-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Shanghai Continues Path Out Of Lockdown

EXECUTIVE SUMMARY

- FED'S HARKER: SOFT LANDING POSSIBLE, NOT FORECASTING RECESSION (RTRS)

- MORE WORK TO RESUME IN SHANGHAI'S ZERO-COVID AREAS FROM JUNE (RTRS)

- EU READY TO TURN MEASURES TARGETING FEARS OVER N IRELAND PROTOCOL INTO DRAFT LAW (FT)

- JAPAN INC TURNS AGAINST CENTRAL BANK'S MONETARY STIMULUS, REUTERS SURVEY SHOWS

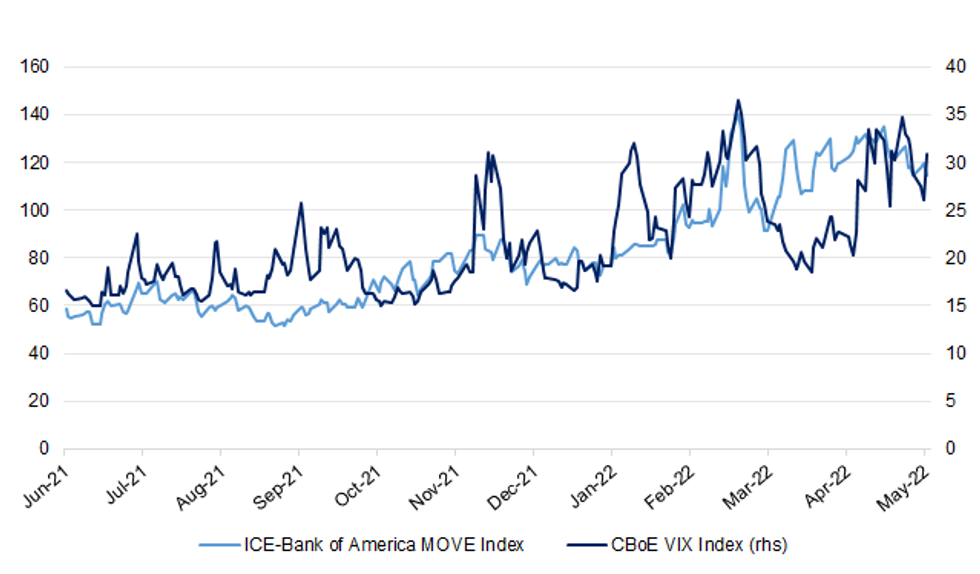

Fig. 1: ICE-Bank of America MOVE Index Vs. CBoE VIX Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BREXIT: Brussels wants to formalise proposals aimed at easing frictions on the border between Great Britain and Northern Ireland, as it seeks ways to address the stand-off with UK prime minister Boris Johnson. Maroš Šefčovič, the EU’s Brexit negotiator, told MEPs this week that he wants to turn a previously proposed EU package of solutions to the trade row into draft legislation to show that they provide workable ways around the impasse over the Northern Ireland Protocol, which governs post-Brexit trade on the island of Ireland. The move comes as the commission is urging the UK to engage over the protocol after London announced plans to table legislation of its own that would override parts of the deal. Šefčovič also told MEPs that the bloc was ready to take retaliatory measures if the UK went through with its threat to disapply measures in the protocol. Commission officials told the FT that they are working on a package of possible goods to hit with tariffs, although Brussels’ first step would probably be to restart legal action against London for failing to implement full border checks in Northern Ireland. It paused the process in July 2021 to support negotiations between the two sides. (FT)

BREXIT: The European Union is considering a targeted trade war on troublesome Brexiteer MPs and Tory ministers, sources told The Telegraph, as the bloc war-gamed its response to Boris Johnson’s plan to override the Northern Ireland Protocol. (Telegraph)

BOE: The Bank of England is focused on getting inflation back to its 2% target, British finance minister Rishi Sunak said on Wednesday. "It is the Bank of England's role to control inflation, and they are rightly independent," Sunak said in a speech to a Confederation of British Industry dinner. "Over the quarter century since we took monetary policy out of the hands of politicians, inflation has averaged precisely 2% and I know the governor and his team are completely focused on getting inflation back to target." (RTRS)

FISCAL: Chancellor of the Exchequer Rishi Sunak said that extra government spending to help ease Britain’s cost-of- living crisis risks further stoking inflation, as he warned of tough months ahead for the UK economy. “We need to be careful,” Sunak said at the annual dinner of the Confederation of British Industry on Wednesday evening, speaking to hundreds of executives. “At a time of severe supply restrictions, an unconstrained fiscal stimulus does risk making the problem worse.” (BBG)

FISCAL: Ministers are facing growing calls to bring forward large increases in benefits and the state pension which will be paid from next April. Charities want benefits to increase now to help people struggling with the cost of living, particularly energy bills. A well-established system means the annual increase in benefits will match this September's inflation rate - but will only be paid from April 2023. The Treasury says there are technical constraints in making earlier payments. (BBC)

FISCAL: No 10 is resisting pressure for a windfall tax on energy companies on the grounds that it would be “ideologically unconservative”. Treasury officials believe that the levy is “politically unavoidable” but are being blocked by the prime minister’s advisers. Rishi Sunak, the chancellor, has left the door open on imposing a one-off tax on energy suppliers as he comes under increasing pressure to do more to help people with the cost of living. In conversations with No 10, Treasury officials have argued that while a windfall tax would not raise a significant amount it would send a powerful message to the public that the government was “on their side”. (The Times)

EUROPE

SWEDEN: Swedish home prices fell in April and early May as the central bank’s plan to raise borrowing costs risks upending a housing market that became hotter than ever during the pandemic. In April, the HOX Sweden housing-price index fell by 0.5% from the previous month and the decline appears to have accelerated since then, according to Valueguard, which compiles the index. In the capital, Stockholm, apartment prices fell by 1.7% in the first half of this month. (BBG)

U.S.

FED: Philadelphia Federal Reserve Bank President Patrick Harker on Wednesday said he believes the central bank can bring inflation down without sending the economy into a recession, in part because the labor market is currently strong. "We may have a few quarters of negative growth, but again, that's not what I'm estimating, what I'm forecasting right now," Harker said in a virtual event with the Mid-Size Bank Coalition of America, adding the economy can withstand a "measured" and "methodical" tightening of financial conditions that would bring down demand. "We don't want to overdo it, but we have to act." (RTRS)

FED: U.S. Federal Reserve nominee Michael Barr, nominated by Democratic President Joe Biden to be the central bank's Wall Street cop, said on Wednesday that he is committed to bringing inflation back down to 2%. "Inflation is running far too high, affecting communities all across our country. I would be strongly committed to bringing down inflation to the Federal Reserve’s target, consistent with the Federal Reserve’s dual mandate of maximum employment and price stability," Barr said in testimony released ahead of a Congressional hearing on Thursday where he will make the case for why he should take on the Fed's sweeping regulatory portfolio as Vice Chair for Supervision. Barr, a former senior Treasury Department official under President Barack Obama, will testify before the Senate Banking Committee at 10:00 a.m. ET. (RTRS)

OTHER

GLOBAL TRADE: The cargo surge swamping U.S. ports for almost two years is starting to overwhelm the Port of New York and New Jersey. A backup of container ships waiting outside the East Coast’s busiest port last week reached an average of 14 vessels a day, the highest it has been since the Covid-19 pandemic began battering supply chains. Port officials are talking to ocean carriers, truckers and warehouses to ease the logjams amid expectations of a stronger rush of shipments in summer as the peak shipping season begins, said Rick Cotton, executive director of the Port Authority of New York and New Jersey. (WSJ)

GLOBAL TRADE: United Nations Secretary-General Antonio Guterres said he’s negotiating with Russian, US, Ukrainian and EU officials to give Russian food and fertilizers “unrestricted access” to global markets as the Ukraine invasion has exacerbated what already was a global food crisis. Guterres told a ministerial conference on food security at the UN in New York that there’s a “long way to go” in negotiations and he won’t go into details “because public statements could undermine the chances of success.” Speaking at the same event, US Secretary of State Antony Blinken said they were meeting during “the greatest global food security crisis of our time,” caused by a the deadly combination of the Covid-19 pandemic, a worsening climate crisis and the Russian invasion. He pledged an additional $215 million in emergency food aid, and called on Russia to create safe corridors for Ukraine to export food by land and sea. “There are an estimated 22 million tons of grains sitting in silos in Ukraine right now,” Blinken said. (BBG)

GLOBAL TRADE: China has removed restrictions on imports of Canadian canola seed that were put in place three years ago, Canadian officials said on Wednesday. "Canada has been advised that China has reinstated access to its market for two Canadian companies that China Customs had suspended from exporting canola seed to China since March 2019," Canadian Trade Minister Mary Ng and Agriculture Minister Marie-Claude Bibeau said in a statement. (RTRS)

U.S./CHINA/TAIWAN: China’s top diplomat again warned the US over its increased support for Taiwan, showing the island democracy remains a major sticking point between the world’s biggest economies as Beijing sent more military aircraft toward the island. “If the US side insists on playing the Taiwan card and goes further and further down the wrong road, it will certainly lead to a dangerous situation,” Yang Jiechi, Beijing’s top diplomat, said in a phone call with National Security Advisor Jake Sullivan. (BBG)

GEOPOLITICS: US Secretary of State Antony Blinken and Turkish Foreign Minister Mevlut Cavusoglu discussed Turkey’s resistance to expanding NATO to add Finland and Sweden as they began a meeting in New York. Turkey has always supported NATO’s open-door policy, Cavusoglu told reporters, but his country “has security concerns that must be met.” Blinken said the alliance would work through the concerns of all three countries as “allies and partners.” (BBG)

JAPAN: Japan will waive quarantine for travelers from about 100 countries including the US and the UK that have low coronavirus rates, public broadcaster NHK reports without attribution. Move will apply to countries with a low percentage of arrivals testing positive Travelers from another 90 countries including Egypt and Vietnam will be exempt from testing requirements if they’ve had 3 vaccine shots. (BBG)

JAPAN: Japan ruling coalition lawmakers are considering pushing for raising the corporate tax rate while giving greater tax cuts to companies for capital spending, Jiji reports without attribution. Effective corporate tax rate is currently 29.74%, having gradually been reduced from 34.62% since fiscal 2015. Tax policy research commissions of the Liberal Democratic Party and junior partner Komeito are in talks with the government; look to make the change in fiscal 2023. Would be first increase since 1984. (BBG)

BOJ: More than 60% of Japanese companies want the central bank to end its policy of massive monetary easing this fiscal year due to pain from the weak yen, with roughly a quarter calling for it to take action now, a Reuters survey shows. Less than a year ago, Japan Inc had enthusiastically backed the Bank of Japan's policy but this year's rapid slide in the yen to a two-decade low has jacked up prices of fuel and raw materials imports, lifting not only corporate costs but also hitting household spending. (RTRS)

NEW ZEALAND: Weekly $27 cash payments, fuel discounts and half-price public transport are among the short-term sweeteners offered up by New Zealand’s government in its latest budget, as it tries to juggle the cost-of-living crisis with big-ticket spending commitments, including $11.1bn of healthcare system reform and $2.9bn responding to the climate crisis. “While we know the current storm will pass, it is important we take the hard edges off,” prime minister Jacinda Ardern said in remarks accompanying the budget’s release. “The plan this year is to do two things,” Ardern said. To “ensure Aotearoa New Zealand’s economic and social security for generations to come … making us less vulnerable to external shocks,” and “cushion the impact of the inflation cycle on families”. (Guardian)

NORTH KOREA: U.S. national security adviser Jake Sullivan said on Wednesday that he discussed the possibility of North Korean nuclear or missile tests with China's top diplomat Yang Jiechi during a call focused on regional security issues and nonproliferation. Sullivan told a White House briefing that U.S intelligence shows North Korea could be preparing for such a test before, during or after President Joe Biden's trip to South Korea and Japan starting this week. "I spoke with my Chinese counterpart this morning, and covered this issue of the DPRK," Sullivan said of the call with Yang. The United States was prepared to make short- and long-term adjustments to its military posture to ensure defense and deterrence to its allies in the region, Sullivan said. (RTRS)

NORTH KOREA: North Korea has been gauging the timing to conduct what would be its seventh nuclear test after completing its preparations, South Korea's spy agency said Thursday. The National Intelligence Service also said in a closed-door briefing to lawmakers that there are signs North Korea could launch an intercontinental ballistic missile (ICBM) even though it is grappling with the COVID-19 outbreak. The assessment came amid concerns that North Korea could carry out a major provocation during U.S. President Joe Biden's visit to Seoul this week for a summit with President Yoon Suk-yeol. (Yonhap)

NORTH KOREA: The U.S., Japan and South Korea are planning to hold a meeting of defense chiefs in Singapore in June to discuss North Korea and other pressing security issues, Nikkei has learned, restarting in-person talks after nearly two and a half years. (Nikkei)

NORTH KOREA: South Korea’s spy agency carefully estimates North Korea’s coronavirus cases may reach peak in late May or early June, a lawmaker tells reporters after the agency briefed parliament’s intelligence committee on North Korea issues. North Korea has completed preparation for nuclear test and gauges timing for the test. South Korea detects signs of N. Korea’s missile test preparation despite coronavirus outbreak. (BBG)

CANADA: Alberta Premier Jason Kenney steps down as United Conservative Party leader after barely surviving a leadership review vote. Kenney received 51.4% of approval in his leadership review vote but still decided to resign. "I have informed the president of the party of my intention to step down," he announced after the result was revealed. The vote came after weeks of political turmoil in the western province, with Kenney facing criticism over his handling of the COVID-19 pandemic and relations with the federal government. Kenney's falling popularity was reflected in his poor approval rating, which made him a liability for the UCP, already falling behind the New Democrats ahead of the provincial election slated for May 2023. (MNI)

MEXICO: The US asked Mexico to investigate whether workers at a Panasonic Holdings Corp. auto-parts plant are being denied labor rights, a third such review under a trade pact between the countries and Canada. Using the rapid-response mechanisms to deal with worker-rights issues under the agreement, US Trade Representative Katherine Tai wants Mexico to determine whether employees at the facility in Reynosa, Tamaulipas, are being denied the rights of free association and collective bargaining, her office said in a statement Wednesday. (BBG)

BRAZIL: Brazil's Supreme Court Justice Dias Toffoli on Wednesday dismissed a lawsuit filed by President Jair Bolsonaro against justice Alexandre de Moraes, saying there was no fair cause for it to go forward, according to a decision reviewed by Reuters. Bolsonaro had announced late on Tuesday he was suing Moraes for abuse of authority, citing alleged "attacks on democracy," marking the latest episode in a running showdown between the president and the court that could spill into the country's upcoming presidential election. (RTRS)

BRAZIL: Brazil's president Jair Bolsonaro asked the country's top public prosecutor to investigate supreme court justice Alexandre de Moraes, a source told Reuters on Wednesday. The decision comes a day after Bolsonaro filed a lawsuit against Moraes, accusing him of abuse of authority. Earlier on Wednesday, another supreme court justice has dismissed the lawsuit. (RTRS)

BRAZIL: Brazil’s government got the green light by auditors to privatize Centrais Eletricas Brasileiras SA, or Eletrobras, the nation’s biggest electricity generation company. The country’s audit court approved the sale by 7-1 votes on Wednesday, when it resumed deliberations after delaying its final decision by 20 days to give one of its members more time to evaluate the process. President Jair Bolsonaro’s administration seeks to raise about 67 billion reais ($13.5 billion) for its majority stake in the company, which generates about 30% of all the electricity in Brazil. (BBG)

RUSSIA: Russian forces in eastern Ukraine are scaling back their operations, focusing on smaller objectives like towns, villages and crossroad intersections after failing to make significant progress in their assault on territory in that region, a senior US defense official said. The Russians have been using company-sized units to capture objectives, instead of the larger battalion-sized units they had been using, the official told reporters, adding that the Russians continue to have issues with communicating between units. (BBG)

RUSSIA: Ukrainian forces shelled a border village in Russia's western region of Kursk at dawn on Thursday, killing at least one civilian, regional governor Roman Starovoit said. Shells have hit an alcohol factory in the village of Tyotkino and several other buildings, Starovoit wrote on messaging app Telegram. (RTRS)

RUSSIA: The US has reopened its embassy in Ukraine’s capital three months after shutting it down. “Today we are officially resuming operations at the US Embassy in Kyiv,” Secretary of State Blinken said in a statement. “The Ukrainian people, with our security assistance, have defended their homeland in the face of Russia’s unconscionable invasion, and, as a result, the Stars and Stripes are flying over the Embassy once again.” Blinken said “we have put forward additional measures to increase the safety of our colleagues who are returning to Kyiv.” The decision to close the embassy in February had drawn criticism as sending a signal of doubt about Ukraine’s ability to hold out against the threatened Russian invasion that came soon after. (BBG)

RUSSIA: Societe Generale SA said it closed the sale of its Russian activities to billionaire Vladimir Potanin, a move that will result in a 3.2-billion euro ($3.4 billion) hit on its second-quarter earnings. SocGen’s sale of Rosbank PJSC and of its local insurance business to Potanin’s Interros Capital will also have a residual negative impact on its CET1 ratio, a key measure of financial strength, of 7 basis points, the bank said in a statement on Wednesday. The French bank, whose ratio stood at 12.9% at end March, saw a residual impact of 6 basis points earlier this month. (BBG)

RUSSIA: Russia’s economic growth slowed in the first quarter, as the initial impact of sanctions imposed following President Vladimir Putin’s invasion of Ukraine began to show up. Gross domestic product rose 3.5% from a year earlier, down from a gain of 4% in the previous three months, the Federal Statistics Service said Wednesday, citing preliminary numbers. Most of the latest results were recorded before Putin sent troops into Ukraine on Feb. 24, triggering sweeping sanctions from the US and its allies. The sanctions are expected to set off a deep recession in Russia, with the economy contracting as much as 10% this year, according to the central bank. (BBG)

RUSSIA: Russia's weekly inflation rate eased further in May, data from statistics service Rosstat showed on Wednesday, after spiking sharply soon after Russia began what it calls a "special military operation" in Ukraine on Feb. 24. Inflation is slowing even after the central bank lowered its key interest rate to 14% from 17% in April and said it saw room for more cuts, as it tries to manage a shrinking economy and high inflation. Inflation was 0.05% in the week to May 13, down from 0.12% a week earlier and well below the 2.22% hit in early March. So far this year, consumer prices in Russia rose 11.84%, Rosstat said. Prices on nearly everything, from vegetables and sugar to clothes and smartphones, have risen sharply in recent weeks as Russia encountered logistics disruptions and increased volatility in the rouble. Annual inflation has accelerated to 17.83% in April, its highest since January 2002. The central bank, which targets inflation at 4%, said the annual increase in consumer prices was on track to reach to 18-23% in the whole of 2022. (RTRS)

RUSSIA: The firming rouble along with a decline in recently elevated consumer demand are the main factors behind a slowdown in inflation, the Russian central bank said on Wednesday, predicting that price volatility will remain in the near future. The central bank, which last cut its key rate to 14% in April, said it expects annual inflation to slow to 5-7% in 2023 and then to its 4% target in 2024. For the first time in many weeks, annual inflation slowed to 17.69% as of May 13 from 17.77% a week earlier, data showed earlier on Wednesday, after spiking sharply soon after Russia began what it calls a "special military operation" in Ukraine on Feb. 24. (RTRS)

RUSSIA: Russian Finance Ministry is working on canceling VAT for private investors purchasing polished diamonds, Kommersant reports, citing the ministry. (BBG)

METALS: A reluctance by European metal users to buy Russian material will become an increasing factor over the coming year as purchase contracts come up for renewal, according to Christoph Eibl, the head of metals trader Tiberius Group. “One thing is clear: European consumption doesn’t want to procure Russian-sourced and produced metal, whether that’s lead, whether that’s aluminum, whether that’s palladium or copper,” he said in an interview on Bloomberg Television. “We haven’t even seen the full extent of that.” (BBG)

OIL: The Russian economy ministry expects prices for Russia's natural gas for consumers outside the CIS countries to rise 72% in 2022 to $523.3 per 1,000 cubic metres, RIA news agency reported on Wednesday. Russia's gas exports will shrink 10% this year to 185 billion cubic metres (bcm), RIA said, citing the economy ministry's forecasts. The economy ministry also expects Russia's gas output to decline to 721 bcm in 2022 from 764 bcm in 2021, Interfax reported, citing the ministry's forecasts. (RTRS)

OIL: Indian oil-and-gas company ONGC is considering bidding for other Russian energy assets after its bid for Shell’s stake in Siberian fields wasn’t accepted, Economic Times reports, citing unidentified people familiar with the matter. It’s considering bidding for Shell’s 27.5% stake in the Sakhalin-II oil and gas project and ExxonMobil’s 30% stake in Sakhalin-I. The board hasn’t yet considered the possible bids ONGC, Bharat Petroleum, Indian Oil, and Oil India have also held preliminary discussions among themselves to consider buying BP’s 20% stake in Rosneft, Economic Times said, citing the same people. ONGC, Bharat Petroleum, Indian Oil and Oil India didn’t respond to requests for comment. (BBG)

OIL: Aramco Trading Co. sold its first shipment of West African crude, underscoring the Saudi Arabian oil giant’s expansion ambitions for its trading arm. The company assigned a million-barrel cargo of Equatorial Guinea’s Zafiro crude for early June loading to Exxon Mobil Corp., according to traders with knowledge of the matter. The shipment will be processed by Exxon’s own refining system in Europe, they said. (BBG)

OIL: There was widespread disruption on several North Sea platforms on Wednesday after crew members staged unplanned walkouts. Workers on installations for some of the sector’s largest operators, including BP’s ETAP and Harbour Energy’s Judy, downed tools in an effort to force an increase to pay, in what has been described by some as a “wage revolution”. (Energy Voice)

CHINA

CORONAVIRUS: The COVID-19-hit financial hub of Shanghai will start to allow more businesses in zero-COVID areas to resume normal operations from the start of June, deputy mayor Zhang Wei said on Thursday as the city prepares for the end of lockdown. Zhang told a news briefing that the economy has been steadily returning to normal, with daily container throughput at Shanghai's ports now at around 90% of levels a year ago. (RTRS)

ECONOMY: China should issue more consumer coupons to help change consumers’ cautious attitudes on spending, the 21st Century Business Herald reported citing analysts after April retail sales fell 11.1% y/y to hit two-year low. Local governments should take an active role in coupon design and tilt toward lower-income groups. In Guangxi, an autonomous region in southern China, consumer coupons issued from April 30 to May 1 had driven sales with a leverage ratio of 1:13.5, the newspaper said. Analysts also noted that imported pressures may restrain household consumption if international food and energy prices continue to rise or remain high, the newspaper said. (RTRS)

ECONOMY: Retail car sales in China rose to 230,000 units during the period May 9 to 15, up 26% from the same period in April, data from China Passenger Car Association (CPCA) showed. During the first half of May, retail sales increased 27% from the same period a month earlier but still fell 21% year-on-year, CPCA said. (RTRS)

EQUITIES/SOES: China is pushing for deeper mixed-ownership reforms for SOEs to increase competitiveness in capital markets, according to the state-own Shanghai Securities Journal, citing an official with SASAC. State-owned enterprises need to explore spinning off multi-sectoral conglomerates for IPOs, said Wen Jieming, deputy director of the State-owned Assets Supervision and Administration Commission. Firms need to create plans for more share buybacks to restore market confidence in undervalued stocks. It called for more dividends and equity incentives to encourage investors and executives to hold stocks for longer. (BBG)

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.1% on Thursday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1000% at 09:23 am local time from the close of 1.5550% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 44 on Wednesday vs 46 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7524 THURS VS 6.7421

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.7524 on Thursday, compared with 6.7421 set on Wednesday.

OVERNIGHT DATA

CHINA APR SWIFT GLOBAL PAYMENTS CNY 2.14%; MAR 2.20%

JAPAN APR TRADE BALANCE -Y839.2BN; MEDIAN -Y1.1500TN; MAR -Y414.1BN

JAPAN APR TRADE BALANCE ADJ -1.6189TN; MEDIAN -Y1.5209TN; MAR -Y1.0194TN

JAPAN APR EXPORTS +12.5% Y/Y; MEDIAN +13.9%; MAR +14.7%

JAPAN APR IMPORTS +28.2% Y/Y; MEDIAN +35.0%; MAR +31.2%

JAPAN MAR CORE MACHINE ORDERS +7.6% Y/Y; MEDIAN +3.3%; FEB +4.3%

JAPAN MAR CORE MACHINE ORDERS +7.1% M/M; MEDIAN +3.9%; FEB -9.8%

AUSTRALIA APR UNEMPLOYMENT RATE 3.9%; MEDIAN 3.9%; MAR 3.9%

AUSTRALIA APR EMPLOYMENT CHANGE +4.0K; MEDIAN +30.0K; MAR +20.3K

AUSTRALIA APR FULL-TIME EMPLOYMENT CHANGE +92.4K; MAR +19.9K

AUSTRALIA APR PART-TIME EMPLOYMENT CHANGE -88.4K; MAR +0.4K

AUSTRALIA APR PARTICIPATION RATE 66.3%; MEDIAN 66.4%; MAR 66.4%

AUSTRALIA APR RBA FX TRANSACTIONS GOV’T -A$882MN; MAR -A$1.319BN

AUSTRALIA APR RBA FX TRANSACTIONS MARKET +A$872MN; MAR +A$1.298BN

AUSTRALIA APR RBA FX TRANSACTIONS OTHER -A$878MN; MAR +A$1.445BN

NEW ZEALAND Q1 PPI INPUT +3.6% Q/Q; Q4 +1.2%

NEW ZEALAND Q1 PPI OUTPUT +2.6% Q/Q; Q4 +1.5%

MARKETS

SNAPSHOT: Shanghai Continues Path Out Of Lockdown

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 470.37 points at 26441.23

- ASX 200 down 108.763 points at 7073.9

- Shanghai Comp. down 2.584 points at 3083.393

- JGB 10-Yr future up 7 ticks at 149.59, yield down 0.5bp at 0.240%

- Aussie 10-Yr future up 6.5 ticks at 96.575, yield down 5.9bp at 3.401%

- U.S. 10-Yr future -0-05 at 119-09, yield up 2bp at 2.904%

- WTI crude up $0.92 at $110.51, Gold down $1.47 at $1815.15

- USD/JPY up 61 pips at Y128.83

- FED'S HARKER: SOFT LANDING POSSIBLE, NOT FORECASTING RECESSION (RTRS)

- MORE WORK TO RESUME IN SHANGHAI'S ZERO-COVID AREAS FROM JUNE (RTRS)

- EU READY TO TURN MEASURES TARGETING FEARS OVER N IRELAND PROTOCOL INTO DRAFT LAW (FT)

- JAPAN INC TURNS AGAINST CENTRAL BANK'S MONETARY STIMULUS, REUTERS SURVEY SHOWS

US TSYS: Bear Steepening After 2-Way Asia Trade

Early Asia-Pac trade saw Wednesday’s risk-negative mood spill over, although the S&P 500 e-mini’s failure to make a meaningful, lasting break below the 4,000 mark allowed wider risk appetite to stabilise. Touted Japanese demand for USD/JPY provided some cross-market impetus, while an uptick in throughput at the Shanghai port and further positive developments surrounding Shanghai’s removal of COVID restrictions fuelled the wider recovery from lows in equity indices (the S&P 500 e-mini is now 0.2% higher on the session).

- This applied pressure to the U.S. Tsy curve, which managed to bear steepen, with the major cash benchmarks running 0.5-3.0 cheaper into London hours. TYM2 currently prints -0-06+ at 119-07+, 0-01+ off the bottom of its 0-14 range, on volume of ~145K. A screen lift of TYM2 which saw paper pay 119-08 up to 118-09 on ~4.6K helped the contract and wider space find a bit of a base.

- Thursday’s NY session will see the release of existing home sales data, the latest Philly Fed business survey and weekly jobless claims prints. We will also hear from Minneapolis Fed President Kashkari (’23 voter) and get 10-Year TIPS supply.

JGBS: Flatter, Futures In Tight Range

Spill over from NY dealing and the defensive start to Asia-Pac trade facilitated a small uptick for JGB futures at the Tokyo re-open, with the contract extending through its overnight high before paring back, as wider risk appetite stabilised.

- The downtick in cover ratios observed at the latest batch of BoJ Rinban operations (covering 1- to 3-, 5- to 10- and 25+-Year JGBs) did little to support the space during the afternoon, although ranges remained relatively tight, with futures +7 at typing.

- Wider cash JGB trade saw bull flattening, with no real sense of retracement forthcoming in the super-long end. That leaves the major cash JGB benchmarks little changed to 2bp richer across the curve.

- National CPI data headlines the domestic docket on Friday, with 20-Year JGB supply also due (as noted above, there wasn’t much willingness to try and force some meaningful pre-auction concession in 20s today).

JGBS AUCTION: Japanese MOF sells Y2.8308tn 1-Year Bills:

The Japanese Ministry of Finance (MOF) sells Y2.8308tn 1-Year Bills:

- Average Yield -0.0884% (prev. -0.0789%)

- Average Price 100.089 (prev. 100.079)

- High Yield: -0.0804% (prev. -0.0659%)

- Low Price 100.081 (prev. 100.066)

- % Allotted At High Yield: 36.9716% (prev. 1.5135%)

- Bid/Cover: 4.862x (prev. 3.081x)

AUSSIE BONDS: Off Best Levels, Labour Market Report Is No Gamechanger

Wider risk appetite dominated price action for most of the Sydney session, with futures pulling back from their respective Sydney peaks (YM broke above its overnight high, while XM did not) on the previously outlined factors. YM is +3.5, while XM is +6.5 at typing. Wider cash ACGB trade sees the super-long end print 7.0-7.5bp richer on the day. EFPs are incrementally narrower on the session.

- There was a light bid in the wake of the release of the latest monthly domestic labour market. Note that headline employment provided a notable miss vs. exp. (+4.0K vs. BBG median of +30.0K) although a fall in part-time employment was the driver there. Elsewhere, the underemployment and underutilisation measures continued their move lower (registering fresh multi-year lows), while unemployment printed steady at 3.9% (once you account for the downside revision observed in March’s data) as participation softened.

- This shouldn’t be a gamechanger for the RBA. The continued move lower in underutilisation and underemployment bodes well for remuneration, with the RBA’s liaison programme already revealing more notable upward wage pressures than that observed in the lagged WPI data (which is also hindered by its construction when it comes to tracking non-standard remuneration measures). We would argue that yesterday’s WPI reading probably takes any need for a larger than expected 25bp hike off of the table when it comes to the Bank’s June meeting, unless RBA liaison digs up a more timely and meaningful surge in pay awards or it really wants to get back to the traditional 25bp multiples for the headline cash rate target level. Wider risk-off price action observed since yesterday’s close saw IB strip pricing re: the RBA’s June meeting narrow a touch, to price in ~31bp of tightening vs. ~34bp of tightening at yesterday’s Sydney close (per BBG’s WIRP function).

- A$700mn of ACGB Apr-27 supply and the release of the weekly AOFM issuance slate are due on Friday.

EQUITIES: Off Worst Levels In Asia, But Plenty Of Worry Still Evident

Early Asia-Pac trade saw Wednesday’s risk-negative mood spill over, although the S&P 500 e-mini’s failure to make a meaningful, lasting break below the 4,000 mark allowed wider risk appetite to stabilise. Some Japanese demand for USD/JPY, coupled with an uptick in throughput at the Shanghai port and further positive developments surrounding Shanghai’s removal of COVID restrictions, further fuelled the wider recovery from lows in equity indices.

- Although Chines equities opened lower, some pointed to Wednesday’s after market communique from Chinese Premier Li as another supportive factor, which helped limit early losses. As a reminder, Li noted that China will step up the adjustment of its macro policies, while repeating a vow of support for tech platforms and the private sector. He also insisted that China has the policy space to deal with the challenges that it currently faces.

- The CSI 300 is down a mere 0.25% as a result, although the Hang Seng Tech Index is a more pronounced 3.4% lower on the day. The latter saw tech giant Tencent struggle after executives warned that it would take time for Beijing to act on its promises re: support for the sector, which came alongside an earnings miss for the company. Elsewhere, the Nikkei 225 and ASX 200 are over 1.50% cheaper, with Wednesday’s U.S. equity weakness leaving a firmer imprint on those indices.

- The major U.S. e-mini contracts sit little changed to 0.2% firmer vs. settlement. Note that CISCO reported disappointing revenue after hours on Wednesday, with the company’s guidance metrics also providing notable disappointment.

OIL: Crude Reverses Early Losses In Asia

Wider swings in risk appetite made for a lively Asia-Pac session, with WTI & Brent recovering early losses to last print ~$1.oo/bl & $1.50 higher on the day, respectively. WTI last deals at ~$110.50, while Brent sits just above $110.60, comfortably within their recent ranges.

- Wednesday’s risk-negative impulse spilled over into early Asia-Pac dealing, before the ability of the S&P 500 e-mini contract to find a base, followed by news that Shanghai port had resumed 90% of throughput capacity, with further re-opening steps for the city outlined, facilitated the bid.

- This comes after Wednesday’s equity-driven risk negative flows meant that the major crude benchmarks registered losses of over $2.00/bbl, with the latest round of DoE inventory data failing to provide any meaningful impulse, overpowered by the wider backdrop.

GOLD: Non-Committal

Bullion has coiled during Asia-Pac hours, leaving spot little changed at ~$1,815/oz. Gold has stuck to a narrow range, even with wider risk appetite operating in a two-way fashion. Participants have shown a lack of commitment to pushing the envelope in either direction over the last 24 hours, which leaves a familiar technical backdrop in play.

- Note that known ETF holdings of gold have started to pare back from the recent high over the last month or so, which has removed a leg of support for bullion. That particular metric now sits a little over 2% shy of its April YtD peak.

FOREX: Shanghai Reopening Plan Facilitates Risk Recovery

Market sentiment stabilised in the wake of Wednesday's equity rout on Wall Street, as e-minis shed initial weakness and climbed into the green. The turnaround in risk appetite was supported by the news that the Shanghai port has resumed 90% of its cargo-handling capacity, with local authorities outlining further re-opening steps.

- The yen paced losses among traditional safe-haven currencies. A contact flagged USD/JPY purchases linked to Japanese corporate names as well as retail clients who were adding to longs.

- Commodity-tied currencies benefited from an uptick in crude oil prices, with the Aussie dollar taking the lead. AUD/USD returned above the $0.7000 mark, while regional risk barometer AUD/JPY ripped through the Y90.00 figure.

- The latest batch of Australia's jobs market figures failed to move the needle on RBA expectations to any significant degree, as below-forecast employment growth was offset, but full-time positions soared. Still, the unemployment rate slipped to the lowest level in almost 50 years.

- U.S. initial jobless claims & existing home sales will take focus after Asia hours. Central bank speaker slate features Fed's Kashkari, ECB's de Guindos, de Cos, Verstager, Holzmann as well as Riksbank's Floden. In addition, the ECB will publish the minutes from its April monetary policy meeting.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/05/2022 | 0130/1130 | *** |  | AU | Labor force survey |

| 19/05/2022 | 0800/1000 | ** |  | EU | EZ Current Acc |

| 19/05/2022 | 0900/1100 | ** |  | EU | Construction Production |

| 19/05/2022 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 19/05/2022 | 1130/1330 |  | EU | ECB April meeting Accounts | |

| 19/05/2022 | - |  | EU | ECB Lagarde & Panetta in G7 Meeting | |

| 19/05/2022 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 19/05/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 19/05/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 19/05/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 19/05/2022 | 1230/1430 |  | EU | ECB de Guindos Keynote Address at Harvard | |

| 19/05/2022 | 1400/1000 | *** |  | US | NAR existing home sales |

| 19/05/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 19/05/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 19/05/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 19/05/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 19/05/2022 | 2000/1600 |  | US | Minneapolis Fed's Neel Kashkari |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.