-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

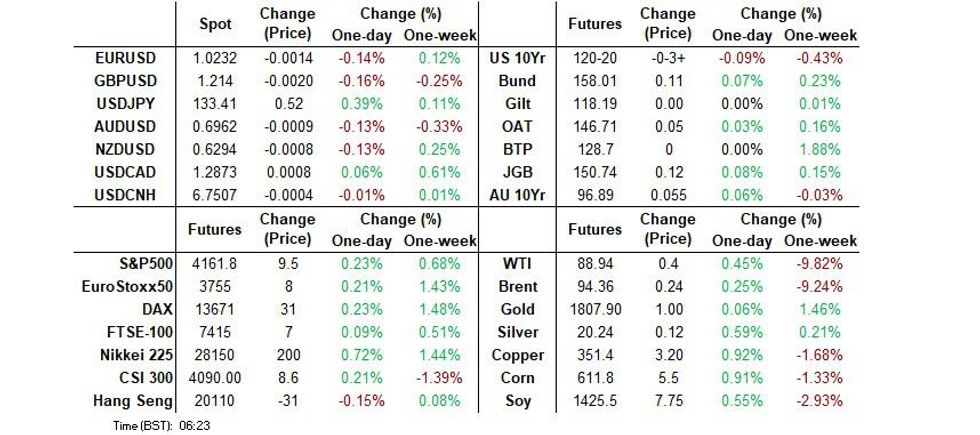

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Coiling Into NFPs

- A tight pre-NFP Asia session for most markets saw focus fall on the Taiwan situation & U.S. fiscal matters.

- While the U.S. NFP report will steal the limelight later in the day, its Canadian equivalent as well as German industrial output data and comments from Fed's Barkin & BoE's Pill are also due.

US DATA PREVIEW: MNI Payrolls Preview: Just How Much Softer

EXECUTIVE SUMMARY

- Friday, 0830ET: Consensus sees nonfarm payrolls growth moderating to 250k in July in a resumption of a downward trend after four remarkably steady months as the gap on pre-pandemic employment levels is almost completely shut.

- Particular focus is likely on the strength of jobs growth plus any differences between establishment and household surveys, with FOMC speakers putting weight on labour market strength as evidence against the economy already being in recession.

- Unusually large swings in markets in the run in to this release create sizeable two-sided risk. Fed Funds futures are currently torn between a 50bp or 75bp hike at the Sept FOMC with a second payrolls report, two CPI reports and the Jackson Hole symposium still to come before then.

- Full report including previews from 13 sellside analysts here.

US DATA: PREVIEW: Primary Dealer NFP Estimates

| Primary Dealer | Estimate | Primary Dealer | Estimate |

|---|---|---|---|

| Amherst Pierpoint | +325K | RBC | +320K |

| Citi | +300K | Credit Suisse | +300K |

| Morgan Stanley | +300K | TD Securities | +300K |

| Scotiabank | +290K | BNP Paribas | +280K |

| Bank of America | +275K | Barclays | +275K |

| Daiwa | +275K | NatWest | +270K |

| Jefferies | +260K | Deutsche Bank | +250K |

| HSBC | +250K | Nomura | +240K |

| Wells Fargo | +240K | Goldman Sachs | +225K |

| Societe Generale | +225K | J.P.Morgan | +200K |

| Mizuho | +200K | BMO | +150K |

| UBS | +150K | ||

| Dealer Median | +270K | BBG Whisper | +226K |

US TSYS: Tight Asia Trade Ahead Of NFPs

A muted pre-NFP Asia-Pac session saw a modest early bid on the back of the dynamics that supported most of the Tsy curve on Thursday, with a sprinkling of regional worry surrounding the Taiwan situation also thrown in. The space then moved away from best levels as the Democrats came to an agreement re: the overarching finalities of the Inflation Reduction Act (voting, technicalities and the view of the Parliamentarian re: several matters will likely be addressed over the weekend/in the coming days), before the latest round of Chinese incursions surrounding Taiwanese borders in the Taiwan Strait provided some modest support.

- TYU2 deals in the middle of an 0-08 range into London hours, -0-03 at 120-20+, on sub-standard volume of ~45K lots. Cash Tsys sit 0.5bp richer to 0.5bp cheaper across the curve.

- Looking ahead, the aforementioned labour market report headlines the NY docket today (click for our full preview of that event), with comments from Richmond Fed President Barkin (’24 voter) also due.

JGBS: Modest Early Moves Stick

JGB futures have nudged higher during the Tokyo afternoon, after unwinding overnight gains during early Tokyo trade. The contract last deals +13 as we work towards the bell.

- Firmer than expected household spending and wage data, coupled with a very modest dip in the wider fixed income sphere and an uptick for the Nikkei 225, provided early sources of pressure. Although it seems to be continued worry surrounding the situation in Taiwan (with Japan’s rhetoric resulting in the cancellation of a bilateral meeting between the Japanese & Chinese Foreign Ministers, in addition to the Japanese ambassador to China being summoned) that allowed a bid to reassert itself in the Tokyo afternoon.

- The early bull flattening has extended as a result, with the major cash JGB benchmarks running little changed to 4.5bp richer across the curve.

- Looking ahead, Monday’s domestic docket includes BoP data and the latest economy watchers survey.

AUSSIE BONDS: Back From Lows

Aussie bonds are off their session extremes, sitting little changed from levels witnessed before the release of the RBA’s quarterly SoMP. Meanwhile, U.S. Tsys stuck to a tight range, providing little by way of meaningful, lasting direction for ACGBs throughout the Sydney session (coiling ahead of NFP data due in the NY session).

- Cash ACGBs run 3.0-5.5bp richer across the curve, with the belly leading the bid. YM and XM are +3.5 and +5.0, with the latter operating a little below ts overnight peaks after failing to meaningfully break above those levels earlier. Bills run 2 ticks cheaper to 2 ticks richer through the reds.

- The latest round of ACGB Apr-2027 supply went smoothly, with the weighted average yield pricing 2.01bp through prevailing mids (per Yieldbroker estimates), while the cover ratio dipped to 3.14x - below the six-auction average at 4.13x, but not suggesting anything by way of a worrying decline in demand at that level. The easily digestible DV01 on offer (A$321K) and the fact that the line is borrowed via the RBA’s SLF (indicating wider demand for access to the line) likely aided the firm pricing.

- The release of the RBA’s quarterly Statement on Monetary Policy (SoMP) did little to rock ACGBs, with the major economic forecasts having already been released in Tuesday’s post-meeting statement. The highlights surrounding the release remains the lifting of the RBA’s inflation outlook to 7.75% by Dec ’22, with unemployment expected to bottom out by end-’22 before rising to 4% by end ‘24. RBA assumptions surrounding the cash rate at year end were in line with the midpoint of analyst and market expectations, meaning there wasn’t any meaningful market reaction to that verse of the release.

- The release of the weekly AOFM issuance slate similarly saw little reaction in the Aussie bond space, with three rounds of ACGBs on offer for a total of A$1.8bn.

- Monday will see July foreign reserves headline the data docket, with A$300mn of ACGB Apr-2037 on offer via auction.

FOREX: Yen Loses Ground, USD/JPY Flirts With Weekly Gain

The yen gave back its initial gains and retreated, extending gains after the Tokyo fix, amid a positive showing from the equity space. Both regional benchmarks and U.S. e-minis crept higher despite a mixed Thursday session on Wall Street.

- The rebound in USD/JPY may have been facilitated by a degree of widening in U.S./Japan yield spread. Risk reversal held steady after soaring to multi-week highs on Thursday. A large ($1.5bn) option expiry at Y134.00 for today's NY cut may render this level magnetic.

- Sterling traded on a slightly softer footing, likely due to regional reaction to the BoE's commentary that came alongside yesterday's rate decision. Gov Bailey outlined a downbeat assessment of the economy and said GBP decline is "not a crisis."

- The greenback outperformed at the margin, with the BBDXY index moving away from yesterday's lows, with participants preparing for a key jobs market report out of the U.S.

- While U.S. NFP report will steal the limelight later in the day, its Canadian equivalent as well as German industrial output data and comments from Fed's Barkin & BoE's Pill are also due.

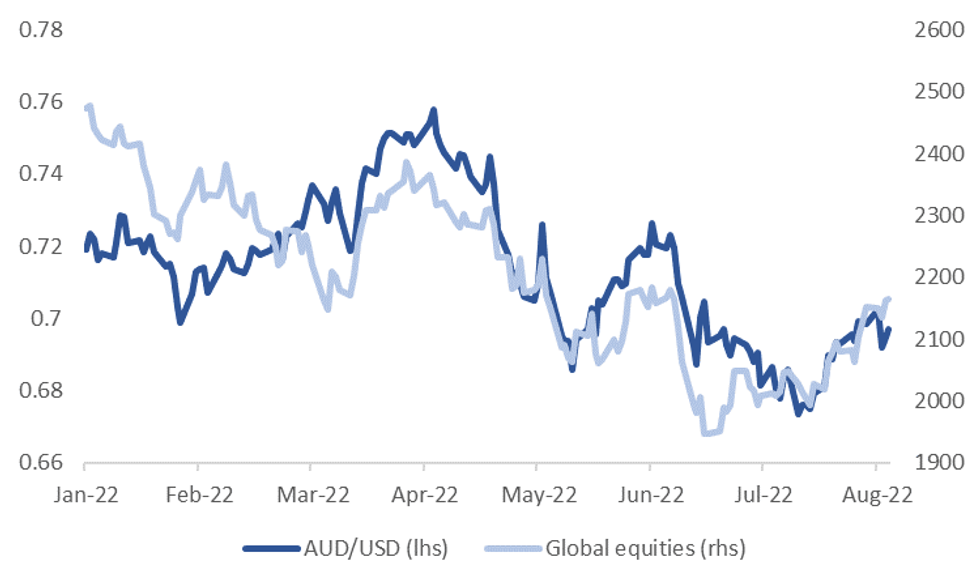

AUD: A$ Lagging Better Equity Market Sentiment

A$ correlations have shifted over the past week. As is usually the case in RBA decision week's, the short term correlations with yield spreads has bounced back, see the table below. Short end spreads are slightly higher for the week, albeit around a volatile trend. The 2yr spread currently sits roughly middle of the range for the past month at -40bps (-20bps to -60bps range).

- The 5yr and 10yr spreads are basically unchanged over the past week at +10bps and +42bps respectively.

- The other shift is lower correlations with respect to global commodity price and equity market moves. The dip in correlations with iron ore is also noticeable, nearly flat for the past week, and under 50% for the past month.

- The drop in correlations with global equities is more significant though, but remains elevated on a monthly horizon. The A$ has lagged better global equity sentiment this past week, see Fig 1 below.

Table 1: AUD/USD Correlations

| 1wk | 1mth | |

| 2yr yield differential | 0.61 | 0.62 |

| 5yr yield differential | 0.85 | 0.35 |

| 10yr yield differential | 0.88 | 0.06 |

| Global commodity prices | 0.62 | 0.82 |

| Iron ore | 0.07 | 0.49 |

| Global equities | 0.24 | 0.88 |

| US VIX index | -0.36 | -0.88 |

Source: MNI - Market News/Bloomberg

Fig 1: AUD/USD Lagging Global Equities This Past Week

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

ASIA FX: Gains Across The Board, CNH Lags

Asian FX is stronger across the board today, with the exception of CNH, which has lagged and sits unchanged against the USD. Strong gains have been evident for KRW, THB, PHP and INR. FX in the region has outperformed the majors, with the DXY up close to 0.2% so far today.

- CNH: USD/CNH had a brief dip under 6.7500, but we back at 6.7520 now, unchanged for the session. China equities are higher, but aren't outperforming within a regional context. Note July trade data prints this Sunday.

- KRW: USD/KRW has broken lower, further catching up with the on-going improvement in local equities (up a further 0.90% today). Offshore investors have added nearly $1.6bn in local shares over the past 6 sessions. The 1 month NDF is eyeing a test of the late July lows around 1295.50 (currently at 1296.60)

- TWD: TWD FX is trading slightly firmer, with both USD/TWD spot and the 1 month NDF back below 30.00. Onshore equities have risen more than 2% today, supported by better tech sentiment offshore. Rhetoric around China's continued military exercises persists, but broader market fallout remains limited for now.

- INR: The RBI hiked rates by 50bps, taking the policy rate to 5.40%. This was above market expectations of a move to 5.25%. The RBI remains focused on withdrawing accommodation. INR is slightly firmer, with USD/INR dipping back under 79.00 post the decision from 79.10/15 prior.

- IDR: Spot USD/IDR is down -33 figs to 14900 currently. In line with a firmer sentiment elsewhere, while Indonesia's GDP data exceeded expectations as annual growth accelerated to +5.44% Y/Y in Q2 from +5.01% prior (versus +5.17% BBG consensus forecast). The quarterly jump of +3.72% also topped expectations (+3.47%).

- PHP: CPI data was the focus, which revealed a surprise acceleration in headline inflation. Price growth quickened to +6.4% Y/Y in July, the fastest pace since October 2018. Following the release of CPI data today, the central bank noted that it is prepared to take all necessary policy action to bring inflation toward a target-consistent path over the medium term. USD/PHP is down -0.70% to 55.215 so far today.

- THB: In Thailand CPI figures were mixed, with headline softer at 7.61%, versus 8.00% expected. Core was stronger though at 2.99% versus 2.63% expected. Almost all economists surveyed by Bloomberg already expect a 25bp rate rise, at next week's BoT meeting, with the sole dissenter calling for a 50bp move. USD/THB has slumped more than 1% today, to be back at 35.65.

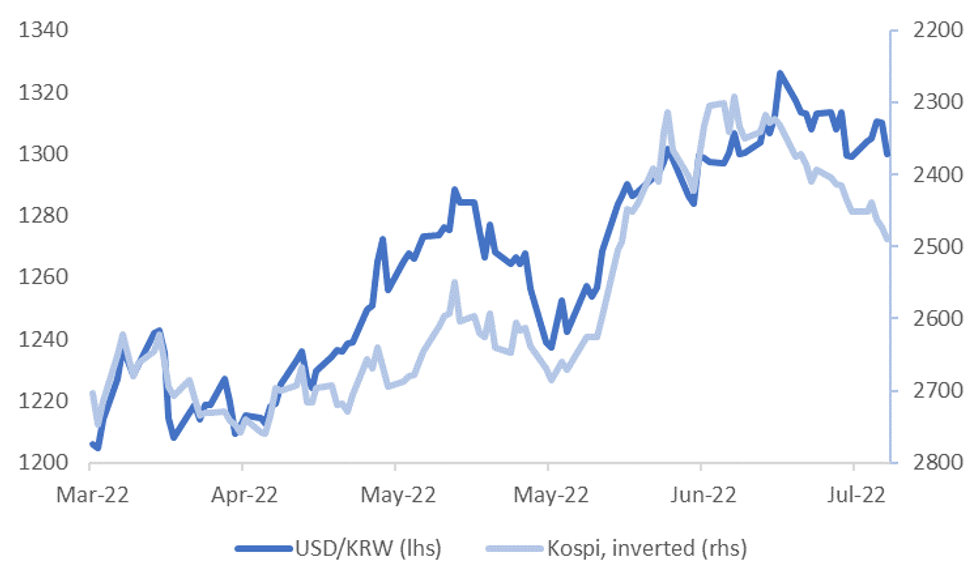

KRW: Won Firming With Equities, Outperforming Firmer USD Seen Elsewhere

USD/KRW is sub 1300, with spot down 0.8% from yesterday's close, while the 1 month NDF is down close to 0.30% from NY closing levels (last at 1299). Onshore equities continue to grind higher. The won is moving in line with the equity trend, although a wedge persists, see the chart below, note the Kospi is inverted on the chart.

Fig 1: USD/KRW & Kospi Trends

Source: MNI/Market News/Bloomberg

Source: MNI/Market News/Bloomberg

- As we highlighted earlier, offshore net equity inflow momentum remains positive and continues some catch up to the better onshore equity picture.

- The second chart below plots the rolling 1 month sum of equity inflows, versus the 1 month change in KRW/USD. Net inflows are just over $2.5bn over the past month, with nearly $1.6bn in flows coming in over the past 6 trading sessions.

- Won gains beyond 1300 have not been sustained in recent weeks. Obviously, broader USD performance is important, although the KRW is outperforming dollar strength today. This is particularly evident in USD/KRW moving lower as USD/JPY pushed back above 133.00.

- The KRW NEER has stabilized in recent weeks but hasn't seen much upside beyond the 106.00 level (according to the J.P. Morgan estimate, see JBDNKRW <Index> on Bloomberg).

Fig 2: Net Equity Flows & KRW/USD Rolling 1 month Changes

Source: MNI/Market News/Bloomberg

Source: MNI/Market News/Bloomberg

INR: Hikes By 50bps, As Inflation Fight Prioritized

The RBI hiked rates by 50bps. This takes the policy rate to 5.40%, which was above the market consensus of 5.25%. As we noted in our preview, today's call was a close decision between a 35bps or a 50bps hike. In the event the RBI has prioritized the inflation fight.

- RBI Governor Das stated that Q2 and Q3 inflation was seen above upper tolerance levels. Recall, the June CPI YoY print came in at 7% YoY, while the RBI maintains a 2-6% target.

- In terms of the growth and inflation outlook, Das stated the risks were evenly balanced.

- The growth projection for the current financial year of 7.2% was retained. The domestic recovery was seen as broadening, but risks were posed by the external sector.

- On inflation, the current projection of 6.7% was retained for this financial year. Household inflation expectations had moderated but remained at a high level, while there signs of easing supply chain pressures and global commodity prices are off highs.

- In terms of market reaction USD/INR moved below 79.00 post the announcement but we have stabilized back above this level now. Onshore bond yields have climbed, the 10yr rebounding to 7.25%, +10bps for the session. Local equities are off earlier highs.

- With the policy rate now above 2019 highs, our sense is that the pace of rate hikes is likely to slow going forward, although a lot depends on how inflation evolves. Next Friday July figures print, with the market expecting an easing in YoY momentum to 6.80%.

EQUITIES: Mostly Higher In Asia; Defence Stocks Gain As Chinese Live-Fire Drills Continue

Major Asia-Pac equity indices are mostly higher at typing, bucking a mixed, tech-focused lead from Wall St. Notable gains were observed in semiconductor and defence-related stocks across the region, with the latter sector catching a bid as reports of China firing missiles over Taiwan and into Japan’s EEZ has done the rounds.

- The Nikkei is 0.8% better off at typing, hitting two-month highs in the process. Consumer staples and tech stocks outperformed, with the former catching a bid after domestic household spending data beat expectations, pointing to Japanese consumers increasing their spending for the first time in four months. Looking ahead, index heavyweight Tokyo Electron (+3.0%) reports earnings next Monday, with focus likely turning to its outlook amidst recent gloom-tinged forecasts issued by semiconductor industry peers.

- The Hang Seng trades 0.1% higher at typing, paring opening gains of as much as 0.5%. The property (+0.6%) and finance (+0.2%) sub-indices are in the green for a change, supported by Securities Times reports of several cities strengthening supervision of property presale funds in escrow accounts to ensure home deliveries.

- The ASX200 is 0.4% firmer at writing, with gains in materials (+1.7%) and healthcare (+0.8%) countering losses in energy and tech. The S&P ASX All Tech Index deals 0.7% softer at typing, with sentiment in the sector weaker after heavyweight Block Inc’s (-5.9%) earnings disappointment.

- The Taiex is 2.0% better off at writing after opening higher, on track to completely unwind losses observed earlier this week despite ongoing tensions with China on the back of outperformance in the Semiconductor (+2.7%) sub-gauge.

- E-minis trade 0.3% firmer apiece, with NASDAQ 100 contracts hitting three-month highs earlier in the session.

GOLD: Little Changed In Asia; $1,800/oz Eyed

Gold deals~$2/oz weaker to print ~$1,789/oz at typing, backing away from its earlier bid as an initial downtick in nominal U.S. Tsy yields has reversed course. The precious metal however remains on track for a third straight higher weekly close as the USD (DXY) has extended a pullback away from cycle highs, with rising geopolitical and recession-related worry providing support for the space as well.

- To recap Thursday’s price action, gold closed ~$26 higher, facilitated by a downtick in the DXY, while wider worry re: economic slowdowns were bumped higher as the BoE forecast that the UK will potentially enter a recession in Q4 ‘22 that may last for over a year, after unveiling its largest rate hike in 27 years.

- Elsewhere, the commencement of Chinese live-fire drills in the waters surrounding Taiwan (with Japan accusing China of firing missiles over Taiwanese territory and into its own EEZ) has contributed to some haven demand, with condemnation from the likes of the U.S. and Japan kicking geopolitical tensions higher a notch (note that China on Thursday cancelled a planned bilateral meeting of foreign ministers with Japan over the G7’s joint statement re: Taiwan).

- From a technical perspective, gold is through initial resistance at the $1,783.1/oz (50-Day EMA), with the relatively clear break higher suggesting potential for a bullish extension, exposing further resistance at $1,804.6/oz (trendline resistance).

OIL: A Little Off Five Month Lows; Demand Worry In Focus

WTI and Brent are ~$0.20 firmer apiece, operating a little above their respective troughs established on Thursday. Both benchmarks are on track for a lower weekly close, weighed down in recent sessions by demand destruction worry amidst high energy prices and well-documented recession fears, offsetting moderating concerns re: disruptions to near-term crude supplies.

- To recap, WTI and Brent hit fresh six- and five-month lows respectively before closing >$2 weaker on Thursday, with crude now back at ranges observed before the Russian invasion of Ukraine.

- U.S. energy data this week has contributed to the bulk of debate re: demand destruction, with Cushing hub stocks reporting a build for a fifth straight week, while gasoline consumption remains below ‘20 levels even as the country eases out of “peak demand” season.

- Keeping within the country, EIA data has shown U.S. airline fuel consumption dipping below last year’s levels (on a seasonal basis) amidst reduced flying activity, with the industry reeling from labour woes and high fuel costs.

- Looking to supply concerns, RTRS source reports on Thursday pointed to Saudi Arabia and the UAE being prepared to make a “significant increase” in oil output during the winter months of ‘22 should a “severe supply crisis” arise. Estimates of OPEC’s spare capacity typically place it at >2mn bpd at present, concentrated in Saudi Arabia and the UAE.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/08/2022 | 0600/0800 | ** |  | DE | Industrial Production |

| 05/08/2022 | 0600/0700 | * |  | UK | Halifax House Price Index |

| 05/08/2022 | 0645/0845 | * |  | FR | Industrial Production |

| 05/08/2022 | 0645/0845 | * |  | FR | Foreign Trade |

| 05/08/2022 | 0645/0845 | * |  | FR | Current Account |

| 05/08/2022 | 0700/0900 | ** |  | ES | Industrial Production |

| 05/08/2022 | 0800/1000 | * |  | IT | Industrial Production |

| 05/08/2022 | 1115/1215 |  | UK | BOE Pill Monetary Policy Report National Agency Briefing | |

| 05/08/2022 | 1200/0800 |  | US | Richmond Fed's Tom Barkin | |

| 05/08/2022 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 05/08/2022 | 1230/0830 | *** |  | US | Employment Report |

| 05/08/2022 | 1400/1000 | * |  | CA | Ivey PMI |

| 05/08/2022 | 1900/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.