-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - ECB Set to Deliver Third Consecutive Cut

MNI China Daily Summary: Thursday, December 12

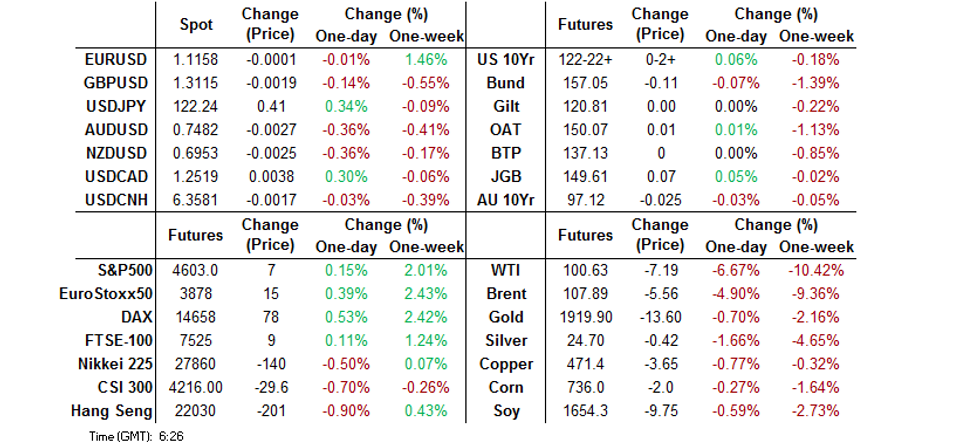

MNI EUROPEAN MARKETS ANALYSIS: Crude Tumbles In Asia, WTI Nears $100.00

- Crude oil markets struggled in Asia-Pac hours, with focus on the potential for an imminent, notable U.S. SPR-IEA crude stockpile release and a report pointing to Russia offering steeply discounted crude to India.

- There was no reaction to softer than expected Chinese official PMI data, nor to news that the Russia-Ukraine talks will resume (online) on 1 April.

- U.S. PCE data & MNI Chicago PMI, Eurozone unemployment as well as UK & Canadian GDPs take focus on the data front. Central bank speaker slate features Fed's Williams as well as ECB's Lane & de Guindos.

BOND SUMMARY: Mixed Fortunes In Asia

U.S. Tsys looked through the softer than expected official Chinese PMI data for the month of March, with well-documented issues such as the localised COVID-related lockdowns evident in China & Russia-Ukraine related worry/disruptions already at the fore of participants’ minds. Note that the Chinese policymaking sphere has previously pledged to do more to support the economy, via several well-documented addresses, which likely limited any potential post-data follow through when it comes to market action. TYM2 printed through Wednesday’s high on source reports pointing to the potential for a meaningful release from the U.S. SPR oil stockpiles (with an IEA meeting scheduled for Friday to discuss such a move), but has pulled back, with oil markets continuing to soften (WTI is within touching distance of $100) as the market juggles the stagflation/inflation narrative and reports of Russia offering oil to India at steep discounts. The contract is last +0-00+ at 122-20+, with a lack of momentum evident after the initial pull higher. Cash Tsys are unchanged across the curve. There was no reaction to news that Russia-Ukraine talks will restart on 1 April (in an online format). Flow was headlined by a block sale of TUM2 futures (-2,407). Looking ahead, the NY session will bring the release of the PCE data suite, weekly jobless claims, the monthly MNI Chicago PMI release and Challenger job cuts. We will also get comments from NY Fed President Williams, although the scope for monetary policy-related language may be limited given the fact that he will make opening remarks at a conference on the future of NYC.

- JGB futures traded in a more contained manner during the Tokyo session, dealing either side of unchanged, with participants seemingly happy to pause for breath after yesterday’s volatility, in what is the final Tokyo trading session of the Japanese FY. The super-long end of the cash JGB curve was a little more active, with the impact of yesterday’s BoJ action still being felt there, as 30s and 40s sit over 8bp richer on the day, with 40s back below 1.00% in yield terms, just. Note that 10-Year JGB yields are little changed on the session, printing around the 0.225% mark, 2.5bp shy of the upper boundary of the BoJ’s permitted trading range, with no offers tendered at today’s BoJ fixed rate operations (As you would expect, given yield levels). Futures are +7 last. This week’s reaffirmation of the BoJ’s dovish credentials, combined with the Japanese bias for domestic securities ahead of FY end & cross currency basis-related FX hedged yield pickup for some quarters of the foreign investor sphere outweighed any headwinds from offshore investors’ propensity to sell Japanese bonds ahead of the end of the Japanese FY when it came to today’s 2-Year JGB auction. That allowed the cover ratio to hit the highest level observed at a 2-Year auction since April ’20, with the price tail holding tight and low price topping wider expectations (which stood at 100.050). Participants now eye the release of the BoJ’s quarterly Rinban schedule, which will be published at 17:00 Tokyo/09:00 London. Given the BoJ’s clear support of its current YCC settings many expect the BoJ to increase the size of its Rinban purchase in Q222, via larger operations and/or more frequent purchases. Still, this doesn’t mean the BoJ will not face issues in defending its YCC strategy further down the line e.g. if global yields rise further or if it decides to reduce the cumulative size of its Rinban operations at some point.

- The Aussie bond space operates off of best levels with YM +2.0 and XM -5.0, pulling lower into the bell, with nothing in the way of notable month-end buying to counter the move. This comes after a short squeeze in YM faded, with gyrations surrounding the reports re: a potential sizeable U.S. SPR oil release evident, as wider market moves began to re-exert control on the space. Aussie bonds looked through local data, which included much firmer than expected building approvals, in line with expected private sector credit and a continued increase in job vacancies in February (albeit at a slower 3-month rate vs. January). The latter added to the evidence of an ever-tightening labour market.

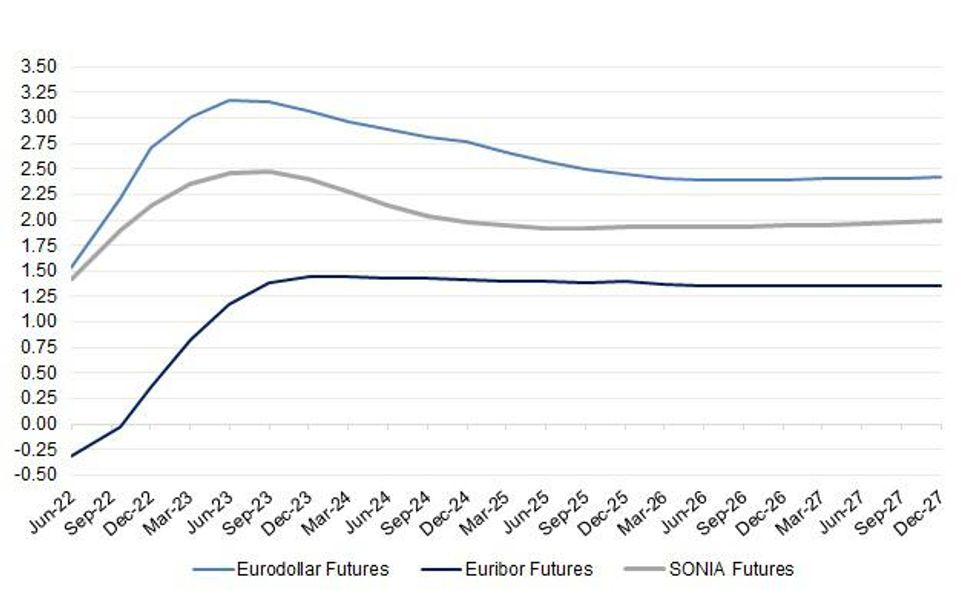

STIR: Let's Talk About Policy Error

While the major central bank hiking cycles embedded into the various STIR curves have been widely discussed, we want to quickly highlight the other side of the coin when it comes to Fed, BoE & ECB market pricing i.e. the degree of “policy error” priced into the major 3-month futures curves at present (this is of course an approximation given that we are using Eurodollar, EURIBOR & SONIA futures for liquidity and time horizon purposes, not OIS).

- Note that we use contract price levels observed on 30 March ’22 for consistency.

- The highest implied rate on the Eurodollar curve currently sits at 3.18%, in June ‘23. That is then pared down to 2.385% come Sep ’26 (the curve is virtually flat beyond this point), implying 79.5bp of rate cuts over that horizon, with 42bp of that cutting cycle priced by Dec ’24. This suggests that the Fed hiking cycle will be shorter, in time horizon terms, than the central bank currently believes (albeit occurring at a faster velocity than was projected in the latest dot plot), with a need to hike clearly above the assumed neutral level before cuts begin i.e. the market is saying that the Fed will not be able to engineer a soft landing, despite the central bank making assurances to the contrary. A reminder that the Fed discussion re: the velocity of hikes has already moved on since the most recent FOMC decision, with hawkish tones becoming more apparent.

- The story for the BoE is relatively similar when it comes to market projected rate hikes, albeit with shallower moves foreseen. SONIA futures are indicating a peak rate of 2.47% in Sep ’23, with 56bp of cuts then priced through Sep ’25, and the curve virtually flat thereafter. A reminder that the BoE already started to sound a little more cautious/guarded at its most recent MPC meeting, although that hasn’t stopped the contracts from Dec ’22 further out from registering fresh cycle lows i.e. new highs in implied rate terms. Meanwhile, the aforementioned BoE caution leaves the Jun ’22 contract ~30bp above its cycle low, with worry about UK standards of living owing to spiralling inflation evident.

- Meanwhile, the EURIBOR strip continues to price relatively aggressive hikes when compared to the ECB’s gradualist guidance, with this week’s regional inflation data (namely the CPI readings out of Germany & Spain) allowing markets to further test the ECB’s view. Note that the EURIBOR strip currently projects a peak rate of 1.45%, although that comes a touch later than what is seen for the Fed & BoE, in Mar’24. The “policy error” priced into the strip isn’t anywhere near that seen in the Eurodollar and SONIA futures curves, with 9bp of cuts seen between the Mar ’24 implied rate peak and Jun ’26.

Fig. 1: Implied Interest Rates On The Eurodollar, SONIA & EURIBOR Futures Strips (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

FOREX: Oil Weakness Spills Over Into FX Space, Yen Goes Offered Again

Major oil-tied currencies came under pressure as crude prices plunged on the back of a BBG source report suggesting that the Biden administration is considering a major release of oil from the U.S. Strategic Petroleum Reserve (SPR). The release could total 180mn barrels, or around 1mn barrels a day, amid rising fuel prices and supply shortages related to Russia's war on Ukraine.

- The yen resumed losses with the BoJ showing resolve in enforcing its official cap on 10-Year JGB yield. Some suggested that month-/FY-end flows amplified pressure to the yen, with USD/JPY adding ~50 pips as a result. The pair's RSI stayed below the 70 ("overbought") threshold, just. The index fell below that level Wednesday as a corrective pullback in USD/JPY seen earlier this week occurred amid the unwinding of overbought technical conditions.

- The U.S. dollar edged higher amid lower oil prices. The gauge of broader greenback strength (DXY) moved away from a four-week low lodged on Wednesday.

- U.S. PCE data & MNI Chicago PMI, EZ unemployment as well as UK & Canadian GDPs take focus on the data front. Central bank speaker slate features Fed's Williams as well as ECB's Lane & de Guindos.

FOREX OPTIONS: Expiries for Mar31 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1000(E3.4bln), $1.1069-80(E1.2bln), $1.1100(E1.5bln), $1.1110-15(E531mln), $1.1125(E759mln), $1.1200(E1.7bln)

- GBP/USD: $1.3195-00(Gbp804mln)

- USD/JPY: Y121.60($585mln)

- AUD/USD: $0.7400(A$500mln), $0.7500(A$1.5bln)

- USD/CNY: Cny6.3270($750mln), Cny6.3355($631mln)

ASIA FX: Peso Leads Gains As Asia Sees Tight Ranges

Most USD/Asia crosses held fairly tight ranges as regional headline flow failed to rock the boat.

- CNH: Offshore yuan oscillated around neutral levels as recent comments from top Chinese officials reinforcing their commitment to supporting the economy seemingly countered the impact of below-forecast official PMI readings.

- KRW: Spot USD/KRW respected yesterday's extremes. FinMin Hong said that the government considers bond market stabilisation steps and further cutting fuel taxes.

- PHP: BSP Gov Diokno said that CPI is expected to rise 3.3%-4.1% Y/Y this month, the day after he noted that the policy rate could rise to +2.50%-2.75%, which would be "reasonable and consistent" with growth and inflation targets. The peso caught a bid, outperforming its regional peers.

- THB: Spot USD/THB extended yesterday's losses in early trade before swinging into a gain. Participants digested Wednesday's monetary policy decision from the BoT, who kept the policy rate unchanged despite a solid upgrade to 2022 inflation forecast. Worth noting that monthly BoP current account & trade balance data will hit the wires later today.

- IDR and MYR: The rupiah and ringgit traded sideways, with local headline flow offering little of real note.

EQUITIES: Mostly Lower As Russia-Ukraine Ceasefire Hopes Ease; Chinese PMIs Miss Estimates

Most major Asia-Pac equity indices deal 0.3% to 0.8% weaker at typing on a negative lead from Wall St., with the Australian ASX200 and Korean KOSPI bucking the broader trend of losses in the region. Debate re: progress in ongoing Russia-Ukraine ceasefire talks has done the rounds in Asia, with participants noting continued Russian shelling of Ukrainian positions in the north despite the former’s assurances to the contrary earlier in the week

- The ASX200 sits 0.2% better off at typing, led by outperformance in the materials sub-index despite weakness in major commodity benchmarks. Large gains were observed in index heavyweights BHP Group, Rio Tinto, and Telstra, overcoming muted performance in financials and energy-related names.

- The CSI300 deals 0.5% softer at typing, trading lower after official PMI figures for March came in below expectations while pointing to contractions in manufacturing and non-manufacturing activity, exacerbating worry re: slower growth as China has deployed lockdowns to fight an ongoing COVID-19 outbreak. Richly valued consumer discretionary equities underperformed, led by losses in Chinese liquor stocks.

- The Hang Seng trades 0.8% lower at writing, with 54 of the index’s 66 constituents in the red. China-based tech stocks struggled, with the Hang Seng Tech Index sitting 1.3% weaker at typing after tech giant Baidu was added by the U.S. SEC to a list of companies that could get “kicked off” U.S. stock exchanges over well-documented auditing disputes re: U.S.-listed Chinese companies.

- U.S. e-mini equity index futures have backed away from session highs and deal 0.1% to 0.4% firmer at typing. NASDAQ contracts outperformed, with the broader move higher coming as major crude benchmarks have declined in Asia.

GOLD: Lower In Asia

Gold is ~$6/oz softer at ~$1,927/oz, operating a little above session lows at writing. Major crude benchmarks have tumbled in Asia, applying pressure to the precious metal as stagflation-linked worry in some quarters re: elevated energy prices has eased.

- To elaborate, WTI and Brent futures have traded sharply lower after BBG source reports pointed to the Biden administration considering a plan to release “as much as 180 million barrels” of crude from the U.S. SPR over “several months”.

- Ultimately, gold continues to trade clear above one-month lows made earlier in the week after closing ~$15/oz firmer on Wednesday, with that move higher facilitated by a downtick in the USD and U.S. real yields. Elsewhere, optimism surrounding progress towards a diplomatic resolution in the Russia-Ukraine conflict has moderated as both sides continue to play down progress in ongoing ceasefire negotiations. The next round of talks is due for Friday, and will be held online (as opposed to face-to-face on Tuesday).

- From a technical perspective, bullion continues to trade within previously defined levels, with support located at $1,890.2/oz (Mar 29 low), while resistance is seen at $1,966.1 (Mar 24 high).

OIL: Lower In Asia As Potential For Largest-Ever U.S. SPR Release In Focus

WTI is ~-$6.00 and Brent is ~-$5.20, operating around the session’s worst levels at writing. Both benchmarks have tumbled past Wednesday’s lows on BBG source reports of the Biden administration considering a sizeable release of crude from the U.S. SPR, with the report detailing plans to “release roughly a million barrels of oil a day”, totalling “as much as 180 million barrels”. Looking ahead, U.S. President Biden is expected to deliver remarks re: the plan later on Thursday.

- Turning to China, demand worry re: pandemic control measures remains elevated, as COVID case counts for Mar 30 show overall fresh daily infections hovering at recent highs. Official Chinese Mar PMI data crossing earlier in the Asian session also pointed to contractions in manufacturing and non-manufacturing activity as both metrics have fallen below the 50-mark, although major oil benchmarks were little changed on the release.

- Elsewhere, OPEC+ ministers will meet later on Thursday, with RTRS source reports on Wednesday suggesting that the group will likely stick to previously mentioned cumulative output increase targets (400K bpd).

- Weekly U.S. EIA data released on Wednesday saw a surprise build in gasoline and distillate stocks, while there was a larger than expected drawdown in crude inventories, with Cushing hub stocks declining as well. The data release runs somewhat counter to Tuesday’s reports re: weekly API inventory estimates, with those reports having pointed to drawdowns across all inventories.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 31/03/2022 | 0600/0700 | *** |  | UK | GDP Second Estimate |

| 31/03/2022 | 0600/0700 | * |  | UK | Quarterly current account balance |

| 31/03/2022 | 0630/0730 |  | UK | DMO Gilt Operations Calendar April-June | |

| 31/03/2022 | 0630/0830 | ** |  | CH | Retail Sales |

| 31/03/2022 | 0645/0845 | ** |  | FR | Consumer Spending |

| 31/03/2022 | 0645/0845 | ** |  | FR | PPI |

| 31/03/2022 | 0645/0845 | *** |  | FR | HICP (p) |

| 31/03/2022 | 0755/0955 | ** |  | DE | Unemployment |

| 31/03/2022 | 0800/1000 |  | EU | ECB Lane Lecture at Paris School of Economics | |

| 31/03/2022 | 0900/1100 | ** |  | EU | Unemployment |

| 31/03/2022 | 0900/1100 | *** |  | IT | HICP (p) |

| 31/03/2022 | 1000/1200 |  | EU | ECB de Guindos at Discussion at University of Amsterdam | |

| 31/03/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 31/03/2022 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 31/03/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 31/03/2022 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 31/03/2022 | 1300/0900 |  | US | New York Fed's John Williams | |

| 31/03/2022 | 1345/0945 | ** |  | US | MNI Chicago PMI |

| 31/03/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 31/03/2022 | 1530/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 31/03/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 31/03/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 31/03/2022 | 1600/1200 | ** |  | US | USDA GrainStock - NASS |

| 31/03/2022 | 1600/1200 | *** |  | US | USDA PROSPECTIVE PLANTINGS - NASS |

| 01/04/2022 | 2200/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.