-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI PODCAST: FedSpeak: Ghamami Sees Higher R-Star On Deficits

MNI BRIEF: Canada Household Debt Tops $3 Trillion In 3Q

Let's Talk About Policy Error

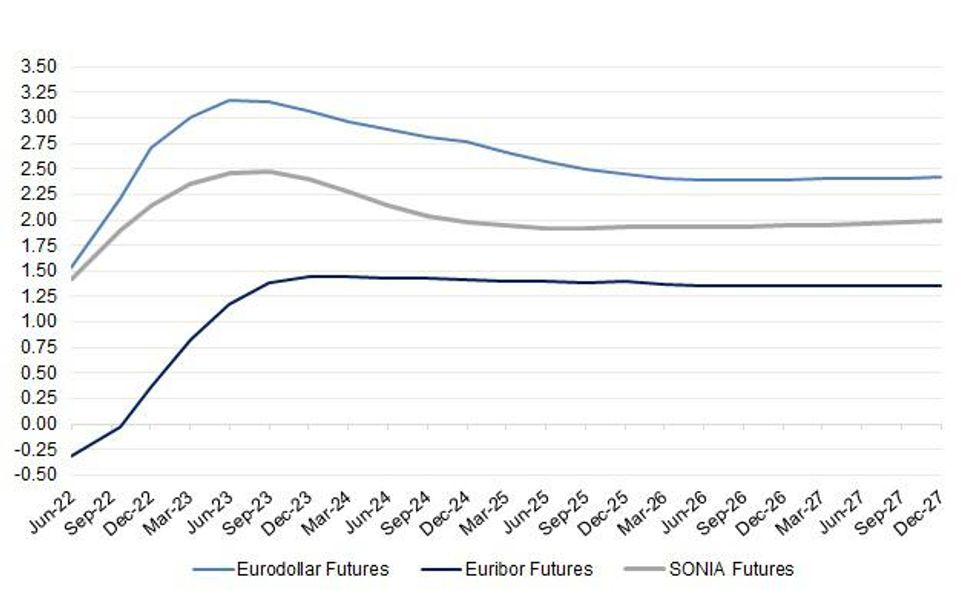

While the major central bank hiking cycles embedded into the various STIR curves have been widely discussed, we want to quickly highlight the other side of the coin when it comes to Fed, BoE & ECB market pricing i.e. the degree of “policy error” priced into the major 3-month futures curves at present (this is of course an approximation given that we are using Eurodollar, EURIBOR & SONIA futures for liquidity and time horizon purposes, not OIS).

- Note that we use contract price levels observed on 30 March ’22 for consistency.

- The highest implied rate on the Eurodollar curve currently sits at 3.18%, in June ‘23. That is then pared down to 2.385% come Sep ’26 (the curve is virtually flat beyond this point), implying 79.5bp of rate cuts over that horizon, with 42bp of that cutting cycle priced by Dec ’24. This suggests that the Fed hiking cycle will be shorter, in time horizon terms, than the central bank currently believes (albeit occurring at a faster velocity than was projected in the latest dot plot), with a need to hike clearly above the assumed neutral level before cuts begin i.e. the market is saying that the Fed will not be able to engineer a soft landing, despite the central bank making assurances to the contrary. A reminder that the Fed discussion re: the velocity of hikes has already moved on since the most recent FOMC decision, with hawkish tones becoming more apparent.

- The story for the BoE is relatively similar when it comes to market projected rate hikes, albeit with shallower moves foreseen. SONIA futures are indicating a peak rate of 2.47% in Sep ’23, with 56bp of cuts then priced through Sep ’25, and the curve virtually flat thereafter. A reminder that the BoE already started to sound a little more cautious/guarded at its most recent MPC meeting, although that hasn’t stopped the contracts from Dec ’22 further out from registering fresh cycle lows i.e. new highs in implied rate terms. Meanwhile, the aforementioned BoE caution leaves the Jun ’22 contract ~30bp above its cycle low, with worry about UK standards of living owing to spiralling inflation evident.

- Meanwhile, the EURIBOR strip continues to price relatively aggressive hikes when compared to the ECB’s gradualist guidance, with this week’s regional inflation data (namely the CPI readings out of Germany & Spain) allowing markets to further test the ECB’s view. Note that the EURIBOR strip currently projects a peak rate of 1.45%, although that comes a touch later than what is seen for the Fed & BoE, in Mar’24. The “policy error” priced into the strip isn’t anywhere near that seen in the Eurodollar and SONIA futures curves, with 9bp of cuts seen between the Mar ’24 implied rate peak and Jun ’26.

Fig. 1: Implied Interest Rates On The Eurodollar, SONIA & EURIBOR Futures Strips (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.