-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Canada Commits To Just One Of Three Fiscal Anchors

MNI POLITICAL RISK - Thune Eyes 'Deficit-Negative' Legislation

MNI EUROPEAN OPEN: Moving On To BoE After Fed Delivers 50bp Hike, UK Local Elections Eyed

EXECUTIVE SUMMARY

- FED PLEDGES MORE 50BP MOVES TO TAME PRICES (MNI)

- TORIES BRACE FOR UK LOCAL ELECTION WOES

- CHINA ECONOMY TO REBOUND IN MAY ON POLICY SUPPORT (CSJ)

- CHINA CAIXIN SERVICES PMI SOFTER THAN EXPECTED AS CONTRACTION ACCELERATES

- JD.COM, PINDUODUO ADDED TO SEC LIST FOR POSSIBLE DELISTING (BBG)

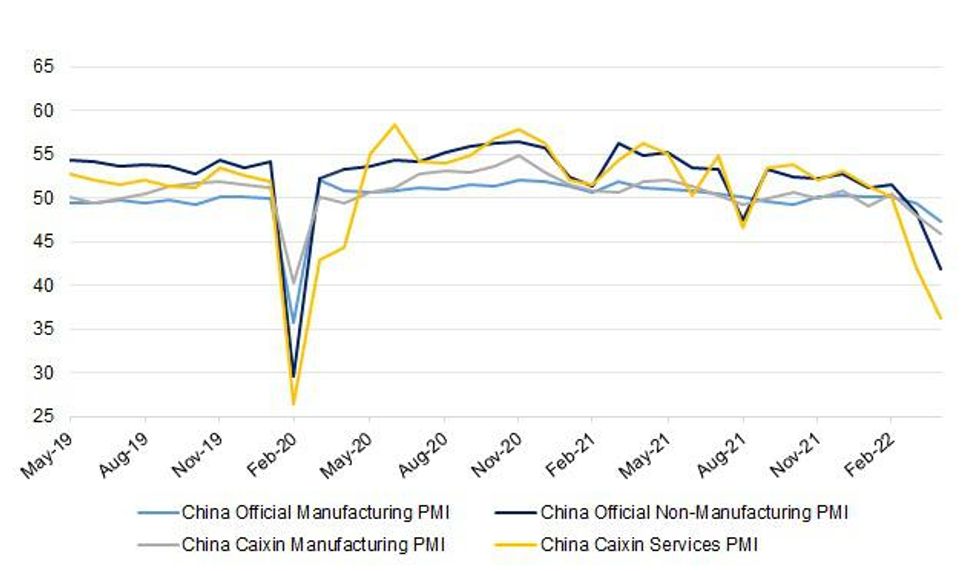

Fig. 1: China Official & Caixin PMIs

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BREXIT: Boris Johnson is to give talks with the European Union over Northern Ireland “one last chance” before introducing legislation that will allow him to override the controversial protocol. The prime minister has sent Conor Burns, the Northern Ireland minister, to Washington in an attempt to explain the government’s new strategy that would give ministers the power to unilaterally suspend part of the agreement that was signed by Johnson in 2019. (The Times)

BREXIT: A specific piece of legislation relating to the Northern Ireland Protocol will not be in the Queen's Speech, a government source has said. Senior sources previously told the BBC there would be a bill allowing ministers to override post-Brexit border arrangements. The protocol is the Brexit deal that prevents a hard border in Ireland. The Queen's Speech, on 10 May, will allow the government to set out what laws it wants to pass. The BBC understands there will be language included in the speech about upholding the integrity of the Good Friday Agreement - the 1998 peace deal which helped bring an end to the Troubles. It is also understood a bill could be introduced at a later stage. (BBC)

POLITICS: Millions of people are expected to take part in elections across the UK, when polling stations open at 07:00 BST. Voters in England, Scotland and Wales will choose the local councillors they want to run services that affect everyday life in their area. In Northern Ireland, people will cast ballots for their representatives in the Northern Ireland Assembly. Polling stations will close at 22:00 and most results should be known by Friday evening. Some councils in England will begin counting overnight on Thursday, while the rest will get started on Friday morning. Counts in Scotland, Wales and Northern Ireland are also expected to begin on Friday. (BBC)

POLITICS: Labour is likely to advance in key battlegrounds in the local elections but may struggle to win significant numbers of new councils outright, according to a major new results projection by YouGov for Sky News. Labour looks set to make slower progress tomorrow in the north of England than elsewhere in the local council elections, despite Sir Keir Starmer putting regaining the "red wall" lost in the 2019 general election at the top of his agenda. YouGov project the numbers voting Conservative are likely to decrease but not all necessarily swing to Labour. They expect Liberal Democrats and Greens to take votes off both Tories and Labour. You can find results where you live with our dedicated elections service. And we'll have a special election programme on Sky News from 11pm on Thursday night. YouGov expects Labour to advance in London, where every council is up for election, despite coming from a very high baseline in 2018. Elsewhere in the South, Labour will also make progress on 2018 but is less likely to win battleground councils while the Tory to Labour swing in the north is expected to be smaller than elsewhere, YouGov said. Overall this means that Labour could face a potentially complex picture once the votes are counted on Friday, gaining potentially significant numbers of seats - experts suggest this could be in the hundreds - but few overall councils. (Sky)

POLITICS: Boris Johnson is expected to delay a reshuffle until the summer after allies said he wants to be clear of the parties scandal before resetting his team. Tory MPs have been speculating that the prime minister will hold a reshuffle shortly after the local elections today as he rebuilds his team before the next general election. A government source told The Times, however, that Johnson was unlikely to conduct the reshuffle until June or July because he could face further fines. (The Times)

EUROPE

ITALY: MNI: Italy Reform Progress Slows As Elections Near-Sources

- The Italian government is facing tougher-than-expected parliamentary resistance to an overhaul of competition laws whose approval may now narrowly miss an informal deadline required for accessing EUR19 billion in European Union funds, while a tax reform and plans to reduce dependence on Russian energy may not be complete before next year’s elections, sources close to the matter told MNI - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

IRELAND: The near record pace of growth in Ireland's services sector moderated slightly in April, and the prices charged by firms hit a fresh high as they grappled with rising costs, a survey showed on Thursday. The AIB S&P Global Purchasing Managers' Index (PMI) fell to 61.7 from 63.4 in March, well above the 50 mark that separates growth from contraction. The series hit a 20-year high of 66.6 last July. Rising input price inflation, which last month soared to the highest level since the survey began in 2000, also moderated a touch last month but was still significantly higher than the long-run average. Irish inflation hit a near 40-year high of 7.3% in April, according to estimates from Eurostat on Friday. Prices charged by service providers rose at a record pace for the second successive month. (RTRS)

IRELAND: Ireland collected 31% more tax in the first four months of the year than the same period in 2021 following a sharp jump in income tax receipts in April, the finance ministry said on Wednesday. After collecting far more tax in 2021 than any previous year after the economy weathered one of Europe's toughest lockdowns, the finance ministry estimated last month that tax revenues would rise by a further 11% this year. It also forecast that the budget deficit would narrow at a faster than expected rate to 0.8% of gross national income this year and Wednesday's data showed that an exchequer deficit of 1.1 billion euros was recorded at the end of April. (RTRS)

ENERGY: Spain said it’s working with Portugal on some technical details of a plan to cap the prices of natural gas used for power generation as the two governments try to contain the surge in electricity costs in the Iberian Peninsula. “There are some differences in the type of tariffs, in the type of actors, on the concerns that there may be in Portugal or that Spanish consumers may have,” Environmental Transition Minister Teresa Ribera said at the Cercle d’Economia conference in Barcelona on Wednesday. Portugal and Spain on April 26 said they reached a “political agreement” with the European Commission about a plan to try to separate electricity prices from the impact of high natural gas prices. (BBG)

U.S.

FED: MNI STATE OF PLAY: Fed Pledges More 50BP Moves To Tame Prices

- Federal Reserve Chair Jerome Powell took the unusual step of addressing his post-meeting remarks directly to the American people, declaring inflation is far too high and officials may keep hiking by 50bps to bring it down. “The labor market is extremely tight and inflation is much too high,” Powell said at a press conference Wednesday after lifting the upper bound of the Fed funds rate to 1%. “We are on a path to move our policy rate expeditiously to more normal levels,” he said, echoing committee language that signals the prospect of multiple 50 basis point rate hikes. Powell downplayed the prospect of a 75bp move that became fodder for market speculation after St. Louis Fed President James Bullard mentioned it as a possibility. “A 75 basis point increase is not something the committee is actively considering,” Powell said. The FOMC will keep 50 basis point hikes “on the table over the next few meetings,” he said. Powell didn't specify what economic shifts might warrant a stepping down of rate rises to quarter point moves. “The test is really just economic and financial conditions evolving broadly in line with expectations. And the expectation is that we’ll start to see inflation flattening out,” he said - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

FED: The Federal Reserve will need to be "skillful" and "also lucky" to guide the economy to a soft landing as the central bank combats inflation running at too-high a level, U.S. Treasury Secretary Janet Yellen said on Wednesday. Yellen, speaking to a Wall Street Journal conference, said she has great confidence in the current health of the U.S. economy, but inflation, currently the highest in four decades, is a problem, and it is primarily the Fed's job to bring it down. (RTRS)

ECONOMY: MNI INTERVIEW: Prices Top Challenge For Services -ISM Chief

- Elevated prices remain the top challenge to the U.S. services sector, but should fall quickly over the next quarter, Institute for Supply Management services chair Anthony Nieves told MNI Wednesday. "I think we can start to see the prices index fall to the 70s because, one, we're starting to see fuel prices decline, and also consumer demand has waned just a little bit," Nieves said. "I wouldn't be surprised over the next quarter or so to see" the index fall to the 50s or 60s, he said - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

ECONOMY: U.S. Treasury Secretary Janet Yellen said she expects solid growth in the coming year, with a possible “soft landing” for the economy as the Federal Reserve moves to bring down inflation. “I do believe we’re going to see solid growth in the coming year,” Yellen said in an interview at a Wall Street Journal event Wednesday. “The Fed will need to be skillful and also lucky, but I believe it’s a combination that is possible.” The Treasury chief said that while consumer prices have surged, medium-term expectations for inflation haven’t been so affected. That means this is a different type of inflation than that faced by former Fed Chair Paul Volcker, Yellen said. Volcker tightened monetary policy so aggressively in the early 1980s that it caused a sharp recession. (BBG)

ECONOMY: A rapidly widening U.S. trade gap caused one of the biggest hits to the country’s gross domestic product from net exports in the postwar era last quarter. Yellen called the disappointing GDP data “peculiar” and “not really a good read on the underlying strength of the economy.” Preliminary data released last week by the Commerce Department showed U.S. gross domestic product shrank at a 1.4% annual pace in the first three months of this year, the first drop since the second quarter of 2020. The decline was also affected by a slower buildup of inventories. (BBG)

INFLATION: U.S. households could see a 30% to 40% hike in monthly energy bills this year if high natural gas prices persist, according to new analysis from Barclays Plc. Average electric and natural gas bills will be $55 to $75 higher than in 2020 if natural gas costs remain at $6 to $7 per million British thermal units, Barclays said in a research note. Benchmark gas futures surged to a 13-year high of $8.474 on Wednesday as hot weather boosted domestic demand for the power-plant fuel. (BBG)

OTHER

U.S./CHINA: U.S. regulators added more than 80 companies, including JD.com Inc., Pinduoduo Inc. and Bilibili Inc., to a expanding list of firms that face possible expulsion from American exchanges because of Beijing’s refusal to allow access to the businesses’ financial audits. The Securities and Exchange Commission on Wednesday put the corporations on a provisional lineup of U.S.-listed Chinese entities that face delisting under a 2020 law, starting a three-year clock to comply with inspection requirements. Some of the largest Chinese companies traded on U.S. exchanges, including China Petroleum & Chemical Corp., JinkoSolar Holding Co. Ltd., NetEase Inc., and NIO Inc. were also added. (BBG)

RBNZ: New Zealand’s central bank was “courageous” to start tightening monetary policy before many of its peers, and being too out of step with others carries its own risks, Governor Adrian Orr said. Appearing before parliament’s Finance and Expenditure select committee Thursday in Wellington, Orr was asked if the Reserve Bank was too slow to respond to inflation risks. He said getting out of step with other central banks risks instability in output and exchange rates. “We were one of the first countries in the world to stop quantitative easing and to start raising our interest rates,” Orr said. “As much as we like to think we are a big important country, going alone on monetary policy in a global shock takes enormous courage. I congratulate our monetary policy committee members and our staff for doing that.” (BBG)

BOK: While the outcome of the Federal Reserve’s meeting was broadly in line with market expectations, Chair Jerome Powell’s comments were somewhat dovish, Senior Deputy Bank of Korea Governor Lee Seung-Heonsaid at a meeting with officials to assess the local impact of the U.S. central bank’s decisions, according to a statement Thursday. Possibility of volatility in financial markets continues amid strong U.S. inflation and projections for further Fed hikes. Uncertainties in external conditions remain high due to Russia’s ongoing war on Ukraine and economic slowdown in China. Asks BOK officials to strengthen monitoring of domestic financial, FX markets. (BBG)

BRAZIL: Brazil’s central bank raised its benchmark interest rate by a full percentage point for a second straight meeting and signaled another likely hike of smaller size next month as it seeks to contain the country’s rampant inflation. The bank board lifted the Selic to 12.75% late on Wednesday, as expected by all economists in a Bloomberg survey. Policy makers have now raised borrowing costs by a whopping 10.75 percentage points since March, 2021. “For its next meeting, the Committee foresees as likely an extension of the cycle, with an adjustment of lower magnitude,” policy makers wrote in the statement accompanying their decision. “The Committee emphasizes that it will persist in its strategy until the disinflation process consolidates and anchors expectations around its targets.” (BBG)

RUSSIA: Russian troops have not made the kind of progress in the eastern and southern regions of Ukraine “that they have wanted to make,” Pentagon spokesman John Kirby told reporters Wednesday, citing problems with supply lines and morale. “We don’t believe they have solved their logistics and sustainment issues” he said, adding that Russian troops are “wary” of getting out too far ahead of their supply lines. Kirby also said that their missile strikes have been off target but that the U.S. does not know whether that’s related to technical problems, Ukrainian defenses, or “incompetence” on the part of the Russians. (BBG)

RUSSIA: Russia’s Defense Ministry said it will offer safe passage for civilians still trapped in the Azovstal steel plant in Mariupol on May 5 to 7, Tass reported. The humanitarian corridors will be open from 8 a.m to 6 p.m over the three days, the ministry said. The civilians can choose whether to go to Russia or Ukrainian-controlled areas, according to Interfax. Russia has seized control of almost all of the port city of Mariupol after a brutal weeks-long siege. The remaining defenders are holding out in the giant industrial facility, where hundreds of civilians have taken refuge. (BBG)

RUSSIA: The United States has provided intelligence about Russian units that has allowed Ukrainians to target and kill many of the Russian generals who have died in action in the Ukraine war, according to senior American officials. Ukrainian officials said they have killed approximately 12 generals on the front lines, a number that has astonished military analysts. The targeting help is part of a classified effort by the Biden administration to provide real-time battlefield intelligence to Ukraine. That intelligence also includes anticipated Russian troop movements gleaned from recent American assessments of Moscow’s secret battle plan for the fighting in the Donbas region of eastern Ukraine, the officials said. Officials declined to specify how many generals had been killed as a result of U.S. assistance. (NYT)

RUSSIA: In case Finland and Sweden join NATO, they will turn into a space for confrontation of the alliance with Russia, Foreign Ministry Spokeswoman Maria Zakharova cautioned in an interview with Spain’s ABC daily issued on Wednesday. "In case Finland and Sweden join the alliance, they will turn into a space for confrontation of the North Atlantic bloc with Russia will all the ensuing consequences, including for our time-tested good-neighborly relations. Is it what the peoples of Sweden and Finland are seeking?" the diplomat asked. (TASS)

RUSSIA: The U.S. rushed cyber forces to Lithuania to help defend against online threats that have risen since Russia’s invasion of Ukraine, an Army general said Wednesday. “Our deployment in Lithuania was directly related to the ongoing crisis in the Ukraine,” Major General Joe Hartman, who commands the U.S. Cyber National Mission Force, told reporters at a roundtable interview in Nashville. (BBG)

RUSSIA: Germany will work for an extension of the EU's peacekeeping mission in Bosnia as concerns mount about instability spilling over from the Ukraine war, but has not yet decided whether to provide troops, Defence Minister Christine Lambrecht said. "(The EU mission) EUFOR is an important signal for the stabilization of the country," she told reporters after meeting her Bosnian counterpart Sifet Podzic in Sarajevo on Wednesday. "Germany will do its part for this work to continue". (RTRS)

RUSSIA: U.S. President Joe Biden on Wednesday said he would speak with other leaders from the Group of Seven advanced economies this week about potential additional sanctions against Russia over its continuing and intensifying war in Ukraine. Biden told reporters, "We're always open to additional sanctions" when asked about U.S. plans after the European Union proposed its toughest sanctions yet against Russia, including a phased oil embargo. "I'll be speaking with the members of the G7 this week about what we're going to do or not do," Biden added. The White House declined to say when Biden would speak with the leaders of the other G7 countries - Britain, France, Germany, Japan, Canada and Italy. (RTRS)

RUSSIA: The United States is in constant talks with its partners about further sanctions against Russia and could take "additional actions" to pressure Moscow to halt its aggression against Ukraine, Treasury Secretary Janet Yellen said on Wednesday. Yellen told a Wall Street Journal conference she would not preview any specific actions, but said further measures were likely "if Russia continues this war against Ukraine." (RTRS)

IRAN: The United States is now preparing equally for both a scenario where there is a mutual return to compliance with Iran on a nuclear deal, as well as one in which there is not an agreement, the State Department said on Wednesday. "Because a mutual return to compliance with the JCPOA is very much an uncertain proposition, we are now preparing equally for either scenario," Department spokesperson Ned Price said in a briefing. (RTRS)

PERU: Peru’s congress approved a bill to allow individuals to withdraw 18,400 soles ($4,900) from private pension funds, Congreso TV showed. The bill now goes to President Pedro Castillo for him to sign into law. (BBG)

METALS: Just days before a vote that could change the ground rules for Chile’s giant copper mines, the president of Minerals Americas at BHP Group is hopeful for the future of an industry that accounts for more than half the country’s exports. The body charged with rewriting Chile’s constitution will vote on a series of proposals within the next week that include articles that could severely restrict private ownership in mining. At stake are future investments in the world’s largest copper reserves that are crucial for supplying the clean energy transition. BHP, the biggest mining company, is hoping for a swift resolution of all the uncertainties to allow it to execute on “some really, really exciting plans for Chile,” Ragnar Udd said. They may include new processing facilities or even underground operations at the giant Escondida mine that BHP has run for 30 years. Without investments, Escondida ore quality will continue to decline. (BBG)

ENERGY: Japan will consider providing financial support to boost production of liquefied natural gas in the U.S., Nikkei has learned, as it seeks to lessen its energy dependence on Russia following Moscow's invasion of Ukraine. (Nikkei)

ENERGY: U.K. Prime Minister Boris Johnson will meet his Japanese counterpart Fumio Kishida in London here they are expected to discuss a plan to support Asian nations to find energy supplies to diversify away from Russian oil and gas. Both leaders will also agree in principle to a new military pact for joint cooperation in the Indo-Pacific. “Bilateral meetings are expected to focus on Russia’s illegal invasion of Ukraine, and how international alliances can continue to exert maximum pressure on President Putin’s regime while supporting Ukraine and other European countries affected by the barbaric invasion,” the U.K. government said in a statement. (BBG)

CHINA

POLICY: China may soon reveal more policies intended to rescue the economy after top leaders vowed to meet growth targets without compromising on the country’s stringent Covid Zero strategy. Actions to promote investment, shore up exports and support technology platform companies are all on the table, state media outlets reported Thursday. The People’s Bank of China also said late Wednesday it would conduct “normalized financial supervision” over online platforms, echoing language used last week by the Communist Party’s Politburo, the top decision-making body. The media reports and PBOC statement come days after the Politburo issued its sweeping pledge to support the economy, which is in the throes of the country’s worst coronavirus outbreak since 2020. Authorities deployed strict lockdowns in places like Shanghai and Jilin province to contain infections. (BBG)

ECONOMY: China’s economy may have bottomed out in April and should start to recover this month due to government policies to support Covid-stricken enterprises and resume production, according to a front-page report in China Securities Journal Thursday. The growth rate could return to normal level of 6% in June given the policy support, report cites Guosen Securities as saying in a report. Manufacturing PMI could rebound in May as high frequency data has shown signs of marginal improvement in late April amid easing of the Shanghai Covid outbreak, the report cites Huachuang Securities analyst Zhou Guannan as saying. (BBG)

ECONOMY: China should increase policy intensity to stabilise economic growth, such as new re-lending tools, consumption stimulus, and subsidies for low- and middle-income groups affected by the pandemic, Yicai.com reported citing analysts. China can issue special treasury bonds, which can help to fund infrastructure projects as well as subsidise lower-income groups and smaller businesses with rent, labor costs and interest payments, the newspaper said citing Luo Zhiheng, chief economist of Yuekai Securities. The Politburo meeting in end-April called for new incremental policy tools as well as the accelerated implementation of pro-growth policies announced earlier, the newspaper said. (MNI)

INFLATION: China’s consumer price index will rebound above 2% with sharp price hikes in fruit, vegetables and eggs as logistics are constrained amid Covid lockdowns, the Economic Information Daily reported citing analysts. Domestic fuel costs have followed the declines in international oil prices as the Russia-Ukraine conflict has been basically priced in the market, the newspaper said. CPI will rise moderately in the following months as costs for goods remains high due to low upstream inventory and the tension in the supply chain, the newspaper cited analysts as saying. CPI rose 1.5% y/y in March. (MNI)

CORONAVIRUS: More than 70% of 1,800 industrial companies monitored by Shanghai government have resumed production as of May 4, Zhang Hongtao, an official with the municipal government’s economic affairs department, says at a briefing. More than 90% of about 660 key industrial companies in the city have resumed output. The city saw continuous recovery in industrial chains in the automobile, integrated circuit and biomedical sectors. The municipal government will coordinate with communities and industrial parks to help companies resume production. Some local regulators imposed excessive limits on production due to Covid concerns, which is unnecessary. About 2.34m people in the city remained under total lockdown as of May 4. (BBG)

PROPERTY: Smaller cities in China will accelerate policies to stimulate housing demand, including removal of home purchase limits, easier loan rules and lower down payment ratios for second homes, the Securities Times reported citing Ding Zuyu, head of Shanghai E-House Real Estate Research Institute. Key big cities may moderately unbundle control policies but it is hard to give up their home purchase limits, the newspaper cited Ding as saying. Several second-tier cities including Wuxi and Xuzhou, have relaxed real estate market policies during the May Day holiday following a Politburo meeting in end-April that set the tone, the newspaper said. (MNI)

CHINA MARKETS

PBOC NET DRAINS CNY40 BILLION VIA OMOS THURSDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.10% on Thursday. The operation has led to a net drain of CNY40 billion after offsetting the maturity of CNY50 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1462% at 09:37 am local time from the close of 2.0053% on April 29, the last working day before May Day holiday.

- The CFETS-NEX money-market sentiment index closed at 39 on April 29.

PBOC SETS YUAN CENTRAL PARITY AT 6.5672 THURS VS 6.6177

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.5672 on Thursday, compared with 6.6177 set on Friday before May Day Holiday.

OVERNIGHT DATA

CHINA APR CAIXIN SERVICES PMI 36.2; MEDIAN 40.0; MAR 42.0

CHINA APR CAIXIN COMPOSITE PMI 37.2; MAR 43.9

The Caixin China General Services Business Activity Index (services PMI) came in at 36.2 in April, down sharply by 5.8 points from the previous month and the lowest reading since February 2020. The new round of Covid-19 outbreaks hit the service sector hard. Supply and demand in the sector contracted severely. Both the services PMI and the measure for new business dropped to the lowest since February 2020, as regional Covid outbreaks limited both supply and demand. As travel restrictions squeezed external demand, the gauge for new export business fell to the lowest point since April 2020. Employment in the service sector continued to decline. The measure for employment has been under 50 for four consecutive months, although the decrease in employment was modest compared to the contraction in supply and demand. Some companies, affected by the drop in orders, laid off workers to lower costs. Backlogs of work in the service sector also rose because of Covid-19. Input costs rose while prices charged fell. The gauge for input costs fell slightly, but remained in expansionary territory, showing that cost pressures still weighed heavily on service enterprises. Meanwhile, energy and raw material prices were still high, and measures to contain Covid outbreaks also increased the operating costs of businesses. Because of sluggish demand, service companies had to lower the prices they charged, with the relevant gauge falling into contractionary territory for the first time since August last year. Businesses were moderately optimistic. Even as regional Covid-19 outbreaks dragged on, entrepreneurs were confident that they would be brought under control, although some worried that the control measures would last too long. (Caixin)

AUSTRALIA MAR TRADE BALANCE A$9,314MN; MEDIAN A$8,400MN; FEB A$7,437MN

AUSTRALIA MAR EXPORTS +0% M/M; MEDIAN +3%; FEB +0%

AUSTRALIA MAR IMPORTS -5% M/M; MEDIAN -5%; FEB +13%

AUSTRALIA MAR BUILDING APPROVALS -18.5% M/M; MEDIAN -12.0%; FEB +42.0%

AUSTRALIA MAR PRIVATE SECTOR HOUSES -3.0% M/M; FEB +14.6%

MARKETS

SNAPSHOT: Moving On To BoE After Fed Delivers 50bp Hike, UK Local Elections Eyed

Below gives key levels of markets in the second half of the Asia-Pac session:

- Japanese markets are closed.

- ASX 200 up 53.322 points at 7358

- Shanghai Comp. up 33.706 points at 3080.769

- JGBs are closed.

- Aussie 10-Yr future up 15 ticks at 96.57, yield down 14.9bp at 3.392%

- US 10-Yr future down 20.3125 ticks at 118.953125, cash Tsys are closed.

- WTI crude up $0.33 at $108.14, Gold up $20.4 at $1901.62

- USD/JPY up 18 pips at Y129.27

- FED PLEDGES MORE 50BP MOVES TO TAME PRICES (MNI)

- TORIES BRACE FOR UK LOCAL ELECTION WOES

- CHINA ECONOMY TO REBOUND IN MAY ON POLICY SUPPORT (CSJ)

- CHINA CAIXIN SERVICES PMI SOFTER THAN EXPECTED AS CONTRACTION ACCELERATES

- JD.COM, PINDUODUO ADDED TO SEC LIST FOR POSSIBLE DELISTING (BBG)

US TSYS: Limited Asia Futures Trade

TYM2 is -0-06+ at 118-30+, 0-01 off the base of its 0-12 overnight range, operating on under 65K lots. Cash Tsys are closed until London hours owing to the observance of a Japanese holiday, while there hasn’t been much in the way of meaningful macro news flow to digest during Asia hours.

- Two-way, but limited, trade was evident overnight with an early bid in Tsy futures reversing. TYM2 had a brief look above its NY session high after regional Fed follow through, a weak post-holiday start for Chinese tech names and a bid in the ACGB market were penned as potential driving factors for the early, limited richening in futures, before a pullback took place as the ChiNExt moved away from worst levels.

- A quick reminder that Fed Chair Powell’s pushback against the idea of a 75bp rate hike and guidance towards 50bp hikes at the next couple of FOMC meetings meant that short-end rates unwound a little of the embedded rate hike premium that could be observed pre-FOMC, resulting in bull steepening of the Tsy curve into the NY bell.

- Softer than expected Chinese services PMI data provided no real tangible impact on the space. Although the reading was much softer than expected (36.2 vs. BBG median of 40.0, representing the fastest rate of contraction observed since the initial COVID outbreak in early ‘20) the market was already looking for a weak print given the well-documented, localised COVID restrictions that have been implemented in China. The key findings of the survey largely reflected knowns. The details revealed the quickest fall in service sector output for over two years as COVID-19 restrictions tighten, a decline in new business gathering pace & a slight fall in employment. Still, Caixin noted that “businesses were moderately optimistic. Even as regional Covid-19 outbreaks dragged on, entrepreneurs were confident that they would be brought under control, although some worried that the control measures would last too long."

- Looking ahead, the latest BoE decision will be eyed during Thursday’s London/NY crossover. The MNI markets team expects a 25bp hike. We think that the biggest thing that could impact market pricing re: the BoE would be the removal of “coming months” from the forward guidance.

- NY hours will bring the release of weekly jobless claims data, challenger job cuts, as well as the monthly productivity and unit labour cost metrics.

AUSSIE BONDS: At Last, A Bid

YM & XM sit ~3bp shy of their respective session peaks, +18.0 & +15.0, respectively, at typing. This comes after both contracts managed to push through their overnight, post-Fed highs, with a weak start for Chinese tech equities, onshore reaction to the FOMC decision (including an unwind of some of the RBA rate hike premium embedded into markets), profit taking/short squeezing and cross market interest vs. U.S. Tsys were identified as potential drivers of the move.

- A recovery in Chinese tech equities and light pressure in U.S. Tsy futures has allowed the space to move back from richest levels of the session.

- Wider cash ACGB trades sees the 3- to 7-Year sector outperform on the curve.

- The IR strip trades 8-21bp richer on the day through the reds.

- A quick look at the BBG WIRP function points to the IB strip pricing a year-end cash rate of 2.95% vs. a peak of 3.10% observed on Wednesday.

- The RBA overnight cash rate set at 0.31%, up from 0.07% (capturing the rate hike from Tuesday), just above the mid-point of the cash rate target/interest rate paid on surplus E/S balance corridor (which stands at 0.30%).

- Local data saw a wider than expected trade surplus, even with exports missing expectations (imports were in line), while building approvals data was on the soft side vs. expectations. That, as well as softer than expected Chinese Caixin PMI data, had no impact on the space.

- Friday will bring the release of the Bank’s SoMP (although the major tweaks to its economic forecasts have already been flagged) and A$1.0bn of ACGB Nov-27 supply.

EQUITIES: Higher In Asia; Chinese Stocks Reverse Early Losses As Policy Support Calls Grow Louder

Most Asia-Pac equity indices trade higher at typing, tracking a strongly positive lead from Wall St. High-beta names across various sectors were notable outperformers, likely benefitting from spillover from an unwinding of worry re: larger Fed rate hikes in ‘22. Japanese and South Korean markets are shut for a holiday.

- The Hang Seng Index sits 0.8% firmer at typing, paring opening gains particularly after Chinese Caixin PMIs crossed, pointing to further contraction in the Services industry (while also corroborating with earlier official estimates). China-based tech leads gains despite fresh reports of U.S. regulators expanding their list of Chinese companies facing the boot from U.S. exchanges over a well-documented audit dispute, with Bilibili Inc, Baidu Inc, and Meituan contributing the most to gains, seeing the Hang Seng Tech Index add 1.7% at writing.

- Zooming out, PBOC’s pledge on Wednesday to “normalise” supervision for internet platform companies appears to have been met with lukewarm reception overall, with the Hang Seng Tech Index trading below three-week highs seen last Friday’s (with that move spurred by similar comments from the CCP’s Politburo meeting).

- The CSI300 deals 0.5% firmer at typing, breaking above neutral levels on a broad surge across virtually all sub-indices, with the most gains contributed by the heavyweight consumer staples sub-index. Chinese equities caught a bid after state media reported on a swathe of measures to promote investments, exports, and support internet platform companies, again reinforcing recent messages from the Politburo and the PBOC. While the announcements have been light on details thus far, Chinese state media has notably carried analyses pointing to possible state support for internet platform companies (particularly to help “stabilise growth” and “ensure employment”), and also on possible further easing of curbs on the property sector.

- U.S. e-mini equity index futures sit a little below neutral levels at typing, trading within a fairly limited range in Asia-Pac dealing after closing ~3% high after Powell’s presser.

OIL: Holding On To Gains As EU Sanctions Meet Resistance, Chinese Data Points To Slowdowns

WTI and Brent are between $0.30 - $0.40 firmer at typing, a little below two-week highs made earlier in the session at $108.93 and $111.34 respectively.

- To recap, both benchmarks closed ~$5 higher apiece on Wednesday as the European Commission unveiled proposed sanctions on Russian crude, including measures targeting insurance and financing operations on its transportation. The proposal now likely enters a phase of negotiation as consensus amongst the bloc’s 27 members is required, with RTRS source reports pointing to debate re: conditional exemptions on the embargo for Hungary and Slovakia.

- Looking to China, worry re: reduced energy demand continues to be front and centre, with the Apr Caixin Services PMI slowing to 36.2 (vs. BBG median 40.0; Mar 42.0), the second-lowest on record since readings began in 2005. COVID cases in the country have continued to stay low at 5K cases nationwide, although Shanghai continues to see low double-digit cases “in the community” (outside of lockdowns).

- Elsewhere, U.S. EIA crude inventory data crossed on Wednesday, recording a surprise build in crude stockpiles (diverging from Tuesday’s reports of API estimates pointing to a decline) and an increase in Cushing hub stocks, while a smaller-than-expected drawdown in gasoline and distillate stocks was observed.

- OPEC+ is expected to meet later on Thursday to discuss production quota increases for June (expected to raise target by 432K bpd), although well-documented difficulties in increasing production amongst some members of the group i.e. Libya and Nigeria) likely remain front and centre for the space.

GOLD: Revisiting $1,900/oz As Powell Puts Away 75bp Hike For Now

Gold deals ~$19/oz higher at typing to print ~$1,900/oz, on track for a third consecutive higher daily close with tailwinds from Fed Chair Powell’s presser on Thursday evident.

- To elaborate, the precious metal builds on a ~$13/oz higher close on Wednesday after Powell said that a 75bp hike was “not something that the committee is actively considering” for the next few meetings, with the overall move higher facilitated by broad declines in U.S. real yields and the USD (DXY).

- Support for gold from a steady beat of negative economic data surprises (keeping in mind well-documented debate re: stagflation) continues to take a back seat to worry re: >50bp rate hikes for now, with little reaction observed in the yellow metal on downside surprises in ADP employment data and the ISM’s service sector index on Wednesday (while noting that U.S. PMI data came in ahead of BBG median expectations).

- A cumulative ~100bp in hikes is now priced into July FOMC dated OIS, implying expectations for back-to-back 50bp hikes in both the June and July meetings. OIS markets now show expectations for around 3 x 50bp hikes across the five remaining FOMC meetings for the year, with a cumulative ~195bp of tightening now priced in through calendar ‘22.

- From a technical perspective, bullion has broken resistance at $1,900/oz (May 2 high), exposing further resistance at its 20-Day EMA (around $1,917.3/oz) and at $1,958.4/oz (Apr 20 high). On the other hand, support is situated at $1,850.5/oz (May 3 low).

FOREX: AUD Weakens On Monetary Policy Musings, China Services PMI Miss

The Aussie dollar went offered even as firmer crude oil prices lent support to the CAD and NOK. The RBA's hawkish pivot communicated earlier this week was reassessed in the light of yesterday's monetary policy decision from the Fed, who delivered the expected 50bp rate hike and played down potential for larger rate increases going forward.

- AUD/NZD extended its pullback from a cycle peak printed on Wednesday in tandem with a parallel move in Australia/New Zealand 2-year swaps spread. RBNZ Gov Orr defended his inflation fighting record, brushing away suggestions from opposition lawmakers that his MPC was too slow in taking the heat out of the economy.

- Spillover from China likely played a role in AUD weakness, as Caixin Services PMI missed expectations by a solid margin, extending its run of downside surprises, as harsh Covid-19 countermeasures took their toll.

- The GBP depreciated, joining the AUD at the bottom of the G10 pile. Local elections to be held in the UK on Thursday provide a key source of political risk, as a poor result for the Tories would deliver another blow to PM Johnson. In addition, polls are showing that unionist Sinn Fein party maintains a lead over its rivals ahead of the Northern Ireland Assembly election.

- Offshore yuan see-sawed as the third consecutive firmer than expected PBOC fixing was countered by local PMI data. The People's Bank returned after the long weekend setting the yuan reference rate 27 pips below sell-side estimate, signalling continued willingness to lean against redback weakness.

- Central bank activity picks up from here, with monetary policy decisions from both the Bank of England and the Norges Bank coming up later in the day, with ECB's Lane, Centeno & Holzmann and BoC's Schembri set to speak. Today's data highlights include German factory orders and U.S. weekly jobless claims.

FX OPTIONS: Expiries for May05 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500-10(E1.2bln), $1.0565-85(E995mln), $1.0600(E1.7bln), $1.0750-65(E1.6bln), $1.0800(E1.5bln)

- GBPUSD: $1.2550(Gbp502mln), $1.2900(Gbp1.2bln)

- EUR/GBP: Gbp0.8600(E952mln)

- USD/JPY: Y127.50($685mln)

- EUR/JPY: Y135.00(E523mln)

- AUD/USD: $0.7135-50(A$571mln)

- USD/CAD: C$1.2865-80($869mln), C$1.2890-05($689mln), C$1.3075($1.2bln), C$1.3100($1.8bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/05/2022 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 05/05/2022 | 0630/0830 | *** |  | CH | CPI |

| 05/05/2022 | 0645/0845 | * |  | FR | Industrial Production |

| 05/05/2022 | 0700/0300 | * |  | TR | Turkey CPI |

| 05/05/2022 | 0730/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 05/05/2022 | 0800/1000 | *** |  | NO | Norges Bank Rate Decision |

| 05/05/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Services PMI (Final) |

| 05/05/2022 | 1000/1200 |  | EU | ECB Lane Speech on Euro Area Outlook | |

| 05/05/2022 | 1100/1200 | *** |  | UK | Bank Of England Interest Rate |

| 05/05/2022 | 1130/1230 |  | UK | BOE post-MPC press conference | |

| 05/05/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 05/05/2022 | 1230/0830 | ** |  | US | Preliminary Non-Farm Productivity |

| 05/05/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 05/05/2022 | 1300/1400 |  | UK | Bank of England DMP Survey | |

| 05/05/2022 | 1340/0940 |  | CA | BOC Deputy Schembri speech to Indigenous group. | |

| 05/05/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 05/05/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 05/05/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.