-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: From Jubilee To NFPs

EXECUTIVE SUMMARY

- FED HIKING PACE FROM SEPTEMBER HINGES ON INFLATION, MESTER SAYS (BBG)

- WHITE HOUSE NOT EXPECTING 'BLOCKBUSTER' JOBS REPORTS EVERY MONTH (RTRS)

- ALL OPTIONS ON TABLE IN CHINA TARIFF REVIEW, U.S. TRADE OFFICIAL SAYS (RTRS)

- RUSSIA IS READY TO GUARANTEE SAFETY OF VESSELS CARRYING GRAIN FROM UKRAINE (INTERFAX)

- BANK OF CANADA OPEN TO HIKING INTEREST RATES PAST 3% IN BID TO BRIDLE INFLATION (CP)

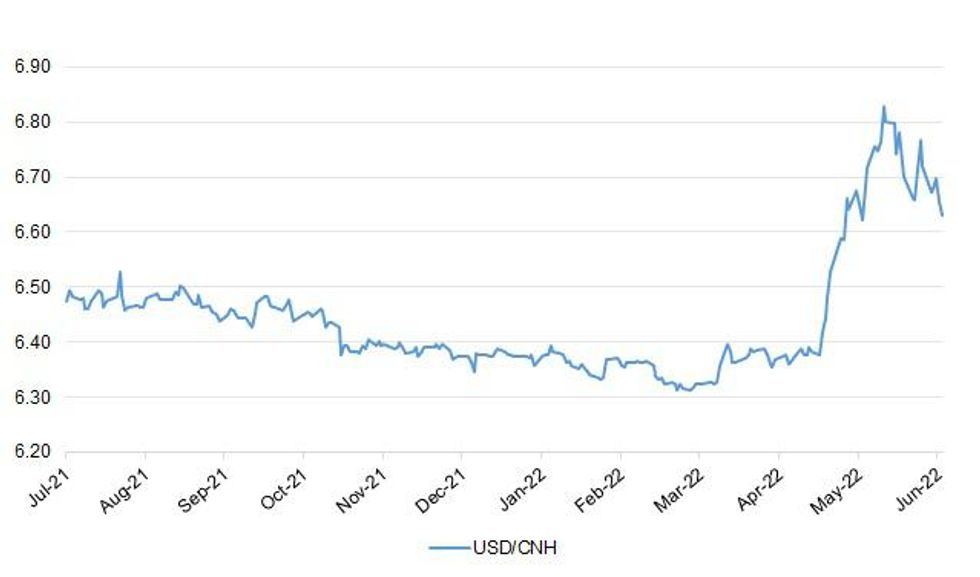

Fig. 1: USD/CNH

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: Rebel Conservative MPs’ plans to oust Boris Johnson next week have descended further into disunity, with some worried that potential contenders to replace the prime minister are not ready to launch their bids. One MP hoping to engineer defeat for Johnson is now encouraging colleagues to withdraw their letters of no confidence to avoid triggering a vote “by accident” as soon as Monday or Tuesday, the Guardian has learned. The speed of the backlash against the prime minister after the Sue Gray report on Covid law-breaking in Downing Street has surprised many, given the lack of coordination by rebels. More than 45 Tory MPs have publicly questioned Johnson’s fitness to hold office. Some MPs told the Guardian they intended to submit a letter calling for a vote on Johnson’s premiership on Monday, to reach the required 54-letter threshold to trigger a ballot but avoid overshadowing the Queen’s platinum jubilee this weekend. However, those who are wargaming how such a vote would play out are conflicted about the best time to force it. Some said they were concerned that would-be leadership candidates had not yet mobilised supporters to summon the 180 votes needed for Johnson to lose a no-confidence vote. (Guardian)

POLITICS: Boris Johnson should resign before he is forced out by his own MPs, the head of the Grassroots Conservatives activist group has said amid signs of concern among leading local Tories. (Telegraph)

EUROPE

ECB: Efforts by European Central Bank hawks to secure an initial half-point hike in interest rates will fail as policy makers agree on a series of smaller increases, according to a Bloomberg survey of economists. The ECB will lift the deposit rate -- now at -0.5% -- by a quarter-point in July and again in September, the poll showed. While in line with President Christine Lagarde’s vow to end subzero borrowing costs in the third quarter, that’s less aggressive than the path sought by officials like Austria’s Robert Holzmann. (BBG)

FISCAL: There is still more work to be done on the rule of law in Poland, the European Commission President said on Thursday during a visit to Warsaw after Brussels approved billions of euros in COVID-19 economic recovery funds for the country. "We are not at the end of the road on the rule of law in Poland," Ursula von der Leyen told a news conference. (RTRS)

IRELAND: Ireland last month posted its first budget surplus since the COVID-19 pandemic threw its finances back into deficit after taking in 27% more tax in the first five months of the year than in the same period of 2021, the finance ministry said. After collecting far more tax in 2021 than in any previous year, the finance ministry forecast in April that tax revenues would rise by a further 11% this year to help narrow the budget deficit at a faster than expected rate to 0.8% of gross national income. While Finance Minister Paschal Donohoe said he expected the impact of the war in Ukraine would prevent a return to a budget surplus this year, the exchequer posted a small 32 million euro surplus on a 12-month rolling basis at the end of May. (RTRS)

SWEDEN: Sweden’s prime minister may next week have to put her fate in the hands of a Kurdish-born lawmaker who has drawn the ire of Turkey, just as the Nordic country is seeking to overcome the veto of Turkish President Recep Tayyip Erdogan to its bid for membership of the NATO defense bloc. Magdalena Andersson said on Thursday she will resign if her Justice Minister Morgan Johansson loses a confidence vote brought by the opposition in parliament, due on June 7. The motion needs one extra vote to pass, putting the spotlight on Amineh Kakabaveh, a non-affiliated member of legislature with Kurdish background. While Andersson’s Social Democrats are gaining in polls just three months before the next elections, the situation is complicated by Sweden’s joint application with Finland for membership in the North Atlantic Treaty Organization. (BBG)

RATINGS: Potential sovereign rating reviews of note scheduled for after hours on Friday include:

- Moody’s on Austria (current rating: Aa1; Outlook Stable) & France (current rating: Aa2; Outlook Stable)

- S&P on Lithuania (current rating: A+; Outlook Stable)

- DBRS Morningstar on Germany (current rating: AAA, Stable Trend)

U.S.

FED: Federal Reserve Bank of Cleveland President Loretta Mester said she favors raising interest rates by 50 basis points this month and next but cautioned that pace could speed up or slow down from September, based on what happens with inflation. “If by the September FOMC meeting, the monthly readings on inflation provide compelling evidence that inflation is moving down, then the pace of rate increases could slow,” Mester said Thursday, referring to the policy-setting Federal Open Market Committee. “But if inflation has failed to moderate, then a faster pace of rate increases could be necessary,” she told a virtual event hosted Philadelphia Council for Business Economics, according to her prepared remarks. (BBG)

ECONOMY: The White House is not expecting to see big increases in jobs data every month as the economy transitions to a new period of more stable growth, White House press secretary Karine Jean-Pierre said on Thursday, ahead of Friday's nonfarm payrolls report. U.S. private payrolls increased far less than expected in May, suggesting demand for labor was starting to slow amid higher interest rates and tightening financial conditions, the ADP National Employment report released on Thursday showed. "As we transition to this new period of stable, steady growth, we aren't looking to see blockbuster job reports month after month, like we have over the last year," she said. "But that's a good thing. That's the sign of a healthy economy with steady job growth, rising wages for working America, everyday costs easing up and a shrinking deficit." (RTRS)

ECONOMY: MNI: St. Louis Fed Model Predicts May Employment Gain Slowed

- U.S. employment likely rose by 440,000 in May, according to a real-time labor market index from the Federal Reserve Bank of St. Louis, economist Max Dvorkin told MNI. That's roughly half the gains predicted by the index for a month earlier. The Coincident Employment Index, using weekly data from time-tracker software provider Homebase, shows "an improvement in employment, as measured by the household survey," in May, Dvorkin said. Homebase users tend to be smaller firms concentrated in retail and food and accommodation services. The index suggested a seasonally adjusted gain of close to 800,000 in April, though official figures from BLS showed a decline of 115,000 for the month. "The large forecast error may be due, in part, to the religious holiday in April and the timing in which the CPS data is collected relative to the Homebase data," Dvorkin said - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

FISCAL: The U.S. Social Security and Medicare trust funds will last slightly longer, thanks to a stronger-than-expected economic recovery from the COVID-19 pandemic that has boosted tax collections, trustees of the federal benefit programs said on Thursday. Social Security's Old-Age and Survivors Insurance Trust Fund will now be able to make timely scheduled benefits payments until 2034, the program's annual trustees report said, one year later than estimated in last year's report. The Medicare trustees report said the Hospital Insurance Trust Fund will be able to pay benefits until 2028, two years later than estimated last year. (RTRS)

ENERGY/FISCAL: The White House is considering congressional proposals that could tax oil and gas producers' profits in order to provide a benefit to consumers struggling with higher energy prices, a U.S. official said on Thursday. "There are a variety of interesting proposals and design choices on a windfall profits tax," Bharat Ramamurti, the deputy director of President Joe Biden's National Economic Council, said during a panel discussion sponsored by the Roosevelt Institute think tank. "We've looked carefully at each of them and are engaging in conversations with Congress about design." (RTRS)

BANKS: Citigroup Inc. may record losses of at least $50 million following a London staffer’s fat-finger trade that caused a flash crash in European stocks last month, according to people familiar with the matter. The bank is still tallying losses from the mistaken trade and the final figure could balloon higher, one of the people said, asking not to be identified discussing a private matter. A trader in the firm’s Delta One trading unit in London was working from home during a bank holiday on May 2 when the person incorrectly added an extra zero to a trade early in European market hours, said the people. The blunder sparked a five-minute selloff in the OMX Stockholm 30 Index and ultimately wreaked havoc in bourses stretching from Paris to Warsaw and wiping out 300 billion euros ($322 billion) at one point. (BBG)

OTHER

GLOBAL TRADE: Russia's defence ministry said on Thursday that vessels carrying grain can leave Ukraine's ports in the Black Sea via "humanitarian corridors" and Russia is ready to guarantee their safety, Interfax news agency said. The defence ministry also said Russia would not use the humanitarian situation in Ukraine for the purposes of what Moscow calls its "special military operation" in Ukraine, Interfax added. (RTRS)

GLOBAL TRADE: Sanctions-hit Russia has limited exports of noble gases such as neon, a key ingredient for making chips, until the end of 2022 to strengthen its market position, its trade ministry said on Thursday. Russia's export curbs could worsen the supply crunch in the global chips market. Ukraine was one of the world's largest suppliers of noble gases until it suspended production at its plants in the cities of Mariupol and Odesa in March. Exports of noble gases, which Russia used to supply to Japan and other countries, will be allowed only with special state permission until Dec. 31, the Russian government said on May 30. Russia accounts for 30% of the global supply of noble gases, according to the ministry's estimate. (RTRS)

GLOBAL TRADE: California port leaders expect imports to rise as Shanghai, home to the world's busiest seaport, emerges from a two-month COVID-19 lockdown. The question is whether that release of pent-up goods will again swamp West Coast ports that have recently emerged from the pandemic's massive cargo wave, they and other experts said. "We will have some form of a surge, given the delay of cargo volume from Shanghai and China overall," Mario Cordero, executive director of the Port of Long Beach, said on the sidelines of a Reuters Events logistics conference in Chicago. "To what extent that surge will be remains to be seen," Cordero said. (RTRS)

GLOBAL TRADE: “It is crystal clear to me that if the United States waits, if Congress dilly dallies and doesn’t swiftly pass this Chips Act in the next couple of months, we in the United States are going to lose out,” Commerce Secretary Gina Raimondo says. (BBG)

U.S./CHINA: The Biden administration is considering "all options" as it reviews potential changes to U.S. duties on Chinese imports, including tariff relief and new trade investigations in a shift of focus to strategic concerns with Beijing, Deputy U.S. Trade Representative Sarah Bianchi said on Thursday. Bianchi told Reuters in an interview that the trade agency is seeking to address long-term challenges from China and "getting a tariff structure that really makes sense." "We're looking at everything and what we're focused on is making sure that we have again, a long term realignment of the relationship with China, focusing on some of the concerns ... such as non-market practices and economic coercion," Bianchi said. (RTRS)

U.S./CHINA/TAIWAN: New U.S. trade negotiations with Taiwan could move more quickly than broader talks with 12 Indo-Pacific countries given strong interest in Taipei and Washington in deepening economic ties, Deputy U.S. Trade Representative Sarah Bianchi said on Thursday. There are parallels between the newly launched Indo-Pacific Economic Framework talks and the Taiwan talks, Bianchi told Reuters in an interview, but the latter initiative is aimed at increasing links with Taiwan on specific economic issues. "I think we are eager to get going with Taiwan and to scope out our negotiating mandate there and ... a range of issues from small-medium enterprises to digital trade to labor and we look forward to getting going as quickly as possible," Bianchi said. (RTRS)

U.S./CHINA/TAIWAN: The U.S. State Department has updated its fact sheet on Taiwan again, to reinstate a line about not supporting formal independence for the Chinese-claimed, democratically-governed island. Last month the State Department changed the wording on its website on Taiwan, removing wording both on not supporting Taiwan independence and on acknowledging Beijing's position that Taiwan is part of China, to anger in Beijing. Washington said the update did not reflect a change in policy. That wording has now be changed again, to reinstate a line saying "we do not support Taiwan independence". (RTRS)

GEOPOLITICS: China is poised to launch its newest, most advanced aircraft carrier, in a major step that will enable its navy to expand its military operations on the high seas. New satellite imagery reviewed by The Wall Street Journal shows that after several years of work in the Jiangnan Shipyard in Shanghai, China’s third carrier, known as a Type 003, may be afloat in coming weeks or even days, analysts said. The Type 003 is China’s third aircraft carrier, and its largest and most advanced. It uses new electromagnetic catapult technology akin to what the U.S. and French carriers have to launch aircraft, analysts said. (WSJ)

GERMANY/CHINA: The German government has declined a request by Volkswagen AG that Berlin renew risk insurance for the car maker's operations in China, marking an inflection point for a country that has long put trade ahead of politics in international relations. The move, justified by Beijing's treatment of the Muslim Uyghur minority in western China, makes good on a pledge by Germany's recently elected government to take a more critical approach to authoritarian governments, including China, Germany's largest trade partner. The decision, which wasn't announced officially but was confirmed by several people familiar with the situation, is unlikely to stop German companies from doing business in China but it raises the risks of doing so. It also sets a precedent that for the first time links support for German companies investing in China with Beijing's treatment of Muslims in the Xinjiang province. (Dow Jones)

NEW ZEALAND/CHINA: China's Ambassador to New Zealand Wang Xiaolong said on Friday that he and New Zealand's foreign minister had discussed how the two countries could steer bilateral relations to benefit both sides. The meeting had been arranged prior to the release Wednesday of a United States-New Zealand statement that China described as gravely interfering in its internal affairs. New Zealand's Ministry of Foreign Affairs said in a statement late Thursday that the minister and ambassador also exchanged views on regional matters, particularly the South Pacific, and Mahuta had expressed concern at the challenges faced by the region. "The Minister took the opportunity to restate Aotearoa New Zealand’s concerns regarding the China-Solomon Islands Security Cooperation Agreement and highlighted that discussion of regional security matters was best undertaken through existing regional institutions," it added. (RTRS)

BOJ: MNI INSIGHT: Weak Corporate Spend A BOJ Virtuous Cycle Concern

- Weak corporate spending on capital investment and on reinvesting profits as a driver of a virtuous economic cycle remains a concern for Bank of Japan officials headed into the June policy review even as the country opens to tourism this month and services return to normal, MNI understands - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

RBA: Australia's central bank will raise rates by a modest 25 basis points for a second straight meeting in June, still opting to move more slowly than most of its peers in a campaign to bring down soaring inflation, a Reuters poll of economists found. With the economy recovering smartly from the pandemic and inflation at a 20-year high of 5.1%, well above a 2-3% target range, the Reserve Bank of Australia has only recently changed its tune on the need to raise interest rates. The median forecast in the May 26-June 2 Reuters poll of 35 economists showed the RBA will lift its official cash rate by another 25 basis points to 0.60% from the current 0.35% at its June 7 meeting. Nearly two-thirds of respondents, 22 of 35, forecast rates at 0.60%, while 11 predicted a 40 basis point increase to 0.75%, where rates were before the pandemic. Only one expected a 50 basis point hike to 0.85% and one other expected no move. But at a time when many of its peers, including the Reserve Bank of New Zealand, the Bank of Canada and the U.S. Federal Reserve have already delivered more than one 50 basis point rate increase, some analysts say the RBA is moving too slowly. (RTRS)

AUSTRALIA: Australia's new centre-left Labor government on Friday proposed raising the minimum wage to ease the financial burden on families hit by soaring energy prices and a spike in consumer price inflation. Prime Minister Anthony Albanese, who was sworn in last week, said he had submitted an application with the independent wage-setting body that could help raise the pay of the lowest-paid workers from A$20.33 ($14.77) an hour. "Workers on the minimum wage deserve a pay rise," Albanese said on Twitter although he did not specify a proposed increase. During the election campaign, Albanese promised he would support a 5.1% rise in wages. (RTRS)

NEW ZEALAND: ASB Bank publishes results of Housing Confidence Survey conducted in the three months through April. Net 11% of respondents expect house prices will rise in next 12 months, down from 49% in January survey. Biggest q/q drop in two years “The surprise is that net housing confidence expectations are still positive”. Net 20% of buyers say it is a bad time to buy, down from 28% in January survey. Net 81% expect interest rates will increase in next 12 months -- highest in 26 years of survey (BBG)

BOK: South Korea's deputy central bank chief said on Friday annual consumer price growth would likely stay in the 5% range in June and July and that containing inflation expectations was important. A statement from the Bank of Korea also quoted Senior Deputy Governor Lee Seung-heon as saying at an internal meeting that demand-side inflation pressure could build up after COVID-related restrictions were recently lifted. (RTRS)

SOUTH KOREA: The rise in consumer price inflation to the highest in 14 years is a serious situation, Vice Finance Minister Bang Ki-sun says in a meeting. Government to strengthen efforts to stabilize supply, demand of vegetables; will work so that tariff cuts could help lower consumer prices. April current account balance may worsen on dividend payment to foreign investors, but is likely to recover in May. (BBG)

SOUTH KOREA: The government will lift a seven-day quarantine mandate for unvaccinated arrivals from overseas starting next Wednesday, as part of its efforts to restore pre-pandemic normalcy, Prime Minister Han Duck-soo said Friday. Despite the lifting, international arrivals should still take a PCR test within three days of their entry into South Korea, Han said during a COVID-19 response meeting. Han said the government will also fully normalize the number of international flights and lift the curfew for arrivals at Incheon International Airport from next Wednesday. (Yonhap)

NORTH KOREA: The United States supports international offers of humanitarian aid to help North Korea battle its COVID-19 outbreak, and will not link that to denuclearisation issues, a top U.S. diplomat said on Friday. Deputy Secretary of State Wendy Sherman made the remarks in a video address to a conference in Seoul. (RTRS)

BOC: The Bank of Canada may need to raise its key interest rate to three per cent or beyond — more than double its current level — to ensure inflation doesn't settle in for the long haul, its deputy governor says. “We’re scared that this inflation becomes entrenched," Paul Beaudry told reporters Thursday afternoon, while assuring Canadians the institution would prevent it. In an earlier speech to the Gatineau Chamber of Commerce, he said the likelihood of even higher consumer prices on the horizon means the central bank will consider pushing its policy rate at least to the top end of its "neutral" range — between two and three per cent, which neither spurs nor hampers growth. (Canadian Press)

CANADA: Doug Ford's Progressive Conservatives cruised to a second majority government in Ontario Thursday, the CBC News decision desk projected, on a night that saw both the NDP and Liberal leaders say they would resign. Just how large the PC majority will be is not yet clear, with final results from some ridings still coming in. It is rare for a provincial party in Canada to expand a majority, though the PCs look on track to add to their caucus at Queen's Park. Nearly an hour after most polls closed at 9 p.m. ET, the PCs were leading in or projected to win at least 82 of Ontario's 124 seats. Premier Doug Ford was re-elected in his west Toronto riding of Etobicoke North, as were a slew of previous PC cabinet ministers including Peter Bethlenfalvy, who served as finance minister, Merilee Fullerton, who was long-term care minister during the worst of the COVID-19 pandemic, and Vic Fedeli, who was most recently minister of economic development. (CBC)

MEXICO: Petroleos Mexicanos raised less money than expected to refinance some of its outstanding debt to suppliers this week, even after it offered buyers a discount, according to people familiar with the matter. The company, known as Pemex, sold $1.5 billion in bonds due 2029, said the people, compared with the $2 billion it had planned to raise according to a press release on Tuesday. The debt was sold at a discount of about 97.6 cents on the dollar to yield 9.25%, above the 8.75% coupon. The weak demand represents an embarrassment for debt-burdened Pemex, which has struggled to pay its suppliers in recent years amid high taxes and lackluster production as the refining arm drains resources. The flop raises questions about why Pemex is failing to generate enough cash to pay short-term debt amid high oil prices, said Aaron Gifford, an emerging-market sovereign-debt analyst at T. Rowe Price Group in Baltimore. “This transaction left a bad taste in investors’ mouths,” Gifford said. “What is going to prevent Pemex from doing this again in six months?” (BBG)

BRAZIL: The board of Brazil's Investment Partnerships Program (PPI) said on Thursday they will include state-run oil company Petrobras in their privatization report. The decision comes after a request by the country's Mines and Energy Ministry to include the company in the report in a step towards a potential privatization. (RTRS)

RUSSIA: Ukrainian forces have had some success fighting Russians in the city of Sievierodonetsk but the overall military situation in the Donbas region has not changed in the day, President Volodymyr Zelenskiy said on Thursday. In a late night video address, Zelenskiy also thanked U.S. President Joe Biden for promising to send missiles and said he expected good news about weapons supplies from other partners. Russian forces, backed by heavy artillery, control most of the eastern industrial city of Sievierodonetsk but fighting is continuing, say Ukrainian officials. (RTRS)

RUSSIA: Russia's Pacific Fleet launched a week-long series of exercises with more than 40 ships and up to 20 aircraft taking part, Russian news agencies quoted the defence ministry as saying. The ministry statement said the exercises, taking place from June 3-10, would involve, among other matters, "groups of ships together with naval aviation taking part in search operations for (enemy) submarines". The exercises were taking place amid Russia's three-month-old incursion into Ukraine, described by Moscow as a "special military operation". Ukraine lies thousands of kilometres to the west of where the exercises are occurring in the Pacific. (RTRS)

RUSSIA: The U.S. on Thursday added 71 new Russian and Belarusian entities to its trade blacklist, including aircraft plants and shipbuilding and research institutes, as part of its latest effort to deprive the Russian military of U.S. technology and other items. The export restrictions are among a raft of new sanctions the U.S. imposed on Thursday in response to Russia's war in Ukraine, including prohibitions on additional Russian oligarchs and members of the country's elite. They include 70 Russian companies and other entities like the Russian Academy of Sciences. In total the Commerce Department has now added 322 entities to its economic blacklist for support of Russia’s military since February. (RTRS)

RUSSIA: The slowdown in Russia's consumer price growth cannot yet be regarded as sustainable, the country's central bank said in its review of trends on Thursday. Consumer price growth in Russia may speed up again as one-off disinflationary factors fade, the central bank said, adding that the balance of risks remains tilted towards the pro-inflationary side. (RTRS)

MIDDLE EAST: The White House took the rare step of recognizing the role played by Saudi Arabia's Crown Prince Mohammed bin Salman in extending a ceasefire in Yemen on Thursday ahead of what is expected to be a trip to Riyadh by President Joe Biden. White House press secretary Karine Jean-Pierre told reporters that bin Salman and Saudi King Salman deserved credit for their roles in the truce extension in Yemen's war. "This truce would not be possible without the cooperative diplomacy from across the region. We specifically recognize the leadership of King Salman and the crown prince of Saudi Arabia in helping consolidate the truce," she said. (RTRS)

METALS: Chile's mining minister Marcela Hernando said the government is not opposed to tenders for lithium, a key metal in batteries, on Thursday. Hernando said the government "is not closed to tenders or any path" at a press conference concerning a Wednesday supreme court ruling that upheld a decision that voided two lithium contracts due to opposition from local indigenous groups. Chile is the world's no. 1 copper producer and second largest lithium producer. (RTRS)

CHINA

POLICY: China's proposed cybersecurity rules for financial firms could pose risks to operations of western companies by making their data vulnerable to hacking, among other things, a leading lobby group has said in a letter seen by Reuters. The latest regulatory proposal comes at a time when a string of western investment banks and asset managers are expanding their presence in China, either by setting up wholly-owned units or by taking a bigger share in existing joint ventures. The China Securities Regulatory Commission (CSRC) released the draft Administrative Measures for the Management of Network Security in the Securities and Futures Industry on April 29, and offered a month-long public consultation on the proposals. The draft rules seek to make it mandatory for investment banks, asset managers, and futures companies with operations in China to share data with CSRC, allow regulator-led testing, and help set up a centralised data backup centre. (RTRS)

CORONAVIRUS: China’s financial capital is bolstering its Covid-19 testing capacity as cases reappear in the community and residents start to move around more freely after the easing of most lockdown curbs. Shanghai reported 16 new Covid infections for Thursday, seven of them outside government mandated quarantine -- the highest tally of so-called community cases since officials started to loosen restrictions last month after declaring an end to community spread. The city will add more PCR testing booths, increase staff at the busiest sites and extend service times to meet residents’ needs, Xia Kejia, an official in charge of Shanghai’s Covid testing work, said at a briefing Thursday. Residents still need a recent negative test result to access public transport, enter shopping malls or go to the office.

OVERNIGHT DATA

JAPAN MAY, F JIBUN BANK SERVICES PMI 52.6; FLASH 51.7

JAPAN MAY, F JIBUN BANK COMPOSITE PMI 52.3; FLASH 51.4

The Japanese service sector saw a further improvement in demand conditions midway through the second quarter. Latest PMI data signalled the strongest expansions in business activity and total new business for six months. Panel members highlighted that the diminishing impact of the pandemic and the easing of remaining restrictions boosted output and demand. Moreover, activity over the coming months looks set to be strong, as the levels of outstanding business rose at the sharpest rate since September 2019, which encouraged the strongest rate of job creation among service providers for 13 months. That said, rising prices remained a slight drag on demand, as cost burdens rose at a record rate. The strength of the larger service sector contributed to a broad acceleration in private sector output in May. Total business activity expanded at the fastest rate for five months amid a renewed rise in private sector new orders. Businesses across the Japanese private sector noted an acceleration in price pressures in the latest survey period as input prices rose at the sharpest pace on record. Panellists attributed this to rising raw material prices amid supply chain disruptions that were exacerbated by the Ukraine war and lockdowns in mainland China. These are likely to remain a dampener on domestic and global activity, though firms in Japan were confident that the impacts would diminish over the year ahead, with business optimism reaching its strongest level for three months. (S&P Global)

AUSTRALIA MAY, F S&P GLOBAL SERVICES PMI 53.2; FLASH 53.0

AUSTRALIA MAY, F S&P GLOBAL SERVICES PMI 52.9; FLASH 52.5

Australia’s service sector growth slowed in May, though remained at a solid pace, according to the S&P Global Australia Services PMI. The easing of COVID-19 disruptions, including border restrictions, continued to support the strong growth of services activity midway into the second quarter. Capacity constraint problems remained prevalent, as observed through the manpower and supply issues that persisted. Price pressures also remained steep, which will be worth watching given the concerns over monetary policy tightening that could further add to business costs. Overall business confidence improved, which was a positive sign. Higher levels of backlogged work also suggest that future output may continue to improve in the coming months. (S&P Global)

AUSTRALIA APR INVESTOR LOAN VALUE -4.8% M/M; MAR +2.5%

AUSTRALIA APR OWNER-OCCUPIER LOAN VALUE -7.3% M/M; MEDIAN -3.5%; MAR +1.9%

AUSTRALIA APR HOME LOANS VALUE -6.4% M/M; MEDIAN -0.5%; MAR +2.1%

NEW ZEALAND Q1 VOLUME OF ALL BUILDINGS SA +3.2% Q/Q; MEDIAN +0.5%; Q4 +9.1%

SOUTH KOREA MAY CPI +5.4% Y/Y; MEDIAN +5.1%; APR +4.8%

SOUTH KOREA MAY CPI +0.7% M/M; MEDIAN +0.4%; APR +0.7%

SOUTH KOREA CORE CPI +4.1%; MEDIAN +3.7%; APR +3.6%

MARKETS

SNAPSHOT: From Jubilee To NFPs

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 344.89 points at 27758.77

- ASX 200 up 56.062 points at 7232

- Shanghai Comp. is closed

- JGB 10-Yr future up 14 ticks at 149.83, yield down 0.5bp at 0.236%

- Aussie 10-Yr future down 2.5 ticks at 96.465, yield up 2bp at 3.52%

- U.S. 10-Yr future down 0-01+ at 118-26, yield up 1.28bp at 2.9204%

- WTI crude down $0.31 at $116.60, Gold down $1.23 at $1867.32

- USD/JPY up 5 pips at Y129.89

- FED HIKING PACE FROM SEPTEMBER HINGES ON INFLATION, MESTER SAYS (BBG)

- WHITE HOUSE NOT EXPECTING 'BLOCKBUSTER' JOBS REPORTS EVERY MONTH (RTRS)

- ALL OPTIONS ON TABLE IN CHINA TARIFF REVIEW, U.S. TRADE OFFICIAL SAYS (RTRS)

- RUSSIA IS READY TO GUARANTEE SAFETY OF VESSELS CARRYING GRAIN FROM UKRAINE (INTERFAX)

- BANK OF CANADA OPEN TO HIKING INTEREST RATES PAST 3% IN BID TO BRIDLE INFLATION (CP)

US TSYS: Holding Pattern Into NFPs

There hasn’t been much to write about for Tsys during a holiday-thinned pre-NFP Asia session, outside of the modest uptick that we flagged earlier (seemingly linked to a reaction to USD/CNH pulling lower), which has since faded. TYU2 sits within the confines of the 0-06 range established in early Asia-Pac dealing, last -0-01 on the day at 118-26+. Cash Tsys run 0.5-1.5bp cheaper across the curve, with the front end leading the way lower. Asia-Pac flow has been dominated by misweighted FV/TY block flatteners (3x -5K/+5K) for a second consecutive session.

- Pre-NY trade will be thin on Friday, owing to the observance of the previously alluded to holidays in London, Hong Kong & China.

- Still, the monthly NFP print provides plenty of event risk ahead of the weekend (see our full preview of that release here).

- Friday will also bring the release of the latest ISM services survey and further Fedspeak from Brainard (although her address will focus on the Community Reinvestment Act, which likely limits the scope for meaningful policy discussion). Note that the Fed goes into its pre-meeting blackout ahead of the weekend.

- President Biden will also make his usual post-NFP address on the labour market, after Thursday saw a White House official note that “as we transition to this new period of stable, steady growth, we aren't looking to see blockbuster job reports month after month, like we have over the last year.”

JGBS: Firmer & Flatter During The Afternoon

JGB futures have pulled higher during the Tokyo afternoon, looking above their overnight session high to last trade +19 on the day. Meanwhile, cash JGB trade sees the major benchmarks trade unchanged to 2bp richer, with 7s and the 20+-Year zone outperforming

- The continued presence of the BoJ in the market may provide the explanatory factor here. The latest round of BoJ Rinban operations saw the following offer/cover ratios:

- 1-to 3-Year: 2.47x (prev. 1.92x)

- 3-to 5-Year: 2.23x (prev. 2.28x)

- 25+-Year: 3.22x (prev. 4.38x)

- The moderation in cover ratio covering 25+-Year JGBs may have provided a bid for the super long end, although it is a little firmer than we would expect. An associated run higher in the liquid futures contract likely explains the bid in 7s.

- Receiving of OIS also looks to have played into the move, with JGB/OIS spreads tighter across the curve.

JGBS AUCTION: Japanese MOF sells Y4.77133tn 3-Month Bills:

Japanese MOF sells Y4.77133tn 3-Month Bills:

- Average Yield: -0.0950% (prev. -0.1050%)

- Average Price: 100.0237 (prev. 100.0262)

- High Yield: -0.0882% (prev. -0.0982%)

- Low Price: 100.0220 (prev. 100.0245)

- % Allotted At High Yield: 44.8892% (prev. 41.3273%)

- Bid/Cover: 2.679x (prev. 2.589x)

AUSSIE BONDS: Futures A Touch Softer On The Day, Back From Lows, Event Risk Eyed

A very mundane round of recent trade in Aussie bond futures sees ranges tighten, with that dynamic aided by the combination of a lack of headline news flow and holidays across Hong Kong, China & the UK. YM -1.0 & XM -2.0 at typing as a result, with wider cash ACGB trade seeing 30s cheapen by ~3bp. Bills run 2-7bp cheaper through the reds, while 3- & 10-Year EFPS are over 1bp wider on the session.

- Event risk will also be feeding into the lacklustre price action observed over the last few hours. Firstly, U.S. NFPs will hit in the overnight session. A little further out, focus will move to the latest RBA decision, due to take place on Tuesday. Note that the BBG consensus looks for a 40bp hike to 0.75%, although there is a degree of debate as to whether we will see a “business as usual” 25bp move (we will flesh this out in more detail in our full preview of the event, which is set to hit on Monday). When it comes to market pricing, the IB strip currently prices in ~35bp of tightening come the end of the Bank’s June meeting (which equates to a 2/3 chance of 40bp hike).

- Note that momentum seemingly helped YM & XM through their respective overnight lows in early Sydney trade, further aided by EFP & swap spread widening. That was before a modest uptick from session cheaps in U.S. Tsys allowed the space to stabilise.

- Softer than expected housing finance data provide the latest signal re: a cooling Australia property market, although there wasn’t anything in the way of meaningful market reaction post-data.

- There was also no reaction to the AOFM’s weekly issuance slate, which contained an uptick in Note issuance and a barbell approach (ACGB Sep-26 & ACGB Jun-51) when it comes to the ACGBs selected for auction next week.

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Monday 6 June it plans to sell A$300mn of the 1.75% 21 June 2051 Bond.

- On Wednesday 8 June it plans to sell A$800mn of the 0.50% 21 September 2026 Bond.

- On Thursday 9 June it plans to sell A$1.5bn of the 26 August 2022 Note & A$1.0bn of the 23 September 2022 Note.

EQUITIES: Higher In Asia On Wall St. Lead

Asia-Pac equity indices are mostly higher at typing, tracking a strong performance from Wall St. A note that Chinese and Hong Kong markets are closed today.

- The Japanese Nikkei 225 sits 1.1% firmer at typing after opening higher, operating a little below one-month highs made earlier in the session. Index heavyweight Fast Retailing Co (+5.8%) contributed the most to gains, rising in early trading after a positive earnings beat from international business unit UNIQLO late on Thursday.

- The ASX200 deals 0.8% firmer at typing, unwinding much of Thursday’s losses in the process. Tech and material-related names lead gains in the benchmark index, with the S&P/ASX All Technology Index adding 1.9% at writing, on track to snap three consecutive days of losses. The Australian tech stock gauge currently sits a little above two-year lows, having recorded losses in four of five months in ‘22 (leading up to May). Elsewhere, the ASX200’s Materials sub-index (+2.6%) now sits a little below one-month highs previously made on May 25, with the gauge on track to record the most gains in a day on outperformance in the major mining stocks.

- The KOSPI lagged regional peers, trading 0.4% higher at writing. The Korean equity benchmark pared gains from a higher open following comments from the BoK’s deputy chief saying that high inflation may continue for a “considerable” amount of time, with the central bank expecting 5% inflation to persist in June and July.

- U.S. e-mini equity index futures are ~0.1% better off apiece at typing, with NASDAQ contracts sitting a little below one-month highs made earlier in the session.

OIL: Unchanged In Asia; OPEC+ Announcement Underwhelms, U.S. Inventories In Focus

WTI and Brent are virtually unchanged, operating at the upper end of Thursday’s range at typing.

- To recap, both benchmarks rose from their respective one-week lows on Thursday as a widely-watched OPEC+ announcement re: collective crude production quotas for July ultimately underwhelmed, keeping in mind the preceding rash of media source reports on the possibility of a Saudi-led, immediate increase in production.

- Elaborating on developments within OPEC+, the ~50% increase in production quotas announced by the group effectively symbolise the compression of September’s quota increases into July and August, with debate re: the ability of OPEC+ to meet even current targets doing the rounds, keeping in mind well-documented difficulties that some members have continued to face in ramping up production.

- WTI and Brent nonetheless remain off of their May 31 highs, with the recent rally capped by warming U.S.-Saudi ties, as well as previously flagged reports of smaller-than-projected declines in Russian crude exports (due to rising Asian demand).

- Elsewhere, U.S. EIA inventory data crossed on Thursday, pointing to a larger-than-expected drawdown in crude inventories (against WSJ estimates), with overall levels now sitting ~15% below the 5-year average. Declines were also observed in gasoline and distillate stockpiles, while there was a build in Cushing hub stocks.

- Gasoline and distillate stocks across the U.S. are coming under severe pressure, with BBG reports flagging that gasoline supplies in the NY region have dipped to their lowest level seasonally since 1993, while diesel supplies on the East Coast have fallen to their lowest levels on record (since 1993). With refinery utilisation rates across the country already coming in above >90%, the outlook for tighter gasoline and distillate supplies in the U.S. (and thus higher prices for oil products) have accordingly renewed debate re: demand destruction.

GOLD: Fresh Highs In Asia; U.S. NFPs Eyed

Gold is ~$3/oz firmer to print $1,872/oz at typing, operating a shade under four-week highs made earlier in the session ($1,874,1/oz).

- To recap Thursday’s price action, gold closed ~$22/oz higher for a second straight day of gains. The overall move higher was facilitated by a downtick in U.S. real yields and the USD (DXY), with the latter giving ground against risk-on proxies (e.g. AUD, NZD) as debate re: stagflation did the rounds amidst speculation of the potential for OPEC+ production increases. The precious metal’s sharpest upward moves in the session were also observed after the release of softer-than-expected U.S. ADP employment data, which came in at its lowest since Apr ‘20.

- Cleveland Fed Pres Mester (voter) on Thursday pointed to her support for 50bp hikes in the Jun and Jul FOMCs, matching recent Fedspeak from colleagues Daly and Bullard, while flagging inflation data-dependence for a potential upward/downward shift in rate hike expectations for the September meeting onwards. July FOMC dated OIS continue to price in a cumulative ~102bp of tightening by that meeting, pointing to relatively stable expectations for back-to-back 50bp hikes in the upcoming two FOMCs.

- Looking ahead, U.S. NFPs (1330 BST) and the ISM Services index (1500 BST) headline the data docket later today.

- From a technical perspective, bullion has broken initial resistance at $1,869.7/oz (May 24 high), and sits a little below resistance at the 50-Day EMA (a little under ~$1,877/oz).

FOREX: Quiet Ahead Of NFP

Post the earlier CNH fireworks, FX markets have been very quiet, particularly in the majors. USD/Asia FX pairs are seeing a little more traction to the downside, in line with the USD/CNH move.

- AUD/USD remains below NY closing levels but only just at 0.7260. The market largely ignored the weaker than expected housing data (-6.4% on home loans, versus -0.5% expected). Iron ore is holding close to $142/tonne, while copper has edged slightly lower after the overnight surge.

- NZD/USD saw better building data for Q1, but has not been moved by domestic factors. NZD/USD sits around 0.6555 at present.

- Cross asset signals have been mixed, with US yields ticking a touch higher in the cash market, while equities are positive for those markets that are open within the region.

- EUR/USD (1.0755 last) and USD/JPY (129.85 last) have been very quiet.

- USD/CNH has stayed heavy post the early break of 6.6500, but hasn't made fresh lows below 6.6170 yet (which was the low post the initial break).

- USD/INR is opening softer, sub 77.50, while USD/IDR is down a further 0.40% in spot terms to 14428 last.

- Even with London on holiday the monthly NFP print provides plenty of event risk ahead of the weekend. Friday will also bring the release of the latest ISM services survey and further Fed speak from Brainard (although her address will focus on the Community Reinvestment Act, which likely limits the scope for meaningful policy discussion). Note that the Fed goes into its pre-meeting blackout ahead of the weekend.

FOREX OPTIONS: Expiries for Jun03 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500(E946mln), $1.0650(E618mln), $1.0750-55(E933mln)

- USD/JPY: Y128.60-75($550mln), Y131.90($575mln)

- AUD/USD: $0.7150(A$557mln)

- USD/CAD: C$1.2630($1.1bln), C$1.2700($782mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/06/2022 | 0600/0800 | ** |  | DE | Trade Balance |

| 03/06/2022 | 0645/0845 | * |  | FR | Industrial Production |

| 03/06/2022 | 0700/0300 | * |  | TR | Turkey CPI |

| 03/06/2022 | 0715/0915 | ** |  | ES | IHS Markit Services PMI (f) |

| 03/06/2022 | 0745/0945 | ** |  | IT | IHS Markit Services PMI (f) |

| 03/06/2022 | 0750/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 03/06/2022 | 0755/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 03/06/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 03/06/2022 | 0800/1000 | * |  | NO | Norway Unemployment Rate |

| 03/06/2022 | 0900/1100 | ** |  | EU | retail sales |

| 03/06/2022 | 1230/0830 | *** |  | US | Employment Report |

| 03/06/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 03/06/2022 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 03/06/2022 | 1430/1030 |  | US | Fed Vice Chair Lael Brainard |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.