-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: AUD Firms As RBA No Longer Patient

- A BBG sources piece suggested that the U.S. Tsy’s move to block Russia US$-debt payment via U.S. banks doesn’t necessarily mean default (after the initial headlines on the matter provided some questions on the matter), although that is listed as one of the potential aims of the move, with other options available to Russia including a drain of US$ reserves held in Russia or spending freshly acquired revenue.

- The RBA dropped its reference to patient, in a hawkish post-meeting statement.

- Trade data from the U.S. and Canada as well as a slew of services PMI readings from across the globe take focus from here, alongside comments from Fed's Williams, Brainard & Daly.

US TSYS: A Little Cheaper & Steeper In Asia

Tsys have cheapened a touch overnight, initially on the back of a BBG sources piece which suggested that the U.S. Tsy’s move to block Russia US$-debt payment via U.S. banks doesn’t necessarily mean default (after the initial headlines on the matter provided a very modest bid), although that is listed as one of the potential aims of the move, with other options available to Russia including a drain of US$ reserves held in Russia or spending freshly acquired revenue, per the source report.

- Impetus from a hawkish RBA decision in Australia also played into the weakness ahead of European hours, with the curve steepening in both twist and bear manners during Asia-Pac dealing, as regional participants reacted to Monday’s NY session.

- Also note that WTI & Brent futures are off best levels of the session, but still over a $1/bbl firmer on the day.

- TYM2 is -0-03 at 122-00, 0-02+ off the base of its 0-12+ range, while cash Tsys are 1.0-2.5bp cheaper across the curve, bear flattening (As mentioned).

- Flow was headlined by a screen lift of the of the EDK2 98.3750/.3125 put spreads (+10K over a few clips)

- NY hours will be headlined by the latest ISM services survey, in addition to Fedspeak from Vice Chair Brainard, NY Fed President Williams & San Francisco Fed President Daly (’24 voter).

JGBS: Twisting Steeper, 10-Year Supply Goes Well

A very modest bid in U.S. Tsys provided some early support for most of the JGB curve, as did comments from BoJ Governor Kuroda, as he went to great lengths to reaffirm the Bank’s ultra-loose policy stance, commitment to YCC and warned that recent run of weakness in the JPY had been “somewhat rapid.”

- The pullback from best levels, and eventual weakness, in wider core FI markets saw the space away from best levels in the afternoon.

- 10-Year JGB supply passed smoothly, with the low price matching expectations, tail holding narrow and cover ratio moving to the highest level observed at a 10-Year auction since Nov ’20, aided by the BoJ’s recent actions re: YCC enforcement.

- The latest round of local data (household spending and wages) was mixed, and failed to provide any impetus for the space.

- The curve has twist steepened on the day, with 10s providing the firmest point on the curve, both pre- and post-auction, with the curve perhaps operating in sympathy to the U.S. Tsy twist steepening on Monday, albeit with a longer dated pivot point. 10s are ~1bp richer on the day with 30s & 40s 1.5 & 2.5bp cheaper respectively. Futures are +7 ahead of the bell.

AUSSIE BONDS: RBA No Longer Patient

The RBA’s removal of the reference to patience in its post-meeting guidance paragraph and focus on upside risks to inflation provided a hawkish read when it came to the post-monetary policy meeting statement. Those matters, coupled with the Bank’s expectations for a continued tightening of the labour market and removal of the phrasing surrounding uncertainty when it comes to the Russia-Ukraine conflict have pressured the ACGB space.

- The Bank’s June meeting is now a very live affair (short-end rate markets had suggested that was the case for some time), with the Bank’s mention of data re: inflation and labour costs in the upcoming months meaning that June is a more probable lift off point than May. May’s (pre-Q122 WPI) SoMP seemingly provided the perfect staging post for guidance re: future action as it comes after the release of Q122 CPI data.

- ~25bp of tightening is priced for the Bank’s June meeting, up a touch vs. pre-RBA levels, but within the realms of what we have seen in recent sessions.

- The degree of futures curve flattening hasn’t really altered, although the move is now bearish in nature, not bullish, with all of the post-settlement gains now reversed and more. YM -6.5 & XM -4.5 at typing. EFPs are comfortably wider on the day, with the 3-/10-Year box flattening, while the IR strip runs 8-14 ticks lower through the reds.

- Pre-RBA trade was dominated by (limited) moves in wider core FI markets.

FOREX: Inflation Tests RBA Patience, Kuroda Calls Yen Moves "Somewhat Rapid"

The yen regained poise in quiet Asia-Pacific trade, with market closures in China, Hong Kong and Taiwan weighing on activity. The choir of Japan's top economic officials pointing to the importance of stability in FX markets was joined by BoJ Governor Kuroda, who called yen moves "somewhat rapid". The first clear indication of the BoJ's discomfort with the yen's recent downswing lent support to the Japanese currency, even as Kuroda-san reiterated that currency weakness is net positive for domestic economy.

- The RBA provided a hawkish surprise in its monetary policy decision, despite keeping the cash rate unchanged this time. The Monetary Board dropped the reference to "patience" in its interest rate outlook, setting the scene for future tightening. The Aussie dollar surged as participants scanned the statement, with the kiwi benefitting from its strength to some extent.

- AUD/USD crossed above key resistance from Oct 28 high of $0.7556, which helped cap gains on Monday. The rate surged as high as to $0.7604 before stabilising near the $0.7600 mark.

- AUD/NZD took out Mar 29 high of NZ$1.0885 on its way to NZ$1.0902, its best level in a year. The pair last operates just shy of the NZ$1.0900 figure.

- Trade data from the U.S. and Canada as well as a slew of services PMI readings from across the globe take focus from here, alongside comments from Fed's Williams, Brainard & Daly.

FOREX OPTIONS: Expiries for Apr05 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0800(E1.0bln), $1.0915-25(E500mln), $1.1050-65(E671mln), $1.1095-10(E1.6bln)

- USD/JPY: Y122.00($656mln)

- GBP/USD: $1.3335-40(Gbp619mln)

- EUR/GBP: Gbp0.8390-00(E661mln), Gbp0.8460(E793mln)

- AUD/USD: $0.7300(A$1.6bln), $0.7500(A$1.1bln)

- USD/CAD: C$1.2510-25($599mln), C$1.2570-80($916mln)

ASIA FX: Peso Leads Gains As Regional Data Show Mounting Inflationary Pressures In Asia

Tuesday was inflation day in Asia, with data from South Korea, Thailand and the Philippines hitting the wires. Markets in China, Hong Kong and Taiwan were shut in observance of public holidays.

- KRW: The won traded with a slight bullish bias after South Korea's consumer price inflation quickened to a decade-high, prompting the BoK to ditch its earlier +3.1% Y/Y inflation forecast for this year with a comment that it will likely be "much higher". The Bank is preparing for a monetary policy meeting next week even as its new Governor-nominee has not yet received parliamentary approval.

- IDR: The rupiah gave away its initial gains, holding a fairly narrow range. Local press cited Bank Indonesia Governor Warjiyo as noting that accelerating inflation stems from higher domestic demand, with policymakers keeping an eye on the impact of higher global commodity prices nonetheless.

- MYR: Spot USD/MYR pulled back from a one-week high. Bloomberg cited speculation that local exporters were reluctant to convert USD earnings into MYR amid heightened global uncertainty.

- PHP: The peso extended its recent bull run, outperforming all regional peers, with spot USD/PHP lodging worst levels in a month. The PSA reported that CPI inflation accelerated to +4.0% Y/Y, beating analysts' expectations. BSP Gov Diokno said that non-monetary measures are best to address supply shocks but policymakers will keep an eye on second-round effects, although they still see CPI anchored to the target.

- THB: The baht held a tight range. Thailand's CPI inflation registered at +5.73% Y/Y in March, smashing expectations of a +5.55% print and reaching the fastest pace since 2008 in a stark reminder of mounting price pressures.

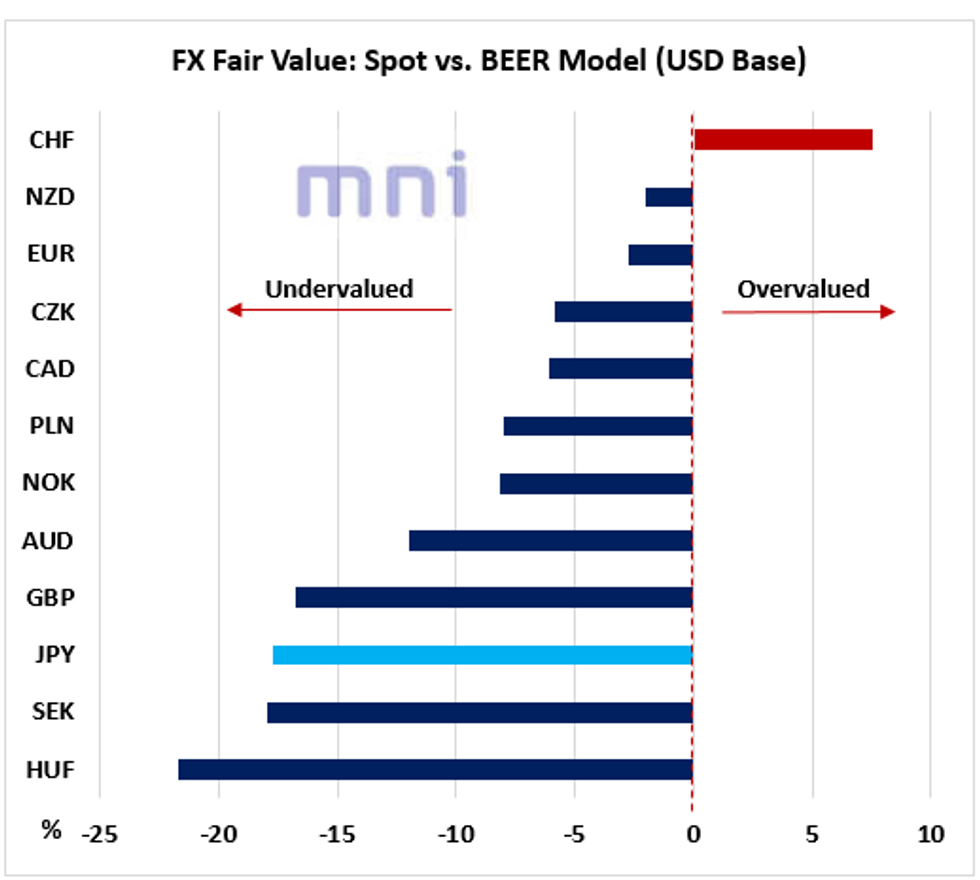

FOREX: JPY Is Now 'Significantly Undervalued' Following March Depreciation

- The HUF remains currently the most ‘undervalued’ currency against the USD among the G10/CEE world (nearly -21.7%), and therefore could continue to appreciate in the short term if market optimism gradually recovers.

- The chart below ranks the major G10 and CEE currencies based on their percentage difference between the current spot rate and their 'fair' value, which we define using a Behavioral Equilibrium Exchange Rate (BEER) model (using terms of trade, inflation and 10y interest rate differentials as explanatory variables).

- The JPY is now ‘significantly undervalued’ against the greenback (-17.7%) following the sharp depreciation in March.

- JPY is the second most ‘undervalued’ currency among the G10 world after SEK (-17.9%)

- Risk-on currency GBP also remains among the ‘cheapest’ currencies (-16.8%) as the pound has been very sensitive to the surge in price volatility since the start of the year.

- On the other hand, the ‘safe-haven’ CHF remains the most ‘overvalued’ currency against the USD (by 7.6%).

Source: Bloomberg/MNI.

EQUITIES: Mixed In Asia

Most Asia-Pac equity indices are mixed at writing, with Chinese and Hong Kong markets remaining shut for the Qingming national holiday. Tech-related names across the region outperformed following Wall St’s tech-focused rally on Monday, countering broader weakness seen in other sectors.

- The Australian ASX200 trades 0.1% higher at typing, back from best levels after the RBA provided a hawkish jolt to the market in its monetary policy decision. Materials and healthcare stocks struggled, while energy and utilities sub-indices outperformed as major crude benchmarks have slightly extended gains in Asia. Technology names broadly rallied as well, with the S&P/ASX All Technology Index dealing 2.0% firmer at writing.

- The Nikkei 225 sits 0.1% better off at writing, having oscillated between gains and losses in Asian hours after opening 0.8% higher. Major export-related names such as Rakuten Group (+5.3%) are mostly higher despite the yen catching a bid, while utilities and financials equities underperformed. The overall move lower in the Nikkei comes as household spending data missed expectations earlier in Asia-Pac dealing, representing two straight months of declines and adding to worry from some quarters re: Q1 economic growth.

- U.S. e-mini equity index futures sit 0.1% weaker apiece, operating a touch below Monday’s best levels at typing.

GOLD: Lower In Asia

Gold deals $4/oz softer to print $1,928/oz at typing, backing away from Monday’s best levels and operating just above session lows as the USD (DXY) continues to hover around one-week highs.

- To recap, the precious metal closed ~$6/oz firmer on Monday despite an uptick in the DXY, with the move higher coming as the west (particularly the EU) has highlighted that they are preparing more sanctions on Russia over alleged war crimes in Ukraine.

- To elaborate, the EU has said it would “significantly tighten” sanctions on Russia. While a full energy product ban still appears unlikely, participants may be watching for progress towards a partial embargo, with German Finance Minister Lindner proposing a more limited ban on Russian coal and oil as “gas cannot be substituted in the short term.”, echoing similar remarks made by French President Macron earlier on Monday.

- Elsewhere, OIS markets now price in a cumulative ~219bp of Fed tightening for the rest of calendar ‘22, with focus turning to Wednesday’s FOMC minutes (1800 GMT).

- From a technical perspective, previously defined resistance levels continue to hold for bullion. Support is located at $1,890.2/oz (Mar 29 low), while resistance is seen at $1,966.1/oz (Mar 24 high).

OIL: Higher As Potential Sanctions On Russian Energy In Focus

WTI and Brent deal ~$1.30 firmer at writing apiece, back from session highs, but operating above Monday’s best levels. Major crude benchmarks have caught a bid as well-documented debate re: the potential for European sanctions on Russian energy exports in response to alleged war crimes in Ukraine, continues to do the rounds in Asia,

- Worry re: Chinese energy demand remains elevated as national case counts have reached levels last witnessed in early ‘20. The lockdown in Shanghai has been extended past its initial Tuesday expiry as total infections continue to rise (asymptomatic and symptomatic), with the case count for Apr 4 suggesting that the city now accounts for >80% of the nationwide total (13.3K in Shanghai vs. 16.4K nationwide).

- Keeping within the country, a note that the Chinese transport ministry on Sunday had earlier forecast sharp declines in road traffic and flights over the ongoing Qingming national holiday, due in part to an expansion of pandemic control measures across the country.

- Elsewhere, details on the next coordinated release of crude from the strategic reserves of International Energy Agency (IEA) member countries are due “early this week”, specifically on its “size and timing”.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/04/2022 | 0630/0830 | ** |  | SE | Services PMI |

| 05/04/2022 | 0645/0845 | * |  | FR | industrial production |

| 05/04/2022 | 0715/0915 | ** |  | ES | IHS Markit Services PMI (f) |

| 05/04/2022 | 0745/0945 | ** |  | IT | IHS Markit Services PMI (f) |

| 05/04/2022 | 0750/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 05/04/2022 | 0755/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 05/04/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 05/04/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Services PMI (Final) |

| 05/04/2022 | - |  | EU | ECB's de Guindos attends Ecofin | |

| 05/04/2022 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 05/04/2022 | 1230/0830 | ** |  | US | Trade Balance |

| 05/04/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 05/04/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 05/04/2022 | 1400/1000 |  | US | Minneapolis Fed's Neel Kashkari and Fed Governor Lael Brainard | |

| 05/04/2022 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 05/04/2022 | 1630/1230 |  | US | San Francisco Fed's Mary Daly | |

| 05/04/2022 | 1800/1400 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.