-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: JPY Rallies, Bund Futures Cheapen

- Weakness in Bund futures ahead of and after German regional CPI data out of NRW applied pressure to the core FI space in overnight dealing, meaning U.S. Tsys unwound their early Asia uptick.

- JPY was the clear outperformer in the G10 FX space as Tokyo reacted to the potential for a slower, data-dependent round of tightening from the Federal reserve. Exiting short positioning in JPY may have aided the move.

- Looking ahead, focus turns to German CPI as well as U.S. advance GDP data. Comments are due form ECB Governing Council member Visco. Participants will also be on the lookout for comments surrounding the latest phone call between U.S. President Biden & Chinese counterpart Xi.

US TSYS: Bund Weakness Unwinds Early Richening

Initial Asia-Pac trade saw regional participants lift Tsys as they looked towards the prospect of a slower round of data-dependent Fed hikes post-FOMC. That was before a pre-NRW CPI dip in German Bund futures pulled the space away from best levels (with the data release itself promoting some short-term vol. in Bunds). TYU2 printed a fresh session low on the back of that data release, and now operates -0-01 off the base of its 0-10+ range, -0-14+ at 119-31, with volume running at a fairly non-descript ~85K. Cash Tsys are marginally mixed across the curve, last dealing -/+0.5bp vs. Wednesday’s closing levels.

- Macro headline flow remains light and the move in Tsys is quite muted when you consider that USD/JPY has shed over 100 pips as Tokyo FX dealers react to the potential for a slower, data-driven round of hikes from the Federal Reserve, with that particular move perhaps being exacerbated by short JPY positioning.

- Looking ahead, German CPI data (on the regional and national levels) will generate interest. Meanwhile, the initial Q2 GDP reading provides the highlight of Thursday’s NY docket (with median estimates looking for the U.S. to escape a technical recession). Weekly jobless claims data and the Kansas City Fed m’fing activity reading are also due, as is 7-Year Tsy supply.

- Participants will also be on the lookout for comments surrounding the latest phone call between U.S. President Biden & Chinese counterpart Xi.

JGBS: Two-Way Session, Curve Twist Steepens

JGB futures have been dragged around by the wider impetus observed in the core global FI space, with the initial uptick reversed by some spill over from the previously outlined weakness in German Bunds. That leaves the contract -5 ahead of the Tokyo close.

- The wider spread downtick in core global FI markets has promoted a further steepening of the JGB curve during the Tokyo afternoon, building on the morning theme, with the major cash benchmarks running 1bp richer to 3bp cheaper, pivoting around 7s. Payside flows in super-long swaps seemed to have helped the long end to cheapen after a couple of days of aggressive flattening of the JGB curve (aided by a well-received round of 40-Year JGB supply)

- Note that the modest bid in the short-end of the curve (2s represent the strongest point) comes in lieu of a well-received round of 2-Year JGB supply. In terms of auction specifics, the low price printed above broader expectations, while the price tail narrowed. The cover ratio came in a little below the six-auction average, but bettered the level observed at the previous auction. The BoJ’s on-hold monetary policy stance likely contributed to the smooth takedown, adding to demand from offshore investors on the lookout for attractive FX-hedged yield pickups on offer, countering negatives from a move away from cycle cheaps (on the BoJ’s decision to stand pat), as well as the steepness of the JGB curve.

- A sidenote that JPY strength was the most notable theme in Tokyo FX trade, as participants reacted to the potential for a slower round of data-dependent Fed hikes in the coming months. Existing short positioning in JPY may have accelerated the move.

- Domestic headline flow has been non-existent, outside of the previously flagged weekly international security flow data which seemingly saw an end of the recent streak of short covering in JGBs on the part of international investors.

- Looking ahead, Friday’s domestic docket will be headlined by Tokyo CPI, retail sales, industrial production and the labour market report. The BoJ will also conduct its latest round of Rinban operations, in addition to releasing the summary of opinions from its most recent monetary policy meeting.

AUSSIE BONDS: Back From Best Levels

Aussie bonds have steadily backed away from best levels as we have worked our way through the Sydney day, mirroring a similar pullback in U.S. Tsys alongside weakness in German Bunds. Cash ACGBs run flat to 6.5bp richer across the curve, bull steepening, with 3s sitting 6bp richer at typing, back from as much as 14bp richer earlier. YM and XM are +8.0 and +4.5, respectively, with the former sliding back below its overnight high. Bills run 8 to 11 ticks richer through the reds, bull flattening. EFPs have narrowed, with a notable steepening of the 3-/10-Year box in play.

- ACGBs were little changed on the domestic retail sales data miss (+0.2% M/M vs. BBG median +0.5%) after quickly reversing an initial blip lower. Elsewhere, Australian Treasurer Chalmers’ state of the economy address did little to rock the Aussie bond space, delivering a cut to GDP growth outlook, while forecasting that inflation will hit 32-year highs at 7.75% by end-22.

- Friday will see Q2 PPI and Jun private sector credit headline the data docket, while A$1.0bn of ACGB Nov-33 will be on offer, followed by the release of the AOFM’s weekly issuance slate

JAPAN: Trends In Bond Flows Broken

The latest round of Japanese weekly international security flow data revealed that Japanese investors put an end to the longest streak of weekly net sales of foreign bonds on record (8 weeks), lodging a fairly paltry round of weekly net purchases of foreign paper last week.

- Elsewhere, foreign investors were marginal net sellers of Japanese bonds, breaking a streak of 4 weeks of net buying that represented short cover after the BoJ stepped up the defence of its YCC parameters and reinforced its on hold stance in June.

- Finally, Japanese investors lodged net purchases of offshore equities for a sixth consecutive week, while foreign investors were net buyers of Japanese equites for a third consecutive week, although both net numbers were unremarkable.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 107.9 | -910.2 | -3705.4 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | 230.6 | 321.7 | 2432.2 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | -15.6 | 1753.2 | 4134.6 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 298.1 | 475.0 | 809.2 |

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

FOREX: Post-FOMC Aftershocks Test Limits Of Shorting Yen

Initially modest USD/JPY sales accelerated over the Tokyo fix, sending the pair toward the Y135.00 mark as bears forced their way through Jul 22 low of Y135.72. Regional players digested the Fed's monetary policy decision and the subsequent press conference with Fed Chair Powell, who raised the prospect of a slower, more data-dependent rate hike path.

- The discrepancy between the Fed's aggressively hawkish posturing and the BoJ's dovish resolve has been a key driver of the dramatic rally in USD/JPY over the past few months.

- Post-FOMC musings lent some support to U.S. Tsys in Asia hours, promoting some light narrowing in the yield gap with Japan. This was partly unwound with Tsys paring gains as the session progressed.

- Bloomberg trader sources flagged liquidation of long USD/JPY positions and said large sell stops were triggered around Jul 22 low of Y135.57, with offers seen toward the Y136.20/25 option strikes due to roll off later today.

- USD/JPY 1-month risk reversal turned its tail, roughly halving yesterday's advance and moving away from a new weekly high printed in the Tokyo morning.

- Demand for the yen was broad based, making the currency a clear G10 outperformer. Regional risk barometer AUD/JPY shed ~87 pips & EUR/JPY dropped more than 1 full figure to a two-week low.

- The BBDXY index gave up and sank to its lowest point in more than three weeks, even as U.S. e-mini futures traded in the red.

- A weak domestic retail sales print applied some light pressure to the Aussie dollar, but the impact was fairly short-lived.

- Focus turns to German CPI as well as U.S. weekly jobless claims & advance GDP/PCE data. Comments are due form ECB Governing Council member Visco.

USD: Will Dips Still Be Supported?

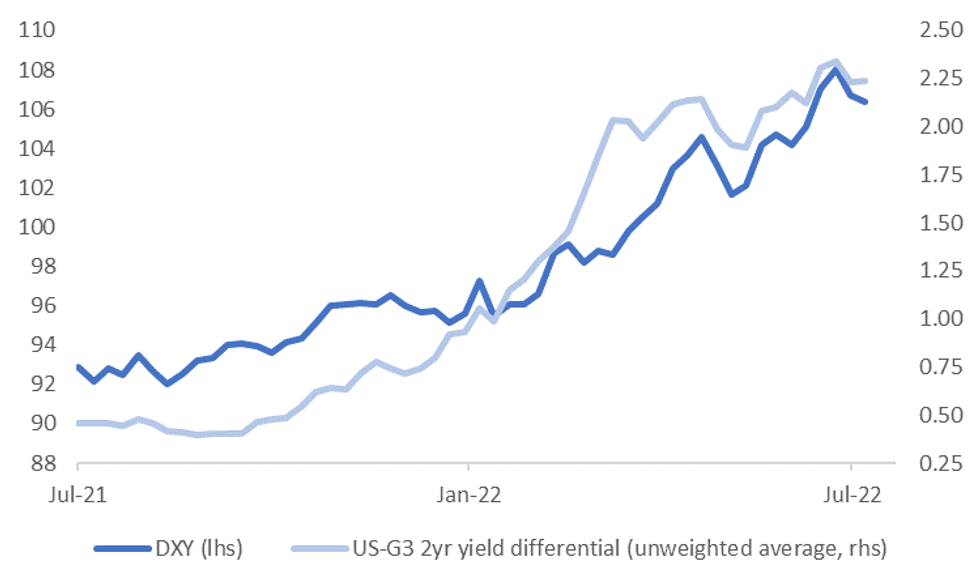

The DXY is not too far away from recent lows close to 106.00 (currently at 106.30). A break below 106.00 will have the market targeting the mid June highs of close to 105.80. Certainly yield momentum for the USD has waned, see the first chart below, although DXY weakness looks a little overdone at present levels.

- A lot is likely to depend on near term data momentum. Whilst the Citi US EASI index remains at depressed levels (last -53.50), it is up from recent lows.

- A number of major US banks upgraded their forecasts for tonight's GDP following better than expected partials (durable good orders and trade). The Atlanta Fed GDP nowcaster is up from its recent trough as well but is still negative at -1.2%.

- Avoiding another negative quarter of growth would certainly allay recession fears and should aid the USD against the likes of EUR and JPY, all else equal, particularly given the EU's on-going economic plight. Eurozone economic data momentum remains quite downbeat and focus is centred on gas supply issues as we progress through H2.

Fig 1: DXY & 2yr U.S. Yield Differential With G3 Economies

Source: MN - Market News/Bloomberg

Source: MN - Market News/Bloomberg

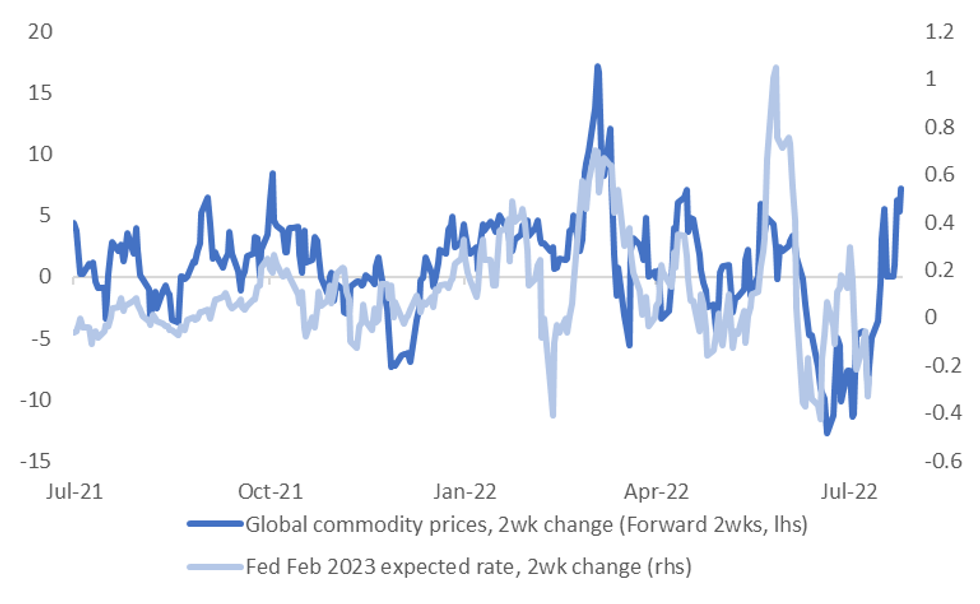

- Beyond the near term data picture, the focus will shift to further Fed action. Interestingly, the recent rebound in commodity prices suggests we won't see much more downside in terms of Fed expectations for early 2023, see the second chart below.

- There are some obvious caveats around this relationship though. Firstly, the link may not be as strong going forward given the extent to which the Fed funds rate has already been raised. Fed Chair Powell moved away from stringent guidance at the press conference on Wednesday. This makes sense with the policy rate operating around neutral levels.

- US real yields have also moved off their recent highs, with the 10yr measure slipping back to 36bps, from early July highs above 70bps.

Fig 2: Will Fed Expectations Continue To Be Lead By Commodity Prices?

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

USDJPY TECHS: Pierces Channel Support

- RES 4: 140.71 1.236 proj of the Jun 16 - 22 - 23 price swing

- RES 3: 140.00 Psychological round number

- RES 2: 137.96/39.39 High Jul 22 / 14 and the bull trigger

- RES 1: 136.58/137.46 Intraday high / High Jul 27

- PRICE: 137.14 @ 16:21 BST Jul 27

- SUP 1: 135.11 Intraday low

- SUP 2: 134.26/27 50-day EMA / Low Jun 23 and a key support

- SUP 3: 132.17 Low Jun 17

- SUP 4: 131.50 Low Jun 16

USDJPY is trading lower today. The pair has pierced an important support at 135.50, the base of a bull channel drawn from the Mar 4 low. A clear break of this channel base would strengthen current bearish conditions and signal scope for a deeper pullback. This would expose support at 134.27, the Jun 23 low. Initial resistance to watch is Wednesday’s 137.46 high. A break of this level would ease the current bearish threat.

FX OPTIONS: Expiries for Jul27 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0100(E1.5bln), $1.0125(E650mln), $1.0197-10(E1.7bln), $1.0250-55(E1.2bln), $1.0270(E533mln), $1.0300(E1.1bln)

- EUR/JPY: Y142.40(E1.4bln)

- USD/CAD: C$1.2750($590mln), C$1.2850-55($850mln), C$1.2910-25($648mln)

- USD/CNY: Cny6.7000($1.2bln), Cny6.7500($617mln)

ASIA FX: KRW & IDR The Strongest Performers

KRW and IDR have been the best performers today. USD/IDR slipping back below 15000, while USD/KRW is threatening to test below the 1300 level. Other pairs have been quieter. CNH has underperformed USD weakness elsewhere and higher onshore equities.

- CNH: USD/CNH wasn't able to sustain a break below 6.7400. We sit back at 6.7460 now, little changed on the day, despite a weaker USD elsewhere, particularly against the yen. There have been further reports of support for the property sector which has aided a turnaround in the property equity sub index. Aggregate stock indices are also higher.

- KRW: In contrast, the won has outperformed, we are threatening to break back below 1300. Onshore equities are higher, and as we wrote earlier there is scope for offshore equity inflow momentum to recovery further. Early in the day business confidence continued to ease. The NPS has also engaged in some tactical hedging of overseas assets

- INR: USD/INR is tracking lower in early trade. The pair back to 79.75. Onshore equities are up by over 1% at this stage. Offshore investors could come back into the equity market after being net sellers earlier in the week.

- IDR: USD/IDR is down -44.5 figs to 14968. Lower US real yields post yesterday's FOMC have certainly aided IDR. Palm oil futures have extended gains in morning Kuala Lumpur trade as well. The most active contract last deals ~MYR142/MT higher on the day.

- PHP: The Peso has weakened a touch. The pair was last at 55.75, only 0.10% higher on the day. Onshore equites are up over 1.3%. Philippine authorities confirmed 4 deaths and 60 people wounded in a strong earthquake that shook the nation's largest island on Wednesday, triggering landslides and damaging buildings. The government said it was ready to disburse funds to affected areas, but saw no need to declare a state of national calamity.

KRW: USD/KRW Dips To Multi-Week Lows

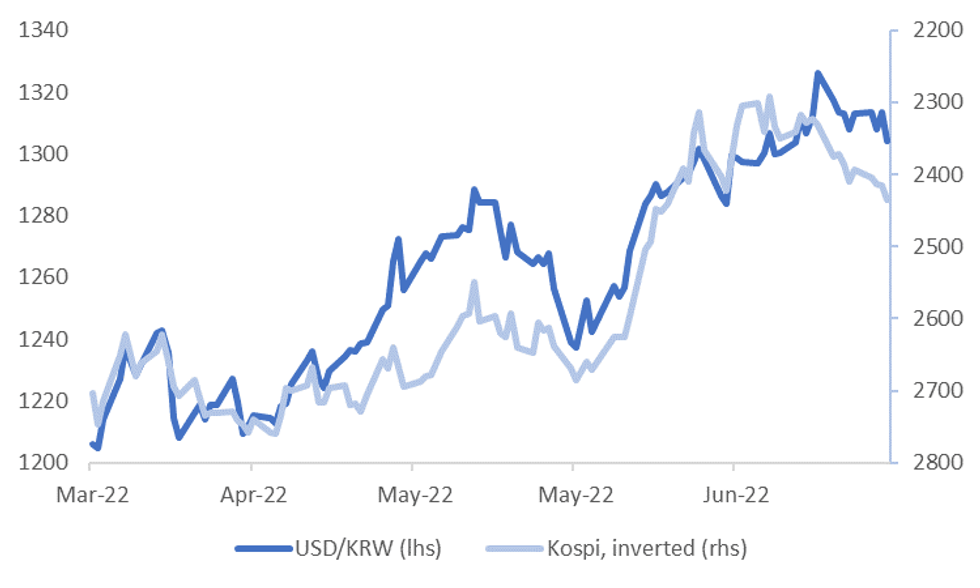

1 month USD/KRW got back to mid-June lows near 1301 early. We are slightly higher now at 1302. A break below 1300 would have the market targeting a move back to the 1295 region. Note the pairs remains comfortably above its 50-day MA, which currently sits at 1286.35.

- The wedge between USD/KRW and the Kospi has diminished somewhat, see the chart below. The Kospi has pushed up again today, +0.90% so far.

Fig 1: The Won Plays Some Catch Up With Firmer Onshore Equities

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

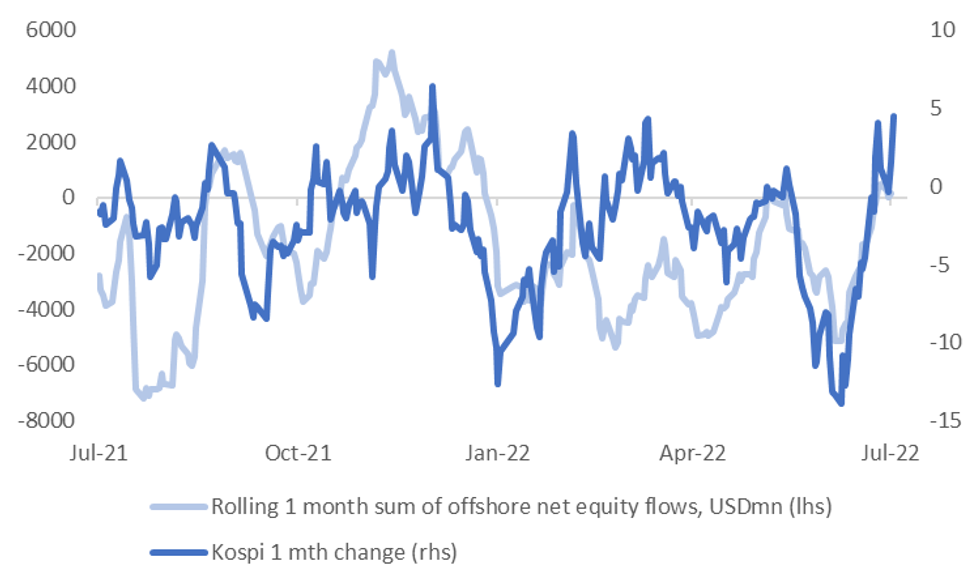

- Offshore investors haven't been participating much in the rebound, although the rate of outflows has certainly slowed, see the second chart below.

- Arguably net inflow momentum should be higher given the extent of the Kospi rebound, +4% over the past month.

- We may need to see increased participation from this investor base to drive further lows in USD/KRW.

- The other interesting development is that Bloomberg has reported the Korean National Pension Service has engaged in some tactical hedging of overseas investments.

- This isn't a game changer for the won, but is does highlight the sensitivity around FX levels at the moment.

Fig 2: Kospi and Net Equity Flows From Offshore Investors

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

EQUITIES: Off Best Levels; Tech Leads Gains Post-FOMC

Asia-Pac equity indices are broadly off best levels seen earlier in the session, as spillover from the FOMC-inspired bid in U.S. equities on Wednesday (that saw the NASDAQ lead peers at +4.1%) has faded from its extremes. High-beta equities region-wide nonetheless lead the way higher, with energy-related stocks outperforming amidst a rally in major crude benchmarks as well.

- The Hang Seng lags peers at -0.6%, operating a little above session lows at typing. The property (-1.3%) and financials (-0.9%) sub-indices again lead losses amidst the latest round of worry in China’s property sector, with real estate giant Country Garden Holdings’ (-2.5%) stock hitting 1-year lows at typing. The HSTECH is back from best levels of as much as +1.4% higher, sitting 0.3% better off at typing amidst a weak showing from Chinese tech large-caps.

- The Nikkei 225 is off best levels after briefly breaching the 28’000 mark for the first time in seven weeks, dealing 0.2% higher at writing. The utilities and energy sectors lead gains in the index, countering losses in financials and consumer staples.

- The ASX200 trades 0.9% higher at typing, on track for a third straight higher close, with gains in tech (S&P/ASX All Tech Index: +2.3%) and the materials sub-index (+1.8%) easily offsetting shallow losses in utilities and healthcare.

- U.S. e-minis sit 0.1-0.4% weaker at typing, but are nonetheless off worst levels, and holding on to the bulk of their post-FOMC gains as we head into European hours.

GOLD: Back From Fresh Two-Week Highs In Asia

Gold sits ~$1/oz firmer to print $1,735/oz at typing, back from two-week highs made earlier in the session ($1,741.8/oz). The precious metal has held on to the bulk of its post-FOMC gains amidst a downtick in the USD, with the DXY operating around session lows at typing after briefly showing through its post-FOMC trough.

- To recap, gold closed ~$17/oz higher on Wednesday mainly on the back of a ~$20 post-FOMC rally as participants in some quarters have interpreted comments from Fed Chair Powell’s presser as raising the possibility of less-aggressive tightening in the coming meetings (mainly over the emphasis on the Fed offering “less clear” guidance on rate hikes, as well as the flagging of data dependence for September’s decision).

- Sep FOMC dated OIS now price in ~54bp of tightening for that meeting, pointing to the removal of ~8bp of tightening premium in the wake of Wednesday’s FOMC decision.

- From a technical perspective, gold’s rally on Wednesday failed to breach initial resistance at $1,745.4/oz (Jul 13 high), keeping in mind that short-term gains still appear to be corrective, following its bounce off $1,681.0/oz last Thursday. On the other hand, initial support is seen at $1,697.7/oz (Jul 14 low).

OIL: Higher In Asia As Demand Worry Eases

WTI and Brent are ~$1.60 firmer apiece, building on their respective ~$2 higher closes on Wednesday, with Brent sitting just shy of fresh one-week highs.

- To recap Wednesday’s price action, crude hit session highs after the EIA data pointed to a significantly larger-than-expected drawdown in crude stockpiles, corroborating with the decline reported through API estimates on Tuesday. Gasoline stockpiles fell by more than expected while there was a surprise drawdown in distillate stockpiles, with a build observed in Cushing hub stocks.

- The large draw in crude inventories comes amidst record high U.S. exports, aided by the previously-flagged widening of the WTI-Brent spread. Domestic gasoline demand was also reported to have surged by 8.5% after two weeks of declines, likely easing recent expectations of demand destruction.

- Wednesday’s FOMC also provided some relief to crude as the prospect of a slower rate hike path suggested by Fed Chair Powell eased wider worry re: a Fed-led slowdown, with a bid in equities observed as well.

- Looking ahead, U.S. Q2 Advance GDP later will take focus, with the BBG median currently looking for a 0.5% expansion. Note that several individual forecast upgrades were made on Wednesday on the back of fresh economic data, with the Atlanta Fed’s Q2 GDPNow real GDP estimate moderating to -1.2% as well (from -1.8% on Jul 26).

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/07/2022 | 0600/0800 | *** |  | SE | GDP |

| 28/07/2022 | 0600/0800 | ** |  | SE | Retail Sales |

| 28/07/2022 | 0645/0845 | ** |  | FR | PPI |

| 28/07/2022 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 28/07/2022 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 28/07/2022 | 0800/1000 | *** |  | DE | Hesse CPI |

| 28/07/2022 | 0900/1100 | ** |  | EU | Economic Sentiment Indicator |

| 28/07/2022 | 0900/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 28/07/2022 | 0900/1100 | * |  | EU | Business Climate Indicator |

| 28/07/2022 | 0900/1100 | *** |  | DE | Saxony CPI |

| 28/07/2022 | 1200/1400 | *** |  | DE | HICP (p) |

| 28/07/2022 | 1230/0830 | * |  | CA | Payroll employment |

| 28/07/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 28/07/2022 | 1230/0830 | *** |  | US | GDP (adv) |

| 28/07/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 28/07/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 28/07/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 28/07/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 28/07/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 28/07/2022 | 1730/1330 |  | US | Treasury Secretary Janet Yellen |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.