-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Shanghai Declares Partial Lockdown

EXECUTIVE SUMMARY

- BORIS JOHNSON TO DECLARE BOOSTING ECONOMIC GROWTH HIS TOP PRIORITY

- SHANGHAI PUTS ONE DISTRICT BACK INTO LOCKDOWN IN HUNT FOR CASES (BBG)

- RBNZ DETAILS PLANNED SALES OF NEW ZEALAND GOVERNMENT BONDS

- FIRE AT KEY U.S. GAS EXPORT TERMINAL A BLOW FOR FUEL-STARVED WORLD (BBG)

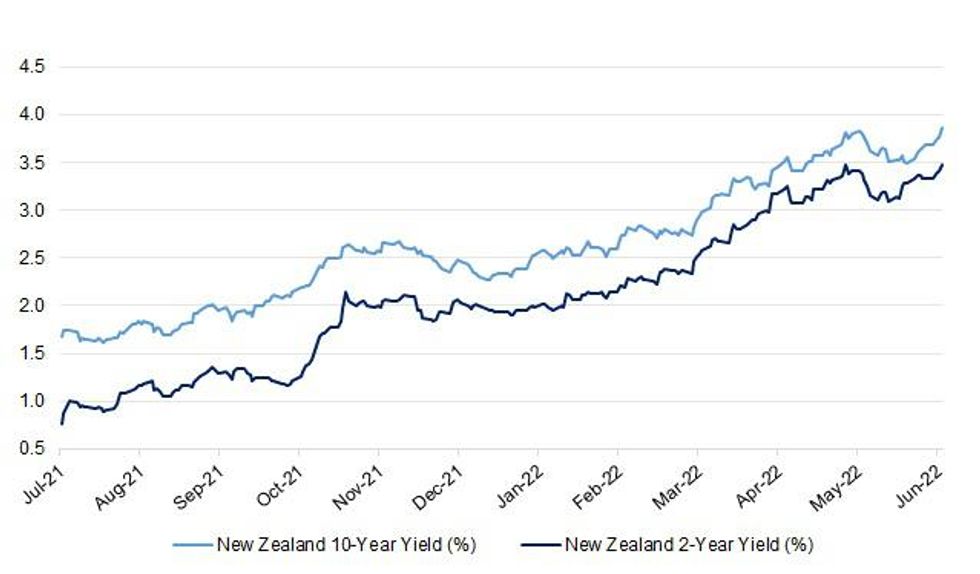

Fig. 1: New Zealand 10-Year Yield (%) & New Zealand 2-Year Yield (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

ECONOMY: Boris Johnson will on Thursday declare that boosting Britain’s economic growth rate is his top priority, as he attempts to create a platform for the income tax cuts that restive Tory MPs and ministers are demanding. The prime minister, rocked by a large scale rebellion by Conservative MPs, will use a speech in Blackpool to insist he has a plan for “generational investments in infrastructure, skills and technology”. The prime minister’s speech on the economy is expected to repeat Sunak’s plan to reform the business tax regime — including investment allowances, research and development tax credits and the apprenticeship levy (FT)

ECONOMY: Lower-paid workers will be able to use their housing benefits to buy homes under plans to be announced by Boris Johnson today. In a speech the prime minister is expected to say that he wants to change the rules so people can use welfare payments to get mortgages and make monthly payments. (Times)

ECONOMY: Boris Johnson’s attempt to reset his troubled premiership has received a double blow after petrol prices had their biggest daily rise in 17 years and a leading international thinktank said the UK economy would slow to a standstill next year. Fears that Britain is heading for a prolonged period of 1970s-style stagflation intensified amid fresh evidence of the damaging impact of the war in Ukraine on the cost of living and growth. Dashing government hopes of a sustained recovery from the Covid pandemic, the Organisation for Economic Co-operation and Development (OECD) singled out the cost of living crisis as a cause of Britain’s slide down the international growth league table. It said the UK would be the weakest economy in the G7 group of leading industrial nations next year. (Guardian)

ECONOMY: Rail industry bosses warned on Wednesday that planned strike action threatened critical parts of the UK’s already strained supply chains, as negotiations continued to try to avert the worst disruption on the network in 30 years. The RMT union has announced plans for 40,000 members at infrastructure owner Network Rail and 13 train operating companies to walk out on June 21, 23 and 25. The union, which is protesting against low pay and proposed job cuts, has also called a strike on the London Underground on June 21. (FT)

ECONOMY: UK estate agents reported a sudden drop-off in inquiries for new homes last month, according to a closely watched survey that indicated the heat could be coming out of the housing market after a frenzied two years. (FT)

POLITICS: Allies of Boris Johnson have warned him not to reward rebels as he begins a policy blitz designed to overcome deep rifts in his party over his leadership. They rejected calls for Mr Johnson to widen his cabinet and woo some of the 148 MPs who tried to end his premiership on Monday night, suggesting instead that he should sack ministers yet to publicly support him. (Independent)

EUROPE

FRANCE: The return of EDF to 100% state ownership is one of the priority projects of the new government which must be undertaken after the legislative elections, alongside the fight against inflation and pension reform. “It would be a winner to do it as quickly as possible”, confirms a source within the public administration. (Echos)

SERBIA/RUSSIA: Deputy Prime Minister and Minister of Mining and Energy of Serbia Zorana Mihajlovic positively assessed the postponement of the visit to Belgrade of Russian Foreign Minister Sergey Lavrov scheduled for June 6-7. “I think it’s good that the Russian minister has not come to visit Serbia now, and we should think about our future path, and Serbia has clearly decided on the path to the EU, which President [Aleksandr] Vučić also said,” the Deputy Prime Minister said. (Izvestia)

UKRAINE: The head of the Luhansk Regional State Administration said that the occupiers controlled most of Severodonetsk. "Fighting is taking place only on the streets inside the city." (Pravda)

UKRAINE: The battle for the Ukrainian city of Sievierodonetsk is brutal and will determine the fate of the Donbas region, said the country's president, as Russian troops lay waste to the city in an assault aimed at controlling eastern Ukraine. (RTRS)

UKRAINE: Western-supplied artillery systems are already making a difference on the ground for Ukraine and it is "just a question of time" before its forces win back significant ground in the south, the governor of the Mykolaiv region said on Wednesday. (RTRS)

UKRAINE: Ukraine hopes to make 1.5 billion euros from electricity exports to the European Union by the end of the year and earn to more in the future after obtaining the right to export its energy there, a Ukrainian energy ministry adviser said on Wednesday. (RTRS)

U.S.

ECONOMY: President Joe Biden called inflation the “bane” of the US in an appearance on a late-night talk show, and said that high food and gas prices could be offset by legislation lowering the cost of prescription drugs and childcare. “Inflation is the bane of our existence. Inflation is mostly in food and in gasoline, at the pump,” Biden said Wednesday in an interview with ABC late-night host Jimmy Kimmel. (BBG)

POLITICS: U.S. President Joe Biden intends to nominate Doug McKalip, a veteran agricultural and trade policy expert, to be the U.S. Trade Representative's next chief agricultural trade negotiator, the White House said on Wednesday. (RTRS)

EQUITIES: Intel Corp (INTC.O) has frozen hiring in the division responsible for PC desktop and laptop chips, according to a memo reviewed by Reuters, as part of a series of cost-cutting measures. Intel is "pausing all hiring and placing all job requisitions on hold" in its client computing group, according to the memo sent on Wednesday. The memo said that some hiring could resume in as little as two weeks after the division re-evaluates priorities and that all current job offers in its systems will be honored. (RTRS)

EQUITIES: The top U.S. securities regulator on Wednesday unveiled a planned overhaul of Wall Street retail stock trading rules, aiming to boost competition for handling orders by commission-free brokerages to ensure mom-and-pop investors get the best price for trades. U.S. Securities and Exchange Commission chair Gary Gensler told an industry audience he wants to require trading firms to directly compete to execute trades from retail investors. The Wall Street watchdog plans to scrutinize growth in recent years of the payment for order flow (PFOF) practice, which is banned in Canada, the UK and Australia. (RTRS)

OTHER

WTO: China will be at the heart of crunch talks on fishing subsidies and intellectual property waivers for Covid-19 vaccines next week at the first World Trade Organization ministerial summit held in five years. WTO chief Ngozi Okonjo-Iweala says it is “within the realm of the possible” that deals will be reached, with the beleaguered Geneva institution in desperate need of wins. (SCMP)

NATO: Spain, as host of an upcoming NATO summit, will push for the inclusion of "hybrid threats" such as irregular migration, food insecurity and terrorism in the alliance's new policy roadmap, Foreign Minister Jose Manuel Albares said in an interview. (RTRS)

GLOBAL TRADE: For the first time ever Apple is moving some iPad production out of China and shifting it to Vietnam after strict Covid-19 lockdowns in and around Shanghai led to months of supply chain disruptions. The US company has also asked multiple component suppliers to build up their inventories to guard against future shortages and supply snags, sources said. (FT)

ASIA-PAC: The United States and China are expected to use Asia's top security meeting this week to trade blows over everything from Taiwan's sovereignty to the war in Ukraine, although both sides have indicated a willingness to discuss managing differences. The Shangri-La Dialogue, which attracts top-level military officials, diplomats and weapons makers from around the globe, will take place June 10-12 in Singapore, the first time the event has been held since 2019 after it was postponed twice because of COVID-19. (RTRS)

ASIA-PAC: American officials increasingly see China losing diplomatic ground in Asia as Pentagon chief Lloyd Austin heads to Singapore for a regional security forum that will include a meeting with a top Chinese defense official. Determined not to be distracted by the war in Ukraine, administration officials say China has provided an opening for the US to solidify relationships in Asia. That’s in large part because of President Xi Jinping’s insistence on Covid-zero policies that have crimped economic growth, as well as a growing backlash against China’s assertive foreign policy. (BBG)

U.S./CHINA: U.S. Treasury Secretary Janet Yellen said on Wednesday the Biden administration was looking to "reconfigure" tariffs on Chinese imports but warned that such cuts would not be a "panacea" for easing high inflation. Yellen told a U.S. House of Representatives Ways and Means Committee hearing that the Biden administration was examining changes to the "Section 301" tariffs on Chinese goods and to the process for product-specific exclusions from those duties. She said more information on the tariff plans would be available in coming weeks, adding that changes were "under active consideration." (RTRS)

U.S./CHINA: The U.S. Commerce Department said on Wednesday it was suspending the export privileges of three U.S.-based firms for 180 days for what it said was the illegal export of satellite, rocket and defense technology to China. Quicksilver Manufacturing Inc, Rapid Cut LLC and U.S. Prototype Inc are subject to the action for the unauthorized export of technical drawings and blueprints used to 3-D print satellite, rocket, and defense-related prototypes, the department said. (RTRS)

AUSTRALIA: Australia’s largest lender expects current aggressive monetary policy tightening to weigh heavily on the economy and force the Reserve Bank to reverse course and cut interest rates in the second half of 2023. Commonwealth Bank of Australia on Thursday downgraded its GDP growth forecasts and now predicts the A$2.2 trillion ($1.6 trillion) economy will expand 3.5% this year, down from a previous 4.7%, and then slow to a “below‑trend” 2.1% in 2023, compared with 3.1% seen previously. (BBG)

RBNZ: New Zealand’s central bank is to begin selling the bonds acquired during its quantitative easing program and intends to gradually dispose of all its holdings over the next five years. Starting next month, the Reserve Bank will sell bonds back to the Treasury Department’s debt management office at a rate of NZ$5 billion ($3.2 billion) per June year in order of maturity date, beginning with the longest maturity, it said in a statement Thursday. Sales will continue in a “gradual and predictable manner” until holdings have reduced to zero, which is expected to be in mid-2027. Shorter-maturity bonds will mature without reinvestment or sales. (BBG)

NEW ZEALAND: The Government is making changes to responsible lending regulations that banks blamed for creating an artificial credit crunch. The changes remove some of the most controversial aspects of the tougher responsible lending laws, including borrowers being asked about their current living expenses based on recent bank transactions. (Stuff)

BOK: South Korea's central bank warned on Thursday that greater attention should be paid to the impact of a weaker won on inflation and reaffirmed that its interest rate policies were focused on fighting inflation. In a scheduled policy report to parliament, the Bank of Korea said the weaker won was responsible for 0.34 of a percentage point in the consumer price index's first-quarter 3.8% rise over a year earlier. (RTRS)

SOUTH KOREA: Thousands of truck drivers in South Korea have gone on strike at major ports and container depots, posing the latest threat to strained global-supply chains. The truckers union, which is seeking to prevent a change to wage rules, is holding protests at 16 locations across the country, according to the International Transport Workers’ Federation. (BBG)

NORTH KOREA: The United States on Wednesday questioned whether China and Russia had elevated their "no limits" strategic partnership above global security by vetoing more U.N. sanctions on North Korea over its renewed ballistic missile launches. "We hope these vetoes are not a reflection of that partnership," senior U.S. diplomat Jeffrey DeLaurentis told a meeting of the 193-member U.N. General Assembly in response to the vetoes in the Security Council two weeks ago. (RTRS)

NORTH KOREA: A key Workers' Party meeting of North Korea opened earlier this week with leader Kim Jong-un in attendance to discuss state policies, according to Pyongyang's media, as speculation is rampant that it may soon carry out a nuclear test. (Yonhap)

NORTH KOREA: The United States is watching "very closely" the continued possibility of a nuclear test by North Korea and will have a robust response, U.S. national security adviser Jake Sullivan said. "We're also watching very closely the continuing possibility of a nuclear test, to which we would also have a robust response," he said. (RTRS)

HONG KONG: Hong Kong is preparing to cocoon some 1,000 people involved in the city’s July 1 handover anniversary, fueling speculation that Chinese President Xi Jinping will attend the celebrations. Security staff, including police officers protecting a “very, very important person,” will enter the closed-loop system in readiness for hosting an unspecified Chinese state leader, the South China Morning Post reported Wednesday evening, citing people it it not identify. (BBG)

AMERICAS: US President Joe Biden on Wednesday urged leaders of the Americas to prove that democracy works as he laid out plans to boost economic cooperation and improve health and food access in a region where China has been making growing inroads. Biden laid out a new regionwide economic plan that was large on ideas but short on commitments, with no promises of further market access or funding. Biden announced $300 million in assistance to address the region's food insecurity, which has been on the rise as Russia's invasion of Ukraine disrupts grain exports. The White House also announced a new Americas Health Corps that aims to improve the skills of 500,000 health workers across the region, building on the lessons from Covid-19, which hit the Western Hemisphere especially hard. The health training will cost $100 million, although the United States will not contribute it all and will seek to raise funds, including through the Pan American Health Organization, an administration official said. (AP)

LATAM: China has widened the gap on the United States in trade terms in large swathes of Latin America since U.S. President Joe Biden came into office early last year, data show, underscoring how Washington is being pushed onto the back foot in the region. An exclusive Reuters analysis of U.N. trade data from 2015-2021 shows that outside of Mexico, the top U.S. trade partner, China has overtaken the United States in Latin America and widened the gap last year. (RTRS)

ARGENTINA: IMF staff, Argentine authorities reach staff-level agreement on first review under Argentina’s 30-month extended fund facility arrangement, according to IMF statement. “All quantitative program targets in the first quarter of 2022 were met. Initial progress is also being made on the growth-enhancing reforms in line with program commitments”. Upon completion of the review, Argentina would have access to about $4.03 billion, equivalent to SDR 3 billion, IMF says. (BBG)

RUSSIA: Russia's economy will shrink 15% this year and 3% in 2023 as the hit from Western sanctions, an exodus of companies, a Russian "brain-drain" and collapse in exports wipe out 15 years of economic gains, a global banking industry lobby group said. (RTRS)

RUSSIA: The number of vacancies on the labor market is declining, Central Bank experts said in a bulletin. Its first wave from the end of February until about mid-April was associated with decisions to suspend previously planned hiring. However, then the actual job cuts began. The largest drop in the number of vacancies in May occurred in insurance, the civil service, the automotive business and the banking sector, hh.ru noted. Companies are forced to reduce recruitment in order to reduce business costs, experts explain. (Izvestia)

RUSSIA: Russian companies cooperating with foreign copyright holders faced the problem of fulfilling financial obligations to their partners under existing license contracts. After the decree of Russian President Vladimir Putin on a new mechanism for payments in rubles for "unfriendly" right holders, which was signed at the end of May, Russian banks suspended payments in foreign currency to foreign licensors. (Vedomosti)

TURKEY: Türkiye will keep making efforts to enhance bilateral relations with Venezuela, the Turkish president said on Wednesday. Addressing a joint press conference after talks with his Venezuelan counterpart Nicolas Maduro in the capital Ankara, President Recep Tayyip Erdogan asserted that Türkiye has “always supported Venezuela and will continue to do so in the future.” He said Türkiye opposes unilateral sanctions against Venezuela, hailing the country as one of Ankara’s “most important partners” in the Latin America and Caribbean region. Responding to questions, Erdogan reaffirmed Türkiye’s stance against Sweden and Finland’s push to become NATO members. “NATO is a security organization, not a terrorist organization,” he said. “Türkiye cannot support Sweden’s NATO bid while its state television broadcasts interviews of terrorist leaders, and the same goes for Finland.” (Anadolu)

ISRAEL: Nir Orbach, a lawmaker from Prime Minister Naftali Bennett’s Yamina party, was in talks to join the opposition’s Likud party, according to Wednesday reports, as the governing coalition appeared headed for a collapse. Orbach has denied the rumors, which came as the coalition careens from one crisis to the next, with government lawmakers increasingly fighting among themselves. (Times of Israel)

ISRAEL: In another failure for the faltering government, opposition bills to raise the minimum wage passed preliminary readings in the Knesset on Wednesday as some coalition lawmakers broke ranks to vote in support of the measures. (Times of Israel)

ISRAEL: United Arab List chairman Mansour Abbas said Wednesday that if Israel's political crisis isn’t resolved he would support going to elections, as he attempts to sway coalition members on the West Bank vote. (Haaretz)

IRAN: The UN nuclear watchdog’s board of governors voted overwhelmingly on Wednesday in favour of a resolution criticising Iran for failing to co-operate sufficiently over its undeclared atomic sites as tensions mount between the Islamic republic and western powers. The resolution came amid mounting concerns over Iran’s atomic activity as diplomatic efforts to save the 2015 nuclear accord Tehran signed with world powers flounder. (FT)

IRAN: Iran has begun installing advanced IR-6 centrifuges in a cluster at an underground enrichment plant in line with a longstanding plan and now intends to add two more such clusters, or cascades, the U.N. nuclear watchdog told its member states on Wednesday. The moves are described in a confidential International Atomic Energy Agency report sent to member states shortly before the IAEA's 35-nation Board of Governors passed a resolution criticising Iran for failing to explain uranium traces found at undeclared sites. Iran had warned of retaliation.(RTRS)

IRAN: Iran foreign minister Hossein Amir-Abdollahian said that Tehran has presented a new proposal to the United States to revive the 2015 nuclear deal, Iran's state TV reported on Wednesday. Since Washington withdrew from that deal in 2018 under then-President Donald Trump and reimposed sanctions against Iran, Tehran has breached many of the deal's restrictions on its nuclear activities including enrichment. (RTRS)

ENERGY: An explosion that will keep a major US liquefied natural gas export terminal shut for weeks will cut vital supplies to Europe, which is already struggling with uncertainty around flows of the fuel from Russia. The Freeport LNG export facility in Texas will remain closed for at least three weeks after a fire on Wednesday, a company spokesperson said. Almost a fifth of all overseas shipments of gas from the US went via the terminal last month. (BBG)

CHINA

UN: Hundreds of millions of people are at risk of “hunger and destitution” because of food shortages due to the Ukraine war, the chief of the UN warned, as talks stalled over ending Russia’s blockade of Black Sea grain shipments. António Guterres spoke as negotiators from Russia and Turkey failed to break an impasse over how to get export food from Ukraine, one of the world’s biggest wheat exporters. (FT)

ECONOMY: Local governments must urgently refine and implement pro-growth policies to ensure reasonable economic growth in the second quarter, in the face of still prominent downward pressure, according to a statement on a government website following a State Council executive meeting chaired by Premier Li Keqiang late Wednesday. It is necessary to further expand opening up and stabilising foreign investment and trade to promote employment, the meeting said. The government will study a phased reduction or exemption of port-related charges and faster customs clearance and port efficiency to help stabilise international supply chains, the meeting said. (MNI)

YUAN: The yuan is likely to stay around the 6.68 level against the U.S. dollar by the end of June, compared to Wednesday’s closing price of 6.6830, Yicai.com reported citing its survey of economists. The economists raised their forecast for the yuan-dollar exchange rate by year-end to 6.63 from a previous 6.67 forecast made last month, Yicai said. The yuan remained relatively strong against the yen, euro and pound, though weakening against the dollar recently. Allowing a more flexible yuan will provide room for monetary policy to stabilise economic growth, said Yicai citing Xu Sitao, chief economist at Deloitte China. (MNI)

DEBT: Increases in liquidity injections are expected from the People’s Bank of China in the next few months as the government accelerates debt issuance to shore up the economy, which would boost China’s aggregate financing and M2, according to market analysts and economists. The total liquidity gap in June would be around CNY600 billion, as bond issuance from both central and local governments is expected to reach as much as CNY1.4 trillion, compared with CNY391.2 billion in April, said Liu Yu, an analyst at Guangfa Securities. Liu estimates the PBOC could increase liquidity injections for medium-term lending facilities next week and restart the 14-day reverse repo in its open market operations to fill the gap. (MNI)

REAL ESTATE: Potential homebuyers remain cautious despite eased rules and lower mortgage interest rates in over 100 cities to prop up the market, the Securities Times reported. The total transaction volume of second-hand housing in first-tier city Shenzhen in the first five months of this year was equivalent to a single month in 2020 when the market thrived, the newspaper said citing an unnamed sales manager. Policies should focus on reducing the cost of the entire supply chain and restoring developers’ credit, given that it is hard to stimulate demand when buyers are afraid of increasing leverage amid uncertain income expectations, the newspaper said citing analysts. (MNI)

CORONAVIRUS: Parts of Shanghai began imposing new lockdown restrictions on Thursday, with residents of sprawling Minhang district forced to stay home for two days in a bid to control COVID-19 transmission risks. Minhang, home to more than 2 million people, will conduct nucleic acid tests for all residents on June 11, and restrictions will be lifted once the testing is completed, the government said on its WeChat account. (RTRS)

CORONAVIRUS: Shanghai is seeing rapid rebound in road and air traffic, deliveries and postal services after a citywide lockdown was lifted, the Shanghai Securities News reported Thursday, citing local logistics operators. The local postal system’s delivery transfer stations have all resumed work and capacity is estimated to rise to 70% of normal level by mid-June, the report cites the postal bureau as saying. More truck drivers have restarted work as nucleic acid tests become much easier. (BBG)

CHINA MARKETS

PBOC INJECTS CNY10 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.1% on Thursday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9289% at 9:42 am local time from the close of 1.6218% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 42 on Wednesday, flat from the close of Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.6811 THURS VS 6.6634

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.6811 on Thursday, compared with 6.6634 set on Wednesday.

OVERNIGHT DATA

CHINA MAY TRADE BALANCE $78.76BN; MEDIAN $57.70BN; APR $51.12BN

CHINA MAY EXPORTS +16.9% Y/Y; MEDIAN +8.0%; APR +3.9%

CHINA MAY IMPORTS +4.1% Y/Y; MEDIAN +2.8%; APR +0.0%

CHINA MAY TRADE BALANCE CNY502.89BN; MEDIAN CNY400.00BN; APR CNY325.08BN

CHINA MAY EXPORTS CNY +15.3% Y/Y; MEDIAN +9.2%; APR +1.9%

CHINA MAY IMPORTS CNY +2.8% Y/Y; MEDIAN +4.2%; APR -2.0%

JAPAN MAY M2 MONEY STOCK +3.2% Y/Y; MEDIAN +3.6%; APR +3.4%

JAPAN MAY M3 MONEY STOCK +2.9% Y/Y; MEDIAN +3.2%; APR +3.1%

JAPAN MAY TOKYO AVERAGE OFFICE VACANCIES 6.37; APR 6.38

NEW ZEALAND MAY ANZ TRUCKOMETER HEAVY -1.7% M/M; APR +2.4%

UK MAY RICS HOUSE PRICE BALANCE 73%; MEDIAN 76%; APR 80%

MARKETS

SNAPSHOT: Shanghai Declares Partial Lockdown

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 120.32 points at 28356.13

- ASX 200 down 74.501 points at 7046.6

- Shanghai Comp. down 15.937 points at 3247.856

- JGB 10-Yr future up 4 ticks at 149.59, yield down 0.6bp at 0.245%

- Aussie 10-Yr future down 3.8 ticks at 96.407, yield up 4.3bp at 3.589%

- U.S. 10-Yr future -0-03 at 117-31+, yield up 1.48bp at 3.0363%

- WTI crude up $0.26 at $122.37, Gold up $0.92 at $1854.28

- USD/JPY down 8 pips at Y134.17

- BORIS JOHNSON TO DECLARE BOOSTING ECONOMIC GROWTH HIS TOP PRIORITY

- SHANGHAI PUTS ONE DISTRICT BACK INTO LOCKDOWN IN HUNT FOR CASES (BBG)

- RBNZ DETAILS PLANNED SALES OF NEW ZEALAND GOVERNMENT BONDS

- FIRE AT KEY U.S. GAS EXPORT TERMINAL A BLOW FOR FUEL-STARVED WORLD (BBG)

BOND SUMMARY: JGB Futures Firm As Cash 10-Yr Yield Nears Ceiling, Mix Of Factors Keeps Lid On ACGBs

The trajectories of core FI futures diverged, although erosion of risk appetite provided some broader support in afternoon trade. Shanghai announced that one of its districts will be placed under lockdown for mass COVID-19 testing on Saturday, in a reminder that China's COVID-19 troubles are not over. Participants parsed regional headlines, with one eye already on the upcoming ECB monetary policy decision, the main risk event today.

- T-Notes extended Wednesday's sell-off as the Asia-Pac session got underway. They pierced yesterday's low and slid as low as to 117-26+ before finding support as market sentiment worsened. TYU2 now trades -0-03+ at 117-31, comfortably above session lows, with Eurodollars last seen unch. to 4.0 ticks lower through the reds. Cash Tsys unwound earlier gains, yields last trade 0.9-1.6bp higher, curve runs a tad flatter. Weekly jobless claims and a 30-year auction headline in the U.S. today.

- ACGBs remained on a softer footing. 10-Year yield showed at its highest point since 2014 as the long end cheapened. Similar dynamics were evident in futures space, with YM last +1.0 & XM -3.5. Bills trade -1 to +10 ticks through the reds. Initial selling pressure seemed linked to a combination of carry-over impetus from NY hours, inflation worry signalled in recent comments from Australian officials, and trans-Tasman spillover from NZGB sell-off. New Zealand bonds went offered across the curve as the RBNZ announced that it will start shedding government bonds acquired under the LSAP programme from next month, with the process expected to be completed by mid-2027.

- JGB futures re-opened on a firmer footing and extended gains from there, defying cues from overnight U.S. Tsys' performance, as the market showed confidence in the BoJ-mandated cap on 10-year yield. The active futures contract last trades at 149.62, 7 ticks above previous settlement but 4 ticks shy of session highs. Cash curve twist steepened as the super-long end sold off. Worth highlighting that 10-Year yield is within 1bp from the 0.25% ceiling of its permitted trading band. Elsewhere, the MoF conducted a liquidity enhancement auction for off-the-run JGBs with 5-15.5 years until maturity, drawing a bid/cover ratio of 6.153x (prev. 4.331x).

JGBS AUCTION: Japanese MOF sells Y2.2649tn 6-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y2.2649tn 6-Month Bills:

- Average Yield: -0.0946% (prev. -0.1110%)

- Average Price: 100.048 (prev. 100.056)

- High Yield: -0.0867% (prev. -0.1070%)

- Low Price: 100.044 (prev. 100.054)

- % Allotted At High Yield: 7.4513% (prev. 90.8094%)

- Bid/Cover: 4.905x (prev. 4.587x)

JGBS AUCTION: Japanese MOF sells Y499.4bn of 5-15.5 Year JGBs in a liquidity enhancement auction:

The Japanese Ministry of Finance (MOF) sells Y499.4bn of 5-15.5 Year JGBs in a liquidity enhancement auction:

- Average Spread: -0.006% (prev. -0.007%)

- High Spread: -0.003% (prev. -0.007%)

- % Allotted At High Spread: 80.6374% (prev. 78.0638%)

- Bid/Cover: 6.153x (prev. 4.331x)

EQUITIES: Lower In Asia As ECB Policy Meeting Eyed; Australian Financials Hit 14-Month Low

Major Asia-Pac equity indices are lower at typing, tracking a negative lead from Wall St., ahead of the ECB’s meeting later on Thursday as well.

- To recap, the ECB is expected to end APP in early July while signalling the commencement of rate hikes, with debate re: the possibility of 50bp rate hikes increasingly coming to the fore. A reminder that this comes as Eurozone inflation last came in at a larger-than-expected, record high in May (+8.1% vs BBG median +7.8%), rising for a seventh consecutive month as well.

- China-linked, high-beta equities underperformed their broader domestic equity benchmarks amidst worry re: previously flagged, partial COVID lockdowns in Shanghai, with the Hang Seng Tech Index being 0.8% worse off, while the ChiNext Index and STAR50 deal 2.2% and 2.4% weaker respectively at typing.

- The Hang Seng Index and CSI300 trade 0.2% and 0.6% lower at typing respectively by comparison, with their respective real estate sub-indices outperforming (Hang Seng Properties: +1.1%; CSI300 Real Estate Index: +2.3%). Energy and materials names caught a bid on a rise in major crude benchmarks as well, with pessimism evident in richly-valued sectors such as the CSI300’s Consumer Staples and Healthcare sub-indices.

- The Australian ASX200 lagged peers, trading 0.9% lower at writing, with tepid performance in the major miners (0.2% firmer to 1.0% weaker) mixing with continued struggles in Australian financials. The ‘Big 4’ Australian banks sit 1.5% to 3.3% softer apiece, with the broader sub-index on track for a fourth consecutive day of losses (-7.3% for the week so far), although the gauge has notably rebounded from 14-month lows made earlier in the session.

- U.S. e-mini equity index futures sit 0.1% to 0.2% worse off at typing, a little above session lows after earlier pessimism surrounding Shanghai’s announced lockdown sent the various contracts to/around Wednesday’s worst levels.

OIL: Northbound On U.S. Inventory Data, OPEC+ Underperformance; Shanghai Lockdown Eyed (Again)

WTI and Brent are $0.40 firmer apiece, operating ~$1 off of Wednesday’s best levels at typing.

- China announced a fresh lockdown and mass testing to begin on Saturday for Shanghai’s Minhang district (~2.7mn pop), with another district (Songjiang, ~1.9mn pop) due to hold mass testing over the weekend as well.

- Sentiment in major crude benchmarks softened a little in Asia-Pac dealing on the news, with WTI and Brent turning away from session highs, but continuing to operate comfortably within the upper-end of Wednesday’s range at typing. Losses in crude have likely been limited as fresh cases reported for Shanghai remain low (with no cases found outside quarantine on Wednesday).

- To recap Wednesday’s price action, WTI made fresh 13-week highs at $123.18, while Brent rose to its own one-week highs at $124.40, with the overall upward move facilitated by U.S. EIA oil inventories pointing to tightness in crude and gasoline supplies.

- To elaborate, EIA inventory data crossed on Wednesday (1530 BST), pointing to a surprise build in crude stockpiles - corroborating with reports of API estimates on Tuesday. There was a surprise drawdown in gasoline stockpiles as well, with inventories declining for a 10th straight week, exacerbating worry from some quarters re: tightness in refined fuel supply in the U.S., even as the EIA forecasts Q3 refinery utilisation rates at ~94%. Apart from that, there was a stronger than expected build in distillate inventories, while Cushing Hub stocks declined.

- Turning to OPEC, UAE energy minister Suhail al-Mazrouei flagged on Wednesday that OPEC+ continues to lag output production quotas, and currently pumps ~2.6mn bpd below stated targets, further suggesting that the return of Chinese oil demand (as the country lifts COVID lockdowns) even as spare output capacity within the group declines, would increase risks to crude markets.

GOLD: Rebounds From Early Dip

Gold has recovered from an early session dip to be back at $1855. This is modestly higher on NY closing levels and we remain well within recent ranges.

- The precious metal is tracking USD developments more closely in the near term rather than US yield moves.

- US yields were higher overnight and are firming again today, but gold has been supported on dips. To be sure, yields elsewhere are trending higher as well, so this is diminishing the upside USD impetus (with USD/JPY being the obvious exception).

- Today's weaker equity sentiment in the region has probably aided Gold to a degree, but it doesn't appear to be a major driver. The OECD painted a bleak picture for the global economic outlook overnight, but this was very much in line with what the World Bank stated in the previous evening.

- Cross asset signals will be watched closely over the next few sessions, with the ECB decision tonight, followed by tomorrow's US CPI print.

- In terms of levels, on the topside, we haven't managed to crack above $1860 this week, while support is evident sub $1845.

FOREX: Yen Finally Finds Poise, Aussie Goes Offered

Risk sentiment soured as Shanghai authorities announced they will lock down the Minhang district on Saturday for mass COVID-19 testing, sending USD/CNH through yesterday's highs. But the rate pulled back into negative territory as the PBOC set the mid-point of permitted USD/CNY trading band 21 pips below the forecast level, while China's May trade surplus printed comfortably above expectations, supported by a solid rebound in shipments.

- Yuan moves were reflected in the Aussie dollar's price action, but broader selling pressure prevailed as AUD remained the worst G10 performer. Bloomberg trader sources pointed to offshore funds shedding local equities and leveraged accounts exiting post-RBA longs.

- AUD/NZD rose to a fresh four-year high in morning trade, but then pulled back as yield differential momentum turned less supportive for the cross. Note that NZGB yields popped higher today as the RBNZ outlined the details of its planned bond holdings reduction.

- The yen turned bid on the back of waning appetite for risk, even as USD/JPY refreshed cycle highs ahead of the Tokyo open. Option traders remain bullish, as 1-month risk reversal operates near its one-month high posted Wednesday, but technical conditions for the spot rate are looking increasingly overbought.

- The Eurozone's single currency garnered some strength before the ECB announces its monetary policy decision later today, with President Lagarde due to hold a press conference shortly after.

- The speaker slate also features BoC's Macklem & Riksbank's Breman, while key incoming data releases are limited to U.S. weekly jobless claims.

FOREX OPTIONS: Expiries for Jun09 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0560-70(E1.4bln), $1.0595-05(E1.1bln), $1.0750-55(E1.3bln), $1.0800(E500mln)

- USD/JPY: Y129.80-00($1.3bln)

- GBP/USD: $1.2600-05(Gbp574mln)

- AUD/USD: $0.7165-85(A$1.4bln)

- USD/CAD: C$1.2500($679mln), C$1.2820($682mln), C$1.2900($570mln)

- USD/CNY: Cny6.7000($2.3bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/06/2022 | 0600/0800 | ** |  | SE | Private Sector Production |

| 09/06/2022 | 1145/1345 | *** |  | EU | ECB Deposit Rate |

| 09/06/2022 | 1145/1345 | *** |  | EU | ECB Main Refi Rate |

| 09/06/2022 | 1145/1345 | *** |  | EU | ECB Marginal Lending Rate |

| 09/06/2022 | - | *** |  | CN | Trade |

| 09/06/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 09/06/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 09/06/2022 | 1230/1430 |  | EU | ECB Press Conference Following Governing Council Meeting | |

| 09/06/2022 | 1400/1000 |  | CA | BOC Financial System Review | |

| 09/06/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 09/06/2022 | 1500/1100 |  | CA | BOC Governor press conference | |

| 09/06/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 09/06/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 09/06/2022 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.