-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: USD Bid & Tsys Offered, Powell-Biden-Yellen Meeting Eyed

- Spill over from Monday’s shunt lower in Bunds (on firmer than expected German CPI) and delayed reaction to the latest round of hawkish remarks from Fed Governor Waller applied pressure to Tsys during Asia-Pac dealing

- The move higher in Tsy yields allowed the greenback to outperform within the G10 FX space.

- On the data front, focus turns to flash Eurozone CPI, German unemployment, Canadian GDP as well as U.S. Conf. Board Consumer Confidence & MNI Chicago PMI. In addition, ECB's Villeroy, Visco & Makhlouf as well as Riksbank's Ingves are set to speak. Elsewhere, U.S. President Biden, Tsy Sec Yellen and Fed Chair Powell will hold a meeting at the White House, while EU leaders will resume their Brussels summit.

US TSYS: Cheaper Ahead Of Powell-Biden-Yellen Meeting

Spill over from Monday’s shunt lower in Bunds (on firmer than expected German CPI) and delayed reaction to the latest round of hawkish remarks from Fed Governor Waller applied pressure to Tsys during Asia-Pac dealing, with TYU2 -0-23+ at 119-13 at typing, 0-03 off the base of its 0-13 overnight range, operating on volume of ~150K during the overnight session. Cash Tsys are 7-11bp cheaper across the curve, with the 3- to 10-Year zone leading the weakness. Wider long end swap spreads suggest payside flows in swaps may have aided the cheapening.

- Note that the OIS strip currently prices a Fed Funds Rate of ~2.75% come the end of the Fed’s Dec ’22 meeting, per BBG WIRP. This is up from the ~2.65% seen at the close on Friday. Meanwhile, the Eurodollar strip runs 0.25-10.5bp cheaper through the reds, with the reds underperforming on the curve. A quick reminder that Atlanta Fed President Bostic (’24 voter) alluded to the potential for a pause in the Fed tightening cycle in September early last week, while some also suggested that a phrase in the minutes of the May FOMC meeting opened the potential for such a pause around year-end. While Waller’s comments didn’t contain much in the way of new information per se (his hawkish views are well documented), the recent Bostic/May FOMC minute conditioning may be exacerbating the market reaction. Some of the move we have seen may also be linked to setup ahead of Tuesday’s Powell-Biden meeting (Biden has laid out his inflation “plan” in a WSJ opinion piece), with Tsy Sec Yellen also set to join that particular gathering.

- Note that the confirmation of a fresh round of EU sanctions on Russian oil exports provided a very light bid for Tsy futures in early Asia trade (S&P e-minis have given up some of Monday’s gains as a result, last +0.2%, while WTI & Brent surged further) before selling kicked in.

- Chinese official PMI data wasn’t as soft as expected but had no meaningful impact on Tsys.

- Overnight block flow included an FV buyer (+4,100), FV/US (+4,250/-1,200) & TY/US steepeners (+2,000/-900) & TY downside interest via TYN2 119.00 puts (+5K).

- Eurozone CPI data provides the most notable economic release during the European morning, while NY hours will bring several rounds of second tier house price data, the monthly MNI Chicago PMI reading, consumer confidence and Dallas Fed m’fing activity data. Still, most of the focus will likely fall on the aforementioned Powell-Biden-Yellen gathering.

JGBS: Futures Lead The Way Lower

Cash JGBs trade little changed to ~1.5bp cheaper across the curve, with 7s providing the weakest point, aided by the extension of the overnight sell off in JGB futures, with the latter running 18 ticks lower than yesterday’s settlement, a little off worst levels of the day. The wider core global FI impetus facilitated the modest cheapening observed during Tokyo hours.

- Fiscal matters dominated local headline flow, with Finance Minister Suzuki noting that there was no change to the government's goal of balancing the primary budget balance during FY25. This came after several media outlets pointed to the government dropping the timeframe reference in an economic policy roadmap draft.

- The latest round of 2-Year JGB supply went well, with the low price coming in above that foreseen in the BBG dealer survey, while the price tail held relatively tight and the cover ratio moved higher, comfortably above its 6-auction average.

- Elsewhere, local data revealed a modest downtick for the unemployment rate, softer than expected industrial production and generally in line, to slightly firmer than expected retail sales readings.

- Q1 capex & corporate profit data headline Wednesday’s local docket.

AUSSIE BONDS: A Sigh Of Relief Re: GDP Allows Bonds To Extend Early Cheapening

Aussie bond futures moved to fresh session lows in the wake of the release of domestic data and the official Chinese PMI readings (which weren’t as soft as expected), after the wider impetus applied pressure pre-data.

- A quick look at the domestic Q1 data reveals a much narrower than exported current a/c surplus, alongside firmer than expected inventories data and company profits (Although the latter was solely driving by the mining industry). The monthly reference points revealed softer than expected building approvals readings, while private sector credit topped expectations.

- The latest round of partials data removed downside worry re: tomorrow’s Q1 GDP reading (some had touted the potential of a negative Q/Q reading in recent days), with notable sell-side expectation adjustments made. Firmer than expected inventory and public spending prints drove upward revisions, with a range of 0.6-1.1% when it comes to Q/Q GDP growth estimates provided by the major sell-side names that we have seen updated revisions for (BBG consensus now stands at +0.7%).

- YM -10.5 & XM -11.0 at typing as a result, just off worst levels of the day. Super long cash ACGBs have cheapened by ~13bp. The IR strip runs 1-16bp cheaper on the session, while EFPS are comfortably wider on the day, with the 3-/10-Year box bull flattening.

- Outside of Q1 GDP data, tomorrow’s domestic docket will being final manufacturing PMI data from S&P Global, the latest CoreLogic house price reading and A$1.0bn of ACGB Apr-25 supply.

FOREX: Greenback Gains As Cash U.S. Tsys Retreat On Return From Holiday

The U.S. dollar turned bid as Tsys retreated once cash trading resumed after the long weekend. Hawkish central bank speak facilitated greenback purchases, as Fed's Waller backed "tightening policy by another 50bp for several meetings," possibly until inflation eases closer to the 2% target.

- EU leaders reached agreement on a partial embargo on Russian oil, which will prohibit seaborne imports without affecting pipeline supplies for now. There were no curveballs in official communique, hence reaction across G10 FX space was limited.

- Spot USD/JPY added ~50 pips, ripping through the Y128.00 mark on its way to a near two-week high. USD/JPY 1-month 25 delta risk reversal advanced in tandem with the spot rate, hitting its best levels since May 18.

- AUD/NZD showed above yesterday's high, supported by relative data outcomes, but gains were capped by the NZ$1.1000 figure. The ANZBO showed further deterioration in NZ business activity, widening the gap with AU business conditions as measured by NAB.

- Regional risk barometer AUD/JPY moved to a three-week high, piercing its 50-DMA in the process. NZD/JPY also lodged a new three-week high, but trimmed gains after rejecting its 50-DMA.

- China's official PMI figures improved and were better than expected in May, but the economy remained in contraction, across both manufacturing and non-manufacturing sectors. Offshore yuan was steady after the release, having slipped earlier.

- On the data front, focus turns to flash EZ CPI, German unemployment, Canadian GDP as well as U.S. Conf. Board Consumer Confidence & MNI Chicago PMI. In addition, ECB's Villeroy, Visco & Makhlouf as well as Riksbank's Ingves are set to speak.

- Elsewhere, U.S. President Biden, Tsy Sec Yellen and Fed Chair Powell will hold a meeting at the White House, while EU leaders will resume their Brussels summit.

FX OPTIONS: Expiries for May31 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0590-00(E8.3bln), $1.0625-30(E1.6bln), $1.0645-50(E1.1bln), $1.0740-60(E1.3bln), $1.0800(E1.1bln), $1.0875-00(E1.6bln)

- USD/JPY: Y127.75-85($739mln)

- GBP/USD: $1.2550(Gbp3.5bln), $1.2645(Gbp2.2bln), $1.2680(Gbp827mln)

- AUD/USD: $0.7000(A$616mln), $0.7118-25(A$662mln)

- USD/CNY: Cny6.7200($709mln)

ASIA FX: Most Asian FX Down on Broad Based USD Strength

Asian FX has lost ground today, although KRW and TWD have outperformed the region and broader USD strength.

- CNH: USD/CNH is modestly higher today in line with broad based USD strength. We are down from intra-day highs of above 6.6900, as China PMI prints came out better than expected, while further stimulus was also announced by China's cabinet. Last trading at 6.6770.

- KRW: Spot USD/KRW tracked as high as 1243 in early trade before renewed selling interest emerged. Local equities are higher, so too are China and Hong Kong stocks. This, along with firmer China PMI's has helped the won outperform today. Spot KRW and TWD are the only currencies in the region up against the USD today.

- INR: USD/INR has opened with a firmer tone, pushing back up to 77.65, which is close to recent highs. A stronger USD and Brent crude through $123/bbl are not helping. Q1 GDP is due later today.

- IDR: Spot USD/IDR has crept higher today, back up towards the 14600 level. This is in line with regional trends. CPI data and PMI prints on Thursday are the next major data focus points.

- PHP: Spot USD/PHP is back above 52.40, while the 1 month NDF is through 52.50. Topside focus falls on May 12 high of PHP52.850, while bears look for losses past May 23 low of PHP52.070.

- THB: USD/THB has rebounded from the low 34.00 region, +0.33% on the day to 34.19. BoP and trade figures for April are due out later today. PM Prayuth is preparing for a busy political season. Parliament will begin the first reading of the FY2023 budget bill today, while the opposition is planning to submit a censure motion on June 15.

EQUITIES: Mixed In Asia; Chinese PMIs Add To Relief Amidst COVID Easing Hopes

Major Asia-Pac equity indices are mixed at writing, with Chinese and Hong Kong equities outperforming.

- The Hang Seng Index is 0.5% better off at typing, operating a little below four-week highs made earlier in the session. Hong Kong-listed stocks have caught a bid on a better-than-expected official Chinese PMI print, pointing to a moderating pace of contraction in the manufacturing and services sectors as the country accelerates towards the lifting of COVID-related restrictions in Shanghai and Beijing. China-based tech stocks outperformed, with the Hang Seng Tech adding 1.8% to hit its own four-week highs at writing. A note that a majority of the Hang Seng’s constituents have reported Q1 earnings thus far, with Meituan and Sino Biopharmaceutical’s earnings likely being the events to watch later this week.

- Looking to China, the CSI300 trades 1.1% higher at writing, on track to make a third straight day of gains on tailwinds from aforementioned COVID-related easing and PMI print.

- The Nikkei 225 sits a little below neutral levels at typing, albeit back from worst levels earlier in the session. Broad gains in energy and materials-related names were neutralised by a mixed performance amongst major exporters on JPY weakness, adding to underperformance in the real estate sub-index

- The Australian ASX200 lagged regional peers, trading 0.6% lower at typing, on track to break a two-day streak of gains after hitting 3-week highs on Monday. A mixed performance in energy and material-related names was worsened by drag from a miss in Building Approvals data, adding to weakness in technology-related equities. On the latter, the S&P/ASX All Technology Index deals 1.5% softer, led lower by losses in large-caps Block Inc (-3.3%) and Xero Ltd (-1.5%).

- U.S. e-mini equity index futures sit 0.1% to 0.5% better off with NASDAQ contracts outperforming, operating a little below their respective four-week highs made in Monday's session.

GOLD: Lower In Asia; Facing Headwinds Above $1,850/oz

Gold is ~$5/oz weaker to print $1,850/oz at typing, back from worst levels earlier in the session, and continuing to operate within a ~$30/oz trading range observed over the past week.

- The largest moves in gold came on the cash open of US Tsys after the long weekend, seeing bullion dive to session lows amidst a rise in the USD (DXY) and nominal U.S. Tsy yields, with nominal U.S. 10-Year Tsy yields rising ~9bp to 2.83% at typing. The move in the latter was possibly facilitated by previously flagged remarks on Monday by the Fed’s Waller, emphasising the need for “several” 50bp rate hikes until inflation is brought down to the 2% target. A note that this comes after U.S. Personal Consumption Expenditure (PCE) data last Friday came in at +6.3% Y/Y. Looking elsewhere, gold registered little reaction to better-than-expected Chinese PMIs.

- To recap Monday’s price action, the precious metal closed a little higher, with a downtick in the USD (DXY) to five-week lows providing little by way of an observable bullish impetus.

- From a technical perspective, a corrective cycle remains in play for gold despite recent highs. A recent break of resistance at the 20-Day EMA suggests a potential test of the 50-Day EMA (~$1,882.0/oz), although gains are still considered corrective, with a downward primary trend direction observed by our technical analyst. Immediate support is seen at $1,807.5/oz (May 18 low).

OIL: Multi-Month Highs On Prospect Of EU Sanctions, Improvements In Chinese COVID Situation

WTI is ~+$3.00 and Brent is ~+$0.90 at typing, operating a little below their respective 12 and 10-week highs made earlier in the session. Both benchmarks have caught a bid as EU leaders announced in-principle agreement to cut over two-thirds of all oil imports from Russia by end-22 (~90% when factoring in separate German and Polish commitments to cut Russian crude supplies), sending crude to levels last witnessed around mid-March.

- Turning to China, participants are eyeing the planned re-opening of Shanghai on Wednesday, where most residents (~22.5mn out of the city’s 25mn total pop.) will be allowed to leave their homes and drive their cars after two months of lockdowns.

- Zooming out, Chinese authorities reported 97 fresh COVID cases nationwide for Monday, the first time the national daily case count has come in below 100 since Mar 2. Well-documented worry re: the nation’s COVID-zero strategy remains evident however, with little sign that officials are looking to dial back the strategy ahead of the Chinese Communist Party’s (CCP) 20th Party Congress scheduled for the second half of ‘22.

- Elsewhere, the U.S. “summer driving season” has kicked off, although record high gasoline prices in the country have continued to drive debate over the extent of demand destruction, raising expectations from some quarters re: a smaller-than-expected rise in fuel demand.

- Looking ahead, OPEC+ meets on Thursday, although RTRS source reports have pointed to the group sticking to the previously-mentioned 432K bpd output target increase for July (keeping in mind the group’s well-documented difficulties in hitting production targets).

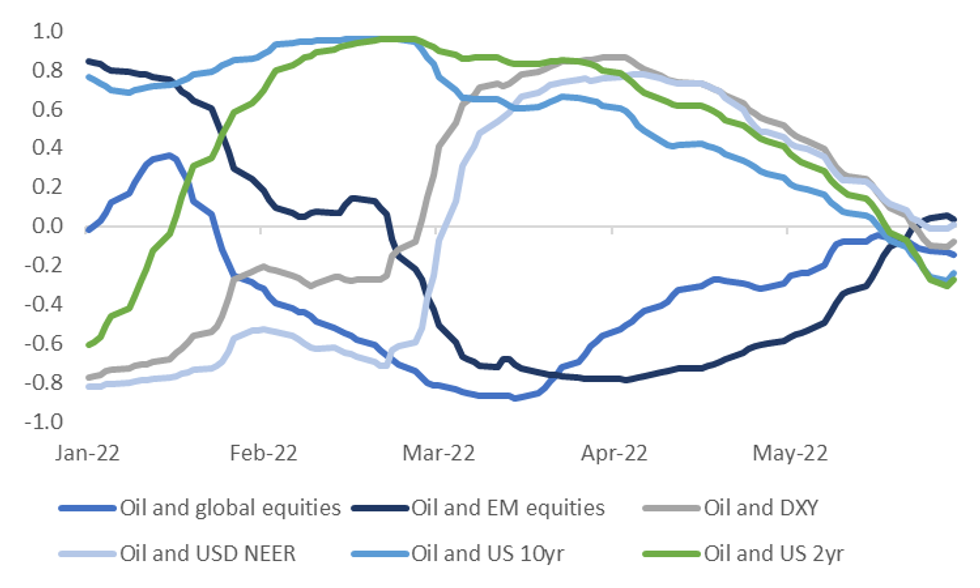

OIL: Will Oil & Major Asset Correlations Return to 2022 Highs?

Oil prices are coming back into macro focus, as prices get back to multi-month highs. Interestingly though, correlations between oil and other major macro variables are clustered at low levels and are well down on 2022 highs.

- The chart below plots the rolling 3-month correlation between Brent crude prices and other major variables - global and EM equities, the DXY and USD NEER and US 2yr and 10yr yields.

- Correlations peaked around late March (in an absolute sense), after oil spiked above $120/bbl on numerous occasions. Higher oil prices were positively correlated with US yields and broad dollar performance and negatively correlated with global and EM equities.

- Can we see a repeat this time around? It is possible, higher energy prices could feed US inflation expectations, driving up Fed expectations, which sees renewed USD strength and weaker global/EM equities.

- However, there could be some important differences this time around. The headline shock of the Ukraine invasion is now behind us, at least to some extent. Fed tightening expectations are also much more advanced, while other central bank expectations have picked up, most notably the ECB, which can help mitigate USD strength.

- There is also perhaps greater potential for demand surprises to play a role, particularly as China emerges from lockdown. Whilst this will bias oil prices higher, all else equal, the market could view the latest oil bounce as less supply driven, at least compared to the March period. In turn this could see less fallout for risk asset sentiment.

Fig 1: Oil & Major Macro Correlations - Rolling 3 Month

Source: MNI - Market News/Bloomberg

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 31/05/2022 | 0630/0830 | ** |  | CH | Retail Sales |

| 31/05/2022 | 0645/0845 | *** |  | FR | HICP (p) |

| 31/05/2022 | 0645/0845 | ** |  | FR | PPI |

| 31/05/2022 | 0645/0845 | ** |  | FR | Consumer Spending |

| 31/05/2022 | 0645/0845 | *** |  | FR | GDP (f) |

| 31/05/2022 | 0700/0900 | *** |  | CH | GDP |

| 31/05/2022 | 0755/0955 | ** |  | DE | Unemployment |

| 31/05/2022 | 0830/0930 | ** |  | UK | BOE M4 |

| 31/05/2022 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 31/05/2022 | 0900/1100 | *** |  | IT | HICP (p) |

| 31/05/2022 | 0900/1100 | *** |  | EU | HICP (p) |

| 31/05/2022 | 1230/0830 | *** |  | CA | CA GDP by Industry and GDP Canadian Economic Accounts Combined |

| 31/05/2022 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 31/05/2022 | 1300/0900 | ** |  | US | FHFA Quarterly Price Index |

| 31/05/2022 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 31/05/2022 | 1345/0945 | ** |  | US | MNI Chicago PMI |

| 31/05/2022 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 31/05/2022 | 1430/1030 | ** |  | US | Dallas Fed Manufacturing Survey |

| 31/05/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 31/05/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.