-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Flows Dominate In Headline Light Asia Session

EXECUTIVE SUMMARY

- FED’S BOSTIC SAYS NO NEED TO MOVE FASTER THAN HALF-POINT HIKES (BBG)

- EU WEIGHS JOINT DEBT TO FUND UKRAINE’S LONG-TERM RECONSTRUCTION (BBG)

- HUNGARY SEES ‘SOME PROGRESS’ IN EU TALKS ON OIL EMBARGO (BBG)

- TRUSS SET TO DITCH NORTHERN IRELAND PROTOCOL AFTER GIVING UP ON EU TALKS (TIMES)

- CHINA’S YUAN UNLIKELY TO SEE FURTHER SHARP DROP (SEC DAILY)

- CHINA VICE PREMIER REITERATES DYNAMIC COVID ZERO POLICY (XINHUA)

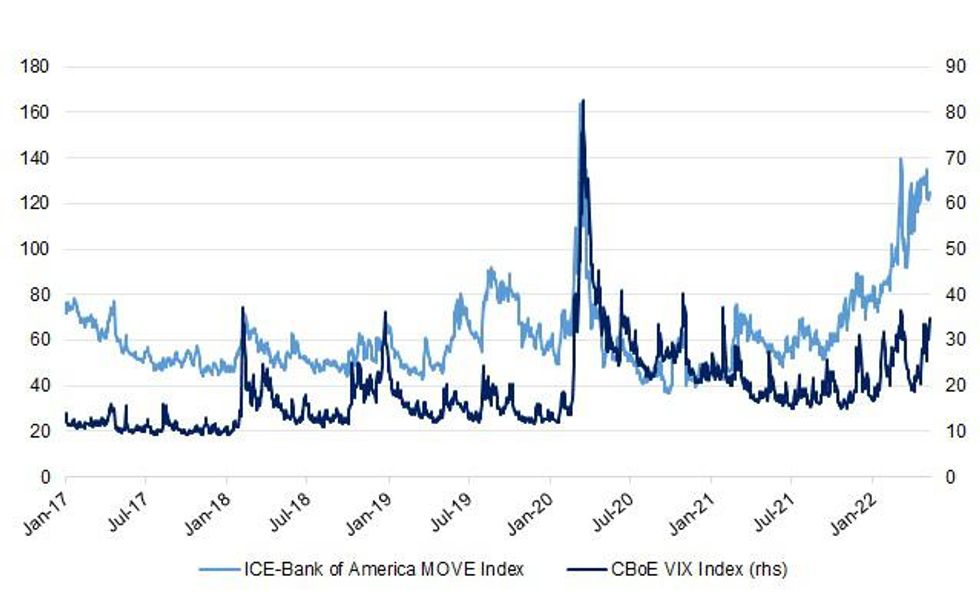

Fig. 1: ICE-Bank of America MOVE Index vs. CBoE VIX Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BREXIT: The foreign secretary has concluded that there is little point trying to reach a Brexit deal with the European Union and will move as soon as next week to scrap large parts of the Northern Ireland protocol in British law. Officials working for Liz Truss have drawn up draft legislation that would unilaterally remove the need for all checks on goods being sent from Britain for use in Northern Ireland. It would also allow businesses in the province to disregard EU rules and regulations and take away the power of the European Court of Justice to rule on issues relating to Northern Ireland. (The Times)

ECONOMY: British shoppers, feeling the hit from surging inflation, cut their spending for the first time since early 2021 when the country was under a coronavirus lockdown, according to a survey published on Tuesday. The British Retail Consortium (BRC) said total retail spending among its members - mostly large chains and supermarkets - was 0.3% lower than a year earlier, compared with 3.1% annual growth in March. "The rising cost of living has crushed consumer confidence and put the brakes on consumer spending," BRC chief executive Helen Dickinson said. (RTRS)

ECONOMY: Separate data from payment processor Barclaycard, covering a broader range of spending, showed outlays on essential items grew by slightly less in April than in March as drivers cut back on fuel and shoppers sought to save money on groceries. But average spending on utilities leapt by almost 30% compared with a year ago as household energy tariffs went up. Overall spending by consumers grew 18.1% in April compared to the same period in 2019, reflecting the rising energy costs. (RTRS)

EUROPE

FISCAL: The European Union is considering the issuance of joint debt to finance Ukraine’s long-term reconstruction, which may end up costing hundreds of billions of euros, according to an EU official familiar with the plan. The European Commission is also weighing the use of loans from the EU budget -- and guaranteed by member states -- to provide urgent funds to Ukraine to pay salaries and benefits that may amount to as much as $15 billion over the next three months, said the official, who asked not to be identified because the plan is private. The commission, the bloc’s executive arm, will present the plan as part of a broader package addressing the financial needs of Ukraine on May 18, according to the official. The bloc wants to set up a platform with Group of Seven countries to contribute to the effort, with the EU taking the lead. (BBG)

FISCAL: The European Commission is planning to issue new EU debt to cover Ukraine’s short-term financing needs over the next three months, estimated at €15 billion, three diplomats with knowledge of the discussion told POLITICO. The plan would be unveiled as early as May 18, they said. The Commission briefed EU ambassadors Friday on a plan to bridge that gap, which would entail the Commission issuing debt on the back of guarantees provided by EU countries. That's similar to the so-called SURE program used during the pandemic to raise funds for the short-term unemployed, the diplomats said. (POLITICO)

GERMANY: Germany’s economy faces losing around 12 per cent of its annual output — some €429bn — if Russian natural gas supplies stopped abruptly, according to a new study by an adviser to the government. The study by Tom Krebs, an economics professor at the University of Mannheim who advises the finance ministry in Berlin on economic policy, is more pessimistic than most previous estimates and is likely to stiffen the government’s resolve in resisting calls for an immediate EU embargo on all Russian energy imports. (FT)

FRANCE: France's economy will escape from stagnation in the current quarter and eke out meagre growth, although inflation will continue to weigh on consumers, the INSEE official statistics agency forecast on Monday. The euro zone's second-biggest economy will return to growth in the second quarter, expanding 0.25% over the three months as parts of the service sector see business pick up after COVID restrictions were eased at the start of the year, INSEE said in its economic outlook. The economy flatlined in the first quarter as record-high inflation sapped consumer spending, usually the driver of French growth, INSEE said last month. (RTRS)

ITALY/BTPS: Italy plans to sell up to EU2 billion ($2.11 billion) of 1.2% bonds due Aug. 15, 2025 in an auction on May 12. Italy plans to sell up to EU3.75 billion ($3.95 billion) of bonds due June 15, 2029 in an auction on May 12. Italy plans to sell up to EU1 billion ($1.05 billion) of 3.45% bonds due March 1, 2048 in an auction on May 12. (BBG)

ENERGY: The governments of Portugal and Spain will decree on Tuesday the introduction of a Brussels-backed temporary cap on reference prices of natural gas and coal used by power plants, Portuguese Prime Minister Antonio Costa said on Monday. The European Commission agreed two weeks ago to allow the Iberian nations to initially cap prices at 40 euros per megawatt-hour, with the price limit projected to average out at 50 euros over the coming 12 months. (RTRS)

U.S.

FED: Federal Reserve Bank of Atlanta President Raphael Bostic said he favors policy makers continuing to raise rates by half-point increments rather than doing anything larger. A half-point hike ‘’is already a pretty aggressive move,” Bostic told Michael McKee in an interview on Bloomberg Television on Monday. “I don’t think we need to be moving even more aggressively. I think we can stay at this pace and this cadence and really see how the markets evolve.” In a later interview with Reuters broadcast on Twitter, Bostic added that he while he saw low odds for a 75-basis-point hike in the next several months, “I am not taking anything off the table.” (BBG)

FED: A report from the Fed Res said sharp increase in interest rates to prevent inflation shocks will pose a risk to the American economy, a higher than normal chance that trading conditions in financial markets will suddenly deteriorate. In the Fed’s financial stability report, further adverse surprises in inflation and interest rates, particularly if accompanied by a decline in economic activity, could negatively affect the financial system. US also issued a warning about liquidity following several frenzied months in US markets. A sell-off has wiped trillions of dollars off the value of stocks and bonds while closing the door on new share listings and raising borrowing costs for consumers and corporations. (FT)

INFLATION: President Joe Biden said that his infrastructure law had cut broadband internet bills for millions of Americans, casting the program as part of his efforts to fight high inflation. The Biden administration said Monday that 20 of the largest broadband providers would make high-speed plans—at least 100 megabits per second—available for $30, making the plans free after the discount. The companies cover about 80% of the U.S. population. “We made sure there would be no hidden fees, no tricks—this is straight-up stuff,” Biden said. He added later: “My top priority is fighting inflation and lowering prices for families and things they need.” (BBG)

ECONOMY: MNI INTERVIEW: Lawmakers Push For More Frequent US Income Data

- Democratic U.S. lawmakers are pushing for the Bureau of Economic Analysis to produce more frequent quarterly disaggregated data on U.S. personal income, Congressman Jim Himes, who is advocating Commerce Department funding of the project and says more frequent data would help policymakers including those at the Federal Reserve, told MNI. "You can't manage what you don't measure and aggregate measures in a economy as diverse as ours miss most of the story," said Himes, a Democrat of Connecticut, adding he thinks the measure will attract bipartisan support - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

FISCAL: Congressional Democratic leaders have reached a bipartisan accord to send $39.8 billion to Ukraine to bolster its months-long battle to stave off a brutal Russian assault. And that deal is now expected to move swiftly to President Joe Biden’s desk after Democrats agreed to drop another one of their top priorities — billions of dollars in pandemic aid that has stalled on the Hill. The Ukraine aid could come to the House floor for a vote as soon as Tuesday, according to a person familiar with the discussions who spoke candidly on condition of anonymity. (POLITICO)

MARKETS: Treasury Secretary Janet Yellen believes the U.S. financial system is in working order, but that Russia’s invasion of Ukraine and China’s Covid-19 lockdowns are making some goods more expensive. Yellen, set to testify before the Senate Banking Committee on Tuesday, said she and other top financial regulators wouldn’t be surprised to see market turbulence keep up into the summer. “There is the potential for continued volatility and unevenness of global growth as countries continue to grapple with the pandemic,” Yellen said in her written testimony, which was released by the committee ahead of the hearing. (CNBC)

MARKETS: Goldman Sachs Group Inc. is pulling out of working with most SPACs it took public, spooked by new liability guidelines from regulators and throwing into doubt the fate of billions raised for those blank-check vehicles. The Wall Street giant, the second-biggest underwriter of special purpose acquisition companies last year, has been telling sponsors of the vehicles it will be ending its involvement, according to people with knowledge of the matter. The bank is also electing to pause new U.S. SPAC issuance for now, one of the people said. (BBG)

OTHER

GEOPOLITICS: As Europe’s largest conflict since World War II rages in Ukraine, top Biden administration aides are increasingly convinced it could provide the U.S. with an unexpected advantage -- against China. U.S. officials see the conflict’s toll and the slew of sanctions placed on Moscow as leaving Russia hobbled for years to come. Combined with bolstered European defense spending, that means the U.S. may have a freer hand to accelerate its long-term shift toward China, viewed as America’s biggest future challenge, according to several officials interviewed by Bloomberg News. The officials acknowledge that the war’s outcome is uncertain. And previous attempts to channel U.S. government attention toward Asia have ended up derailed by events in the Middle East and elsewhere, including former President Barack Obama’s “pivot” to Asia. (BBG)

GEOPOLITICS: U.S. President Joe Biden's upcoming trip to Seoul and Tokyo seeks to send a clear message that the U.S. continues to remain committed to addressing various challenges in the region, a White House official said Monday. Kurt Campbell, Indo-Pacific policy coordinator at the National Security Council, added the U.S. also recognizes that larger and most pressing challenges for the country and the rest of the world lie in the Indo-Pacific region. "The overriding message that we are seeking to send is that although there are urgent and immediate tasks ahead of us in Ukraine that are unavoidable and must be met by a transatlantic unity that is profound, deep and sustained, but at the same time, we must recognize that the larger, more fundamental challenges for the 21st century really lay in the Indo-Pacific region," Campbell said of Biden's upcoming trip. (Yonhap)

JAPAN: Japan will closely communicate with the United States and other Group of Seven countries in any actions it takes in response to a rapidly weakening yen, Finance Minister Shunichi Suzuki said on Tuesday. Suzuki made the remarks as the Japanese currency hovered around 20-year lows against the dollar, stoking worries about boosting the cost of living to households. "Stability is important and rapid moves as seen recently are undesirable," Suzuki told reporters after a cabinet meeting. (RTRS)

BOJ: Bank of Japan Executive Director Shinichi Uchida says that widening the central bank’s yield target band would be equivalent to a rate hike and wouldn’t be favorable for Japan’s economy. Uchida responds to questions in parliament about BOJ’s 10-year yield target range of 25 basis points either side of zero. Japan’s economy is still in the process of a recovery from the pandemic and needs support from monetary easing, he says. (BBG)

AUSTRALIA: Australia’s home buying intentions fell 13.1% in April from a year earlier, the largest drop since April 2019, according to a report released by the Commonwealth Bank of Australia. General household spending intentions fell 3.8% from a month earlier due to seasonal factors such as the Easter holiday. (BBG)

RBNZ: New Zealand's central bank said on Tuesday it continues to support plans from an independent government body to strengthen climate-related disclosures by the country's financial firms. Officials had said that the disclosure requirements will be based on standards from New Zealand's independent accounting body, the External Reporting Board (XRB), which is responsible for implementing accounting, auditing and climate standards. The Reserve Bank of New Zealand (RBNZ) said on Tuesday it was engaging closely with the XRB on how to implement the laws. (RTRS)

NORTH KOREA: The United States scheduled an emergency meeting of the U.N. Security Council on Wednesday following North Korea’s latest test of a ballistic missile that was likely fired from a submarine as it presses for new sanctions on the reclusive northeast Asian nation. So far this year, North Korea has fired missiles 15 times. They include the country’s first test of an intercontinental ballistic missile since 2017 in March that demonstrated a potential range to reach the entirety of the U.S. mainland. (AP)

NORTH KOREA: South Korea's new president, Yoon Suk-yeol, said on Tuesday that North Korea's weapons programmes pose a threat but that he is ready to provide an "audacious" economic plan if the North is committed to denuclearisation. "While North Korea's nuclear weapon programs are a threat not only to our security and that of Northeast Asia, the door to dialogue will remain open so that we can peacefully resolve this threat," Yoon said. "If North Korea genuinely embarks on a process to complete denuclearisation, we are prepared to work with the international community to present an audacious plan that will vastly strengthen North Korea's economy and improve the quality of life for its people," he added. (RTRS)

BRAZIL: Brazil’s government is studying removing import tariffs on steel and ten more items, including food and construction products, to help cool down consumer prices, said a source familiar with the matter. The source, who spoke on condition of anonymity as the measures are under study, also pointed out that the government plans a tax reform with a 10% tax on dividends and a reduction in the tax burden on corporate income to 30% from 34%. (RTRS)

BRAZIL: Petrobras’ 8.87% hike in diesel prices increased pressure on the Brazilian government to grant a fuel subsidy ahead of the election, adding to discussions to mitigate the effects of energy tariff increases, local newspaper O Estado de S. Paulo says, citing people close to the subject. Government officials want to avoid even greater wear and tear in election year. Government‘s political segment argues that government revenues will increase with the payment of dividends by the company, according to the Estado. Changes to the spending cap would be necessary to grant the subsidy, which the Economy Ministry does not support at the moment. (BBG)

BRAZIL: Brazil’s government plans to change Eletrobras’s privatization model, which is under analysis by country’s audit court, and instead use the funds to try and avoid increases in energy rates during an election year, Folha de S.Paulo newspaper reported without citing how it obtained the information. The change being studied would establish the Treasury receiving funds from the state-owned company’s privatization in installments. Changes could affect country’s public accounts and delay the privatization process, according to the report. (BBG)

RUSSIA: Joe Biden said Vladimir Putin believed he could break up NATO and the European Union with the war in Ukraine, calling the Russian leader “a very, very, very calculating man.” The U.S. president, speaking at a Democratic National Committee fundraising event near Washington, added “the problem I’m worried about now is that he doesn’t have a way out right now. I’m trying to figure out what we do about that.” (BBG)

RUSSIA: President Joe Biden signed a bill Monday that will streamline the lengthy process of supplying Ukraine with the military equipment needed for the fight against Russia. “I’m signing a bill that provides another important tool that directly supports the government of Ukraine and the Ukrainian people and their fight to defend their country and their democracy against Putin’s brutal war,” Biden said from the Oval Office. “The cost of the fight is not cheap, but caving to aggression is even more costly,” Biden added. (CNBC)

RUSSIA: U.S. Deputy Treasury Secretary Wally Adeyemo said sanctions on Moscow are forcing Russia “to choose between using their resources to prop up their economy or to fight their war in Ukraine” and that the pressure on Putin will only increase. The truth is that Russia now has to make choices and that’s exactly what we want them to do,” Adeyemo said in an interview on Bloomberg Television. “And we want to continue to make that choice even harder by continuing to level sanctions until the invasion ends.” (BBG)

RUSSIA: French President Emmanuel Macron Monday admitted that Ukraine's accession to the European Union could take "several decades" as he proposed a new, multi-tiered framework for a "European political community." (Axios)

ENERGY: German officials are quietly preparing for any sudden halt in Russian gas supplies with an emergency package that could include taking control of critical firms, three people familiar with the matter told Reuters. The preparations being led by the Ministry for Economic Affairs show the heightened state of alert about supplies of the gas that powers Europe's biggest economy and is critical for the production of steel, plastics and cars. Russian gas accounted for 55% of Germany's imports last year and Berlin has come under pressure to unwind a business relationship that critics says is helping to fund Russia's war in Ukraine. (RTRS)

ENERGY: Brussels has shelved its plans to ban the EU shipping industry from carrying Russian crude after failing to secure agreement from key partners to mirror the sanction. However, the European Commission still aims to ban European companies from insuring tankers carrying Russia oil as a way of constraining Moscow’s ability to make crude shipments. The EU is trying to push through its sixth package of penalties aimed at Russia, which was intended to include the shipping ban and an embargo on Russian oil imports. The commission has been seeking to convince Hungary and a number of other central and eastern European countries to sign up to the phased-in oil ban, with president Ursula von der Leyen travelling to Budapest for discussions on Monday. (FT)

ENERGY: Germany's VNG will transfer euro payments for Russian gas to Gazprombank in the future and expects no problems during a conversion to roubles, it said on Monday, meeting Moscow's key demands under a fresh payment scheme. VNG, which is majority-owned by German regional utility EnBW, said it was taking all necessary measures, in line with existing sanctions law, to continue to ensure supply and therefore economic stability in Germany. The company did not respond to written follow-up questions asking to clarify whether it had opened two accounts with Gazprombank, one for euro payments and one for the rouble conversion. (RTRS)

OIL: European Commission President Ursula von der Leyen said on Monday she had made progress in talks with Hungarian Prime Minister Viktor Orban on a possible EU-wide ban on Russian fossil fuels. "This evening's discussion with PM Viktor Orban was helpful to clarify issues related to sanctions and energy security", von der Leyen said in a tweet. "We made progress, but further work is needed", she added. Von der Leyen said she would convene a video conference with other countries in the region to strengthen regional cooperation on oil infrastructure. (RTRS)

OIL: Prime Minister Viktor Orban’s talks with the head of the European Union about proposed sanctions on Russian oil imports made “some progress,” though further talks are needed to assuage Hungary’s energy security concerns, according to the country’s foreign minister. “We made some progress, we could say we took a small step forward,” Foreign Minister Peter Szijjarto said in a Facebook video after the conclusion of the talks. “A lot more needs to be done, though, for us to potentially change our position.” (BBG)

OIL: Japan will decide the timing and method of a Russian oil embargo while considering actual conditions, its industry minister said on Tuesday, after Japan agreed on a ban with other Group of Seven nations to counter Moscow’s invasion of Ukraine. To help secure a stable global supply of energy, the United States has a major role to play as a producer of oil and natural gas, Japanese industry minister Koichi Hagiuda told a news conference. (RTRS)

OIL: Crude oil production by OPEC and its partners fell to a six-month low of 41.58 million b/d in April as Russian production took a battering from Western sanctions, the latest Platts survey by S&P Global Commodity Insights found. OPEC's 13 members raised output by 70,000 b/d to 28.80 million b/d, led by gains in Saudi Arabia and Iraq, but production by key ally Russia fell by 900,000 b/d, and Kazakhstan also registered significant losses. This meant the glaring gap between OPEC+ production and quotas rose to a record-high 2.59 million b/d as 13 out of the 19 countries with quotas struggled to hit their output targets, the survey found. The shortfall propelled the group's quota compliance to 220.3% -- illustrating how the sanctions on Russia, along with capacity constraints faced by several members, have eroded the alliance's ability to balance the market even as it keeps raising its production targets every month. The latest OPEC+ meeting on May 5 resulted in another 432,000 b/d collective quota increase for June. (Platts)

OIL: Iran’s president said Monday the country is exporting twice as much oil as when he took office in August, despite heavy sanctions on oil exports imposed by the U.S. Ebrahim Raisi made the claim in a live interview on state-run TV without elaborating, including on the amount of oil being exported. “Oil sales have doubled," he said. “We are not worried about oil sales.” (AP)

OIL: Venezuela has begun importing Iranian heavy crude to feed its domestic refineries, documents from the state-run oil company PDVSA showed, a deal that widens a swap agreement signed last year by the U.S. sanctioned countries. The two last year initially agreed to a swap deal, with PDVSA importing Iranian condensate to dilute and process its extra heavy oil for export. In return, Venezuelan crude was shipped via the National Iranian Oil Company (NIOC). (RTRS)

CHINA

YUAN: There is no basis for a substantial weakening of the yuan although short-term fluctuations are still possible, Securities Daily reported, citing analysts. The yuan will still face some pressure versus the dollar in the short term due to factors including weak exports and a stronger greenback, according to Ming Ming, chief economist at CITIC Securities. The Chinese currency will be supported by the nation’s economic fundamentals, measured monetary policy and an expected balance of payments surplus, Wang Qing, chief macroeconomic researcher at Golden Credit Rating, said. (BBG)

CORONAVIRUS: Chinese Vice Premier Sun Chunlan reiterates the country’s adherence to the dynamic Covid zero policy and calls for efforts to consolidate achievements in fighting Covid-19, Xinhua reports. Sun made the comment at a teleconference of the State Council. An outbreak should be stamped out as soon as it is detected to ensure the epidemic is manageable and controllable. Sun urges agility in epidemic monitoring and early warning, and stresses the availability of nucleic acid testing within 15 minutes’ walk in big cities. Quarantine centers and makeshift hospitals must be built to a high standard so that they can be put into use within 24 hours when necessary. (BBG)

CORONAVIRUS: After six weeks of strict lockdown, Shanghai authorities are again tightening Covid-19 restrictions amid a renewed push by central-government officials to eradicate the virus, sparking a new wave of frustration in the coastal city of 25 million people. Though Shanghai officials haven’t formally announced any new citywide measures, residential communities and grass-roots authorities have expanded the scope of people being taken into centralized quarantine while cutting off deliveries of nonessentials to swaths of the city, according to half a dozen Shanghai residents who have received notices and shared them with The Wall Street Journal. (WSJ)

CORONAVIRUS: Tesla Inc. hasn’t halted output at its Shanghai factory, though it is experiencing some disruption to logistics amid the city’s long-running Covid-19 lockdown, a spokesperson for the U.S. carmaker said Tuesday. Reuters reported earlier that output had halted, prompting Tesla to issue a statement saying it had received no notice of any Shanghai plant cessation and pointing out that some vehicles are still being made. (BBG)

CORONAVIRUS: Sony partially restarted its plant in Shanghai, China, on Sunday after suspending operations on March 28 due to the outbreak of coronavirus there, spokeswoman Noriko Shoji says by phone. Will gradually increase the output in line with local regulations. Will probably take time to return to full operations. (BBG)

CHINA MARKETS

PBOC NET INJECTS CNY10 BLN VIA OMOS TUESDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rates unchanged at 2.10% on Tuesday. The operation has led to a net injection of CNY10 billion as no reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8436% at 09:39 am local time from the close of 1.6499% on Monday.

- The CFETS-NEX money-market sentiment index closed at 42 on Monday vs 39 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7134 ON TUESDAY VS 6.6899

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.7134 on Tuesday, compared with 6.6899 set on Monday.

OVERNIGHT DATA

JAPAN MAR HOUSEHOLD SPENDING -2.3% Y/Y; MEDIAN -3.3%; FEB +1.1%

AUSTRALIA APR NAB BUSINESS CONFIDENCE 10; MAR 16

AUSTRALIA APR NAB BUSINESS CONDITIONS 20; MAR 18

Business conditions continued to strengthen in April, while confidence eased but remained above its long-run average. Trading conditions and profitability continued to strengthen, while employment was steady. The gains came on the back of a long-awaited recovery in the recreation & personal services sector, where conditions rose 20pts. Both confidence and conditions now look fairly strong across most industries, with the exception of transport & utilities and construction where cost pressures have been most acute. Qld saw conditions strengthen considerably while conditions in Vic eased, but both conditions and confidence are fairly strong across the states with only Tas showing softer confidence levels. Capacity utilisation also continued to rise, reaching 83.9%. Cost pressures continued to build, with labour cost growth up to 3.0% and purchase cost growth reaching 4.6% (in quarterly terms) – both at new highs. However, output price inflation eased with final product prices rising 1.7% and retail prices up 2.1%. Still, these rates of price growth remain high in the history of the survey and the strength in underlying costs suggests inflationary pressure is likely to continue building over coming months. Overall, the survey highlights the ongoing strength in activity and the broad-based nature of the recovery, against a backdrop of cost pressures continuing to pose a significant challenge for businesses. (NAB)

AUSTRALIA Q1 RETAIL SALES EX INFLATION +1.2% Q/Q; MEDIAN +1.0%; Q4 +8.2%

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 90.5; PREV 90.7

Consumer confidence dropped by just 0.2% last week after a 6.0% drop the week before. This suggests that consumers had anticipated the likely increase in interest rates by the RBA. Still, the rise was not entirely without impact. Confidence among people who are ‘paying off their home loan’ dropped by 5.0%, reinforcing the 9.6% drop in the previous week. This was partially offset by the increase in confidence for those who already own their home or are renting by 1.3% and 2.6% respectively. Household inflation expectations dropped 0.2ppt to 5.1% despite a slight increase in petrol prices last week. (ANZ)

AUSTRALIA APR CBA HOUSEHOLD SPENDING +5.0% Y/Y; MAR +5.6%

AUSTRALIA APR CBA HOUSEHOLD SPENDING -3.8% M/M; MAR +9.2%

The CommBank HSI Index fell by 3.8%/mth in April to take the index down to 112.3. The fall in April came after a seasonally strong March reading that was boosted by strength in 11 out of the 12 categories. There is volatility month to month in the HSI readings due to seasonal patterns. April is generally weak due to additional public holidays falling in the month. In April 2022 the Easter long weekend and ANZAC Day holidays occurred. Falls in April were led by a 21.5%/mth fall in Home Buying, with falls also occurring in Health & Fitness, Transport spending intentions and Household services. There were gains in Travel, Entertainment and Retail. 8 out of the 12 spending categories fell in April after broad based gains in March.Given month to month seasonal volatility, the annual movement is best reflective of the state of the Australian economy. On an annual basis the HSI Index is up 5.0%/yr, although some of this gain is likely reflecting increases in prices. The HSI remains solid and is consistent with the RBA commencing its interest rate hiking cycle in May. We expect further interest rate hikes in June, July, August and November 2022 and one final hike in February 2023 taking the cash rate to 1.60%. We expect a fairly shallow hiking cycle compared to market pricing.Going forward it will be important to watch the HSI categories,including Home buying, Motor vehicles, Retail and Entertainment to judge the impact of the interest rate rises. (CBA)

NEW ZEALAND APR CARD SPENDING TOTAL +7.0% M/M; MAR +1.7%

NEW ZEALAND APR CARD SPENDING RETAIL +7.0% M/M; MAR -1.3%

NEW ZEALAND APR ANZ TRUCKOMETER HEAVY +2.3% M/M; MAR +0.7%

Throughout the COVID disruptions, the Heavy Traffic Index has been a surprisingly good indicator for quarterly GDP growth. It’s suggesting weak but positive growth in Q1, and the large monthly lift in April is consistent with our view that the rebound continued into the second quarter. In non-COVID times the Light Traffic Index provided a six-month lead on economic momentum, but we’ll have to wait for people movement to normalise before that will once more be the case. In time, we expect that the sharp rise in petrol prices and other living costs will see people reduce their discretionary spending, including the likes of weekends away, and that this will show up in light traffic. For now, though, the light traffic is rebounding strongly as Omicron fears subside, and we’d interpret that as a positive indicator for the here and now, rather than a strong indicator for where the economy will be in six months’ time. (ANZ)

SOUTH KOREA MAR BOP CURRENT ACCOUNT BALANCE $6,729.4MN; FEB $6,419.4MN

MARKETS

SNAPSHOT: Flows Dominate In Headline Light Asia Session

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 179.11 points at 26137.51

- ASX 200 down 80.454 points at 7041.5

- Shanghai Comp. up 5.078 points at 3009.219

- JGB 10-Yr future up 9.0 ticks at 149.18, yield up 0.2bp at 0.250%

- Aussie 10-Yr future up 2.5 ticks at 96.42, yield down 1.6bp at 3.547%

- US 10-Yr future +0-08 at 118-14+, yield up 1.41bp at 3.048%

- WTI crude down $1.18 at $101.91, Gold up $8.67 at $1862.8

- USD/JPY up 13 pips at Y130.42

- FED’S BOSTIC SAYS NO NEED TO MOVE FASTER THAN HALF-POINT HIKES (BBG)

- EU WEIGHS JOINT DEBT TO FUND UKRAINE’S LONG-TERM RECONSTRUCTION (BBG)

- HUNGARY SEES ‘SOME PROGRESS’ IN EU TALKS ON OIL EMBARGO (BBG)

- TRUSS SET TO DITCH NORTHERN IRELAND PROTOCOL AFTER GIVING UP ON EU TALKS (TIMES)

- CHINA’S YUAN UNLIKELY TO SEE FURTHER SHARP DROP (SEC DAILY)

- CHINA VICE PREMIER REITERATES DYNAMIC COVID ZERO POLICY (XINHUA)

US TSYS: Tsys Unchanged Into Europe After Busy Asia Trade

Cash Tsys are essentially unchanged across the curve after a fairly frenetic round of overnight dealing. TYM2 is last dealing +0-09+ at 118-15+, in line with late NY levels, 0-02 off the base of its 0-0-16+ range, with volume comfortably above 200K lots.

- The drift away from firmest levels of the session has continued through the second half of Asia-Pac trade, after the earlier technical/flow-related bid in U.S. Tsys faded.

- Note that the major U.S. Tsy futures contracts broke above their respective Monday highs in early Asia dealing, with yields across the curve through their Monday troughs. The richening took place at the same time that S&P 500 e-minis crossed below their Monday low (although technical support in the contract wasn’t tested) and Bitcoin looked below 30,000 (we do not usually comment on cryptocurrencies, but correlations with risk assets have increased in recent times).

- There was no overt headline news to trigger the move, leaving pure flows at the fore. Note that the move extended on the back of 3 block buys in TY futures (totaling 9,750 lots).

- A subsequent recovery in risk appetite, with the S&P 500 e-mini contract reclaiming the 4,000 level and mainland Chinese tech stocks (namely the ChiNext) reversing the early gap lower, allowed the space to move away from worst levels. Subsequent comments from Chinese market regulators have looked to soothe any worry re: Chinese equities, while a state-run media article flagged comments from analysts playing down the risk of further CNY depreciation.

- Small business optimism data is due during Tuesday’s NY session, with a deluge of Fedspeak (Williams, Waller, Mester, Kashkari & Barkin) & 3-Year Tsy supply also slated.

JGBS: Off Best Levels Even As 10-Year Auction Cover Ratio Surges

Spill over from Monday’s NY session and the previously outlined swings in wider risk appetite during Tuesday’s Asia-Pac session drove JGB trade on Tuesday.

- JGB futures are comfortably off of best levels as a result, last dealing +8 on the day.

- Cash JGBs run little changed to 1.5bp richer across the curve, with 7s and 20s providing the firmest points on the curve. Outperformance in 7s was likely linked to the overnight and early Tokyo bid in futures. Note that 10s have underperformed all day, which would have been linked to pre-auction concession ahead of today’s 10-Year JGB supply.

- In terms of specifics, the latest 10-Year JGB auction saw softer than expected pricing, with the low price missing wider expectations, coming in at 99.53 (the BBG dealer poll looked for a low price of 99.56). Still, the cover ratio jumped to the highest level observed at a 10-Year JGB auction since the first half of the ‘00s, while the price tail experienced some incremental narrowing. It would seem that short cover and the BoJ’s reinforcement of its existing YCC settings outweighed any worry surrounding relative value appeal, with yields operating around 0.5bp shy of the upper limit of the BoJ’s permitted 10-Year JGB yield trading band. Still, as mentioned, wider price action in core FI markets dictated price action in JGBs, facilitating some very modest cheapening during the Tokyo afternoon.

- Local headline flow was dominated by comments from BoJ senior official Uchida, as he pushed back against any speculation that the BoJ could widen/alter its permitted 10-Year JGB yield trading band, likening such a move to a rate hike, while stressing that Japan doesn’t need to tighten monetary policy.

- Domestic household spending data was a touch firmer than expected but still in negative territory (-2.3 Y/Y vs. BBG median -3.3%).

- Tomorrow’s local docket looks particularly thin.

JGBS AUCTION: Japanese MOF sells Y2.1887tn 10-Year JGBs:

Japanese MOF sells Y2.1887tn 10-Year JGBs:

- Average Yield 0.245% (prev. 0.201%)

- Average Price 99.56 (prev. 99.99)

- High Yield: 0.248% (prev. 0.203%)

- Low Price 99.53 (prev. 99.97)

- % Allotted At High Yield: 25.2561% (prev. 80.3585%)

- Bid/Cover: 5.742x (prev. 3.611x)

AUSSIE BONDS: Off Best Levels, Following Wider Flows

Wider risk appetite has been in the driving seat on Tuesday, with local headline flow lacking, while domestic data failed to provide any notable impetus for the space. The previously flagged recovery in risk appetite during Asia-Pac hours has allowed the space to pull back from best levels observed earlier in the session, with YM +7.0 & XM +2.0. This came after Monday’s U.S. Tsy bull steepening impulse drove price action in the overnight session. Longer dated cash ACGBs are ~1bp richer on the day.

- Retail sales ex-inflation for Q1 was marginally firmer than expected (+1.2 Q/Q vs. BBG median of +1.0%), although that was accompanied by a 0.3ppt reduction in the Q4 Q/Q reading, via revisions.

- Meanwhile, the monthly NAB business survey revealed an uptick in conditions but a downtick in confidence. The survey collator noted that “business conditions continued to strengthen in April, while confidence eased but remained above its long-run average. Trading conditions and profitability continued to strengthen, while employment was steady… Both confidence and conditions now look fairly strong across most industries, with the exception of transport & utilities and construction where cost pressures have been most acute. Capacity utilisation also continued to rise… Cost pressures continued to build, with labour cost growth up to 3.0% and purchase cost growth reaching 4.6% (in quarterly terms) - both at new highs. However, output price inflation eased with final product prices rising 1.7% and retail prices up 2.1%. Still, these rates of price growth remain high in the history of the survey and the strength in underlying costs suggests inflationary pressure is likely to continue building over coming months. Overall, the survey highlights the ongoing strength in activity and the broad-based nature of the recovery, against a backdrop of cost pressures continuing to pose a significant challenge for businesses.”

- Lower tier data also failed to impact the space.

- A quick look at tomorrow’s domestic docket suggests that the monthly Westpac consumer confidence data and A$400mn of ACGB Jun-51 supply will provide the focal points.

AUSSIE BONDS: The AOFM sells A$100mn of the 1.00% 21 Feb 2050 I/L Bond, issue #CAIN415:

The AOFM sells A$100mn of the 1.00% 21 Feb 2050 I/L Bond, issue #CAIN415:

- Average Yield: 1.3154% (prev. 0.3107%)

- High Yield: 1.3300% (prev. 0.3225%)

- Bid/Cover: 3.1000x (prev. 3.6000x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 42.9% (prev. 70.0%)

- Bidders 41 (prev. 36), successful 20 (prev. 10), allocated in full 18 (prev. 8)

EQUITIES: Hang Seng Gaps Down Again; Chinese Stocks Gain As Support For SMEs Outlined

Most Asia-Pac equity indices are in the red on a negative lead from Wall St., with the MSCI Asia Pacific Index tipped to close lower for a seventh straight session.

- The ASX200 sits 1.4% weaker at typing, paring earlier losses of ~2.5% (fresh three-month lows at the time). Steep losses were seen in major mining stocks with the ASX200’s materials and energy sub-indices leading losses, tracking broad declines in major commodity benchmarks. Australian tech equities fared a little better as seen in the S&P/ASX All Technology Index trading 0.2% lower at writing, although notable losses in index heavyweight Block Inc (-12.8%) largely neutralised gains elsewhere in the sector.

- The Hang Seng Index is on track to close in the red for a fourth straight session, sitting 2.8% lower at typing, led by weakness in China-based tech stocks. The Hang Seng Tech Index correspondingly sits 4.7% worse off, with steep losses seen in large-caps JD.com (-9.7%), Tencent Holdings (3.7%), and Trip.com (-7.4%). Headlines proclaiming the exit of global investors from Chinese equities have been gaining momentum in recent weeks, with titan BlackRock reported on Monday to have changed their previously bullish stance, citing growth risks from pandemic control measures. Regulatory measures imposed by the Chinese authorities on internet live streaming platforms over the weekend again sparked debate re: recent pledges for regulatory reprieve and targeted support towards internet platform companies.

- The CSI 300 was the sole major Asia-Pac index to notch gains, sitting 0.2% firmer at typing, reversing earlier losses after opening at two-week lows (~1.5% lower). The bid in Chinese equities came largely after the State Council and PBOC issued guidance supportive of SMEs, with the former outlining that local authorities should provide small businesses with subsidies for rent, utilities, and insurance, while also highlighting separate (but related) guidance to banks in areas such as loan extensions and forex hedging.

- U.S. e-mini equity index futures deal 0.3% to 0.8% firmer at writing after hitting fresh cycle lows earlier in Asia-Pac dealing, with Nasdaq contracts trading around levels last witnessed in end-’20.

OIL: Fresh One-Week Lows In Asia As Soft Economic Data Abounds

WTI and Brent are ~$1.50 worse off apiece at typing, extending Monday’s losses and operating a little above their respective one-week lows made earlier in the session.

- To recap, both benchmarks notched ~$6 declines on Monday, tracking broader selloffs in equities globally with worry evident re: China’s ongoing pandemic control measures and global stagflation risks, while a fresh 20-year high in the USD (DXY) applied some pressure to the space.

- On stagflation worry, a NY Fed survey released on Monday pointed to rising long-term inflation expectations amongst consumers, suggesting expectations for slower growth as well. Looking at Europe, a German economist was cited as saying that an end to Russian gas imports would see a “deep recession” in Europe’s biggest economy and trigger half a million job losses “by most calculations”, coming as Russia has already cut gas supplies off EU members Poland and Bulgaria.

- Turning to China, COVID cases in China have continued their steady descent, although authorities have continued to double down on the country’s zero-COVID policy, elevating uncertainty re: lockdowns across the country. Recent economic data releases have shown Chinese exports slowing to their weakest pace in nearly two years, with refinery throughput estimated to have fallen ~6%, the sharpest such decline since early 2020.

- Elsewhere, a Platts survey has pointed to collective production in OPEC+ for April falling ~2.59mn bpd short of the current production quota, led lower by struggling Russian production amidst well-documented difficulties in the Russian crude industry.

GOLD: Key Support Eyed Ahead Of Fedspeak; Ukraine Escalation Risk Put Away For Now

Gold trades ~$6/oz higher, printing $1,860/oz at writing. The precious metal has risen a little above Monday’s worst levels at writing catching a bid as nominal U.S. Tsy yields continue to trade around the bottom of their respective ranges on Monday.

- To recap Monday’s price action, gold closed ~$30/oz lower, hitting one-week lows as U.S. real yields broadly moved higher by the session’s end, while the USD (DXY) was little changed on the day after backing away from fresh 20-year highs.

- Looking to Russia, Putin’s Victory Day speech made on Monday overall showed no indication of meaningful escalation in the Russia-Ukraine war, easing prior worry from some quarters re: a wider conflict. Defence analysts have however highlighted significant unresolved issues such as an “off-ramp” for Russia to de-escalate, as well as the lingering possibility of escalation in the coming weeks given the plausibly inconvenient timing (May is a traditional Russian holiday period).

- A note that a packed Fedspeak slate is due later today from the likes of Williams (voter), Barkin (‘24), Waller (voter), Kashkari (‘23), and Mester (‘24).

- From a technical perspective, gold remains vulnerable after moving below support at the 50-Day EMA, and trades a short distance away from support at $1,848.8/oz (76.4% retracement of the Jan28-Mar8 rally). On the other hand, resistance sits at $1,909.8/oz (May 5 high).

FOREX: Offshore Yuan Goes Bid, Poised To Snap Three-Day Losing Streak

Spot USD/CNH reversed gains after a failed re-test of a cycle high printed on Monday. There was little in the way of notable headline flow coinciding with that pullback, but Chinese equity indices clawed back their initial gap lower amid a strong rebound in Chinese tech.

- The pair's advance towards recent cycle highs may have been facilitated by the virtual removal of appreciation bias from the PBOC fixing. China's central bank set the mid-point of permitted USD/CNY trading range just 5 pips below sell-side estimate, ending a streak of downside surprises.

- The yen briefly turned bid into the Tokyo fix, possibly bolstered by comments from FinMin Suzuki, who noted that Japan is in close communication with the U.S. on FX and called recent rapid yen weakening "undesirable." It did not take USD/JPY much time to recoup resultant losses, the rate is back to neutral levels and the yen is among worst G10 performers.

- The greenback is trading on a heavier footing as we are heading for the London open. It underperforms all its G10 peers, with the DXY extending its move away from a cycle high printed on Monday.

- German ZEW Survey and Norwegian CPI headline the data docket going forward. Central bank rhetoric will be aplenty, with a decent number of Fed & ECB members due to speak.

FOREX OPTIONS: Expiries for May10 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0665-75(E716mln)

- AUD/USD: $0.7200(A$506mln)

- USD/CAD: C$1.2935($3.2bln)

- USD/CNY: Cny6.6440($650mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/05/2022 | 0600/0800 | * |  | NO | CPI Norway |

| 10/05/2022 | 0800/1000 | * |  | IT | Industrial Production |

| 10/05/2022 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 10/05/2022 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 10/05/2022 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 10/05/2022 | 1140/0740 |  | US | New York Fed's John Williams | |

| 10/05/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 10/05/2022 | 1315/0915 |  | US | Richmond Fed's Tom Barkin | |

| 10/05/2022 | 1345/0945 |  | US | Treasury Secretary Janet Yellen | |

| 10/05/2022 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 10/05/2022 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 10/05/2022 | 1700/1300 |  | US | Minneapolis Fed's Neel Kashkari and Governor Christopher Waller | |

| 10/05/2022 | 1720/1920 |  | EU | ECB de Guindos at IESE Banking Industry Meeting | |

| 10/05/2022 | 1900/1500 |  | US | Cleveland Fed's Loretta Mester |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.