-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI EUROPEAN OPEN: Fed Day, 75bp Step Eyed

EXECUTIVE SUMMARY

- BIDEN-XI CALL TO TAKE PLACE THURSDAY, PER REPORTS

- ECB'S DE COS SAYS RISKS TO INFLATION OUTLOOK IN EUROZONE HAVE INTENSIFIED (RTRS)

- RISHI SUNAK IN MAJOR TAX U-TURN AS HE ANNOUNCES PLAN TO SCRAP VAT ON ENERGY BILLS (SKY)

- TURKEY SAYS UKRAINE GRAIN EXPORTS COULD START WITHIN A WEEK (BBG)

- CHINA’S BORROWING COST SLUMP SHOWS LIMITS OF PBOC POLICY EASING (BBG)

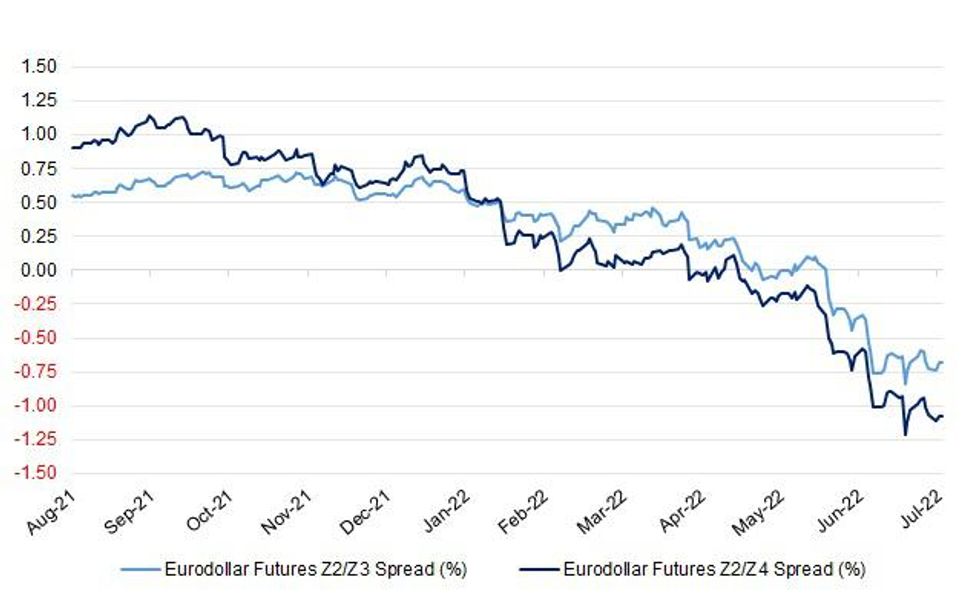

Fig. 1: Eurodollar Futures Z2/Z3 Spread (%) Vs. Eurodollar Futures Z2/Z4 Spread (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: Liz Truss and Rishi Sunak last night accused each other of immoral economic policies before the second televised Tory leadership debate was cut short after a presenter collapsed. (The Times)

POLITICS/FISCAL: Rishi Sunak has announced a plan to scrap VAT on energy bills - a significant U-turn on his previous pledge not to make any immediate tax cuts. (Sky)

POLITICS: Senior Conservatives have privately voiced scepticism about a poll demanding party members be given a vote on the removal of Boris Johnson, after the party’s headquarters found fewer than half of a sample of signatories were party members. (Guardian)

EUROPE

ECB: Risks to the inflation outlook in the eurozone remain on the upside and have intensified, particularly in the short term, European Central Bank policymaker Pablo Hernandez de Cos said on Tuesday. (RTRS)

GERMANY: Germany is rethinking its plan to exit nuclear power by the end of the year, as concern increases that Russia’s moves to cut gas supplies could trigger a winter electricity crunch in Europe’s largest economy. (FT)

U.S.

ECONOMY: Treasury Secretary Janet Yellen to hold a news conference on the economy Thursday at 1:30pm Washington time, according to a statement. (BBG)

ECONOMY: All the same, consumers are holding their own for now, according to Brian Deese, the director of the National Economic Council at the White House, though they are directing their spending to different things as conditions change. “We’re seeing less spending on goods, more spending on services and we are seeing some discounting activity as well,” Deese said at a news conference on Tuesday. (BBG)

FISCAL: President Joe Biden is considering extending a pause on student loan repayments for several more months, as well as forgiving $10,000 in student loan debt per borrower, according to people familiar with the matter, as he seeks to appeal to young voters ahead of the November midterms. (BBG)

HOUSING: U.S. mortgage rates look like they have already peaked and home prices are not likely to fall on a national basis, boosting the chances the broader economy will dodge recession, Freddie Mac deputy chief economist Len Kiefer told MNI. (MNI)

EQUITIES: Google parent Alphabet Inc. reported the slowest quarterly sales growth in two years, as macroeconomic pressures weigh on the market for digital ads. Alphabet posted $69.69 billion of second-quarter revenue on Tuesday, up 13% from the same period last year. That marked the slowest rate of growth since the second quarter of 2020, when the pandemic crimped demand for advertising in some areas, including travel. (WSJ)

EQUITIES: Microsoft shares rose 5% in extended trading on Tuesday after the software maker issued a rosy income forecast for the year ahead, despite issuing quarterly results that failed to reach Wall Street consensus. Microsoft turned in the slowest revenue growth since 2020, at 12% year over year in the quarter, which ended on June 30, according to a statement. (CNBC)

OTHER

GLOBAL TRADE: Turkey said grain exports from Ukrainian ports could resume within a week and reach 25 million tonnes by the end of the year, after it brokered a deal between Kyiv and Moscow that eased fears of a global food crisis. Exactly when exports halted by Russia’s invasion would begin will be determined by logistical groundwork, Turkish President Recep Tayyip Erdogan’s spokesman, Ibrahim Kalin, said in an interview on Tuesday. (BBG)

GLOBAL TRADE: A bipartisan bill to bolster domestic semiconductor manufacturing and boost U.S. competitiveness with China has cleared a key Senate vote, setting it up for final passage in the chamber in the coming days. (BBG)

U.S./CHINA: U.S. President Joe Biden and China's leader Xi Jinping are expected to talk on Thursday, a source familiar with the planning said, amid fresh tensions over Taiwan and Russia's invasion of Ukraine. White House national security spokesperson John Kirby told reporters on Tuesday that managing economic competition between the two countries would also be a focus of the call. (RTRS)

U.S./CHINA: The Chinese military’s “aggressive and irresponsible behavior” in the South China Sea is one of the most significant threats to peace and stability in the Indo-Pacific and it is only a matter of time before there is a major incident or accident, a senior Pentagon official said on Tuesday. (BBG)

U.S/CHINA: The U.S. public company accounting regulator will not accept any restrictions on its access to the audit papers of Chinese companies listed in New York, including where firms have been delisted, two people with knowledge of the U.S. agency's thinking told Reuters. (RTRS)

U.S./CHINA/TAIWAN: The United States should focus on whether Taiwan has weapons that "are adequate to the threat that may come from mainland China," U.S. Senate Republican leader Mitch McConnell said on Tuesday. (RTRS)

U.S./CHINA/RUSSIA: Senator Marco Rubio wants the US to sanction China’s purchases of oil and other energy supplies from Russia in an effort to cut off funding for that country’s war against Ukraine. (BBG)

SOUTH KOREA: South Korean consumers' inflation expectations in July hit their highest in at least 20 years, a central bank survey showed on Wednesday, suggesting a rising challenge for authorities in containing price rises. (RTRS)

HONG KONG: Hong Kong will have no choice but to raise interest rates, although the pace or scale need not follow US hikes and it is unlikely to trigger the kind of property market crisis seen in 1998, according to the city’s financial secretary. (SCMP)

BRAZIL: Top Brazilian bankers and businessmen issued a letter on Tuesday in defense of Brazil's electronic voting system that has been attacked by far-right President Jair Bolsonaro, and warned that the country's democracy was in "grave danger." (RTRS)

UKRAINE: Ukraine’s state-owned energy company said it’s on track to default on its foreign bonds after the government issued a decree last week compelling it to pursue a debt moratorium that creditors have so far rejected. (BBG)

ENERGY: At a time when natural gas buyers are fighting over every last molecule, China -- the world’s top importer -- is noticeably quiet. In stark contrast to rivals across the region, China’s liquefied natural gas importers aren’t procuring additional shipments for winter, gambling that the nation’s Covid Zero policy will continue to temper demand, said traders. A global supply crunch has made LNG very expensive, and traders don’t want to pay if the fuel won’t be needed. (BBG)

CHINA

PBOC/CREDIT: There is so much cash sloshing around China’s banking system and so little appetite for loans that a key rate has dropped to a level unseen since January 2021. The cost to borrow in the overnight repo market fell below 1% on Wednesday, down 94 basis points this month, in another sign that much of the liquidity the People’s Bank of China is providing is sitting in banks. (BBG)

FISCAL: China should increase fiscal policy intensity to maintain recovery momentum in the second half of the year, including issuing special treasury bonds or front-loading next year’s quota of local government special bonds, Yicai.com reported citing analysts. If without additional fiscal policy to help fill local governments’ funding gap caused by lower land sales revenues and increased spending on pandemic controls, infrastructure investment and economic growth may decelerate in Q4, Yicai said citing Luo Zhiheng, chief economist of Yuekai Securities. Zhu Baoliang, chief economist of the State Information Center believes it requires additional quotas of special bonds from 2023 and CNY1 trillion special treasury bonds to fill the gap in H2, said Yicai. (MNI)

INFRASTRUCTURE: China’s infrastructure investment may grow over 10% y/y in Q3, supported by the expected use of over CNY2 trillion in local government special bonds, a CNY800 billion credit line of policy banks and CNY300 billion in financial bonds by policy banks, the Securities Times reported citing analysts. The issuance of a planned CNY3.65 trillion special bonds this year has basically been completed, much earlier than in previous years, which help to offset the decline in land sales revenue for local governments, the newspaper said citing analysts. As of June, local governments have issued CNY3.41 trillion of special bonds, with the issuance in June peaking at CNY1.37 trillion, the newspaper said citing data by the Ministry of Finance. (MNI)

CORONAVIRUS: China's central metropolis of Wuhan temporarily shut some businesses and public transport in a district with almost a million people on Wednesday, as the city where the pandemic first emerged raised vigilance after several new infections. (RTRS)

PROPERTY: China’s real estate market may see a soft landing in the second half of the year as it accelerates recovery, according to a commentary on 21st Century Business Herald written by Pang Ming, chief economist at JLL Greater China. Major indicators, such as land acquisition, new project starts and construction are expected to bottom out around end-Q3 with further policy support, Pang said. Housing hotspots, even first- and second-tier cities are expected to further relax purchase and loan restrictions, as well as lower transaction taxes and fees, while developers will receive necessary credit support, said Pang. (MNI)

PROPERTY: Country Garden Holdings Co. is looking to raise about HK$2.83 billion ($361 million) selling new shares at a discount, further underscoring the liquidity problems faced by Chinese property developers. (BBG)

CHINA MARKETS

PBOC NET DRAINS CNY1 BILLION VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) injected CNY2 billion via 7-day reverse repos with the rate unchanged at 2.10% on Wednesday. The operation has led to a net drain of CNY1 billion after offsetting the maturity of CNY3 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.6236% at 09:31 am local time from the close of 1.5766% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 42 on Tuesday vs 43 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7731 WEDS VS 6.7483

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.7731 on Wednesday, compared with 6.7483 set on Tuesday.

OVERNIGHT DATA

CHINA JUN INDUSTRIAL PROFITS +0.8% Y/Y; MAY -6.5%

CHINA JUN INDUSTRIAL PROFITS YTD +1.0% Y/Y; MAY +1.0%

AUSTRALIA Q2 CPI +6.1% Y/Y; MEDIAN +6.3%; Q1 +5.1%

AUSTRALIA Q2 CPI +1.8% Q/Q; MEDIAN +1.9%; Q1 +2.1%

AUSTRALIA Q2 CPI TRIMMED MEAN +4.9% Y/Y; MEDIAN +4.7%; Q1 +3.7%

AUSTRALIA Q2 CPI TRIMMED MEAN +1.5% Q/Q; MEDIAN +1.5%; Q1 +1.4%

AUSTRALIA Q2 CPI WEIGHTED MEDIAN +4.2% Y/Y; MEDIAN +4.3%; Q1 +3.2%

AUSTRALIA Q2 CPI WEIGHTED MEDIAN +1.4% Q/Q; MEDIAN +1.5%; Q1 +1.0%

SOUTH KOREA JUL CONSUMER CONFIDENCE 86.0; JUN 96.4

UK JUL BRC SHOP PRICE INDEX +4.4% Y/Y; JUN +3.1%

July saw the highest rate of shop price inflation since our index began in 2005, as heightened cost pressures continued to filter through to customers. Rising production costs – from the price of animal feed and fertiliser to availability of produce, exacerbated by the war in Ukraine – coupled with exorbitant land transport costs, led food prices to rocket to 7 per cent. Some of the biggest rises were seen in dairy products, including lard, cooking fats and butter. Meanwhile, non-food prices were hit by rising shipping prices, production costs and continued disruption in China. (BRC)

MARKETS

SNAPSHOT: Fed Day, 75bp Step Eyed

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 59.86 points at 27715.07

- ASX 200 up 13.627 points at 6820.90

- Shanghai Comp. down 3.063 points at 3274.373

- JGB 10-Yr future up 1 tick at 150.22, yield down 0.5bp at 0.206%

- Aussie 10-Yr future up 6.5 ticks at 96.695, yield down 6.7bp at 3.273%

- U.S. 10-Yr future -0-04+ at 119-23, yield down 0.36bp at 2.803%

- WTI crude up $0.23 at $95.21, Gold down $2.83 at $1714.48

- USD/JPY up 10 pips at Y137.01

- BIDEN-XI CALL TO TAKE PLACE THURSDAY, PER REPORTS

- ECB'S DE COS SAYS RISKS TO INFLATION OUTLOOK IN EUROZONE HAVE INTENSIFIED (RTRS)

- RISHI SUNAK IN MAJOR TAX U-TURN AS HE ANNOUNCES PLAN TO SCRAP VAT ON ENERGY BILLS (SKY)

- TURKEY SAYS UKRAINE GRAIN EXPORTS COULD START WITHIN A WEEK (BBG)

- CHINA’S BORROWING COST SLUMP SHOWS LIMITS OF PBOC POLICY EASING (BBG)

US TSYS: Tight Pre-FOMC Asia Trade

Tsys experienced a limited round of Asia-Pac trade, which is typical of pre-FOMC decision sessions, with a tech (Microsoft & Alphabet) earnings/guidance related bid in e-mini futures and an Australian CPI-related bid in ACGBs having little impact on the space. TYU2 deals -0-04 at 119-23+, sticking within a 0-06 range on sub-par volume of ~57K. Cash Tsys are flat to 0.5bp richer across the curve.

- Flow was headlined by block buys in TYU2 120.50 calls (+5.0K over 2 blocks) and FV 113.00 calls (+2.0K).

- Wednesday’s domestic docket Is headlined by the latest FOMC monetary policy decision, with consensus looking for a 75bp rate hike. Focus will be on Powell’s press conference and the Statement that accompanies the decision, assuming the 75bp hike is delivered. The key immediate question is re: the FOMC’s thinking on the magnitude of the next rate hike. A reduction in the size of hikes is likely starting in September, especially given weakening economic data and the ongoing moderation in inflation expectations. But for now the FOMC is likely to be non-committal, apart from saying that it anticipates ongoing hikes are appropriate (see our full preview here: https://marketnews.com/mni-fed-preview-july-2022 ).

- Note that the likes of the EDZ2/Z3 and EDZ2/Z4 spreads operate a touch above their deepest levels of inversion ahead of the FOMC decision, but the pullbacks have been shallow thus far. Elsewhere, the 3-month/3-month 18 months forward yield spread sits around the 55bp mark, hovering just above its own cycle flats.

- Wednesday will also bring the release of prelim. durable goods data, as well as pending home sales and MBA mortgage apps.

JGBS: Long End Bid Dominates Tokyo Trade

JGB futures have recovered from lows during the Tokyo afternoon, last dealing +5. This comes after the contract found some poise alongside the wider core global FI space in the wake of the latest Australian CPI reading, although moves were limited.

- Cash JGBs have continued their early twist flattening, as the major benchmarks run 0.5bp cheaper to 5bp richer, with 20+-Year paper bid from the get go. A reminder that yesterday’s well-received 40-Year JGB auction has been a trigger for notable flattening of the wider JGB curve, with 40s now operating ~15bp shy of yesterday’s yield peak.

- The bid seems JGB centric, with swap spreads wider across the entire curve, while only 30- & 40-Year swap rates are (marginally) lower on the day.

- Both domestic and macro headline flow has been rather limited since the Tokyo open, leaving cross-market impetus at the fore.

- BlueBay Asset Management have noted that they maintain their notable short position in 10-Year JGBs, even in light of the recent rally/BoJ defence of its current YCC settings, with their CIO stating that “we have been looking for the Bank of Japan to signal a policy shift in September as inflation continues to rise with the yen trending weaker as policies diverge. This continues to be the case.”

- Looking ahead, 2-Year JGB supply headlines Thursday’s domestic docket.

AUSSIE BONDS: Richer Post-CPI As 75bp Hike Swept Off The Table

Aussie bonds are comfortably higher after Australia’s Q2 CPI print, catching a bid as the slight miss in headline inflation has spurred a downward revision of RBA rate hike bets for the Aug meeting. Cash ACGBs are a little off best levels, running 6.0-11.5bp richer across the curve, bull steepening, with 3s sitting 10.0bp richer after printing as much as 14bp cheaper earlier. YM is +11.0, operating comfortably through its overnight highs, while XM is +7.0, sitting just shy of its own overnight peak. Bills run 10 to 19 ticks richer through the reds, bull steepening.

- Australian Q2 headline CPI missed expectations slightly (+6.1% Y/Y vs. BBG median +6.3%), although trimmed mean CPI (the RBA’s preferred measure of underlying inflation for this slate of data) came in slightly above expectations (+4.9% Y/Y vs. BBG median +4.7%), with the ABS noting that the figure was at the “highest since the series commenced in 2003”.

- The data has seen Goldman Sachs and Deutsche reduce their calls for 75bp rate hikes in Aug to 50bp, with NAB, CBA, and ANZ re-affirming their previous calls for 50bp of tightening next month.

- STIR markets have unwound any pricing of a 75bp RBA hike in Aug, and currently price just under 50bp of tightening at that meeting (vs. ~56bp prior to the CPI print). A cumulative ~191bp is now priced in for the remaining five meetings of the year, pointing to an average of ~38bp of tightening at each meeting (on a simple average basis), with a cumulative ~20bp of tightening premium through the remainder of ’22 unwound post-CPI.

- Thursday will see the release of Jun retail sales and Q2 terms of trade, while Treasury Secretary Dr Chalmers is expected to deliver his economic update for July in parliament at some point in the day, having noted earlier on Wednesday that he would be addressing “confronting” news re: a lower national growth outlook and the impact of inflation on real wage growth.

EQUITIES: Mostly Lower In Asia; Chinese Developers Resume Slide

Most major Asia-Pac equity indices are lower at typing on the back of a negative lead from Wall St., with Japanese stocks narrowly bucking the broader trend of losses.

- The Hang Seng brings up the rear amongst peers, dealing 1.6% softer at typing, seeing the property sub-index (-2.6%) lead the way lower after an announced ~$361mn share placement by Chinese developer Country Garden Holdings (-14.0%) raised worry re: wider liquidity worries in the sector. Large-cap Alibaba Group (-3.8%) was among the Hang Seng’s worst performers, erasing the bulk of its 4.8% move higher on Tuesday, with the HSTECH (-1.7%) underperforming as well.

- The Nikkei 225 trades 0.1% higher at typing, with the broader TOPIX index sitting a shade above neutral levels. Semiconductor and pharmaceuticals lead gains in the index, offsetting weakness in energy and retailers (with large-cap Fast Retailing sitting 1.3% weaker at typing).

- The ASX200 has pared its pre-CPI decline of as much as 0.4% to sit a shade below neutral levels at writing, with the financials sub-index (+0.6%) hitting seven-week highs after reversing earlier losses, contributing to outperformance in the healthcare (+1.3%) and consumer staples (+0.6%) sub-indices. Tech-related equities struggled, with the S&P/ASX All Tech Index trading 0.7% lower, tracking some of the weakness in U.S. tech stocks on Tuesday.

- E-minis deal 0.3% to 1.4% firmer apiece, off best levels, but holding on to the bulk of its gains observed after Google and Microsoft’s earnings beat after the bell on Tuesday.

OIL: Little Changed In Asia; U.S. Crude Inventories Eyed

WTI is ~+$0.20 and Brent is virtually unchanged at typing, with both benchmarks operating a little above their respective Tuesday’s troughs.

- To recap, WTI and Brent closed between ~$1-2 lower on Tuesday, reversing earlier gains of as much as ~$2.20 apiece, with worry re: economic growth exacerbated after the IMF’s lowered its global growth outlook in ‘22 from 3.6% to 3.2% while stating that the risk of a recession in ‘23 was “particularly prominent”.

- Adding to the gloom, U.S. new home sales and Conf. Board consumer confidence hit two-year and seventeen-month lows respectively after missing expectations, offsetting the beat from the earlier Richmond Fed m’fing index print, with WTI and Brent falling to session lows after the data release.

- Both benchmarks currently trade a little below levels observed prior to the latest round of U.S. API inventory estimates on Tuesday, despite reports pointing to a significantly larger-than-expected drawdown in crude stockpiles, more than unwinding the build reported last week. Elsewhere, gasoline and distillate inventories declined, while there was a build in Cushing hub stocks.

- Looking ahead, the EIA’s Weekly Petroleum Status Report will cross at 1530 BST, with BBG median estimates calling for a build in crude inventories.

GOLD: Range Bound Ahead Of FOMC; Little Moved On Growth Worry

Gold sits virtually unchanged to print ~$1,717/oz at typing after sticking to a ~$4/oz range, with the precious metal seeming content to operate around the $1,720/oz handle in recent sessions.

- To recap, gold closed ~$2/oz lower on Tuesday amidst an uptick in the USD (DXY) and U.S. real yields, with its daily trading range narrowing for a third consecutive day, as proximity to the upcoming FOMC decision (with a 75bp hike fully priced in) again likely contributed to its muted moves.

- Gold was little-changed in the wake of the IMF’s downward revision to global GDP growth for ‘22 (from 3.6% to 3.2%), with the organisation also stating that it would be "increasingly challenging" for the U.S. to avoid a recession.

- OIS markets currently point to ~78bp of tightening for the Jul FOMC, with a cumulative ~139bp priced in through to the Fed’s Sept meeting, pointing to ~56% odds of a 75bp hike then. Focus later will be on the Statement and comments from Fed Chair Powell, particularly over cues to the size of the next hike.

- From a technical perspective, short-term gains in gold still appear to be corrective, following its bounce off $1,681.0/oz last Thursday. Previously outlined levels remain intact, with initial support situated at $1,697.7/oz (Jul 14 low), and resistance seen at $1,745.4/oz (Jul 13 high).

FOREX: AUD Takes Hit As CPI Data Inspires RBA Re-Pricing, Earnings Reports Buoy Risk

Risk sentiment improved on the back of decent earnings reports from two U.S. tech giants (Microsoft & Alphabet), which pushed e-mini futures higher. This sapped some strength from traditional safe havens such as the USD, JPY and CHF.

- Sales of Aussie dollar stole the limelight later in the session, as the market dialled back expectations of an outsized rate hike from the RBA in response to Australia's quarterly CPI data. Modest pricing of a 75bp rate rise in August was reduced to zero as headline annual inflation missed, even as the trimmed mean topped estimates. When this is being typed, the market prices a ~79% chance of a 50bp hike next month.

- AUD weakness spilled over into the kiwi dollar to an extent, as New Zealand's headline flow failed to provide much in the way of notable catalysts. AUD/NZD probed the water below NZ$1.1100 amid a drop in Australia/New Zealand 2-year swaps spread.

- While Australian inflation data influenced price action in Asia, risk relief remained evident in the European FX bloc. NOK led the Scandies higher, outperforming all of its major peers, while EUR was the second-best performer in G10 FX space despite familiar risks to the Eurozone's economic outlook.

- The key risk event today is the announcement of the FOMC's monetary policy decision, with firm consensus for a 75bp hike shifting focus to the statement and comments from Fed Chair Powell.

- Post-Asia data releases include U.S. durable goods orders, wholesale inventories & pending home sales.

FX OPTIONS: Expiries for Jul27 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0100(E1.5bln), $1.0125(E650mln), $1.0197-10(E1.7bln), $1.0250-55(E1.2bln), $1.0270(E533mln), $1.0300(E1.1bln)

- EUR/JPY: Y142.40(E1.4bln)

- USD/CAD: C$1.2750($590mln), C$1.2850-55($850mln), C$1.2910-25($648mln)

- USD/CNY: Cny6.7000($1.2bln), Cny6.7500($617mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/07/2022 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 27/07/2022 | 0600/1400 | ** |  | CN | MNI China Liquidity Suvey |

| 27/07/2022 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 27/07/2022 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 27/07/2022 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 27/07/2022 | 0800/1000 | ** |  | EU | M3 |

| 27/07/2022 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 27/07/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 27/07/2022 | 1230/0830 | ** |  | US | durable goods new orders |

| 27/07/2022 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 27/07/2022 | 1400/1000 | ** |  | US | NAR pending home sales |

| 27/07/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 27/07/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 27/07/2022 | 1800/1400 | *** |  | US | FOMC Statement |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.