-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Johnson Scrambles As Key Ministers Resign, Potential Ousters Circle

EXECUTIVE SUMMARY

- JOHNSON CLINGS ON AFTER RESIGNATIONS, NAMES ZAHAWI CHANCELLOR (BBG)

- MAJORITY OF OUR MPS WANT A NEW LEADER, TORY REBELS INSIST (TIMES)

- 1922 COMMITTEE REBELS PLAN RULE CHANGE TO OUST BORIS JOHNSON (TELEGRAPH)

- US PUSHES FOR ASML TO STOP SELLING KEY CHIPMAKING GEAR TO CHINA (BBG)

- NORWAY OIL AND GAS WORKERS END STRIKE AS GOVERNMENT STEPS IN (RTRS)

- RUSSIAN COURT ORDERS CPC TO HALT OIL LOADINGS FOR 30 DAYS (BBG)

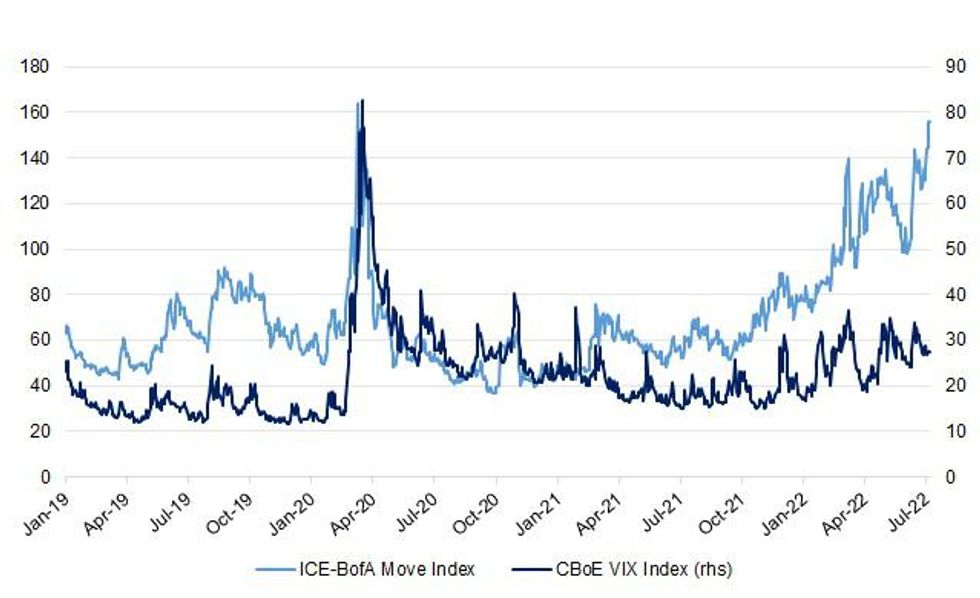

Fig. 1: ICE-BofA Move Index Vs. CBoE Vix Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: Boris Johnson is digging in as UK prime minister, after the resignation of two of the most senior members of his government brought his premiership to the brink on another febrile day in Westminster. The prime minister appointed Nadhim Zahawi as his new Chancellor of the Exchequer, replacing Rishi Sunak, while Steve Barclay takes Sajid Javid’s former role as health secretary. Michelle Donelan was named education secretary following Zahawi’s promotion. (BBG)

POLITICS: Conservative rebels turned to Sir Graham Brady last night to tell Boris Johnson that his time as prime minister is over. Johnson’s opponents are adamant a majority of Conservative MPs want a new leader. Last night a string of senior Conservatives called on Johnson to quit before he is forced out, including Lord Frost, the man who negotiated the government’s Brexit deal. He said there was “no chance” the prime minister could make the necessary changes to continue in No 10. (The Times)

POLITICS: Rebel candidates in the 1922 Committee elections are planning to change its rules to oust Boris Johnson in the aftermath of Tuesday’s two resignations from the Cabinet. (Telegraph)

BOE: Active sales from the Bank of England's more than 800 billion pounds of government bond holdings are unlikely to have a material economic impact, Bank of England policymaker Silvana Tenreyro said on Tuesday. "I wouldn't expect the effect of the unwind, of QT (quantitative tightening), to have a material impact on the economy. So far our experience with the beginning of the shrinking of the portfolio is consistent with that," Tenreyro said at a conference hosted by King's Business School in London. Since February the BoE has not reinvested the proceeds of government bonds that have matured from its portfolio. BoE staff are due to report to the Monetary Policy Committee on options for active bond sales next month. (RTRS)

PROPERTY: Britain’s red-hot property market may be about to cool after a 24% jump in the number of prospective sellers bringing homes to market. The listing website Rightmove said the appraisals that estate agents are doing have reached the highest level since January. (BBG)

EUROPE

FRANCE: French President Emmanuel Macron is under increasing pressure to introduce a windfall tax on oil, gas and transport giants to fund his bill aimed at protecting consumers’ purchasing power. (BBG)

AUSTRIA: Austria will order industry and utilities to make plants run on alternatives to natural gas where possible, especially oil, its energy minister said on Tuesday, as the country scrambles to hoard gas in case Russia cuts it off. (RTRS)

U.S.

FISCAL: Seeking to boost his standing with frustrated blue-collar voters, President Joe Biden on Wednesday will use the backdrop of a union training center in Cleveland to tell workers his policies will shore up troubled pension funding for millions now on the job or retired. (The Washington Post)

OTHER

GLOBAL TRADE: Turkish President Recep Tayyip Erdogan has said he intends to “intensify” negotiations with Russia and Ukraine in the hope of reaching a deal on a United Nations plan to export Ukrainian grain to world markets. “We will intensify our talks within a week or 10 days and try to reach a result,” he told reporters. (AP)

U.S./CHINA: U.S. President Joe Biden’s team is still looking at options on China tariffs, White House press secretary Karine Jean-Pierre said on Tuesday, when asked about a timeline for a decision on potentially lifting some of the levies. (RTRS)

U.S./CHINA: The US is pushing the Netherlands to ban ASML Holding NV from selling to China mainstream technology essential in making a large chunk of the world’s chips, expanding its campaign to curb the country’s rise, according to people familiar with the matter. (BBG)

GEOPOLITICS: U.S. Secretary of State Antony Blinken will call on G20 nations this week to put pressure on Russia to support U.N. efforts to reopen sea lanes blocked by the Ukraine conflict and repeat warnings to China not to support Moscow's war effort. Blinken heads to Asia on Wednesday for a meeting of Group of 20 foreign ministers in Bali on Friday. His trip will include his first meeting with Chinese counterpart Wang Yi since October, but no meeting is expected with Russian Foreign Minister Sergei Lavrov. (RTRS)

CHINA/RUSSIA: Deputy Foreign Minister Ma Zhaoxu said while meeting with Russian ambassador Andrey Denisov Tuesday that China is willing to strengthen strategic coordination and cooperation in various sectors. (BBG)

BOJ: BOJ officials are watching corporate cost pass-through trends from higher energy prices traced to cost-push inflation. The dynamic is likely to continue beyond fiscal 2022 and keeps the focus on whether higher prices will be accepted by consumers amid weak real wages, which fell 1.8% y/y in May for the second consecutive monthly dip. (MNI)

JAPAN: The Japanese government will make an “appropriate” decision within the first half of July on its planned nationwide support program to encourage domestic travel, Deputy Chief Cabinet Secretary Seiji Kihara says in a regular briefing. (BBG)

BOK: South Korea's Prime Minister Han Duck-soo said on Wednesday that it is inevitable the Bank of Korea will take "financial normalisation" measures to ease inflationary pressures, local media News1 reported. (RTRS)

HONG KONG: Hong Kong Chief Executive John Lee says he doesn’t agree with “lying flat” Covid-19 approach and won’t tolerate rising cases in the city. H.K. will discuss with authorities in China to explore ways to expand the limited travel between the two places, Lee says in legislature. (BBG)

BRAZIL: Luiz Inacio Lula da Silva lunched with some of Brazil’s richest and most powerful company executives Tuesday, the latest in a series of get-togethers to dispel concern about policies the leftist former president would implement if elected in October. (BBG)

BRAZIL: Brazil central bank workers said they halted a three-month long strike that delayed the publication of economic data and analyst surveys that are closely watched by investors. (BBG)

RUSSIA: Regional Governor Pavlo Kyrylenko urged people who remain in the eastern Ukrainian towns of Kramatorsk and Slovyansk to evacuate as Russian attacks intensify. Kyrylenko said in a nationally televised address that the Russian army was firing randomly, targeting local residents and seeking to spread panic. (BBG)

RUSSIA: The governor of Kaliningrad said he’s hopeful the European Union may ease limitations this week on the transit of goods to Russia’s Baltic exclave. “We’re getting signals through various channels that they’re likely to take this decision this week,” Anton Alikhanov told Rossiya 24 state channel, Interfax reported. (BBG)

RUSSIA: Lavrov will also attend the G20 meetings in Bali, but is not expected to meet with Blinken. “Russia is waging an unprovoked, brutal war against the people and the country of Ukraine, and so for that reason the time is not right for [Blinken] to engage with Foreign Minister Lavrov,” Price said. “We would like to see the Russians be serious about diplomacy. We have not seen that yet.” (SCMP)

IRAN: State Department spokesperson Ned Price said there was currently not another round of talks on the book with Iran, adding that Tehran has repeatedly introduced, over the recent weeks and months, extraneous demands that go beyond the confines of the nuclear deal struck in 2015. (RTRS)

ENERGY: The Norwegian government on Tuesday intervened to end a strike in the country's energy sector that had cut oil and gas output, a union leader and the labour ministry said. (RTRS)

OIL: A Russian court ordered the Caspian Pipeline Consortium to halt Black Sea oil loadings for 30 days due to violations of a spill-prevention plan. The CPC statement, which came late Tuesday, didn’t specify when the 30-day period begins. (BBG)

CHINA

ECONOMY: The Chinese economy may grow 4.8% in 2022, given that the additional credit of CNY800 billion by policy banks would largely stimulate infrastructure investment, wrote Lian Ping, dean of Zhixin Investment Research Institute in an article published by NetEase News. Retail sales may reverse the current decline in Q3, likely to grow about 2% throughout the year, said Lian. The annual growth is still likely to reach 5% or even meet the expected target of “around 5.5%”, should investment, consumption and exports all be significantly better than expected, said Lian. The rising possibility for the U.S. to remove some additional tariffs on Chinese goods may help to boost exports against weakening external demand, Lian added. (MNI)

ECONOMY: China’s demand for gasoline and diesel is nearing a return to pre-virus levels as the nation cautiously emerges from strict virus lockdowns. Overall consumption of the major transport fuels last month was at almost 90% of June 2019 levels, according to people with direct knowledge of the nation’s energy industry. Gasoline and diesel account for about half of China’s total oil demand, and fuel use has steadily recovered after crumbling in April. (BBG)

PBOC: Shrinking liquidity injections by the People’s Bank of China via open market operations is signaling that capital market interest rates may gradually return to policy interest rates, with a marginal tightening of liquidity, the 21st Century Business Herald reported citing analysts. This is more of the central bank's active response to tame the risk of weakening control over the banking system and rising bond market leverage, the newspaper said citing Gao Yu, chief analysts of Zheshang Securities. The PBOC only injected CNY3 billion seven-day reverse repos each day starting this week, much lower than the CNY100 billion daily injections in end-June, the newspaper said. The weighted average interest rate of DR007 closed at 1.5703% on Tuesday, still significantly lower than the central bank’s seven-day reverse repo rate of 2.1, the newspaper said. (MNI)

INFLATION: China’s consumer price index likely rose 2.4% in June from May’s 2.1% amid rapidly higher pork prices, as breeding companies are reluctant to sell when the prices are seen bullish, the Securities Dailly reported citing analysts. The average wholesale price of pork nationwide is CNY26.69 per on Wednesday, which has increased by about 26% from June 1, the newspaper said citing data by the Ministry of Agriculture and Rural Affairs. The National Development and Reform Commission is releasing pork reserves and meeting with major breeding companies to safeguard supply and stabilise prices this week, the newspaper said. China is set to release the latest CPI data on Saturday. (MNI)

PROPERTY: China’s real estate slump is probably past its worst -- but the market remains a long way from a full recovery. Sales at China’s largest housing developers fell 43% in June from a year earlier, according to China Real Estate Information Corp., less than the previous month’s 59% decline. Weekly sales data from CRIC show that some major cities, including Shenzhen and Guangzhou in southern China, generated year-on-year growth at the end of June. (BBG)

CHINA MARKETS

PBOC NET DRAINS CNY97 BILLION VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) injected CNY3 billion via 7-day reverse repos with the rate unchanged at 2.10% on Wednesday. The operation has led to a net drain of CNY97 billion after offsetting the maturity of CNY100 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8347% at 09:44 am local time from the close of 1.5703% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 43 on Tuesday vs 46 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7246 WEDS VS 6.6986

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.7246 on Wednesday, compared with 6.6986 set on Tuesday.

MARKETS

SNAPSHOT: Johnson Scrambles As Key Ministers Resign, Potential Ousters Circle

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 304.06 points at 26119.13

- ASX 200 down 25.135 points at 6604.20

- Shanghai Comp. down 42.706 points at 3360.89

- JGB 10-Yr future up 41 ticks at 149.37, yield up 2.3bp at 0.246%

- Aussie 10-Yr future up 15.5 ticks at 96.555, yield down 14.7bp at 3.4%

- U.S. 10-Yr future down -0-03 at 119-26+, yield up 1.46bp at 2.82%

- WTI crude up $0.98 at $100.46, Gold up $1.38 at $1766.16

- USDJPY down 57 pips at 135.28

- JOHNSON CLINGS ON AFTER RESIGNATIONS, NAMES ZAHAWI CHANCELLOR (BBG)

- MAJORITY OF OUR MPS WANT A NEW LEADER, TORY REBELS INSIST (TIMES)

- 1922 COMMITTEE REBELS PLAN RULE CHANGE TO OUST BORIS JOHNSON (TELEGRAPH)

- US PUSHES FOR ASML TO STOP SELLING KEY CHIPMAKING GEAR TO CHINA (BBG)

- NORWAY OIL AND GAS WORKERS END STRIKE AS GOVERNMENT STEPS IN (RTRS)

- RUSSIAN COURT ORDERS CPC TO HALT OIL LOADINGS FOR 30 DAYS (BBG)

US TSYS: A Little Shy Of Tuesday’s Richest Levels

A fairly mundane round of Asia-Pac trade for Tsys saw weaker regional equity indices (on the back of recession fear & worry re: the COVID situation in China) and an early blip higher in oil after a heavy Tuesday session (with the bounce aided by Russian court rulings re: loading at one of its major ports) drawing most of the attention. The latter move moderated as we worked through overnight trade, likely aided by the former.

- TYU2 has stuck to a 0-07+ range on sub-standard volume of 75K, last dealing -0-04+ at 119-25, while cash Tsys run 2-3bp cheaper across the curve. Yields hold away from Tuesday’s lows after a late NY pullback which came alongside a recovery in U.S. equities post the European cash close (the S&P 500 finished +0.2% on Tuesday).

- There hasn’t been anything in the way of major macro news, nor meaningful market flow to flag since the Asia-Pac re-open, with the UK political situation dominating the headlines.

- Wednesday’s NY calendar is headlined by services ISM data and the release of the minutes from the most recent FOMC decision. We will also get weekly MBA mortgage apps, final services PMI data and the latest JOLTS job opening print. The release of the FOMC minutes from the June meeting will be bolstered by Fedspeak from NY Fed President Williams.

JGBS: Futures Unwind Early Blip Lower

JGB futures initially blipped lower at the Tokyo open, adjusting to Tuesday’s late pullback in U.S. Tsys, before recovering from worst levels and then breaching the recent session highs. That leaves JGB futures running +45 ahead of the bell. Note that Tuesday’s cautious tone has weighed on Asia-Pac equities, which likely provided some background support for JGBs. Cash JGBs run little changed to 3.5bp richer across the curve as a result, with 7s leading on the back of the bid in futures. Note that payside flows have shown up again in super-long JGBs, resulting in the widening of super-long swap spreads from both sides as JGBs richen.

- Local news flow was light, with continued discussions surrounding the restart of the government-subsidised local travel scheme evident, although there was nothing in the way of firm details forthcoming.

- BoJ Rinban operations covering 1- to 5- & 10- to 25-Year JGBs had no meaningful impact on the market.

- 30-Year JGB supply headlines domestic matters on Thursday.

AUSSIE BONDS: Richer, But Off Overnight Highs

A lack of notable macro headline flow and tier 1 data releases meant that Aussie bonds didn’t have much to latch onto during Sydney trade, with cash ACGBs running 4.5bp to 15.0bp richer across the curve, bull flattening, as participants adjusted to the latest round of recessionary worry coming out of Europe. YM and XM are +8.0 and +14.5, respectively, sticking to the ranges established during overnight dealing. Bills run flat to 8 ticks richer through the reds, bull flattening.

- The latest round of ACGB Apr-33 supply went smoothly, with the weighted average yield pricing 0.97bp through prevailing mids (per Yieldbroker), as the cover ratio printed at 2.38x, above the 2.00x mark (although a decline from the prev. 3.11x, with the caveat that the prior auction was in Feb, when a different market regime was in place). Wider caution re: the deployment of capital into ACGBs and a lack of outright relative value in the wider sector likely limited broader participation in the auction.

- Thursday will see monthly trade balance data headline the domestic docket.

AUSSIE BONDS: The AOFM sells A$800mn of the 4.50% 21 Apr ‘33 Bond, issue #TB140:

The Australian Office of Financial Management (AOFM) sells A$800mn of the 4.50% 21 Apr ‘33 Bond, issue #TB140:

- Average Yield: 3.4433% (prev. 2.2592%)

- High Yield: 3.4450% (prev. 2.2600%)

- Bid/Cover: 2.3813x (prev. 3.1090x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield: 87.7% (prev 95.5%)

- Bidders 39 (prev. 45), successful 18 (prev. 18), allocated in full 10 (prev. 9)

EQUITIES: Lower In Asia On Recession Worry; COVID Worry Looms (Again) In China

Asia-Pac equity indices are mostly lower at typing, with a mixed lead from Wall St. providing little guidance. Recession worry was evident throughout the session, with several commodity benchmarks broadly extending Tuesday’s losses over fears of economic slowdowns crimping demand.

- The Hang Seng leads losses, sitting 1.4% worse off on losses in >80% of its constituents. Broader sentiment has suffered as Shanghai carries out mass testing in 12 of the city’s 16 districts, unwinding some optimism re: economic recovery, seeing the Hang Seng give up virtually all gains made over the past week.

- The Chinese CSI300 deals 1.3% weaker at typing, on track for its largest decline in a week on weakness in nine of ten sub-indices, with richly-valued consumer staples and healthcare stocks bearing the brunt of the selling over previously-flagged COVID fears. The materials (-2.4%)and energy (-4.8%) sub-indices were softer as well, reflecting declines in major commodity benchmarks.

- The Nikkei 225 trades 1.1% lower, with the broader TOPIX index sitting 1.4% worse off at typing. ~85% of the Nikkei’s constituents are in the red, with the latest bout of JPY strength catalysing weakness in major exporters and large-cap names.

- The ASX200 fell to a lesser extent than regional peers, dealing 0.4% weaker at writing. Outperformance in the tech sub-index (+3.0%) was countered by a sharp decline in the materials sub-gauge (-4.6%), with the likes of Rio Tinto Ltd (-6.4%) and Mineral Resources Ltd (-5.3%) leading the way lower.

- U.S. e-mini equity index futures sit on either side of neutral levels at typing, having whipped between gains and losses throughout Asia-Pac dealing.

OIL: Back From Best Levels; Shanghai COVID Outbreak Eyed

WTI is ~+$0.10 and Brent is ~+$0.70, with WTI trading a little below $100 at typing. Both benchmarks pared earlier gains of as much as ~$2.60 to $3.00, seeming to catch a bid on news re: a court order to halt oil loadings at a Caspian Pipeline Consortium (CPC) port on the Black Sea, potentially affecting ~1.9mn bpd in Kazakh crude exports.

- To recap Tuesday’s price action, both benchmarks closed ~$10 weaker, moving sharply lower amidst growing recession fears in both the U.S. and Europe, fuelling worry re: demand destruction.

- Goldman analysts have since stated that Tuesday’s move may be overdone, worsened by limited liquidity and technicals, highlighting persistent, fundamental supply tightness in crude markets.

- Developments out of China may have applied pressure to crude in Asia, as lockdown fears have again surfaced. Shanghai on Tuesday re-imposed mass testing regimes (in line with their well-documented zero COVID policy) in 12 of the city’s 16 districts, with tests due to be completed by Thursday. Total daily case counts and cases outside of quarantine (two reported for Wednesday morning) in Shanghai have ticked higher, with the latter being a crucial metric for authorities re: pandemic monitoring.

- Elsewhere, indirect Iran-U.S. nuclear talks have seen virtually zero progress, with the State Dept.’s Price saying that no other talks are scheduled at present.

- A short-lived strike in Norway’s O&G sector ended less than a day after it commenced after intervention from the Norwegian gov’t, with the move averting an estimated >300K bpd decline in crude production.

GOLD: Firmer In Asia

Gold sits ~$6/oz firmer at typing to print ~$1,771/oz, a shade below session highs, but extending a move away from six-month lows made on Tuesday (at ~$1,764/oz).

- To recap, the precious metal shed ~$40/oz around Tuesday’s NY session open after keeping above $1,800/oz for much of the Asian session, ultimately closing ~$45/oz lower on the day. The move lower was facilitated by a broad recovery across U.S. real yields and a rally in the USD, with the DXY hitting levels not witnessed since Dec ‘02 (above 106.00) on the back of growth fears in Europe, supporting a diverging policy outlook.

- July FOMC dated OIS now price in ~70bp of tightening for that meeting while a cumulative ~168bp is now priced in through calendar ‘22. The latter has continued to edge lower, reflecting ongoing debate re: less aggressive rate hikes amidst economic growth risks, with BBG Economics forecasting odds for a recession in the U.S. in ‘23 at 38%.

- A note that Fedspeak across the past month has pointed to a Fed prepared to weather hits to economic growth to fight inflation, with Fed Chair Powell last week saying that the process is “highly likely to involve some pain”.

- From a technical perspective, conditions remain bearish for gold. Key support at $1,780.4/oz (Jan 28 low) has been broken, exposing support at $1,753.1/oz (Dec 15 ‘21 low), while a break of that level will bring further support at $1,721.7/oz (Sep 29 ‘21 low) into focus.

FOREX: Outside Of USD/JPY, USD Firmer

Outside of the yen, the USD has been supported against the majors, although ranges have been tight.

- Yen demand was evident early in the session against both the USD and on crosses. USD/JPY dipped below the overnight low, before finding a base between 135.10/15. We last sat at 135.40 and may have seen a sharper pull back in USD/JPY if not for a modest recovery in US yields (2yr up 2bps to 2.84%).

- EUR/JPY dipped just below 138.70, through overnight lows and the 50-Day MA, which comes in at 139.01. The pair last traded at 138.85. EUR/USD has drifted towards 1.0250 this afternoon.

- AUD and NZD have struggled to gain much upside traction, although more so NZD. AUD/USD has oscillated around 0.6800. Weaker commodity prices have curbed any upside impetus. Iron ore is back to a $107/tonne handle. Lockdown concerns in China has weighed on the outlook, with large parts of Shanghai undergoing mass testing as case numbers track higher.

- Copper is also down, off a further -1%, while oil gains have slipped as the session has progressed. Brent back sub $104/bbl, from earlier highs of close to $106/bbl.

- CAD and NOK are back weaker against the USD, although only modestly.

- GBP/USD got above 1.1970 in early trade, but is now back to 1.1950. Local politics is likely to be watched closely when the London session kicks off.

- Looking ahead, German factor orders are on tap, along with the construction PMI. The UK construction PMI is also due. Retail sales for Euro Area also print.

- In the US, the docket will be headlined by services ISM data and the release of the minutes from the most recent FOMC decision. We will also get weekly MBA mortgage apps, final services PMI data and the latest JOLTS job opening print. The release of the FOMC minutes from the June meeting will be bolstered by Fedspeak from NY Fed President Williams.

FX OPTIONS: Expiries for Jul06 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2030(E530mln)

- USD/JPY: Y135.00($615mln)

- NZD/USD: $0.6410(N$1.2bln)

- USD/CAD: C1.2610-25($2.0bln), C$1.3200-10($595mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/07/2022 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 06/07/2022 | 0600/0800 | ** |  | SE | Private Sector Production |

| 06/07/2022 | 0730/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/07/2022 | 0800/1000 | ** |  | ES | Industrial Production |

| 06/07/2022 | 0810/0910 |  | UK | BOE Pill Speaks at Qatar Centre Conference | |

| 06/07/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/07/2022 | 0900/1100 | ** |  | EU | retail sales |

| 06/07/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 06/07/2022 | 1230/1330 |  | UK | BOE Cunliffe Panels Qatar Centre Conference | |

| 06/07/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 06/07/2022 | 1300/0900 |  | US | New York Fed President John Williams | |

| 06/07/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 06/07/2022 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 06/07/2022 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 06/07/2022 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 06/07/2022 | 1800/1400 |  | US | FOMC Minutes |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.