-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Crude Takes A Tumble

- WTI & Brent crude oil futures shed the best part of $4 apiece, with source reports pointing to an imminent announcement re: a gasoline tax holiday in the U.S., weaker equities and technical breaks driving the sell off in crude.

- Tsys were better bid as a result.

- On the data front, UK & Canadian inflation figures take focus from here. Elsewhere, Fed Chair Powell will deliver his semi-annual monetary policy testimony today. His address provides the highlight of the global central bank speaker slate, which also features Fed's Barkin, Evans & Harker, BoE's Cunliffe & BoC's Rogers

US TSYS: Firmer As Crude Tumbles

Lower crude oil prices (WTI & Brent are down the best part of $4 apiece at typing) and a downtick in e-mini futures (S&P 500 contract -0.9% at typing) provided support for the Tsy space in Asia dealing, as participants looked ahead to day 1 of Fed Chair Powell’s testimony on the Hill. That leaves TYU2 +0-10 at 116-03+ at typing, 0-02+ off the peak of its Asia session range, while cash Tsys run 0.5-2.0bp richer across the curve, with the belly leading.

- There wasn’t much in the way of meaningful macro headline flow to digest, outside of various news outlets pointing to U.S. President Biden formally declaring a short-term gasoline tax holiday later on Wednesday.

- A 5.0K block trade in the TYN2 119.25/118.00 put spread headlined on the flow side. The direction of the trade wasn’t immediately clear, but owing to the open interest, recent market moves and perceived cash flow surrounding such a position, some pointed to a seller of the put spread.

- Looking ahead, Fedspeak dominates Wednesday’s NY docket, with Chair Powell’s aforementioned appearance in DC headlining. Elsewhere, Evans, Harker & Barkin are all due to speak. 20-Year Tsy supply will also take place, with only second tier local data evident, in the form of the weekly MBA mortgage applications print.

JGBS: Twist Steepening

JGBs mostly richened during the Tokyo morning, as a pull lower in crude oil prices and general downtick in equities provided support, with the front end of the curve outperforming. The exception to that rule came in 7s, which cheapened on catch up to the overnight weakness in futures.

- The curve then developed more of a twist steepening pattern in the afternoon, although the move was generally modest, with the major cash JGB benchmarks running 1bp richer to 0.5bp cheaper, pivoting around the 5- to 7-Year zone.

- The breakdown of the latest round of BoJ Rinban operations seemed to be the driving factor behind the modest steepening, with the following offer/cover ratios observed:

- 1- to 3- Year: 2.73x (prev. 2.00x)

- 5- to 10- Year: 1.80x (prev. 3.22x)

- 25+- Year: 4.91x (prev. 1.89x)

- Note that the jump in cover ratio observed in 25+-Year JGBs was a function of the BoJ operations reverting to “normal” size after last week’s impromptu purchases (the market offered to sell Y248.1bn of 25+-Year paper to the Bank to vs. the Y283.4bn seen in last week’s off-schedule operation).

- Futures oscillated around late overnight session levels and head into the Tokyo close 16 ticks softer on the day.

AUSSIE BONDS: Pushing Higher Post-Lowe

ACGBs turned bid in the wake of comments on the RBA by Westpac Chief Economist Bill Evans (Evans sees the Bank reaching a terminal rate of 2.35% in February ’23, which is much less aggressive than market pricing). A downtick in major crude benchmarks and U.S. e-mini futures also lent support to the space, ultimately seeing ACGBs extend their rally following RBA Governor Lowe’s pushback against market pricing of tightening on Tuesday, with yields across the curve operating around one-week lows in the process, with ACGBs bull steepening.

- YM and XM are +9.0 and +5.0 respectively, backing away from their respective best levels of the session heading towards the Sydney close. Bills run +9 to +18 through the reds.

- The latest round of ACGB Apr-25 supply went smoothly, with the cover ratio comfortably above the 3.00x level, and the weighted average yield sitting comfortably through the prevailing mids (1.43bp, per Yieldbroker).

- STIR markets continue to show moderating expectations for tightening in July, with the IB strip pricing in ~45bp of tightening at that meeting, and a cumulative ~255bp of tigthening priced in for the remaining six meetings of calendar ‘22.

- The S&P Global Services and Composite PMIs will headline the domestic data docket on Thursday, with little else on tap for the rest of the week.

FOREX: Flight To Safety

Risk sentiment soured as the three main U.S. e-mini futures contracts retreated, shedding ~1% apiece. There were no particular headline catalysts behind the defensive moves, with yesterday's spell of reprieve for risk seemingly running its course. The proximity of a key address from Fed chief may have helped fray the nerves of market participants.

- Traditional safe havens gained on the back of general aversion to risk, with the yen sitting atop the G10 pile. Spot USD/JPY has shed some 50 pips thus far after refreshing its 24-year highs in early Tokyo trade.

- The Antipodeans paced losses, closely followed by their commodity-tied peers CAD & NOK. Retreating crude oil and iron ore prices amplified selling pressure that weighed on the space.

- Regional risk barometer AUD/JPY fell 1 full figure, but struggled to return below Y94.00 or challenge Tuesday's lows.

- Greenback strength drove spot USD/CNH higher, with a weaker than expected PBOC fix facilitating the move. The People's Bank set the mid-point of permitted USD/CNY trading band 27 pips above sell-side estimate, which represented the weakest bias in two months.

- On the data front, UK & Canadian inflation figures take focus from here. Elsewhere, Fed Chair Powell will deliver his semi-annual monetary policy testimony today. His address provides the highlight of the global central bank speaker slate, which also features Fed's Barkin, Evans & Harker, BoE's Cunliffe & BoC's Rogers.

FOREX OPTIONS: Expiries for Jun22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500(E594mln), $1.0580(E595mln), $1.0595-00(E714mln), $1.0630-35(E554mln), $1.0650-60(E760mln)

- USD/JPY: Y134.40-57($710mln)

- GBP/USD: $1.2245(Gbp738mln)

- EUR/GBP: Gbp0.8700(E570mln)

- USD/CAD: C$1.3020($550mln)

- NZD/USD: $0.6300(N$998mln)

- USD/CNY: Cny6.70($920mln)

ASIA FX: Weakens On Lower Equities, Won Back to 2009 Lows

All USD/Asia pairs are higher, as risk-off grips equities. Dovish rhetoric from regional central banks is also weighing.

- CNH: USD/CNH has climbed above 6.7200, although some selling interest is evident above this level. Earlier, the CNY fix came in weaker than expected, in line with the sharp bounce in USD/JPY overnight. China equities are lower, but have outperformed other major bourses in the region.

- KRW: USD/KRW got close to 1298, fresh highs going back to 2009. Korean equities continue to weaken, while equity outflows persist, although we are still above previous trough points. We remain wary of official rhetoric around FX weakness, although the fundamental backdrop for the won suggests it remains a tough battle to turnaround this trend.

- INR: Spot USD/INR is pushing higher, back close to 78.20, but we remain sub previous record highs of 78.27/28. The 1 month NDF is unchanged though at 78.37. Some relief for INR, at least on a relative value basis, may be coming through from the sharp drop in oil prices.

- IDR: Renewed aversion to risk coupled with dovish BI talk have allowed spot USD/IDR to rip through recent cycle highs and run as high as to IDR14,863, its highest point since Oct 2020. BI Governor Warjiyo pushed back against hawkish BI bets. The monetary policy decision is due tomorrow, with the consensus looking for an on hold decision (see this link for more details).

- PHP: USD/PHP continues to trend higher, last +0.24 to 54.50, though off session highs printed earlier at PHP54.615. The Philippines reported a balance of payments deficit of $1.606bn for the month of May vs. April's $415mn deficit. The central bank said it reflected foreign debt payment by the national government. The BSP will announce its monetary policy decision on Thursday, with consensus looking for a 25bp hike to the policy rate (see this link for more details).

- THB: Baht has lost a further 0.5% today. USD/THB last tracked just under 35.48. The Finance Minister noted that the BoT is closely monitoring THB movements, but it is "difficult" to guide the currency as its weakness stems from external factors, including sharp USD appreciation.

CNH: Is The Weaker Yen Trend Influencing The USD/CNY Fix?

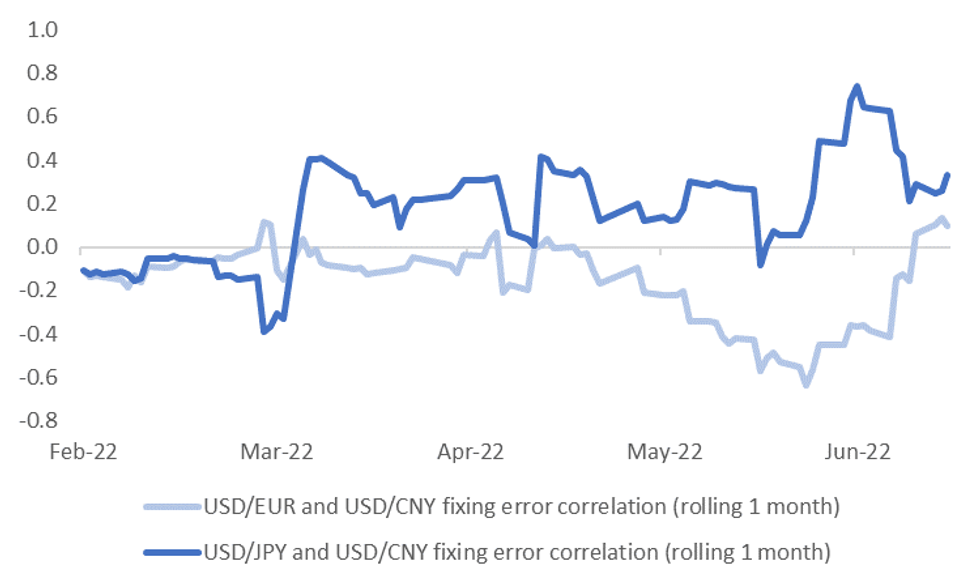

We noted earlier the weaker than expected CNY fix may have been influenced by the sharp drop in yen since the previous fixing. Interestingly, the correlation between the USD/CNY fixing error term and USD/JPY has pushed higher this year, although it remains below 1.

- The first chart below plots the rolling 1-month correlations between the daily USD/CNY fixing error (USD/CNY actual fix - USD/CNY fixing market estimate) and the previous day's change in USD/JPY. We also present the same correlation between the fixing error and USD/EUR.

- Since around March of this year, the correlation has pushed into positive territory in terms of the fixing error and the previous day's change in USD/JPY. This suggests stronger daily USD/JPY changes is having some influence on the fixing bias.

- The CNH/JPY cross is up around 10% so far YTD, and it may be the authorities want to temper the rate of further gains in the cross, particularly with clouds still hanging over China's economic outlook and on-going efforts to boost the performance of trade/exports.

- The equivalent correlation with USD/EUR moves is much weaker.

- However, it’s important to note the correlation with USD/JPY moves is still fairly modest in an absolute sense, i.e. we remain comfortably below 1 in terms of the most recent reading.

Fig 1: USD/CNY Fixing Error & JPY, EUR Correlations

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

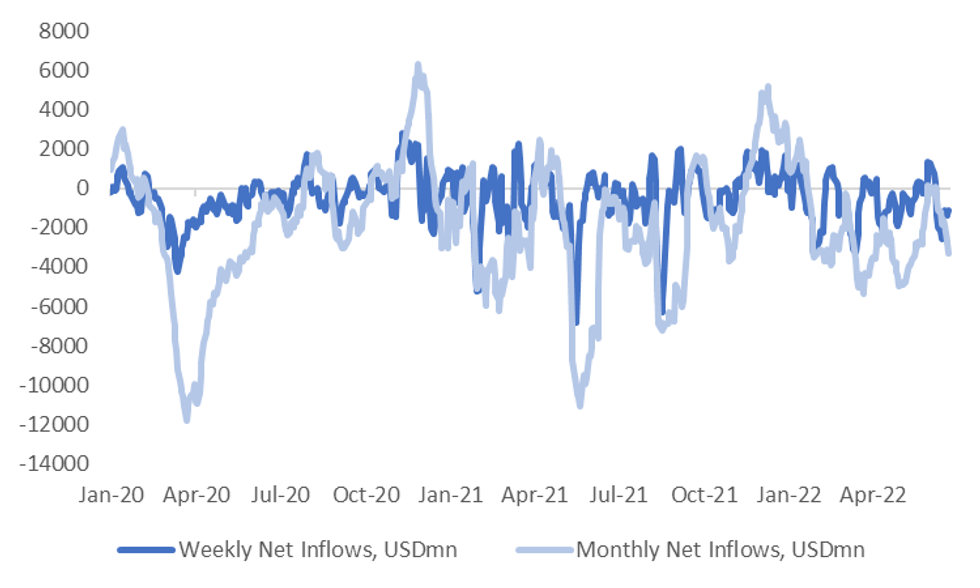

KRW: Korean Equity Outflow Momentum Not Yet At Past Extremes

Spot USD/KRW got close to 1298 earlier, through the 2020 high and fresh highs going back to 2009. Net equity outflows persist, but we remain above previous trough points from a momentum standpoint. Spot USD/KRW is also elevated relative to its own 200 day MA but implied vols and risk reversals paint a more benign picture.

- The Kospi remains an underperformer in the regional equity context, down close to 2%. As we highlighted earlier, equity outflows persist, now at $281mn for day.

- The first chart below plots the trends for the rolling weekly and monthly net equity flow picture. The past 5 trading sessions has seen just over $1.1bn in net outflows according to exchange data, while the past month has seen just under $3.3bn in net outflows.

- Whilst clearly negative, we remain above trough points seen in recent years, as the chart demonstrates.

- Year to date net outflows are also very large at more than $15bn, but remain below net outflows seen for 2020, 2021 and 2008.

Fig 1: Equity Outflows Persist But Not at Extremes Yet

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

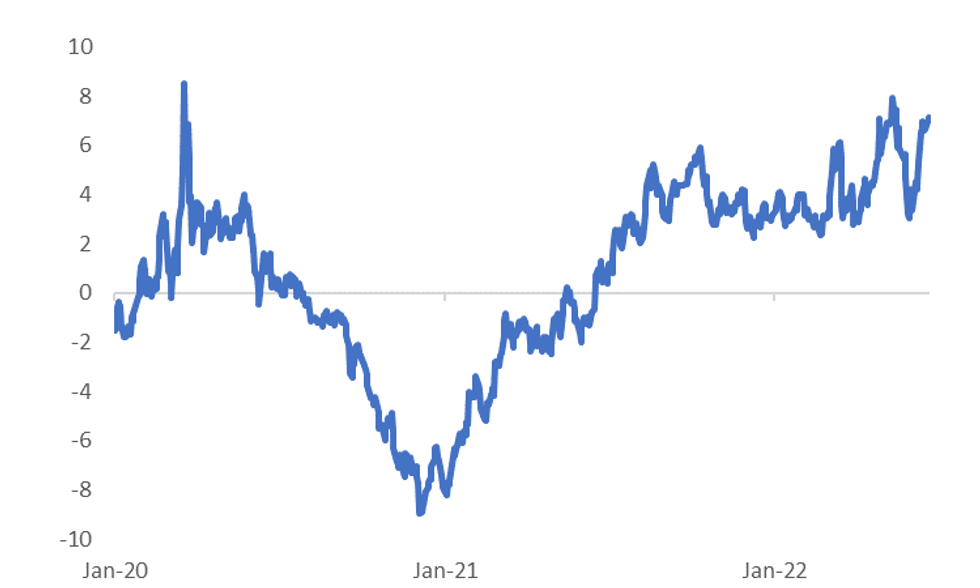

- USD/KRW spot is sitting quite elevated relative to its 200 day MA, see the second chart below. We are +7% above the 200 day MA, which is close to levels we got to earlier this year, but below highs we saw in 2020.

- 1 month implied vol remains elevated at +10%, but we aren't at fresh highs for the year. The picture is more benign in the risk reversal space, with the latest 1 month reading at +1.25, versus earlier YTD highs at +2.0.

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

EQUITIES: Lower In Asia As Risk Sentiment Sours

Virtually all major Asia-Pac equity indices are lower at typing, bucking a strongly positive lead from Wall St. High-beta equities across the region broadly underperformed, tracking a similar decline in U.S. e-mini equity index futures, with defensive flows in the G10 FX space pointing to drag on sentiment towards richly-valued equities.

- The Nikkei 225 sits 0.3% worse off at typing after reversing opening gains, with the broader TOPIX Index posting a (marginally) more modest 0.1% decline. The move in the Nikkei effectively halts momentum from the +1.8% recovery seen on Tuesday, which had come after the steep sell-off in Japanese stocks through much of mid-June. Limited gains in large caps and export-related names such as Fast Retailing and Keyence Corp were unable to overcome losses in energy and material names, with financials posting a relatively flat performance as well.

- The Hang Seng Index trades 1.3% lower at typing after opening lower, shedding the bulk of Tuesday’s gains, and putting it on track to snap a three-day streak of gains in the process. China-based tech underperformed, dealing 2.5% weaker with gains in electric vehicle names (led by Li Auto after they had announced a new SUV model) unable to overcome broad losses observed in large-cap constituents such as the internet platform companies (JD.com: -5.1%, Meituan: -3.3%, Alibaba Group: -2.2%).

- The ASX200 trades 0.1% lower at writing after opening higher, slipping below neutral levels as gains in energy and utility names were countered by shallower losses observed across most other sub-indices. Tech names have lagged peers, seeing the S&P/ASX All Technology Index 0.9% worse off, while large-cap financials and the major miners are mostly flat to lower at typing.

- U.S. e-minis sit 0.9% to 1.0% worse off, operating around session lows at typing, with NASDAQ contracts narrowly leading losses.

GOLD: Lower In Asia; Powell MonPol Comments Eyed

Gold sits ~$6/oz weaker to print $1,827/oz at typing, operating below Tuesday’s worst levels, and taking it to one-week lows in the process. The move lower comes amidst a fresh bid in the USD (DXY), seeing the latter rising above Tuesday’s best levels in Asia-Pac dealing.

- To recap, the precious metal closed ~$6/oz lower on Tuesday despite limited downticks in U.S. real yields and the USD (DXY). Debate re: the possibility of a Fed-led recession has continued to do the rounds, possibly lending support to bullion, with Richmond Fed Pres Barkin being the latest on Tuesday to voice support for a possible 75bp rate hike in July.

- July FOMC dated OIS continue to squarely price in 75bp of tightening for that meeting, with a cumulative ~193bp of tightening priced in for calendar ‘22 - a decline from earlier in the week (as high as >210bp).

- Looking ahead, focus will be turn to Fed Chair Powell’s comments re: monetary policy to the Senate Banking Committee (1430 BST), where he is expected to provide details on the Fed’s ongoing inflation fight and the corresponding recessionary risks.

- From a technical perspective, previously outlined support and resistance levels remain intact at $1,787.0/oz (May 16 low) and $1,889.1/oz (trendline resistance from Mar 8 high) respectively.

OIL: WTI Retreats Below $110; U.S. Gasoline Woes Take Focus

WTI and Brent are ~$4.00 worse off apiece following our earlier writing on crude, a little off their respective session lows at writing.

- Both benchmarks currently sit at five-week lows, with the sharpest declines of the session coming after U.S. President Biden was announced to be speaking on Wednesday (1400 ET) re: gasoline prices (keeping in mind previously-flagged caution re: the significance of the development on crude prices).

- To elaborate, BBG and RTRS source reports have pointed to expectations for Biden to call for a suspension of the federal gasoline tax, a development that has been well-documented by a slew of source reports over the past week.

- Turning to the debate re: demand destruction, gasoline savings app GasBuddy (tracks prices at gas stations through crowdsourced data) announced that U.S. gasoline demand ending last Sunday was 5.5% firmer than the week before, while being 11.4% higher than the rolling average of the last four weeks.

- Looking to supply-related issues, data from the EIA has shown that U.S. refining capacity has declined for another straight year, coming as the Biden administration is setting up a showdown this Thursday with U.S. oil executives over high profits and perceptions of low refining output. A note that Chevron CEO Mike Wirth had earlier this month stated that “I don’t think you are ever going to see a refinery built again in this country”, alluding to the potential trajectory of the upcoming talks.

- The International Energy Forum (IEF) has flagged that global investment in crude production will likely come in below 2019 levels in ‘22 for a third consecutive year, with rising project costs and supply chain issues likely to prove supportive of oil prices in the face of tight global supply. The IEF’s view corroborated with broader remarks made by the CEOs of Vitol and Exxonmobil on Tuesday, with the latter predicting at least three to five years of tightness in oil markets.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/06/2022 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 22/06/2022 | 0600/0700 | *** |  | UK | Producer Prices |

| 22/06/2022 | 0600/0800 | ** |  | SE | Unemployment |

| 22/06/2022 | 0700/0900 |  | EU | ECB de Guindos Q&A at Universidad Internacional Menendez Pelayo | |

| 22/06/2022 | 0735/0935 |  | EU | ECB Elderson Speech on Climate & Q&A at Frankfurt School of Finance | |

| 22/06/2022 | 0830/0930 | * |  | UK | ONS House Price Index |

| 22/06/2022 | 0840/0940 |  | UK | BOE Cunliffe Panels Point Zero Forum | |

| 22/06/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 22/06/2022 | 1230/0830 | *** |  | CA | CPI |

| 22/06/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 22/06/2022 | 1300/0900 |  | US | Richmond Fed President Tom Barkin | |

| 22/06/2022 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 22/06/2022 | 1400/1000 |  | US | Fed Chair Jerome Powell | |

| 22/06/2022 | 1440/1040 |  | CA | BOC Deputy Rogers "fireside chat" | |

| 22/06/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 22/06/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 22/06/2022 | 1600/1200 |  | US | Richmond Fed's Tom Barkin | |

| 22/06/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 22/06/2022 | 1730/1330 |  | US | Fed's Patrick Harker and Tom Barkin |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.