-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Two-Way Asia Session, Regional Equities Still Lower

- Early Asia-Pac trade saw Wednesday’s risk-negative mood spill over, although the S&P 500 e-mini’s failure to make a meaningful, lasting break below the 4,000 mark allowed wider risk appetite to stabilise. Touted Japanese demand for USD/JPY provided some cross-market impetus, while an uptick in throughput at the Shanghai port and further positive developments surrounding Shanghai’s removal of COVID restrictions fuelled the wider recovery from lows in equity indices (the S&P 500 e-mini is now 0.2% higher on the session).

- JPY found itself at the bottom of the G10 FX table as a result, while the greenback struggle against the remainder of its major peers.

- U.S. initial jobless claims & existing home sales will take focus after Asia hours. The central bank speaker slate features Fed's Kashkari, ECB's de Guindos, de Cos, Verstager, Holzmann as well as Riksbank's Floden. In addition, the ECB will publish the minutes from its April monetary policy meeting.

US TSYS: Bear Steepening After 2-Way Asia Trade

Early Asia-Pac trade saw Wednesday’s risk-negative mood spill over, although the S&P 500 e-mini’s failure to make a meaningful, lasting break below the 4,000 mark allowed wider risk appetite to stabilise. Touted Japanese demand for USD/JPY provided some cross-market impetus, while an uptick in throughput at the Shanghai port and further positive developments surrounding Shanghai’s removal of COVID restrictions fuelled the wider recovery from lows in equity indices (the S&P 500 e-mini is now 0.2% higher on the session).

- This applied pressure to the U.S. Tsy curve, which managed to bear steepen, with the major cash benchmarks running 0.5-3.0 cheaper into London hours. TYM2 currently prints -0-06+ at 119-07+, 0-01+ off the bottom of its 0-14 range, on volume of ~145K. A screen lift of TYM2 which saw paper pay 119-08 up to 118-09 on ~4.6K helped the contract and wider space find a bit of a base.

- Thursday’s NY session will see the release of existing home sales data, the latest Philly Fed business survey and weekly jobless claims prints. We will also hear from Minneapolis Fed President Kashkari (’23 voter) and get 10-Year TIPS supply.

JGBS: Flatter, Futures In Tight Range

Spill over from NY dealing and the defensive start to Asia-Pac trade facilitated a small uptick for JGB futures at the Tokyo re-open, with the contract extending through its overnight high before paring back, as wider risk appetite stabilised.

- The downtick in cover ratios observed at the latest batch of BoJ Rinban operations (covering 1- to 3-, 5- to 10- and 25+-Year JGBs) did little to support the space during the afternoon, although ranges remained relatively tight, with futures +7 at typing.

- Wider cash JGB trade saw bull flattening, with no real sense of retracement forthcoming in the super-long end. That leaves the major cash JGB benchmarks little changed to 2bp richer across the curve.

- National CPI data headlines the domestic docket on Friday, with 20-Year JGB supply also due (as noted above, there wasn’t much willingness to try and force some meaningful pre-auction concession in 20s today).

AUSSIE BONDS: Off Best Levels, Labour Market Report Is No Gamechanger

Wider risk appetite dominated price action for most of the Sydney session, with futures pulling back from their respective Sydney peaks (YM broke above its overnight high, while XM did not) on the previously outlined factors. YM is +3.5, while XM is +6.5 at typing. Wider cash ACGB trade sees the super-long end print 7.0-7.5bp richer on the day. EFPs are incrementally narrower on the session.

- There was a light bid in the wake of the release of the latest monthly domestic labour market. Note that headline employment provided a notable miss vs. exp. (+4.0K vs. BBG median of +30.0K) although a fall in part-time employment was the driver there. Elsewhere, the underemployment and underutilisation measures continued their move lower (registering fresh multi-year lows), while unemployment printed steady at 3.9% (once you account for the downside revision observed in March’s data) as participation softened.

- This shouldn’t be a gamechanger for the RBA. The continued move lower in underutilisation and underemployment bodes well for remuneration, with the RBA’s liaison programme already revealing more notable upward wage pressures than that observed in the lagged WPI data (which is also hindered by its construction when it comes to tracking non-standard remuneration measures). We would argue that yesterday’s WPI reading probably takes any need for a larger than expected 25bp hike off of the table when it comes to the Bank’s June meeting, unless RBA liaison digs up a more timely and meaningful surge in pay awards or it really wants to get back to the traditional 25bp multiples for the headline cash rate target level. Wider risk-off price action observed since yesterday’s close saw IB strip pricing re: the RBA’s June meeting narrow a touch, to price in ~31bp of tightening vs. ~34bp of tightening at yesterday’s Sydney close (per BBG’s WIRP function).

- A$700mn of ACGB Apr-27 supply and the release of the weekly AOFM issuance slate are due on Friday.

JAPAN: Modest Net Flows In Latest Weekly International Security Flow Data

The latest round of weekly international security flow data out of Japan revealed flips in terms of the sign in front of the 4 major net flow metrics.

- Japanese investors were net buyers of foreign bonds for the first week since early April, although the 4-week rolling sum of the measure remains comfortably in negative territory.

- Foreign investors flipped to net buying of Japanese bonds after 3 consecutive weeks of net sales.

- Meanwhile Japanese investors sold foreign equities, bringing an end to 4 consecutive weeks of net buying, although net sales were light in absolute terms.

- Finally, foreign investors ended their run of 6 consecutive weeks of net purchases of Japanese equities.

- To reiterate, the net flows observed across the 4 major headline metrics were modest in absolute terms.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 370.8 | -820.3 | -2685.1 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -57.4 | 404.8 | 1320.2 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 373.8 | -212.9 | -1658.6 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | -342.9 | 78.8 | 833.2 |

FOREX: Shanghai Reopening Plan Facilitates Risk Recovery

Market sentiment stabilised in the wake of Wednesday's equity rout on Wall Street, as e-minis shed initial weakness and climbed into the green. The turnaround in risk appetite was supported by the news that the Shanghai port has resumed 90% of its cargo-handling capacity, with local authorities outlining further re-opening steps.

- The yen paced losses among traditional safe-haven currencies. A contact flagged USD/JPY purchases linked to Japanese corporate names as well as retail clients who were adding to longs.

- Commodity-tied currencies benefited from an uptick in crude oil prices, with the Aussie dollar taking the lead. AUD/USD returned above the $0.7000 mark, while regional risk barometer AUD/JPY ripped through the Y90.00 figure.

- The latest batch of Australia's jobs market figures failed to move the needle on RBA expectations to any significant degree, as below-forecast employment growth was offset, but full-time positions soared. Still, the unemployment rate slipped to the lowest level in almost 50 years.

- U.S. initial jobless claims & existing home sales will take focus after Asia hours. Central bank speaker slate features Fed's Kashkari, ECB's de Guindos, de Cos, Verstager, Holzmann as well as Riksbank's Floden. In addition, the ECB will publish the minutes from its April monetary policy meeting.

JPY: Trade Deficit Still A Yen Headwind

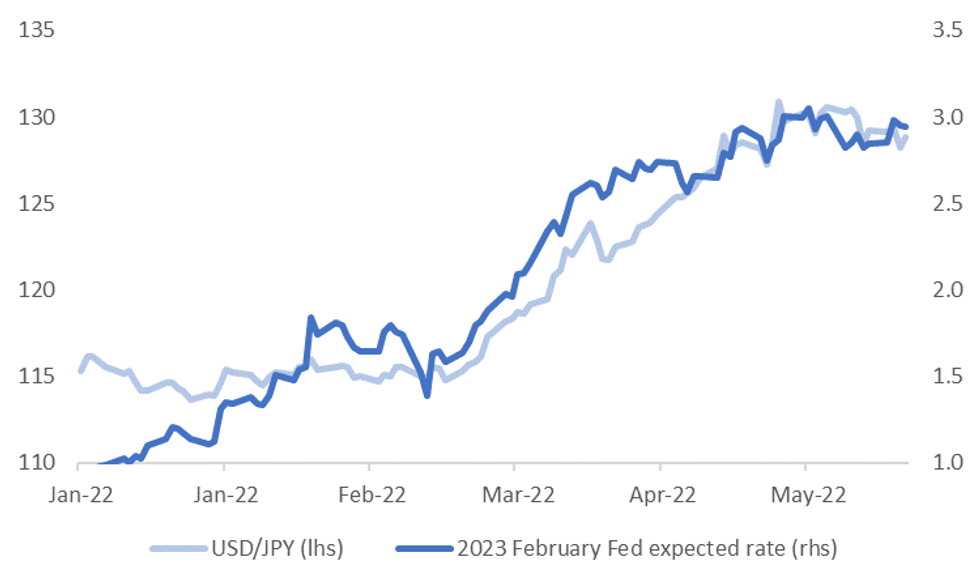

This time last week we noted that USD/JPY may struggle to make fresh highs if we saw a rangebound US Tsy environment and plateauing of Fed expectations (see this link).

- USD/JPY hasn't made fresh highs over this period, with a couple of sharp falls, however, dips remain supported, particularly sub 128.00, as was seen both last Thursday and today.

- Fed hiking expectations have edged higher over this period. The February 2023 implied rate sits close to 2.94%, up from the low 2.80% region last week, see the first chart below. Some of the major shifts in the Fed outlook have led USD/JPY moves, particularly since February.

Fig 1: USD/JPY & Fed Rate Expectations

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

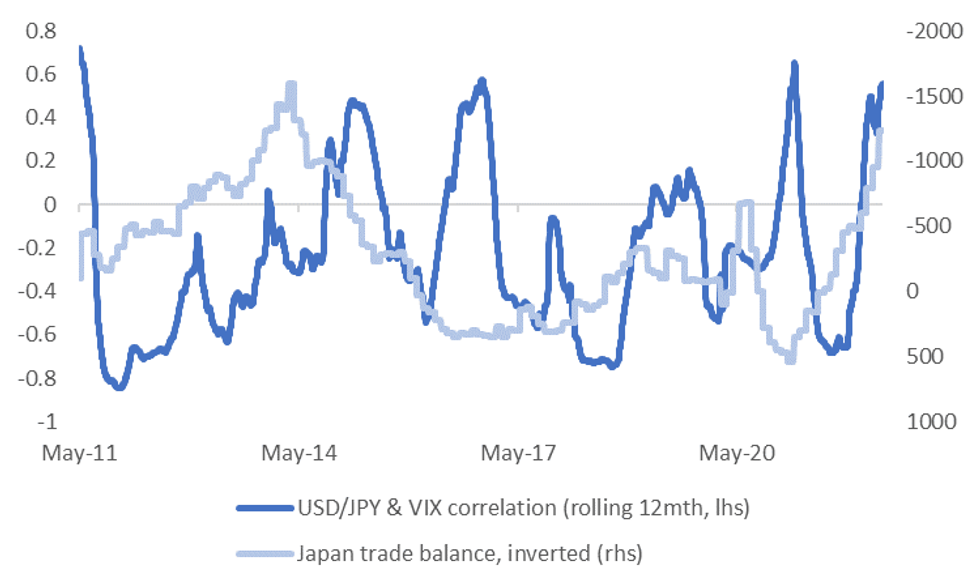

- The other factor to be mindful of is that the correlation between USD/JPY and the VIX index is quite positive at the moment, see the second chart below. The other line on the chart is Japan's trade balance, which is inverted.

- The basis for the chart is that when Japan is running a trade deficit, as it is at the moment, there is likely to be less support for the yen during risk off periods, as it has less external support to draw on. This is borne out in the chart to some degree, although the relationship is far from perfect.

- Today's Japanese trade data, for April, still showed import growth comfortably running ahead of export growth.

- Correlations can obviously change quickly, but for the moment risk off moves are not providing as much support to the yen than otherwise might be the case.

Fig 2: USD/JPY & VIX Correlations

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

ASIA FX: Risk-Off Impetus Carried Over From Wall Street Peters Out

Risk-off impetus from Wednesday's NY hours spilled over into Asia, but petered out as the session progressed. Positive news on Shanghai's COVID-19 situation helped to soothe the nerves, as local authorities outlined further re-opening plans and confirmed that the city's port restored 90% of throughput capacity.

- CNH: Spot USD/CNH lost some altitude. The PBOC set the mid-point of permitted USD/CNY trading band 15 pips shy of sell-side estimate.

- KRW: The won trimmed its opening losses, but remained on the back foot, as growth concerns took centre stage. Across the 38th parallel north, the DPRK appeared to be preparing an ICBM or nuclear test that could coincide with U.S. President Biden's visit to Seoul.

- IDR: Spot USD/IDR soared to its best levels since Oct 2020 before trimming gains. Indonesian palm oil producers continued to voice their opposition against the export ban applied to the edible oil. Elsewhere, Indonesian FinMin said that the 2022 average USD/IDR exchange rate is seen at IDR14,300-14,700.

- MYR: Spot USD/MYR went bid, showing at its highest point since Mar 2020, even as Malaysia's April trade surplus beat expectations.

- PHP: The peso outperformed after BSP Governor Diokno said the space for accommodative monetary policy has "considerably narrowed" as "second round effects are starting to manifest." He spoke on the eve of rate decision, due within a couple of hours.

- THB: Spot USD/THB ticked higher but remained within yesterday's range. The local COVID-19 task force will consider re-opening bars and pubs, with the final decision expected Friday.

EQUITIES: Off Worst Levels In Asia, But Plenty Of Worry Still Evident

Early Asia-Pac trade saw Wednesday’s risk-negative mood spill over, although the S&P 500 e-mini’s failure to make a meaningful, lasting break below the 4,000 mark allowed wider risk appetite to stabilise. Some Japanese demand for USD/JPY, coupled with an uptick in throughput at the Shanghai port and further positive developments surrounding Shanghai’s removal of COVID restrictions, further fuelled the wider recovery from lows in equity indices.

- Although Chines equities opened lower, some pointed to Wednesday’s after market communique from Chinese Premier Li as another supportive factor, which helped limit early losses. As a reminder, Li noted that China will step up the adjustment of its macro policies, while repeating a vow of support for tech platforms and the private sector. He also insisted that China has the policy space to deal with the challenges that it currently faces.

- The CSI 300 is down a mere 0.25% as a result, although the Hang Seng Tech Index is a more pronounced 3.4% lower on the day. The latter saw tech giant Tencent struggle after executives warned that it would take time for Beijing to act on its promises re: support for the sector, which came alongside an earnings miss for the company. Elsewhere, the Nikkei 225 and ASX 200 are over 1.50% cheaper, with Wednesday’s U.S. equity weakness leaving a firmer imprint on those indices.

- The major U.S. e-mini contracts sit little changed to 0.2% firmer vs. settlement. Note that CISCO reported disappointing revenue after hours on Wednesday, with the company’s guidance metrics also providing notable disappointment.

GOLD: Non-Committal

Bullion has coiled during Asia-Pac hours, leaving spot little changed at ~$1,815/oz. Gold has stuck to a narrow range, even with wider risk appetite operating in a two-way fashion. Participants have shown a lack of commitment to pushing the envelope in either direction over the last 24 hours, which leaves a familiar technical backdrop in play.

- Note that known ETF holdings of gold have started to pare back from the recent high over the last month or so, which has removed a leg of support for bullion. That particular metric now sits a little over 2% shy of its April YtD peak.

OIL: Crude Reverses Early Losses In Asia

Wider swings in risk appetite made for a lively Asia-Pac session, with WTI & Brent recovering early losses to last print ~$1.oo/bl & $1.50 higher on the day, respectively. WTI last deals at ~$110.50, while Brent sits just above $110.60, comfortably within their recent ranges.

- Wednesday’s risk-negative impulse spilled over into early Asia-Pac dealing, before the ability of the S&P 500 e-mini contract to find a base, followed by news that Shanghai port had resumed 90% of throughput capacity, with further re-opening steps for the city outlined, facilitated the bid.

- This comes after Wednesday’s equity-driven risk negative flows meant that the major crude benchmarks registered losses of over $2.00/bbl, with the latest round of DoE inventory data failing to provide any meaningful impulse, overpowered by the wider backdrop.

COMMODITIES: Commodity Prices Still Leading Fed Expectations

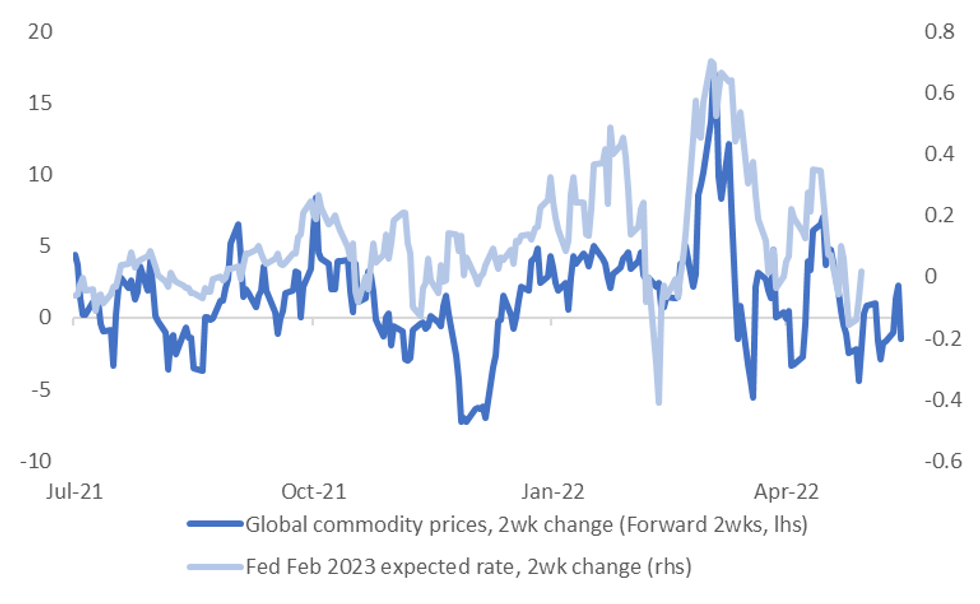

Risks to US data outcomes appear skewed to the downside, which should bias US growth and Fed expectations lower. However, commodity prices are still showing a decent leading relationship over Fed expectations.

- Thursday will likely see the focus for US data watchers fall on the latest Philly Fed survey. The market looks for a 15.0 headline print, versus 17.6 previously. Also out is jobless claims data and existing home sales.

- As we noted earlier in the week, the Citi US economic surprise index is back 0 for the first time since mid February We have stayed below this level even after firmer U.S. retail sales data.

- JPM economists have also revised down their US growth forecasts, citing tighter financial conditions. This will be reflected in the JPM forecast revision index (FRI), which is updated with a lag.

- Waning US growth expectations should flatten out Fed tightening expectations, all else equal, particularly over the medium term.

- However, an important offset in the near term is commodity price action. The chart below overlays the 2 week change in spot commodity prices and the 2 week change in the expected Fed funds rate in Feb 2023.

- Interestingly, the correlation is stronger between the two series when we lead commodity prices by 2 weeks. Since the the start of the year that correlation is 56%.

- Greater downside risks to US/global growth should ultimately weigh on commodity prices, but supply chain pressures, which have become more pronounced in recent months, see this link, are providing an important offset.

Fig 1: Commodity Price Changes & Fed Expectations

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/05/2022 | 0130/1130 | *** |  | AU | Labor force survey |

| 19/05/2022 | 0800/1000 | ** |  | EU | EZ Current Acc |

| 19/05/2022 | 0900/1100 | ** |  | EU | Construction Production |

| 19/05/2022 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 19/05/2022 | 1130/1330 |  | EU | ECB April meeting Accounts | |

| 19/05/2022 | - |  | EU | ECB Lagarde & Panetta in G7 Meeting | |

| 19/05/2022 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 19/05/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 19/05/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 19/05/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 19/05/2022 | 1230/1430 |  | EU | ECB de Guindos Keynote Address at Harvard | |

| 19/05/2022 | 1400/1000 | *** |  | US | NAR existing home sales |

| 19/05/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 19/05/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 19/05/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 19/05/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 19/05/2022 | 2000/1600 |  | US | Minneapolis Fed's Neel Kashkari |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.