-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Familiar Headlines Fill The Pre-CPI Void

- FED OFFICIALS BACK HALF-POINT HIKES, MESTER OPEN TO DOING MORE (BBG)

- GUINDOS SAYS ECB TO NORMALIZE POLICY SOONER RATHER THAN LATER (BBG)

- ECB’S VILLEROY SAYS GOVERNMENTS MUST TACKLE DEBT AS RATES RISE (BBG)

- UKRAINE, RUSSIA GAS CLASH RAISES THREAT TO EUROPE’S SUPPLY (BBG)

- CHINESE INFLATION DATA TOPS EXP.

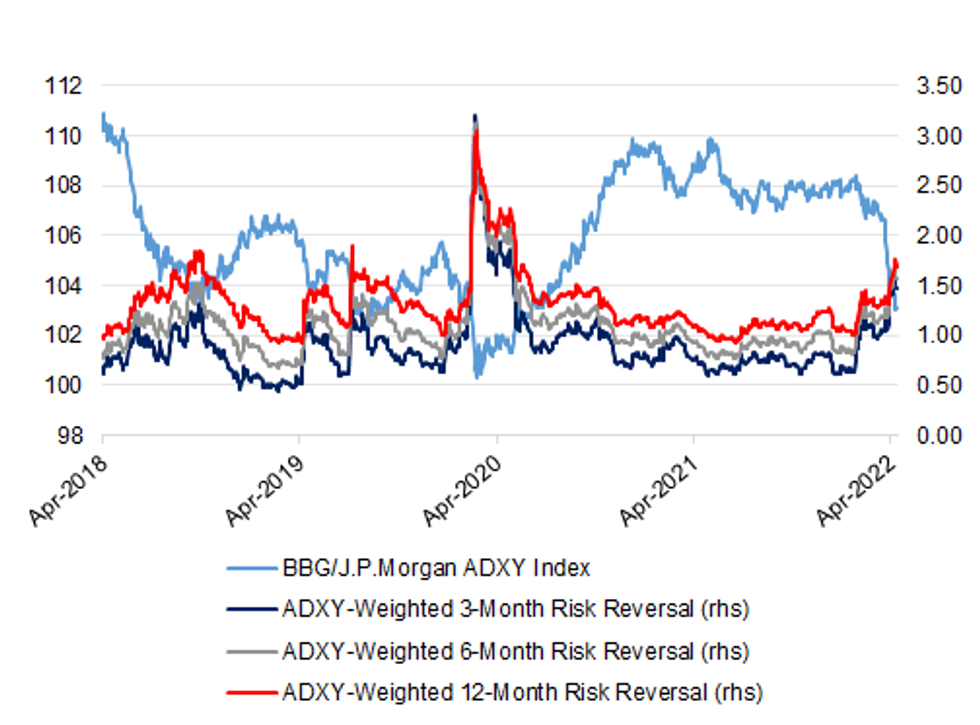

Fig. 1: ADXY-Weighted 3, 6, & 12-Month Risk Reversals

Source: MNI - Maket News/Bloomberg

Source: MNI - Maket News/Bloomberg

UK

BOE: According to a forecast by National Institute of Economic and Social Research, the BoE will need to bring interest rates higher to 2.5% next year and hold it there until mid of decade. NIESR forecasts UK inflation peaking at 8.3%, which is lower than BoE’s prediction that prices would past 10% this year. NIESR also said BoE would have to carefully navigate the treacherous waters caused by tensions between letting inflation expectations and plunging the economy into deep recession. (FT)

BREXIT: Liz Truss told Brussels on Tuesday that its proposed solutions to the problems with the Northern Ireland Protocol would actually make the situation worse, after EU leaders threatened a trade war. The Foreign Secretary is preparing to announce that the UK will unilaterally change parts of the Protocol - which defines the trading terms for Northern Ireland since Brexit - as early as next week. Government figures are expected to point to the impasse over power-sharing in Northern Ireland in the wake of last week's elections as proof that the current arrangement is unsustainable. There were warnings on Tuesday from Europe about the economic consequences if the UK chooses to renege on the promises made in the 2019 Brexit withdrawal agreement. (Telegraph)

BREXIT: Boris Johnson is facing a parliamentary revolt over a plan to unilaterally override the Northern Ireland Brexit deal as European leaders warned the prime minister not to touch the agreement. Olaf Scholz, the German chancellor, told Johnson not to “scrap or break or in any way change” the protocol, which was signed by the prime minister in 2019. Micheál Martin, the Irish prime minister, condemned the plan, saying it would destabilise the peace process. Alexander De Croo, the prime minister of Belgium, told Johnson: “Don’t touch this.” Liz Truss, the foreign secretary, will speak to her EU counterpart, Maros Sefcovic, later this week and call again for compromise. Brussels is understood to be considering retaliatory measures to be imposed should legislation reneging on the protocol become law. They could include tariffs on UK exports and the suspension of elements of the Brexit free trade deal. (The Times)

BREXIT: As prime minister, Boris Johnson does not follow the normal rules. To put it mildly. And this year's Queen's Speech, announcing his legislative programme for the coming parliamentary session, is no exception. That's because probably the most important piece of planned legislation, a new law to waive parts of the contentious Northern Ireland Protocol, is not mentioned, even though it almost certainly will be announced at the end of this week (and by the Prime Minister). The reason this matters is because there is a constitutional crisis in Northern Ireland following last week's elections to its Assembly. The runners up in the election, the unionist DUP, won't allow the NI executive or government to be formed unless and until the Protocol is binned. Johnson is planning to say, as I understand it, that the UK government will use powers in legislation to breach its treaty obligations under the NI Protocol. It will suspend all those border checks on goods flowing from Great Britain to Northern Ireland which were such an important part of its Brexit deal with the EU. But he'll announce all of that on Friday, not today. (The Spectator)

BREXIT: A British government source described as "not correct" a report that Prime Minister Boris Johnson is planning to announce on Friday that he will breach post-Brexit treaty obligations under the Northern Ireland Protocol. Earlier on Tuesday, ITV television's political editor Robert Peston said the government would say it was suspending border checks on goods flowing from Great Britain to Northern Ireland. Asked about the report, Johnson's office said: "No decisions have yet been taken on the way forward however the situation is now very serious." (RTRS)

ECONOMY: The number of Britons living in destitution could reach 1 million over the next year unless the government takes urgent action to tackle the cost of living crisis, a leading think tank warned. In a stark assessment, the National Institute of Economic and Social Research said a further 250,000 households will slide into extreme poverty without help and warned that the country will soon be in recession. To ease the crunch, Prime Minister Boris Johnson’s government needs to provide a £4.2 billion ($5.2 billion) support package to ensure the hardest-hit households can feed themselves, NIESR said. (BBG)

EUROPE

ECB: “Our mandate is price stability, and therefore the process of monetary policy normalization has started,” European Central Bank Vice President Luis de Guindos says at event in Madrid Tuesday. “Even though this issue of monetary policy fine tuning, whether it’s this month or the next, doesn’t make much sense, it will surely be sooner rather than later” in the third quarter, he says, when asked about when the ECB may start to hike rates. Says the topics of fragmentation and taming inflation should be handled separately. (BBG)

ECB: Euro-area nations must end massive pandemic-era spending and ensure public finances are sustainable as the European Central Bank removes stimulus to tame record inflation, according to Bank of France Governor Francois Villeroy de Galhau. “Our Governing Council will act as much as necessary to fulfill our priority mandate of price stability -- have no doubt about it,” said Villeroy, who last week backed raising rates back above zero this year. “It’s therefore all the more important that fiscal authorities ensure debt sustainability in a context of rising rates, which has begun and will dominate the coming years,” he said Tuesday in a speech to France’s High Council on Public Finances. (BBG)

U.S.

FED: Federal Reserve Governor Christopher Waller pledged Tuesday that the rate-setting group wouldn’t make the same mistakes on inflation that it did in the 1970s. Back then, he said during a panel chat with Minneapolis Fed President Neel Kashkari, the central bank talked tough on inflation but wilted every time tighter monetary policy caused an uptick in unemployment. This time, Waller said he and his colleagues will follow through on its intentions to raise interest rates until inflation comes down to the Fed’s targeted level. The central bank has raised rates twice this year, including a half percentage point move last week. (CNBC)

FED: Cleveland Fed President Loretta Mester said Tuesday that she would be "comfortable" with 0.50% interest rate increases at the Fed’s next two meetings, as the central bank continues to fight high inflation. “We have to get inflation under control, that means moving interest rates up,” Mester told Yahoo Finance on the sidelines of a conference in Florida. Mester suggested she does not currently favor moving interest rates in increments larger than 0.50%, although she emphasized that the Fed will be flexible. “There’s always something on the table,” Mester said. (RTRS)

FED: Atlanta’s Raphael Bostic, who backs raising rates in half-point steps at the next two or three meetings and then assessing, later told a Fed conference on Florida’s Amelia Island that if the gap between excess demand and constrained supply shrinks quickly enough, the central bank may end up having to do less than otherwise. “Inflation is driven by this imbalance between high demand and low supply and a lot of the dynamics we have in play, the forces that are pushing us, could actually hit the demand side as well,” he said, citing uncertainty caused by the war in Ukraine. “If that gap starts to narrow -- and there are many sources that could drive that -- then we might be able to do less in our policy. And I think there is benefit to us being purposeful and intentional but not just running to get to a number.” (BBG)

FED: The Senate voted to confirm Lisa Cook to the Federal Reserve, making her the first Black woman to sit on the central bank’s board. Ms. Cook was approved Tuesday on a party-line vote, 51-50, with Vice President Kamala Harris breaking a tie. Ms. Cook is the second Fed nominee of President Biden to win Senate confirmation, following Fed governor Lael Brainard, who was approved as the central bank’s vice chairwoman last month. Ms. Cook’s confirmation Tuesday evening paves the way for lawmakers to confirm two additional picks this week, including Jerome Powell, whose four-year term as chairman expired in February. He has been serving in an acting capacity since then and is poised to win bipartisan support for a second term as chairman. Philip Jefferson, an economist at Davidson College, is set to join the board and won unanimous support from the Senate Banking Committee in March. (WSJ)

INFLATION: Joe Biden has reiterated his support for the Federal Reserve’s efforts to combat inflation, giving the green light for the US central bank to continue raising interest rates without a political backlash. The president on Tuesday said fighting inflation was his administration’s “top economic challenge”, as polls suggest his party will be punished for spiralling prices at this year’s midterm elections. Biden promised the White House would take action to bring down costs, but also emphasised the Fed’s “primary role” in tackling inflation, in a signal that the administration is more concerned about high prices than a possible recession triggered by rapid rate rises. He said: “There are things we can do and we can address. That starts with the Federal Reserve, which plays a primary role in fighting inflation.” (FT)

INFLATION: The White House has announced that President Biden will visit the Chicago area on Wednesday, May 11. White House officials report that Biden will make numerous stops in the Chicago area, including one to O'Hare International Airport and another to a family farm in Kankakee. WMAQ-TV reports that the Kankakee visit will include a discussion of how the invasion of Ukraine has impacted food supply chains and how to lower food costs for Illinois families. (WREX)

FISCAL: The US House of Representatives easily passed a more than $40 billion Ukraine aid bill that funds new weapons and provides economic assistance. The legislation, which is significantly larger than the $33 billion package President Joe Biden requested last month, now heads to the Senate where approval is likely next week. (BBG)

POLITICS: Elon Musk said Tuesday that he would restore former President Donald Trump's banned account on Twitter if his deal to acquire the company is completed. "I do think it was not correct to ban Donald Trump, I think that was a mistake," Musk said. "I would reverse the perma-ban. ... But my opinion, and Jack Dorsey, I want to be clear, shares this opinion, is that we should not have perma-bans." (CNN)

OTHER

GLOBAL TRADE: China should strengthen overall planning and coordination among various industries, enterprises and regions, in order to keep key industrial chain and supply chain running smoothly, Economic Information Daily says in a commentary. China should also enhance coordination with the international community by actively introducing high-quality foreign capital and advanced technologies, and encouraging foreign enterprises to increase investment in high-end manufacturing and R&D. (BBG)

GLOBAL TRADE: The EU is finalizing a plan to facilitate land exports of Ukraine’s stocks of food products with the Russian invasion blocking access to the country’s vital Black Sea ports. The bloc on Wednesday will consider a strategy that would address technical and bureaucratic initiatives to speed up the shipping of vegetable oils, corn and wheat, some of Ukraine’s key exports, people familiar with the discussions said. The EU’s executive arm is concerned about logistical bottlenecks that could hamper efforts to utilize alternative land routes via neighboring countries, since infrastructure gaps could hinder exports despite recent moves to remove trade barriers with Kyiv. It will be a challenge to move a significant portion of the 25 million tons of products stuck there in time for the beginning of the next harvest season. (BBG)

U.S./CHINA: President Joe Biden said he could drop some of the tariffs imposed against Chinese imports to help control rising consumer prices in the U.S. — just as Wall Street braces for another inflation report north of 8%. The White House is reviewing the penalties imposed under former President Donald Trump — which raised p rices on everything from diapers to clothing and furniture — and could opt to remove them altogether, Biden said in addressing the nation from Washington on Tuesday. “We’re looking at what would have the most positive impact,” Biden said, adding that removing the tariffs was currently under discussion. (CNBC)

U.S./CHINA/TAIWAN: America’s intelligence community will engage with Taiwan’s military and political leadership about the lessons that can be drawn from Russia’s faltering war in Ukraine for the island’s defense in the event of a Chinese attack, a top US spy chief said. There are several things that US military and intelligence officers can do to help Taiwan make China less likely to consider an invasion, Lieutenant General Scott Berrier, director of the Defense Intelligence Agency, told the Senate Armed Services Committee on Tuesday. “We have to engage with our Indo-Pacom partners within the Department of Defense, the Taiwan military and leadership to help them understand what this conflict has been about -- what lessons they can learn and where they should be focusing their dollars on defense and their training,” Berrier added, referring to the US military’s Asia-focused Indo-Pacific Command. (BBG)

AUSTRALIA/CHINA: China’s ambassador to Australia has called on the nations to reach “a healthy and stable relationship” after growing tensions in recent years, continuing a conciliatory tone five months into his posting in Canberra. “Both China and Australia are great countries,” Xiao Qian said in an editorial celebrating the nations’ 50th anniversary of establishing diplomatic ties, which was published in the Australian Financial Review on Wednesday. Since arriving in Canberra, the ambassador has said he wants to get the relationship “back on the right track” and agreed to meet Foreign Minister Marise Payne for talks in the most senior publicized contact between the nations in about two years, after Beijing suspended ministerial-level ties. (BBG)

NEW ZEALAND: New Zealand will fully reopen its border two months early, allowing the arrival of tourists, students and migrants from non visa-waiver countries like China and India. The border will be accessible to all from 11:59 p.m. on July 31, Prime Minister Jacinda Ardern said Wednesday. Previously, the government had said the final re-opening step would occur in October, though it signaled the date would likely be brought forward. The maritime border will also open for cruise ships on July 31. Visitors from visa-waiver countries such as the US, UK, Canada and Germany were able to enter from May 2, while Australians could arrive from April 13. (BBG)

SOUTH KOREA: South Korea's new finance minister indicated on Wednesday the government would issue no or a very small amount of bonds to fund an upcoming supplementary budget aimed at defraying losses at small businesses due to COVID restrictions. "As for the funding, we have made all efforts to secure resources, including readjustment of existing spending plans and carried-over tax revenue surplus," Minister Choo Kyung-ho said at the beginning of a meeting with the ruling party. He said the government would finalise the supplementary budget bill, widely expected to be about 35 trillion won ($27.4 billion), on Thursday and send it to the parliament on Friday for approval. (RTRS)

SOUTH KOREA: The economy is in a very difficult situation and prices are the biggest concern, South Korean President Yoon Suk Yeol says at a meeting with his senior secretaries. South Korea needs to think over the cause of rising prices and ways to contain inflation; need to pay attention to rising prices of food, energy. (BBG)

MEXICO: Mexican President Andres Manuel Lopez Obrador said on Tuesday that his government will ask state-oil company Pemex to reveal information regarding the alleged receiving of bribes from Vitol, the world's largest independent energy trader. (RTRS)

BRAZIL: Brazilian Economy Minister Paulo Guedes asked his team to reconsider a tax cut on steel rebar, Aco Brasil, the agency that represents the sector, said on Tuesday, adding that a decision on the matter is expected on Wednesday. Aco Brasil explained at a press conference on Tuesday that the government was considering reducing the steel rebar import tax to 4% from 10.8% and that the measure would be reconsidered after a meeting between steel makers and Guedes. (RTRS)

BRAZIL: Brazil’s economic team is facing increasing pressure from President Jair Bolsonaro’s political advisers to find room to pay for fuel and energy subsidies as inflation erodes purchasing power ahead of the October elections. The team is struggling with both fiscal and electoral limitations to come up with the aid, said three people with knowledge of the matter, asking not to be named because the discussions are not public. The first hurdle is Brazil’s spending cap rule, which limits the growth of public expenditures to the previous year’s inflation rate, and leaves no room for new subsidies. Moreover, the country’s electoral law does not allow for that kind of aid in an election year except in case of calamity or emergency, which the Economy Ministry does not see as the case, one of the people said. (BBG)

AMERICAS: Brazilian far-right President Jair Bolsonaro is not planning to attend the Summit of the Americas next month in Los Angeles, two people familiar with the matter told Reuters on Tuesday. They said Bolsonaro has told his aides he won't be going to the U.S.-hosted gathering of heads of state from across the continent, but gave no reason why. A spokesman for Brazil's Foreign Ministry said no decision has been taken yet. "The president's attendance is being studied and is not confirmed," the official said. A third source said diplomatic talks to arrange a meeting between Biden and Bolsonaro have been dropped since the Brazilian president decided not to go to Los Angeles. (RTRS)

AMERICAS: Mexico’s president said Tuesday that he would not attend next month’s Summit of the Americas in Los Angeles if the Biden administration excludes Cuba, Venezuela and Nicaragua — adding his voice to increasing warnings of a boycott by some leaders across the region. President Andrés Manuel López Obrador has been saying in recent weeks that the U.S. government should not exclude anyone from the summit, but he had not previously threatened to stay home. “If they exclude, if not all are invited, a representative of the Mexican government is going to go, but I would not,” López Obrador said during his daily news conference, fresh off a visit to Cuba. He said his foreign affairs secretary, Marcelo Ebrard, would go. (The Washington Post)

RUSSIA: Until recently, the southwestern-most corner of Ukraine that curls between Moldova and Romania had been largely untouched by the war, providing a transit corridor for cargoes no longer able to use sea ports that once handled 70% of Ukraine’s trade. Fears have risen since April 27, when missiles twice struck the crossing at Zatoka, which carries the only road and rail connection between Bessarabia and the rest of Ukraine. Trucks now have to drive through Moldova to get from one part of Ukraine to the other, or to and from the Romanian border. That road crosses a second bridge, whose destruction would complete the region’s isolation from the rest of Ukraine. The loss of the main road through Zatoka remains a concern for the government of Moldova. It sees a risk of being drawn into the war if perceived by either side as allowing the 8 km stretch of road that’s now the sole connection between two parts of Ukraine to be used for military purposes, according to an official who asked not to be named due to the sensitivity of the matter. (BBG)

RUSSIA: The Pentagon said Russian forces are about two weeks behind schedule in their assault of the Donbas in eastern Ukraine. Russian President Vladimir Putin “has not achieved any of the success that we believe he wanted to achieve, certainly not on a timeline,” a senior U.S. Defense official said on a call with reporters. The official, who declined to be named per ground rules established by the Pentagon, said that the U.S. assesses Putin’s forces are “easily two weeks or even maybe more behind.” “We would not assess that the Russians have made any appreciable or significant progress,” the official added. (CNBC)

RUSSIA: Italian Prime Minister Mario Draghi said allies should start work on negotiations toward a long-lasting peace process in Ukraine, even as they continue to sanction Russia over its invasion of the country. “People are asking, how can we end those atrocities? How can we reach a cease fire? At the moment it is hard to have answers to that, but we need to think carefully about those questions,” Draghi told President Joe Biden during a meeting at the White House Tuesday. He said that Russian President Vladimir Putin has failed at damaging the US alliance with Europe. Biden told Draghi that Italy has been one of the US’s closest allies in confronting the Kremlin. “If Putin ever thought he could divide us, he failed,” Draghi said. (BBG)

RUSSIA: The US Treasury is busy examining whether or not it will extend a time-limited carveout from sanctions measures that has so far allowed Russia to keep making payments on its foreign currency bonds and steer clear of default. The future of those provisions -- which allow US holders of Russian sovereign bonds to receive payments on the debt and are currently set to expire May 25 -- are being “actively” examined at present, Yellen told lawmakers Tuesday in response to questioning. “We want to make sure that we understand what the potential consequences and spillovers would be of allowing the license to expire,” Yellen said. (BBG)

RUSSIA: Currency traders are preparing to jettison Russia’s local exchange rate for the ruble on some transactions, a sign of the growing split between the country’s domestic currency market and its international counterpart since the outbreak of the war in Ukraine. The Trade Association for the Emerging Markets is recommending that, starting on June 6, traders use pricing data from WM/Refinitiv as a primary settlement rate option for some derivative contracts, according to an April 20 statement. That could come as a relief to traders who had questioned the reliability of the ruble’s foreign-exchange rate since Russia was slapped with wide-reaching sanctions and imposed capital controls after the invasion. (BBG)

ENERGY: Ukraine said on Tuesday it would suspend the flow of gas through a transit point which it said delivers almost a third of the fuel piped from Russia to Europe through Ukraine, blaming Moscow for the move and saying it would move the flows elsewhere. Ukraine has remained a major transit route for Russian gas to Europe even after Moscow's invasion. GTSOU, which operates Ukraine's gas system, said it would stop shipments via the Sokhranivka route from Wednesday, declaring "force majeure", a clause invoked when a business is hit by something beyond its control. (BBG)

ENERGY: Ukraine and Russia clashed over natural gas sent via pipelines to Europe in a spat that could disrupt supplies transiting the former Soviet Union nation for the first time since the war started. “Ukraine doesn’t bear responsibility for gas transit via Russia-occupied territories and Gazprom was properly informed about that,” Ukrainian state-run energy company Naftogaz said in a statement on its website. The firm said it offered to reroute the gas, a switch that it said presents no technical difficulties and doesn’t involve additional costs for Russia. A Gazprom spokesman said the company was notified by Ukraine of the pending disruption, but didn’t receive any confirmation of force majeure. While the company said switching to Sudzha would be technically impossible, gas orders show an increase of 12% through the entry point. (BBG)

ENERGY: The head of Ukraine’s gas system operator told Reuters on Tuesday that Russian occupying forces had started taking gas transiting through Ukraine and sending it to two Russia-backed separatist regions in the country’s east. The operator’s CEO Sergiy Makogon, without citing evidence, made the comment to Reuters after Ukraine said on Tuesday it would suspend the flow of gas through a transit point which it said delivers almost a third of the fuel piped from Russia to Europe through Ukraine. (RTRS)

ENERGY: The European Union is “massively” underestimating the cost of weaning itself off Russian natural gas by billions of euros unless it can speed up its shift to renewable energy. Europe is so reliant on gas that even cutting Russian supplies still means governments could be on the hook for about 203 billion euros ($214 billion) of extra energy spending by 2030 at current prices, according to a report by climate think-tank Ember and Global Witness, an anti-corruption group. Without the bloc’s plan to diversify supplies and boost renewables, that figure could hit 250 billion euros. (BBG)

ENERGY: The EU is preparing to loosen its environmental regulations as it seeks to replace Russian fossil fuels with renewable energy and imported hydrogen power. Companies in the bloc would be allowed to build wind and solar projects without the need for an environmental impact assessment, according to draft proposals obtained by the Financial Times that call for the fast-track permitting of renewable projects in designated “go-to” areas. The EU’s 27 member states, which control energy policy, would be obliged to earmark a sufficient number of these areas to meet the bloc’s renewable energy targets. A “strategic” impact assessment would be needed before an area was selected. “Lengthy and complex administrative procedures are a key barrier for investments in renewables and their related infrastructure,” according to the draft. The plans could “result in the occasional killing or disturbance of birds and other protected species”, it added. (FT)

OIL: The European Union’s top diplomat Josep Borrell said on Tuesday he hoped for a deal soon on an EU oil embargo on Russia, possibly for EU foreign ministers to agree. Foreign ministers are due to meet on Monday, May 16. Borrell said last week he could also call an emergency meeting of the ministers to sign off on the sanctions if they were ready, or to move negotiations forward. If EU ambassadors could not agree this week, he also said foreign ministers could try to break any deadlock, in a bid to win over reluctant states, particularly Hungary. The European Commission proposed the oil embargo on May 4. (RTRS)

OIL: Top OPEC ministers have hit back at new U.S. legislation intended to regulate its output, saying such efforts would bring greater chaos to energy markets. UAE Energy Minister Suhail Al Mazrouei told CNBC Tuesday that OPEC was being unfairly targeted over the energy crisis, and moves by U.S. lawmakers to disrupt its established system of production could see oil prices shoot up by as much as 300%. (CNBC)

OIL: Opec+ production fell massively short of its target in April as capacity constraints and international sanctions undermined supply. Output by the Opec+ coalition was down for the second consecutive month, dropping by around 500,000 b/d compared with March to 37.56mn b/d in April. Production was nearly 2.4mn b/d below the group's combined target of 39.94mn b/d for the month — an 890,000 b/d increase in the shortfall between the target and actual output compared with March. The fall in Opec+ output was driven by an 870,000 b/d slump in Russian production to 9.13mn b/d, a 16-month low. Many European refiners and trading firms have cut back on Russian crude purchases ahead of EU and Swiss sanctions that come into effect on 15 May. The European Commission has proposed an "orderly" phasing out of EU oil imports from Russia by the end of this year, but the proposal faces some resistance and demands for carve-outs from EU members Hungary, Slovakia and the Czech Republic. Lower Russian production more than offset a 500,000 b/d increase in supply by Opec member countries that are subject to targets as Saudi Arabia and Iraq boosted output. But total Opec production was only 330,000 b/d higher on the month owing to renewed disruption in Libya. Libyan oil production fell by as much as 530,000 b/d during the month after protests starting on 17 April that led state-owned NOC to declare force majeure restrictions at Libya's largest oil field and two export terminals. The latest production figures, as estimated by Argus, highlight the difficulty that the Opec+ coalition increasingly faces in meeting production targets that are scheduled to rise in line with a roadmap outlined last summer. The group agreed on 5 May to maintain a scheduled 432,000 b/d increase in its June crude production ceiling. (Argus Media)

OIL: American drillers will increase oil production at a slower pace than previously expected amid surging costs, stymieing the Biden administration’s hope that the industry will boost output to tame fuel prices. The US cut its forecast for domestic oil production to 11.9 million barrels a day this year, compared with a previous estimate of 12.01 million, the Energy Information Administration said in a monthly report. It’s the first time 2022 supply was forecast under the 12 million barrel mark since February but an increase from last year’s output of 11.2 million barrels a day. (BBG)

OIL: Fathi Bashagha, the prime minister backed by Libya’s parliament, says the closed oil fields will restart after successful efforts by the parliament and the Libyan government to end the blockade by protesters. Fathi Bashagha comments on the oil fields restart in a Twitter post. (BBG)

CHINA

PBOC: Cuts to China’s reserve requirement for banks and interest rates are still worth looking forward to in the second quarter because the Fed’s monetary tightening won’t be a constraint on the PBOC’s monetary policy, Guan Tao, a former official at the State Administration of Foreign Exchange, writes in an article published Wednesday by the Shanghai Securities News. China is expected to maintain the strength of fiscal expenditures and accelerate spending, he writes. Pro-growth measures taken so far have gone beyond just traditional fiscal and monetary policies, and will provide support for economic recovery in the second quarter. Whether the economy will bottom out depends on how effective these policies are against a backdrop of China sticking to its Covid Zero policy. How well the economy withstands the shocks from policy tightening by developed nations and rising geopolitical risks will also be factors. (BBG)

POLICY: China’s macro leverage, or debt-to-GDP ratio rose by 4.4 percentage points to a historica high of 268.2% in Q1 from the previous quarter, as debt growth recovers while economic growth is at a low level, Yicai.com reported citing a report by the National Institution for Finance & Development. The main driver was the sharp increase in the leverage ratio of non-financial enterprises, reflecting easier credit supply, the report said. The macro leverage ratio may rise by more than 10 pps in 2022 should the annual GDP fail to reach 5%, the report said. This compares to 2021 when the ratio dropped by 6.3 pps amid a steady economic recovery with the epidemic under control, Yicai said. (MNI)

LIQUIDITY: Large banks in China are expected to lower provision coverage ratios to release more funds to support the real economy, the Economic Information Daily reported citing analysts. Funds released can be used to increase write-offs of non-performing loans and boost credit supply, the newspaper said citing Ming Ming, chief economist of CITIC Securities. Ten listed banks have already cut the ratio in Q1, with China Merchants Bank making the largest cut by 21.19 percentage points to 462.68%, the newspaper said. (BBG)

CORONAVIRUS: Shanghai said half of the city’s districts have reached “basically no community spread”, Zhao Dandan, deputy head of the city’s health commission says at a press conference. Some areas in Pudong New Area also reached “basically no community spread”. (BBG)

CORONAVIRUS: China risks a “tsunami” of coronavirus infections resulting in 1.6 million deaths if the government abandons its long-held Covid Zero policy and allows the highly-infectious omicron variant to spread unchecked, according to researchers at Shanghai’s Fudan University. The peer-reviewed study, published in the journal Nature, found that the level of immunity induced by China’s March vaccination campaign would be “insufficient” to prevent an omicron wave that would swamp intensive care capacity, given low vaccine rates among the elderly and the nation’s reliance on less effective, domestic shots. (BBG)

CHINA MARKETS

PBOC NET INJECTS CNY10 BLN VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rates unchanged at 2.10% on Wednesday. The operation has led to a net injection of CNY10 billion as no reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8346% at 09:59 am local time from the close of 1.5366% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 44 on Tuesday vs 42 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7290 WEDS VS 6.7134

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.7290 on Wednesday, compared with 6.7134 set on Tuesday.

OVERNIGHT DATA

CHINA APR CPI +2.1% Y/Y; MEDIAN +1.8%; MAR +1.5%

CHINA APR PPI +8.0% Y/Y; MEDIAN +7.8%; MAR +8.3%

JAPAN MAR, P LEADING INDEX CI 101.0; MEDIAN 100.9; FEB 100.1

JAPAN MAR, P COINCIDENT INDEX 97.0; MEDIAN 97.0; FEB 96.8

AUSTRALIA MAY WESTPAC CONSUMER CONFIDENCE 90.4; APR 95.8

AUSTRALIA MAY WESTPAC CONSUMER CONFIDENCE -5.6% M/M; APR -0.9%

The Index is now at its lowest level since August 2020 when households were unnerved by the ‘second wave’ lockdown in Victoria. The weakness in this survey is not related to another pandemic shock but to the combination of rising cost of living pressures and the prospect of rising interest rates. Excluding the shocks to confidence associated with the pandemic, this fall of 5.6% is the largest since a 6.9% fall in June 2015, when a steep fall in global share markets was triggered by concerns about the stability of the European financial system and a slowdown in China. That came shortly after May 2014 when a poorly received Federal Budget smashed confidence by 6.8%. The May print is 8.4% below the average seen in 2019, when consumer spending was generally described as lacklustre, essentially holding flat over the year. Consumer spending is much more buoyant over 2022 to date, as households respond to the reopening of the economy. This lift reflects a normalisation from the ‘low spending/high saving’ pattern seen during the COVID restrictions and is being supported by a large reserve of excess savings accumulated over the past two years. The survey of 1200 respondents was conducted over the week May 1 to May 5, which covered the announcement by the Reserve Bank of the 0.25% increase in the cash rate from 0.1% to 0.35%. Two stunning developments are clearly unnerving consumers. Firstly, on April 27, headline inflation was reported to have lifted above 5% for the first time since 2007. Then, on May 2, the Reserve Bank raised the cash rate for the first time since 2010. While headline inflation pressures may ease from this point, consumers are aware that the Reserve Bank plans to continue increasing the cash rate for some time. Westpac expects multiple increases through the remainder of the year with the cash rate peaking at 2.25% in May 2023. (Westpac)

SOUTH KOREA APR UNEMPLOYMENT RATE SA 2.7%; MEDIAN 2.8%; MAR 2.7%

SOUTH KOREA APR BANK LENDING TO HOUSEHOLDS KRW1,0602TN; MAR KRW1,059.0TN

MARKETS

SNAPSHOT: Familiar Headlines Fill The Pre-CPI Void

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 17.66 points at 26187.82

- ASX 200 down 4.66 points at 7046.5

- Shanghai Comp. up 49.59 points at 3085.43

- JGB 10-Yr future up 11.0 ticks at 149.3, yield up 0.3bp at 0.2500%

- Aussie 10-Yr future up 6.5 ticks at 96.46, yield down 6.5bp at 3.500%

- US 10-Yr future +0-01+ at 118-26+, yield down 0.75bp at 2.983%

- WTI crude up $1.71 at $101.47, Gold up $0.05 at $1838.14

- USD/JPY down 7 pips at Y130.38

- FED OFFICIALS BACK HALF-POINT HIKES, MESTER OPEN TO DOING MORE (BBG)

- GUINDOS SAYS ECB TO NORMALIZE POLICY SOONER RATHER THAN LATER (BBG)

- ECB’S VILLEROY SAYS GOVERNMENTS MUST TACKLE DEBT AS RATES RISE (BBG)

- UKRAINE, RUSSIA GAS CLASH RAISES THREAT TO EUROPE’S SUPPLY (BBG)

- CHINESE INFLATION DATA TOPS EXP.

US TSYS: Limited Pre-CPI Trade

Tsys have coiled during Asia-Pac hours, with a lack of meaningful macro headline flow and the proximity to the impending CPI print limiting price action during overnight dealing. Meanwhile, slightly firmer than expected Chinese inflation data and an uptick in Chinese equities capped the space.

- TYM2 sits +0-01+ at 118-26+, holding within the confines of a narrow 0-05+ on limited volume of ~65K. Cash Tsys are little changed across the curve, twist flattening, pivoting around 5s, with yields between -/+1.0bp vs closing levels. This comes after Tuesday’s frenetic session, which ended with the space pulling back from best levels into the bell, aided by a late and modest uptick in U.S. equities.

- Asia-Pac flow was headlined by a block buyer of TUM2 futures (+3K).

- The aforementioned CPI print headlines the docket on Wednesday (see our full preview of that release here), with 10-Year Tsy supply and Fedspeak from Bostic (’24 voter) due. Note that Bostic has made several appearances in recent days, expressing his preference for 50bp hikes at the next 2-3 Fed meetings.

AUSSIE BONDS: Futures Hold Higher In Tight Trade

A muted Sydney session for the space has seen the overnight bull flattening in futures give way to a more parallel move, with YM +6.5 & XM +7.0 at typing, as both contracts stick to narrow ranges ahead of Wednesday’s notable offshore event risk (namely U.S. CPI).

- Cash ACGB trade sees some light outperformance for the 5- to 10-Year zone of the curve.

- EFPs are a touch wider on the day, although the 3-/10-Year box has seen some light flattening.

- The IR strip is -1 to +6 through the reds, with relatively limited Sydney dealing observed.

- The latest round of ACGB Jun-51 supply went smoothly enough (there were some worries evident among desks ahead of supply), with the cover ratio holding above 2.00x and the weighted average yield comfortably through prevailing mids, to the tune of 1.86bp, per Yieldbroker. Note that the high yield was only 0.24bp above the weighted average yield, perhaps revealing some domestic demand for yield in the wake of the latest sell off, given the previously outlined worry of international investors re: market vol.

- Local data saw a tumble in the monthly Westpac consumer confidence reading, with tighter RBA policy & higher inflation the main drivers there.

- Looking ahead to tomorrow’s session, we will get consumer inflation expectations data.

AUSSIE BONDS: The AOFM sells A$400mn of the 1.75% 21 Jun ‘51 Bond, issue #TB162:

The AOFM sells A$400mn of the 1.75% 21 Jun ‘51 Bond, issue #TB162:

- Average Yield: 3.8326% (prev. 3.2119%)

- High Yield: 3.8350% (prev. 3.2175%)

- Bid/Cover: 2.0775x (prev. 2.0133x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 74.4% (prev. 36.0%)

- Bidders 54 (prev. 39), successful 27 (prev. 23), allocated in full 18 (prev. 16)

EQUITIES: Mixed Ahead Of U.S. CPI; Chinese Stocks Catch A Bid On COVID Relief, Renewed Easing Hopes

Major Asia-Pac equity indices are mixed at writing, tracking a similar performance from Wall St on Tuesday.

- The Hang Seng Index sits 1.7% better off at typing, on track to break a four-session streak of lower daily closes. The index’s Commerce & Industry sub-index was the only benchmark in the green, powered by gains in China-based tech such as BYD (+6.8%), Tencent (+4.4%), and Meituan (8.2%). The Hang Seng Tech Index correspondingly trades 4.6% higher at typing, largely unwinding Tuesday’s losses in the process.

- The CSI300 outperformed major equity index peers, dealing 2.0% higher at typing on broad strength across nearly all sub-indices. Chinese tech was notably bid, with the tech-heavy ChiNext sitting 4.3% better off.

- The strength in Chinese and Hong Kong-listed equities comes as the Chinese PPI print earlier in the session came in at a one-year low, with debate re: sufficient room for policy easing later doing the rounds in Asia. Falling COVID cases and a steady elimination of closely-watched community spread figures in the city of Shanghai also lent support to the positive mood, adding to support from additional remarks by the Biden administration re: the possible lifting of Trump-era tariffs on Chinese exports in the “coming weeks”.

- The ASX200 is 0.2% worse off at typing, back from worst levels (~0.8% lower), but continuing to operate a little above three-month lows made on Tuesday. Financial names lead losses in the index with the Big Four banks underperforming the ASX200 at typing, neutralising gains in the major mining stocks.

- U.S. e-mini equity index futures trade 0.2% to 0.8% higher at writing, extending a move higher from their respective multi-month lows made on Tuesday.

OIL: Off Lows In Asia; EU Sanctions On Russia See Little Progress

WTI is ~+$1.60 and Brent is ~+$1.70 at typing, rising above their respective two-week lows made earlier in the session. Both benchmarks nonetheless sit ~$8 lower for the week so far, with concern re: reduced Chinese energy demand and global stagflation worry remaining front and centre.

- Doubt re: the imminence of EU sanctions of Russian oil continues to do the rounds, with Hungarian officials continuing to indicate that little progress has been made in discussions with the EU.

- Looking to China,sharp inter-day declines in fresh daily case counts were observed in Shanghai and Beijing, with Shanghai officials declaring that half of the city’s districts have reached “basically no community spread”. Worry re: reduced industrial activity remains elevated however, with automakers Toyota and Tesla recently flagging supply chain disruptions due to ongoing pandemic control measures nationwide, with participants continuing to watch for the effectiveness of ongoing “closed loop” measures in Chinese factories for now.

- Turning to the Middle East, Libyan Parliament-elect PM Bashagha tweeted on Wednesday that government efforts to lift a protestor-led blockade on Libyan oil fields has been successful, noting that Libya had previously reported a half-million bpd decline in production over the issue.

- Elsewhere, the latest round of U.S. API inventory estimates crossed late on Tuesday, with reports pointing to a build in Cushing, crude, gasoline, and distillate stocks, coming as WSJ median estimates for EIA inventory figures later on Wednesday (1530 BST) have called for declines in the latter three stockpiles.

GOLD: Three-Month Lows Ahead Of U.S. CPI

Gold sits a little below neutral levels to print $1,837/oz at typing, operating a little above fresh 3-month lows made earlier in the session amidst an uptick in U.S. real yields.

- To recap, gold closed ~$16/oz lower on Tuesday, notching a second consecutive daily loss. The move lower came amidst a flurry of mildly hawkish Fedspeak, with officials continuing to voice support for back-to-back rate 50bp hikes in June and July while broadly refusing to rule out 75bp hikes later in ‘22, flagging data-dependence.

- To elaborate, Cleveland Fed Pres Mester (with her and NY Fed Pres Williams being the only “first-time” post-FOMC speakers on Tuesday) stated that back-to-back 50bp hikes for June and July made “perfect sense”, but cautioned that “we don’t rule out 75 forever”.

- July FOMC dated OIS now price in a shade under 2 x 50bp hikes for the next two meetings (~98bp), largely consistent with growing Fed consensus for the same. U.S. dated OIS markets are pricing in a cumulative ~190bp of tightening for calendar ‘22, with the probability re: 3 x 50bp hikes for the year continuing to edge downwards since the May FOMC held last week.

- Looking ahead, U.S. CPI will cross later on Wednesday (1330 BST).

- From a technical perspective, gold has broken immediate support at $1,848.8/oz (76.4% retracement of the Jan28-Mar8 rally), exposing further support at $1,821.1/oz (Feb 11 low).

FOREX: Sentiment Improves As Covid Community Transmission In Shanghai Grinds To Halt

Market sentiment turned positive in Asia hours as Shanghai declared zero new infections in the community, which triggers countdown to easing restrictions. Under the current guidance, the megacity could relax curbs after three consecutive days of no community transmission.

- Glimmers of hope provided by Shanghai Covid numbers generated light risk-on flows across G10 FX space. The Antipodeans pace gains as we type, while the greenback brings up the rear.

- AUD/NZD oscillated around neutral levels after finding support near the 50% Fibo retracement of its Apr 25 - May 4 rally at NZ$1.0987 over the past two days.

- Offshore yuan regained poise as China's inflation figures topped expectations. Spot USD/CNH pulled back to a session low of CNH6.7318 before unwinding some of its data-inspired losses.

- Focus turns to the much awaited consumer inflation report from the U.S. Separately, Germany will release its final CPI figures.

- The central bank speaker slate abounds with ECB members, including President Lagarde. Fed's Bostic is also set to make an address.

FOREX OPTIONS: Expiries for May11 NY cut 1000ET (Source DTCC)

- USD/CAD: C$1.2765($1.2bln), C$1.2950($1.9bln), C$1.3000($1.4bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/05/2022 | 0600/0800 | *** |  | DE | HICP (f) |

| 11/05/2022 | 0600/0800 |  | EU | ECB Elderson Fireside Chat with Sonja Gibbs | |

| 11/05/2022 | 0800/1000 |  | EU | ECB Lagarde Speech at 30th anniversary of Banka Slovenije | |

| 11/05/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 11/05/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 11/05/2022 | 1220/1420 |  | EU | ECB Schnabel Keynote Speech at Austrian National Bank | |

| 11/05/2022 | 1230/0830 | *** |  | US | CPI |

| 11/05/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 11/05/2022 | 1600/1200 |  | US | Atlanta Fed's Raphael Bostic | |

| 11/05/2022 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 11/05/2022 | 1800/1400 | ** |  | US | Treasury Budget |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.