-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI EUROPEAN OPEN: Focus Moves To NFPs, Meanwhile UK Tories Eye Partygate Fallout In Local Elections

EXECUTIVE SUMMARY

- ECB TO DISCUSS RATE HIKE IN JUNE, PROBABLY ACT, HOLZMANN SAYS (BBG)

- TORIES LOSE SEATS IN EARLY ENGLISH LOCAL POLL RESULTS (BBC)

- CHANCELLOR RISHI SUNAK URGED TO SLASH TAXES TO STAVE OFF RECESSION

- CHINA MAY EASE MONETARY POLICY IN Q2 DESPITE FED HIKE (ECO INFO DAILY)

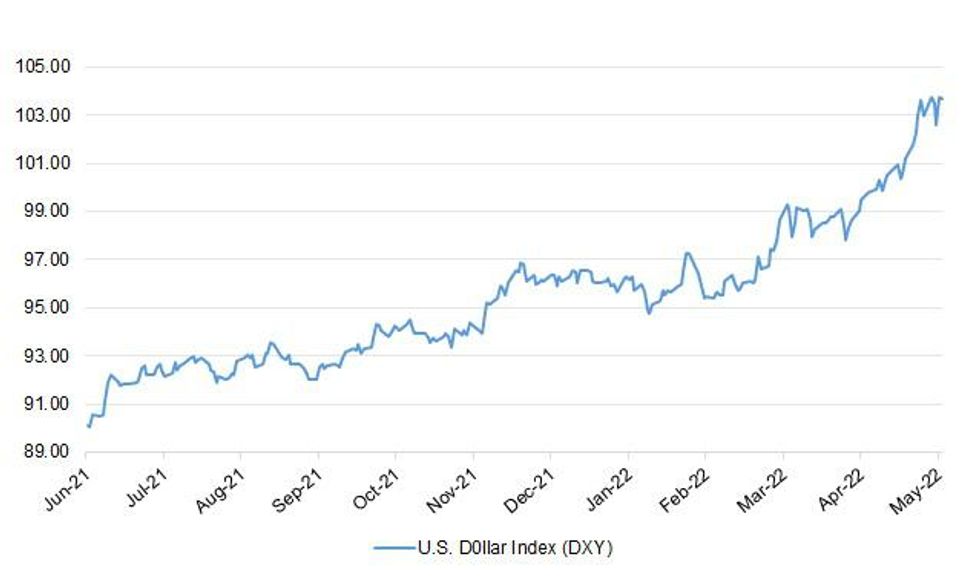

Fig. 1: Dollar Index (DXY)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

ELECTIONS: More than half of English councils where elections were held are counting overnight with the rest beginning on Friday morning. The Conservatives are losing about one in six of the seats they are defending - although some Tories had feared they would do worse. Labour has won control of Wandsworth from the Conservatives and looks set to take other London targets. Labour has also taken Southampton from the Tories, but is making only modest gains in other parts of England, outside London. The Lib Dems are having a good night, winning control of Hull from Labour. (BBC)

POLITICS: A cabinet minister moved to shore up support for Boris Johnson yesterday before today’s local election results. Conservative opponents of the prime minister hope to capitalise on a poor showing by the party to renew calls for Johnson to quit. However, with no obvious successor emerging, one cabinet minister said that any contest would look like the children’s cartoon Wacky Races, with no certainty that any alternative leader would improve the party’s fortunes. “It previously felt like a prize-fighting contest,” they said. “Now if Boris goes, it looks more like Wacky Races. Who wants that when there’s no clear alternative?” (The Times)

FISCAL: Rishi Sunak is under mounting pressure from cabinet colleagues to implement radical tax cuts after the Bank of England warned that the economy could tip into recession next year. (The Times)

BREXIT: The EU will take a very negative view of any move by the UK to disapply parts of the Northern Ireland Protocol, RTÉ News understands. The move is expected to be signalled around the Queen's Speech next Tuesday. The speech normally sets out the British government’s legislative priorities for the next session of parliament. UK officials have been briefing that London will bring forward legislation to disapply parts of the Protocol in the wake of tomorrow’s Northern Ireland Assembly elections. The EU believes that while threatening the legislation, the UK may refrain from acting on the threat. Member states and the European Commission will strongly discourage such a course of action, RTÉ News understands. Any such move would be viewed by the EU as particularly unfortunate in view of the Russian army’s Victory Day parade in Moscow, the day before the Queen’s Speech, given the need for Western unity in the face of Russia’s invasion of Ukraine. The EU will reinforce its view that the UK must uphold its international treaty obligations at a time when Vladimir Putin is attempting to harshly undermine the rules-based international order. While the EU is expected to deliver a muted response, officials are likely to say that unilateral action by the UK will not solve the problems of the Protocol and that the EU remains committed to working with London to find joint solutions on implementing the Protocol. (RTE)

POLICY: UK ministers will not legislate in the next parliamentary session to empower a new technology regulator to police big internet companies such as Facebook and Google, Whitehall officials confirmed on Thursday. The government had been weighing plans to include a bill in the forthcoming Queen’s Speech that would put the digital markets unit based within the UK competition regulator on a statutory footing, but has backed away from legislating. On Thursday, the government only gave a vague promise that a full bill would eventually be produced: “The government will introduce legislation to put the Digital Markets Unit on a statutory footing in due course,” it said. (FT)

EUROPE

ECB: The European Central Bank will discuss an interest-rate increase at its June meeting and is likely to also decide on one, according to Governing Council member Robert Holzmann. “We plan to do it,” he said in Salzburg on Thursday when asked about raising borrowing costs. “We will discuss it in our June meeting, probably do it.” The Austrian central bank chief is the most hawkish member of the ECB’s rate-setting body and has repeatedly called for the institution to start normalizing policy. (BBG)

FISCAL: Germany has rejected a proposal by European Stability Mechanism economists to create a new aid fund worth 250 billion euros ($262.83 billion) for euro zone states, Handelsblatt newspaper reported on Thursday, citing a senior finance ministry official. "The ESM is the fire brigade of the euro area. If the fire brigade doesn't have to be called out every day, that's good news," Florian Toncar, parliamentary state secretary in the Finance Ministry, was quoted as saying. The ESM was established in 2012 to help euro zone countries avoid and overcome financial crises by providing loans and other financial assistance. (RTRS)

EU: Hungary has accused Brussels of threatening EU unity with its plans to impose an embargo on Russian oil imports, saying Budapest would not support proposals that would undermine its energy security. Prime minister Viktor Orbán told European Commission president Ursula von der Leyen in a letter seen by the Financial Times that Hungary was unable to support the EU’s latest sanctions plan “in its current form”. “If the commission insists on the adoption of its proposal, it will have to bear full responsibility for a historical failure in the course of European integration,” Orbán said. (FT)

SPAIN: Spanish Economy Minister Nadia Calvino said there’s evidence that the country has passed the peak of inflation and that prices will slow in the second half. “At this moment, everything indicates that we left behind the peak of inflation in March and that in the second part of the year it will slow and fall to about 2% next year,” Calvino said at the Cercle d’Economia conference on Thursday. Inflation is the “main concern” at the moment and there is still “high uncertainty,” the minister said. In April, Spain’s inflation rate declined to 8.3%. (BBG)

GREECE: Greece will introduce additional support measures to mitigate the impact of surging energy costs for both households and businesses, with the country’s premier saying that the European Union has done too little to combat the crisis. Europe “has not met expectations, at least for now,” Prime Minister Kyriakos Mitsotakis said Thursday in a national televised address. “I am not going to wait until the slow-moving European ocean liner changes course,” he said. (BBG)

SWEDEN: Swedish apartment prices rose by 7% in April from a year earlier, while house prices increased by 8%, according to a statement from Svensk Maklarstatistik. Apartment prices rose 3% on a 3-month basis and were unchanged m/m. House prices rose 3% on a 3-month basis and gained 1% m/m. (BBG)

RATINGS: Potential sovereign rating reviews of note scheduled for after hours on Friday include:

- Fitch on the Czech Republic (current rating: AA-; Outlook Stable) & Portugal (current rating: BBB; Outlook Stable)

- Moody’s on Ireland (current rating: A2; Outlook Positive) & Norway (current rating: Aaa; Outlook Stable)

U.S.

FED: The Federal Reserve will need to raise short-term interest rates to at least 3.5% to bring surging inflation under control, former Vice Chairman Richard Clarida said. “Expeditiously ‘getting to neutral’ will not be enough this cycle to return inflation over the forecast horizon back to the 2% longer-run goal,” he said in remarks prepared for delivery to a Hoover Institution conference on Friday. “The funds rate will I believe ultimately need to be raised well into restrictive territory, by at least a percentage point above the estimated nominal neutral rate of 2.5%.” (BBG)

ECONOMY: The Covid pandemic sent more than 8 million workers to the sidelines at one point, including many folks who decided it was the right time to retire as the workplace as they knew it faded out of sight. But with a thriving jobs market in which workers virtually have their pick on where to go, coupled with soaring inflation and the fading of Covid fears, some are finding it a good time to rethink their plans and come back to the fold. In fact, the level of workers who retired then came back a year later is running around 3.2%, just about where it was before the pandemic, after dipping to around 2% during Covid’s worst days, according to calculations from job placement site Indeed. (CNBC)

OTHER

U.S./CHINA: U.S. Trade Representative Katherine Tai said on Thursday her agency's review of punitive tariffs on Chinese goods will be a "robust" consultative process that will collect a wide range of industry comments and assess potential economic impacts. Tai, speaking to reporters in Ottawa with Canada Trade Minister Mary Ng, said decisions about tariffs would not be made "in a vacuum." Asked whether she views the tariffs as important leverage to hold China to commitments including a "Phase 1" trade deal negotiated by the Trump administration in early 2020, Tai said she was focused on the longer term. "It is important for us to focus on a durable, effective strategy with respect to our ability to compete with China, in this global environment and through the very disruptive period that we are experiencing right now that is causing pain to the ordinary American back at home," Tai said. (RTRS)

GEOPOLITICS: The United States is confident it can address any security concerns Sweden and Finland may have about the period of time after they apply for NATO membership and before they are accepted into the alliance, the White House said on Thursday. "We are confident that we could find ways to address any concerns either country may have about the period of time between a NATO membership application and the formal accession to the alliance," White House spokesperson Jen Psaki told a briefing. Both Sweden and Finland are expected to make a decision about whether to apply to join NATO this month. (RTRS)

GEOPOLITICS: The war in Ukraine and the billions of dollars in weapons the U.S. is sending there to help fight Russia’s invasion won’t siphon off attention or resources for the Indo-Pacific region, Pentagon spokesman John Kirby said. There’s no concern that “our focus on Ukraine is somehow going to take our focus, our eye, off the Indo-Pacific or specifically our obligations under the Taiwan Relations Act,” Kirby told reporters. (BBG)

GEOPOLITICS: Japanese Prime Minister Fumio Kishida told a news conference in a visit to London that “Ukraine could be tomorrow’s East Asia,” without providing further details. Kishida also announced additional sanctions on neighbor Russia, including freezing the assets of more individuals and halting exports to more organizations. “The invasion by Russia is not just a European problem. It’s a problem for the international community, including the Indo-Pacific.” (BBG)

GEOPOLITICS: China has ordered central government agencies and state-backed corporations to replace foreign-branded personal computers with domestic alternatives within two years, marking one of Beijing’s most aggressive efforts so far to eradicate key overseas technology from within its most sensitive organs. Staff were asked after the week-long May break to turn in foreign PCs for home-made alternatives that run on operating software developed domestically, people familiar with the plan said. The exercise, which was mandated by central government authorities, is likely to eventually replace at least 50 million PCs on a central-government level alone, they said, asking to remain anonymous discussing a sensitive matter. (BBG)

JAPAN: Japan plans to allow a small number of tourists into the country as soon as this month, broadcaster FNN reports, citing several unidentified government officials. Move to accept vaccinated and boostered tourists traveling in small numbers under a package tour plan will be test case for larger-scale opening in future. Plans to open borders to wider group from June, depending on coronavirus cases nationwide. (BBG)

RBA: The Reserve Bank of Australia said it will need to raise interest rates further as unemployment is forecast to drop to the lowest level since 1974, fueling wages growth and underpinning inflation. Both headline and core inflation are seen remaining above the central bank’s 2-3% target through this year and next before easing to 2.9% at the end of the forecast period in June 2024, the bank said in its quarterly Statement on Monetary Policy. The cash rate is assumed to be 1.75% in the fourth quarter of this year and 2.5% at the end of next year, the estimates showed. “Higher labor costs in response to a tight labor market are expected to become the primary driver of inflation outcomes later in the forecast period,” the RBA said Friday. Business liaison contacts are “now reporting that they are paying larger wage increases or that they expect materially higher wages growth over the coming year. (BBG)

AUSTRALIA: The latest NAB/SEEK employment report noted that “SEEK new job ads rose 2.9% m/m in April, further extending record highs in a 4th consecutive month of growth. Overall, jobs ads are an incredible 74.1% higher than pre-pandemic levels, indicating labour demand remains elevated even as employment has more than recovered pre-pandemic levels and the unemployment rate has declined to a near five-decade low. In the month, job ad growth was seen across all states and territories. The increase in job ads was again led by QLD, up a further 5% following March’s 8% gain. SA, TAS and the NT each posted growth over 4%, closely followed by NSW and WA at 3% m/m. VIC and the ACT each saw slower growth of 1% m/m. Strong labour demand continues to be broad based with job ads across all but one sector experiencing positive growth since the pandemic. Hospitality & Tourism continues to lead growth in advertising, with ads almost triple pre-pandemic. Agriculture, Manufacturing and Transport, and Retail have also seen large increases. Candidate availability (reported with a one month lag) also shows a very tight labour market. An advertised job received only 43% as many applicants as prior to the pandemic. That’s after a further 7.6% m/m fall In the index in March. The low number of applicants is consistent with widespread reports of labour shortages and difficulty finding suitable labour.” (MNI)

RBNZ: Reserve Bank of New Zealand says it has conducted an internal review of its monetary policy implementation framework. “As a result of this review, the Reserve Bank will retain a floor system for monetary policy implementation, and does not intend to reintroduce credit tiers”. “The current settlement cash level (SCL) is more than sufficient to keep short-term interest rates anchored at or near the OCR, and for payment and settlement needs. However, we expect the SCL to decline in the coming years”. “As the SCL reduces, staff will continue to monitor money market conditions, facilities and operations usage, and the distribution of settlement cash, to ensure that payments and settlements systems function smoothly and that short-term interest rates trade at or near the OCR”. The RBNZ is reviewing its facilities and operations to ensure that these remain effective at all levels of settlement cash, and will be engaging with market participants on this topic over coming months. This announcement “has no implications for the Reserve Bank’s monetary policy stance”. (BBG)

NORTH KOREA: U.S. President Joe Biden will discuss North Korea's nuclear and missile programs with his counterparts in South Korea and Japan during a trip to those two countries later this month, White House press secretary Jen Psaki told reporters on Thursday. Psaki said Biden will also discuss holding Russia accountable for its invasion of Ukraine during the trip, which will also include talks in Tokyo with the leaders of the Quad grouping of nations, the United States, Australia, Japan and India. (RTRS)

BRAZIL: Brazilian President Jair Bolsonaro on Thursday urged state-run oil company Petrobras not to raise fuel prices again, and compared the company's profits to a "rape" of the country. The far-right leader said a new fuel price hike by Petroleo Brasileiro SA, as the company is formally known, could bankrupt Brazil and cause what he called a "national convulsion". His remarks came as the oil giant reported its first quarter results, with net income jumping more than 40 times to 44.56 billion reais ($8.9 billion) as oil companies take advantage of rocketing crude prices. (RTRS)

RUSSIA: Ukrainian President Volodymyr Zelenskiy said the evacuation of civilians from the besieged port city of Mariupol had continued on Thursday but did not say how many people had managed to leave. In a video address, Zelenskiy also said Russian forces were still storming and shelling the city's Azovstal plant, where civilians and military forces are sheltering. (RTRS)

RUSSIA: German Chancellor Olaf Scholz and U.S. President Joe Biden agreed in a call on Thursday they would not recognize any Russian territorial gains in Ukraine, a German government spokesperson said in a statement. The two leaders also denounced "recent comments of the Russian leadership seeking to discredit the democratically legitimized Ukrainian leadership," the spokesperson said. "They agreed that Ukraine needed to be further substantially and continuously supported in the practice of its legitimate right to self defence," the spokesperson added. (RTRS)

RUSSIA: U.S. Energy Secretary Jennifer Granholm said on Thursday that the United States was working on a strategy to ensure steady uranium supply and that the country should not be sending any more money to Russia. Republican Senator John Barrasso, the top Republican on the Senate energy committee, asked Granholm at a hearing on President Joe Biden’s proposed FY2023 budget whether the president would ban imports of uranium used for U.S. nuclear energy as a way to further weaken Russia. (RTRS)

RUSSIA: Ukraine’s ambassador to the U.S., Oksana Markarova, said funds from frozen Russian assets should be used to help rebuild the country. “We fully support the idea to use those frozen assets in the future to compensate Ukraine and to use this money to for the rebuilding and reconstruction effort,” Markarova said at an event sponsored by the Christian Science Monitor. The ambassador said the move was justified because there is “no such thing as private banks or drilling companies in Russia.” (BBG)

RUSSIA: The European Union has proposed sanctioning Alina Kabaeva, a former gymnast who chairs the National Media Group and is “closely associated” with Putin, according to a document seen by Bloomberg News and people familiar with the matter. The Kremlin has repeatedly denied media reports that Putin, 69, has been romantically involved with Kabaeva or has children with her. (BBG)

RUSSIA: European Union countries are "almost there" in agreeing the bloc's proposed new package of sanctions against Russia, including an oil embargo, the bloc's foreign policy chief Josep Borrell said on Thursday. "I hope that they will get an agreement. They are almost there. And we need this agreement because we have to push still more our economic and financial pressure on Russia," Borrell told an event in Italy. (RTRS)

IRAN: Emboldened by an oil price surge since Russia invaded Ukraine, Iran's clerical rulers are in no rush to revive a 2015 nuclear pact with world powers to ease sanctions on its energy-reliant economy, three officials familiar with Tehran's thinking said. Last year, the Islamic Republic engaged in indirect talks with the United States as a route to cancelling U.S. sanctions that have gutted revenues and dramatically worsened economic hardships for ordinary people, stirring discontent. But the talks have been on hold since March, chiefly over Iran's insistence on Washington removing the Islamic Revolutionary Guard Corps (IRGC), Tehran's elite security force, from the U.S. Foreign Terrorist Organization (FTO) list. (RTRS)

CHILE: Chile’s central bank raised its key interest rate more than expected by economists, increasing borrowing costs by 125 basis points in an effort to bring torrid consumer prices and inflation forecasts back to target. The bank board, led by Rosanna Costa, lifted the overnight rate to 8.25% on Thursday. Eleven analysts surveyed by Bloomberg forecast a full percentage point hike, while one expected a third straight rise of 1.5 percentage points, two an increase of 75 basis points and two a 50-basis point boost. (BBG)

METALS: Peru pledged to review conditions around a major copper mine but said it will not lift by Friday an emergency declaration temporarily suspending civil liberties in the area, a step demanded by indigenous protesters camped out at the mine, forcing its closure. According to a letter on Thursday from the presidency's council of ministers addressed to two local indigenous leaders, the government will only commit to announce findings of a review of conditions around the shuttered Las Bambas mine on Saturday ahead of any possible change to the emergency declaration. Reuters obtained a copy of the letter, signed by Prime Minister Anibal Torres. (RTRS)

ENERGY: Germany will show solidarity with European Union countries seeking alternatives to Russian gas and oil, for example helping eastern states without ports in the North or Baltic Seas access liquefied natural gas (LNG), Chancellor Olaf Scholz said on Thursday. Speaking after meeting with Czech Prime Minister Petr Fiala, Scholz said many countries faced an even bigger challenge than Germany in reducing reliance on Russian energy imports. Russian gas imports that arrive via pipeline account for more than 90% of gas consumption in the Czech Republic, which is landlocked, Fiala said. “We must be prepared to help countries that do not have direct access to the North or Baltic Sea and that must rely on us cooperating with them,” Scholz said, adding that the details had yet to be worked out. (RTRS)

ENERGY: Austria’s top energy official said it will take years to wean off Russian natural gas, and there’s a possibility that an upcoming tender to accumulate a strategic fuel reserve will have to rely on Russian inventories. Leonore Gewessler also said the invasion of Ukraine has forced the nation to confront “uncomfortable truths” as her government tries to break free of Gazprom PJSC’s half-century stranglehold on gas supplies. “It will be a huge effort, and we have to be up front that it will take time,” said the minority Green Party minister, who exercises authority over climate, energy and transportation policy. “If we need to build a strategic reserve now, there might also be Russian gas included.” (BBG)

OIL: A U.S. Senate committee passed a bill on Thursday that could expose the Organization of the Petroleum Exporting Countries and partners to lawsuits for collusion on boosting crude oil prices. The No Oil Producing or Exporting Cartels (NOPEC) bill sponsored by senators, including Republican Chuck Grassley and Democrat Amy Klobuchar, passed 17-4 in the Senate Judiciary Committee. Versions of the legislation have failed in Congress for more than two decades. But lawmakers are increasingly worried about rising inflation driven in part by prices for U.S. gasoline, which briefly hit a record above $4.30 a gallon this spring. (RTRS)

OIL: The White House is concerned about legislation gaining momentum that would allow the U.S. to sue the Organization of the Petroleum Exporting Countries for manipulating energy markets. “The potential implications and unintended consequences of this legislation require further study and deliberation, particularly during this dynamic moment in the global energy markets brought about by President Putin‘s invasion of Ukraine,” White House Press Secretary Jen Psaki said Thursday. The White House has no official position yet on the bill, she said. (BBG)

CHINA

PBOC: The tightening of the global financial environment led by Federal Reserve’s interest rate hike will not fundamentally affect the direction of China’s monetary policy, the Economic Information Daily reports. China has leaned on structural monetary tools to boost targeted support to sectors hit by Covid but there’s room to lower the RRR and interest rates once the pace of Fed’s rate hikes moderates, the report cites Cheng Shi, economist at ICBC International Holdings, as saying. Wang Qing, chief macro analyst at Golden Credit Rating, expects a 10 basis point cut to the medium-term lending facilities rate in 2Q; also foresees a 0.5 percentage point reduction in RRR. (BBG)

YUAN: Having plunged by the most on record in offshore trade last month, China’s yuan is now facing the threat of selling pressure from the nation’s companies. Chinese firms are poised to ramp up dividend payments in coming months, with more than 500 Hong Kong-listed companies to hand out around HK$677 billion ($86.2 billion) this year, according to data compiled by Bloomberg as of Thursday. This summer’s June-August peak is set to be 16% higher in terms of payment size than the same period in 2021. As capital outflow concerns mount and strict Covid lockdown measures wreak havoc on China’s economy, a potential wave of yuan selling by companies to pay dividends in foreign currency could exert further downward pressure. (BBG)

FISCAL: China is likely to boost infrastructure investment, which is expected to grow as much as 10% for the year, following a call by top policymakers for an all-in effort, the China Securities Journal reported citing analysts. Tech-based infrastructure, likely to grow 11.54% y/y to total CNY1.74 trillion in 2022 will be a main driver for economic growth, adding 0.16-0.53 percentage points, the newspaper said citing analysts from China Industrial Secs. To maintain a relatively high infrastructure investment growth rate, medium and long-term financing needs to be expanded, the newspaper said, citing analysts. Infrastructure investment grew 8.5% in Q1. (MNI)

PROPERTY: When a bellwether Chinese property developer reportedly sought buyers for $12 billion of assets to repay debt this year, the move sparked hopes of a liquidity boost for the nation’s embattled real estate firms. But since January, only about three of 34 assets listed by Shimao Group Holdings Ltd. -- one of the biggest issuers of dollar bonds in the sector -- have been sold, according to exchange filings. While some of the luxury builder’s prime assets drew interest, buyers have become more cautious about acquisitions in response to the deepening liquidity crisis, according to a person familiar with the discussions. That, along with the broader property slowdown, has led to a price gap that’s often impossible to bridge, this person and another person familiar with the market said. Both declined to be identified discussing private information. (BBG)

CORONAVIRUS: The number of COVID-19 infections in China's financial hub of Shanghai has been on a "continuous downward trend" since April 22, the city's vice major Wu Qing said on Friday. "Currently, our city's epidemic prevention and control situation is steadily improving, and the epidemic has come under effective control," he told a news conference. (RTRS)

CORONAVIRUS: China’s top leaders warned against questioning Xi Jinping’s Covid Zero strategy, as pressure builds to relax virus curbs and protect the economic growth that has long been a source of Communist Party strength. The Politburo’s supreme Standing Committee pledged Thursday during a meeting led by Xi to “fight against any speech that distorts, questions or rejects our country’s Covid-control policy,” state broadcaster China Central Television said. The body reaffirmed its support for the lockdown-dependent approach, saying China had made progress toward overcoming its worst outbreak since the first wave in Wuhan two years ago. “Our pandemic prevention-and-control strategy is determined by the party’s nature and principles,” the seven-member committee said, according to CCTV. “Our policy can stand the test of history, and our measures are scientific and effective.” (BBG)

CORONAVIRUS: The majority of Japanese factories in Shanghai are yet to resume any production, with the city’s lockdown still damaging business activity even as the local government claims that production is getting back on track. Almost two-thirds of factories haven’t resumed any production yet, while another 28% are running at less than 30% capacity, according to the results of a survey of Japanese firms in the city. None of the 54 companies with factories in Shanghai are back to planned levels of output, and only 37% of firms had permission to resume output. (BBG)

CHINA MARKETS

PBOC INJECTS CNY10 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.1% on Friday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9299% at 09:42 am local time from the close of 1.8454% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 44 on Thursday vs 39 on April 29.

PBOC SETS YUAN CENTRAL PARITY AT 6.6332 FRI VS 6.5672

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.6332 on Friday, compared with 6.5672 set on Thursday.

OVERNIGHT DATA

JAPAN APR TOKYO CPI +2.5% Y/Y; MEDIAN +2.3%; MAR +1.3%

JAPAN APR TOKYO CORE CPI +1.9% Y/Y; MEDIAN +1.8%; MAR +0.8%

JAPAN APR TOKYO CORE-CORE CPI +0.8% Y/Y; MEDIAN +0.6%; MAR -0.4%

JAPAN APR MONETARY BASE +6.6% Y/Y; MAR +7.9%

JAPAN APR MONETARY BASE END OF PERIOD Y688.4TN; MAR Y688.0TN

MARKETS

SNAPSHOT: Focus Moves To NFPs, Meanwhile UK Tories Eye Partygate Fallout In Local Elections

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 192.42 points at 27011.47

- ASX 200 down 171.849 points at 7192.8

- Shanghai Comp. down 70.774 points at 2996.985

- JGB 10-Yr future down 21 ticks at 149.16, yield up 1bp at 0.241%

- Aussie 10-Yr future down 9.0 ticks at 96.480, yield up 8bp at 3.47%

- US 10-Yr future up 0-02 at 118-04, yield up 1.67bp at 3.0532%

- WTI crude up $0.40 at $108.65, Gold down $0.94 at $1876.09

- USD/JPY up 38 pips at Y130.59

- ECB TO DISCUSS RATE HIKE IN JUNE, PROBABLY ACT, HOLZMANN SAYS (BBG)

- TORIES LOSE SEATS IN EARLY ENGLISH LOCAL POLL RESULTS (BBC)

- CHANCELLOR RISHI SUNAK URGED TO SLASH TAXES TO STAVE OFF RECESSION

- CHINA MAY EASE MONETARY POLICY IN Q2 DESPITE FED HIKE (ECO INFO DAILY)

US TSYS: Back From Early Cheaps, NFPs Eyed

TYM2 is +0-02+ at 118-04+ ahead of London hours, trading closer to the top than the base of its 0-15 overnight range, on volume of ~150K. Cash Tsys sit 0.5-1.5bp cheaper on the day.

- Asia-Pac participants were happy to sell Tsys in early dealing, although there was a lack of overt headline catalysts apparent. This meant that most pointed to Japanese reaction after the three-day Tokyo holiday, while a fresh leg higher in USD/CNH wouldn’t have harmed the early Tsy dynamic.

- Still, a bid has come back into the space, with the failure of 10-Year yields and TY futures when it came to cracking below their respective cycle cheaps allowing the space to correct from worst levels.

- Swap and invoice spreads are back from their Thursday tights, which suggests that cash Tsys at least when compared to futures, and payside swap flow helped the early cheapening move, at least incrementally (a reversal of what was observed during Thursday’s NY session, when the cheapening seemed to be futures driven).

- All in, it was quiet when it came to macro headline flow during Asia-Pacific hours, with participants awaiting the monthly NFP print (see our full preview of that release here).

- Elsewhere, there will be a deluge of Fedspeak on Friday, with Williams, Waller, Bullard, Kashkari, Daly & Bostic (Bullard & Daly will speak after market) all due up.

JGBS: Cheaper After The Holiday, But Off Lows

JGB futures are a touch above worst levels, last -19 on the day. Meanwhile, cash JGBs sit 0.5-2.5bp cheaper across the curve, bear steepening.

- Tokyo participants played catch up after their three-day holiday, with firmer than expected Tokyo CPI data (largely driven by a waning impact of lower mobile phone costs and the well documented jump in energy prices) also factoring into the weakness that was observed. Re: the latter, this will not impact BoJ policy, given the Bank’s continue focus on a lack of demand-pull inflation.

- Payside flows in swaps also seemed to help the weakness, with 5+-Year swap spreads wider on the day.

- The BoJ continues to offer fixed rate operations on a daily basis as it looks to hammer home its commitment to enforcing the upper end of its permitted 10-Year JGB yield trading band. Note that 10-Year JGB yields sit at ~0.24%, 1bp shy of the BoJ’s YCC upper limit.

- Off-the-run supply saw the spreads widen a touch via the prior 1- to 5-Year liquidity enhancement auction, while the cover ratio ticked higher. There was nothing in the way of meaningful reaction post-supply, with the stabilisation away from lows in wider core FI markets helping JGBs find a bit of a base after the Tokyo lunch break.

- Domestic news flow focused on the further wind back of COVID-related border restrictions.

- Looking ahead, wage data headlines the domestic docket on Monday, with the latest round of BoJ Rinban operations and outdated meeting minutes from the Bank’s March MPM also slated.

JGBS AUCTION: Japanese MOF sells Y4.771tn 3-Month Bills:

- Average Yield -0.1343% (prev. -0.1191%)

- Average Price 100.0335 (prev. 100.0320)

- High Yield: -0.1162% (prev. -0.1172%)

- Low Price 100.0290 (prev. 100.0315)

- % Allotted At High Yield: 92.9294% (prev. 32.6938%)

- Bid/Cover: 2.500x (prev. 3.893x)

JGBS AUCTION: Japanese MOF sells Y498.7bn of 1-5 Year JGBs in a liquidity enhancement auction:

Japanese MOF sells Y498.7bn of 1-5 Year JGBs in a liquidity enhancement auction:

- Average Spread: +0.005% (prev. -0.002%)

- High Spread: +0.007% (prev. 0.000%)

- % Allotted At High Spread: 39.1222% (prev. 17.0668%)

- Bid/Cover: 4.4182x (prev. 4.0664x)

AUSSIE BONDS: Off Lows, Largely Being Driven By U.S. Tsy Flows

Flows surrounding U.S. Tys were a dominant factor for the space during Sydney dealing. Meanwhile, the removal of any hedging pressure after A$500mn of 2030-32 NSW TCorp issuance priced further played into the move away from worst levels of the Sydney session.

- YM -6.0 and XM & XM -7.0 at typing, after both failed to get anywhere near challenging their respective cycle lows earlier in the session.

- ACGB Nov-27 supply saw the weighted average yield print 1.19bp through prevailing mids, although cover came in at ~2.50x. As we flagged in our preview, it would seem that market vol. and the hawkish RBA market pricing is keeping many prospective bidders sidelined, while the lack of liquidity means that those that want to guarantee access to the line are having to pay up at auction.

- Elsewhere, the formal release of the RBA’s SoMP provided little impetus for markets as the RBA’s post-meeting statement and Governor Lowe’s subsequent press conference had already fleshed out the shift in the Bank’s inflation forecasts. Wage growth expectations were marked higher, with such a move also flagged in the Bank’s post-decision rhetoric. There was nothing in the way of further discussion when it came to terminal & neutral rate assumptions.

- Next week’s AOFM issuance slate is a little busier, with some Note supply, a couple of ACGB auctions (including A$400mn of ACGB Jun-51) and indexed issuance all due.

AUSSIE BONDS: The AOFM sells A$1.0bn of the 2.75% 21 Nov ‘27 Bond, issue #TB148:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 2.75% 21 November 2027 Bond, issue #TB148:

- Average Yield: 3.2963% (prev. 0.7875%)

- High Yield: 3.3000% (prev. 0.7875%)

- Bid/Cover: 2.5250x (prev. 5.6750x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 63.8% (prev. 66.3%)

- Bidders 36 (prev. 57), successful 18 (prev. 11), allocated in full 9 (prev. 1)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Tuesday 10 May it plans to sell A$100mn of the 1.00% 21 February 2050 Indexed Bond.

- On Wednesday 11 May it plans to sell A$400mn of the 1.75% 21 June 2051 Bond.

- On Thursday 12 May it plans to sell A$1.5bn of the 22 July 2022 Note.

- On Friday 13 May it plans to sell A$1.0bn of the 1.25% 21 May 2032 Bond.

EQUITIES: Lower In Asia; JPY Weakness Helps Japan Avoid Peer Rout

Most Asia-Pac equity indices are lower at writing, largely tracking Wall St.’s rout on Thursday. Richly valued names across sectors and geographies broadly led losses, with spillover debate from the NY session re: highly-valued equities in a time of rising rates, doing the rounds in Asia.

- The Hang Seng brought up the rear amongst index peers, trading 3.6% lower at typing. Investors are continuing to shrug off multiple specifically-worded pledges from Chinese authorities and state media to support the development of “internet platform companies”, with the Hang Seng Tech Index sitting 5.0% worse off at typing, led by losses in Tencent (-4.5%), JD.com (-6.7%), and Bilbili (-9.0%). The selloff in China-based tech largely tracks a decline in the NASDAQ Golden Dragon China Index (-7.7%) on Thursday, with the move in the latter coming amidst notable weakness in tech and software-related names during the NY session.

- The Nikkei 225 bucked the broader negative trend, outperforming major equity index peers on its first day back from a three-day holiday, sitting 0.9% better off and operating at session highs at typing. Energy and utility equities saw the most gains, tracking gains in major energy benchmarks over the holiday period. Export-related names (such as automakers) caught a broad bid as well, with large-caps such as Fast Retailing (+1.6%) rising amidst another bout of JPY weakness. Overall, ~200 of the index’s 225 constituents are in the green at typing.

- U.S. e-mini equity index futures are virtually unchanged at writing, belying a 3.1% to 5.0% lower daily close on Thursday, led by losses in NASDAQ contracts. The overall move lower has erased virtually all post-FOMC gains, seeing the e-minis operate at ranges seen earlier in the week.

OIL: Higher In Asia; WTI Holding Below Multi-Week Highs

WTI and Brent are ~$0.50 firmer apiece at writing to print $108.80 and $111.40 respectively, having risen above neutral levels to extend a move off of Thursday’s trough.

- To recap, WTI and Brent pared gains after hitting nine-week ($111.37) and three-week ($114.00) highs respectively on Thursday, both ultimately closing little changed on the day. Worry over stagflation and Dollar strength has continued to take centre stage against well-documented fears over disruptions to global supplies, with downward pressure from issues such as Chinese energy demand destruction receding as the country shows signs of bringing the current COVID outbreak under control.

- To elaborate on the latter, COVID cases in China have continued their steady downtrend, with officials in Shanghai declaring that community spread there has been “effectively contained”. The matter may bear watching however, with surveys of Japanese factories in Shanghai reportedly pointing to a majority still being shut, with those opening reporting reduced output as well. Cases in Beijing have continued edging upwards as well (count for May 5 stands at 72 vs 50 for May 4), coming as China’s Politburo doubled down on their COVID-Zero strategy on Thursday.

- Elsewhere, the U.S. govt fuelled some concern re: tight fuel supplies, announcing a plan to buy up to 60mn bbls of crude for strategic reserves by end-2022, with delivery to happen sometime “after FY23”. The move was tipped as part of an effort to replenish the planned 180mn bbl drawdown announced earlier this year, potentially paving the way for similar announcements in the future.

GOLD: Headed For Pre-FOMC Range As Dollar, Nominal Tsy Yields Surge

Gold sits ~$5/oz lower, printing $1,872/oz at typing. The move lower extends Thursday’s losses and sees the precious metal give up virtually all post-FOMC gains, with the weakness facilitated by an uptick in nominal U.S. Tsy yields and the USD (DXY) during the session.

- To recap, gold closed ~$11/oz lower on Thursday as U.S. real yields and the USD (DXY) broadly surged to/above pre-FOMC levels, facilitating a sharp decline in the NY session after hitting one-week highs at $1,909.8/oz.

- Zooming out, the yellow metal trades in a range just above 11-week lows made earlier this week, with the geopolitical risk premium re: the Russia-Ukraine conflict almost entirely countered by evident worry re: rising rates and Dollar strength.

- Looking ahead, U.S. labour data (NFPs, AHE, Hours Worked etc.) crosses later on Friday at 1230 GMT. A note that this comes after the ADP employment data miss and ISM Services employment sub-component decline earlier in the week, while also keeping in mind debate re: the long-term correlation between ADP and NFP data.

- From a technical perspective, resistance for bullion is situated around $1,913.9.oz (20-Day EMA), while support is eyed at $1,850.5/oz (May 3 low).

FOREX: Yuan In Retreat Despite Appreciation Bias In PBOC Fix, Yen Goes Offered After Holiday

Offshore yuan went offered despite the PBOC's continued efforts to push back against its depreciation via the daily USD/CNY fixing. Spot USD/CNH ripped through the CNH6.7000 figure for the first time since Nov 2020, which generated an incremental tailwind for USD crosses across the board, keeping the DXY close to its recent cycle highs. Gains for USD/CNH were capped at CNH7339 and the pair eased off from there, while consolidating above CNH6.7000.

- The yen went offered as Japanese financial markets re-opened after a three-day hiatus. USD/JPY extended its rally after yesterday's swing into a weekly gain. This puts the rate on track for a ninth consecutive week of gains, the longest uninterrupted winning streak since 2013.

- Sterling regained poise with BoE monetary policy decision & accompanying gloomy economic forecasts already in the rear-view mirror. Vote counting began overnight after the UK held local elections on Thursday.

- U.S. NFP repot headlines the global data docket on Friday, with Canada also due to report its labour market figures.

- There is plenty of central bank speak coming up today, from a diverse cohort of Fed, ECB, BoE & Riksbank members.

FOREX OPTIONS: Expiries for May06 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0425-30(E550mln), $1.0570-75(E523mln), $1.0600(E581mln), $1.0650(E782mln), $1.0700(E569mln)

- GBPUSD: $1.2450(Gbp542mln)

- EUR/GBP: Gbp0.8500-10(E551mln), Gbp0.8575(E755mln)

- USD/JPY: Y128.50($1.1bln)

- AUD/USD: $0.7100(A$765mln), $0.7200(A$931mln), $0.7300(A$2.1bln)

- AUD/NZD: N$1.1000(A$509mln), N$1.1050(A$507mln)

- USD/CAD: C$1.2700($639mln), C$1.2750-60($934mln), C$1.2800($991mln), C$1.2840($1.4bln), C$1.3055($1.7bln)

- USD/CNY: Cny6.6500($630mln), Cny6.7000($1.5bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/05/2022 | 0545/0745 | ** |  | CH | unemployment |

| 06/05/2022 | 0600/0800 | ** |  | DE | Industrial Production |

| 06/05/2022 | 0600/0700 | * |  | UK | Halifax House Price Index |

| 06/05/2022 | 0700/0900 | ** |  | ES | Industrial Production |

| 06/05/2022 | 0730/0930 |  | SE | Riksbank Minutes April meet | |

| 06/05/2022 | 0800/1000 | * |  | IT | Retail Sales |

| 06/05/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/05/2022 | 1115/1215 |  | UK | BOE Pill Monetary Policy Report National Agency briefing | |

| 06/05/2022 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 06/05/2022 | 1230/0830 | *** |  | US | Employment Report |

| 06/05/2022 | 1315/0915 |  | US | New York Fed's John Williams | |

| 06/05/2022 | 1400/1000 | * |  | CA | Ivey PMI |

| 06/05/2022 | 1500/1600 |  | UK | BOE Tenreyro Lecture at Irish Economic Association | |

| 06/05/2022 | 1500/1100 |  | US | Minneapolis Fed's Neel Kashkari | |

| 06/05/2022 | 1900/1500 | * |  | US | Consumer Credit |

| 06/05/2022 | 1920/1520 |  | US | Atlanta Fed's Raphael Bostic |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.