-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Pre-European Moves As NRW CPI Pulls Back From Extreme

- Fixed income markets turn bid ahead of European trade as Germany's NRW sees a moderation in its latest inflation print. A county level level lockdown in the Chinese province Anhui provide some modest defensive flows before that.

- EUR ticked lower on the back of the NRW inflation print.

- German CPI data provides interest from here, European hours will see the release final EZ consumer confidence. After that, focus turns to the third reading of U.S. GDP & PCE. In addition, comments are due from Fed's Powell, Mester & Bullard, ECB's Lagarde, de Guindos & Schnabel as well as BoE's Bailey & Dhingra (many of them will speak during the ECB's Forum on Central Banking 2022).

US TSYS: Bid Into Europe As Chinese Lockdown & German State CPI Data Support

Tsys have firmed ahead of European hours, on the back of the most populous region in Germany (NRW) experiencing a slight moderation in inflation during the month of June. Note that the state has the largest weighting in the national German CPI reading, with the remainder of the regional releases and flash national reading set to filter out through the day.

- Earlier in the session we saw a pullback in oil prices and some weight for the regional equity indices, stemming from news that a county in the Chinese province of Anhui had gone into a COVID-related lockdown, provide some light support for the space.

- TYU2 trades 0-03 off of best levels at typing, +0-18+ at 117-09, operating in a 0-17 range, on volume of ~110K.

- Wednesday’s NY session will see the final Q1 GDP print, weekly MBA mortgage apps data and Fedspeak from Powell, Mester & Bullard. The aforementioned round of German CPI readings will clearly also provide interest, given the market reaction and dynamic observed in the NRW print.

JGBS: Firmer & Flatter On Cross Market Impetus

The wider impetus surrounding core global fixed income markets in the wake of the previously outlined NRW CPI release out of Germany means that JGB futures are +3 ahead of the close of Tokyo trade, with the contract trading a little shy of best levels. The aforementioned bid in the wider core global FI space has resulted in some bull flattening of the JGB curve, with the major benchmarks running 1-3bp richer at typing. There wasn’t much in the way of idiosyncratic news flow to shape trade in the space, with the latest round of BoJ Rinban operations failing to provide anything in the way of meaningful market impact. Note that today’s rally leaves 10-Year JGB yields at 0.23%, 2bp off the upper limit of the BoJ’s permitted trading band. Tomorrow’s local docket is headlined by preliminary industrial production data and the release of the BoJ’s Rinban plan.

AUSSIE BONDS: Reversing Earlier Cheaps On German NRW CPI Beat

Aussie bonds reversed losses observed after the release of firmer than expected Australian retail sales data, with core FI markets catching a bid on the release of German NRW CPI data, pointing to easing inflation in Germany’s most populous state (details on data release fleshed out earlier).

- YM and XM are +4.5 and +1.0 respectively, operating around session highs and a little below Tuesday’s best levels, while bills run 1-2 ticks firmer through the reds. Cash ACGBs have bull steepened, running 1.0bp to 5.0bp richer across the curve, with the release of NRW CPI data unwinding the bear steepening seen just prior, with yields running flat to 5.0bp higher then.

- STIR markets are continuing to price in ~45bp of tightening for the RBA’s July meeting, little changed on the week, with a cumulative ~244bp priced in for calendar ‘22 (up from ~240bp at the beginning of the week).

- The local data docket sees May job vacancies and private sector credit due (0230 BST) on Thursday, with A$1.0bn of the 9 Sep ‘21 and A$1.5bn of the 7 Oct ‘22 Treasury Notes on tap.

FOREX: EUR Drops On CPI Data From Germany’s Most Populous State

The Eurozone’s shared currency dipped upon the release of June CPI report out of North Rhine Westphalia, with headline inflation slowing to +7.5% Y/Y from +8.1% prior. Monthly inflation printed at -0.1% M/M after a 0.9% increase in May. Owing to NRW being Germany’s most populous state, its CPI is the largest contributor (21.7%) to the nationwide index, which will hit the wires later in the day.

- Reaction to NRW CPI resulted in modest recovery in gauges of greenback strength, with EUR being the largest contributor to these indices.

- Most G10 FX crosses meandered through the Asia-Pac session, as overnight headline flow failed to offer any notable catalysts.

- The Antipodeans diverged, as the Aussie landed near the bottom of the G10 pile, while the kiwi outperformed at the margin. A beat in Australian retail sales did little to rescue the Australian dollar.

- Apart from German CPI, European hours will see the release final EZ consumer confidence. After that, focus turns to the third reading of U.S. GDP & PCE.

- In addition, comments are due from Fed's Powell, Mester & Bullard, ECB's Lagarde, de Guindos & Schnabel as well as BoE's Bailey & Dhingra (many of them will speak during the ECB's Forum on Central Banking 2022).

FOREX OPTIONS: Expiries for Jun29 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0550(E898mln), $1.0620-25(E1.1bln), $1.0665-75(E714mln)

- GBP/USD: $1.2750(Gbp1.5bln)

- USD/JPY: Y135.00($505mln), Y136.20($715mln), Y137.50($780mln)

ASIA FX: INR To Fresh Record Lows, KRW Lower on Equity Outflows

A mixed picture for USD/Asia pairs. USD/CNH has been range bound, while the won has resumed its downtrend, with USD/KRW back above 1293. INR has weakened to fresh record lows, while the PHP peso has also depreciated. THB has outperformed on tourism hopes.

- CNH: USD/CNH has been range bound today. We met offers above 6.7100, much like the overnight session. The pair last tracked just below 6.7050. The CNY fixing was slightly weaker than expected. China equities are lower but in line with regional trends. Note tomorrow sees PMI prints.

- KRW: Spot USD/KRW has rebounded back to levels that prevailed at the start of the week, +1293. Renewed net equity outflows on the back of weaker equity leads is the main driver. Earlier Korea consumer sentiment fell back to 2021 lows, while onshore media reported the BoK will consider a large hike (likely 50bps) if June inflation gets to 6% YoY.

- INR: USD/INR continues to push higher after yesterday's sharp bounce. The pair is up another 0.20% today and close to the 79.00 level. We got to 78.98 in early trade, but are now back to 78.91. We still expect the RBI to curb the rate of depreciation.

- IDR: Spot USD/IDR has edged higher and last deals +8.5 figs at IDR14,846. Monthly CPI data is up on Friday. Bloomberg consensus looks for a +4.18% Y/Y headline. Bank Indonesia said it expects inflation to print at +0.5% M/M, but didn't provide the estimate for annual price growth.

- PHP: Spot USD/PHP turned bid as onshore markets re-opened, playing catch-up with overnight risk-off impetus. We hit a high of 55.08 before selling interest emerged and now sit back below 55.00. Selling pressure that saps strength from the peso is amplified by recent comments from the Philippines' top central bankers, who said that they are allowing the market to freely determine currency levels.

- THB: USD/THB is down slightly today, back to the low 35.00 region. Further spillover from China's relaxation of covid quarantine travel rules is still evident. The Thai authorities also noted tourist arrivals jumped 44% YoY in June. A further recovery is expected in the second half.

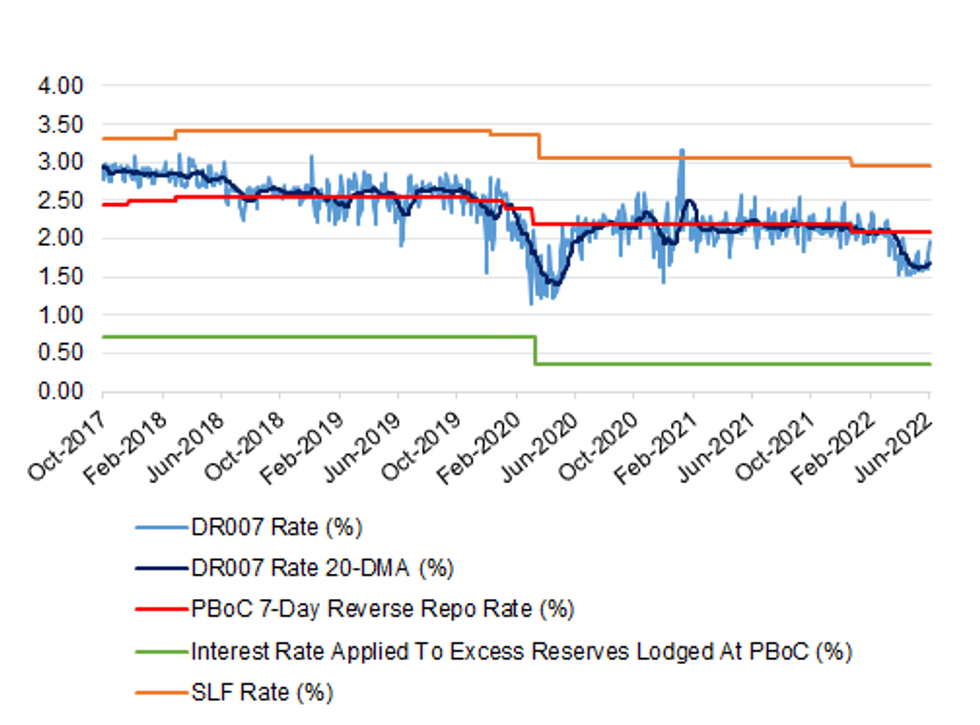

CHINA: Month-End Matters See Repo Rates Pull Higher

China’s 7-day repo rate has jumped in recent days, with month-end matters cited as a driving force. The 7-day repo rate between deposit taking institutions (DR007) has also moved higher (although holds below 2.00%). Note that this particular month-end effect is mostly driven by tighter cash conditions stemming from record monthly local government bond issuance in June (as policymakers look to stimulate the faltering economy via infrastructure investment) and tax payments. This has pulled the headline 7-day repo rate above the short-term policy rate (the 7-day reverse repo rate, which currently sits at 2.10%), although the DR007 rate has not challenged that level as of yet.

- DR007 has been operating below 2.00% since April, on the back liquidity overflows into the wholesale market after the PBoC’s series of easing moves, which included a cut in the reserve requirement ratio, increases in relending tools and a turnover of its profits.

- The 7-day repo rate has historically been a reliable indicator when it comes to future PBoC moves, with the previously alluded to discount seen as being indicative of an easing bias at the central bank, as it looks to get the Chinese economy back on track as the likes of Beijing and Shanghai move away from the depths of their well-documented COVID restrictions. Note that the re-opening observed in those key cities may also be adding to the usual month-/quarter-end cash demand. The recently reported shortening of the quarantine period surrounding international travellers entering China may also result in cash demand in the coming weeks, applying further tightening pressure.

- The PBoC has already stepped in to bridge the liquidity gap, coming to market with the largest round of daily net OMO injections observed since March in recent days.

- A quick reminder that our policy team recently flagged communique with local market participants who suggested that “the PBoC may guide money market rates up, approaching their policy rates, if the economy continues to improve” (see here).

- It will be interesting to see where money markets settle after the month-end gyrations subside. The combination of looser COVID mobility restrictions, a possible closing of the PBoC’s easing window as the U.S. Federal Reserve accelerates its monetary tightening cycle and the potential for the PBoC to exert an upward bias on money market rates if the economy improves could mean that we do not see the DR007 trading at the discount that we had become accustomed to in recent weeks.

- A quick heads up that the latest MNI China Liquidity Index survey findings will be published later today (07:00 London time), with the release set to give deeper insight on the matter after surveying local market participants.

Fig. 1: PBoC Interest Rate Corridor

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

US: Record Gap In Consumer Sentiment Metrics

- Conference Board consumer confidence fell in June as the present situation index was little changed (from a downward revised May) but expectations fell to a new low since Mar-2013.

- The move sideways in the present situation measure helps open an even wider gap with its equivalent in the U.Mich survey, which last week was revised to a new all-time low of 53.8.

- The gap between the two (with the Conference Board typically better reflecting the state of the labour market) has historically roughly trended with the slope of the yield curve, and currently implies an even further decline in 2s10s from the already very flat 8bps.

US U.Mich current conditions (white), Conf Board present situation (yellow), gap between the two (green) and UST 2s10s (pink)Source: Bloomberg

US U.Mich current conditions (white), Conf Board present situation (yellow), gap between the two (green) and UST 2s10s (pink)Source: Bloomberg

EQUITIES: Lower In Asia; Chinese Real Estate Catches Bid On Vanke Comments

Asia-Pac equity indices are mostly lower at typing, with the MSCI Asia Pacific Index on track to break a four-day streak of gains. Tech equities region-wide have borne the brunt of the session’s downward pressure, tracking a similar performance from the tech-heavy NASDAQ in Tuesday’s NY session.

- The CSI300 sits 0.8% lower at typing, with losses in consumer staples dragging the index lower. Chinese property stocks bucked broader losses with the CSI300 Real Estate Index dealing 5.6% firmer at typing, catching a bid after The Paper reported comments by China Vanke Chairman Yu Liang at Vanke’s AGM on Tuesday that “in the short-term, the market has bottomed out”.

- The Hang Seng leads losses amongst regional peers, trading 1.8% lower, with >80% of the index’s constituents in the red at typing. China-based tech underperformed, seeing the Hang Seng Tech Index deal 3.0% worse off, neutralising minor gains seen in the real estate sub-index (+0.3%).

- The Nikkei 225 sits a little above session lows, dealing 1.1% weaker at typing. Utilities lead gains on gains in Tokyo Electric Power Co, with residents in Tokyo asked to restrict electricity usage for a third day amidst an ongoing heatwave. Large-cap and tech-related stocks contributed the most to losses, with a sub-gauge of information technology equities sitting 2.1% worse off at writing.

- The ASX200 sits 1.1% worse off at typing, with limited gains in energy and financials countered by broader weakness across virtually every other sector. Tech names lead losses here as well, with the S&P/ASX All Technology Index dealing 3.7% weaker at writing.

- U.S. e-mini equity index futures deal 0.2% firmer apiece, operating well within the bottom end of their respective ranges made on Tuesday at typing.

GOLD: Little Changed In Asia

Gold sits $2/oz firmer, printing $1,822/oz at typing. The precious metal operates within a tight ~$5/oz range after briefly showing below Tuesday’s worst levels earlier in the session, with a limited downtick in the USD (DXY) providing some support for the space.

- To recap, bullion closed $2/oz lower on Tuesday amidst an uptick in U.S. real yields and the DXY. Gold has established a fairly limited $60 range in June, tracking meandering in U.S. real yields and the DXY, with focus coalescing around Fed hawkishness and expectations from some quarters re: the potential for a Fed-led economic slowdown.

- July FOMC dated OIS now price in ~66bp of rate hikes for that meeting, down from Tuesday’s intraday high (~73bp), while a cumulative ~181bp of tightening is now priced in for calendar ‘22.

- Up next, Fedspeak from Fed Chair Powell, (1400 BST), Cleveland Fed Pres Mester (1630 BST, ‘22 voter) and St. Louis Fed Pres Bullard (1805 BST, ‘22 voter) is due, with the latter noted to have written an essay on Tuesday re: the merits of keeping the Fed policy rate ahead of the inflation rate.

- From a technical perspective, gold has continued to move lower over the past two weeks, approaching initial support at $1,805.2/oz (Jun 14 low), a break of which would expose further support at $1,787.0/oz (May 16 low and bear trigger).

OIL: Weaker In Asia; EIA’s Delayed Inventory Release Eyed

WTI is -~$0.60 and Brent is -~$0.90, with both benchmarks operating comfortably within Tuesday’s range at typing after backing away from two-week highs made earlier in the session.

- To recap, WTI and Brent closed $2-3 higher apiece on Tuesday, with worry surrounding tightness in global crude supplies taking focus.

- To elaborate, major crude benchmarks built on an initial bid following the release of API inventory estimates late on Tuesday, with reports pointing to a larger-than-expected fall in U.S. crude inventories, paring a large build in the previous week. On the other hand, there was a reported build in gasoline and distillate stockpiles, while Cushing hub stocks declined.

- Turning to OPEC+, the group has reported a 562mn bbl shortfall re: group production targets since May ‘20, keeping in mind that collective daily output fell further to ~2.7mn bpd short of target in May.

- BBG source reports have pointed to Libya’s state oil company declaring force majeure at the port of Las Ranuf (~200K bpd loading capacity), with participants watching for further force majeure declarations at the remaining three oil ports around the Gulf of Sirte (around ~430K bpd capacity).

- Looking ahead, the EIA is due to release last week’s delayed Petroleum Status report (week ended Jun 17) later today, followed by this week’s release (week ended Jun 24) scheduled for 1530 BST.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 29/06/2022 | 0600/0800 | ** |  | SE | Economic Tendency Indicator |

| 29/06/2022 | 0600/1400 | ** |  | CN | MNI China Liquidity Suvey |

| 29/06/2022 | 0700/0900 | *** |  | ES | HICP (p) |

| 29/06/2022 | 0700/0900 |  | ES | Spain Retail sales | |

| 29/06/2022 | 0745/0945 |  | EU | ECB de Guindos on Real Estate Cycles at ECB Forum | |

| 29/06/2022 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 29/06/2022 | 0800/1000 | ** |  | EU | M3 |

| 29/06/2022 | 0845/1045 |  | EU | ECB de Guindos on Global Value Chains & Trade at ECB Forum | |

| 29/06/2022 | 0900/1100 | *** |  | DE | Saxony CPI |

| 29/06/2022 | 0900/1100 | ** |  | EU | Economic Sentiment Indicator |

| 29/06/2022 | 0900/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 29/06/2022 | 0900/1100 | * |  | EU | Business Climate Indicator |

| 29/06/2022 | 1015/1215 |  | EU | ECB Schnabel on Inflation Expectations at ECB Forum | |

| 29/06/2022 | 1030/0630 |  | US | Cleveland Fed's Loretta Mester speaking at ECB forum | |

| 29/06/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 29/06/2022 | 1200/1400 | *** |  | DE | HICP (p) |

| 29/06/2022 | 1230/0830 | *** |  | US | GDP (3rd) |

| 29/06/2022 | 1300/0900 |  | US | Fed Chair Jerome Powell speaking at ECB forum | |

| 29/06/2022 | 1300/1500 |  | EU | ECB Lagarde pm Monetary Policy Challenges | |

| 29/06/2022 | 1300/1400 |  | UK | BOE Bailey Panels ECB Forum | |

| 29/06/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 29/06/2022 | 1500/1700 |  | EU | ECB Lagarde Closing Remarks at ECB Forum | |

| 29/06/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 29/06/2022 | 1705/1305 |  | US | St. Louis Fed's James Bullard |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.