in Ukraine, which were taken over by Russian forces last month, have stopped transmitting data to the U.N. nuclear watchdog, it said on Tuesday. "The Director General ... indicated that remote data transmission from safeguards monitoring systems installed at the Chornobyl NPP had been lost," the International Atomic Energy Agency said in a statement. (RTRS)

RUSSIA: The European Union is discussing a new round of sanctions that would target Russia’s National Wealth Fund, 14 wealthy individuals and more than 140 members of the upper house of the Russian Parliament, according to several diplomats. The individuals under consideration include Russians in senior positions at companies operating in the internet, agriculture, air transport, telecommunications, metallurgical and chemical sectors, as well as some of their family members, according to a person familiar with the matter. The National Wealth Fund is a sovereign wealth fund controlled by the Russian finance ministry. (BBG)

RUSSIA: Leaders in Saudi Arabia and the United Arab Emirates (UAE) declined calls with President Biden as the war in Ukraine intensified, Middle East and U.S. officials told The Wall Street Journal on Tuesday. "There was some expectation of a phone call, but it didn’t happen," a U.S. official told the Journal regarding a call between Biden and Saudi Crown Prince Mohammed bin Salman. "It was part of turning on the spigot [of Saudi oil]." UAE leader Sheikh Mohammed bin Zayed also declined a call from Biden, according to the officials. Officials told the outlet that U.S. relations with the two Gulf countries have been strained over the Biden administration's lack of support in the war in Yemen and the revived negotiations concerning the Iran nuclear deal. (The Hill)

RUSSIA: Russian President Vladimir Putin is banning exports of certain commodities and raw materials, according to a decree issued Tuesday evening in Moscow. The actual commodities that will be banned from export will be determined by the Russian cabinet, the decree said. Mr. Putin gave them two days to come up with a list of commodities and of countries subject to the ban. (WSJ)

RUSSIA: The Russian stock market’s trading halt is being extended in an effort to keep prices from tumbling in the wake of vast international sanctions, while currency trading is set to reopen. The Moscow Exchange equity market will remain shut again on Wednesday, the Bank of Russia said in a statement on Tuesday. The trading halt, which began on Feb. 28, is the longest in the country’s modern history. But trading on the foreign exchange, money and repo markets of the Moscow Exchange will resume, according to the statement. The exchange has not been conducting trading or settlements across all its markets since March 5. (BBG)

RUSSIA: Bank of Russia banned banks from selling cash currency to citizens who do not already have FX accounts, for period of 6 months starting March 9, it said in a statement. Russians who have accounts in FX can withdraw up to $10,000 in cash; can withdraw additional amounts in rubles at market rate on day of issue. 90% of accounts in foreign currency do not hold over $10,000 and so will be unaffected, central bank says. FX withdrawals will be paid in U.S. dollars, regardless of original foreign currency of account; conversion to dollars will be at market rate. For citizens who open new accounts in FX, withdrawals will be in rubles during this period. Citizens will still be able to sell FX to banks. All above measures are temporary for period through Sept. 9. (BBG)

RUSSIA: Consumer giants including McDonald's, Coca-Cola and Starbucks have joined the list of firms halting business in Russia due to the invasion in Ukraine. (BBC)

RUSSIA: PayPal says it’s suspending services in Russia due to military hostilities commenced by Russia in Ukraine. (BBG)

RUSSIA/RATINGS: Fitch Downgrades Russia To C. (MNI)

IRAN: The European parties negotiating the revival of the 2015 Iran nuclear deal warned Russia on Tuesday not to add conditions that would complicate reaching an accord, they said in a joint statement to the U.N. nuclear watchdog's 35-nation Board of Governors. "The window of opportunity is closing. We call on all sides to make the decisions necessary to close this deal now, and on Russia not to add extraneous conditions to its conclusion," Britain, France and Germany said after Russia announced extra demands that stalled negotiations. (RTRS)

METALS: The London Metal Exchange said it doesn’t expect the nickel market will reopen before March 11, after trading was suspended Tuesday following an unprecedented surge in prices. The exchange stressed that it was not announcing a firm date “given the uncertainties in the broader market,” and laid out a series of steps it’s planning to ensure order in the market after the restart. It expects to open trading in European hours only to begin with, set a daily 10% limit on price moves, and is exploring whether it can voluntarily reduce the number of outstanding short positions prior to reopening to ease the upward pressure on prices. (BBG)

METALS: The unprecedented surge in the price of nickel on the London Metal Exchange in the last two days has disrupted China’s downstream industrial production, the 21st Century Business Herald said. Some nickel suppliers stopped accepting orders to wait out the turmoil, the newspaper said. On Tuesday, a major stainless-steel exchange in the eastern city of Wuxi halted nickel trading due to uncertainties, the newspaper said. Nickel is an essential metal for producing stainless steel and batteries. The price of nickel surged as much as 250% in two days, touching record USD101,365 per ton, fueled partly by the speculation that top Chinese producer Tsingshan was caught in a massive short squeeze. (MNI)

ENERGY: A gas pipeline that is under construction from Norway via Denmark to Poland is expected to be ready for shipments in October or November this year, Polish Prime Minister Mateusz Morawiecki told a news conference in Oslo on Tuesday. The European Commission has published plans to cut EU dependency on Russian gas by two-thirds this year and end its reliance on Russian supplies of the fuel "well before 2030". (RTRS)

OIL: Countries around the world are uniting over the need to take concrete steps to cut reliance on Russian oil even if that is difficult for some central European nations, British Prime Minister Boris Johnson said on Tuesday. Britain earlier said it would phase out Russian imports of oil and oil products by the end of 2022 and the United States has announced a ban on such imports over Russia's invasion of Ukraine. "(There was agreement on) the need to move beyond dependence on Russian oil and gas as we as we go forward, even though it's incredibly difficult for some European countries... What we're doing is making the first step," Johnson said after meeting leaders from the Czech Republic, Hungary, Poland and Slovakia. (RTRS)

OIL: The House now plans to vote Wednesday on a bill banning Russian oil imports to the U.S., delaying one day after eleventh-hour objections from Republicans. Speaker Nancy Pelosi and her leadership team had planned to vote Tuesday on a bill that would ban Russia imports of oil and other energy products, as well as mandate a review of Russia’s status in the World Trade Organization. Pelosi also said the bipartisan bill would allow the U.S. to impose further sanctions on Russia by updating a human rights bill known as the Magnitsky Act. But Republicans complained that the bill did not include a key trade provision, which would have revoked normal trading relations with Russia and Belarus after hesitancy from the White House about the policy’s effect on U.S. allies. (POLITICO)

OIL: The outgoing general secretary of OPEC, Mohammad Barkindo, said that while oil prices in the futures markets have risen more than 30% since Russia invaded Ukraine, there’s “no physical shortage of oil, as of this morning.” The futures markets are “paper barrels,” but in the physical market supplies are guaranteed, Barkindo said in an interview to Bloomberg TV during CERAWeek by S&P Global in Houston. OPEC and its allies will continue to guarantee supplies to the market. (BBG)

OIL: The United States and other nations would consider releasing more oil barrels from reserves if necessary, U.S. State Department senior adviser Amos Hochstein said on Tuesday. "If we need to do something again on a global basis with our allies, we will," Hochstein said at the CERAWeek energy conference in Houston. Initially, the White House did not want to directly sanction Russian oil and gas exports, he noted, fearful that it would primarily punish global consumers. However, numerous buyers of Russian energy have self-sanctioned, avoiding purchasing those barrels "because there is such outrage in Europe about what is happening in Ukraine," Hochstein said. He estimated that about 3 million barrels of oil are now stranded as purchasers in Europe and elsewhere refuse to buy them. (RTRS)

OIL: U.S. is actively consulting with allies within the International Energy Agency on whether it is appropriate to release more oil, White House National Economic Council Director Brian Deese tells Bloomberg TV. (BBG)

OIL: U.S. crude production is set to continue climbing as surging oil prices following Russia’s attack on Ukraine prompt producers to drill even more. This year’s production forecast will rise to 12 million barrels a day from an earlier projection of 11.97 million, the EIA said in its monthly Short-Term Energy Outlook report. Oil output will average 13 million barrels a day in 2023, an increase from its previous estimate of 12.6 million, according to Energy Information Administration data. The current annual all-time high of 12.3 million barrels a day was set in 2019. (BBG)

OIL: U.S. officials have demanded Venezuela supply at least a portion of oil exports to the United States as part of any agreement to ease oil trading sanctions on the OPEC member nation, two people close to the matter said. (RTRS)

OIL: Alberta Premier Jason Kenney urged the U.S. to change its energy policies that he said prioritizes oil and gas imports from OPEC countries over liberal democracies like Canada. Kenney called for bilateral talks between the U.S. and Canada to improve energy security, and for Canada to prioritize the construction of more liquefied natural gas terminals to export more energy to Europe. He also urged investors to rethink corporate environmental, social and governance goals, in order to consider oil and gas investments in liberal democracies that have more transparent environmental records. “It’s time to add a second S to the ESG, and that is security,” Kenney said. “It’s something we can no longer pretend is immaterial to ethical investment in energy.” (BBG)

OIL: Canada’s top energy official downplayed the country’s ability to immediately boost oil and gas exports to help ease soaring prices as the world deals with an energy crunch arising from sanctions on Russia. “I wouldn’t want to oversell what Canada can do in the short term,” Natural Resources Minister Jonathan Wilkinson told Bloomberg TV. The government is looking at ways to remove bottlenecks in infrastructure to provide more oil to Europe and the U.S., “but that’s going to be limited.” (BBG)

OIL: Libya's National Oil Corporation (NOC) announced on Tuesday that it resumed production at the country's two major oil fields after days of hiatus. The NOC announced it stopped production at the two fields on Sunday after an armed group closed the pumping valves in the oil fields, and declared force majeure, a legal maneuver that lets a company get out of its contracts because of extraordinary circumstances. "The National Oil Corporation confirms that production continues gradually, with the aim to return to production rates prior to the closure," the NOC said in a statement. The NOC added the current daily oil production in the North African country exceeds 1.1 million barrels. (Xinhua)

CHINA

YUAN: The Chinese yuan is supported by inflows of funds from Europe seeking to avoid geopolitical turmoil, hedge funds' bullishness on the currency after China reported robust trade, as well as foreign exchange settlements by trade companies, the 21st Century Business Herald reported citing traders. The first two factors lead to more than half of new yuan trading activities in the offshore market since last week, the newspaper said. Wall Street investment institutions have raised the short-term expectation of yuan to around 6.25 against the U.S. dollar, but few expect rapid gain fearing the recent strength in the dollar index, the newspaper said. (MNI)

ECONOMY: China still has large potential space to boost effective investment to power its economic growth, including 102 mass projects to be carried out through 2025, the Economic Information Daily reported citing He Lifeng, director of the National Development and Reform Commission. China's investment priorities are to strengthen the weak links of infrastructure, reduce carbon emission and develop emerging industries and urbanization, the newspaper said citing He. (MNI)

PROPERTY: One of Chinese developers’ remaining funding channels is drying up, further weakening their abilities to repay debt amid an industrywide cash squeeze. Domestic issuance of asset-backed securities by real estate firms was almost halved the first two months of this year to 47.5 billion yuan ($7.5 billion), the slowest annual start since 2018 according to data from Heyi Fintech, a Chinese information provider focusing on the bond-like instrument. The weakness in ABS sales shows that lenders and investors are shunning Chinese developers well beyond mainstream fundraising venues likes loans and bonds, after a crackdown on excessive debt and slumping homes sales helped trigger a record wave of defaults. It also comes as at least two real estate firms have encountered difficulties honoring ABS payments on time. “As the risk associated with ABS emerges, investors will become even more sensitive to credit risk,” said Ma Dong, partner at Beijing BG Capital Management Ltd., a Chinese private bond fund. “That will further narrow developers’ access to ABS fundraising.” (BBG)

CORONAVIRUS: China’s domestic Covid-19 infections topped 500 for a third day as outbreaks widened across the country and penetrated into mega cities like Shanghai and Beijing as well as manufacturing hubs in southern Chinese province Guangdong. While cases reach levels unseen since the initial outbreak in Wuhan two years ago, health authorities in major cities have largely avoided lockdowns and mass testing. Shanghai, which saw several dozen new cases, has largely adhered to targeted restrictions, such as locking down buildings that detected cases for two days for testing. Nearly 90% of China’s 1.4 billion people have been fully vaccinated and more than one third have received booster shots. (BBG)

OVERNIGHT DATA

CHINA FEB PPI +8.8% Y/Y; MEDIAN +8.6%; JAN +9.1%

CHINA FEB CPI +0.9% Y/Y; MEDIAN +0.9%; JAN +0.9%

JAPAN FEB M2 MONEY STOCK +3.6% Y/Y; MEDIAN +3.5%; JAN +3.6%

JAPAN FEB M3 MONEY STOCK +3.2% Y/Y; MEDIAN +3.1%; JAN +3.3%

JAPAN Q4, F GDP ANNUALISED SA +4.6% Q/Q; MEDIAN +5.6%; FLASH +5.4%

JAPAN Q4, F GDP SA +1.1% Q/Q; MEDIAN +1.4%; FLASH +1.3%

JAPAN Q4, F GDP NOMINAL SA +0.3% Q/Q; MEDIAN +0.3%; FLASH +0.5%

JAPAN Q4, F GDP DEFLATOR -1.3% Y/Y; MEDIAN -1.3%; FLASH -1.3%

JAPAN Q4, F GDP PRIVATE CONSUMPTION +2.4% Q/Q; MEDIAN +2.7%; FLASH +2.7%

JAPAN Q4, F GDP BUSINESS SPENDING +0.3% Q/Q; MEDIAN +0.8%; FLASH +0.4%

JAPAN Q4, F INVENTORY CONTRIBUTION % GDP -0.1% Q/Q; MEDIAN -0.1%; FLASH -0.1%

JAPAN Q4, F NET EXPORTS CONTRIBUTION % GDP +0.2% Q/Q; MEDIAN +0.2%; FLASH +0.2%

AUSTRALIA MAR WESTPAC CONSUMER CONFIDENCE INDEX 96.6; FEB 100.8

AUSTRALIA MAR WESTPAC CONSUMER CONFIDENCE SA -4.2% M/M; FEB -1.3%

This is the weakest print since September 2020, which is also the last time the index was below the 100-level indicating that pessimists outnumber optimists. That previous low marked the end of a fifteen-month run of pessimism that began when the economy hit a flat patch in the second half of 2019 and worsened dramatically with the onset of the global pandemic just over two years ago.The survey was conducted in the week of February 28 to March 4. It would have captured most of the response to the south-east Queensland and Northern NSW floods but preceded most of the current disasters in greater Sydney. Confidence in rural areas generally was quite resilient in the survey, probably reflecting the encouraging developments in agricultural commodity prices and growing conditions across wider rural Australia.On the other hand, confidence in Brisbane plummeted by 11.2%, contrasting with Melbourne which has been unaffected by the floods where confidence was down by only 3.4%.The latest monthly fall comes as no surprise. The war in Ukraine; the floods in south- east Queensland and Northern NSW; ongoing concerns about inflation and higher interest rates were all likely to impact confidence, although the size of the decline is still notable. (Westpac)

NEW ZEALAND FEB ANZ TRUCKOMETER HEAVY +1.4% M/M; JAN -0.4%

NEW ZEALAND Q4 M’FING ACTIVITY SA +12.0% Q/Q; Q3 -2.3%

NEW ZEALAND Q4 M’FING ACTIVITY VOLUME +8.2% Q/Q; Q3 -6.6%

CHINA MARKETS

PBOC INJECTS CNY10 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Wednesday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.0811% at 09:29 am local time from the close of 2.0888% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 45 on Tuesday vs 46 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3178 WED VS 6.3185

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3178 on Wednesday, compared with 6.3185 set on Tuesday.

MARKETS

BONDS: Hong Kong & Chinese Equity Weakness Allows Core FI To Move Off Lows

Weakness in Hong Kong & Chinese equities (with some starting to question the scope for meaningful easing from the PBoC after stickier than expected Chinese PPI data given the prospect of notably higher commodity prices starting to feed into the dataset imminently) provided some counter to early core fixed income weakness that came on the back of the U.S. putting the coolers of any talk of Polish airforce planes being stationed at one of its German bases (although talks between the two are ongoing, perhaps linked to the stationing of patriot missiles in Poland).

- TYM2 +0-05 at 127-10, while cash Tsys run little changed across the curve. There wasn’t much in the way of wider headline flow to observe in Asia, with a fairly contained 0-08+ range in play in TYM2 on volume of ~85K (paltry by recent Asia-Pac session standards).

- JGB futures consolidated the bulk of their overnight losses but rebounded off of worst levels to close -15. The rebound in futures came alongside a rally in the longer end of the JGB curve, which reversed the early steepening theme (we didn’t see a clear catalyst for this move). Cash JGBs sit little changed to 1.5bp cheaper out to 10s, with 7s underperforming, linked to the weakness in futures. Further out, 20+-Year paper was 1.5-2.5bp richer, with 40s leading.

- Aussie bonds looked through RBA Governor Lowe’s embedding of further optionality in lift off deliberations, with some of the phrasing deployed by Lowe pointing to upside risks in inflation, in addition to no plan when it comes to the timing of the first hike (when questioned on potential inflation scenarios). YM was -7.8 at the bell, ticking lower into the close, while XM was -8.7. IRH2 was marginally higher, while the remainder of the IR strip softened.

EQUITIES: Mixed As Commodities Push Higher

Major Asia-Pac equity indices are mixed following a negative lead from Wall St., with Hong Kong and Chinese stocks notably under pressure. Most energy and materials stocks across the region have again caught a bid amidst a continued rally in commodities, while high-beta equities fell amidst elevated inflation worry arising from the well-documented U.S. and UK embargoes of Russian crude.

- The ASX200 outperformed, snapping a three-day streak of losses to finish 1.0% higher, although the wider trend was bucked here, with energy names little changed on net, while the tech sector led the rally..

- The Hang Seng sits 2.2% weaker at typing, taking the index to levels not witnessed since Jul ‘16. An address by Hong Kong Chief Executive Carrie Lam mainly re: the city’s worsening COVID-19 outbreak has done seemingly little to sooth investor nerves, with steep declines seen in the Hang Seng’s Commerce & Industry sub-index. China-based tech companies struggled as well, with the Hang Seng Tech Index plunging to another all-time low.

- The CSI300 is 1.3% worse off at writing, with inflation-sensitive healthcare and consumer discretionary stocks leading losses in the index. Chinese PPI slowed in Y/Y terms during Feb (although still topped wider expectations), while the CPI print held steady, below 1.0% Y/Y. Discussions re: the scope for further easing from the PBoC have done the rounds, with the well-documented commodity price surge widely tipped to impact Chinese inflation readings as early as March.

- U.S. e-mini equity index futures deal 0.3% to 0.5% firmer at typing.

GOLD: Slightly Higher In Asia

Gold trades ~$5/oz firmer, printing $2,055.7/oz at typing. The precious metal has backed away from fresh cycle highs made on Tuesday ($2,070.44/oz), although a continued downtick in broader U.S. real yields provides continued support. The real yield dynamic has ultimately pushed bullion higher in recent weeks, with inflationary spillovers from the Russia-Ukraine conflict remaining front and centre.

- To recap, gold closed ~$50/oz firmer on Tuesday, with the move higher facilitated by the U.S. and the UK announcing embargoes on Russian crude imports, heightening concern re: inflationary spillovers. Elsewhere, Europe and Japan continue to debate their own energy sanctions on Russia (although Germany continues to lead opposition against any such measures, given the European reliance on Russian energy flows).

- From a technical perspective, price action over the previous day has seen the precious metal again break several levels of resistance, confirming the bullish underlying trend. Initial resistance is now located at $2,075.47/oz (Aug ’20 all-time high and major resistance), while support sits some distance away at $1,961.2 (Mar 7 low).

OIL: Higher In Asia In Wake Of U.S. & UK Embargoes Of Russian Oil

WTI is +$2.80 and Brent is +$3.60, with both benchmarks operating ~$2 to $3 below Tuesday’s highs at writing. Crude remains strongly bid as worry re: tightness in global supply continues to mix with well-documented aversion of Russian oil amongst traders, while some focus has shifted to progress in the G7’s partially enacted embargo of Russian energy imports.

- To elaborate, the U.S. is banning Russian oil, gas, and coal imports immediately, while the UK will “phase out” Russian crude imports by end-’22, with further measures re: reduction of Russian natural gas imports expected to come later this week. The announcements have come independent of Japan and Europe, with the latter still facing firm, German-led opposition to proposed sanctions on Russian energy products.

- Elsewhere, the latest round of weekly U.S. API inventory estimates crossed late on Tuesday. Reports pointed to a surprise build in U.S. crude stockpiles, while there was a drawdown in gasoline, distillate, as well as hub inventories.

- Looking ahead, U.S. EIA data is due later Wednesday (1530 GMT), with WSJ median estimates calling for a decline in crude, gasoline, and distillate stocks.

- Looking to technical levels, resistance for WTI and Brent is situated at their Mar 7 highs of $130.50 and $139.13 respectively, while support is seen at $105.18 (Mar 2 low) for WTI, and $106.83 (Mar 2 low) for Brent.

FOREX: JPY Brings Up The Rear

The greenback trades a touch lower against the majority of its G10 FX peers. Asia-Pac hours saw the U.S. effectively note that Polish airforce planes would not be welcome at one its German army bases after Poland made an offer to bolster the Ukrainian armory on Tuesday, although talks between the U.S. & Poland are ongoing (perhaps in relation to the potential deployment of patriot missiles to Poland, which was sketched out by U.S. officials on Tuesday).

- The exception to the broader rule was the JPY, which finds itself at the foot of the G10 FX table. A combination of softer than expected final Japanese GDP data, Japan’s susceptibility to higher crude prices, a light uptick in e-minis/local Japanese stocks and talk of importer-related flows in USD/JPY weighed on the JPY. USD/JPY is ~15 pips higher, printing just above Y115.80. The rate showed above initial technical resistance before backing off. Bulls ultimately look to key resistance in the form of the Feb 10 high/Jan 4 high & bull trigger (Y116.34/35).

- EUR/USD managed to add ~25 pips but sticks within the range observed during the first half of the week, printing $1.1925.

- AUD/USD nudged higher on the USD downtick, with nothing in the way of immediate reaction to the latest round of RBA communique. Governor Lowe seemed to embed further optionality into the timing of the Bank’s cash rate lift off, although he continued to point to the RBA’s ability to be patient.

- Chinese inflation data failed to impact the wider G10 FX space, while USD/CNH stuck to a narrow range.

- There isn’t much in the way of notable risk events slated for Wednesday, with U.S. JOLTS job openings perhaps providing the highlight. It will be a case of headline watching, with focus already moving to Thursday’s ECB meeting & U.S. CPI data.

FOREX OPTIONS: Expiries for Mar09 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0965(E650mln), $1.1100(E561mln), $1.1300(E1.0bln)

- GBP/USD: $1.3280-00(Gbp603mln)

- AUD/USD: $0.7250-65(A$672mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/03/2022 | 0900/1000 | * |  | IT | Industrial Production |

| 09/03/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 09/03/2022 | 1500/1000 | ** |  | US | JOLTS jobs opening level |

| 09/03/2022 | 1500/1000 | ** |  | US | JOLTS quits Rate |

| 09/03/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 09/03/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 09/03/2022 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 09/03/2022 | 1800/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.