-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Powell’s Tones Echo through Asia

EXECUTIVE SUMMARY

- FED'S POWELL SAYS OPEN TO LARGER RATE HIKES IF NEED (MNI)

- REHN: ECB RATE HIKES MAY BEGIN IN LATE 2022, EARLY 2023 (BBG)

- UKRAINE PRESIDENT SAYS ANY COMPROMISES WITH RUSSIA WILL REQUIRE A REFERENDUM (RTRS)

- RUSSIA'S PAYMENT ON ANOTHER BOND IS PROCESSED BY U.S. BANK (RTRS SOURCE)

- JAPAN EYES ADDITIONAL STIMULUS OF MORE THAN Y10TN (SANKEI)

- PBOC MAY CUT LENDING RATES IN Q2 (SEC. DAILY)

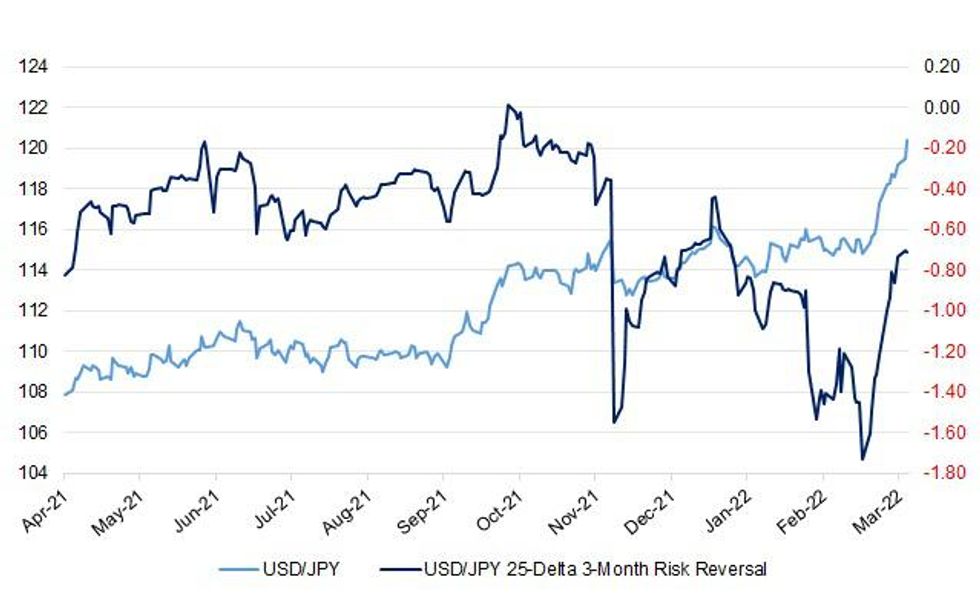

Fig. 1: USD/JPY Vs. USD/JPY 25-Delta 3-Month Risk Reversal

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

FISCAL: The Treasury has drawn up a range of options to help with the cost of living crisis – including a 1p cut to income tax, raising the national insurance threshold and a significant cut to fuel duty. But government sources said Rishi Sunak, the chancellor, was still reluctant to make big fiscal changes. (Guardian)

FISCAL: The National Insurance (NI) rise should be deferred, Cabinet ministers and senior Tories have urged Rishi Sunak, the Chancellor, in a last-ditch appeal before his spring statement on Wednesday. (Telegraph)

FISCAL: Therese Coffey has committed to the pensions triple lock being honoured for the remainder of the Parliament. The work and pensions secretary made the commitment during a Labour backbench business debate on the impact of the cost of living crisis on pensioners. The announcement comes less than 48 hours before Chancellor Rishi Sunak is due to reveal his spring statement to MPs in the Commons. The pensions triple lock is the policy used to set how much the state pension rises each year. The state pension is supposed to increase each year in line with whichever is highest out of CPI inflation, the average wage increase or 2.5%. In the Conservative's 2019 manifesto, Boris Johnson's party committed to keeping the triple lock in place for the duration of this Parliament. (Sky)

FISCAL: Rishi Sunak has given the go-ahead for cheap taxpayer-backed loans to help homeowners install heat pumps, solar panels and other energy efficiency measures to combat rising fuel bills. The chancellor has told the government’s new infrastructure bank to use some of its £22 billion of investment funds to tackle the cost-of-living crisis. The move is expected to help high-street banks offer loans at knockdown interest rates for energy efficiency projects that will pay for themselves by reducing utility bills. Ministers hope the plan will kick-start thousands of new projects as homeowners look for ways to lessen the impact of spiralling energy costs. (The Times)

FISCAL: Downing Street is discussing plans to set up a network of toll roads as ministers search for new ways to tax drivers.Rishi Sunak is expected to cut fuel duty for the first time in more than a decade in Wednesday’s spring statement but No 10 is concerned that income from the tax will plummet in coming years as more people buy electric cars. The only major toll road in Britain is on the M6 in the West Midlands, which on weekdays costs £7.10 for cars and £12.90 for HGVs. A source told The Times: “It’s definitely being taken very seriously in Downing Street. The policy unit is giving it a thorough look and the problems with fuel duty now make it more urgent.” (The Times)

POLITICS: Detectives investigating allegations of breaches of COVID rules in Downing Street and Whitehall have sent questionnaires to more than 100 people as they begin to interview key witnesses. Police are asking the recipients about their participation in the alleged gatherings, with seven days being given for a response. No fixed penalties have been issued so far. The Met Police also confirmed Prime Minister Boris Johnson has not been interviewed by police. (Sky)

EUROPE

ECB: The European Central Bank may begin to raise interest rates late this year or early next year, depending on how the economy develops, Governing Council member Olli Rehn said. Speaking in an interview on Finland’s YLE TV1 on Monday, Rehn says that if the euro-area economy doesn’t take a major hit from the war and sanctions on Russia, “then we continue the normalization of monetary policy and you can expect rates to rise late this year or early next year”. Says ECB’s policy normalization should happen without hurting economic growth, Rehn says. Says wage inflation remains relatively subdued in the euro area and that “as long as there is no wage-price spiral, second-round effects, then we don’t have runaway inflation”. Says there are grounds to use fiscal policy in a careful and targeted fashion to respond to energy-price shocks, “given monetary policy cannot ease this problem”. (BBG)

FISCAL: The European Union will for the first time tap an agricultural crisis fund to cushion the impact of the ongoing war in Ukraine on food producers facing high energy prices and shortages of some key products. The European Commission on Wednesday will propose using the fund’s nearly 500 million euros ($551 million) to support European farmers as part of a package to tackle the fallout of the invasion on the agricultural sector and to ensure food security in the bloc, an EU official said. EU Agriculture Commissioner Janusz Wojciechowski said last week that the EU is also working on measures that would allow fallow land to be used to grow protein crops to avert a scarcity of feed, and measures to support the pork industry. Details will be announced by March 24th. (BBG)

U.S.

FED: MNI: Fed's Powell Says Open to Larger Rate Hikes If Need

- Federal Reserve Chair Jerome Powell on Monday pledged to "take the necessary steps" to return inflation to 2%, including hiking benchmark interest rates by more than 25bps at a time and taking policy into restrictive territory. "We will take the necessary steps to ensure a return to price stability," he told a National Association of Business Economists conference in Washington. "In particular, if we conclude that it is appropriate to move more aggressively by raising the federal funds rate by more than 25 basis points at a meeting or meetings, we will do so. And if we determine that we need to tighten beyond common measures of neutral and into a more restrictive stance, we will do that as well - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

CORONAVIRUS: U.S. government advisers will meet early next month to discuss the use of additional Covid-19 booster shots as states and companies lower prevention safeguards such as masking and work at home. The Vaccines and Related Biological Products Advisory Committee will meet April 6, with the FDA calling the meeting for help deciding which populations, such as the elderly or immunocompromised, might need boosters, and when they should be administered. (BBG)

OTHER

U.S./CHINA: US Secretary of State Antony Blinken announced new visa restrictions on Chinese officials Monday for their actions to repress ethnic and religious minorities both inside and outside the country. In a statement, which provided no specific details on which officials would be targeted, Blinken also reiterated a call for China to "end its ongoing genocide and crimes against humanity" in the northwestern region of Xinjiang. (AFP)

BOJ: Bank of Japan Governor Haruhiko Kuroda said on Tuesday it was premature to debate an exit from ultra-loose policy including how to whittle down its massive holdings of exchange-traded funds (ETF). "Given recent price developments, we need to patiently maintain our powerful monetary easing. That means we're not in a stage to comment on an exit strategy including the fate of our ETF holdings," Kuroda told parliament. (RTRS)

JAPAN: MNI SURVEY: BOJ March Tankan Survey To Show Weaker Corp Views

- Business sentiment is expected to have weakened from three months ago, economists predict, as the Bank of Japan's March Tankan survey will show the impact of higher energy costs and pandemic curbs on companies - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

JAPAN: Japan’s government lifted quasi-state of emergency measures in Tokyo and elsewhere across the country on Monday, bringing to an end steps introduced in early January to help curb a surge in omicron cases. Cases have slid in the capital since peaking in early February, with Tokyo seeing an average of about 7,500 cases a day as of Monday. A Kyodo News survey found that 53% said the timing of ending the steps was appropriate, with 32% saying it was too early. Another 11% felt the move came too late. The quasi-state of emergency in practice largely allowed regional governors to call for bars and restaurants to close early, with eateries that followed the largely voluntary steps in Tokyo having closed at 9 p.m. (BBG)

JAPAN: Japan’s government and ruling coalition are preparing to draw up additional economic stimulus worth more than 10t yen to offset the rising price of crude oil and other commodities as well as support small businesses, Sankei reports without attribution. May include up to several trillion yen to extend subsidies for gasoline and other types of fuel beyond end-March; also considering measures for households including possible subsidy given increase in food prices. Move would come ahead of national election in the summer. Yomiuri separately reports Prime Minister Fumio Kishida’s Liberal Democratic Party and junior partner Komeito are considering expanding planned handouts for pensioners to younger people. (BBG)

JAPAN: Japan is scrambling to keep the lights on in Tokyo on Tuesday, as freezing temperatures and power plant outages after last week’s earthquake put the nation’s capital at risk of blackouts. The situation across the Tokyo area is “extremely tight,” and there could be partial power outages if the supply shortfall continues, according to an official at Tokyo Electric Power Co., who added that there currently aren’t plans for rolling blackouts. The metropolis’ power supply is expected to fall short of demand in the evening, the country’s trade ministry warned. The ministry called for further power conservation efforts, saying that it might need to make stronger requests for users depending on the situation during the day. Households and businesses need to reduce power consumption as much as possible, Trade Minister Koichi Hagiuda said earlier, after the government issued its first-ever electricity supply alert for the Tokyo area. (BBG)

RBA: Reserve Bank chief Philip Lowe acknowledged there had been a shift in Australians’ assessment of inflation in response to the impact on prices from supply-chain disruptions and Russia’s invasion of Ukraine. “The question we are grappling with is whether the inflation psychology is shifting,” Governor Lowe said in response to a question Tuesday at a journalism awards function. “There is a shift going on but how pervasive it is we don’t know yet and until we see the evidence we are not going to respond.” The remarks highlight Lowe’s dovish monetary policy stance at a time when counterparts from Wellington to Washington have already begun raising interest rates to try to restrain soaring prices. The RBA, in contrast, has left its benchmark rate at a record low 0.1% and reiterated that policy will remain unchanged until unemployment is low enough to spark faster wages growth. (BBG)

AUSTRALIA: Australia faces a “national emergency” unless it re-establishes a sovereign commercial shipping fleet to ensure critical goods flow during times of war and economic sanctions. The war in Ukraine, alongside Canberra’s geopolitical tensions with Beijing, has highlighted the vulnerability of Australia’s security and economy given its supply chain is almost completely reliant on ships registered to other countries. The Australian government was forced last week to ask a British ship set to bring in munitions for the defence force to replace Russian crew members. The number of Australian-owned ships is set to wither to just nine by 2024, according to data from Maritime Industries Australia Limited, an industry association. That comprises six roll-on, roll-off ships used in the Bass Strait and three cement ships but no container ships or oil tankers. In the 1980s, the country boasted about 100 Australia-domiciled ships. (FT)

NEW ZEALAND: From late April to late July 2022, road user charges which apply to diesel fueled vehicles will be cut by 36% across all legislated rates, Transport Minister Michael Wood says in emailed statement. “I want to assure road user charges payers they will get three months of reduced rates, even with the later start date. The complexity of road user charges means that a few more weeks are required to put the reduced rates in place” (BBG)

SOUTH KOREA: South Korean President-elect Yoon Suk Yeol asks his transition team to prepare detailed plan to compensate pandemic-hit small merchants. Yoon says his team would request outgoing government to draw up extra budget; if the request is rejected, his government should be ready to submit extra budget plan to parliament as soon as he takes office in May. (BBG)

CANADA: The leadership of the Liberals and the NDP have reached a tentative agreement that would see the NDP support the Liberal government to keep it in power until 2025 in exchange for a commitment to act on key NDP priorities, CBC News has learned. The so-called confidence-and-supply agreement still needs the support of NDP MPs who are meeting late Monday night, according to multiple sources who spoke to CBC News on condition they not be named due to the sensitive nature of the discussions. The agreement would see the NDP back the Liberals in confidence votes, including the next four budgets. In return, the Liberals will follow through on some elements of national pharmacare and dental care programs — programs that have long been promoted by the NDP. Sources say the agreement would also see the two parties collaborate on parliamentary committees, as well as some pieces of legislation. (CBC)

TURKEY: Turkey allows deposit holders to renew FX-protected lira accounts at maturity, according to decree in Official Gazette. Banks get permission to impose fee on FX-protected deposits within the framework determined by Turkish central bank. (BBG)

BRAZIL: Brazil's government announced on Monday it will cut to zero import tariffs for ethanol and six food products until the end of 2022. Officials from the Economy Ministry also said the tax on capital goods, computer and telecommunication products will be permanently reduced by 10%. The estimated cost of the measures is at 1 billion reais. The food products that will have import taxes cut are ground coffee, margarine, cheese, pasta, sugar and soybean oil. (RTRS)

RUSSIA: A meeting with Kremlin leader Vladimir Putin is necessary to determine Russia's position on ending the war he launched in Ukraine, Interfax Ukraine news agency quoted President Volodymyr Zelenskiy as saying in a television interview. Zelenskiy, interviewed by public television channels from European countries, also said it would not be possible to take a decision at such a meeting on what should be done with occupied territories in Ukraine. (RTRS)

RUSSIA: Ukrainian President Volodymyr Zelenskiy on Monday said any compromises agreed with Russia to end the war would need to be voted on by Ukrainians in a referendum. "The people will have to speak up and respond to this or that form of compromise. And what they (the compromises) will be is the subject of our talks and understanding between Ukraine and Russia," he said in an interview published by Ukrainian public broadcasting company Suspilne. Issues that could be raised in any referendum could concern territories occupied by Russian forces, including Crimea, or security guarantees offered to Ukraine by countries in lieu of NATO membership, he said. (RTRS)

RUSSIA: The Russian army is concentrating on seizing the Black Sea port of Mariupol after it failed in its efforts to force regime change in Ukraine, according to officials and diplomats from several countries. The offensive suggests the Kremlin may be adjusting its goals to focus on establishing a land corridor linking Crimea with the Donbas region of eastern Ukraine, two areas where Russia is already in control, the officials and diplomats said. Authorities have been pressing with limited success for humanitarian corridors to evacuate people from the city since March 5. Presidential adviser Oleksiy Arestovych acknowledged on Friday that Ukrainian forces have no way of breaking the siege, because they would have to cross at least 120 km (75 miles) of open terrain to get there. (BBG)

RUSSIA: Russian soldiers used flash grenades and fired other weapons at Ukrainian protesters in the occupied city of Kherson, wounding four, as people continue to demonstrate against the presence of Russian troops in cities and towns across the nation’s south. Protesters in Kherson shouted that the soldiers “should go home while they are still alive,” Halyna Luhova, secretary of the Kherson city council, said in a television interview. (BBG)

RUSSIA: President Joe Biden warned Monday about new indications of possible Russian cyberattacks, pumping up the volume on weeks of growing concern about a possible Kremlin-ordered response to crushing sanctions over the invasion of Ukraine. Biden reiterated those warnings, prompted by what he called “evolving intelligence that the Russian government is exploring options for potential cyberattacks.” He urged the the U.S. private sector: “Harden your cyber defense immediately.” (CNN)

RUSSIA: Russian accusations that Kyiv has biological and chemical weapons are false and illustrate that Russian President Vladimir Putin is considering using them himself in his war against Ukraine, U.S. President Joe Biden said on Monday, without citing evidence. Putin's "back is against the wall and now he's talking about new false flags he's setting up including, asserting that we in America have biological as well as chemical weapons in Europe, simply not true," Biden said at a Business Roundtable event. "They are also suggesting that Ukraine has biological and chemical weapons in Ukraine. That's a clear sign he's considering using both of those." (RTRS)

RUSSIA: The Pentagon on Monday accused Russian forces of committing war crimes in Ukraine and said it would help gather evidence of them, as it accused the Kremlin of carrying out indiscriminate attacks as part of an intentional strategy in the conflict. "We certainly see clear evidence that Russian forces are committing war crimes and we are helping with the collecting of evidence of that," Pentagon spokesman John Kirby told a news briefing. "But there's investigative processes that are going to go on, and we're going to let that happen. We're going to contribute to that investigative process. As for what would come out of that, that's not a decision that the Pentagon leadership would make." (RTRS)

U.S./CHINA/RUSSIA: The Biden administration wants to hear China condemn Russia's actions on the ground in Ukraine, White House press secretary Jen Psaki said on Monday. (RTRS)

RUSSIA: Josep Borrell, the European Union’s foreign policy chief, said he expects leaders to discuss, but probably not approve, further sanctions against Russia when they meet in Brussels this week. “I don’t think there is going to be a formal decision of a new package of sanctions, but certainly the European Council will provide guidance about how to” proceed in the future, Borrell told reporters after a meeting of foreign ministers in Brussels. He added that ministers discussed energy sector Measures. (BBG)

RUSSIA: The UK arm of Russian gas giant Gazprom could be placed into administration in the coming days, the BBC understands. Bloomberg reported the government is preparing to step in and temporarily run Gazprom Marketing & Trading Retail Ltd, which supplies thousands of organisations across the UK. (BBC)

RUSSIA: Britain is concerned that France and Germany will offer President Putin an “easy off-ramp” as they push for further peace talks with Russia. Ministers have become increasingly concerned about bilateral discussions between President Macron and Putin. Liz Truss, the foreign secretary, warned at the weekend that peace talks were a “smokescreen” for Putin while his forces commit further “appalling atrocities”. She is concerned that there will be a repeat of the Minsk agreement in 2014 after Russia’s invasion of Crimea, when Germany and France played a leading role in talks. A government source said: “Any negotiations with Russia should come from a position of utmost strength. The G7 needs to stay united. There should be no easy off-ramp for Putin.” (The Times)

RUSSIA: Russia will stop negotiations with Japan on a peace treaty that would officially end a conflict dating back to World War II after Tokyo imposed unprecedented sanctions over the invasion. The two countries never sealed an official treaty ending the war as they wrangled for decades over a small group of islands close to Hokkaido. The Soviet Union seized the isles in 1945, expelling thousands of Japanese residents. (BBG)

RUSSIA: Russia's coupon payment on its sovereign bond maturing in 2029 was processed by correspondent bank JPMorgan Chase, a source familiar with the situation said on Monday. Russia had been due to make the dollar-denominated payment to bondholders on Monday after last week defying fears it might not be able or willing to do so. (RTRS)

RUSSIA: Trading on the Moscow Exchange for government ruble debt, known as OFZs, to continue March 22, and trading in other instruments on the bourse will take place in the same mode as March 21, Bank of Russia says in statement. (BBG)

RUSSIA: S&P Global Ratings is withdrawing its credit grades on Russian entities after the European Union’s decision last week to ban firms from providing ratings to companies established in the country. The withdrawal will take place before the April 15 deadline imposed by the EU, analysts Michelle James and Arnaud Humblot wrote in a Monday statement. It comes after the rating company suspended commercial operations in the country following Russia’s invasion of Ukraine. (BBG)

SOUTH AFRICA: South Africa’s state power company is planning to propose that some of the funding the country secured to help tackle climate change take the form of loans to the government that could be converted to equity in the utility when needed. The arrangement would enable Eskom Holdings SOC Ltd. to access the $8.5 billion pledged by the U.S., U.K., Germany, France and the European Union without adding to its debt burden, a person familiar with the proposal said. The company wants to use the money to fund the closing of some coal-fired power plants and the construction of renewable-energy facilities to replace them. (BBG)

IRAN: The U.S. State Department on Monday said that an agreement on the Iran nuclear deal is neither imminent nor certain and said that Washington is preparing equally for scenarios with and without a mutual return to the full implementation of the nuclear accord. State Department spokesperson Ned Price warned that Washington is prepared to make "difficult decisions" to return Iran's nuclear program to its limits under the nuclear deal. (RTRS)

FOREX: The U.S. has been “extremely trigger-happy” with stinging economic measures, and central banks may decide to diversify their portfolio of foreign reserves instead of relying heavily on the U.S. dollar, according to the co-director of the Institute for the Analysis of Global Security. “Central banks are beginning to ask questions,” said Gal Luft of the Washington-based think tank, adding that they are wondering if reliance on the dollar and “putting all their eggs in one basket” is a smart idea. “The United States has extended itself, has been extremely trigger-happy when it comes to the use of sanctions and other economic punishments,” he said. (CNBC)

CHINA

PBOC: The People’s Bank of China may cut banks’ reserve requirement ratios in Q2, which will guide the Loan Prime Rate (LPR) lower by 5 bps and rate on medium-term lending facility (MLF) down by 10 bps, the Securities Daily said citing analyst Wang Qing of Golden Credit Rating. China’s inflation remains mild, leaving space for policy maneuvering, it said. More easing policies are expected after policymakers last week called for greater support for growth, it said. (MNI)

FISCAL: China reaffirmed its commitment to large-scale tax cuts and rebates, including CNY1.5 trillion in rebates of value-added tax to help small businesses and support growth, Xinhua News Agency said citing a State Council meeting on Monday. The meeting urged officials to pay high attention to changes in the global situation, increase monetary policy support and use multiple tools to ensure liquidity and growth in credit and social finance, it said. (MNI)

CORONAVIRUS: Shanghai saw 896 Covid-19 cases on Monday, CCTV reported, posting a record for a second straight day. The flareup has come after authorities expanded testing to more residents to root out silent transmission chains. The city last week ruled out imposing a broad lockdown, but officials said Monday that some areas will remain locked down for further testing. (BBG)

PROPERTY: China's property market is expected to stabilize by the middle of this year, as the real estate financing environment improves and more cities relax housing regulations, the PBOC-run Financial News reported citing analysts. Banks have lowered mortgage interest rates and shortened the approval process, with the rate in 103 key cities falling by 13 bps to 5.34% in March, the newspaper said. With increased external uncertainties, policymakers will have stronger determination to revitalize the market and prevent and defuse developers’ risks, the newspaper said. (MNI)

PROPERTY/CREDIT: Evergrande and its financial advisers will hold an investor call which starts at 9pm Hong Kong time Tuesday, according to two investors who received the call invitation. The developer will be represented by executive director Siu Shawn, non-executive director Liang Senlin and risk-management committee member Chen Yong, said the investors who asked not to be named as they are not allowed to discuss private information. Firm didn’t immediately have a comment when reached by Bloomberg. (BBG)

PROPERTY/CREDIT: China Evergrande Group, China Evergrande New Energy Vehicle and Evergrande Property Services will delay publication of 2021 audited results, according to statements to HKEX. China Evergrande Group’s risk management committee is actively looking for solutions and communicating with its creditors in view of the operational and financial challenges it’s facing, according to its statement. Proposes to engage King & Wood Mallesons as an additional legal adviser to assist the company in mitigating and eliminating the risks relating to its debts, following up with demands from the creditors, and dealing with the debts issue on a fair and equitable basis. (BBG)

PROPERTY/CREDIT: Zhenro Properties will also issue 1.59b yuan bond due 2023 after the completion of its exchange offer, according to statement to Hong Kong stock exchange. Co. offered to exchange five USD and yuan bonds due 2022 for new bonds. Both the new USD and yuan bonds will mature March 6, 2023 and bear an interest of 8.0% p.a. (BBG)

OVERNIGHT DATA

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 91.2; PREV 95.8

Consumer confidence dropped 4.8% last week. It is now at its lowest since Victoria’s second COVID wave in early September 2020. The continued rapid increases in petrol prices saw inflation expectations rise to 6.0%. Increasing petrol prices have had a sharp impact on households’ confidence for both ‘current’ and ‘future financial conditions’ with the two subindices dropping 10.3% and 8.4% respectively over the last two weeks. We noted last week that the weakness in consumer sentiment is at odds with the strength in employment and reflects pressure on household budgets as nominal wage growth lags the jump in inflation. The weakness in consumer confidence presents a growing near-term risk to the outlook for household spending. (ANZ)

NEW ZEALAND Q1 WESTPAC CONSUMER CONFIDENCE 92.1; Q4 99.1

Consumer confidence has continued to tumble in recent months, with the Westpac McDermott Miller Consumer Confidence Index dropping to a level of 92.1 in March. That’s down 7 points from the levels we saw at the end of last year and is lower than when the economy first went into lockdown. In fact, the last time confidence was this low was in 2008 when the global economy was in the depths of the financial crisis. The economy is being buffeted by powerful headwinds, and households have become increasingly pessimistic about the economic outlook over the coming years. Among the developments that have been weighing on sentiment has been the surge in Omicron infections. That’s been a big worry for many households, with large numbers of us choosing to spend more time at home, rather than going out. The resulting weakness in hospitality spending has been a particular drag in regions like Queenstown and Nelson, but areas like Auckland and Wellington have also felt the pinch. Also weighing on confidence, a large number of households have told us that their personal financial position has deteriorated over the past year. A key reason for that has been the rapid rise in consumer prices, with inflation hitting a three decade high of 5.9% in the 12 months to December. Earnings growth has not kept pace with those cost increases, with average wage rates rising by 3.8% over the same period. That’s meant many households will have seen the purchasing power of their pay-packets going backwards in recent months. (Westpac)

CHINA MARKETS

PBOC NET INJECTS CNY10 BLN VIA OMOS TUESDAY

The People's Bank of China (PBOC) injected CNY20 billion via 7-day reverse repos with the rates unchanged at 2.10% on Tuesday. The operation has led to a net injection of CNY10 billion after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1000% at 09:29 am local time from the close of 2.0949% on Monday.

- The CFETS-NEX money-market sentiment index closed at 43 on Monday vs 44 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3664 TUES VS 6.3677

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3664 on Tuesday, compared with 6.3677 set on Monday.

MARKETS

SNAPSHOT: Powell's Tones Echo Through Asia

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 367.92 points at 27193.58

- ASX 200 up 62.553 points at 7341.1

- Shanghai Comp. up 19.103 points at 3272.618

- JGB 10-Yr future down 18 ticks at 149.88, yield up 1.2bp at 0.221%

- Aussie 10-Yr future down 14.0 ticks at 97.215, yield up 14bp at 2.723%

- U.S. 10-Yr future -0-05+ at 123-00+, yield up 4.19bp at 2.330%

- WTI crude up $2.89 at $115.01, Gold up $1.78 at $1937.79

- USD/JPY up 87 pips at Y120.33

- FED'S POWELL SAYS OPEN TO LARGER RATE HIKES IF NEED (MNI)

- REHN: ECB RATE HIKES MAY BEGIN IN LATE 2022, EARLY 2023 (BBG)

- UKRAINE PRESIDENT SAYS ANY COMPROMISES WITH RUSSIA WILL REQUIRE A REFERENDUM (RTRS)

- RUSSIA'S PAYMENT ON ANOTHER BOND IS PROCESSED BY U.S. BANK (RTRS SOURCE)

- JAPAN EYES ADDITIONAL STIMULUS OF MORE THAN Y10TN (SANKEI)

- PBOC MAY CUT LENDING RATES IN Q2 (SEC. DAILY)

BOND SUMMARY: Powell’s Words Go A Long Way

Core bond markets were generally a touch above worst levels late in the Asia session.

- The bear flattening of the U.S. Tsy curve continued in Asia-Pac dealing, as the region reacted to Fed Chair Powell’s hawkish tones, delivered Monday. Note that a little over 80bp of cumulative tightening is now priced into OIS covering the next two FOMC meetings, with a total of ~190bp of cumulative tightening priced over the remainder of the year. Also on that front, Goldman Sachs now look for back-to-back 50bp hikes in May & June. There was a brief respite in the sell off during early futures trade, with a very modest uptick observed, before the re-open of cash trade ushered in fresh cheapening pressure that never really looked like reversing. That leaves cash Tsys 4-6bp cheaper ahead of London trade, with 2s leading the way lower. TYM2 is -0-04 at 123-02, 0-05 off the base of its 0-14+ overnight range. There wasn’t much in the way of notable headline flow to observe, with RTRS sources flagging confirmation that J.P.Morgan had processed Russia’s bond coupon payments. Flow was headlined by a block seller of FVM2 (-2,934), while regional $-denominated issuance saw Indonesia start to market multi-tranche 10- & 30-Year paper, which could price as soon as today. NY hours will see Richmond Fed manufacturing activity data complimented by Fedspeak from Williams, Mester (’22 voter) & Daly (’24 voter).

- JGB futures played catch up after the elongated Tokyo weekend, with talk of a Y10tn+ fiscal stimulus package (to be delivered later this year) applying some domestic impetus to the sell off, even as Chief Cabinet Secretary Matsuno noted that the government isn’t looking at compiling a stimulus package at present. Still, JGB futures weren’t able to breach their February cycle low, with the contract closing -20 on the session. Cash JGBs bear steepened with the major benchmarks running little changed to 2bp cheaper on the day (10s are less than 1bp away from the level that triggered the BoJ’s fixed rate operations in Feb). Comments from BoJ Governor Kuroda failed to add anything meaningful to the monetary policy debate. JPY issuance saw Egypt flag a private placement of 5-Year JPY paper for Japanese institutional investors.

- Aussie bonds bear flattened, with U.S. Tsy gyrations in the driving seat, that left YM -19.0 and XM -14.0 at the bell, with longer dated cash ACGBs cheapening by ~11bp. RBA Governor Lowe continued to muddy the optics surrounding the eventual cash rate lift off, noting that the Bank is monitoring how “pervasive” the shift in inflation psychology is in Australia, with evidence required on that front before the Bank responds. The IR strip ran 7-26 lower come settlement.

AUSSIE BONDS: The AOFM sells A$100mn of the 2.50% 20 Sep ’30 I/L Bond, issue #CAIN408:

The Australian Office of Financial Management (AOFM) sells A$100mn of the 2.50% 20 September 2030, issue #CAIN408:

- Average Yield: 0.0775% (prev. -0.6526%)

- High Yield: 0.0850% (prev. -0.6450%)

- Bid/Cover: 2.4800x (prev. 3.0600x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 48.2% (prev. 57.7%)

- Bidders 27 (prev. 28), successful 15 (prev. 10), allocated in full 11 (prev. 7)

EQUITIES: Financials Bid On Powell’s Remarks

Most major Asia-Pac equity indices are flat to higher at writing, bucking a negative lead from Wall St. Financial stocks caught a bid after Fed Chair Powell’s hawkish remarks on Monday (mainly on a willingness to back a more aggressive 50bp hike in May if necessary), outperforming peers in various indices across the region.

- The Nikkei 225 leads gains amongst regional peers, being 1.4% better off at writing to trade at one-month highs. Large-caps in energy and financials outperformed, while export-oriented names were notably bid as well. The move higher in the latter was facilitated by the Japanese Yen falling to fresh 6-year lows, with the USDJPY printing above Y120.00 for the first time since early ‘16.

- The Hang Seng sits 1.6% higher at typing, operating at session highs on gains in technology stocks after Alibaba Group announced a record $25bn stock buyback plan during the session. Broad sentiment in China-based stocks has steadied (Hang Seng China Enterprises Index: +2.2%) as monetary policy easing expectations have risen, with Xinhua reporting pledges from China’s State Council (chaired by Premier Li Keqiang) for market-supportive measures on Monday, building on dovish remarks made last Wednesday by Premier Li as well. Looking elsewhere domestically, the Hang Seng’s utilities sub-index took a beating, led by a ~14% drop in The Hong Kong China & Gas Co. on an earnings miss.

- U.S. e-mini equity index futures deal 0.1% to 0.3% softer at typing.

OIL: Higher In Asia

WTI is +$2.20 and Brent is $3.30 at writing, printing ~$114.30 and ~$118.90 respectively to build on a three-day streak of gains (~+$17). Both benchmarks have caught a bid in recent sessions as earlier optimism re: ongoing Russia-Ukraine ceasefire talks has moderated (with both sides not moving from their well-documented demands), shifting focus amongst participants to the potential impact of Russian crude supplies being removed from global markets in the coming weeks.

- Looking ahead, participants will be watching for possible EU measures (e.g. embargos or taxes) on Russian energy exports to the bloc this week, although outright sanctions are not expected to be enacted yet amidst strong internal opposition. Further discussions will be held on Thursday, when U.S. President Biden is due to arrive in Brussels.

- Elsewhere, there has been little discernible progress in ongoing U.S.-Iran nuclear talks, with Washington stating that an agreement was neither “imminent” nor “certain”, while also emphasising that the U.S. was prepared to make “difficult decisions” to return Iran’s nuclear programme to limits observed under a nuclear deal.

- Keeping within the region, Saudi Arabia has flagged the possibility of more Houthi attacks on its oil facilities, stating that it “won’t bear any responsibility” for disruptions to global crude supplies. A note that OPEC heavyweights Saudi Arabia and the UAE continue to show no sign of plans to speed up planned output increases, although international pressure on the group to do so continues to build (the UK, Japan, and Germany being the most recent parties to call for production increases).

GOLD: Flat In Asia

Gold is back from session lows, dealing ~$1/oz firmer to print $1,937/oz at typing, sticking within a relatively tight ~$8/oz range during Asia hours. The precious metal operates well clear of Monday’s troughs as developments in the Russia-Ukraine conflict remain front and centre, with elevated worry over further armed escalation evident.

- To recap Monday’s price action, gold closed ~$15/oz higher despite U.S. real yields and the Dollar (DXY) ticking higher, with the latter dynamic aided by hawkish remarks from Fed Chair Powell).

- Looking to the Russia-Ukraine conflict, hope surrounding a diplomatic resolution from ongoing ceasefire talks has moderated, with the Kremlin stating on Monday that “there has been no significant progress so far”. Elsewhere, relations between the west and Russia have deteriorated, with former Russian President Medvedev issuing a lengthy letter denouncing the Polish leadership (noting that Russian attacks on Ukraine have come to within 15 miles of Poland’s border), while Moscow summoned the U.S. ambassador to Russia over President Biden’s labelling of President Putin as a “war criminal”, stating that Russo-U.S. relations were “on the verge of rupture”. The European Commission has also called for the stockpiling of supplies essential for protection in a nuclear incident (i.e. suits and iodine pills), exacerbating worry in some quarters re: a nuclear escalation in Europe.

- Looking to technical levels, bullion’s short-term conditions remain bearish, following the pullback from Mar 8 cycle highs at $2,070.4/oz. The longer-term bullish trend remains intact however, with the pullback considered to be corrective. Support is situated at $1,895.3 (Mar 15 low), while resistance is seen at $1,954.7/oz (Mar 15 high).

FOREX: Hawkish Powell Boosts Greenback, Yen Breaches Round Figure En Route To Six-Year Low

USD/JPY was bought into the Tokyo fix, printing above Y120.00 for the first time since early ’16 in the process. Note that several market participants flagged broken barrier options at the Y120.00 level. A brief pullback below that round figure was followed by another round of purchases, which took the pair as high as to Y120.47. BoJ policy divergence vs. wider developed market central banks, Japan’s notable reliance on energy imports (and the surge in related prices in recent weeks, resulting in diminished terms of trade for Japan) and the well-documented cheapening in U.S. Tsys (higher Tsy yields) have been the dominant inputs into price action for the cross during early ’22.

- EUR/JPY punched through the Y132.00 figure as it rose to the highest point since Feb 11, bringing Feb 10 cycle high of Y133.15 into view.

- The Antipodeans advanced, with a surge in AUD/JPY capped by a resistance zone located slightly above the Y89.00 mark and representing a series of intraday highs from January 2018.

- The greenback caught a bid as the Asia-Pacific digested latest comments from Fed Chair Powell, who flagged the possibility of a half-point rate hike if necessary. His hawkish posturing helped reinforce the perception that U.S. policymakers were determined to contain rising consumer prices.

- The PBOC fix fell virtually in line with expectations. China's central bank set the midpoint of permitted USD/CNY trading band at CNY6.3664. Spot USD/CNH edged higher while staying within yesterday's range.

- Central bank speak takes focus today, in the absence of notable data releases. Comments are due from ECB's Lagarde, Lane, de Guindos, Villeroy & Panetta, Fed's Williams, Daly & Mester as well as Riksbank's Ingves & Skingsley.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/03/2022 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 22/03/2022 | 0720/0820 |  | EU | ECB de Guindos in Panel at Money Review Banking Summit | |

| 22/03/2022 | 0900/1000 | ** |  | EU | EZ Current Acc |

| 22/03/2022 | 1000/1100 | ** |  | EU | Construction Production |

| 22/03/2022 | 1100/1100 | ** |  | UK | CBI Industrial Trends |

| 22/03/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 22/03/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 22/03/2022 | 1310/1410 |  | EU | ECB Panetta Opening CCP Risk Management Conference | |

| 22/03/2022 | 1315/1415 |  | EU | ECB Lagarde Speech at BIS Innovation Summit | |

| 22/03/2022 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 22/03/2022 | 1515/1515 |  | UK | BOE Cunliffe Panels BIS Innovation Summit | |

| 22/03/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 22/03/2022 | 1700/1800 |  | EU | ECB Lane Panels Discussion on Flexible Exchange Rates | |

| 22/03/2022 | 1800/1400 |  | US | San Francisco Fed's Mary Daly | |

| 22/03/2022 | 2100/1700 |  | US | Cleveland Fed's Loretta Mester |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.