-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - ECB Set to Deliver Third Consecutive Cut

MNI China Daily Summary: Thursday, December 12

MNI EUROPEAN OPEN: Post-Politburo Blues In China

EXECUTIVE SUMMARY

- BIDEN, XI PLAN IN-PERSON MEET AS TAIWAN TENSIONS INTENSIFY (BBG)

- BIDEN ADMIN CONTINUES TO PUSH BACK AGAINST IDEA OF RECESSION

- E-MINIS BID AFTER APPLE & AMAZON EARNINGS

- JPY FX CROSSES TUMBLE

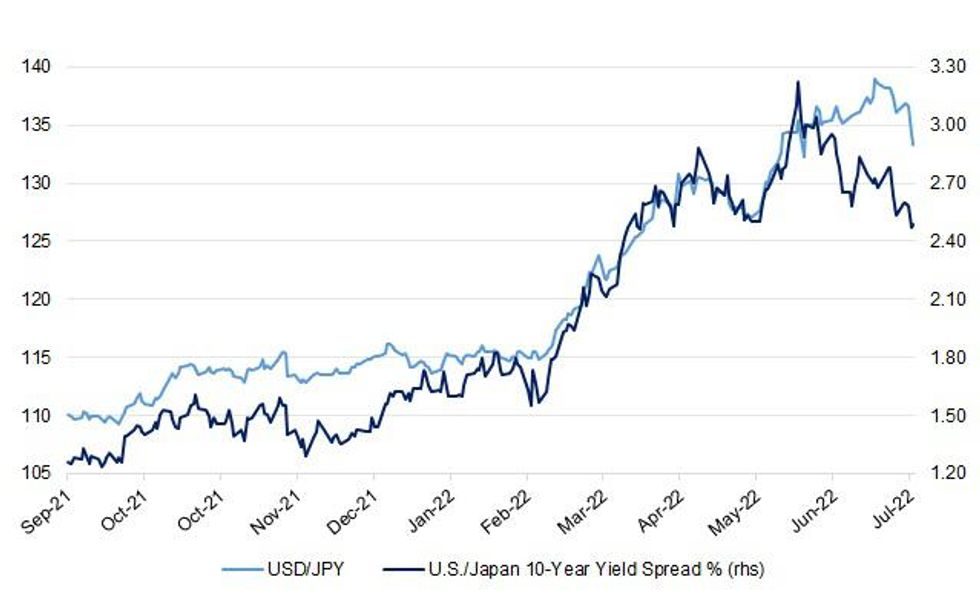

Fig. 1: USD/JPY Vs. U.S./Japan 10-Year Yield Spread

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: Rishi Sunak was on Thursday night taken to task at the first official Conservative leadership hustings by a party member who suggested he had "stabbed [Boris Johnson] in the back" by resigning as Chancellor. (Telegraph)

EUROPE

ECB: The German academic behind the European Central Bank's biggest court setback is weighing legal action against the ECB's new bond-market shield, which he sees as "blatant" aid to Italy and other debt-laden states. Markus Kerber is taking aim at the Transmission Protection Instrument (TPI), which will let the ECB buy bonds from countries that come under what it deems unjustified market pressure provided they follow the European Union's economic prescriptions. (RTRS)

FRANCE: French President Emmanuel Macron's government is too optimistic about the economic outlook and its plans for reducing public debt and the deficit are based on reforms that have yet to be implemented, the head of the top public audit body said. In an interview with Le Figaro newspaper, Pierre Moscovici said a note on its economic outlook that France is due to send to the European Commission already factors in the positive effects of reforms of pensions and unemployment benefits. (RTRS)

RATINGS: Potential sovereign rating reviews of note scheduled for after hours on Friday include:

- Fitch on Norway (current rating: AAA; Outlook Stable)

- Moody’s on Finland (current rating: Aa1; Outlook Stable) and Lithuania (current rating A2; Outlook Stable)

- S&P on Luxembourg (current rating: AAA; Stable Outlook )

- DBRS Morningstar on Austria (current rating AAA; Stable Trend), Estonia (current rating: AA (low), Stable Trend), and Luxembourg (current rating AAA; Stable Trend)

U.S.

ECONOMY: U.S. President Biden stated the following on his twitter account on Thursday, “After historic economic growth – regaining all private sector jobs lost during the pandemic – we knew the economy would slow down as the Fed acts on inflation. Our job market is strong, spending is up, and unemployment is down. We have the resilience to weather the transition.” (MNI)

ECONOMY: While the latest GDP report showed the US economy contracted again in the second quarter, Treasury Secretary Janet Yellen said there's no fear that America is currently in a recession. "That is not what we're seeing right now when you look at the economy," she said. "Job creation is continuing, household finances remain strong, consumers are spending and businesses are growing." (CNN)

FISCAL: President Biden on Thursday praised a new health care, tax and climate package unveiled by Senate Majority Leader Chuck Schumer and Sen. Joe Manchin, and urged lawmakers to pass the plan that he said will lower inflation and take significant steps to combat climate change. (CBS News)

POLITICS: White House Press Secretary Karine Jean-Pierre was again called on to clarify whether or not President Biden would run again in 2024, and told The View’s Alyssa Farah that he “intends to run in 2024.” (Yahoo News)

EQUITIES: With investors on edge about an economic slowdown, Apple Inc. offered just enough good news Thursday to calm fears -- and bought itself some time to ready a wave of new products. The company’s fiscal third-quarter revenue and profit narrowly topped analysts’ estimates, with iPhone sales holding up better than expected. Though Chief Executive Officer Tim Cook decried a “cocktail of headwinds” hampering Apple’s business, he predicted that sales would begin to pick up in the coming months. (BBG)

EQUITIES: Amazon.com Inc. reported revenue that topped estimates and gave a strong sales forecast for the current quarter, allaying investor concerns about potential belt-tightening by inflation-rattled consumers. Shares jumped more than 12% in extended trading. (BBG)

OTHER

U.S./CHINA: US President Joe Biden and Chinese President Xi Jinping told aides to plan an in-person meeting during a call Thursday in which both leaders warned one another about rising risks of a confrontation over Taiwan. While Biden reiterated the US ‘One China’ policy under which only Beijing is recognized as the government of China, he also warned Xi against military action to reunify the mainland and the island. (BBG)

U.S./CHINA: The Chinese leader called on the U.S. to abide by the commitments that serve as the cornerstone for relations established between China and the U.S. in 1979. "The three Sino-U.S. joint communiqués embody the political commitments made by the two sides, and the one-China principle is the political foundation for China-U.S. relations," the readout stated. (Newsweek)

U.S./CHINA/TAIWAN: Chinese President Xi Jinping and US President Joe Biden spoke via telephone for over two hours on Thursday at a juncture of increased tension between China and the US due to the security situation around the Taiwan Straits and US House Speaker Nancy Pelosi's reported plan to visit the island of Taiwan. During the conversation with Xi, Biden reiterated that the one-China policy of the US has not changed and will not change, and that the US does not support "Taiwan independence." (Global Times)

U.S./CHINA/TAIWAN: Taiwan's foreign ministry said on Friday that it will continue to deepen its close security partnership with the United States, after U.S. President Joe Biden and China's leader Xi Jinping spoke on Thursday. (RTRS)

U.S./CHINA/TAIWAN: Hu Xijin, former editor-in-chief and party secretary of the Global Times tweeted the following: “Whether Biden keeps his words, the touchstone will be whether he can prevent Pelosi’s visit to Taiwan. If Pelosi eventually makes the trip, to China, it will be a joint show between the White House and the Capitol Hill. I believe the PLA air force will definitely take action then.” (MNI)

JAPAN: Japan’s government plans to introduce a new framework for prefectures to curb the spread of the highly contagious BA.5 coronavirus subvariant, public broadcaster NHK reports without attribution. (BBG)

BOJ: Bank of Japan board members warned of global headwinds to the economy as counterparts abroad rush to tighten policy to bring inflation back under control, a summary of opinions at its July policy meeting showed. (BBG)

BRAZIL: Datafolha poll carried out between July 27-28 shows former president Luiz Inácio Lula da Silva with 55% of voting intentions in presidential runoff against incumbent Jair Bolsonaro, who marked 35% in the survey. (BBG)

BRAZIL: Brazil govt included operations to transfer money to abroad for the purchase of goods and services in the gradual reduction of the IOF tax, according to an official decree sent by the Presidency. (BBG)

BRAZIL: Brazil deputy Treasury secretary Paulo Valle said state-owned oil firm Petrobras responded that it will stick to its current dividend policy and will not pay "additional" dividends to the government following the Treasury's request to that effect. (RTRS)

RUSSIA: Russia has acknowledged U.S. request for a call between U.S. Secretary of State Antony Blinken and Russian Foreign Minister Sergei Lavrov, U.S. State Department spokesperson Ned Price said on Thursday, adding that Washington was still expecting the conversation to happen in the coming days. (RTRS)

RUSSIA: The United States and 37 other countries are establishing an expert mission to review the human rights situation in Russia, the U.S. State Department said on Thursday. (RTRS)

ARGENTINA: Argentina’s central bank delivered an outsize 800 basis-point hike to its benchmark interest rate, the largest in three years, as inflation accelerates amid a growing political crisis. (BBG)

METALS: Copper producers are pushing back on Chile’s proposed tax overhaul, with Anglo American Plc indicating it needs greater regulatory clarity before proceeding with major investments. (BBG)

OIL: The Port of Fujairah reopened after extreme weather conditions shuttered the port overnight, though oil operations remain disrupted with some berths still out of service. (BBG)

OIL: Demand for transportation fuels remains strong despite mixed signals from inventory data collected by the U.S. Energy Information Administration (EIA), U.S. fuelmakers said on Thursday. (RTRS)

CHINA

ECONOMY: China’s priority in the second half of the year is to ensure the economy returns to its potential growth rate, with analysts expecting about 5.5% or even above 6% growth should the pandemic keep under control and pro-growth policies continue to kick in, the 21st Century Business Herald reported citing analysts. Top policymakers urged to "strive to achieve the best result" for GDP growth in the politburo meeting on Thursday, compared to the previous meeting in April that urged to “meet the expected goals of economic and social development throughout the year”, the newspaper said. It is objectively challenging to achieve the annual growth target of 5.5% as output was sapped in H1, though policymakers still urged major economic powerhouses to meet the expected annual goals, the newspaper said. (MNI)

ECONOMY: The foundation of China's consumption recovery is not solid yet, An Baojun, an official at the commerce ministry said on Friday. More efforts are needed to sustain continuous consumption recovery, An said at a regular press conference in Beijing. (RTRS)

POLICY: China will strengthen efforts to stabilise foreign trade in the second half of the year, the commerce ministry said on Friday. The country's foreign trade faces "high risks, difficulties and many uncertainties," Zhang Bin, an official at the commerce ministry, said at a press conference. China will also expand imports actively and safeguard domestic commodity supplies, Zhang said. (RTRS)

INFRASTRUCTURE: China’s infrastructure investment growth rate may further accelerate to about 13% y/y in the second half of the year from H1’s 7.1%, which would bring the annual growth to 10% and drive 2022 GDP by around 1 percentage point, the 21st Century Business Herald reported citing Wang Qing, chief macro analyst of Golden Credit Rating. China could front-load next year’s local government special bond quota to H2 to support construction or tap into the accumulated remaining quota in previous years, the newspaper cited analysts. Data by the Ministry of Finance shows the balance of special bonds is CNY16.7 trillion as of 2021, while the special debt limit is CNY18.2 trillion, leaving a debt space of CNY1.5 trillion, the newspaper said. (MNI)

CHINA MARKETS

PBOC NET DRAINS CNY1 BILLION VIA OMOS FRIDAY

The People's Bank of China (PBOC) injected CNY2 billion via 7-day reverse repos with the rate unchanged at 2.10% on Friday. The operation has led to a net drain of CNY1 billion after offsetting the maturity of CNY3 billion repos today, according to Wind Information

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9770% at 09:35 am local time from the close of 1.5283% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 45 on Thursday vs 43 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7437 FRI VS 6.7411

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.7437 on Friday, compared with 6.7411 set on Thursday.

OVERNIGHT DATA

JAPAN JUL TOKYO CPI +2.5% Y/Y; MEDIAN +2.4%; JUN +2.3%

JAPAN JUL TOKYO CORE CPI +2.3% Y/Y; MEDIAN +2.2%; JUN +2.1%

JAPAN JUL TOKYO CORE-CORE CPI +1.2% Y/Y; MEDIAN +1.1%; JUN +1.0%

JAPAN JUN, P INDUSTRIAL PRODUCTION +8.9% M/M; MEDIAN +4.2%; MAY -7.5%

JAPAN JUN, P INDUSTRIAL PRODUCTION -3.1% Y/Y; MEDIAN -7.0%; MAY -3.1%

JAPAN JUN RETAIL SALES -1.4% M/M; MEDIAN +0.2%; MAY +0.7%

JAPAN JUN RETAIL SALES +1.5% Y/Y; MEDIAN +2.9%; MAY +3.7%

JAPAN JUN DEPT STORE, SUPERMARKET SALES +1.3% Y/Y; MEDIAN +4.9%; MAY 8.5%

JAPAN JUN JOBLESS RATE 2.6%; MEDIAN 2.5%; MAY 2.6%

JAPAN JUN JOB-TO-APPLICANT RATIO 1.27; MEDIAN 1.25; MAY 1.24

JAPAN JUN HOUSING STARTS -2.2% Y/Y; MEDIAN -1.4%; MAY -4.3%

JAPAN JUN ANNUALISED HOUSING STARTS 0.845MN; MEDIAN 0.850MN; MAY 0.828MN

JAPAN JUL CONSUMER CONFIDENCE INDEX 30.2; MEDIAN 31.5; JUN 32.1

AUSTRALIA Q2 PPI +5.6% Y/Y; Q1 +4.9%

AUSTRALIA Q2 PPI +1.4% Q/Q; Q1 +1.6%

AUSTRALIA JUN PRIVATE SECTOR CREDIT +0.9% M/M; MEDIAN +0.7%; MAY +0.8%

AUSTRALIA JUN PRIVATE SECTOR CREDIT +9.1% Y/Y; MEDIAN +9.0%; MAY +9.0%

NEW ZEALAND JUL CONSUMER CONFIDENCE INDEX 81.9; JUN 80.5

NEW ZEALAND JUL CONSUMER CONFIDENCE INDEX +1.7% M.M; JUN -2.2%

The ANZ-Roy Morgan Consumer Confidence Index was basically flat in July at very subdued levels. Households are understandably worried, with strong inflation eating into budgets, interest rates higher, house prices falling, and uncertainty ongoing. But in aggregate we haven’t seen a big pull-back in spending, which likely reflects the fact that there are job vacancies everywhere you look, and wages are rising. (ANZ)

SOUTH KOREA JUN INDUSTRIAL PRODUCTION +1.4% Y/Y; MEDIAN +2.1%; MAY +0.1%

SOUTH KOREA JUN INDUSTRIAL PRODUCTION SA +1.9% M.M; MEDIAN -0.8%; MAY +0.1%

SOUTH KOREA JUN CYCLICAL LEADING INDEX CHANGE +0.0 M/M; MAY +0.1

UK JUL LLOYDS’ BUSINESS BAROMETER 25; JUN 28

MARKETS

SNAPSHOT: Post-Politburo Blues In China

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 65.52 points at 27749.96

- ASX 200 up 60.055 points at 6949.80

- Shanghai Comp. down 23.718 points at 3258.858

- JGB 10-Yr future up 28 ticks at 150.53, yield down 2.4bp at 0.181%

- Aussie 10-Yr future up 15 ticks at 96.92, yield down 14.1bp at 3.065%

- U.S. 10-Yr future +0-05 at 121-04+, yield down 0.54bp at 2.671%

- WTI crude up $0.29 at $96.71, Gold up $5.49 at $1761.35

- USD/JPY down 85 pips at Y133.42

- BIDEN, XI PLAN IN-PERSON MEET AS TAIWAN TENSIONS INTENSIFY (BBG)

- BIDEN ADMIN CONTINUES TO PUSH BACK AGAINST IDEA OF RECESSION

- E-MINIS BID AFTER APPLE & AMAZON EARNINGS

- JPY FX CROSSES TUMBLE

US TSYS: Light Twist Steepening, Chinese Equity Woes & JPY Strength Eyed

TYU2 last deals +0-04+ at 121-04, 0-01+ off the peak of its 0-10+ range, operating on volume of ~92K.

- Modest early cheapening pressure was unwound across most of the Tsy curve during the final Asia-Pac session of the week, with the impulse from the after-hours bid in e-minis (linked to Apple & Amazon earnings) fading as Hong Kong & Chinese equities pulled lower on the back of fresh regulatory worry surrounding some of the notable Chinese tech giants and a lack of immediate stimulus after yesterday’s Politburo meeting in China. A related shunt lower in USD/JPY was also noted. E-minis have held on to the bulk of their gains, with the NASDAQ 100 leading.

- That leaves the curve twist steepening, with the major cash Tsy benchmarks running 2.5bp richer to 1.0bp cheaper, pivoting around 20s.

- Overnight flow was headlined by a block buy of FV futures (+2.5K).

- Looking ahead, PCE data, the employment cost index, the latest MNI Chicago PMI print and final UoM sentiment data (with an eye on 5- to 10-Year inflation expectations after their pullback in the flash reading) provide the highlights of the NY docket. There isn’t any Fedspeak on the slate, but we would expect some impromptu post-blackout appearances on the usual TV channels.

- Elsewhere, participants will be on the lookout for any fresh colour surrounding a face-to-face meeting between U.S. President Biden and his counterpart Xi, after source reports flagging discussions pertaining to the matter did the rounds in the wake of the call that was held between the leaders on Thursday (the idea was already touted prior to the-call).

JGBS: Reverting To Flattening

Wider core FI gyrations have been at the fore for JGBs from the start of Tokyo trade, with futures eating away at their modest early downtick during the Tokyo afternoon to trade +28 vs. yesterday’s settlement into the bell (failing to challenge overnight session highs).

- JGBs have reverted to flattening after yesterday’s steepening, with the space benefitting from Thursday’s recession worry driven bid in U.S. Tsys and moves lower in Chinese & Hong Kong equities. The major cash JGB benchmarks run 1.0-4.0bp richer on the session, with 40s providing the firmest point on the curve.

- Note that swap spreads are wider across the curve, with super-long swaps even seeing payside flow during the Tokyo morning.

- There was a modest upside surprise across the Tokyo CPI data suite, a non-descript labour market report, while domestic retail sales data provided a miss and prelim industrial production data provided a beat.

- The results from the latest round of BoJ Rinban operations had no meaningful impact on the space.

- As an aside, there was another notable pull lower in JPY crosses, led by a technical break in USD/JPY and short JPY position squaring.

- The BoJ will release its August Rinban plan after hours today. Looking ahead, Monday’s Tokyo docket will be headlined by final manufacturing PMI data.

JGBS AUCTION: Japanese MOF sells Y4.53777tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y4.53777tn 3-Month Bills:

- Average Yield: -0.1323% (prev. -0.1527%)

- Average Price: 100.0330 (prev. 100.0381)

- High Yield: -0.1419% (prev. -0.1443%)

- Low Price: 100.0354 (prev. 100.0360)

- % Allotted At High Yield: 42.3116% (prev. 81.5694%)

- Bid/Cover: 2.504x (prev. 2.778x)

AUSSIE BONDS: Richer

Aussie bonds caught a bid after an earlier blip lower on wider fixed income moves, the marginal beat in private sector credit growth and an uptick in PPI in Y/Y terms (although with a modest moderation in Q/Q terms). Wider core FI market gyrations were at the fore, with the move higher ultimately facilitated by U.S. Tsys unwinding their earlier cheapening. Cash ACGBs run 8.5-21.0bp richer across the curve, with the belly leading the bid. YM is +20.5 while XM is +19.5, off best levels after showing through their respective overnight highs, with XM back below its overnight peaks at typing. Bills run 14 to 26 ticks richer through the reds, bull flattening.

- The first tap of the ACGB Nov-33 bond went smoothly enough, with the weighted average yield pricing 0.97bp through prevailing mids (per Yieldbroker). The cover ratio was less firm however, coming in at 2.25x - while the print did not point to any outright difficulty re: digestion, it came nowhere near the highest level of cover observed at recent ACGB auctions.

- The AOFM issuance slate announced for next week provoked little reaction in Aussie bonds, with the return to A$1.5bn of ACGBs and A$2.0bn of notes on offer.

- Monday will see m’fing PMI, Melbourne Institute Inflation, and ANZ job ads headline the data docket, although their proximity to the RBA’s monetary policy decision on Tuesday may limit any potential impact from that suite of data. Note that CoreLogic house prices are due to cross late Sunday/early Monday.

- Also note NSW will observe a state holiday on Monday.

AUSSIE BONDS: ACGB Nov-33 Supply Smoothly Digested, Cover Ratio Not Too Firm

The first tap of ACGB Nov-33 since its initial syndication went smoothly enough on the pricing side, with the weighted average yield pricing 0.97bp through prevailing mids (per Yieldbroker). The cover ratio story wasn’t as firm, printing 2.25x. Although that level doesn’t point to any outright difficulty when it comes to digestion, it wasn’t anywhere near the highest level of cover observed at recent ACGB auctions. The recent stabilisation of Aussie bonds away from cycle cheaps (with ACGBs on track for their largest one-month gain since 2012) and pickup in yield vs XM futures likely factored into the firm pricing at today’s auction, outweighing incremental negatives from micro relative value matters and the flatness of the 3-/10-Year yield curve, with the previously-flagged larger DV01 on offer proving digestible enough for participants, albeit perhaps limiting overall demand. The line saw some slight cheapening post-supply but has recovered most of the lost ground., while XM futures were already trading off of best levels ahead of the auction.

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Wednesday 3 Aug it plans to sell A$800mn of the 1.75% 21 November 2032 Bond.

- On Thursday 4 Aug it plans to sell A$1.0bn of the 11 November 2022 Note & A$1.0bn of the 16 December 2022 Note.

- On Friday 5 Aug it plans to sell A$700mn of the 4.75% 21 April 2027 Bond.

EQUITIES: Mostly Lower In Asia; Chinese Investors Beat Feet

Most Asia-Pac equity indices are lower at typing, with broader sentiment sapped by steep declines observed in Chinese and Hong Kong benchmarks.

- The Hang Seng sits 2.3% worse off at typing, just off freshly-made nine-week lows. China-based tech (HSTECH: -4.3%) led the way lower as worry re: regulatory crackdowns again re-surfaced, with Alibaba Group (-5.8%) leading losses following WSJ source reports of high-profile founder Jack Ma planning to relinquish control of Ant Group. Reports of regulators blocking tech giant Xiaomi’s (-4.0%) EV project did little to help matters as well, seeing the HSTECH hit fresh session lows afterwards. Elsewhere, the Hang Seng’s property (-1.2%) and finance (-1.2%) sub-indices struggled as well, continuing to reflect recent weakness in sentiment towards Chinese property developers.

- The CSI300 deals 1.1% weaker at writing, hitting fresh six-week lows amidst losses in virtually every sub-index, save a flat showing from Utilities. Richly-valued sectors (such as consumer staples and healthcare) contributed the most to losses, coming as the Chinese leadership has refrained from announcing fresh stimulus at this week’s Politburo meeting despite recent worry from some quarters re: economic growth.

- The ASX200 sits 0.9% firmer at typing, bucking the broader trend of losses, on track for a fourth straight higher daily close on gains in virtually every sub-index. Commodity-related equities lead the bid, with the energy (+1.0%), materials (+0.8%), and utilities (+2.1%) sub-gauges leading the way higher.

- U.S. e-minis are flat to 1.2% firmer at typing, sitting a little below their respective best levels made on Thursday.

OIL: Little Changed In Asia; Supply Outlook Remains Tight

WTI is ~+$0.30 and Brent is ~+$0.10 at typing, back from best levels, and operating a little above their respective lows observed on Thursday after U.S. Q2 advance GDP dipped into negative territory, exacerbating recession-related worry. Both benchmarks nonetheless remain on track to end higher this week, with WTI looking to snap a three-week streak of lower closes.

- A well-documented moderation in Fed rate hike expectations following the recent FOMC decision continues to support crude’s recovery in recent sessions (amidst the easing of prior worry re: a Fed-led economic slowdown/contraction), adding to the previously-flagged easing of demand worry from some quarters (particularly the rebound in U.S. gasoline demand).

- Looking to OPEC+, RTRS source reports have pointed to the group considering to keep the Sep output target unchanged at next week’s meeting (with RTRS sources simultaneously saying that the White House is “optimistic” re: the odds of an output increase), keeping in mind that Argus Media source reports earlier in the week suggested that OPEC+ output shortfalls had worsened in June to ~2.8mn bpd, highlighting long-standing output production issues faced by some members.

- The CEOs of Total Energy and Shell have stated (amidst the backdrop of highly-publicised earnings outperformance in the sector this week) that crude supplies remain tight, with the latter highlighting the lack of spare capacity out of the U.S. and OPEC, even ahead of the full implementation of sanctions on Russian crude.

GOLD: Just Off Post-GDP Highs; On Track For Higher Weekly Close

Gold sits ~$2/oz weaker, printing $1,754/oz at typing. The precious metal operates just shy of Thursday’s best levels ($1,757.1/oz), putting it on track to record a second straight week of gains (that comes after five consecutive weeks of losses prior).

- To recap, gold closed ~$20/oz higher on Thursday, a little below fresh three-week highs made after the U.S. Q2 advanced GDP print missed expectations (indicating a technical recession). The move higher was facilitated by a downtick in U.S. real yields, with the DXY nudging a little lower as well after failing to breach 107.00.

- Gold has rebounded from multi-month lows amidst the post-FOMC shift lower in expectations for a 75bp hike in the Fed’s Sep meeting (Sep FOMC dated OIS now price in ~56bp for tightening vs. ~62bp prior), with recent economic data misses providing support for that narrative as well. The yellow metal however remains firmly set for a fourth straight monthly decline, with progress in the Fed’s inflation fight remaining in focus, as Fed Chair Powell has emphasised “less clear” guidance and data-dependence for future FOMC decisions.

- From a technical perspective, gold has breached initial resistance at $1,745.4/oz (Jul 13 high), strengthening its near-term bullish set-up, and opening the possibility of a stronger bounce. The move higher has exposed further resistance at $1,787.0/oz (May 16 low, recent breakout level), with support seen at $1,711.7/oz (Jul 27 low).

FOREX: Yen Keeps Busting Ceilings, USD/JPY Piercing 50-DMA Provides Initial Trigger

The adjustment of yen positions resumed towards the end of a week marked by the repricing of Fed rate hike trajectory in response to the latest FOMC meeting and a disappointing U.S. GDP print.

- The initial downleg in USD/JPY came as a result of bears forcing their way through the 50-DMA, with no apparent headline catalysts crossing the wires. The said moving average limited losses on Thursday and provided support on the rate's corrective pullback in May, which added to its significance.

- The cross remained heavy amid talk of further JPY short covering. Spot USD/JPY briefly probed the water below Y133.00 for the first time since Jun 17. This puts the $1.2bn of Y132.50 option expiries set to roll off at today’s 10AM NY cut within notably closer proximity.

- Cross-asset signals were conducive to JPY strength, with weakness in Chinese & Hong Kong equities providing a cue to seek shelter in the regional safe haven. Sales of USD/JPY may have been facilitated by a downtick in U.S. Tsy yields.

- The greenback underperformed as a function of its sales against the yen, while the loonie was the second-worst performer. The European FX bloc was broadly softer, save for the Swiss franc.

- The Antipodeans diverged from their high-beta peers and were among the best G10 performers, with regional stock benchmarks eking out some gains. AUD/USD punched through the $0.7000 mark after two consecutive failures to close above there, while NZD/USD moved above its 50-DMA for the first time since April.

- As we head for the European session, focus turns to preliminary EZ GDP, German unemployment and flash CPI figures from France & Italy.

- Later in the day, the American docket features U.S. core PCE data, MNI Chicago PMI & the final reading of Uni. of Mich. Sentiment as well as Canadian GDP.

FX OPTIONS: Expiries for Jul29 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9800(E948mln), $1.0050(E1.1bln), $1.0125(E658mln), $1.0200(E789mln), $1.0247-50(E3.0bln), $1.0300(E646mln)

- USD/JPY: Y132.50($1.2bln), Y135.00($539mln), Y135.95-00($991mln), Y140.00($1.3bln)

- GBP/USD: $1.2100(Gbp985mln)

- USD/CAD: C$1.2830($575mln), C$1.2920-30($1.2bln)

- USD/CNY: Cny6.8000($1.2bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 29/07/2022 | 0530/0730 | ** |  | FR | Consumer Spending |

| 29/07/2022 | 0530/0730 | *** |  | FR | GDP (p) |

| 29/07/2022 | 0600/0800 | ** |  | SE | Unemployment |

| 29/07/2022 | 0600/0800 | ** |  | DE | Import/Export Prices |

| 29/07/2022 | 0630/0830 | ** |  | CH | retail sales |

| 29/07/2022 | 0645/0845 | *** |  | FR | HICP (p) |

| 29/07/2022 | 0700/0900 | * |  | CH | KOF Economic Barometer |

| 29/07/2022 | 0700/0900 | *** |  | ES | GDP (p) |

| 29/07/2022 | 0700/0900 | *** |  | ES | HICP (p) |

| 29/07/2022 | 0755/0955 | ** |  | DE | Unemployment |

| 29/07/2022 | 0800/1000 | * |  | NO | Norway Unemployment Rate |

| 29/07/2022 | 0800/1000 | *** |  | DE | GDP (p) |

| 29/07/2022 | 0800/1000 | *** |  | IT | GDP (p) |

| 29/07/2022 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 29/07/2022 | 0830/0930 | ** |  | UK | BOE M4 |

| 29/07/2022 | 0900/1100 | *** |  | EU | HICP (p) |

| 29/07/2022 | 0900/1100 | *** |  | EU | GDP preliminary flash est. |

| 29/07/2022 | 0900/1100 | *** |  | IT | HICP (p) |

| 29/07/2022 | 0900/1100 | *** |  | EU | EMU Preliminary Flash GDP Y/Y |

| 29/07/2022 | 1000/1200 |  | IT | PPI | |

| 29/07/2022 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 29/07/2022 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 29/07/2022 | 1230/0830 | ** |  | US | Employment Cost Index |

| 29/07/2022 | 1345/0945 | ** |  | US | MNI Chicago PMI |

| 29/07/2022 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 29/07/2022 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.