-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: A New Week, But No New Themes

EXECUTIVE SUMMARY

- ECB’S SCHNABEL: INFLATION PRESSURES INCREASINGLY BROAD-BASED (BBG)

- ECB TO DISCUSS BLOCKING BANKS FROM MULTIBILLION-EURO WINDFALL AS RATES RISE (FT)

- PBOC LIKELY TO GUIDE DOWN LPR IN H2 (SEC DAILY)

- CHINA COVID OUTBREAKS WIDEN AS MASS TESTING TURNS UP MORE CASES (BBG)

- CHINESE DEVELOPER SHIMAO DEFAULTS ON $1 BILLION DOLLAR BOND (BBG)

- RUSSIA MOVES CLOSER TO AIM OF TAKING THE DONBAS

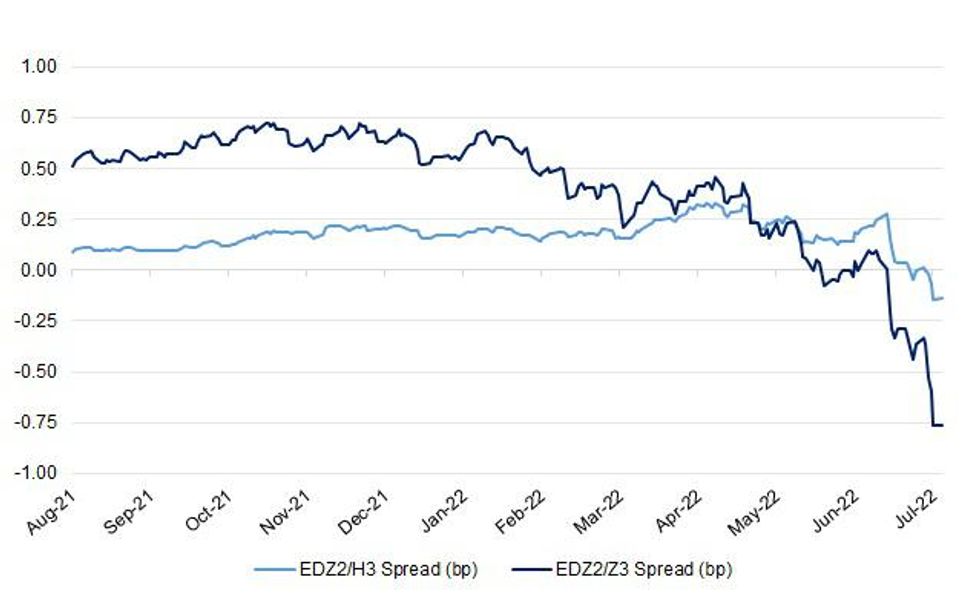

Fig. 1: Eurodollar EDZ2/H3 & EDZ2/Z3 Spreads

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

INFLATION: More UK firms than ever before are expecting to increase prices in the next three months, according to a survey that lays bare the perilous outlook for business. Almost two-thirds of firms now expect their prices to rise in the next three months, the highest proportion since the question was first asked in 1997. That rises to nearly 80% in the retail and wholesale, construction and engineering, and production and manufacturing sectors. (BBG)

FISCAL: Boris Johnson and Rishi Sunak have penned a joint article to outline what they are calling "the single biggest tax cut in a decade" in a show of unity on the cost-of-living crisis. Writing in the Sun on Sunday, the Prime Minister and Chancellor said when the National Insurance threshold rises overnight this coming Wednesday from £9,880 to £12,570 it will save 30 million British workers up to £330 a year. (BBG)

BREXIT: The UK’s Northern Ireland Protocol Bill, which overrides parts of the Brexit agreement and could trigger retaliatory trade measures from EU, may not get through the House of Commons before the summer parliamentary recess begins on July 22, an Institute for Government official told MNI. (MNI)

BREXIT: Boris Johnson has been warned there is “no legal or political justification” for his plans to override the Brexit agreement on Northern Ireland, in an extraordinary joint denunciation by the Irish and German governments. (Observer)

BREXIT/POLITICS: Sir Keir Starmer will on Monday signal that Labour is willing to fight Boris Johnson over his Brexit legacy at the next election, setting out a five-point plan to tackle the economic pain caused by Britain’s EU exit. In a big tactical shift, Starmer will use a speech to denounce the “mess” created by the UK prime minister’s 2020 Brexit deal and the breakdown of trust with the EU caused by the row over the trading arrangements for Northern Ireland. (FT)

POLITICS: British Prime Minister Boris Johnson’s Conservative Party is projected to lose at least 24 battleground seats to Liberal Democrats, a new poll shows, underscoring the swing seen in last month’s special election. (BBG)

POLITICS: Tory rebels have said that Boris Johnson’s handling of claims that a Conservative whip drunkenly groped two men has bolstered their efforts to oust him. (The Times)

SCOTLAND: Voters in Scotland are split over whether a second independence referendum should take place in 2023, according to a new poll. (The Independent)

PROPERTY: Homeowners could soon be taking out 50-year mortgages to then be passed on to their children when they die, under new plans being considered by the government. The Japanese-style lending agreements could see people being able to buy a home with little or no expectation of completing mortgage repayments during their lifetime. Instead the property and outstanding debt would be passed on to their children. (Sky)

BOE: The governor of the Bank of England is opposing plans drawn up by the Treasury that would allow ministers to overrule financial watchdogs on key areas of City regulation. Sky News has learnt that Andrew Bailey has expressed disquiet about a so-called 'call-in power' that will be included in the Financial Services and Markets Bill, which is due to be introduced this year. (Sky)

EUROPE

ECB: The European Central Bank publishes slides of presentation by Executive Board member Isabel Schnabel at the Petersberger Sommerdialog in Koenigswinter, Germany. “Euro-area unemployment rate at record low amid an increasingly tight labor market”. “No signs yet of a wage-price spiral, but risks are increasing”. “Projections are pointing to a decline in inflation,” but there’s a “history of projection errors”. “Energy is the main contributor to headline inflation in the euro area”. “Inflation pressures are becoming increasingly broad-based”. “Markets are expecting a steeper policy path in the euro area and a higher terminal rate”. “Repricing of rate expectations pushes long-term bond yields higher”. (BBG)

ECB/BANKS: The European Central Bank is looking at ways to stop banks earning billions of euros of extra profit from the ultra-cheap lending scheme it launched during the pandemic once it starts to raise interest rates later this month. (FT)

GERMANY: Germany should face the possibility that Russia will continue to suspend gas flows through the Nord Stream 1 pipeline beyond a planned maintenance shutdown this month, Economy Minister Robert Habeck said on Saturday. (RTRS)

GERMANY: Germany's energy regulator has listed priority areas that would have protected access to power if there are severe gas shortfalls this winter, ranging from households and hospitals to pharmaceuticals companies and paper producers. (RTRS)

GERMANY: Top German industries could face collapse because of cuts in the supplies of Russian natural gas, the country’s top union official warned before crisis talks with Chancellor Olaf Scholz starting Monday. (BBG)

GERMANY: German Chancellor Olaf Scholz said his government is continuing talks on aid for gas giant Uniper SE, and signaled that bailout tools developed during the pandemic to rescue big companies like Lufthansa are on the table again. (BBG)

ITALY: Italy posted a state sector budget deficit of 6 billion euros ($6.24 billion) in June compared to a shortfall of 15.7 billion euros in the same month last year, the Treasury said in a statement on Friday. The difference came from higher tax revenues- particularly due to a rise in value added tax payments - and other indirect contributions that offset a fall in excise duties on fossil fuels. (RTRS)

SWITZERLAND: Swiss businesses would be first to have energy rationed in the event of supply shortages, Energy Minister Simonetta Sommaruga told the SonntagsZeitung, warning that the government cannot guarantee there will always be enough gas to go around. (RTRS)

RATINGS: Sovereign rating reviews of note from Friday included:

- S&P affirmed Finland at AA+; Outlook Stable

U.S.

FED: Bringing inflation down is imperative to improve conditions for ordinary workers. That's a key theme we heard from our interview with San Francisco Fed president Mary Daly. (Axios)

ECONOMY: U.S. manufacturers are experiencing weaker business growth in the face of global disruptions and, while data suggest the sector should be able to sustain moderate growth levels through yearend, there is a risk that widening concerns about growth could become self-fulfilling, Institute for Supply Management chair Timothy Fiore told MNI Friday. (MNI)

OTHER

GLOBAL TRADE: Turkish customs authorities have detained a Russian cargo ship carrying grain which Ukraine says is stolen, Ukraine's ambassador to Turkey said on Sunday. (RTRS)

U.S./CHINA: As President Joe Biden debates whether to lift Trump-era tariffs on Chinese imports, his cabinet is split over a politically fraught issue that could influence the November congressional midterm elections. (FT)

U.S./CHINA: A Senate Democrat called on President Joe Biden to repeal tariffs put in place by the Trump administration, saying they haven’t significantly changed China’s trade practices and are contributing to high prices for Americans. (BBG)

JAPAN: Japan's government has revised up its estimates of national tax revenue from the last fiscal year ended in March, as a weak yen and economic recovery from the pandemic helped boost big firms' profits, a draft seen by Reuters showed on Monday. (RTRS)

JAPAN: Japan's ruling coalition is within reach of a majority in the July 10 upper house election, a Nikkei poll shows, with the largest opposition party expected to struggle. (Nikkei)

BOJ: The Bank of Japan may be leaning towards taking its overnight rate out of negative territory rather than raising the upper limit of its yield control range in response to rising inflation and to ease speculative pressure as other major central banks tighten policy, MNI understands. (MNI)

BOJ: The Bank of Japan is likely to keep its current monetary easing program “for many quarters to come” to ensure an economic recovery and pursue a still remote target of sustainable 2% inflation, according to a former BOJ official. (BBG)

SOUTH KOREA: South Korea's finance ministry and central bank said on Monday they had agreed to cooperate in minimizing adverse risks of rising interest rates on vulnerable households and businesses. In a joint statement released after a meeting of finance minister Choo Kyung-ho, Bank of Korea Governor Rhee Chang-yong and others, policymakers said they will closely monitor the impact on currency markets, financial companies and small businesses. (RTRS)

SOUTH KOREA: South Korea’s new administration will hold its first fiscal strategy meeting presided over by President Yoon Suk Yeol as early as this week and announce that it will abolish prior administration’s expansionary fiscal policies and make an official transition to normalizing national finance, JoongAng Ilbo newspaper reports, without citing anyone. (BBG)

HONG KONG: Hong Kong’s new Chief Executive John Lee said there is no immediate need for a universal compulsory Covid testing campaign in the city but stressed that there needs to be a reduction in the number of daily infections, which are at the highest level since April. (BBG)

ASIA: A series of major regional or global events are scheduled to be held in Asian countries starting this month through to the end of the year, ushering in an Asian moment for their role in global governance, with the upcoming Lancang-Mekong regional meeting in Myanmar and the G20 Foreign Ministers' Meeting in Indonesia in the coming week as well as G20 Summit in Indonesia and the Asia-Pacific Economic Cooperation (APEC) meeting in Thailand in November. Experts said China will be prepared to send strong signals of confidence to its key neighbors and partners in the region to further boost economic recovery as well as safeguard unity, peace and security for Asia in a world that faces turbulence and challenges. (Global Times)

ASIA: New Zealand Prime Minister Jacinda Ardern has again raised concerns about China’s ambitions in the Pacific, repeating her comment that Beijing “has become increasingly assertive in our region.” (BBG)

TURKEY: Turkey's trade deficit jumped 184.3% year-on-year in June to $8.16 billion, the Trade Ministry said on Saturday, as surging energy import costs continue to widen the shortfall. (RTRS)

BRAZIL: Brazil posted a trade surplus of $8.814 billion in June, official data showed on Friday, below the median forecast of a $9.994 billion surplus from a Reuters poll of economists. (RTRS)

RUSSIA: Russia's Defence Minister Sergei Shoigu informed President Vladimir Putin that all of Ukraine's Luhansk region had been "liberated" by Russian and separatist forces, the defence ministry said on Sunday. After being beaten back in its initial attempt to capture the capital Kyiv, Russia has focused its efforts on driving Ukrainian forces out of Luhansk and Donetsk regions in the east of the country, where Moscow-backed separatists have been fighting Kyiv since Russia's first military intervention in Ukraine in 2014. (RTRS)

RUSSIA: At least three people were killed and dozens of residential buildings damaged in Russia's Belgorod on Sunday, the local governor said, after earlier reports of several blasts heard in the city that lies near the border with Ukraine. At least 11 apartment buildings were damaged and 39 private residential houses, including five fully destroyed, Vyacheslav Gladkov, the governor of the Belgorod region, said. Reuters was not able to independently verify the reports. There was no immediate reaction from Ukraine to the reports. (RTRS)

RUSSIA: Belarusian President Alexander Lukashenko said on Saturday Ukraine had tried to strike military facilities on Belarusian territory three days ago, but all its missiles had been intercepted, the state-run Belta news agency reported. Lukashenko, who did not provide evidence for the claim, said Belarus does not want war with Ukraine. (RTRS)

RUSSIA: Germany is discussing security guarantees for Ukraine with its allies, in preparation for a time after the war in Ukraine, German Chancellor Scholz told broadcaster ARD on Sunday. (RTRS)

RUSSIA: Senior Brussels officials are discussing the creation of an EU-wide sanctions authority, as they push for tougher and more consistent enforcement of penalties related to the war in Ukraine. Mairead McGuinness, financial services commissioner, said officials were open to introducing an EU version of the Office of Foreign Assets Control (Ofac), the powerful US Treasury agency that spearheads enforcement of its sanctions. (FT)

SOUTH AFRICA: South African state-owned power utility Eskom Holdings SOC Ltd. on Monday will reintroduce so-called stage 6 loadshedding, in which it will remove 6,000 megawatts from the grid. The power utility warned to expect varying levels of power shortages throughout the week as the system recovers to pre-strike levels. (BBG)

ARGENTINA: Argentine President Alberto Fernandez named economist and government official Silvina Batakis as the new economy minister late on Sunday after the abrupt resignation of long-standing minister Martin Guzman amid crises and tensions. (RTRS)

METALS: Chile's finance minister, Mario Marcel, on Friday introduced a tax reform bill that increases copper mining royalties on companies that produce more than 50,000 tonnes a year and raises taxes on high-income earners to fund the government's proposed social programmes and reforms. Chile is the world's biggest copper producer and the proposed bill aims to raise 4.2% of GDP over four years, with 0.7% going to a new guaranteed minimum pension fund. (RTRS)

ENERGY: A planned strike next week by Norwegian energy sector workers could cut the country's gas output by 292,000 barrels of oil equivalent per day, or 13% of output, employers' group the Norwegian Oil and Gas Association (NOG) said on Sunday. (RTRS)

ENERGY: Lebanon's Hezbollah said on Saturday it had sent three unarmed drones towards an Israeli Mediterranean gas rig, which the Israeli military said it had intercepted. (RTRS)

ENERGY: The global surge in the cost of fuel is starting to weigh on demand, according to the world’s biggest independent oil trader. Consumers are being hit by the run-up in gasoline, diesel and other oil products, Mike Muller, head of Asia at Vitol Group, said Sunday on a podcast produced by Dubai-based Gulf Intelligence. (BBG)

OIL: Just as US President Joe Biden was urging OPEC’s biggest members to raise production, supply from the cartel was falling. Production from the Organization of Petroleum Exporting Countries dropped by 120,000 barrels a day in June for a second straight monthly decline, according to a Bloomberg survey. Erratic exporter Nigeria drove the loss, with output slumping to a record low. Yet even group leader Saudi Arabia -- which Biden will visit this month -- failed to deliver its promised increase. (BBG)

OIL: The Biden administration plans to block new offshore oil drilling in the Atlantic and Pacific oceans, while allowing limited expansion in the Gulf of Mexico and Alaska’s south coast.The proposal released by the Interior Department on Friday evening would allow as many as 11 oil lease sales for offshore drilling over the course of five years. (WSJ)

OIL: Iran is being forced to discount its already cheap crude even more as a top ally gains a bigger foothold in the key Chinese market. China has become an important destination for Russian oil as Moscow seeks to maintain flows following the fallout from its invasion of Ukraine. That’s led to increased competition with Iran in one of the few remaining markets for its crude shipments, which have been significantly curtailed by US sanctions. (BBG)

OIL: More than two weeks of protests in Ecuador caused state-run oil company Petroecuador to lose 1.99 million barrels of oil production, the company said on Friday, adding that it expects to reach 90% of pre-crisis output in the next week. (RTRS)

OIL: Production at Venezuela’s largest refinery, which can process about 645,000 barrels of oil per day (bpd), was halted late on Saturday by an electrical fault that caused a blackout, according to five people familiar with the matter. (RTRS)

CHINA

PBOC: The People's Bank of China may further guide down the Loan Prime Rate, mainly the five-year one, in the second half of the year to help boost housing mortgages and stabilise market expectations, the Securities Daily reported citing analysts. The PBOC will also use structural monetary policy tools, such as issuing additional re-lending tools for industries affected by the pandemic, the newspaper said citing Ming Ming, chief economist of CITIC Securities. The PBOC may also increase loan support for private enterprises faced with the dilemma of closing down or reducing production which in turn causes supply chain interruptions, the newspaper said citing Ming. (MNI)

CORONAVIRUS: China’s virus cases continued to climb over the weekend with hundreds of infections detected in Anhui province where two counties were already in lockdown. (BBG)

PROPERTY: Chinese developer Shimao Group Holdings Ltd. said it didn’t pay a $1 billion dollar note that matured Sunday, adding to a record year of offshore-bond delinquencies in the sector. (BBG)

BONDS: China will further open up its bond market to international investors while improving macro-prudential management, strengthening supervision of cross-border capital flows, and conducting real-time monitoring of the market, Pan Gongsheng, deputy governor of the People's Bank of China wrote in an article published in the official China Finance magazine. It will also build a systemic risk monitoring, assessment and early warning mechanism to ensure financial security, said Pan. By the end of May, foreign investors held CNY3.74 trillion of Chinese bonds, up CNY2.81 trillion from five years ago before the launch of the Bond Connect Scheme with Hong Kong, according to the article. (MNI)

RATES: China and Hong Kong are working to develop a trading arrangement to allow overseas investors to execute interest-rate derivatives with onshore traders. The so-called “Swap Connect” is now subject to regulatory approvals, market readiness and the completion of operational arrangements, according to a joint statement by the People’s Bank of China and Hong Kong authorities. The program will be launched in six months, according to the statement. (BBG)

OVERNIGHT DATA

JAPAN JUN MONETARY BASE +3.9% Y/Y; MAY +4.6%

JAPAN JUN MONETARY BASE END OF PERIOD Y677.4TN; MAY Y673.4TN

AUSTRALIA JUN MELBOURNE INSTITUTE INFLATION INDEX +4.7% Y/Y; MAY +4.8%

AUSTRALIA JUN MELBOURNE INSTITUTE INFLATION INDEX +0.3% M/M; MAY +1.1%

AUSTRALIA MAY BUILDING APPROVALS +9.9% M/M; MEDIAN -2.0%; APR -3.9%

AUSTRALIA MAY PRIVATE SECTOR HOUSES BUILT -2.7% M/M; APR -0.2%

AUSTRALIA MAY HOME LOANS VALUE +1.7% M/M; MEDIAN -2.5%; APR -2.8%

AUSTRALIA MAY INVESTOR LOAN VALUE +0.9% M/M; MEDIAN -4.5%; APR -4.8%

AUSTRALIA MAY OWNER-OCCUPIER LOAN VALUE +2.1% M/M; MEDIAN -4.5%; APR -1.7%

AUSTRALIA JUN ANZ JOB ADVERTISEMENTS +1.4% M/M; MAY +1.0%

ANZ Australian Job Ads increased 1.4% m/m in June to exceed the recent March peak. The sheer volume of unmet labour demand suggests underutilisation will keep falling and stay low even as demand growth is curtailed by higher inflation and rising interest rates. The very tight labour market is a key reason why we expect the Australian economy will be resilient in the face of these. (ANZ)

CHINA MARKETS

PBOC NET DRAINS CNY97 BILLION VIA OMOS MONDAY

The People's Bank of China (PBOC) injected CNY3 billion via 7-day reverse repos with the rate unchanged at 2.10% on Monday. The operation has led to a net drain of CNY97 billion after offsetting the maturity of CNY100 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.6524% at 09:37 am local time from the close of 1.6748% on Friday.

- The CFETS-NEX money-market sentiment index closed at 43 on Friday vs 65 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7071 MON VS 6.6863

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.7071 on Monday, compared with 6.6863 set on Friday.

MARKETS

SNPASHOT: A New Week, But No New Themes

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 117.83 points at 26053.45

- ASX 200 up 69.985 points at 6609.90

- Shanghai Comp. up 4.584 points at 3392.221

- JGB 10-Yr future up 5 ticks at 148.95, yield down 0.6bp at 0.22%

- Aussie 10-Yr future up 9.0 ticks at 96.440, yield down 9.2bp at 3.503%

- US 10-Yr future up 0-04 at 119-12+, cash Tsys are closed

- WTI crude down $0.31 at $108.12, Gold up $0.55 at $1811.98

- USDJPY down 13 pips at 135.08

- ECB’S SCHNABEL: INFLATION PRESSURES INCREASINGLY BROAD-BASED (BBG)

- ECB TO DISCUSS BLOCKING BANKS FROM MULTIBILLION-EURO WINDFALL AS RATES RISE (FT)

- PBOC LIKELY TO GUIDE DOWN LPR IN H2 (SEC DAILY)

- CHINA COVID OUTBREAKS WIDEN AS MASS TESTING TURNS UP MORE CASES (BBG)

- CHINESE DEVELOPER SHIMAO DEFAULTS ON $1 BILLION DOLLAR BOND (BBG)

- RUSSIA MOVES CLOSER TO AIM OF TAKING THE DONBAS

US TSYS: Off Best Levels In Holiday-Thinned Trade

TYU2 prints +0-03 at 119-11+ into European hours, 0-01+ off the base of its 0-10+ overnight range, on limited volume of ~45K lots, while cash Tsys are closed for the Independence Day holiday. Early Asia trade was shaped by recessionary worry as Asia-Pac participants reacted to Friday’s softer than expected ISM m’fing reading. Note that the latest Russian advances in Ukraine and rising COVID cases in China’s Anhui province did little when it came to generating wider price action. That was before an uptick in Chinese equities (erasing early losses) allowed e-minis to find a bit of a base (S&P 500 e-minis last -0.5%), facilitating a pullback from best levels in Tsy futures. TYU2 respected Friday’s range after a pullback from Friday’s richest levels was observed ahead of the weekend.

- Note that the EDZ2/H3 & EDZ2/Z3 spreads operate a touch above their respective negative extremes last printing around -15bp and -75bp, respectively.

- There isn’t much in the way of notable economic data releases slated during the remainder of the day, meaning that various rounds of ECB speak will headline during a curtailed Tsy futures trading session.

JGBS: Swap Payside Flow Helps Futures Unwind Overnight Gains

JGB futures have followed the wider core global fixed income space away from overnight highs, with the contract up a mere 7 ticks as we work towards the Tokyo close (40 off the overnight session peak), with domestic equities moving higher and participants perhaps trimming short-term long positions after the rally from cycle cheaps.

- Cash JGBs sit 0.5bp richer to 1.0bp cheaper across the curve, with the curve steeoening as 30+-Year paper cheapens. Note that swaps lagged the early catch up rally observed in the cash JGB space, while the swap spread widening persisted as we moved through Tokyo trade as swap payside flows came to the fore, potentially aiding the cheapening/steepening themes.

- A quick reminder that our policy team have flagged their understanding that the Bank of Japan may be leaning towards taking its overnight rate out of negative territory rather than raising the upper limit of its yield control range in response to rising inflation and to ease speculative pressure as other major central banks tighten policy.

- There was little in the way of meaningful domestic headlines to impact the space, with continued news flow surrounding the Sakhalin 2 situation and impending upper house elections providing no real impetus for markets.

- Looking ahead, 10-Year JGB supply and wage data headline domestic matters tomorrow.

AUSSIE BONDS: Drifting Further From Best Levels

ACGB futures have backed away from overnight highs throughout the Sydney session (after retests for both YM & XM), with a pullback in U.S. Tsy futures (albeit on holiday-thinned trade) facilitating the move lower in the Aussie bond space. Cash ACGBs run 5.5bp to 7.5bp richer across the curve with the belly leading the bid. YM and XM are +7.0 and +7.5 apiece, while Bills run 2 to 11 ticks richer through the reds, bull flattening, but well shy of best levels observed since Friday’s settlement.

- Stronger than expected housing finance data and a firmer ANZ job ads print earlier in the session failed to elicit much reaction from the Aussie bond space, keeping in mind last week’s moves in ACGBs, with proximity to Tuesday’s RBA decision likely foremost in participants’ minds.

- Tuesday will see the S&P Global Services and Composite PMIs cross first, with the RBA’s decision due later in the day (with most looking for a 50bp rate hike).

EQUITIES: Mixed In Asia; KOSPI Hits 20-Month Low

Asia-Pac equity indices are mixed at typing, bucking a positive lead from Wall St.

- The KOSPI has continued its tumble, dealing 1.0% weaker at typing after reversing opening gains, putting it on track for a fourth consecutive day of losses while hitting levels last witnessed in Nov ‘20 earlier in the session. Broader sentiment in the KOSPI continues to be weak amidst the backdrop of recent regulatory efforts to stabilise the stock market, with losses observed in 14 of the index’s 19 sub-industries.

- The Hang Seng Index trades 0.6% lower, dragged lower by underperformance in the financials (-2.0%) and property (-1.3%) sub-indices. Hong Kong Exchanges & Clearing Co (-3.8%) leads the way lower after announcing the launch of a “Swap Connect” between China and Hong Kong, with a BBG analysis suggesting that the initiative may not raise the HKEX’s clearing fees by much.

- The CSI300 deals 0.2% firmer at typing after reversing opening losses, aided by a sustained rally in the healthcare sub-index (+3.7%), as well as by richly valued consumer staples equities paring the bulk of their losses.

- The ASX200 deals 1.2% firmer at writing, with gains observed across virtually every sector. Tech-based large caps such as Block Inc and Xero Ltd lead the bid, adding to moderate gains observed in consumer staples and financials, with the “Big 4” banks sitting ~1.3% to 1.8% better off apiece at writing, making up for lacklustre performance in the materials sub-index.

- U.S. e-mini equity index futures sit 0.6% to 0.8% worse off apiece heading into European hours, a little off their respective session lows, operating comfortably around the upper half of Friday’s range at typing.

OIL: Little Changed In Asia; Recession Worry Lingers

WTI and Brent sit ~$0.10 weaker apiece at typing, paring earlier losses, and operating around the upper end of their respective ranges on Friday. Both benchmarks have risen from session lows as earlier worry re: a recession in the U.S. and an ongoing COVID outbreak in China’s east has moderated for now, mixing with lingering worry re: tight global crude supplies.

- Brent’s prompt spread (~$3.75 at typing) continues to sit at elevated levels despite recent downticks in crude benchmarks, pointing to expectations for near-term tightness in crude markets.

- Japanese PM Kishida offered details re: the G7’s proposed price caps on Russian crude - that they may be fixed at approx. half of its current purchase price. While consensus re: the wider impact of price caps has yet to be reached, some are increasingly pointing to the potential for a surge in oil prices due to issues surrounding the imposition of the measure.

- A previously-flagged worker strike in Norway’s O&G sector is estimated to reduce crude exports by ~130K bpd (~6.8% of national output), with little progress reported in ongoing wage talks.

- Elsewhere, Libyan crude production has declined, now averaging ~365K to ~409K bpd, down from >600K bpd in June, and less than half of the ‘21 average of ~1.1mn bpd. Several critical facilities (such as the 300K bpd El Sharara oilfield) remain under force majeure amidst political unrest.

- On the other hand, Ecuadorian crude output is expected to rise this week to ~90% of levels witnessed before recent political unrest, possibly representing ~200K bpd in recovered oil production.

GOLD: Little Changed In Asia; Minor Reprieve On Recession Worry

Gold sits $2/oz worse off at typing to print $1,809/oz, a little below best levels highs after briefly showing above Friday’s high earlier in the session.

- To recap, gold recovered from five-month lows (at $1,784.6/oz) on Friday to close ~$4/oz firmer, breaking a four-day streak of losses. The recovery in gold on Friday was facilitated by a miss in the U.S. ISM m’fing survey and May construction spending, exacerbating heightened recession worry from some quarters, with the Atlanta Fed’s GDPNow tracker for Q2 ‘20 declining to -2.1% in the wake of the data print (from -1.0% prior).

- Elsewhere, BBG source reports over the weekend have pointed to the EU preparing bloc-wide sanctions on Russian gold imports, with Australia declaring their embargo on Russian gold on Sunday. The moves may ultimately change little, taking reference to previously-flagged reports of earlier western sanctions since Mar ‘22 already having restricted flows within the space.

- From a technical perspective, the move lower on Friday has seen gold briefly break support and the bear trigger at $1,787.0/oz (May 16 low), a clearer break of which could expose key support at $1,780.4 (Jan 28 low).

FOREX: USD Off Smalls, A$ Underperforms

The USD is lower on the day, but moves have been well contained, in what has been a quiet start to the week. AUD underperformance has been evident, but is not dramatic.

- AUD weakness has reflected commodity falls, with focus on the sharp drop in iron ore today. Active Singapore futures are down 4.5% to sub $110/tonne. The metal has lost over 11% from recent highs. The dip in AUD/USD sub 0.6900 was short lived though.

- China headlines around another property default and rising covid case numbers from the weekend have not helped broader recessionary fears in terms of the global outlook. However, other China assets have shrugged off this, with equities rebounding from earlier weakness today, while USD/CNH is back to the low 6.6900 region.

- AUD/NZD is lower, back to a 1.0970/75. This comes despite better than expected Australian domestic data, although the weaker commodity picture outlined above is weighing. AU-NZ spreads have generally move in favor of the AUD today. NZD/USD is holding above just 0.6200 for now, versus an earlier high of 0.6217.

- Elsewhere, USD/JPY continues to be supported sub 135.00. We got just below 134.80, as US equity futures fell, but now sit back close to 135.150. US futures are off worse levels.

- EUR/USD is up smalls on the day, but within recent ranges, last at 1.0425. NOK has been an outperformer, up over 0.4% against the USD. USD/NOK sits with a 9.95 handle, but we did get close to 9.9000 in earlier trade.

- In terms of upcoming event risks, note US markets are closed for the US Independence Day holiday, so no US Cash Tsys trading. In the EU, German trade data is on tap, Switzerland CPI, and EU Sentix Investor Confidence are also due, along with the EU PPI. ECB members Nagel and Guidos also speak.

FX OPTIONS: Expiries for Jul04 NY cut 1000ET (Source DTCC)

- USD/JPY: Y135.00-05($769mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/07/2022 | 0600/0800 | ** |  | DE | Trade Balance |

| 04/07/2022 | 0630/0830 | *** |  | CH | CPI |

| 04/07/2022 | 0700/0300 | * |  | TR | Turkey CPI |

| 04/07/2022 | 0900/1100 | ** |  | EU | PPI |

| 04/07/2022 | 1430/1030 | ** |  | CA | BOC Business Outlook Survey |

| 04/07/2022 | 1430/1630 |  | EU | ECB Elderson on Climate Change at ECB Seminar | |

| 04/07/2022 | 1500/1700 |  | EU | ECB de Guindos Speech at Frankfurt Euro Finance Summit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.