-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS ANALYSIS: Markets Assess Potential Policy Impact Of Abe Shooting Ahead Of NFPs

- Afternoon trade in JGBs focused on news that PM Abe, he was hospitalised as a result and is reportedly unconscious and in cardio-respiratory arrest. Futures initially ticked lower in the wake of the news, with participants perhaps looking at the potential knock-on impact of receding Abe influence in the Japanese policymaking sphere. e.g. the potential for expedited changes to defence and monetary policies.

- JPY moved to the top of the G10 FX table as a result of the news, with light defensive flows seen in the space.

- The U.S. NFP report provides the main point of note on today's data docket, with final U.S. wholesale inventories & Canadian jobs figures also due. The central bank speaker slate includes Fed's Williams and ECB's Lagarde, Muller, Visco & Villeroy.

US DATA PREVIEW: MNI US Payrolls Preview: Growth Concerns Thrown Into The Mix

EXECUTIVE SUMMARY

- Nonfarm payrolls are seen rising 268k in June as the pace eases further from the 390k in May but remains well above average growth of 164k through 2019, with wage growth and the u/e rate unchanged from May.

- Rising growth concerns could see focus on the composition of payrolls growth, adding to the familiar focus on labour market tightness.

- Potentially small downside risk to July pricing (currently 71bp) but it would likely take a very weak report to materially change those expectations.

- Skittish markets in the run up to the release see two-sided risk for meetings further out where the Fed is seen to likely be back at neutral and increasingly data dependent (currently 180bps of hikes year-end). The fact labour indicators tend to be lagging indicators could however at the margin add some downside risk from those coming into this report with a pessimistic view on the US economy.

- Click for full report.

US DATA PREVIEW: Primary Dealer NFP Estimates

| Primary Dealer | Estimate | Primary Dealer | Estimate |

|---|---|---|---|

| Amherst Pierpoint | +375K | TD Securities | +350K |

| Bank of America | +325K | Morgan Stanley | +325K |

| Jefferies | +320K | Societe Generale | +310K |

| Daiwa | +300K | NatWest | +300K |

| Scotiabank | +300K | Citi | +290K |

| Nomura | +290K | Barclays | +275K |

| Credit Suisse | +275K | J.P.Morgan | +275K |

| Goldman Sachs | +250K | HSBC | +250K |

| Wells Fargo | +240K | BNP Paribas | +230K |

| Deutsche Bank | +225K | UBS | +225K |

| BMO | +200K | Mizuho | +200K |

| Dealer Median | +282.5K | BBG Whisper | +245K |

US TSYS: Light Bid After Abe Shot, Little Conviction Ahead Of NFPs

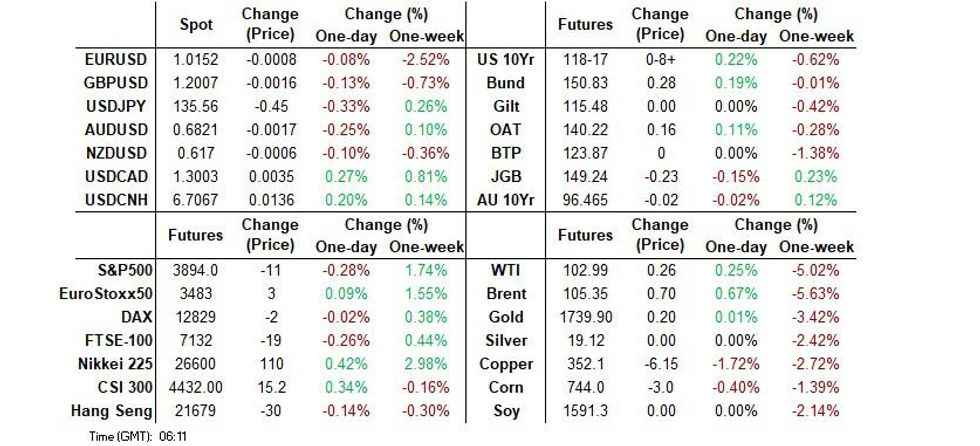

TYU2 sits +0-08+ at 118-17, 0-03 off the peak of its overnight high, running on volume of ~100K within a 0-12 range. Meanwhile, cash Tsys sit 1.0-2.5bp richer across the curve at typing, with the belly leading the bid.

- Tsys have seen a light bid during the Asia-Pac session, with the shooting and subsequent hospitalisation of former Japanese PM Abe creating some light risk-off price action. Note that the more important factor for markets may be whether the incident results in the reduction of Abe’s influence within the wider Japanese policymaking sphere e.g. expediting potential changes to Japan’s defence and monetary policy stance.

- Outside of that, the space meandered through early Asia trade, with a lack of real conviction ahead of today’s NFP release (please see our full preview of that release here)

- We have noted elsewhere that the impaired market liquidity and apparent lack of conviction evident among some risk takers (as evidenced by a couple of recent sell-side surveys) could make for an interesting round of post-NFP price action. An idea that is probably compounded by the Fed’s focus on suppressing inflation even if it comes at the expense of economic growth, which limits the read-through of today’s payrolls release when it comes to wider market pricing of future Fed policy.

- On top of the NFP print Friday will bring the latest round of comments from NY Fed President Williams (permanent voter).

US TSYS: Impaired Liquidity And A Lack Of Conviction May Cloud Post-NFP Price Action

A couple of sell-side surveys covering positioning and conviction matters seem to flag some indecision/a lack of conviction after a volatile start to ’22 has seen the ICE/Bank of America MOVE index surge back towards its recent peak, which was observed back in the depths of the initial COVID outbreak during Mar ’20.

- Earlier this week the J.P.Morgan rates strategy desk noted that “risk appetite has fallen, and this is evident in our Treasury Client Survey: the share of neutrals climbed to 74%, the highest since August 2017, and in reality amongst the highest readings we have observed over the last 15 years. In our minds, it’s likely this reflects relatively low conviction, as investors try to calibrate the Fed’s reaction function, amid both persistently above-target core inflation and a growth outlook that has weakened decisively.”

- More recently, a BMO survey noted that when it comes to the next move in 10-Year Tsy yields “46% see 2.50% being reached ahead of 3.50% and 54% see 3.50% initially.”

- With 10-Year yields trading around the mid-point of that range at present, the above lack of conviction, coupled with ongoing impaired liquidity in the Tsy market could make for an interesting round of post-NFP price action. An idea that is probably compounded by the Fed’s focus on suppressing inflation even if it comes at the expense of economic growth, which limits the read-through of today’s payrolls release when it comes to wider market pricing of future Fed policy.

JGBS: Assessing Policy Implications Of The Shooting Of Abe

Afternoon trade in JGBs focused on news that PM Abe, he was hospitalised as a result and is reportedly unconscious and in cardio-respiratory arrest. Futures initially ticked lower in the wake of the news, with participants perhaps looking at the potential knock-on impact of receding Abe influence in the Japanese policymaking sphere. e.g. the potential for expedited changes to defence and monetary policies, although the contract is off of worst levels into the Tokyo bell, -36 after making fresh session lows in the Tokyo afternoon. Cash JGBs are little changed to 3bp cheaper across the curve, with 7s weaker than surrounding lines owing to the move in futures, while 20s provide the weakest point on the curve.

- There wasn’t much in the way of pre-lunch news flow to digest for the space, outside of soft household spending data.

- Note that JPX data, released late on Thursday, revealed continued short covering of the wider net short position held by foreign investors last week, albeit at a slower rate than what was observed in the previous week (similar to what we suggested on the back of the weekly international security flow data).

- Looking ahead, core machine and machine tool orders data, in addition to an address from BoJ Governor Kuroda, headline domestic matters on Monday.

AUSSIE BONDS: Back From Cheapest Levels

ACGBs have recovered from session cheaps, with Cash ACGBs running 2.0-6.5bp cheaper across the curve, bear flattening. YM and XM are -5.5 and -3.0, respectively, after failing to meaningfully break out of their respective overnight ranges (YM did show through overnight lows, XM did not). Another push wider in EFPs suggests that swap flows helped keep the pressure on the space, even as futures moved off worst levels. Bills run 2 to 10 ticks cheaper through the reds, bear steepening.

- When it comes to the move off lows, the Aussie Bond space caught a light bid in tandem with core FI markets on the reported shooting of ex-Japanese PM Abe, with debate re: the impact of the event on Japanese policy continuity taking focus, particularly on issues of Japan’s defence and monetary policy stances.

- The latest round of ACGB Nov-24 supply went smoothly, with the weighted average yield pricing 2.45bp through prevailing mids which the cover ratio (4.6597x) came in above the 4.000x mark. Recent market stabilisation and clear demand for access to the line (as seen from the amount on loan via the RBA’s SLF) was expected to result in a smooth round of digestion for the auction.

- The AOFM issuance slate announced for next week saw little reaction in the ACGB space, with a cumulative A$1.5bn in Bonds A$2.5bn in Notes on offer.

- Looking to next week, the domestic data docket is virtually empty on Monday, with consumer confidence, business conditions, and household spending data expected to provide the first point of interest on Tuesday.

FOREX: Abe Shooting Inspires Rush To Safety, Yen Paces Gains

The yen turned bid and defensive flows swept across G10 FX space as Japanese media outlets reported that former PM Shinzo Abe was shot in the chest while on campaign trail in Nara. The incident raised questions over Japan's future policy trajectory, given Abe's strong influence over the ruling Liberal Democratic Party.

- The prospect of a shift in the distribution of power within the LDP reopened the debate over the sustainability of the BoJ's ultra-loose monetary policy. The Abe/Kuroda tandem was a critical driving force behind the Bank's powerful monetary easing. There was also speculation that PM Kishida could meet less resistance in pursuing his "new capitalism" reforms.

- JPY crosses went offered in the immediate reaction to the news, while USD/JPY implied volatilities climbed across the curve. Regional risk barometer AUD/JPY is ~1% off from its session highs.

- Price action across the rest of G10 FX space reflected wider aversion to risk as news from Japan diverted attention from other regional headlines/market moves. The greenback edged higher, out of sync with U.S. Tsy yields.

- U.S. NFP report provides the main point of note on today's data docket, with final U.S. wholesale inventories & Canadian jobs figures also due. Central bank speaker slate includes Fed's Williams and ECB's Lagarde, Muller, Visco & Villeroy.

FX OPTIONS: Expiries for Jul08 NY cut 1000ET (Source DTCC)

- USD/JPY: Y135.00($1.1bln)

- EUR/GBP: Gbp0.8585-00(E996mln)

- AUD/USD: $0.7100(A$2.2bln)

ASIA FX: Lower USD/Asia Levels Short Lived

Lower USD/Asia levels early in the session proved to be short-lived. Risk off took hold after reports that Japan's ex-PM Abe had been shot hit the wires. Lower US equity futures have weighed, while China equities are only modestly higher despite stimulus hopes. USD/CNH is back above 6.7000, likewise for USD/KRW above 1300. USD/THB's dip sub 36.00 also didn't last.

- CNH: USD/CNH has drifted higher, about +0.20% above NY closing levels. We are seeing selling interest closer to 6.7100 though, last at 6.7055/60. The CNY fixing was slightly weaker than expected, while China equities have only recorded modest gains, despite fresh stimulus hopes. Tomorrow, June inflation data is due.

- KRW: USD/KRW attempted to break sub 1296, but this proved to be short-lived. The pair is back above 1301 on broader risk aversion, as JPY rallied on news ex-PM Abe had been shot. The Kospi is holding up reasonably well (+1.00%), while offshore investors have added just under $90mn in local equities.

- INR: USD/INR is up modestly to 79.24, well up from yesterday's sub 79.00 lows, as analysts state it will take time for the RBI's measure to encourage capital inflows (announced on Wednesday) to aid the rupee. Brent crude is also firmer.

- THB: USD/THB has had a volatile session. Spot USD/THB last -0.057 at THB36.088, back from session low of THB35.890. Familiar technical levels remain in play. Thailand's central bank signalled that it would only intervene in FX markets to curb excessive volatility, adding that the baht's slump to six-year lows has reflected fundamentals. The BoT also played down the need to raise interest rates in line with the Fed.

- IDR: USD/IDR dipped in early trade but has edged higher. The 1 month NDF is back above 15000, while spot is at 14984, versus earlier lows of 14973. Consumer confidence eased back to 128.2 from 128.9 according to the BI measure for June.

- PHP: Spot USD/PHP had a look above PHP56.000 Thursday for the first time since 2005 as another round figure surrendered to the rallying pair. We are slightly lower today, last at 51.915, while momentum watchers should take note of the fact that the RSI for spot USD/PHP has remained in overbought territory for almost a month now. BSP Governor Medalla upped the ante ahead of next month's monetary policy meeting, suggesting that members are ready to consider an outsized half-point rate hike.

CHINA: Busy Data Week Coming Up

China's data calendar swings back into gear tomorrow. PPI and CPI prints are out for June. PPI is expected to ease to 6.0% from 6.4%, but CPI is forecast to rise to 2.4%, versus 2.1% previously. There is some chatter of a potentially higher CPI print due to rising food prices. The authorities have steeped in to curb pork prices rises this week.

- Beyond that, from Monday onwards aggregate financing and new loans for June are also due. Further gains are expected in both prints (aggregate finance to 4200bn yuan versus 2792.1bn previously, and new loans to 2400bn yuan from 1883.6bn yuan).

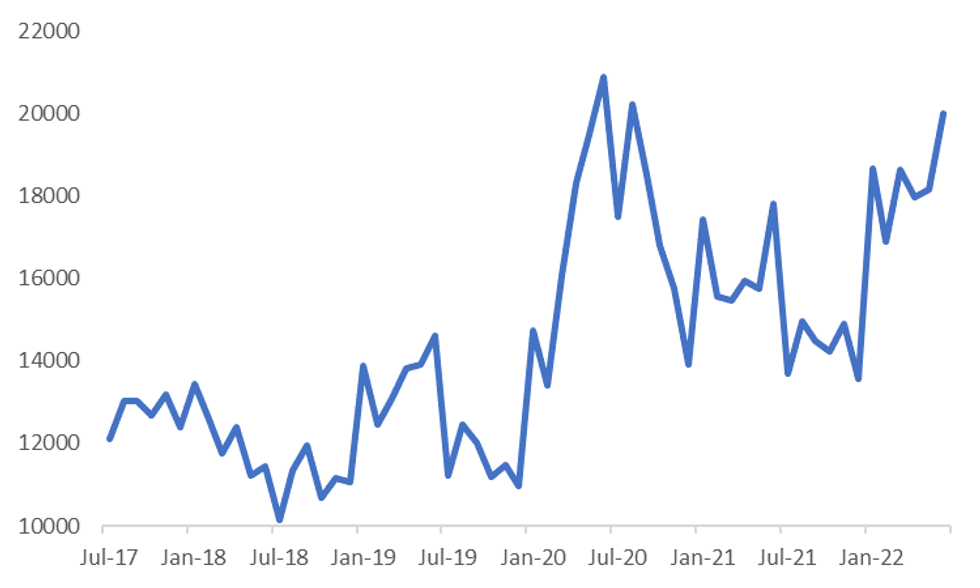

- If the projected increase in aggregate finance is realized it would push the rolling 6 month sum of financing activity back close to 2020 highs, see the chart below.

Fig 1: China Aggregate Finance - 6 Month Sum (Assumes June Consensus Forecast Is Realized)

Source: MNI - Market News/Bloomberg

- On Wednesday trade figures are due for June. The market expects export and import growth to ease slightly (12.9%yoy from 16.9% for exports and 4.0% from 4.1% for imports). The trade surplus is forecast to remain strong at $76.80bn, versus $78.76bn last month.

- From Wednesday onwards we may also have the 1-yr MLF lending decision. No change is expected at 2.85%.

- On Friday, we get the monthly data run for June. IP and retail sales are expected to improve further, but fixed asset investment is forecast to moderate.

- The same day also delivers Q2 GDP, which is expected to contract by -2.3% in QoQ terms, bringing YoY growth down to 1.0% from 4.8% in Q1. These numbers may be revised as more forecasts are submitted to Bloomberg.

EQUITIES: Off Best Levels

Major Asia-Pac equity indices trade higher at typing but are off their respective best levels, with tailwinds from a BBG report on Thursday (re: potential support for the Chinese economy through frontloading of local government bond issuance) waning. Elsewhere, news of ex-Japanese PM Abe being shot dragged Japanese stocks from session highs after the lunch hour with defensive flows evident, seeing e-minis hit session lows, and the yen turning bid on the news.

- The Nikkei 225 trades 0.7% higher at typing, paring gains of as much as 1.5% on news of Abe’s shooting. Focus has turned to the parsing of the event’s impact re: the policy continuity (as fleshed out previously), with some debate re: the government’s stance towards monetary policy easing and PM Kishida’s stance on taxes and share buyback rules observed.

- The Hang Seng Index sits 0.1% better off at writing, operating around session lows after opening ~1.5% higher. The properties sub-gauge (+0.3%) contributed the most to gains, narrowly countering underperformance in the financials sub-index, while tech names have pared opening gains, with the Hang Seng Tech Index dealing 0.4% firmer at typing (down from +2.2% earlier).

- The ASX200 trades 0.6% firmer at typing, putting it on track for a fourth day of gains in five. Commodity-related stocks outperformed, with the energy sub-index sitting 2.6% better off, rebounding from losses in recent sessions as major crude benchmarks have stabilised.

- U.S. e-minis deal 0.3% - 0.4% worse off at typing, a touch above their respective session lows.

GOLD: A Little Higher In Asia As Dollar Eases

Gold sits $3/oz firmer to print $1,743/oz at typing, a little shy of best levels, operating comfortably within Thursday’s range at typing. The precious metal has caught a minor bid amidst a downtick in the USD, with the DXY off worst levels, but operating below the 107.00 handle at typing.

- To recap Thursday’s price action, gold closed $1/oz higher, edging away from Wednesday’s nine-month lows, narrowly snapping a three-day streak of losses in the process. The flat performance in gold came as the DXY struggled to break through Wednesday’s 20-year highs, mixing with a limited downtick in U.S. real yields.

- Gold nonetheless remains on track for a fourth weekly decline, the longest such losing streak since mid-May, as focus remains squarely on DM central bank hawkishness, countering wider recession-related worry.

- From a technical perspective, conditions remain bearish for gold. A break of initial support at $1,753.1/oz (Dec 15 ‘21 low) was broken prior, exposing support at $1,721.7/oz (Sep 29 ‘21 low). On the other hand, resistance is seen at $1,787.0/oz (May 16 low and recent breakout level).

OIL: Range Bound In Asia; Shanghai COVID Outbreak Remains In Focus

WTI and Brent are flat to $0.20 softer apiece at writing, operating within ~$1.20 trading ranges through Asia-Pac dealing. Both benchmarks sit ~$2 off Thursday’s best levels, with worry re: developments in China’s ongoing COVID outbreak remaining in focus, adding to downward pressure on the space from a surprise build in U.S. crude inventories.

- To elaborate on the latter, U.S. EIA crude inventory data crossed on Thursday, with a relatively large, surprise build in U.S. crude stockpiles reported (8.2mn bpd). Gasoline and distillate inventories declined, while there was a minor build in Cushing hub stocks. WTI and Brent briefly hit session highs on the release before quickly falling below pre-release levels, ultimately closing ~$4 higher apiece on the day, finding support from well-documented global crude undersupply fears.

- Turning to China, fresh COVID cases have been reported in more cities/provinces in the country’s east (particularly for Shandong province, which reported 66 cases after reporting no cases last week), while Shanghai’s case count for Thursday remains relatively high (45 vs. 54 for Wed), fuelling lockdown fears (although all cases were detected “in quarantine”).

- Elsewhere, worry remains elevated re: an impending court order to halt to loadings from a Caspian Pipeline Consortium (CPC) port on the Black Sea (potential to disrupt >1mn bpd of Kazakh crude), with the CPC requesting a delay of the order over concerns of permanent damage to facilities.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/07/2022 | 0645/0845 | * |  | FR | Foreign Trade |

| 08/07/2022 | 0645/0845 | * |  | FR | Current Account |

| 08/07/2022 | 0800/1000 | * |  | IT | Industrial Production |

| 08/07/2022 | 1155/1355 |  | EU | ECB Lagarde at Les Rencontres Economiques | |

| 08/07/2022 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 08/07/2022 | 1230/0830 | *** |  | US | Employment Report |

| 08/07/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 08/07/2022 | 1230/0830 |  | US | New York Fed's John Williams | |

| 08/07/2022 | 1400/1000 | ** |  | US | Wholesale Trade |

| 08/07/2022 | 1500/1100 |  | US | New York Fed's John Williams | |

| 08/07/2022 | 1900/1500 | * |  | US | Consumer Credit |

| 09/07/2022 | 0130/0930 | *** |  | CN | CPI |

| 09/07/2022 | 0130/0930 | *** |  | CN | Producer Price Index |

| 09/07/2022 | 1330/1530 |  | EU | ECB Schnabel on Green Economy |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.