-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI EUROPEAN MARKETS ANALYSIS: King USD Reigns Supreme In Asia Hours

- Risk-negative headline flow coupled with an uptick in longer dated U.S. Tsy yields (in reaction to Friday's NY dynamic) weighed on eminis and supported the USD overnight.

- Worry surrounding well-defined areas of geopolitical risk, in addition to the Chinese labour market and COVID in China dominated weekend news flow.

- The global data docket is rather thin today and includes Norwegian industrial output & Canadian building permits. More focus is set to fall on Russian President Putin's annual Victory Day address, which could be used to outline the country's next steps in the "special operation" in Ukraine.

US TSYS: Back From Early Lows, Risk-Off Headlines Fight With Friday Spill Over

Early Asia trade saw the major Tsy futures contracts provide fresh cycle lows as participants reacted to Friday’s NY bear steepening.

- Still, it wasn’t all one-way trade, with risk-off weekend headline flow, including focus on fresh western sanctions on Russia, another North Korean missile launch, a warning re: the “complicated and grave” situation that the Chinese labour market is facing via the country’s Premier and deeper mobility restrictions in areas of Beijing (confirmed) & Shanghai (rumoured, per RTRS sources), allowing the space to recover from worst levels. Note that the aforementioned cocktail of risk-negative headline flow, coupled with participants’ being cognisant of headline risks surrounding the Russia-Ukraine conflict (ahead of President Putin’s annual Victory Day parade address, scheduled for later today), leaves e-minis ~1.0% lower on the day at typing. Still e-minis are off of worst levels of the session, allowing Tsys to move away from richest levels.

- The latest round of monthly Chinese trade data did little for the space (exports and imports both beat exp., providing a slightly narrower than expected Chinese trade surplus for the month of April).

- TYM2 hovers just below the middle of its 0-12+ Asia-Pac range as a result, last dealing -0-06 at 117-19+. Note that technical support isn’t really seen until the 0.764 projection of the Mar 7-28-31 price swing (116-28), with the contract’s primary downtrend extending and moving average studies in bear mode. Cash Tsys have twist steepened around 5s, running 0.5bp richer to ~2bp cheaper across the curve.

- Looking ahead, Monday’s NY docket is slim, with wholesale data due.

JGBS: Tight Tokyo Trade

Cash JGBs sit little changed to ~2.0bp cheaper, with 7s running 1.0bp cheaper, underperforming surrounding lines, while 30s provide the weakest point on the curve. This was a function of Friday’s bear steepening on the U.S. Tsy curve. Meanwhile, futures stuck to a tight range, dealing -12, respecting the confines of the overnight range observed ahead of the weekend.

- 10-Year JGB yields hover around 0.245%, 0.5bp away from the upper limit of the BoJ’s permitted 10-Year JGB yield trading band.

- Local headline flow has been relatively light.

- March’s domestic wage data was a touch firmer than expected, although real wage data still printed in negative territory.

- BoJ Rinban operations provided no real market moving impetus.

- Household spending data and 10-Year JGB supply headline Tuesday’s domestic docket.

AUSSIE BONDS: Off Lows But Still Cheaper

Weakness in e-minis and a subsequent bid in the U.S. Tsy space (on the previously outlined risk-negative headline flow) has provided support for Aussie bond futures, which were already relatively resilient in early Sydney trade, perhaps representing a degree of cross-market demand vs. the likes of U.S. Tsys after Friday’s U.S. Tsy-driven cheapening in futures during post-Sydney dealing. Still, bond futures have faded from best levels of the day, with e-minis off lows, even with the S&P 500 contract ~1.0% lower vs. Friday’s settlement. This comes after both YM & XM respected their overnight lows in early Sydney dealing, with the former dealing -2.5 & the latter -8.5 at typing.

- The cash ACGB curve has bear steepened, with a fairly parallel shift observed in the 10+-Year zone.

- EFPs have narrowed a touch, with the 3-/10-Year box flattening.

- The IR strip has twist steepened, running +6 to -7 through the reds.

- Monthly Chinese trade data did little for the space.

- Tuesday’s local event risk includes the monthly NAB business survey, CBA household spending data and the Q1 retail sales ex-inflation reading. We will also get index-linked supply from the AOFM.

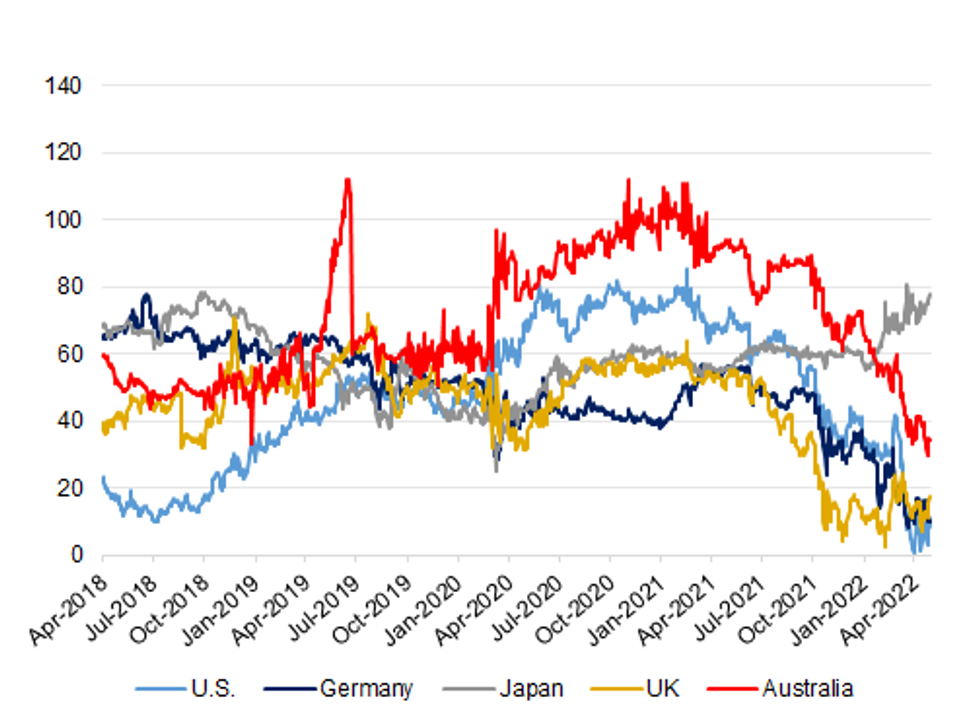

BONDS: JGB Curve Still Steep Vs. Major Peers

The JGB curve continues to offer by far the steepest 10-/30-Year slope when compared to a group of its major global fixed income peers (namely the U.S., UK, Germany & Australia).

- Wider core fixed income markets have been subjected to the hawkish repricing of the major global central banks in recent months (excluding the BoJ), pressuring the short end of the previously flagged global core FI curves (excluding Japan), while growth and recession fears are also playing into the broader flattening dynamic. Granted, the U.S. curve operates a little off cycle flats with the FOMC pushing back against some of the more hawkish market expectations re: tightening, while flow specific matters may have also played into Tsy curve dynamics in recent weeks.

- Conversely, the BoJ’s continued commitment to its 10-Year JGB yield target band of -/+0.25%, which has been backed up by action in recent months, coupled with the combination of a relative lack of BoJ control in the longer end of the JGB curve and the wider bearish impulse observed in the core global FI space, has allowed the JGB curve to steepen.

- This dynamic, alongside the wider vol. observed in global financial markets, jumping FX-hedging costs (magnified by the well-documented run of JPY weakness observed in recent weeks), inflationary threat and questions re: the required level of wider central bank tightening is seemingly keeping Japanese investors away from offshore fixed income markets. Indeed, Japanese participants have net sold foreign paper during 11 of the latest 13 weeks observable via the Japanese weekly international security flow data (with the two weeks that didn’t see net selling flows only seeing Y10.5 and Y18.0bn of net purchases), net selling ~Y7.1tn of foreign paper in that time. More granularly, there have been some suggestions that Japanese investors have been showing interest in European paper in recent weeks, while shedding exposure to U.S. Tsys.

- Note that this general dynamic when it comes to asset allocation e.g. some hesitance surrounding/shedding of U.S. Tsys, eying European bonds and diversifying in to credit markets were all factors alluded to in the recent semi-annual investment interviews released by Japanese life insurers. As was the potential for a more pronounced home bias to develop.

Fig. 1: Major 10-/30-Year Government Bond Yield Curves (bp)

Source: MNI Market News/Bloomberg

Source: MNI Market News/Bloomberg

FOREX: China Jobs Market Worry, Geopolitical Risks Undermine Risk Appetite

The mood music turned sombre in response to risk-negative headline flow from over the weekend. North Korea test-launched a ballistic missile from a submarine. This latest drill comes ahead of the presidential inauguration of South Korea's Yoon Suk-yeol, who will take office on Tuesday. As we near the European session, focus turns to the annual Victory Day military parade in Russia, with President Putin expected to touch upon the ongoing invasion of Ukraine in his address to the nation.

- Downbeat comments from Chinese Premier Li on domestic labour market situation reverberated across Asia, applying pressure to the redback and the broader Asia EM FX space. Offshore yuan went offered, even as the PBOC continued to lean against its depreciation via the daily fixing of USD/CNY mid-point.

- Yuan weakness amplified pressure to the Antipodeans, with AUD/USD finding itself within touching distance from the psychologically significant $0.7000 figure. The AUD and NZD led commodity-tied FX lower, even as crude oil prices recouped their initial dip.

- The greenback gained across the board as hawkish Fedspeak was doing the rounds. During NY hours on Friday, MNI ran comments from Fed's Barkin who said that "anything would be on the table," including an outsized 75bp rate hike.

- The prospect of tighter monetary policy helped the U.S. dollar outperform its safe haven peers CHF and JPY. As a result of greenback strength, USD/JPY marched to its best levels since Apr 28, when the pair printed its multi-decade high of Y131.25.

- The global data docket is rather thin today and includes Norwegian industrial output & Canadian building permits.

FOREX OPTIONS: Expiries for May09 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500-20(E929mln), $1.0680-95(E1.5bln)

- AUD/USD: $0.7100(A$1.3bln), $0.7125(A$658mln)

- USD/CAD: C$1.2805-20($1.4bln)

ASIA FX: Risk-Off Flows Sweep Through Asia EM Space

Risk aversion dominated at the start to the week in Asia amid expectations of hawkish resolve from the Fed as well as concerns over the state of China's economy and a range of geopolitical risks.

- CNH: The yuan went offered across the board after Chinese Premier Li warned of "complicated and grave" situation in domestic labour market. The redback ignored another firmer than expected PBOC fix, with the USD/CNY reference rate set 39 pips below sell-side estimate. Spot USD/CNH advanced to a fresh cycle high of CNH6.7475.

- KRW: Spot USD/KRW traded on a slightly firmer footing. Over the weekend, North Korea conducted a test of a submarine-launched missile, ahead of Tuesday's inauguration of South Korean President-elect Yoon.

- IDR: Spot USD/IDR crept higher ahead of the release of local GDP & CPI data. Bank Indonesia's Director Susianto said the central bank was committed to be in the market to stabilise the rupiah if needed, but will prioritise market mechanism in managing the FX rate. Onshore markets re-opened after a week-long closure.

- The MYR went offered as risk-off flows took hold, which allowed spot USD/MYR to lodge a new cycle high. Cautious feel also sapped strength from THB, albeit spot USD/THB failed to re-test May 3 cycle high.

- INR: The rupee tumbled to an all-time low as the risk switch was flicked to off.

- Financial markets in the Philippines were closed for the Election Day.

EQUITIES: Lower In Asia; Nikkei Gives Up Holiday Gains

Most Asia-Pac equity indices are in the red at typing, following a negative lead from Wall St., and a well-documented series of risk-off headlines over the weekend.

- The Nikkei 225 trades 2.2% lower after opening lower, operating a touch above session lows at writing. The move lower has unwound the Nikkei’s post-Golden Week holiday gains, with the benchmark index facing resistance above 27’000 points. Large-caps such as Fast Retailing Co (-6.2%) and Keyence Corp (-3.2%) provided most drag to the index, Ultimately, ~200 of the index’s 225 constituents are in the red at typing, with only the utilities and energy sub-indices managing to eke out gains.

- The Australian ASX200 is 1.2% worse off at typing, with notable losses in the major miners such as Rio Tinto (-3.0%), BHP Group (-1.5%), and Fortescue Metals (-6.2%) neutralising gains seen in energy-related equities. A note that the 6-month correlation between the ASX200 and the AUD has recently climbed to decade-long highs, with today’s AUD weakness (noting broader weakness in the commodity-related currencies as commodities such as iron ore have come under pressure in Asia-Pac dealing) contributing to underperformance in the relatively commodity-heavy Australian equity space.

- The CSI300 deals 0.7% weaker at typing, with weakness in consumer discretionary and consumer staples equities bearing the brunt of losses in the index. Equity benchmarks saw virtually no reaction to Chinese trade data showing Chinese exports slowing to near two-year lows.

- U.S. e-mini equity index futures sit 0.9% to 1.0% worse off, operating at/around multi-month lows made earlier in the session at typing.

GOLD: Lower In Asia; Eyeing Fedspeak, CPI Later This Week

Gold sits ~$7/oz worse off to print $1,877/oz, operating around session lows and the middle of its pre-weekend range at typing.

- The move lower comes as nominal U.S. Tsy yields across the curve have broadly continued to hold a little below recent cycle highs despite a light bid in U.S. Tsys, while renewed Dollar strength has seen the USD (DXY) approach cycle highs made last Friday.

- Looking at Friday’s price action, gold finished a little higher on the day, but was unable to avoid a third consecutive lower weekly close. The yellow metal has struggled in recent sessions as U.S. real yields and the DXY have staged consecutive weekly higher closes of their own, with the latter hitting two-decade highs on Friday before recording a fifth straight week of gains.

- Focusing on the week ahead, a packed Fedspeak itinerary is scheduled for Tuesday from the likes of Williams (voter), Barkin (‘24), Waller (voter), Kashkari (‘23), and Mester (‘24), right before U.S. Apr CPI and PPI crosses on Wed and Thu respectively.

- From a technical perspective, bullion remains vulnerable given a sustained pullback from recent highs at $1,998.4/oz (Apr 18 high) and a break below $1,890.2/oz (Mar 29 low). Support is seen at $1,848.8/oz (76.4% of the Jan28-Mar8 rally), while resistance is situated at ~$1,910.4/oz (20-Day EMA).

OIL: Higher As Worry Over Chinese Demand Moderates; EU Struggles Towards Oil Embargo

WTI and Brent are ~$0.40 better off apiece, printing ~$110.20 and ~$112.80 respectively at writing. Both benchmarks have reversed earlier losses, with the move higher receiving support from news surrounding improvements in China’s ongoing COVID outbreak, easing some well-documented concern re: continued pressure on Chinese energy demand.

- To elaborate, COVID cases in China have continued their downward trend, with the tally of fresh cases for Sunday in the outbreak epicentre of Shanghai hitting their lowest levels in six weeks. Factory activity has increased, with battery-maker CATL declaring that production at their Shanghai factory has returned to pre-pandemic levels. Turning to Beijing, fresh daily cases have moderated (49 for Sunday), while the city has continued tightening pandemic control measures at a relatively slow pace.

- On the latter topic, authorities in Beijing further tightened measures in the city’s outbreak epicentre of Chaoyang, instructing office workers in the district to work from home, adding to existing measures for shutdowns of some non-essential businesses (e.g. gyms and theatres).

- Elsewhere, worry surrounding tightness in fuel supply arising from EU sanctions on Russian crude has eased amidst resistance towards the proposal from Hungary, which last voiced opposition to the proposal on Sunday. With the 27-member bloc requiring consensus to move ahead with sanctions, BBG source reports have pointed to discussions to be held “over the next few days”, aimed at addressing well-documented Hungarian opposition.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/05/2022 | 0645/0845 | * |  | FR | Current Account |

| 09/05/2022 | 0645/0845 | * |  | FR | Foreign Trade |

| 09/05/2022 | 1230/0830 | * |  | CA | Building Permits |

| 09/05/2022 | 1300/1400 |  | UK | BOE Saunders Speaks at Resolution Foundation Event | |

| 09/05/2022 | 1400/1000 | ** |  | US | Wholesale Trade |

| 09/05/2022 | 1500/1100 | ** |  | US | NY Fed Survey of Consumer Expectations |

| 09/05/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 09/05/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.