-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Ontario To Cut U.S. Energy Flows When Tariffs Hit

MNI BRIEF: Aussie Labour Market Tightens, Unemployment At 3.9%

MNI EUROPEAN OPEN: No Letup In Recession Worry

EXECUTIVE SUMMARY

- ECB'S HOLZMANN TELLS PAPER HE WOULD HAVE PREFERRED FASTER ACTION ON RATES (RTRS)

- TSMC SEES CLIENTS SCALE BACK ORDERS (DIGITIMES)

- CHINA GREAT WALL POSTPONES EARNINGS, ECHOING HUARONG DELAY (BBG)

- WIDER RECESSIONARY WORRY CONTINUES TO REVERBERATE THROUGH MARKETS

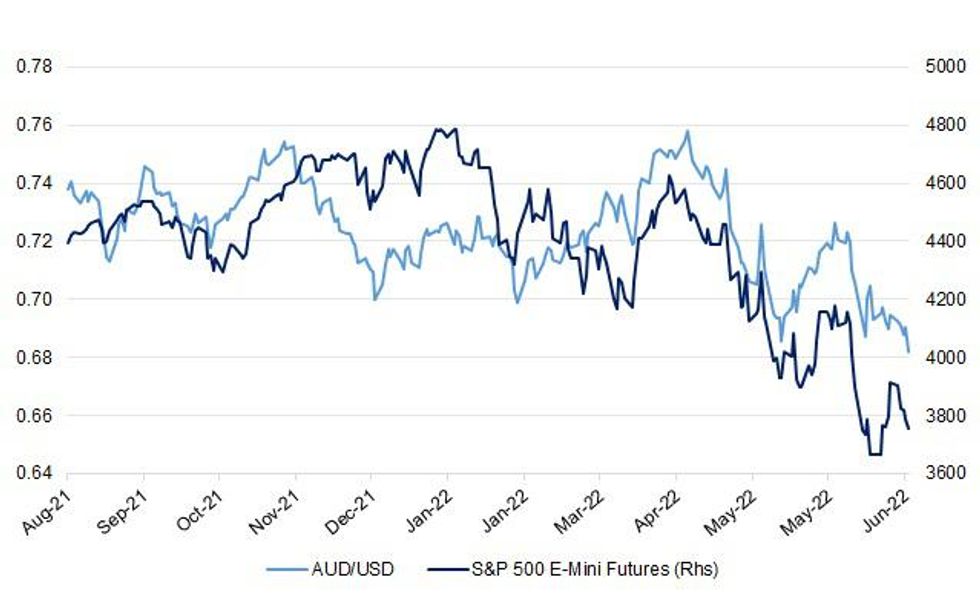

Fig. 1: AUD/USD Vs. S&P 500 E-Mini Futures

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

FISCAL: A cut in VAT has been proposed by No 10 to curb inflation and help households with the cost of living crisis. Steve Barclay, the prime minister’s chief of staff, suggested reducing the 20 per cent headline rate of the tax, The Times has been told. He proposed that a temporary cut would reduce the tax bill for millions and ease inflation, which is at 9.1 per cent — the highest for 40 years. However, the Treasury is concerned about the cost of the move and has warned that it could ultimately fuel inflation by overstimulating the economy. It has also raised the point that it would benefit wealthy households as well as poorer ones. (The Times)

FISCAL: Nadhim Zahawi has asked the Treasury to give teachers pay rises of up to nine per cent in an attempt to see off strike action, The Telegraph has learned. (Telegraph)

BREXIT: The UK government has not been "even handed" when it comes to resolving the row over the Northern Ireland Protocol, Leo Varadkar has said. The tánaiste (Irish deputy PM) accused Number 10 of "siding" with unionists in seeking to scrap parts of the deal agreed in 2019. The DUP has said the protocol damages Northern Ireland's place in the union. But Mr Varadkar said the UK government's bid to unilaterally change the protocol was a "strategic mistake". His comments come just days after MPs gave their initial approval to the government's Northern Ireland Protocol Bill. (BBC)

EUROPE

ECB: European Central Bank policymaker and fiscal hawk Robert Holzmann would have preferred earlier action on interest rates than the ECB's current plan to raise them in July for the first time in more than a decade, he said in remarks published on Thursday. "From my Austrian point of view, I would have preferred earlier moves on interest rates but I am only one of 25 at the European Central Bank (Governing Council)," Holzmann, who heads the Austrian National Bank, said in an interview with Austrian newspaper Oberoesterreichische Nachrichten. (RTRS)

GERMANY: Germany’s Uniper is in talks about a possible government bailout as the financial fallout from dwindling supplies of Russian gas reverberates across Europe, sending shares in the energy company sliding. (RTRS)

ITALY: The government is not at risk and 5-Star Movement (M5S) leader and former premier Giuseppe Conte has "confirmed" the M5S will not be exiting the government for an external support over a row over a rumoured ouster request by his successor, Premier Mario Draghi said Thursday. (ANSA)

ITALY: Italy’s Prime Minister Mario Draghi said on Thursday he was confident of achieving the year-end target of gas storage filled to 90% of its capacity by November. (RTRS)

RATINGS: Sovereign rating reviews of note scheduled for after hours on Friday include:

- S&P on Finland (current rating: AA+; Outlook Stable) & France (current rating: AA; Outlook Stable.

U.S.

FED: Aggressive Federal Reserve policy spurred by ongoing price spikes will usher in low economic growth this year and perhaps a recession next year, which could push the central bank to reconsider guidance suggesting it will push rates further toward 4% in 2023, Global Chief Economist at S&P Global Ratings Paul Gruenwald told MNI. (MNI)

FED/INFLATION: The Trimmed Mean PCE inflation rate over the 12 months ending in May was 4.0 percent. According to the BEA, the overall PCE inflation rate was 6.3 percent on a 12-month basis, and the inflation rate for PCE excluding food and energy was 4.7 percent on a 12-month basis. (Dallas Fed)

OTHER

GLOBAL TRADE: TSMC has seen its major clients adjust downward their chip orders for the rest of 2022, which may prompt the pure-play foundry to cut its revenue outlook for 2022, according to industry sources. (DigiTimes)

GLOBAL TRADE: Russia to ban export of rice and some related products to ensure nation’s food security, maintenance of stable domestic prices, Interfax reports, citing the Agriculture Ministry. (BBG)

EU/CHINA: EU states and lawmakers on Thursday agreed to rules to put a brake on state-backed foreign firms acquiring EU companies with annual turnover of 500 million euros ($520 million), underlining a more protectionist approach against a possible Chinese buying spree. The takeover rules will apply to companies getting more than 50 million euros in subsidies. The EU countries and lawmakers also agreed to prevent foreign subsidised companies from taking part in public tenders above 250 million euros, confirming a Reuters story on Thursday. (RTRS)

UK/CHINA: Prime Minister Boris Johnson said Britain would do all it could to hold Beijing to its commitments on democratic rights made 25 years ago when Hong Kong was handed back to China. Johnson said China had failed to comply with its commitment to respect a "One Country, Two Systems" arrangement agreed under the deal that ended British colonial rule in 1997. (RTRS)

BOJ: A strong performance for Japanese Prime Minister Fumio Kishida in upper house elections next month could prompt him to bring forward the selection process to replace Bank of Japan Governor Haruhiko Kuroda once his term expires next year, in a bid to send a signal to markets that the BOJ could adjust its extremely easy monetary policy to support the yen, MNI understands. (MNI)

JAPAN: The Japanese government’s tax revenue rose to a record ~67t yen in fiscal 2021, Nikkei reports without attribution. Previous record was 60.8t yen in fiscal 2020. Corporate tax revenue rose as businesses bounced back from the coronavirus pandemic, with a weaker yen also providing a tailwind for exporters. Revenue from income tax and consumption tax was also strong. (BBG)

HONG KONG: Chinese President Xi Jinping says there are no reasons to change the “one country, two systems“ in Hong Kong and Macau, when addressing the inaugural ceremony of new Hong Kong Chief Executive John Lee. The “one country, two systems” are in the interests of Hong Kong, Macau; the system targets the cities’ long-term prosperity. China “fully supports” Hong Kong in maintaining its unique status and advantages. Relations between the Hong Kong government and the market should be more balanced. (BBG)

BRAZIL: Brazil's Senate on Thursday approved a major pre-election aid package, sending the government-backed measure to the lower house. At the last minute, government-backed senators managed to include in the proposal two more measures, an aid targeting taxi drivers and to grant more funding to an existing food security program. The two latest benefits will together cost an additional 2.5 billion reais, senators said, bringing the cost of the whole proposal to around 40 billion reais ($7.61 billion). (RTRS)

RUSSIA: Russia said on Thursday it had summoned the British ambassador to voice a strong protest against "offensive" British statements, including about alleged Russian threats to use nuclear weapons. (RTRS)

SOUTH AFRICA: South African state-owned power utility Eskom will cut 6,000 megawatts of power from the from 4pm until 10pm, according to statement on Twitter. (BBG)

IRAN: The chances of reviving the 2015 Iran nuclear deal are worse after indirect U.S.-Iranian talks in Doha that ended without progress, a senior U.S. official told Reuters on Thursday. (RTRS)

IRAN: The European Union on Thursday said it was worried it may not be possible to strike an agreement to revive the 2015 Iran nuclear deal, urging all sides to seize the opportunity to conclude an accord based on the text on the table. (RTRS)

GOLD: India increased its import tax on gold in a surprise move that aims to reduce inflows to the world’s second-largest consumer, after the country’s ballooning trade gap pushed its currency to a record low. The import duty on gold was increased to 12.5% from 7.5%, according to a government notice dated June 30. This is a reversal of last year when India cut the tax to 7.5% in the federal budget. (BBG)

POWER: European grid operators are ready to implement immediately a long-term plan to bring the Baltic states, which rely on the Russian grid, into the European Union system in the event Moscow cuts them off, three sources familiar with the matter told Reuters. (RTRS)

GAS: The second-biggest U.S. liquefied natural gas export facility hit by fire earlier this month will not be allowed to repair or restart operations until it addresses risks to public safety, a pipeline regulator said on Thursday. Closely-held Freeport said it will continue working with PHMSA and other regulatory bodies to obtain necessary approvals to restart operations. It estimated resumption of partial liquefaction operations to be in early October and a return to full production by year-end. (RTRS)

OIL: The U.S. Interior Department has recommended to the White House that all federal offshore oil and gas drilling auctions over the next five years be located in the Gulf of Mexico, where the drilling industry has already been focused for decades, according to two sources familiar with the matter. (RTRS)

OIL: Libya’s National Oil Corp. declares force majeure on Asidra and Ras Lanuf terminals and the Al-Feel field. Continues force majeure on terminals of Brega and Zueitina. Says it has become impossible to meet the natural-gas needs of three power stations. (BBG)

OIL: Ecuador expects to begin recovering oil wells closed during more than two weeks of protests from Thursday, Energy Minister Xavier Vera told Reuters, after President Guillermo Lasso declared a security zone around energy infrastructure in two provinces. (RTRS)

OIL: India has raised taxes on exports of petroleum fuels such as gasoline, diesel and jet fuel, according to a government notification. (BBG)

CHINA

PROPERTY: China’s property market is expected to gradually stabilise in the second half of the year, with first- and second-tier cities improve while third- and fourth-tier cities digest high inventories, the 21st Century Business Herald reported citing analysts. Housing transactions in cities in Yangtze River Delta such as Shanghai, Hangzhou and Hefei are likely to turn positive in H2, the newspaper said citing analysts. The average sales of the Top 100 developers was CNY35.64 billion in H1, decreasing 48.6% y/y, and there are nine developers in the 100-billion-yuan camp, compared to 19 same period last year, the newspaper said citing data by China Index Academy. (MNI)

PROPERTY: New homes prices in China rose at a slightly faster pace in June from a month earlier, a private survey showed on Friday,driven by a slew of policy easing measures by small- and medium-sized cities to stimulate demand. New home prices in 100 cities rose 0.04%, edging up from the 0.03% gain in May, according to survey data from China Index Academy, one of the country's largest independent real estate research firms. (RTRS)

CREDIT: China Great Wall Asset Management Co. missed a second deadline to publish its 2021 annual report, renewing concerns about the health of the nation’s state-controlled bad debt managers, which roiled the Asian credit market a year ago. (BBG)

OVERNIGHT DATA

CHINA JUN CAIXIN M’FING PMI 51.7; MEDIAN 50.2; MAY 48.1

The Caixin China General Manufacturing PMI rose to 51.7 in June, up 3.6 points from the month before and marking the highest reading for 13 months. The easing of regional Covid-19 lockdowns and other restrictions contributed to the recovery. (Caixin)

JAPAN JUN, F JIBUN BANK M’FING PMI 52.7; FLASH 52.7

June PMI data pointed to a softer expansion of the Japanese manufacturing sector. The health of the sector improved at the joint-slowest rate for nine months amid a broad stagnation in new order inflows and slowing output growth. (S&P Global)

JAPAN Q2 TANKAN LARGE M’FING INDEX 9; MEDIAN 13; Q1 14

JAPAN Q2 TANKAN LARGE M’FING OUTLOOK 10; MEDIAN 13; Q1 9

JAPAN Q2 TANKAN LARGE NON-M’FING INDEX 13; MEDIAN 13; Q1 9

JAPAN Q2 TANKAN LARGE NON-M’FING OUTLOOK 13; MEDIAN 16; Q1 7

JAPAN Q2 TANKAN LARGE ALL INDUSTRY CAPEX +18.6%; MEDIAN +8.3%; Q1 +2.2%

JAPAN Q2 TANKAN SMALL M’FING INDEX -4; MEDIAN -6; Q1 -4

JAPAN Q2 TANKAN SMALL M’FING OUTLOOK -5; MEDIAN -5; Q1 -5

JAPAN Q2 TANKAN SMALL NON-M’FING INDEX -1; MEDIAN -2; Q1 -6

JAPAN Q2 TANKAN SMALL NON-M’FING OUTLOOK -5; MEDIAN -2; Q1 -10

JAPAN MAY JOBLESS RATE 2.6%; MEDIAN 2.5%; APR 2.5%

JAPAN MAY JOB-TO-APPLICANT RATIO 1.24; MEDIAN 1.24; APR 1.23

JAPAN JUN TOKYO CPI +2.3% Y/Y; MEDIAN +2.5%; MAY +2.4%

JAPAN JUN TOKYO CORE CPI +2.1% Y/Y; MEDIAN +2.1%; MAY +1.9%

JAPAN JUN TOKYO CORE-CORE CPI +1.0% Y/Y; MEDIAN +1.0%; MAY +0.9%

JAPAN JUN VEHICLE SALES -15.8% Y/Y; MAY -16.7%

SOUTH KOREA JUN S&P GLOBAL M’FING PMI 51.3; MAY 51.8

June data provided evidence that price and supply pressures were actively hindering production and demand in the South Korean manufacturing sector. The latest Manufacturing PMI was the softest for three months and pointed to a modest expansion in operating conditions - a far cry from the strong levels of growth seen at this time last year. (S&P Global)

SOUTH KOREA JUN EXPORTS +5.4% Y/Y; MEDIAN +3.8%; MAY +21.3%

SOUTH KOREA JUN IMPORTS +19.4% Y/Y; MEDIAN +22.0%; MAY +32.0%

SOUTH KOREA JUN TRADE BALANCE -$2,470MN; MEDIAN -$4,315MN; MAY -$1,710MN

AUSTRALIA JUN CORELOGIC HOUSE PRICES -0.8% M/M; MAY -0.3%

AUSTRALIA JUN, F S&P GLOBAL M’FING PMI 56.2; FLASH 55.8

According to the latest S&P Global PMI data, Australia’s manufacturing sector sustained strong growth momentum in June. Stronger underlying demand conditions underpinned the latest expansion in production levels and supported higher employment and purchasing activity. (S&P Global)

NEW ZEALAND MAY BUILDING PERMITS -0.5% M/M; APR -8.6%

NEW ZEALAND JUN ANZ CONSUMER CONFIDENCE INDEX 80.5; MAY 82.3

NEW ZEALAND JUN ANZ CONSUMER CONFIDENCE -2.2% M/M; MAY -2.5%

The ANZ-Roy Morgan Consumer Confidence Index fell 1.8 points in June. Households are dealing with a lot right now: incomes not keeping up with inflation, lifting interest rates, falling house and other asset prices, and ongoing COVID and general economic uncertainty. The good news: with the labour market so tight, job security is still looking good. Overall, these data are sending sobering signals about the outlook. In particular, retail spending could soon find itself on the ropes if consumers follow through with their stated answers to the question of whether it is a good time to buy a major household item. So far, spending has been holding up, but this is an ominous sign for retailers nonetheless. Stepping back, however, economic fundamentals aren’t all weak by any means. The labour market is extremely tight, and that’ll be supporting consumers’ perceptions of job security. (ANZ)

CHINA MARKETS

PBOC NET DRAINS CNY50 BILLION VIA OMOS FRIDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.10% on Friday. The operation has led to a net drain of CNY50 billion after offsetting the maturity of CNY60 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.9224% at 09:28 am local time from the close of 2.2914% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 65 on Thursday vs 54 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.6863 FRI VS 6.7114

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.6863 on Friday, compared with 6.7114 set on Thursday.

MARKETS

SNAPSHOT: No Letup In Recession Worry

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 483.53 points at 25905.12

- ASX 200 up 8.136 points at 6575.8

- Shanghai Comp. down 6.252 points at 3392.364

- JGB 10-Yr future up 32 ticks at 148.93, yield down 0.9bp at 0.222%

- Aussie 10-Yr future up 13.5 ticks at 96.415, yield down 10.5bp at 3.555%

- U.S. 10-Yr future +0-08 at 118-25, down 5.36bp at 2.957%

- WTI crude down $0.35 at $105.39, Gold down $4.92 at $1802.34

- USD/JPY down 60 pips at Y135.13

- ECB'S HOLZMANN TELLS PAPER HE WOULD HAVE PREFERRED FASTER ACTION ON RATES (RTRS)

- TSMC SEES CLIENTS SCALE BACK ORDERS (DIGITIMES)

- CHINA GREAT WALL POSTPONES EARNINGS, ECHOING HUARONG DELAY (BBG)

- WIDER RECESSIONARY WORRY CONTINUES TO REVERBERATE THROUGH MARKETS

US TSYS: Richer Overnight As Recession Worries Continue To Swirl

TYU2 +0-06+ at 118-23+ ahead of London hours. We have pared back from the bullish extremes witnessed overnight, with TYU2 last operating 0-06 off its session peak, on volume of ~140K (not hindered by a holiday in Hong Kong). Cash Tsys sit 3.0-6.5bp richer across the curve, with the belly leading the bid. Recessionary worry embedded itself further as we worked through overnight dealing, after a brief early uptick in e-minis (alongside cryptocurrencies) was seen during a fairly muted start to Asia-Pac dealing. Regional stories aided wider risk-negative price action, with reports re: chip giant TSMC experiencing downward adjustments in orders from major clients and fears surrounding China Great Wall Asset M’ment missing another deadline to publish its ’21 annual report. E-minis now sit 1.0% lower on the day, This comes after softer than expected real consumer spending data fuelled its own brand of recessionary worry on Thursday (with the Atlanta Fed GDP Nowcast pointing to a technical recession).

- Asia-Pac flow was highlighted by bullish expressions in the form of a block buy of FV futures (+2K) and a block buy of the TYQ2 118.75/120.25 call spread (+5K).

- Note that the space showed nothing in the way of meaningful reaction to the release of Chinese Caixin m’fing PMI data. The print came in comfortably ahead of expectations (after the official Chinese PMI reading moved back into expansionary territory when it hit yesterday), although the text of the print pointed to continued questions re: the footing that the Chinese economy is operating on at present.

- M’fing PMI data out of Europe will be eyed ahead of NY hours (although the Eurozone and UK releases represent final readings), while Friday’s domestic docket will be headlined by the ISM m’fing survey.

- A quick reminder that the Independence Day Holiday (which will be observed on Monday) means that SIFMA recommend an early cash Tsy close on Friday (14:00 NY/19:00 London), although Tsy futures will be open for usual trading hours ahead of the weekend.

JGBS: Belly Outperforms, Long Swaps Widen On BoJ Inaction

JGB futures pushed higher during Tokyo trade as local participants reacted to the latest deepening of recessionary worries gripping the globe. The contract deals +31 ahead of the bell, with bulls failing to force a sustainable break above the 149.00 mark as of yet. Cash JGBs are little changed to ~2bp richer across the curve, although the long-end lagged the futures-driven bid observed in 7s, perhaps on the back of inaction when it came to the BoJ simply rolling over the current size and frequency of Rinban purchases into Q3 (note that the curve bull flattened yesterday as some participants speculated that the BoJ would up the size and/or frequency of purchases covering paper with more than 10 years until maturity, with longer end swap rates higher today as a result, driving a clear widening of long swap spreads).

- Note that the latest BoJ Tankan survey’s sentiment readings were generally in line with exp. to a touch softer on net (the headline large manufacturers index was the most disappointing print, which may have added further support to JGBs), while CapEx plans at large firms provided a notable upside surprise.

- Elsewhere, the uptick in Tokyo core CPI readings for June met expectations, while there was a modest uptick in the unemployment rate in May (which hit 2.6%).

- Note that local headline flow may also be feeding into the wider bid, with Japan rumoured to have taken record tax receipts in FY21, while other reports pointed to Russian President Putin signing over the rights of the Sakhalin-2 oil & gas project to a Russian company (Japan’s Mitsubishi Corp. & Mitsui are partial owners of the original company/project).

- Monday’s local docket is limited at best, with no major points of interest slated.

JGBS AUCTION: Japanese MOF sells Y4.52898tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y4.52898tn 3-Month Bills:

- Average Yield: -0.1339% (prev. -0.1836%)

- Average Price: 100.0334 (prev. 100.0458)

- High Yield: -0.1222% (prev. -0.1443%)

- Low Price: 100.0305 (prev. 100.0360)

- % Allotted At High Yield: 57.1428% (prev. 27.7161%)

- Bid/Cover: 3.383x (prev. 2.865x)

AUSSIE BONDS: Off Best Levels

ACGBs have backed away from earlier session highs, with the cash curve running 5.0bp to 15.0bp richer, bull flattening. YM +16.0 and XM +9.5 at typing, sitting a little lower after bettering their overnight highs, while bills run 4 to 21 ticks higher through the reds.

- Aussie bonds have caught a bid in line with core FI markets on the back of wider recessionary worry, with defensively-tilted flows observed in the G10 FX space as well on the back of previously fleshed-out developments across the region such as the move lower in Taiwanese chip giant TSMC and bad debt manager China Great Wall Asset Management missing its second deadline for its ‘21 annual report. This helped to extend risk-off flows that initially stemmed from Thursday’s recessionary-induced price action.

- STIR markets continue to see little movement re: expectations for rate hikes ahead of the RBA next Tuesday, continuing to point to ~45bp of rate hikes priced in for July, with a cumulative ~229bp priced in for calendar ‘22.

- The AOFM issuance slate announced for next week provoked little reaction in the ACGB space, with the latest update headlined by AOFM fleshing out its intention to issue a new May-34 bond via syndication in Q2 of the current FY.

- Monday will see a slew of data due - Melbourne Institute Inflation, ANZ job advertisements, housing data, and building approvals, although Tuesday’s RBA meeting will provide more impetus for the space.

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Wednesday 6 July it plans to sell A$800mn of the 4.50% 21 April 2033 Bond.

- On Thursday 7 July it plans to sell A$1.5bn of the 7 October 2022 Note & A$1.0bn of the 25 November 2022 Note.

- On Friday 8 July it plans to sell A$700mn of the 0.25% 21 November 2024 Bond.

AUSSIE BONDS: AOFM Issuance Program Update

The AOFM notes that "this provides further details of planned issuance of Australian Government Securities by the Australian Office of Financial Management (AOFM) over the first half of 2022-23."- "In March, the AOFM indicated planned 2022-23 Treasury Bond issuance of around $125 billion. An update on gross Treasury Bond issuance in 2022-23 will be provided following the release of the Budget in October."

- "A new May 2034 line will be issued by syndication in the second quarter of 2022-23 (subject to market conditions)."

- "Planned issuance of Treasury Indexed Bonds in 2022-23 will be around $2.5 billion. Two tenders will be held most months."

- "Regular issuance of Treasury Notes will continue. Weekly issuance volumes will depend on the timing and size of government receipts and outlays and the AOFM’s assessment of its cash portfolio requirements."

- "Details of weekly transactions will be announced at midday on the preceding Friday."

EQUITIES: Lower In Asia Amidst Broad Risk Aversion

Major Asia Pac equity indices are mostly lower at typing, tracking a negative lead from Wall St. The MSCI Asia Pacific on track for second straight lower close, with broader risk appetite during the Asian session sapped by fresh worry re: recessionary risks. A note that Hong Kong markets are closed for a holiday today.

- The Taiwanese Taiex leads the way lower, dealing 2.7% weaker, operating around session lows at typing. Index heavyweight TSMC (-3.8%, >25% weightage on the index) leads the way lower, with broader weakness in microchip-related sectors across the region observed after the release of Micron Technology’s lowered forecasts on Thursday.

- The CSI300 deals 0.3% worse off at typing, sitting a little below four-month highs made on Thursday. Shallow gains in the utilities and materials sectors were countered by weakness in the virtually every other sector, with risk sentiment sapped by broader worry during the session re: economic slowdown fears and potentially over concerns re: the health of the country’s bad debt managers (specifically on news of China Great Wall Asset management missing a second deadline to publish its ‘21 annual report).

- The ASX200 narrowly bucked the broader trend of losses, dealing 0.2% firmer at typing. Tech leads the bid, countering weakness in materials and energy-related names, with the S&P/ASX All Technology Index sitting 0.8% better off at typing.

- U.S. e-mini equity index futures sit 1.0% to 1.2% worse off at writing, on track to end the week sharply lower.

OIL: Back From Best Levels; Tight Supply Factors Abound

WTI and Brent sit a little above neutral levels after paring an earlier, light bid, leaving both benchmarks operating around the bottom of Thursday’s range at writing.

- To recap, WTI and Brent closed ~$3-4 lower on Thursday, falling to session lows after OPEC+ announced no change to its output targets for August, adding to worry re: slowing economic growth after the release of weaker than expected consumer spending data and the previously-flagged Atlanta Fed GDPNow pointing to a technical recession in H1 ‘22.

- Thursday’s move lower in oil markets also comes despite wider, persistent tightness in the outlook for global crude supplies, with a few participants pointing to the squaring of positions ahead of the upcoming extended weekend in the U.S. (Independence Day) as a potential driver.

- Looking to the U.S., President Biden has stated that he will ask all Gulf states to increase crude production ahead of a closely-watched three-stop visit to the Middle East later this month, although Nigeria and French President Macron have previously pointed out a lack of spare capacity from the likes of the UAE and Saudi Arabia.

- Elsewhere, Libya has declared force majeure over the Asidra and Ras Lanuf terminals (>500K bpd capacity, as well as the El-Feel oilfield (~90K bpd capacity).

- A previously-flagged worker’s strike in Norway’s oil & gas sector is expected to affect ~4% (~83K bbpd) of the country’s capacity.

GOLD: Weaker In Asia; $1,800 Eyed

Gold trades $2/oz lower to print $1,805/oz, operating a little above Thursday’s troughs at typing. The precious metal is on track for its third straight weekly decline, with the USD (DXY) and U.S. real yields remaining within sight of cycle highs made around mid-June.

- To recap, gold hit seven-week lows mid-way through Thursday’s session on a surge in the USD (DXY) to its own two-week highs, ultimately closing ~$10/oz lower on Thursday for a fourth consecutive daily loss.

- July FOMC dated OIS price is ~65bp of tightening for that meeting, with odds of a 75bp hike for that meeting pulling to its lowest levels in two weeks. The shift lower comes after the revision in the Atlanta Fed GDPNow (implying a technical recession in 1H22), likely feeding into well-documented debate re: a Fed-led economic slowdown.

- Looking ahead, U.S. m’fing PMIs and the ISM m’fing survey are due ahead of the NY session.

- From a technical perspective, the move lower in gold on Thursday has broken initial support at $1,805.2/oz (Jun 14 low), with a clearer break of the level potentially exposing further support at $1,787.0/oz (May 16 low and bear trigger).

FOREX: Recession Risk Looms Large Driving Hunt For Safety

Participants flew to safety as recession fears resurfaced in the absence of any notable reassuring headlines. E-mini futures went offered, signalling that Thursday's Wall Street rout may not be over, with a long weekend in the U.S. drawing nearer.

- Data released out of the U.S. on Thursday fanned speculation re: inbound recession as core PCE & personal spending both printed slightly below expectations, with further data signals inbound today.

- Safe haven currencies firmed and the yen paced gains in Tokyo trade. Spot USD/JPY retreated in tandem with its 1-month risk reversal as Japan/U.S. 10-Year yield gap continued to shrink. Lower U.S. Tsy yields helped the yen become the only G10 currency to outperform the greenback.

- High-betas took a beating, with the Antipodeans leading losses. NZD/USD sank through a congestion of recent troughs near the $0.6200 mark on its way to worst levels in two years. AUD/USD also lodged two-year lows after breaching support from the low print of May 12.

- Weakness in Antipodean FX space may have been exacerbated by weak New Zealand consumer confidence figures, which came on the heels of a survey showing that local business conditions deteriorated last month.

- Offshore yuan plunged on broader aversion to risk, even as Caixin M'fing PMI came in better than expected, while the PBOC set the mid-point of permitted USD/CNY trading band nearly 30 pips below sell-side estimate.

- There was speculation that reports of another delay to the publication of China Great Wall's 2021 annual report helped weaken the redback. A similar postponement by rival Huarong last year sent Asian credit markets into a tailspin.

- Financial markets in Hong Kong were closed in observance of a public holiday, sapping regional liquidity.

- Manufacturing PMI readings from across the globe will keep trickling through today. Central bank speaker slate features ECB's de Cos & Panetta.

FX OPTIONS: Expiries for Jul01 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0350(E766mln), $1.0450(E807mln), $1.0475-80(E914mln), $1.0540-50(E1.2bln), $1.0575(E2.2bln), $1.0600-15(E2.5bln), $1.0630(E994mln), $1.0700(E1.6bln)

- USD/JPY: Y133.50($1.5bln), Y134.00($1.6bln)

- EUR/JPY: Y145.00(E545mln)

- AUD/USD: $0.6800(A$884mln), $0.6900-05(A$838mln), $0.7050(A$2.0bln)

- NZD/USD: $0.6400(N$1.2bln)

- USD/CNY: Cny6.6500($685mln), Cny6.8000($547mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/07/2022 | 0715/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/07/2022 | 0745/0945 | ** |  | IT | IHS Markit Manufacturing PMI (f) |

| 01/07/2022 | 0750/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/07/2022 | 0755/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/07/2022 | 0800/1000 | * |  | NO | Norway Unemployment Rate |

| 01/07/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/07/2022 | 0830/0930 | ** |  | UK | BOE M4 |

| 01/07/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Manufacturing PMI (Final) |

| 01/07/2022 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 01/07/2022 | 0900/1100 | *** |  | EU | HICP (p) |

| 01/07/2022 | 0900/1100 | *** |  | IT | HICP (p) |

| 01/07/2022 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/07/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/07/2022 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 01/07/2022 | 1400/1000 | * |  | US | Construction Spending |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.