-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: UK PM Still Has Plenty Of Problems Even As Inflation Exp. Edge Lower

EXECUTIVE SUMMARY

- UK PUBLIC INFLATION EXPECTATIONS FALL TO LOWEST SINCE JANUARY - CITI/YOUGOV (RTRS)

- MOVE TO OVERRIDE BREXIT DEAL GETS INITIAL BACKING FROM MPS (BBC)

- MOST MAJOR U.S. BANKS UP SHAREHOLDER COMPENSATION AFTER PASSING STRESS TESTS, SOME EXCEPTIONS

- CHINA PROMISES TIMELY POLICY MEASURES TO COPE WITH ECONOMIC CHALLENGES (RTRS)

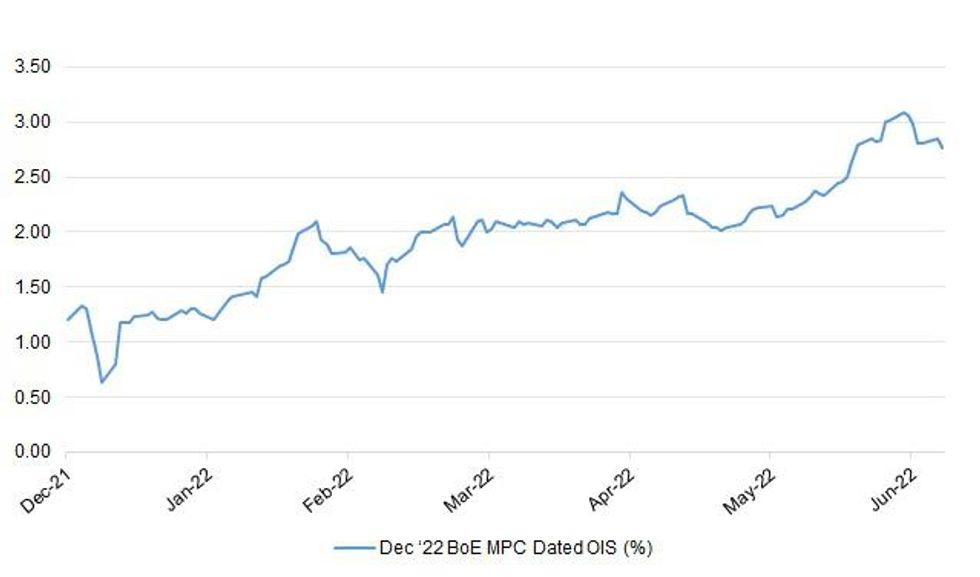

Fig. 1: Dec ‘22 BoE MPC Dated OIS (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

INFLATION: The British public's expectations for inflation in future years receded this month to the lowest level since January, a survey showed on Monday in good news for Bank of England officials who fear price pressures are becoming embedded. U.S. bank Citi and pollsters YouGov said the expectations for inflation in five to 10 years fell to 4.0% in June from 4.2% in May, a move Citi described as encouraging. Inflation expectations for 12 months time were steady at 6.1%, the survey showed. (RTRS)

FISCAL: Boris Johnson and Rishi Sunak will resist calls from Conservative MPs to announce tax cuts in a joint economic speech next month setting out the government’s economic strategy. The prime minister and his chancellor are coming under pressure from cabinet ministers and backbenchers to bring forward such measures to help people with the cost of living. Government sources previously suggested that Johnson and Sunak would announce a broad timeline for future tax cuts as they seek to alleviate pressure from the Tory ranks. However, any announcements will now be delayed until the autumn budget at the earliest. Johnson and Sunak have also said that tax cuts would not be implemented while inflation remained high. (The Times)

POLITICS: Three Red Wall Conservative MPs are in defection talks with Labour, The Telegraph can reveal. (Telegraph)

BREXIT: Government plans to override parts of the Brexit deal relating to Northern Ireland have passed their first hurdle in Parliament. By 295 votes to 221, MPs gave initial approval to a controversial bill allowing ministers to scrap parts of the Northern Ireland Protocol. It comes despite warnings, including from former PM Theresa May, that it breaches international law. (BBC)

BREXIT: Britain does not rule out using an emergency clause in its Brexit deal known as Article 16, Foreign Secretary Liz Truss said on Monday, but she added triggering the clause would not resolve fundamental issues surrounding Northern Ireland. "We came to the conclusion that it (triggering Article 16) would not resolve the fundamental issues in the (Northern Ireland) protocol. It's only a temporary measure," Truss told parliament. "We don't rule out using Article 16 further down the line if the circumstances demand it." (RTRS)

SCOTLAND: Nicola Sturgeon will explain on Tuesday how she plans to hold a second referendum on Scottish independence. The first minister will make a statement in the Scottish Parliament shortly after 14:00 BST. She is expected to lay out her plan for holding a lawful vote in October next year, with or without the formal consent of UK ministers. (BBC)

EUROPE

ITALY/BTPS: Italy's Treasury said on Monday it would offer a new 5-yr bond, maturing December 1, 2027, in the third quarter of this year. The total minimum final outstanding will be 10 billion euros ($10.60 billion). The Treasury sees medium- and long-term gross issuances for 150 billion euros in second half of the year. (RTRS)

ITALY/BTPS: Italy plans to sell up to EU4 billion ($4.24 billion) of bonds due Dec. 1, 2027 in an auction on June 30. Italy plans to sell up to EU2 billion ($2.12 billion) of 2.5% bonds due Dec. 1, 2032 in an auction on June 30. Italy plans to sell up to EU1 billion ($1.06 billion) of floating bonds due April 15, 2029 in an auction on June 30. The sale is a reopening of previously issued securities with EU16.0033 billion outstanding. (BBG)

U.S.

BANKS: Morgan Stanley and Goldman Sachs Group Inc. led the way as US banks boosted dividends and share buybacks in response to their success in clearing this year’s stress tests. JPMorgan Chase & Co. held its dividend steady at $1 a share. Goldman Sachs said its quarterly dividend would jump 25% to $2.50 a share from $2. Morgan Stanley boosted its payout to 77.5 cents a share from 70 cents, according to a statement Monday. (BBG)

OTHER

U.S./CHINA: U.S. President Joe Biden on Monday signed a national security memorandum to fight illegal fishing, part of pledged efforts to help countries combat alleged violations by fishing fleets, including those of China. (RTRS)

GEOPOLITICS: Sweden will continue to take a firm stance on terrorism and will not be a safe haven for extremists, Swedish Prime Minister Magdalena Andersson said on Monday. "Sweden condemns terrorism in the strongest possible terms. We are unequivocally committed to the fight against terrorism in all its forms and manifestations," she told reporters after meeting NATO Secretary-General Jens Stoltenberg in Brussels. (RTRS)

BOJ: The Bank of Japan may have been saddled with as much as 600 billion yen ($4.4 billion) in unrealized losses on its Japanese government bond holdings earlier this month, as a widening gap between domestic and overseas monetary policy pushed yields higher and prices lower. (Nikkei)

SOUTH KOREA: South Korean economy faces concerns on growth slowdown amid high inflation and weakening export recovery, Finance Minister Choo Kyung-ho says in a meeting with Korea Enterprises Federation members. (BBG)

HONG KONG: Hong Kong’s government is considering shortening hotel quarantine to five days for inbound travelers, Cable TV reports, without citing anyone. That would be followed by two days of home quarantine. (BBG)

TURKEY: President Tayyip Erdogan said on Monday that inflation in Turkey will come down to "appropriate" levels as of February-March next year, after it exceeded 73% in May and was expected to rise further. Speaking after a cabinet meeting, Erdogan said a supplementary government budget, currently being debated in parliament, was required due to price volatility caused by inflation. (RTRS)

TURKEY: President Tayyip Erdogan said he has asked the Labour Ministry to review the minimum wage in Turkey due to persistently high inflation, after hiking it by 50% at the end of last year. Speaking after a cabinet meeting, Erdogan said the ministry would finalise work on the issue this week and he would make an announcement afterwards. (RTRS)

TURKEY: Türkiye would start new military operations as soon as preparations on Syrian border were completed, Turkish President Recep Tayyip Erdogan has said. He made the comments after a cabinet meeting in Ankara on Monday. Earlier this month, Erdogan had said Türkiye was set to clear two areas of northern Syria, near the Turkish border, of PKK/YPG terrorist elements in a bid to eliminate the terror threat from the region. (TRT World)

BRAZIL: Brazil President Jair Bolsonaro said on Monday that state-run oil company Petrobras will have a "new dynamic" on fuel issues under its incoming chief executive officer. Bolsonaro has clashed frequently with the company leadership over fuel prices. Caio Paes de Andrade was elected earlier Monday as CEO, as Petrobras nears the end of a messy management transition. (RTRS)

RUSSIA: Any encroachment on the Crimea peninsula by a NATO member-state could amount to a declaration of war on Russia which could lead to "World War Three," Russia's former president, Dmitry Medvedev, was quoted as saying on Monday. "For us, Crimea is a part of Russia. And that means forever. Any attempt to encroach on Crimea is a declaration of war against our country," Medvedev told the news website Argumenty i Fakty. (RTRS)

RUSSIA: While in Europe for a NATO summit with world leaders, President Joe Biden plans to announce the extension of some of the increased U.S. troop presence in Poland and changes to U.S. deployments in several Baltic countries that he authorized ahead of Russia’s invasion of Ukraine, said two defense officials, two former administration officials and a European official. (NBC News)

RUSSIA: U.S. President Joe Biden on Monday raised the tariff rate on certain Russian imports to 35% as a result of suspending Russia's "most favored nation" trading status over its war in Ukraine, according to a proclamation issued by the White House. The higher 35% duty applies to imports of "certain other products of the Russian Federation, the importation of which has not already been prohibited," the proclamation said. The Biden administration previously banned U.S. imports of Russian petroleum and energy products, fish, seafood, alcoholic beverages and non-industrial diamonds. An annex listing the products subject to the higher duty was not immediately available. (RTRS)

RUSSIA: German Chancellor Olaf Scholz said at a summit of the Group of Seven rich democracies on Monday there would be no return to the times before Russia's attack on Ukraine, which had ushered in long-term changes in international relations. (RTRS)

RUSSIA: Russia defaulted on its international bonds for the first time in more than a century, the White House and Moody's credit agency said, as sweeping sanctions have effectively cut the country off from the global financial system, rendering its assets untouchable. (RTRS)

IRAN: The United States and Iran will have indirect discussions in Doha this week, a U.S. State Department spokesperson said, adding that Iran needs to decide to drop additional demands that go beyond the 2015 nuclear deal. (RTRS)

IRAN: Indirect talks between Tehran and Washington will start on Tuesday in Qatar's capital, Iran's foreign ministry spokesman Naser Kanani told the state news agency IRNA on Monday. "Iran's chief nuclear negotiator Ali Bagheri Kani will travel to Doha on Tuesday for nuclear talks," Kanani said. (RTRS)

ENERGY: A "serious disruption" to the European Union's gas supplies from Russia is likely, the bloc's energy chief said on Monday as she urged countries to update contingency plans to cope with supply shocks and switch to other fuels wherever possible to conserve gas. "Since the beginning of Russia's invasion of Ukraine we have known that a very serious disruption is possible, and now it seems likely. We have done much important work to be prepared for this. But now is the time to step it up," EU energy commissioner Kadri Simson said after a meeting of energy ministers from EU countries. The European Commission will propose an EU plan to prepare for further gas shocks in July, as Russia has already cut or reduced supplies to 12 of the bloc's 27 member states. (RTRS)

ENERGY: Group of Seven leaders are set to instruct ministers to explore implementing a price cap on Russian gas, according to people familiar with the discussions. The mandate is expected to be announced as the three-day summit ends Tuesday. It comes as part of broader discussions on how to limit the profit Russia makes on its energy exports. The leaders are also expected to mention a mechanism to cap prices on Russian oil in the final communique. (BBG)

ENERGY: The Group of Seven is moving toward reversing a commitment to halt the financing of overseas fossil-fuel projects by year’s end, a proposal now viewed favorably by most members, according to people familiar with the matter. (BBG)

OIL: French President Emmanuel Macron said on Monday the president of the United Arab Emirates, Sheikh Mohammed bin Zayed al-Nahyan (MbZ), told him two top OPEC oil producers, Saudi Arabia and the United Arab Emirates, can barely increase oil production. "I had a call with MbZ," Macron was heard telling U.S. President Joe Biden on the sidelines of the G7 summit. "He told me two things. I'm at a maximum, maximum (production capacity). This is what he claims. And then he said Saudis can increase by 150 (thousands barrels per day). Maybe a little bit more but they don't have huge capacities," Macron said. (RTRS)

OIL: The United Arab Emirates' oil production is near to maximum capacity based on its current OPEC+ production baseline, which is 3.168 million barrels per day, Energy Minister Suhail al-Mazrouei told state news agency WAM on Monday. (RTRS)

OIL: U.S. crude inventory in the Strategic Petroleum Reserve (SPR) fell by 6.9 million barrels in the week to June 24, according to data from the Department of Energy. Stockpiles in the Strategic Petroleum Reserve (SPR) fell to 497.9 million barrels, the lowest since April 1986, according to the data. About 1 million barrels of sweet crude and 6 million barrels of sour crude were released in to the market. (RTRS)

OIL: Mexico's state-owned oil company Pemex substantially increased crude oil exports to the North American market in May, according to the firm's most recent report, which shows a significant cut in shipments to Europe and Asia. (RTRS)

CHINA

POLICY: Chinese officials will have to roll out additional fiscal and monetary policies in 2H to support economic growth, and there is still ample room for such moves, Securities Times reports on Tuesday, citing analysts including Wang Qing at Golden Credit Rating. Fiscal policies will continue to play a major role, while more structural monetary policy tools could be adopted. It is feasible to adjust the budget deficit, issue special sovereign bonds or front-load next year’s quota for special local government bonds. China Securities News reports that growth in industrial profits is set to speed up in June, citing people including Ming Ming, chief economist at Citic Securities, as the impact of Covid controls wanes and more industrial operations resume. (BBG)

POLICY: China will roll out tools in its policy reserve in a timely way to cope with economic challenges, as COVID-19 outbreaks and risks from the Ukraine crisis pose a threat to employment and price stability, a state planner official said on Tuesday. China will safeguard food and energy security and stabilise industrial supply chains, Ou Hong, deputy secretary general at the National Development and Reform Commision, told a press conference. (RTRS)

PBOC: China still has room to lower interests rate and cut banks’ required reserve ratio in the second half of the year, as inflation is expected to be mild, China Securities Journal reports on Tuesday, citing China Minsheng Banking Chief Economist Wen Bin in an interview. Inflation is set to be mild, as bumper summer harvest and efforts to stabilize energy supplies and prices will help China to respond to import inflation: report, citing Wen. It has become normal for China to adopt different fiscal policies than the US, and China’s fiscal policies should be more domestic focused: report, citing Wen. (BBG)

PBOC: The People’s Bank of China will increase injections via open market operations this week to keep mid-year liquidity stable, the China Securities Journal reported citing analysts. The current liquidity in the banking system is still at a high level and increased fiscal spending and allocated local government special bonds at the month-end will help supplement the liquidity, the newspaper said citing analysts. There won’t be a large liquidity gap into July even when the tax season comes, as accelerated fiscal expenditure will help filling in any gap, the newspaper said citing analysts. (MNI)

PROPERTY: China Evergrande Group said on Tuesday a winding-up petition was filed against it by investment holding firm Top Shine Global Ltd in Hong Kong for not fulfilling a financial obligation of HK$862.5 million ($109.91 million). Evergrande in an exchange filing said it will oppose the petition, adding, it would not impact its offshore debt restructuring plan in works that is slated to be announced before the end of next month. (RTRS)

CHINA MARKETS

PBOC INJECTS NET CNY100 BILLION VIA OMOS TUESDAY

The People's Bank of China (PBOC) injected CNY110 billion via 7-day reverse repos with the rate unchanged at 2.1% on Tuesday. This led to a net injection of CNY100 billion after offsetting the maturing CNY10 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity stable at the end of mid-year, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0606% at 9:35 am local time from the close of 1.9536% on Monday.

- The CFETS-NEX money-market sentiment index closed at 49 on Monday vs 47 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.6930 TUES VS 6.6850

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.6930 on Tuesday, compared with 6.6850 set on Monday.

OVERNIGHT DATA

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 84.7; PREV 81.7

Consumer confidence increased 3.7% last week, possibly helped by the state budget initiatives in NSW and Queensland. Confidence increased by 4.3% and 5.2% in NSW and Queensland respectively. Household inflation expectations dropped 0.2ppt to 5.7%, despite an increase in the average petrol price over the week. The subindex capturing whether it is a good ‘time to buy a major household item’ has jumped 14.2% over the past two weeks and was the biggest driver of last week’s gain in confidence. The improvement in sentiment doesn’t mask the fact that it remains exceptionally weak, with all subindices well below neutral. We expect this week’s retail figures for May to confirm that spending is holding up despite low confidence. (ANZ)

SOUTH KOREA MAY RETAIL SALES +10.1% Y/Y; APR +10.6%

SOUTH KOREA MAY DEPT STORE SALES +19.9% Y/Y; APR +19.1%

SOUTH KOREA MAY DISCOUNT STORE SALES -3.0% Y/Y; APR +2.0%

MARKETS

SNAPSHOT: UK PM Still Has Plenty Of Problems Even As Inflation Exp. Edge Lower

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 74.68 points at 26942.98

- ASX 200 up 36.35 points at 6742.20

- Shanghai Comp. down 2.103 points at 3377.082

- JGB 10-Yr future down 10 ticks at 148.42, yield down 0.9bp at 0.236%

- Aussie 10-Yr future up 4.0 ticks at 96.195, yield down 3.7bp at 3.737%

- U.S. 10-Yr future +0-05+ at 116-31+, yield down 2.63bp at 3.173%

- WTI crude up $1.33 at $110.89, Gold up $2.75 at $1825.61

- USD/JPY down 13 pips at Y135.33

- UK PUBLIC INFLATION EXPECTATIONS FALL TO LOWEST SINCE JANUARY - CITI/YOUGOV (RTRS)

- MOVE TO OVERRIDE BREXIT DEAL GETS INITIAL BACKING FROM MPS (BBC)

- MOST MAJOR U.S. BANKS UP SHAREHOLDER COMPENSATION AFTER PASSING STRESS TESTS, SOME EXCEPTIONS

- CHINA PROMISES TIMELY POLICY MEASURES TO COPE WITH ECONOMIC CHALLENGES (RTRS)

US TSYS: Firmer In Asia

Weakness for some of the major regional Asia-Pac tech equity indices (which later moderated) coupled with spill over from a bid in the ACGB space allowed Tsys to richen a touch overnight, leaving TYU2 +0-05 at 116-31, 0-02 off the peak of the 0-11 range, on sub-par volume of ~70K. Meanwhile, cash Tsys run 1.5-3.0bp richer across the curve.

- There wasn’t much in the way of meaningful headline flow to digest.

- Market flow was headlined by what seemed to be a block buy of the TYU2 116/114 put spread, hedged with a block buy of the TYU2 119.50 calls (+5K vs. +2K).

- Looking ahead, Tuesday’s NY session will bring the release of trade balance data, various house price metrics, the consumer confidence reading and Richmond Fed m’fing index. We will also get 7-Year Tsy supply (hot on the tail of Monday’s particularly week 5-Year auction) and Fedspeak from San Francisco Fed President Daly (’24 voter).

JGBS: Lacklustre Tokyo Trade

JGB futures operated below unchanged levels during Tokyo dealing and were seemingly a little more hesitant to go bid when compared to their global FI counterparts (liquidity/market function/BoJ recalibration worry, or perhaps a combination of the 3, remaining evident), even as some of the major Asia-Pac tech equity indices faltered.

- That leaves the contract -9 ahead of the close with the space off worst levels, while the major cash JGB benchmarks sit little changed to 1bp cheaper as the curve comes under some light steepening pressure.

- There hasn’t been anything in the way of meaningful domestic headline flow to drive the space.

- Today’s sale of 2-Year JGBs saw the cover ratio decline to 3.81x from 5.43x at the previous auction, moving below the six-auction average of 4.65x. The price tail widened a little, although the low price matched dealer expectations (100.100 as per the BBG dealer poll). As we suggested in our preview, this auction was likely supported by domestic investors with capital to deploy, while the wider international investment community would likely stay away on the back of worry re: some form of BoJ recalibration.

- Looking ahead, retail sales data and BoJ Rinban operations headline domestic matters on Wednesday.

JGBS AUCTION: The MOF sells Y2.3558tn 2-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.3558tn 2-Year JGBs:

- Average Yield: -0.049% (prev. -0.058%)

- Average Price: 100.109 (prev. 100.127)

- High Yield: -0.044% (prev. -0.054%)

- Low Price: 100.100 (prev. 100.120)

- % Allotted At High Yield: 59.1854% (prev. 32.8287%)

- Bid/Cover: 3.814x (prev. 5.426x)

AUSSIE BONDS: Richening Aided By AOFM Shelving 20-Year Supply Plan

Aussie bonds more than unwound the overnight cheapening observed in futures, with the initial firming coming on the back of a softening for Chinese tech equities (which later pulled back from extremes). The space then caught a further bid as a speech from AOFM CEO Nicholl (link here) saw the Agency shelve a plan to establish new ACGB ‘43 or ‘44 maturities. The space has backed away from best levels since Nicholl stopped speaking.

- That leaves cash ACGBs running 3.0 to 5.5bp richer across the curve with 2s outperforming, while YM and XM deal +3.0 and +3.5, respectively. EFPs are essentially unchanged on the day.

- Bills sit -1 to +3 through the reds, twist flattening. Retail sales data headlines Wednesday’s domestic docket.

AUSSIE BONDS: The AOFM sells A$150mn of the 3.00% 20 Sep ‘25 I/L Bond, issue #CAIN407:

The Australian Office of Financial Management (AOFM) sells A$150mn of the 3.00% 20 Sep ‘25 I/L Bond, issue #CAIN407:

- Average Yield: -0.3566% (prev. -1.1400%)

- High Yield: -0.3425% (prev. -1.1300%)

- Bid/Cover: 3.7333x (prev. 4.8667x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield: 70.0% (prev 80.0%)

- Bidders 45 (prev. 48), successful 17 (prev. 14), allocated in full 15 (prev. 12)

EQUITIES: Mixed In Asia; Tech Goes Offered

Major Asia-Pac equity indices are mixed at typing, with tech-related equities across the region broadly softer on a negative lead from Wall St. Elsewhere, limited debate re: economic slowdown worry did the rounds on a rally in major crude benchmarks.

- The Hang Seng Index trades 0.9% lower at writing, on track to snap a three-day streak of gains that had taken it to 12-week highs on Monday. Tencent Holdings (-4.7%) contributed the most to losses for a second day on prior news of a major shareholder announcing intent to reduce its stake, facilitating wider weakness in China-based tech, with the Hang Seng Tech Index sitting 1.7% worse off at typing.

- The CSI300 deals 0.1% weaker, halting its own three-day streak of gains. Outperformance in richly-valued consumer staple equities was neutralised by losses in real estate and tech-related equities, with the CSI300 Real Estate Index and the ChiNext Index sitting 1.7% and 1.1% worse off respectively.

- The ASX200 trades 0.6% firmer at typing, operating a little below two-week highs made earlier in the session. Major miners contributed the most to gains in the index, with a rally in major commodity benchmarks (BCOM: +0.4%) facilitating outperformance in the materials and energy sub-indices. On the other hand, tech names provided the most drag, with the S&P/ASX All Technology Index sitting 1.3% worse off at typing.

- U.S. e-mini equity index futures deal 0.1% to 0.2% weaker off at typing, reversing an initial, limited bid near the open.

OIL: Fresh One-Week Highs In Asia; Supply Worry Remains At The Fore

WTI is ~+$1.30 and Brent is ~+$1.50, operating a little below their respective one-week highs at writing, with both benchmarks on track for a third straight day of gains.

- Brent’s prompt spread is continuing to notch fresh highs (~$4.30 at writing), reflecting elevated worry re: near-term tightness in crude supplies. The measure operates above levels last seen around early-March, when Russia’s invasion of Ukraine had pushed major benchmarks to cycle highs.

- Looking to wider supply-related issues, Libya’s state oil company is continuing to consider declaring force majeure in major oil-loading ports amidst well-documented political unrest, while Ecuador remains at risk of halting oil production entirely over previously-flagged anti-government protests.

- French President Macron stated on Monday that the UAE and Saudi Arabia were effectively able to increase crude production by a maximum of ~150K bpd, citing an exchange with UAE President Sheikh Mohammed, potentially sinking already-scant hopes from some quarters for additional OPEC-sourced oil supply.

- Looking ahead, the U.S. EIA’s Petroleum Status report that was scheduled to cross last week is yet to be re-scheduled. Delayed reports will likely be released before new ones however, raising the prospect of a data release later today (keeping in mind the regular report usually crosses on Wednesdays).

GOLD: Little Changed In Asia; G7 Matters Eyed

Gold sits $1/oz firmer to print $1,824/oz at typing, operating a little above Monday’s worst levels in fairly limited Asia-Pac dealing.

- To recap, the precious metal reversed an early bid on Monday to close ~$4/oz weaker, with the move lower facilitated by an uptick in U.S. real yields. Initial support stemming from news over the weekend of an upcoming G7 ban on Russian gold imports has receded entirely, with gold trading below last Friday’s close at typing.

- The ongoing G7 meeting should nonetheless provide a potential source of headline risk for bullion, with leaders expected to formally announce the gold import ban later on Tuesday, while negotiations over a plan to impose price caps on Russian oil and gas continue to play out.

- Up next, San Francisco Fed Pres Daly (‘24 voter) participates in an interview with LinkedIn’s Chief Economist later on Tuesday (1730 BST), with U.S. Conf. Board Consumer Confidence and flash Wholesale Inventories headlining the U.S. data docket.

- Looking to technical levels, well-documented support and resistance levels remain intact at $1,787.0/oz (May 16 low) and $1,889.1/oz (trendline resistance from Mar 8 high) respectively.

FOREX: Yen Regains Poise, Market Mood Sours

The yen caught a bid over the Tokyo fix and jumped onto the top of the G10 pile as U.S. e-mini futures reversed their initial gains. Marginal narrowing in U.S./Japan 10-Year yield spread applied some pressure to spot USD/JPY, putting the rate on track to snap a two-day winning streak. Meanwhile, the pair's 1-month risk reversal edged higher for the first time in five days.

- Continued advance in crude oil prices lent support to commodity-linked CAD & NOK, but Antipodean currencies failed to benefit from that trend. AUD/USD 1-week implied volatility jumped as it now covers the next RBA monetary policy meeting, with the Reserve Bank expected to raise the cash rate target by 50bp.

- The greenback meandered, with the U.S. dollar index (BBDXY) respecting the confines of yesterday's range.

- Today's data highlights include U.S. Conf. Board Consumer Confidence & flash wholesale inventories.

- Multiple ECB policymakers will speak at the Forum on Central Banking in Sintra. Also coming up are comments from Fed's Daly & Riksbank's Skingsley.

FOREX OPTIONS: Expiries for Jun28 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0450(E1.5bln), $1.0585-00(E1.2bln)

- USD/JPY: Y132.00-15($1.2bln), Y135.00($780mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/06/2022 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 28/06/2022 | 0600/0800 | ** |  | SE | Retail Sales |

| 28/06/2022 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 28/06/2022 | 0800/1000 |  | EU | ECB Lagarde Intro at ECB Forum | |

| 28/06/2022 | 0830/1030 |  | EU | ECB Lane on Globalisation & Labour Markets at ECB Forum | |

| 28/06/2022 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 28/06/2022 | 0930/1130 |  | EU | ECB Elderson on Energy Prices & Sources at ECB Forum | |

| 28/06/2022 | 1100/1300 |  | EU | ECB Panetta on Digital Currencies at ECB Forum | |

| 28/06/2022 | 1100/1200 |  | UK | BOE Cunliffe Panels ECB Forum | |

| 28/06/2022 | 1200/0800 |  | US | Richmond Fed President Tom Barkin | |

| 28/06/2022 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 28/06/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 28/06/2022 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 28/06/2022 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 28/06/2022 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 28/06/2022 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 28/06/2022 | 1630/1230 |  | US | San Francisco Fed's Mary Daly | |

| 28/06/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.