-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: NATO Summit Eyed

EXECUTIVE SUMMARY

- FED’S BULLARD REPEATS CALL FOR FASTER RATE HIKES TO COOL PRICES (BBG)

- NATO SUMMIT EYED

- U.S., EUROPE CLOSING IN ON DEAL TO CUT DEMAND FOR RUSSIAN ENERGY (BBG)

- WHITE HOUSE: U.S. TO ANNOUNCE RUSSIA-RELATED SANCTIONS ON THURSDAY (RTRS)

- STOCK TRADERS BRACE FOR A CHAOTIC REOPENING TO RUSSIA’S MARKET (BBG)

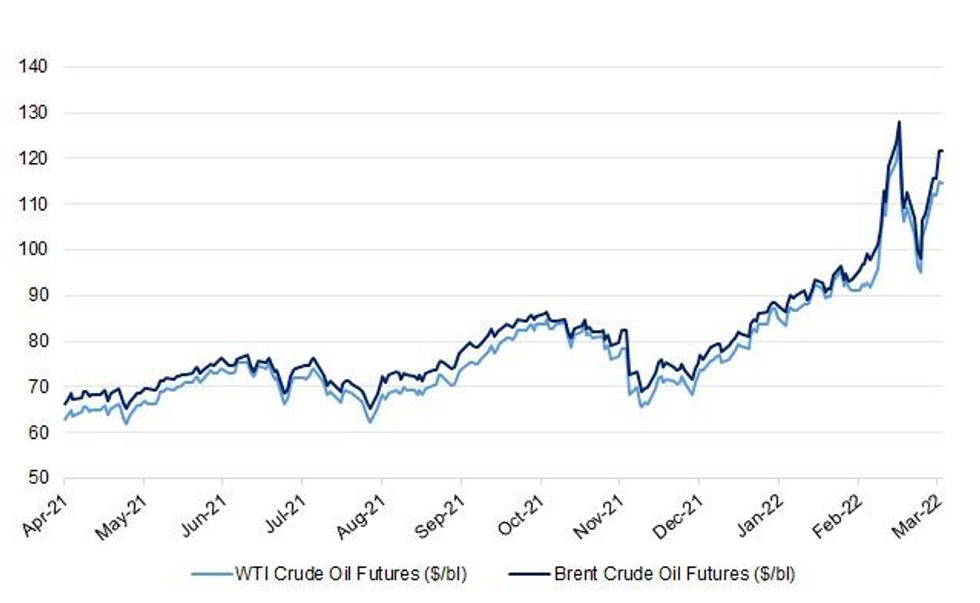

Fig. 1: WTI & Brent Crude Oil Futures ($/bl)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

FISCAL: U.K. taxpayers may face billions of pounds in costs if the government ends up nationalizing a unit of Gazprom PJSC that supplies about a fifth of the country’s commercial gas. Temporarily running the unit, an energy provider to the National Health Service, would cost about 4 billion pounds ($5.3 billion), according to people familiar with the matter. The U.K. is preparing to step in as the unit and its parent company are coming under pressure from customers turning their backs on Russian business. The government may have to appoint a special administrator, instead of going through the usual process of letting other suppliers bid to take over the clients. (BBG)

GILTS: MNI INTERVIEW: UK Linker Sales At Comfortable Level - DMO Chief

- The UK’s move to rein in issuance of index-linked gilts has taken its sales to more comfortable levels in terms of the longer-term trajectory of its inflation portfolio, capping the government’s exposure at a time when consumer prices are surging, Debt Management Office head Robert Stheeman told MNI - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

GILTS: Britain's 2 trillion-pound ($2.64 trillion) government bond market is in good shape to take whatever 2022 might throw at it, the head of the country's debt agency told Reuters on Wednesday. (RTRS)

EUROPE

INFLATION: The European Union will distribute 500 million euros ($550 million) to help farmers and allow them to grow crops on fallow land to mitigate food price spikes and potential shortages resulting from Russia's war in Ukraine. (RTRS)

PORTUGAL: Portuguese Prime Minister Antonio Costa has picked Fernando Medina, a former mayor of Lisbon like himself, as his new finance minister, tasked with reducing the budget gap just as the war in Ukraine clouds the prospects of post-pandemic recovery. Medina, 49, replaces Joao Leao, who had been in office since mid-2020 in Costa's minority Socialist government. The new government, this time backed by the party's parliamentary majority, will be sworn in on March 30. Medina is one of 17 ministers proposed by Costa and accepted by President Marcelo Rebelo de Sousa, according to a statement from the presidency. (RTRS)

NORWAY: Jens Stoltenberg may continue on as NATO Secretary General and thus not be able to become governor of the Norwegian central bank at the end of the year as planned, the Nordic country’s finance ministry said on Wednesday. “We are preparing for the situation that Jens Stoltenberg could stay longer in his job as NATO Secretary General. We don’t know how long it could be, for one or two years,” a ministry spokesperson told Reuters. Earlier on Wednesday, when asked whether he would stay on at NATO, Stoltenberg said any such decision was up to member-countries to make. (RTRS)

U.S.

FED: Federal Reserve Bank of St. Louis President James Bullard says the U.S. central bank has a “long ways to go” in getting inflation back to its 2% target and repeated his call for more aggressive interest-rate increases. “It is going to mean moving faster than what we are used to” he said, adding that the 1994-1995 tightening cycle that saw the Fed raise rates by 300 basis points was a play-book to replicate. “This is a lot of inflation and way above the 2% target set by the market committee”. (BBG)

FED: Some parts of the U.S. economy might be overvalued and there might be “excesses in U.S. financial markets,” said Federal Reserve Bank of St. Louis President James Bullard. “There are certainly points of the U.S. economy that you could point to that look like they might be overvalued,” Bullard said Thursday. (BBG)

FISCAL: President Joe Biden plans to request $813.3 billion in national security spending -- including $773 billion for the Pentagon -- in the federal budget he will send to Congress on Monday, according to officials familiar with the plan. It’s an increase of $31 billion, or 4%, from approved spending for the current fiscal year and about $43 billion more than the White House budget office had projected a year ago for fiscal 2023. The full national security budget includes spending for the Defense Department, the Energy Department’s nuclear weapons and the FBI’s national security functions. The officials familiar with the budget plan asked not to be identified before its release. (BBG)

CORONAVIRUS: The Biden administration could authorize a second Covid-19 booster shot for older Americans within weeks, amid rising concern over a potential resurgence of cases, four people with knowledge of the matter told POLITICO. The move under consideration by senior health officials would recommend the additional vaccine dose for adults 65 and older, in an effort to better protect high-risk people and stave off a wave of hospitalizations should infections climb rapidly as a result of the spread of the Omicron subvariant, BA.2. Currently, second boosters are only recommended for those with compromised immune systems. (POLITICO)

OTHER

GLOBAL TRADE: The United States will "absolutely" enforce export controls if Chinese companies send semiconductors to Russia that were made with U.S technology, a move that could "essentially shut them down," Commerce Secretary Gina Raimondo said on Wednesday. (RTRS)

U.S./CHINA: The U.S. Trade Representative's office said on Wednesday it has reinstated 352 expired product exclusions from U.S. "Section 301" tariffs on Chinese imports, well short of the 549 exclusions that it was previously considering. The reinstated product exclusions will be effective retroactively from Oct. 12, 2021 and extend through Dec. 31, 2022, USTR said. They cover a wide range of the initially estimated $370 billion worth of Chinese imports that former president Donald Trump hit with punitive tariffs of 7.5% to 25%. (RTRS)

U.S./CHINA: Weibo shares fell as much as 10% before paring some losses on Wednesday trading, after the Chinese social media company was added to SEC’s provisional list of issuers identified under the Holding Foreign Companies Accountable Act. According to the act, companies fail to comply with auditing requirements for three consecutive years would be subject to delisting from U.S. exchanges. The addition of Weibo came after the SEC on March 8 identified five Chinese firms including BeiGene Ltd., Yum China Holdings Inc., Zai Lab Ltd., ACM Research Inc. and HUTCHMED (China) Ltd. (BBG)

RBNZ: New Zealand’s central bank should continue with the swift normalization of monetary policy to curb a growing inflation threat, according to the International Monetary Fund. “Given New Zealand’s strong cyclical position and inflationary pressures, significant increases in the official cash rate in the near term are appropriate,” the IMF said in the Concluding Statement of its Article IV review of the economy, released Thursday in Wellington. While monetary policy should remain data dependent, “continued, swift policy normalization will be appropriate under baseline conditions,” it said. (BBG)

BOJ: Bank of Japan policymakers agreed that consumer inflation may overshoot their expectations if companies pass on rising costs quicker than forecast, minutes of the central bank's January meeting showed on Thursday. One member said consumer inflation may temporarily hit 1.5per cent, while another projected a brief rise near the central bank's 2per cent target as companies pass on rising raw material costs to households, the minutes showed. "Many companies are feeling the limit of sticking to a business model that was effective deflation. As they change their price-setting behaviour, inflationary pressure may heighten," one member was quoted as saying. "We're seeing stock prices rise for companies that hike prices," another member said. "Price hikes may broaden, and heighten medium- to long-term inflation expectations." (RTRS)

BOJ: Japan's consumer inflation may briefly exceed 1.5% but likely will not gain momentum to sustainably head toward the central bank's 2% target, Bank of Japan board member Goushi Kataoka said on Thursday. In a speech, Kataoka also said risks to the economic outlook were skewed to the downside, because of the fallout from the crisis in Ukraine and the lingering impact of the COVID-19 pandemic. (RTRS)

JAPAN: Japan's lower house of parliament on Thursday approved the government's nominees to replace two policymakers who will retire from the Bank of Japan's (BOJ) board in July, all but sealing full approval for the appointments in the legislature.Hajime Takata, a private sector economist and a bond market expert, will replace Goushi Kataoka, a vocal advocate of massive stimulus policy. Meanwhile Naoki Tamura, a senior adviser at Sumitomo Mitsui Banking Corp, is set to succeed former commercial banker Hitoshi Suzuki. (RTRS)

JAPAN: The Japanese government considers offering a fourth Covid-19 vaccine shot from May, broadcaster TV Tokyo reports, citing an unidentified ruling party official. Will take into account latest scientific findings and study the case of Israel, which set a 5-month span between the third and fourth shots, before official decision. (BBG)

BOK: South Korea's nominee for its new central bank chief said on Thursday worries about inflationary and economic risks are mounting and that he would thoroughly review how to manage growth, price pressures and financial imbalances. "Concerns that inflation and economic risks at home can intensify simultaneously are mounting as uncertainty in external conditions heightens," Rhee Chang-yong, a veteran International Monetary Fund official, said in a written speech. His remarks come a day after the presidential office nominated Rhee as the new central bank chief. (RTRS)

SINGAPORE: Singapore is moving ahead with a plan to significantly ease longstanding Covid-19 curbs, lifting “most restrictions” for fully vaccinated visitors and removing a requirement to wear masks outdoors, said Prime Minister Lee Hsien Loong. With the latest wave of the virus subsiding, the prime minister said that Singapore will double the group size from the current five persons to 10 and allow up to 75% of employees who can work from home to return to their workplaces, he said. The city-state will also “drastically streamline” testing and quarantine requirements for travelers. The changes will take effect March 29, Lee said. Singapore’s Straits Times index extended gains, with shares of Singapore Airlines and other reopening-linked stocks advancing. (BBG)

MEXICO: Mexico’s central bank brought forward two key monetary policy meetings this week as they clashed with the country’s annual banking conference in Acapulco, adding a wrinkle to the process of setting interest rates to rein in the fastest inflation in two decades. The bank, known as Banxico, moved the meeting in which its five-member board decides on the key interest rate to Wednesday afternoon from the evening of the same day, according to people familiar with the matter who asked to speak anonymously while discussing private information. It also changed the meeting to agree on the statement that accompanies its decision to Wednesday evening from Thursday morning, one of the people said. (BBG)

RUSSIA: The United States will announce a package of Russia-related sanctions on political figures and oligarchs on Thursday while U.S. President Joe Biden meets with NATO leaders on Ukraine, U.S. national security adviser Jake Sullivan said on Wednesday. Sullivan, speaking to reporters as Biden headed to Brussels for the NATO summit, said G-7 leaders will also agree on Thursday to coordinate on sanctions enforcement and plan to issue a statement. (RTRS)

RUSSIA: The leaders of the United States and European Union will discuss China’s perceived support for Russia’s war against Ukraine at a flurry of major summits on Thursday, after US President Joe Biden arrived in Brussels on Wednesday evening. Senior EU officials expect Biden to relay a message about China’s potential assistance to Moscow in circumventing crippling sanctions and providing military equipment, “whether it’s intentional or not”, amid speculation that Beijing was ready to offer an economic lifeline. Biden will “certainly consult on the question of China’s potential participation in the conflict of Ukraine while he’s in Brussels”, his national security adviser, Jake Sullivan, said on Tuesday. “We believe we’re very much on the same page with our European partners and we will be speaking with one voice on this issue.” (SCMP)

RUSSIA: NATO members are debating how best to express concern over possible Chinese cooperation with Russia in a joint statement after an extraordinary summit Thursday, amid fears that military and financial support from Beijing could reinvigorate Moscow's offensive in Ukraine. (Nikkei)

RUSSIA: White House National Security Advisor Jake Sullivan told reporters travelling with Biden to Brussels that "what we'd like to hear is that the resolve and unity that we've seen for the past month will endure for as long as it takes". Sullivan said there was no sign that China was providing military assistance in the wake of a nearly two-hour phone call between President Xi Jinping and Biden last Friday. "This is something we are monitoring closely," he said. "The president will certainly consult on the question of China's potential participation in the conflict of Ukraine while he's in Brussels. He'll do so at NATO," Sullivan said. (AFP)

RUSSIA: President Xi Jinping has spoken to at least eight world leaders, including Vladimir Putin, in the month since Russia invaded Ukraine on Feb. 24. But there’s one big omission from his diplomatic outreach: Zelenskiy. While the Chinese leader has encouraged Russia to move toward negotiations, offered to work with France and Germany to promote talks and told Biden that China “stands for peace,” the silence between Xi and Zelenskiy raises questions over Beijing’s commitment to mediation. (BBG)

RUSSIA: Leaders of NATO countries are set to agree at a summit Thursday on Jens Stoltenberg, the military alliance’s secretary general, staying on in his post possibly for another year despite his being picked as Norway’s next central bank chief. Senior officials from several members of the North Atlantic Treaty Organization have held talks about Stoltenberg prolonging his mandate, as he leads the alliance’s response to Russia’s invasion of Ukraine, according to a western diplomat who declined to be named on a confidential issue. Leaders meeting at NATO headquarters in Brussels will discuss Stoltenberg’s mandate and are set to agree on his remaining in the job, the diplomat said. This may be for another year, but the timing has yet to be determined. (BBG)

RUSSIA: The White House on Wednesday left open the possibility that Russia could be kicked out of the Group of Twenty, but declined to weigh in publicly on reports that the US and allies want the country removed from the group. “We don't believe it can be business as usual with Russia an international institutions,” National Security Adviser Jake Sullivan told reporters on Air Force One, when asked directly if Russia could be booted from the forum. “In terms of specific answers to that kind of question, for the G20, or other international organizations, we want to have the opportunity to consult with our allies partners around the world…before I opine on that question publicly.” (CNN)

RUSSIA: Australia Prime Minister Scott Morrison on Thursday said he has been raising concerns about Russian President Vladimir Putin's plans to attend the next G20 summit in Indonesia this year. "The idea of sitting around a table with Vladimir Putin, who the United States are already in the position of calling out (for) war crimes in Ukraine, for me is a step too far," Morrison said during a media briefing. Russia's ambassador to Indonesia on Wednesday said Putin intends to attend the G20 summit, dismissing suggestions by some G20 members that Russia could be barred from the group. (RTRS)

RUSSIA: The US government has formally declared that members of the Russian armed forces have committed war crimes in Ukraine, Secretary of State Antony Blinken said in a statement Wednesday. The official US declaration that Moscow's troops had violated the laws of conflict comes after Blinken, President Joe Biden and Deputy Secretary of State Wendy Sherman all said it was their personal opinion that war crimes have taken place. "Today, I can announce that, based on information currently available, the US government assesses that members of Russia's forces have committed war crimes in Ukraine," Blinken said in a statement. (CNN)

RUSSIA: The first shipments from the latest $800 million security assistance package will arrive in Europe within a day for transport to Ukraine, a senior U.S. defense official said Wednesday. Much of the equipment goes in by ground, and the U.S. hasn’t seen any threats yet to those routes, the official said. In the war, the U.S. official said, Russia appears to be digging in, taking defensive positions on land while its pilots are cautious and shy away from lingering in contested air space over Ukraine. (BBG)

RUSSIA: Germany will fast track its internal decision making on arms exports to Ukraine, German newspaper Die Welt reported on Wednesday, citing Economy Minister Robert Habeck. The German Defence Ministry applied on Wednesday for the supply of 2,000 additional anti-tank weapons to Ukraine from Bundeswehr stocks, the newspaper reported. On Wednesday, German Foreign Minister Annalena Baerbock also said further Strela missiles, which had been in the inventories of the former Communist East German army, were on the way to Ukraine after delays in deliveries. (RTRS)

RUSSIA: The White House has quietly assembled a team of national security officials to sketch out scenarios of how the United States and its allies should respond if President Vladimir V. Putin of Russia — frustrated by his lack of progress in Ukraine or determined to warn Western nations against intervening in the war — unleashes his stockpiles of chemical, biological or nuclear weapons. The Tiger Team, as the group is known, is also examining responses if Mr. Putin reaches into NATO territory to attack convoys bringing weapons and aid to Ukraine, according to several officials involved in the process. Meeting three times a week, in classified sessions, the team is also looking at responses if Russia seeks to extend the war to neighboring nations, including Moldova and Georgia, and how to prepare European countries for the refugees flowing in on a scale not seen in decades. (BBG)

RUSSIA: Russia told Washington on Wednesday it would throw out a number of American diplomats in response to a U.S. move to expel Russian staff from the permanent U.N. mission, Interfax news agency said. The agency also cited the foreign ministry as telling the United States any hostile actions against Russia would provoke a decisive response. (RTRS)

RUSSIA: The United States Embassy in Moscow on Wednesday received a list of its diplomats that were declared "persona non grata", a State Department spokesperson said, in what Russian media said was a response to a U.S. move ousting Russian staff at the United Nations. Interfax news agency said."The American side was told very firmly that any hostile U.S. actions against Russia would provoke a decisive and comparable response," the agency said. (RTRS)

RUSSIA: A Russian-drafted call for aid access and civilian protection in Ukraine that does not mention Moscow's role in the crisis failed at the U.N. Security Council on Wednesday, with only Russia and China voting yes and the remaining 13 members abstaining. "If Russia cared about the humanitarian situation, it would stop bombing children and end their siege tactics. But they haven't," Britain's U.N. Ambassador Barbara Woodward told the council after the vote. Russia denies attacking civilians. (RTRS)

RUSSIA: The Japanese government is considering extending additional humanitarian aid of $100 million to Ukraine and neighbouring countries, on top of the $100 million in assistance Japan has already announced, public broadcaster NHK said on Thursday. The government is also looking into doubling emergency loans to Ukraine to $200 million and dispatching Self-Defence Force medical officers to support Ukrainian refugees in Poland and other neighbouring nations, NHK said. Prime Minister Fumio Kishida has said he plans to unveil Japan's new support measures for Ukraine at a G7 summit meeting scheduled to take place in Brussels on Thursday. (RTRS)

RUSSIA: The U.S. Treasury was preparing sanctions against Russian oligarch Roman Abramovich, but Ukraine’s President Zelenskiy urged President Biden to hold off and action was delayed, according to the Wall Street Journal. Zelenskiy told Biden in a phone call to wait because Abramovich could become a go-between in efforts to negotiate peace, the Journal said, citing people familiar with the plans that it didn’t identify. “We are not going to read out private conversations” between Biden and Zelenskiy, Emily Horne, a spokesperson for the U.S. National Security Council told the Journal. (BBG)

RUSSIA: Renault SA, the Western carmaker most exposed to the Russian market, said on Wednesday it would suspend operations at its plant in Moscow while it assesses options on its majority stake in Avtovaz, the country's No. 1 carmaker. The move came amid mounting pressure over the French company's continued presence in Russia since the country invaded Ukraine. Ukraine's foreign minister, Dmytro Kuleba, has called for a global boycott of Renault. (RTRS)

RUSSIA: In a video address, Zelenskiy -- speaking in English – urged people across the world to hold rallies in solidarity with Ukraine starting on March 24, a month after Russia invaded. “Come to your squares, your streets, make yourselves visible and heard,” the president said. “Come from your offices, your homes, your schools and your universities. Come in the name of peace. Come with Ukrainian symbols to support Ukraine, to support freedom, to support life.” (BBG)

RUSSIA: Fitch will withdraw ratings on all Russian entities and their subsidiaries in order to comply with European Union sanctions, the ratings agency said on Wednesday, as Western nations tighten their grip around Moscow's economy. The ratings will be withdrawn before April 15, the company said. Its parent company Fitch Group has already suspended its commercial operations in Russia earlier this month. The latest move comes days after credit ratings firm S&P Global Ratings also announced its intention to withdraw ratings for all Russian entities before April 15. (RTRS)

RUSSIA: Russia's space agency Roscosmos will switch to rouble-denominated contracts with other countries, TASS state news agency cited the agency's head Dmitry Rogozin as saying on Wednesday. The move comes after President Vladimir Putin said Russia will seek payment in roubles for gas sales from "unfriendly" countries, sending European gas prices soaring on concerns the move would exacerbate the region's energy crunch. (RTRS)

RUSSIA: A Google spokesperson confirmed that some people were having difficulty accessing its news app and website in Russia, adding that this was not due to technical issues on its end. (BBG)

RUSSIA: The Russian stock market is set to partially reopen after being shut for a month -- the longest break since the collapse of the Soviet Union in 1991. The question is what will the price action actually indicate in a severely restricted market that many consider untestable. When trading resumes at 9:50 a.m. in Moscow on Thursday for a shortened four-hour session, only 33 stocks will be active, including some of the nation’s biggest companies, such as Gazprom PJSC and Sberbank PJSC. However, foreigners won’t be allowed to sell equities in a ban scheduled to last until April 1, and short selling won’t be permitted. (BBG)

RUSSIA: Russian steelmaker Severstal appears to have missed a Wednesday deadline to make good on a $12.6 million interest payment to bondholders. The money was originally due to creditors by March 16, but paying and transfer agent Citigroup Inc. wouldn’t remit the cash without the company receiving express permission from the U.S. Treasury. With a five-day grace period now expired, there’s been no sign that the payment has been passed on. Severstal would become the first Russian company to fail to meet a deadline on its foreign-currency debt since the war in Ukraine began. The company said in a statement earlier Wednesday that it’s applying for the licenses required to process the payment, and that it expects the situation to be resolved as soon as possible. (RTRS)

RUSSIA: Global banks including Citigroup Inc, JPMorgan Chase & Co and Societe Generale face pressure to commit to remaining as custodian banks in Russia, as rivals and funds fret they may lose services critical to future investment in the country. (RTRS)

IRAN: White House national security adviser Jake Sullivan said on Wednesday the United States and its allies have made progress in Iran nuclear talks but issues remain, and it is unclear if they will be resolved. "We've made progress over the course of the last several weeks. There are still some issues left," Sulllivan told reporters aboard Air Force One as President Joe Biden flew to Brussels. He said it is "unclear if this will come to closure or not" but the allies are trying to use diplomacy to put Iran's nuclear program "back in a box." (RTRS)

ENERGY: Russia will seek payment in roubles for gas sold to "unfriendly" countries, President Vladimir Putin said on Wednesday, and European gas prices soared on concerns the move would exacerbate the region's energy crunch. German Economy Minister Robert Habeck called Putin's demand a breach of contract and other buyers of Russian gas echoed the point. "This would constitute a breach to payment rules included in the current contracts," said a senior Polish government source, adding Poland has no intention of signing new contracts with Gazprom after their existing deal expires at the end of this year. (RTRS)

ENERGY: The U.S. and EU are close to a deal aimed at slashing Europe’s dependence on Russian energy sources. Biden’s national security adviser Jake Sullivan said an agreement would be announced as soon as Friday. Sullivan said there’ll likely be a “surge” in U.S. supplies of liquefied natural gas to Europe “not just over the course of years, but over the course of months.” (BBG)

ENERGY: Japan does not know how Russia will handle the required rouble payments for its energy sold to "unfriendly" countries, the finance minister said on Thursday. Japan accounted for 4.1% of Russia's crude oil exports and 7.2% of its natural gas exports in 2021. "Currently, we're looking into the situation with relevant ministries as we don't quite understand what is (Russia's) intention and how they would do this," Finance Minister Shunichi Suzuki said in a parliament session. The government will also coordinate with Japanese companies to collect information about the move, Chief Cabinet Secretary Hirokazu Matsuno told a Thursday news conference. (RTRS)

OIL: U.S. oil producer Chevron on Wednesday said it is assessing the status of a export terminal at a Black Sea port that Russia said was closed by storm damage, but the pipeline to the port remains in operation. Chevron holds a 15% stake in the Caspian Pipeline Consortium (CPC), a key route which ships about 1% of the world's oil from oilfields in Kazakhstan to an export terminal in Russia. The company's Tengizchevroil (TCO) joint venture oil production in Kazakhstan that relies on the export terminal "continues uninterrupted, and transportation of TCO crude oil through the CPC pipeline is also continuing at this time," a Chevron spokesperson said.

OIL: North Sea crude trade has dropped as growing fears of a European diesel shortage has pushed producers to keep oil for their own refining systems, four trade sources told Reuters. (RTRS)

OIL: Brazil will increase its crude production in the coming months, adding 300,000 b/d "by the end of the year," the country's minister of mines and energy Bento Albuquerque said today at the IEA's 2022 ministerial meeting. "This represents an increase of 10pc in our current output," Albuquerque said. Brazil produces around 3mn b/d of crude, around a third of which is exported. (Argus Media)

CHINA

PBOC: The People’s Bank of China may cut reserve requirement ratios (RRR) soon to help boost banks’ long-term funding, the China Securities Journal said citing chief economist Ming Ming at Citic Securities. About 63% of investors expect RRR cuts in the next three months, while only 47% also expect rate cuts, the newspaper said citing a survey by Huatai Securities. Commercial banks are under liabilities pressure as seen in the recent rise in the interbank deposit rate, the newspaper said. The central bank has made net injections of liquidity for the last five straight days, signaling its intention to keep liquidity ample, said the journal. (MNI)

PROPERTY: China's northeastern city Harbin, the capital of Heilongjiang province, said on Wednesday it plans to end restrictions on new home purchases imposed since 2018, the Securities Daily reported citing the city. As Harin became the first so-called tier-2 city in the country to scrap real estate bans, more cities with sluggish property sales may follow its lead with further measures to revive the market, the newspaper said citing Zhang Dawei, chief analyst of Centaline Property. Still, the impact of ending home purchase curbs may be limited as buyers' desire for buying new homes remains low, the newspaper said citing Meng Xinzheng, analyst of China Index Academy. The price of new homes in Harbin has fallen for seven consecutive months since August 2021, the newspaper said. (MNI)

CORONAVIRUS: China reported 4,732 Covid infections on Thursday amid signs outbreaks in northeastern Jilin and Shanghai are stabilizing. About 10% of new infections are from areas not cordoned off in Shanghai, indicating omicron’s community spread is coming under control and a turning point for the Shanghai outbreak may be near, according to the city’s Covid adviser and infectious disease doctor, Zhang Wenhong. Meanwhile, cases in southern tech hub Shenzhen is falling to single digits, days after it lifted lockdown restrictions.

OVERNIGHT DATA

CHINA FEB SWIFT GLOBAL PAYMENTS CNY 2.23%; JAN 3.20%

JAPAN MAR, P JIBUN BANK SERVICES PMI 48.7; FEB 44.2

JAPAN MAR, P JIBUN BANK M’FING PMI 53.2; FEB 52.7

JAPAN MAR, P JIBUN BANK COMPOSITE PMI 49.3; FEB 45.8

“Flash PMI data indicated that activity at Japanese private sector businesses fell for the third month running during March. The decline in output eased from the previous survey period however, and was only marginal as companies noted that COVID-19 cases had continued to reduce, allowing the lifting of the quasi-state of emergency across Japan. By sector, manufacturers noted a renewed rise in output at the end of the first quarter, while service providers indicated a softer deterioration in business activity. Firms across the Japanese private sector reported a further intensification of price pressures. Input prices rose at the fastest pace since August 2008 with businesses attributing the rise to surging raw material prices, notably energy, oil and semiconductors amid deteriorating supplier performance. Despite falling infection rates caused by the Omicron variant, Japanese private sector companies reported softer optimism regarding the year-ahead outlook for activity in March. Positive sentiment was the weakest for 14 months amid concerns regarding the economic impact of the Russia-Ukraine conflict.” (IHS Markit)

JAPAN FEB NATIONWIDE DEPT STORE SALES -0.7% Y/Y; JAN +15.6%

JAPAN FEB TOKYO DEPT STORE SALES +5.1% Y/Y; JAN +23.9%

AUSTRALIA MAR, P S&P GLOBAL SERVICES PMI 57.9; FEB 57.4

AUSTRALIA MAR, P S&P GLOBAL M’FING PMI 57.3; FEB 57.0

AUSTRALIA MAR, P S&P GLOBAL COMPOSITE PMI 57.1; FEB 56.6

“The Australian economy continued to expand strongly in March, according to the S&P Global Flash Australia Composite PMI, reflecting robust business conditions post the COVID-19 Omicron wave. Price pressure worsened, however, unsurprisingly aggravated by the slew of issues including floodings in Australia, the Ukraine war and broader supply chain constraints. This will be worth watching going forward with business confidence amongst private sector firms clearly hit by concerns over rising costs. Higher employment levels in March had been a positive sign, though firms also widely reported higher wages. Meanwhile, the reopening of international borders led to the first new export business growth in the service sector since June 2021, which was a boost for domestic activity.” (S&P Global)

CHINA MARKETS

PBOC NET DRAINS CNY60 BILLION VIA OMOS THURSDAY

The People's Bank of China (PBOC) injected CNY20 billion via 7-day reverse repos with the rate unchanged at 2.10% on Thursday. The operation has led to a net drain of CNY60 billion after offsetting the maturity of CNY80 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0662% at 09:30 am local time from the close of 2.0551% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 43 on Wednesday vs 45 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3640 THURS VS 6.3558

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.3640 on Thursday, compared with 6.3558 set on Wednesday.

MARKETS

SNAPSHOT: NATO Summit Eyed

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 70.23 points at 28110.39

- ASX 200 up 9.196 points at 7387.065

- Shanghai Comp. down 8.008 points at 3262.961

- JGB 10-Yr future down 12 ticks at 149.64, yield up 0.4bp at 0.230%

- Aussie 10-Yr future up 1.0 tick at 97.170, yield down 0.8bp at 2.767%

- U.S. 10-Yr future -0-09 at 122-27+, yield up 5.45bp at 2.346%

- WTI crude down $0.35 at $114.59, Gold down $4.98 at $1938.77

- USD/JPY up 26 pips at Y121.40

- FED’S BULLARD REPEATS CALL FOR FASTER RATE HIKES TO COOL PRICES (BBG)

- NATO SUMMIT EYED

- U.S., EUROPE CLOSING IN ON DEAL TO CUT DEMAND FOR RUSSIAN ENERGY (BBG)

- WHITE HOUSE: U.S. TO ANNOUNCE RUSSIA-RELATED SANCTIONS ON THURSDAY (RTRS)

- STOCK TRADERS BRACE FOR A CHAOTIC REOPENING TO RUSSIA’S MARKET (BBG)

BOND SUMMARY: Payside Flows In U.S. Swaps & A Downtick In Oil Weigh On Core FI In Asia

Payside flows in U.S. swaps and a pullback from fresh ~2-week highs in crude oil futures (a marginal downtick in stagflationary worry) applied pressure to broader core fixed income markets overnight. There was a lack of major headline flow apparent ahead of the heavily awaited NATO summit, with fresh U.S. sanctions directed towards Russia and measures to mitigate European reliance on Russian energy supply front and centre at the upcoming gathering.

- TYM2 pushed to fresh session lows ahead of London trade, with TYM2 last -0-08 at 122-28+, 0-03 off the base of the 0-16+ overnight range, on volume of ~140K. Cash Tsys run 3-6bp cheaper on the day, with 5s leading the way lower (note that 5s provided the focal point of the aforementioned payside swap flows,), allowing the 5- 30-Year yield spread to tag another fresh cycle low. Futures flow was headlined by a block seller of FVM2 (-5,375) & block buyer of TUM2 (+3,399). Fedspeak from Bullard (’22 voter, hawk) offered nothing of any real interest during Asia-Pac hours. Looking ahead, outside of the NATO summit, NY hours will see the release of weekly jobless claims data, durable goods, 10-Year TIPS supply and Fedspeak from Waller, Kashkari (’23 voter), Evans (’23 voter) & Bostic (’24 voter).

- JGB futures finished 12 ticks lower on the day, softening in the Tokyo afternoon, although the contract failed to breach its overnight session lows. 10-Year JGB yields closed at 0.23%, the level that triggered BoJ intervention back in February. Will the Bank announce fixed rate operations after hours today? It did so in February, in a pre-emptive step to protect the upper end of its permitted -/+25bp 10-Year JGB yield trading band. The cash curve twist steepened around the 5-Year point, with 7s (futures-driven) and 40s providing the weak points, cheapening by ~1.5bp on the session. Dovish BoJ dissenter Kataoka provided his usual round of reflationist rhetoric in his latest speech.

- ACGBs were dominated by the wider core FI impetus (allowing the space to move back from its early Sydney peak). Contained swings were once again observed into the futures close (as has been the case on several occasions this week). That left YM -1.0 & XM +1.0 at the close, with the cash curve twist flattening as longer dated cash ACGBs richened by ~3bp.

JGBS AUCTION: Japanese MOF sells Y2.7563tn 6-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y2.7563tn 6-Month Bills:

- Average Yield -0.0769% (prev. -0.0823%)

- Average Price 100.039 (prev. 100.042)

- High Yield: -0.0769% (prev. -0.0804%)

- Low Price 100.039 (prev. 100.041)

- % Allotted At High Yield: 61.0473% (prev. 72.9028%)

- Bid/Cover: 3.923x (prev. 3.498x)

JGBS AUCTION: Japanese MOF sells Y399.1bn of 1-5 Year JGBs in liquidity enhancement auction:

The Japanese Ministry of Finance (MOF) sells Y399.1bn of 1-5 Year JGBs in a liquidity enhancement auction:

- Average Spread: -0.002% (prev. -0.008%)

- High Spread: 0.000% (prev. -0.007%)

- % Allotted At High Spread: 17.0668% (prev. 16.7522%)

- Bid/Cover: 4.066x (prev. 4.429x)

EQUITIES: Lower As Commodities Hover Near Two-Week Highs

Major Asia-Pac equity indices are mostly lower at typing, following a negative lead from Wall St. Commodity-related sectors across the region largely outperformed peers despite a slight downtick in commodity and crude prices during Asia-Pac dealing, with major commodity benchmarks continuing to trade a touch below two-week highs, above their respective ranges observed in Wednesday’s Asian session, pointing to some “catch up.”

- The ASX200 led regional index peers, finishing 0.1% better off, reversing earlier losses due to gains in materials, energy, and utilities stocks. On the other hand, the technology, healthcare, and financials sub-indices were unable to fully recover from initial losses, providing some counter to the commodity-led rally.

- The CSI300 underperformed, dealing 0.8% softer at typing. Chinese liquor stocks bore the brunt of the day’s selling, led by losses in large-caps such as Kweichow Moutai and Luzhou Laojiao.

- The Hang Seng sits 0.3% softer at typing.after pulling back from worst levels of the day. Underperforming China-based tech names were largely able to pare their early losses, although Tencent Holdings (-3.5%) underperformed after showing no signs of plans for fresh stock buybacks (as well as reporting an earnings miss on Wednesday), after Alibaba and Xiaomi announced their own stock buybacks earlier in the week. Around two-thirds of the Hang Seng’s constituents have reported earnings, with releases underperforming analyst expectations by ~0.8% thus far.

- U.S. e-mini equity index futures sit 0.2% to 0.5% firmer at writing, benefitting from the downtick in crude oil prices.

OIL: Slightly Lower In Asia

WTI is -$0.70 and Brent is -$0.30, printing $114.30 and $121.30 respectively at writing.

- Both benchmarks have backed away from two-week highs made earlier in the session but operate near the top of Wednesday’s range, finding support as debate over possible EU sanctions on Russian energy exports has done the rounds in Asia, while disruptions to the Caspian Pipeline Consortium (CPC) pipeline has exacerbated worry re: tightness in global crude supplies.

- To elaborate on the latter, CPC officials announced that crude exports from the port of Novorossiysk were completely halted on Wednesday, flagging “abnormal storms” as the cause of “critical” damage to facilities. The closure is expected to remove up to 1.2mn bpd of crude from global markets for the duration of repair works (estimated to be ~2 months).

- Looking at possible EU measures re: Russian energy exports, U.S. national security adviser Jake Sullivan has pointed to a “practical roadmap” to increase LNG supplies to Europe, which will be unveiled on Friday, with the obvious aims of addressing concerns re: cuts in Russian gas supplies & reducing European reliance on Russian energy. Ultimately, the timeline surrounding fresh measures to curb Russian energy exports to the EU remains uncertain, with French officials casting doubt over new energy-related sanctions on Russia this week.

- Weekly EIA data released on Wednesday saw a surprise drawdown in crude stockpiles with larger-than-expected declines in gasoline and distillate inventories (against WSJ estimates), while there was a build in stocks at the Cushing hub. The release largely matched the figures observed in reports covering Tuesday’s weekly API inventory estimates.

GOLD: Lower In Asia

Gold deals $5 weaker at writing to print ~$1,938/oz, backing away from one-week highs made earlier in the session, with an uptick in the Dollar (DXY) and U.S. Tsy yields applying some modest pressure.

- To recap Wednesday’s price action, the precious metal closed ~$20/oz firmer, with the move higher facilitated by a broad downtick in U.S. real yields.

- Gold’s geopolitical risk premium remains elevated ahead of the U.S.-NATO summit later on Thursday. Even as there has been little discernible progress in ongoing Russia-Ukraine ceasefire negotiations, tensions between Russia and the west have continued to rise. The spectre of fresh U.S. & European sanctions on Russia lingers.

- Looking to technical levels, bullion isn’t far away from initial resistance at $1,954.7/oz (Mar 15 high). A successful break of that level will expose further resistance at $2,009.2 (Mar 10 high), while support is located some distance away at $1,895.3 (Mar 15 low and 50-Day EMA).

FOREX: USD Edges Higher, Antipodeans Lag Behind

Modest defensive flows took hold in Asia-Pac trade as regional headline flow failed to provide anything to bolster market sentiment. Regional risk barometer AUD/JPY backed off a multi-year high, as the Antipodeans landed at the bottom of the G10 pile, while the yen got some reprieve in the wake of its recent sharp sell-off.

- The greenback crept higher along U.S. Tsy yields as Fed's Bullard reiterated his view that policymakers should act more aggressively. Demand for U.S. dollar pushed USD/JPY higher, but yesterday's cycle high remained intact.

- Offshore yuan regained poise after the PBOC set the mid-point of permitted USD/CNY trading band 23 pips below the expected level. This allowed USD/CNH to ease off after a brief look above yesterday's high.

- The Norwegian krone garnered some strength ahead of today's monetary policy decision from Norges Bank, even as Brent crude oil futures pulled back into the red.

- Today's data highlights include U.S. jobless claims & durable goods order as well as a slew of PMI readings from across the world. Central bank speaker slate features several Fed, ECB & BoE members.

FOREX OPTIONS: Expiries for Mar24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0950-70(E1.1bln), $1.1000-20(E615mln), $1.1065-70(E544mln), $1.1100(E1.2bln)

- GBP/USD: $1.3150-60(Gbp1.3bln)

- USD/CAD: C$1.2650($1.1bln), C$1.2800($2.1bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/03/2022 | 0030/0930 | ** |  | JP | IHS Markit Flash Japan PMI |

| 23/03/2022 | 0105/2105 |  | US | St. Louis Fed's James Bullard | |

| 24/03/2022 | 0745/0845 | ** |  | FR | Manufacturing Sentiment |

| 24/03/2022 | 0815/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 24/03/2022 | 0815/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 24/03/2022 | 0830/0930 |  | CH | SNB interest rate decision | |

| 24/03/2022 | 0830/0930 | *** |  | CH | SNB policy decision |

| 24/03/2022 | 0830/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 24/03/2022 | 0830/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 24/03/2022 | 0900/1000 | *** |  | NO | Norges Bank Rate Decision |

| 24/03/2022 | 0900/1000 | ** |  | EU | IHS Markit Services PMI (p) |

| 24/03/2022 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (p) |

| 24/03/2022 | 0900/1000 | ** |  | EU | IHS Markit Composite PMI (p) |

| 24/03/2022 | 0930/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 24/03/2022 | 0930/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 24/03/2022 | 0930/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 24/03/2022 | 0930/1030 |  | EU | ECB Elderson at IIEA Webinar | |

| 24/03/2022 | 1030/1030 |  | UK | Bank of England Financial Policy Report | |

| 24/03/2022 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 24/03/2022 | - |  | EU | ECB Lagarde at European Council Meeting | |

| 24/03/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 24/03/2022 | 1230/0830 | ** |  | US | durable goods new orders |

| 24/03/2022 | 1230/0830 | * |  | US | Current Account Balance |

| 24/03/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 24/03/2022 | 1230/0830 |  | US | Minneapolis Fed's Neel Kashkari | |

| 24/03/2022 | 1300/1300 |  | UK | BOE Mann Panels Institute of International Finance event | |

| 24/03/2022 | 1300/1400 |  | EU | ECB Elderson in Panel at LSE | |

| 24/03/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 24/03/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 24/03/2022 | 1350/0950 |  | US | Chicago Fed's Charles Evans | |

| 24/03/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 24/03/2022 | 1500/1100 |  | US | Atlanta Fed's Raphael Bostic | |

| 24/03/2022 | 1530/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 24/03/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 24/03/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 24/03/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 24/03/2022 | 1900/1500 | *** |  | MX | Mexico Interest Rate |

| 25/03/2022 | 2330/0830 | ** |  | JP | Tokyo CPI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.