-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI EUROPEAN OPEN: Pelosi Touches Down In Asia, Chinese M'fing PMIs Disappoint

EXECUTIVE SUMMARY

- FED’S KASHKARI SAYS OFFICIALS ARE ‘A LONG WAY’ FROM BACKING OFF INFLATION FIGHT (NEW YORK TIMES)

- PELOSI STARTS ASIA TRIP IN SINGAPORE WITH NO MENTION OF TAIWAN (BBG)

- CHINA CONDUCTS MILITARY DRILLS IN TAIWAN STRAIT, WHILE HARDLINE NEWSPAPERS PROVIDE PELOSI WARNINGS

- CHINESE MANUFACTURING PMIS DISAPPOINT

- UKRAINE’S FIRST GRAIN SHIP MAY DEPART ON MONDAY, TURKEY SAYS (BBG)

- SUNAK PLEDGES TAX CUTS IN ATTEMPT TO OVERCOME TRUSS’ HUGE LEAD

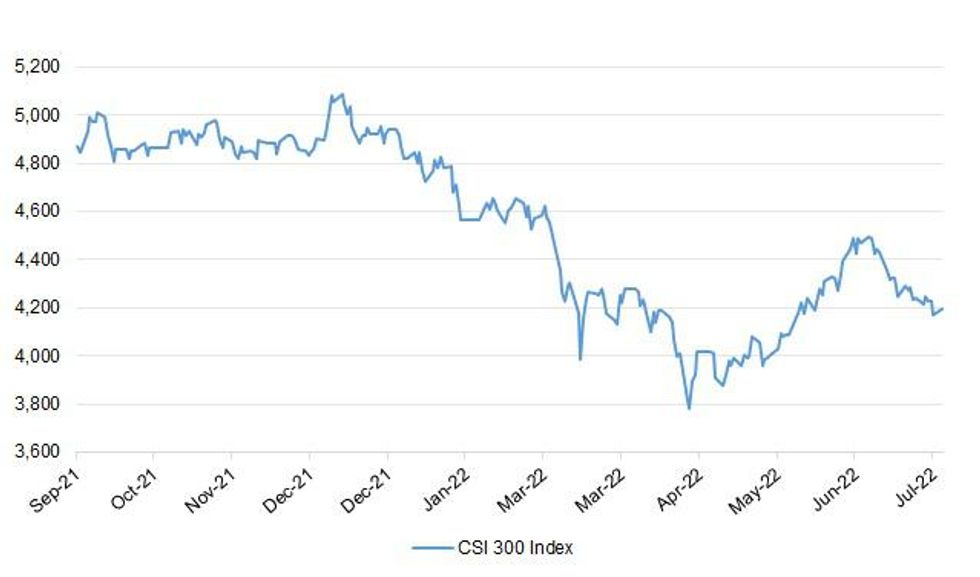

Fig. 1: CSI 300 Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS/FISCAL: Rishi Sunak, trailing in the race to become Britain's next prime minister, has vowed to slash the basic rate of income tax by 20% by 2029 in a potentially make-or-break throw of the dice by the former finance minister. Sunak, once seen as the favourite to replace Boris Johnson when he helped to steer the economy through the ravages of the COVID-19 pandemic, has struggled against his rival, Foreign Secretary Liz Truss, who has pledged immediate tax cuts. (RTRS)

POLITICS: British finance minister Nadhim Zahawi formally endorsed Liz Truss to be the next Conservative Party leader, The Telegraph reported on Sunday. Foreign secretary Truss "will overturn stale economic orthodoxy and run our economy in a Conservative way," Zahawi wrote in The Telegraph. (RTRS)

EUROPE

GERMANY: Germany’s gas-storage facilities are gradually increasing capacity despite reduced flows through the Nord Stream 1 pipeline and a lack of alternative supplies via other routes, said the president of the country’s Federal Network Agency. (BBG)

RATINGS: Sovereign rating reviews of note from after-hours on Friday include:

- Fitch affirmed Norway at AAA; Outlook Stable

- Moody's affirmed Finland at Aa1; Outlook Stable

- DBRS Morningstar confirmed Austria at AAA, Stable Trend

- DBRS Morningstar confirmed Estonia at AA (low), Stable Trend

- DBRS Morningstar confirmed Luxembourg at AAA, Stable Trend

U.S.

FED: Neel Kashkari, the president of the Federal Reserve Bank of Minneapolis, said the Fed had more work to do in trying to control price increases. Neel Kashkari, the president of the Federal Reserve Bank of Minneapolis, suggested on Friday that markets had gotten ahead of themselves in anticipating that the central bank — which has been raising interest rates swiftly this year — would soon begin to back off. “I’m surprised by markets’ interpretation,” Mr. Kashkari said in an interview. “The committee is united in our determination to get inflation back down to 2 percent, and I think we’re going to continue to do what we need to do until we are convinced that inflation is well on its way back down to 2 percent — and we are a long way away from that.” (New York Times)

FED: Federal Reserve Bank of Minneapolis President Neel Kashkari said the central bank is committed to doing what’s necessary to bring down demand in order to reach its 2% long-term inflation goal, a target that remains far off.“We are committed to bringing inflation down and we’re going to do what we need to do,” he told CBS’s Face the Nation in an interview on Sunday. “We are a long way away from achieving an economy that is back at 2% inflation, and that’s where we need to get to.” (BBG)

FED/INFLATION: The Trimmed Mean PCE inflation rate over the 12 months ending in June was 4.3 percent. According to the BEA, the overall PCE inflation rate was 6.8 percent on a 12-month basis, and the inflation rate for PCE excluding food and energy was 4.8 percent on a 12-month basis. (Dallas Fed)

POLITICS/CORONAVIRUS: President Biden tested positive for a rebound case of COVID-19 on Saturday morning after being treated with Paxlovid, his physician said in a letter. (Axios)

OTHER

GLOBAL TRADE: The first ship to export Ukrainian grain since an agreement was reached for the safe transit of vessels may depart as soon as Monday, a Turkish official said. More than a week after a deal was reached that aimed at releasing millions of tons of Ukrainian grain through three Black Sea ports, no ships have sailed. (BBG)

U.S./CHINA: The US is tightening restrictions on China’s access to chipmaking gear, according to two major equipment suppliers, underscoring Washington’s accelerating efforts to curb Beijing’s economic ambitions. (BBG)

U.S./CHINA: Alibaba Group Holding Ltd. has moved a step closer toward getting booted off US stock exchanges for American inspectors not being able to access to financial audits. (BBG)

U.S./CHINA/TAIWAN: US House Speaker Nancy Pelosi will visit Asian countries including Singapore and Japan in her trip to the region, according to a statement from her office that skipped any mention of a possible stopover in Taiwan. (BBG)

U.S./CHINA/TAIWAN: White House national security spokesperson John Kirby said on Friday the U.S. has seen no evidence of looming Chinese military activity against Taiwan, when asked about a possible visit to the island by U.S. House Speaker Nancy Pelosi. "(We've) seen no physical, tangible indications of anything untoward with respect to Taiwan," Kirby told reporters. Pelosi has not confirmed a potential trip to Taiwan. (RTRS)

U.S./CHINA/TAIWAN: "Don't say we didn't warn you!" - a phrase that was used by the People's Daily in 1962 before China was forced to fight the border war with India and ahead of the 1979 China-Vietnam War, was frequently mentioned during a forum held Friday by a high-level Chinese think tank, as analysts warned that open military options and comprehensive countermeasures ranging from the economy to diplomacy from China await if US House Speaker Nancy Pelosi gambles with a visit to the Taiwan island during her Asia tour. (Global Times)

JAPAN: An advisory panel at Japan’s labor ministry is set to recommend raising the nationwide average minimum wage by at least 30 yen/hour this fiscal year, Mainichi reports, citing an unidentified person. (BBG)

JAPAN: Support for Japanese Prime Minister Fumio Kishida’s government slipped in two major polls as the country battles record Covid cases but the approval rate still remained at some of the highest levels that any premier has seen in years. Approval for Kishida’s cabinet fell 2 percentage points to 58% in a poll by the Nikkei newspaper from July 29 to 31, reaching its second-lowest level in its polling since he took office in October. (BBG)

BOK: South Korea's central bank said Monday it is "appropriate" to raise its key interest rate in small increments going forward as long as inflation and growth trends do not deviate much from the expected paths. (Yonhap)

SOUTH KOREA: The acting leader of South Korea’s ruling party offered to resign over in-fighting in the People Power Party, adding to the growing woes for new President, Yoon Suk Yeol, whose approval ratings have plunged to historic lows. (BBG)

BRAZIL: Brazil's government wants to conclude voting on tax reform later this year to boost welfare aid from 2023 on, if President Jair Bolsonaro wins re-election in October, an official source said. (RTRS)

RUSSIA: Ukrainian President Volodymyr Zelensky has ordered the evacuation of the Donetsk region, where the fight against Russian forces continues at full force. (Axios)

RUSSIA: President Vladimir Putin said Russia’s navy would soon be fitted with powerful Zircon hypersonic cruise missiles, which can fly at five times the speed of sound. He signed an expansive new naval doctrine and vowed to respond “with lightning speed to anyone who decides to encroach on our sovereignty and freedom.” (BBG)

RUSSIA: U.S. Secretary of State Antony Blinken said on Friday he pressed Russian Foreign Minister Sergei Lavrov to accept a U.S. proposal for the release of detained Americans Brittney Griner and Paul Whelan. Blinken said he had a "frank and direct" conversation with Lavrov earlier on Friday, and told his counterpart that Russia must fulfill commitments it made as part of deal on the export of grain from Ukraine and that the world would not accept Russian annexation of Ukrainian territory. (RTRS)

RUSSIA: Russian Foreign Minister Sergei Lavrov on Friday told U.S. Secretary of State Antony Blinken that Washington was not living up to promises regarding the exemption from sanctions for the supply of food from Russia, Moscow said. A Russian foreign ministry read-out of the call also cited Lavrov as telling Blinken that Russia would achieve all the goals of its "special military operation" in Ukraine and said western arms supplies would only drag out the conflict. (RTRS)

SOUTH AFRICA: South Africa’s ruling African National Congress has revived plans to introduce a new tax on the wealthy to fund its basic income grant, Johannesburg-based Sunday Times said, citing an interview with Mmamoloko Kubayi, the party’s head of economic transformation. (BBG)

SOUTH AFRICA: South Africa’s governing party rejected calls to review a so-called step-aside rule that compels indicted officials to step down from their roles. The decision at the African National Congress’s five-yearly policy conference is a setback for President Cyril Ramaphosa’s detractors. (BBG)

SOUTH AFRICA: South Africa's ruling African National Congress (ANC) party reaffirmed its position that the central bank should be nationalised during a policy conference over the past three days, President Cyril Ramaphosa said on Sunday. (RTRS)

SOUTH AFRICA: South Africa’s fuel pump prices will fall from record highs in August as dipping demand for crude oil and rising supply from oil producers cool the average brent crude oil costs. (BBG)

IRAN: Iran has responded to top European Union diplomat Josep Borrell's proposal aimed at salvaging Tehran's 2015 nuclear deal with world powers, and seeks a swift conclusion to negotiations, the top Iranian nuclear negotiator said on Sunday. (RTRS)

IRAQ: Thousands of supporters of Shi'ite populist cleric Moqtada al-Sadr stormed Baghdad's fortified government zone and broke into parliament on Saturday for the second time in a week, leaving at least 125 people injured and escalating a political stand-off. (RTRS)

COLOMBIA: Colombia's central bank board raised the benchmark interest rate by 150 basis points to 9%, in line with market expectations, on Friday, taking the rate to its highest level since February 2009, as it continues hikes in response to persistent inflation pressures. The board was divided on how sharply to increase the rate, with six policymakers backing the 150-point increase, while one voted for a more dovish 100 basis-point uptick. (RTRS)

SERBIA: The Kosovo government postponed implementation of a decision that would oblige Serbs in the north of the country to apply for car license plates issued by Pristina institutions over tensions between police and local communities that set roadblocks. "The overall security situation in the Northern municipalities of Kosovo is tense," NATO-led mission to Kosovo KFOR said in a statement. (RTRS)

EMERGING MARKETS: Foreign investors have pulled funds out of emerging markets for five straight months in the longest streak of withdrawals on record, highlighting how recession fears and rising interest rates are shaking developing economies. (FT)

GAS: Gazprom's senior manager said on Friday that the delivery of the Nord Stream 1 gas turbine to Germany from Canada after maintenance was not in line with the contract. Vitaly Markelov, Gazprom's Deputy Chief Executive, also said that Siemens Energy, which is servicing the Nord Stream 1 equipment, succeeded in fixing only a quarter of the faults found. (RTRS)

GAS: Latvia does not expect Gazprom's decision to halt gas exports to the Baltic country to have any major impact, Edijs Saicans, deputy state secretary on energy policy at the Latvian ministry of economics, said on Saturday. Gazprom earlier said it had stopped supplying neighbouring Latvia with gas, accusing it of violating conditions for gas withdrawal. (RTRS)

OIL: The U.S. is considering sanctions that would target a United Arab Emirates-based businessman and a network of companies suspected of helping export Iran’s oil, part of a broader effort to escalate diplomatic pressure on Tehran as U.S. officials push to reach a deal on Iran’s nuclear program. (WSJ)

OIL: OPEC's new secretary general said that Russia's membership in OPEC+ is vital for the success of the agreement, Kuwait's Alrai newspaper reported on Sunday, quoting an exclusive interview with Haitham al-Ghais. Al-Ghais added that OPEC is not in competition with Russia, which he called "a big main player in the world energy map", Alrai reported. (RTRS)

OIL: European governments have eased back on efforts to curb trade in Russian oil, delaying a plan to shut Moscow out of the vital Lloyd’s of London maritime insurance market and allowing some international shipments amid fears of rising crude prices and tighter global energy supplies. (FT)

OIL: Russia's idled primary oil refining capacity was revised up to 2.591 million tonnes in August, up 34% from the previous estimate, sources citing refinery maintenance data and Reuters calculations showed on Friday. The offline primary oil refining capacity data for July was also revised up by 1.6% to 3.274 million tonnes. The revisions follow several changes to Russian oil refinery maintenance schedules. (RTRS)

OIL: Libya’s crude output has rebounded to its early April levels, the OPEC member’s oil minister said, in an increase that could help cool a jittery global oil market. (BBG)

CHINA

ECONOMY: Weakening demand, especially from consumers, will become a long-term restriction on the Chinese economy, as China enters the era of negative population growth and an ageing society, the 21st Century Business Herald reported citing Cai Fang, member of the People’s Bank of China’s Monetary Policy Committee. China’s population may peak this year or next year and India’s population will exceed China’s to make a very significant gap, Cai predicted. Fiscal policy will play a more important role than monetary policy in addressing demand constraints, with fiscal spending tilting more to safeguard people's livelihood and social welfare, Cai was cited as saying. (MNI)

PBOC: China’s monetary policy still has sufficient experience and tools to deal with external uncertainties, supported by its economic resilience, moderate inflation and robust financial system, the Economia Daily reported citing analysts. China should cherish the current time window, when the monetary tightening by developed countries, to push forward pro-growth policies, with monetary policies focusing on ensuring employment and stabilising enterprises, especially supporting SMEs, the newspaper said citing analysts. (MNI)

SHADOW BANKING: The assets and risks of China's "shadow" banking sector have declined significantly through continuous regulation, the state-run Securities Times on Saturday quoted a top regulator as saying. The sector has reduced by more than 29 trillion yuan ($4.3 trillion) as of the end of June from its historical high, Liang Tao, vice chairman of China Banking and Insurance Regulatory Commission, was quoted as saying. (RTRS)

MARKETS: China Securities Regulatory Commission’s chairman Yi Huiman vowed to keep the nation’s capital markets stable in the long-term, according to the Communist Party’s Qiushi magazine. Yi writes it’s not suitable for the authorities to intervene in the stock market in the event of normal fluctuations. (BBG)

CORONAVIRUS: Macau will reopen public services and entertainment facilities, and allow dining-in at restaurants from Tuesday, authorities said, as the world's biggest gambling hub seeks a return to normalcy after finding no COVID-19 cases for nine straight days. (RTRS)

PROPERTY: China Evergrande Group, the world’s most indebted developer, failed to deliver a ‘preliminary restructuring plan’ it had promised by the end of July, fueling risks investors will grow more impatient just as a broader debt crisis in the nation’s property industry spreads. The beleaguered real estate giant presented instead what it called ‘preliminary restructuring principles’ for its offshore debt, in an exchange filing late Friday. The stakes are high, with some $20 billion in dollar bonds among total liabilities of about $300 billion. Any restructuring could be among China’s biggest ever. (BBG)

PROPERTY/BANKING: China’s banks face mortgage losses of $350 billion in a worst-case scenario as confidence plunges in the nation’s property market and authorities struggle to contain deepening turmoil. (BBG)

CHINA MARKETS

PBOC NET DRAINS CNY3 BILLION VIA OMOS MONDAY

The People's Bank of China (PBOC) injected CNY2 billion via 7-day reverse repos with the rate unchanged at 2.10% on Monday. The operation has led to a net drain of CNY3 billion after offsetting the maturity of CNY5 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0214% at 09:48 am local time from the close of 1.6329% on Friday.

- The CFETS-NEX money-market sentiment index closed at 44 on Friday vs 45 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7467 MON VS 6.7437

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.7467 on Monday, compared with 6.7437 set on Friday.

OVERNIGHT DATA

CHINA JUL CAIXIN M’FING PMI 50.4; MEDIAN 51.5; JUN 51.7

The Caixin China General Manufacturing PMI in July fell 1.3 points from the previous month to 50.4, as the sector continued to recover from recent Covid outbreaks, though at a slower pace. Supply and demand improved. Manufacturing production grew for the second straight month. The subindexes for output and total new orders both remained in expansionary territory, but came in lower than in the previous month, indicating a slowing recovery. Electricity shortages faced by some companies and scattered Covid outbreaks in some regions were among factors that cut into market demand and confidence in July. New export orders remained stable, with the gauge slightly higher than 50. (Caixin)

CHINA JUL M’FING PMI 49.0; MEDIAN 50.3; JUN 50.2

CHINA JUL NON-M’FING PMI 53.8; MEDIAN 53.9; JUN 54.7

CHINA JUL COMPOSITE PMI 52.5; JUN 54.1

JAPAN JUL, F JIBUN BANK M’FING PMI 52.1; FLASH 52.2

The Japanese manufacturing sector saw a modest improvement in operating conditions at the start of the second half of the year, however the headline PMI masked some worrying trends when looking at the underlying sub-indices, which add downside risks for the sector. New order inflows fell for the first time in ten months and at the fastest pace since November 2020, which contributed to a renewed contraction in production levels - the first since February. (S&P Global)

JAPAN JUL VEHICLE SALES -13.4% Y/Y; JUN -15.8%

AUSTRALIA JUL, F S&P GLOBAL M’FING PMI 55.7; FLASH 55.7

Expansion across Australia’s manufacturing sector continued into July, according to the latest S&P Global PMI® data. A further acceleration in new orders growth was recorded while manufacturing output expanded but at a rate unchanged from June. Strong underlying demand conditions supported a faster rate of job creation but some firms continued to report difficulties in hiring new staff. Subsequently, staff shortages constrained output levels and contributed to the accumulation of backlogged orders and the renewed contraction in stocks of finished goods. (S&P Global)

AUSTRALIA JUL MELBOURNE INSTITUTE INFLATION +5.4% Y/Y; JUN +4.7%

AUSTRALIA JUL MELBOURNE INSTITUTE INFLATION +1.2% M/M; JUN +0.3%

AUSTRALIA JUL ANZ JOB ADVERTISEMENTS -1.1% M/M; JUN +1.4%

ANZ Job Ads decreased 1.1% m/m in July, a signal that we may be past the peak. But even if labour demand growth is starting to ease, we don’t think that will translate immediately into rising unemployment and underemployment. In fact, we now forecast unemployment to fall below 3% by early-2023. This reflects both the sharp improvement in the June data, with employment rising by 88,400 and unemployment dropping 0.4ppt to 3.5%, as well as the record high job vacancy rate. ABS job vacancies have significantly outpaced ANZ Job Ads during the pandemic recovery, as discussed in last month’s report, but both point to a significant volume of unfilled labour demand. There are 480,000 job vacancies across the economy, with sharp rises evident in most industries and geographies. Consequently, as higher inflation and rising rates curtail demand growth, it will take time for the gap between labour demand and supply to close enough to put upward pressure on unemployment. Newly arrived skilled migrants, temporary visa holders, students and backpackers are adding to the supply of workers, but also to already strong demand. So, while the return of migration improves labour mobility and matching, it doesn’t mean the gap is going to close quickly. (ANZ)

AUSTRALIA JUL CORELOGIC HOUSE PRICES -1.4% M/M; JUN -0.8%

NEW ZEALAND JUN BUILDING PERMITS -2.3% M/M; MAY -0.5%

SOUTH KOREA S&P GLOBAL M’FING PMI 49.8; JUN 51.3

South Korean manufacturers reported that strong inflationary pressures and sustained supply chain disruption had hindered production and demand at the start of the third quarter. The headline PMI fell below the neutral 50.0 threshold for the first time since September 2020 amid the first reduction in new orders since this point as well as the quickest reduction in output levels for nine months. (S&P Global)

SOUTH KOREA JUL TRADE BALANCE -$4,670MN; MEDIAN -$4,368MN; JUN -$2,575MN

SOUTH KOREA JUL EXPORTS +9.4% Y/Y; MEDIAN +10.0%; JUN +5.2%

SOUTH KOREA JUL IMPORTS +21.8% Y/Y; MEDIAN +22.7%; JUN +19.4%

MARKETS

SNAPSHOT: Pelosi Touches Down In Asia, Chinese M'fing PMIs Disappoint

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 179.35 points at 27979.64

- ASX 200 up 44.952 points at 6990.10

- Shanghai Comp. up 5.218 points at 3258.456

- JGB 10-Yr future down 12 ticks at 150.39, yield up 0.6bp at 0.191%

- Aussie 10-Yr future down 4.5 ticks at 96.875, yield down 15bp at 3.056%

- U.S. 10-Yr future -0-03 at 121-01+, yield up 1.99bp at 2.669%

- WTI crude down $1.30 at $97.32, Gold down $5.59 at $1760.32

- USD/JPY down 72 pips at Y132.56

- FED’S KASHKARI SAYS OFFICIALS ARE ‘A LONG WAY’ FROM BACKING OFF INFLATION FIGHT (NEW YORK TIMES)

- PELOSI STARTS ASIA TRIP IN SINGAPORE WITH NO MENTION OF TAIWAN (BBG)

- CHINA CONDUCTS MILITARY DRILLS IN TAIWAN STRAIT, WHILE HARDLINE NEWSPAPERS PROVIDE PELOSI WARNINGS

- CHINESE MANUFACTURING PMIS DISAPPOINT

- UKRAINE’S FIRST GRAIN SHIP MAY DEPART ON MONDAY, TURKEY SAYS (BBG)

- SUNAK PLEDGES TAX CUTS IN ATTEMPT TO OVERCOME TRUSS’ HUGE LEAD

US TSYS: A Touch Cheaper To Start The Week

TYU2 is -0-03 at 121-01+ ahead of European hours, dealing within the confines of a narrow 0-06 range overnight, on subdued volume of ~58K. Cash Tsys run 1.5-2.5bp cheaper across the curve, with some modest bear steepening in play.

- To summarise, U.S. Tsys cheapened a touch through Asia, looking through the softer than expected manufacturing PMI released out of China since Friday’s close and continued bubbling Sino-U.S. tensions re: Taiwan (no official word from U.S. House Speaker Pelosi’s camp re: visiting Taiwan, with her Asia tour getting underway in Singapore after fresh warnings from the Chinese press and Chinese military drills in the Taiwan Strait).

- It would seem that comments from Minneapolis Fed President Kashkari (’23 voter) explained the modest cheapening, although the previously identified risk-negatives tempered the pressure. Kashkari stressed that the Fed is a long way from where it needs to be in its fight against inflation, flagging his surprise re: the market’s interpretation of the central bank’s language. A reminder that Kashkari has historically been one of the more dovish Fed voices, which probably gives extra weight to such comments.

- Looking ahead, final m’fing PMIs from across Europe are due ahead of U.S. hours, while the ISM m’fing survey and final S&P m’fing PMI headline the domestic docket on Monday.

JGBS: Steepening Accelerates In The Afternoon As Super-Long End Softens

JGB futures nudged lower in early Toyo trade alongside the wider impulse observed in global core fixed income markets, with the contract having a shallow look through its overnight trough, although bears failed to force a meaningful extension. That leaves the contract off of worst levels ahead of the Tokyo close, -10, with wider market gyrations in the driving seat as the space looked through domestic news flow. The latter was headlined by a decline in Prime Minister Kishida’s approval rating, linked to the rise in COVID cases, and press reports flagging the potential for a record increase (~3.2%) to the minimum wage in Japan. Cash JGBs have twist steepened with 2s running 1bp richer, while the rest of the curve softens, led by 40s, which run ~3bp cheaper, with most of the cheapening taking place in the 20+-Year zone.

- Looking ahead, tomorrow’s local docket will be headlined by 10-Year JGB supply.

AUSSIE BONDS: Softer Ahead Of RBA

Aussie bond futures are off worst levels but have held on to the bulk of their early losses, aided by a similar move in U.S. Tsys. Cash ACGBs are closed owing to a NSW holiday. YM is -6.5, operating a little below its overnight low, while XM is -5.0, failing to challenge its own overnight boundaries. Bills run 6 to 10 ticks cheaper through the red, bear flattening.

- Domestic data releases (final manufacturing PMI, Melbourne Institute inflation, and ANZ job advertisements) provided little by way of meaningful, lasting direction for Aussie bond futures, with participants likely sidelined due to the proximity to tomorrow’s RBA decision, as well as diminished liquidity owing to aforementioned holiday in the state of NSW.

- It would seem that the impulse from hawkish Fedspeak released over the weekend (fleshed out elsewhere) dominated matters, although soft manufacturing PMI data out of China and Sino-U.S. tensions surrounding Taiwan likely tempered the losses.

- Tuesday will see home financing data and building approvals hit the wires ahead of the RBA’s monetary policy decision. Re: the latter, STIR markets are pricing in ~48bp of tightening at present.

EQUITIES: Mostly Higher In Asia; Chinese Property Developers Founder

Major Asia-Pac equity indices are mostly higher at typing, loosely tracking a positive lead from Wall St.

- The CSI300 trades 0.6% firmer at writing, reversing earlier losses of as much as 1.0%, with a rally in tech (ChiNext: +2.0%) and high-beta stocks aiding the rebound. Property (-2.7%) and financials (-0.8%) struggled, pressured by news of developer Evergrande offering “preliminary restructuring principles” instead of a “preliminary restructuring plan”, sidestepping earlier promises. Elsewhere, housing data released on Sunday by CRIC pointed to a 39.7% Y/Y decline in sales (-28.6% M/M), exacerbating worry surrounding the ongoing “mortgage revolt”. BBG source reports on Friday had also pointed to Chinese regulators considering a plan to seize land from distressed developers to complete halted projects, further souring sentiment.

- The Hang Seng Index deals 0.2% weaker at typing, paring earlier losses of as much as 1.3% on gains in industrials and tech (HSTECH: +0.4%). The property (-1.6%) and financials (-0.8%) sub-indices underperformed, while elsewhere, Alibaba Group (-1.8%) declined after the U.S. SEC on Friday placed it on a list of companies due to be delisted over ongoing Sino-U.S. audit disputes.

- The ASX200 sits 0.5% better off at typing, hitting seven-week highs as gains in the healthcare (+1.1%) and materials (+1.1%) sub-indices have countered shallow losses in the financials, real estate, and consumer discretionary sub-gauges. Note that the bank holiday in the state of NSW is expected to result in a volume-light session today.

- E-minis deal 0.4-0.5% worse off at writing, a little off worst levels heading into European hours.

OIL: Lower Amidst Weak Chinese PMIs; OPEC+ Meets This Week

WTI is ~-$1.00 and Brent is ~-$0.80 at typing, with both benchmarks operating around session lows after the Chinese Caixin manufacturing PMI print missed expectations (albeit narrowly staying within expansionary territory), adding to earlier worry re: economic slowdowns following the unexpected contraction in the official Chinese manufacturing PMI over the weekend.

- OPEC+ meets later this week (Aug 3), with the group’s communication re: adjustments to supply in focus, following RTRS sources last week reporting that a “modest” hike for Sep may be discussed. The group’s lack of accessible spare capacity remains well-documented however, with members missing collective output targets by ~2.7mn bpd for May (and widening to ~2.8mn bpd in June based on prior Argus Media source reports)

- Libya announced that crude production has returned to >1.2mn bpd, returning ~600K bpd of crude global supplies from the peak of the country’s political crisis in recent months.

- Iran on Sunday expressed the desire for a “swift conclusion” to nuclear talks in Vienna after the EU’s Borrell delivered a draft text early last week to both Iran and the U.S. (the U.S. State Dept is continuing to review the EU’s proposal).

- Elsewhere, debate re: the end of U.S. SPR crude releases in October has increasingly come to the fore, with the loss of ~1mn bpd in supply via the measure likely to exacerbate tightness in crude markets.

GOLD: Little Changed In Asia

Gold sits ~$1/oz weaker to print ~$1,765/oz at typing, off Friday’s three-week highs ($1,768.0/oz) as nominal U.S. Tsy yields have edged a little higher.

- Fed-related matters remain front and centre for the precious metal, with gold operating within a tight ~$6/oz range in Asia despite a spread of risk-negative headlines over the weekend (from weak Chinese official PMIs to U.S. House Speaker Pelosi’s potential visit to Taiwan). Elsewhere, there was little by way of a meaningful reaction in the yellow metal observed to the slight miss in Caixin m’fing PMI earlier in the session as well.

- Sep FOMC dated OIS now price in ~59bp of tightening for that meeting in the wake of previously-flagged comments by Minneapolis Fed Pres Kashkari, edging away from post Jul FOMC lows of ~54bp.

- To recap Friday’s price action, gold closed ~$10/oz firmer, rising from worst levels after slightly above-expectation prints for ECI and some measures of PCE, helping bullion cap a three-day streak of gains amidst a simultaneous downtick in U.S. real yields and the USD (DXY).

- From a technical perspective, gold’s recent bounce is still seen as corrective, with focus now on initial resistance at ~$1,786.1/oz (50-Day EMA), a break of which would bring $1, 814.5/oz (trendline resistance) into view. On the other hand, support is seen at ~$1,743.0/oz (20-Day EMA).

FOREX: Yen Remains On Tear

The yen was the big mover in G10 FX space again, with USD/JPY extending losses into the Tokyo fix. The rate sank as low as to Y132.07 before trimming some losses and last sits ~70 pips below neutral levels. The move seemed to be a continuation of dynamics that were in play towards the back end of last week, with participants exiting short JPY positions amid recent reduction in hawkish Fed bets, with some fresh demand for safe havens amplifying demand for the Japanese currency.

- USD/JPY 1-month risk reversal remained heavy, printing its worst levels since Jul 14 at one point, indicating bearish sentiment among options traders. Elsewhere, Bloomberg circulated latest CFTC data showing that leveraged funds have cut net-short futures/options position on JPY to the lowest since Mar 2021, citing market talk to the same effect.

- Reports did the rounds last Friday that Japan's government approved a guideline for the FY2023 budget that "will allow ministries to make request as appropriate to respond to currency swings," another indication of officials' discomfort with rapid yen depreciation this year.

- The yen likely capitalised on its safe haven status on Monday, as participants digested disappointing manufacturing PMI data out of China and examined reports of geopolitical tensions in the Balkans and the Taiwan Strait. While most regional equity benchmarks firmed, with a positive lead from Friday's Wall Street session lending support, e-mini futures stayed in the red.

- Riskier currencies generally went offered, albeit the NZD stood out, beating all G10 peers save for the yen. The kiwi may have been helped by AUD/NZD sales in response to weak Chinese data. The Antipodean cross slid below the NZ$1.1100 mark, with activity in Australia limited by a New South Wales holiday.

- Risk-off flows were evident in the price action of European FX, albeit liquidity was obviously limited in the Asia hours. The Swiss franc was the strongest performer in the region.

- Manufacturing PMI readings from across the globe will keep trickling through over the coming hours. Other notable data releases include U.S. construction spending, Eurozone unemployment & German retail sales.

FX OPTIONS: Expiries for Aug01 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0100-25(E1.2bln), $1.0200-10(E692mln), $1.0250(E550mln), $1.0300(E842mln)

- GBP/USD: $1.2125(Gbp587mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/08/2022 | 0600/0800 | ** |  | DE | retail sales |

| 01/08/2022 | 0715/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/08/2022 | 0745/0945 | ** |  | IT | IHS Markit Manufacturing PMI (f) |

| 01/08/2022 | 0750/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/08/2022 | 0755/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/08/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/08/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Manufacturing PMI (Final) |

| 01/08/2022 | 0900/1100 | ** |  | EU | Unemployment |

| 01/08/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/08/2022 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 01/08/2022 | 1400/1000 | * |  | US | Construction Spending |

| 01/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 01/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 01/08/2022 | 1900/1500 |  | US | Treasury Marketable Borrowing Estimates |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.