-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Markets Coil, Awaiting A Catalyst

EXECUTIVE SUMMARY

- RISHI SUNAK AND LIZ TRUSS RULE OUT EMERGENCY BUDGET BEFORE NEW UK PM CHOSEN (TELEGRAPH)

- TAIWAN BEGINS LIVE-FIRE ARTILLERY DRILL TO DEFEND AGAINST CHINA (BBG)

- PBOC MAY REDUCE MLF INJECTIONS NEXT MONDAY (21CBH)

- CHINA UNLIKELY TO CUT INTEREST RATE AND RRR IN SHORT-TERM (SEC. DAILY)

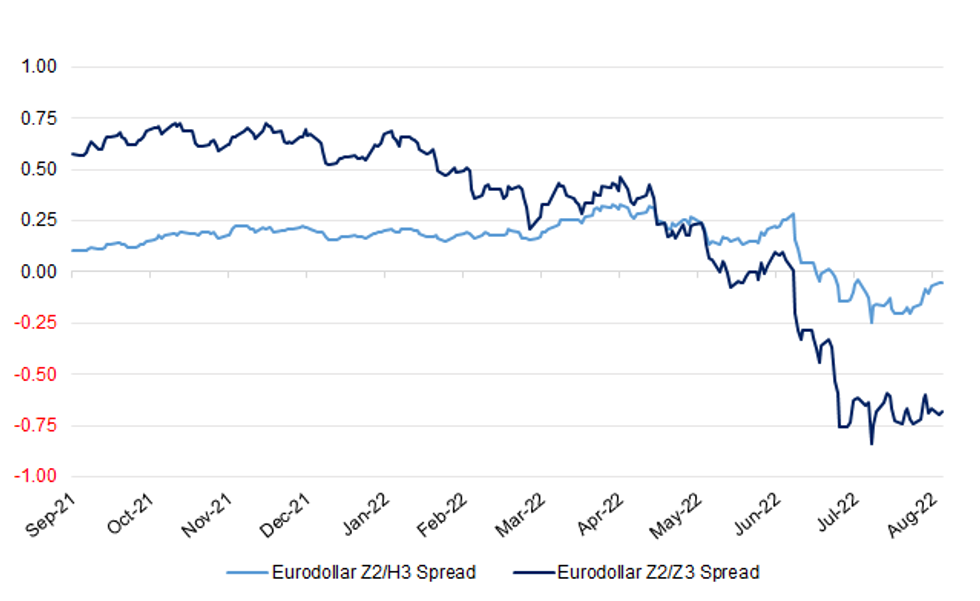

Fig. 1: Eurodollar Z2/H3 & Z2/Z3 Spreads

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS/FISCAL: Boris Johnson and both Conservative leadership candidates have ruled out an emergency cost of living Budget until the next prime minister is chosen, amid calls led by Gordon Brown for immediate action. (Telegraph)

POLITICS/FISCAL: Rishi Sunak promised to offer more support to households facing a crippling cost-of-living crisis as pressure builds on Boris Johnson’s government to reassure people amid soaring energy bills. (BBG)

POLITICS/FISCAL: The Conservatives will be writing an “electoral suicide note” if Liz Truss pushes ahead with her plans for an emergency tax-cutting budget, Boris Johnson’s deputy has warned. (The Times)

FISCAL: Campaigners have demanded a 25p cut in fuel prices to help reduce the cost of living. FairFuelUK said fuel duty should be cut by 20 to 25p per litre in a similar manner to cuts seen in Europe. (Sky)

POLITICS/BOE: Former Chancellor of the Exchequer Norman Lamont, who introduced the UK’s first inflation target in 1992, said it would be a mistake to abandon the measure in favor of a money supply goal, in an implicit criticism of proposals by Liz Truss, the front-runner to be Britain’s next prime minister. (BBG)

BOE: The Bank of England will struggle to reduce its balance sheet quickly enough to reduce the danger of political interference in the next few years, but the pace of quantitative tightening will still pose difficult debt management issues in tricky markets, former top BOE official William Allen told MNI. (MNI)

ECONOMY: Figures from payments processor Barclaycard also contrasted with the prevailing gloom over the economy. Consumer spending in July was 7.7% higher than a year earlier, pushed up by sales of clothing, beauty products and staycations as well as a 44% leap in utilities and a 30% leap on fuel, Barclaycard. (RTRS)

BREXIT: The UK has been given extra time to respond to legal action launched by the EU over plans to scrap parts of the Northern Ireland Protocol. Legislation to give UK ministers powers to override the post-Brexit trade arrangements is going through Parliament. (BBC)

U.S.

FED: High and persistent inflation will force Federal Reserve policymakers to raise interest rates much more than they are currently projecting, perhaps nearly twice as much, ex-Fed board economist Andrew Levin told MNI. (MNI)

POLITICS: The FBI is raiding Mar-a-Lago, former President Donald Trump’s resort home in Palm Beach, Florida, Trump said Monday evening. In a lengthy statement, Trump said his residence is “currently under siege, raided, and occupied by a large group of FBI agents. (CNBC)

OTHER

GLOBAL TRADE: The first crop cargo to depart Ukraine’s newly opened grain ports is now floating in the Mediterranean Sea, searching for a new destination after losing its buyer. (BBG)

GLOBAL TRADE: Ships exporting Ukraine grain through the Black Sea will be protected by a 10 nautical mile buffer zone, according to long-awaited procedures agreed by Russia, Ukraine, Turkey and the United Nations on Monday and seen by Reuters. (RTRS)

CHINA TAIWAN: China looks for excuses for military exercises, and the excuse this time was U.S. House of Representatives Speaker Nancy Pelosi's visit, Taiwan foreign minister Joseph Wu said on Tuesday. Wu said China would not have been able to prepare the drones, cyberattacks and misinformation campaigns in such a short period of time. The best way to deal with a regime that is trying to intimidate Taiwan is to show it is not intimidated, he said. (RTRS)

CHINA/TAIWAN: Taiwan proceeded with a live-fire artillery drill simulating a defense against a Chinese invasion, days after Beijing began its most provocative military exercises in decades in the wake of US House Speaker Nancy Pelosi’s visit to Taipei. (BBG)

U.S./CHINA/TAIWAN: The United States has not changed its assessment on China's timeline for potentially retaking Taiwan militarily, a senior Pentagon official said on Monday, sticking by previous statements that Beijing would not try to take it in the next few years. Asked if the Pentagon's assessment that China would not try to retake China militarily in the next two years had changed since House of Representatives Speaker Nancy Pelosi's trip to the island, Under Secretary of Defense for Policy Colin Kahl said: "No." (RTRS)

JAPAN: Japanese Prime Minister Fumio Kishida is likely to appoint Industry Minister Koichi Hagiuda to a position outside the cabinet, while retaining his current finance and foreign ministers in a reshuffle expected this week, media said. (RTRS)

JAPAN: Japan’s transport ministry recommended raising taxi fares in Tokyo by ~14% at a panel meeting on Mon., Nikkei reports. (BBG)

RBA: The Reserve Bank of Australia will trial its own digital currency as part of a research project to evaluate the future of Central Bank Digital Currencies (CBDC) in Australia. (ABC News)

BRAZIL: Govt will propose Brazil’s minimum wage at 1,302 reais per month in 2023 budget draft bill, with no real increase for the fourth year in a row, Folha de S.Paulo newspaper said citing people with direct knowledge of the matter. (BBG)

RUSSIA: As many as 80,000 Russian troops have been wounded or killed in less than six months of fighting in Ukraine, the Pentagon said Monday, the first time the U.S. military announced its estimates of the toll of the invasion on Russia. (WSJ)

RUSSIA: Russia has told the United States it is suspending inspection activities under the START arms control treaty, the Russian foreign ministry said on Monday, adding that Moscow remains committed to all provisions of the treaty. (RTRS)

IRAN: The European Union on Monday said it put forward a "final" text to revive the 2015 Iran nuclear deal as four days of indirect talks between U.S. and Iranian officials wrapped up in Vienna. (RTRS)

COLOMBIA: Colombia's new leftist government on Monday formally proposed a tax reform bill to lawmakers which would raise some 25 trillion pesos ($5.76 billion) in 2023 in an effort to increase revenue to fund anti-poverty programs. Finance Minister Jose Antonio Ocampo said the bill would eventually add some $11.53 billion annually to government coffers, with revenue gradually climbing as parts of the legislation come into force. (RTRS)

OIL: Canadian and U.S. officials met in late July for technical discussions about Enbridge Inc.'s Line 5 pipeline, said Canada's Ambassador to the U.S. Kirsten Hillman. Michigan is trying to shut down the pipeline, which is a major source of oil and petroleum products to Canada's Ontario and Quebec provinces. (Dow Jones)

OIL: A tanker of U.S. sour crude was delivered at Germany's port of Rostock last week for the first time ever, according to sources, analysts and vessel tracking data, as local refiners test alternatives to Russian oil. (RTRS)

CHINA

ECONOMY: Half of China’s provinces are sticking to their commitments on regional economic growth targets for this year, even as Beijing has softened its tone on achieving the broader national target. (SCMP)

PBOC: China is unlikely to cut key rates in short term amid interest rate gap between China and US and rising inflationary pressure, as well as deficit demand that counters loosening monetary policy, Securities Daily reports, citing Wu Chaoming, deputy dean of Chasing Securities Co.’s Chasing Institute. (BBG)

PBOC: The PBoC may reduce the amount of medium-term liquidity in the banking system during next Monday’s MLF operation, as the continued presence of loose funding conditions in the interbank market has resulted in increased leverage and arbitrage plays, the 21st Century Business Herald reported, citing analysts. In the first week of August, the DR001 rate fell to around 1%, while the DR007 rate fell below 1.3%, with both measures reaching the lowest level observed in 2022, operating clearly below the 7-day reverse repo rate of 2.1%. The substantial deviation of market interest rates from policy rates will weaken the guiding role of policy rates and hinder monetary policy transmission, with the newspaper noting that the central bank is likely to intervene moderately if the DR001 rate falls below 1%, citing Ming Ming, chief economist at CITIC Securities. (MNI)

FISCAL: China is expected to further increase its use of pro-growth policies, with fiscal and monetary policy becoming fully coordinated in the second half of 2022, the Securities Daily reported, citing analysts. Local governments may be allowed to add up to CNY1.55 trillion of special bonds in H222, which would facilitate a continued acceleration of infrastructure investment, the newspaper said, citing Wang Qing, chief analyst of Golden Credit Rating. The People’s Bank of China should keep liquidity reasonably ample amid fiscal expansion, so to prevent market interest rates from rising too quickly, Wang said. (MNI)

CORONAVIRUS: China’s Hainan province government held a meeting Monday and set the target to achieve zero community transmission by Aug. 12, according to a statement on the local government website. (BBG)

CHINA MARKETS

PBOC SETS YUAN CENTRAL PARITY AT 6.7584 TUES VS 6.7695 MON

The People's Bank of China (PBOC) set the dollar-yuan central parity rate Lower at 6.7584 on Tuesday, compared with 6.7695 set on Monday.

PBOC NET DRAINS CNY40 BILLION VIA OMOS TUESDAY

The People's Bank of China (PBOC) injected CNY2 billion via 7-day reverse repos with the rate unchanged at 2.10% on Tuesday. The operation has led to a net drain of CNY40 billion after offsetting the maturity of CNY2 billion repos and CNY40 billion Treasury deposits at commercial banks today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.6901% at 09:53 am local time from the close of 1.2850% on Monday.

- The CFETS-NEX money-market sentiment index closed at 48 on Monday vs 42 on Friday.

OVERNIGHT DATA

JAPAN JUL M2 MONEY STOCK +3.4% Y/Y; MEDIAN +3.3%; JUN +3.3%

JAPAN JUL M3 MONEY STOCK +3.0% Y/Y; MEDIAN +3.0%; JUN +3.0%

AUSTRALIA JUL NAB BUSINESS CONFIDENCE 7; JUN 2

AUSTRALIA JUL NAB BUSINESS CONDITIONS 20; JUN 14

Business confidence rose back above average and conditions strengthened in July as businesses reported new record levels of capacity utilisation, cost growth and price rises. After a steady decline over recent months, confidence rose to +7 index points - a marked rally in the face of headwinds from inflation and rising interest rates, as well as a deteriorating global economic outlook. Business conditions remain well above average after rising 6pts in the month, with trading conditions, profitability and employment all higher. The strength in conditions remained broad-based across states and industries, with a notable pickup in the construction sector. Capacity utilisation rose to a record 86.7% - well above the long-run average of 81.1%, suggesting the economy could be running up against capacity constraints. Further evidence the economy is reaching its limits comes from cost indicators, which jumped higher again in July after hitting new records in June. In quarterly terms, purchase costs grew 5.4% (previously 4.8%), and labour costs grew 4.6% (previously 3.1%), with the latter likely reflecting a combination of new hiring, increased hours, bonus payments and underlying wage increases, including the minimum wage decision taking effect. Importantly, the strength in demand continues to allow firms to pass higher costs onto their customers, with overall product prices growing 2.7% and retail prices growing 3.3% - both at new highs. Overall, the survey suggests that despite global and domestic economic headwinds, demand has remained strong - and inflationary pressure continues to build suggesting that inflation is yet to peak. (NAB)

AUSTRALIA AUG WESTPAC CONSUMER CONFIDENCE 81.2; JUL 83.8

This reading is on a par with the lows of the Covid and Global Financial Crisis although still well above the lows during the late 80/s/ early 90’s recession. Since the recent peak in November 2021 the Index has fallen every month for a cumulative decrease of 22.9%. Individual movements in the sub-indexes over that period are: “Finances relative to a year ago” (-18%);” Finances over the next 12 months” (-19%);” the economy over the next five years” (-18%);” the economy over the next 12 months” (-31%) and “whether now is a good time to buy a major household item” (-27%). Our experience is that the 12month economic outlook has been the most volatile of the sub- indexes. A strong message from the collapse in the Index over the last nine months has been the negative attitude to major household purchases where confidence has fallen almost as fast as the 12month economic outlook. (Westpac)

AUSTRALIA ANZ-ROY MORGAN WEEKLY CONSUMER CONFIDENCE INDEX 80.3; PREV. 84.1

Consumer confidence declined 4.5% last week, to its lowest levels since April 2020, as the RBA increased interest rates by 50bp for the third month in a row to 1.85%. Household inflation expectations increased 0.1ppt to 5.6% despite petrol prices falling for a fourth consecutive week. Demand for housing has been dropping, along with house prices. That and rising interest rates caused confidence among homeowners to drop 7% last week. So far in 2022, household spending has been robust despite very weak consumer sentiment, with strong employment gains, high levels of household saving and a desire to travel more than offsetting concerns about the rising cost of living. It remains to be seen whether this divergence between confidence and spending can continue. Certainly, we expect employment to remain robust through 2022 and wages growth to pick up. This may be enough to keep households spending, even if they feel wary about the outlook. (ANZ)

NEW ZEALAND JUL TOTAL CARD SPENDING -0.2% M/M ; JUN -0.3%

NEW ZEALAND JUL RETAIL CARD SPENDING -0.2% M/M ; JUN 0.0%

NEW ZEALAND JUL ANZ TRUCKOMETER HEAVY -0.1% M/M; JUN -3.0%

The Light Traffic Index fell again in July, to be down 5% over the last two months, though off a high level. The Heavy Traffic Index is below trend, which we suspect reflects a month of illness and staff shortages amongst trucking firms and the economy more generally. (ANZ)

UK JUL BRC SALES LIKE-FOR-LIKE +1.6% Y/Y; JUN -1.3%

MARKETS

SNAPSHOT: Markets Coil, Awaiting A Catalyst

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 279.09 points at 27970.15

- ASX 200 up 3.276 points at 7023.9

- Shanghai Comp. up 10.013 points at 3246.947

- JGB 10-Yr future up 7 ticks at 150.61, yield down 1bp at 0.165%

- Aussie 10-Yr future up 5.5 ticks at 96.820, yield down 5.7bp at 3.156%

- U.S. 10-Yr future +0-01+ at 119-29, yield down 0.55bp at 2.752%

- WTI crude down $0.21 at $90.54, Gold down $2.97 at $1785.98

- USD/JPY down 2 pips at Y134.93

- RISHI SUNAK AND LIZ TRUSS RULE OUT EMERGENCY BUDGET BEFORE NEW UK PM CHOSEN (TELEGRAPH)

- TAIWAN BEGINS LIVE-FIRE ARTILLERY DRILL TO DEFEND AGAINST CHINA (BBG)

- PBOC MAY REDUCE MLF INJECTIONS NEXT MONDAY (21CBH)

- CHINA UNLIKELY TO CUT INTEREST RATE AND RRR IN SHORT-TERM (SEC. DAILY)

US TSYS: Nothing To See Here

A very tight round of Asia-Pac trade for Tsys leaves TYU2 +0-02 at 119-29+, with the contract sticking to the confines of a narrow 0-04 range, operating just shy of Monday’s peak on vert limited volume of ~35K. Note that a lack of meaningful macro headline flow, lower than usual liquidity owing to a public holiday in Singapore and the proximity to Wednesday’s CPI print would have given many reason to stay on the sidelines overnight. Cash Tsys are little changed to 1bp richer across the curve.

- Looking ahead, NFIB small business optimism and unit labour cost data headline the NY economic data docket on Tuesday, with 3-Year Tsy supply also due.

JGBS: Flatter, Even As 30-Year Auction Presents A Soft Outcome

Tuesday provided a relatively subdued round of trade for the JGB space.

- The JGB curve has bull flattened, initially playing catch up to Monday’s move in Tsys, with the flattening impetus extending through the day. The major cash benchmarks run little changed to ~4bp richer across the curve.

- Meanwhile, JGB futures have coiled, last +12, sticking to a tight range since the Tokyo re-open, failing to challenge their overnight session peak.

- Local headline flow has been limited, outside of speculation surrounding the impending government cabinet reshuffle.

- A soft round of 30-Year JGB supply saw the low price miss wider expectations, with the width of the tail widening a touch and cover ratio moving to the lowest level observed at a 30-Year JGB auction since October ’21. It would seem that the degree of the move away from outright cycle cheaps and pre-action richening provided enough of a reason for the lifer & pension community to stay on the sidelines. 30s saw some incremental cheapening post-auction, while JGB futures move a couple of ticks lower, before a bid came back in.

- Looking ahead, PPI data and BoJ Rinban operations covering 1- to 10-Year JGBs headline the domestic docket on Wednesday.

JGBS AUCTION: 30-Year Auction Results

The Japanese MOF sells Y724.7bn 30-Year JGBs:

- Average Yield: 1.119% (prev. 1.234%)

- Average Price: 104.04 (prev. 101.43)

- High Yield: 1.127% (prev. 1.240%)

- Low Price: 103.85 (prev. 101.30)

- % Allotted At High Yield: 84.7290% (prev. 19.3059%)

- Bid/Cover: 2.952x (prev. 3.245x)

JGBS AUCTION: 6-Month Bill Auction Results

The Japanese MOF sells Y3.25487tn 6-Month Bills:

- Average Yield: -0.1763% (prev. -0.2120%)

- Average Price: 100.089 (prev. 100.107)

- High Yield: -0.1387% (prev. -0.1823%)

- Low Price: 100.070 (prev. 100.092)

- % Allotted At High Yield: 38.7829% (prev. 89.0000%)

- Bid/Cover: 3.955x (prev. 4.265x)

AUSSIE BONDS: Flatter, In Confined Two-Way Trade

Sydney participants were happy to try and force an extension of the overnight U.S. Tsy-driven richening in futures during the early rounds of the session, although there wasn’t much in the way of a meaningful break higher observed.

- YM and XM then traded to session cheaps in the wake of the latest NAB business survey (with the front end leading the move), which saw the confidence reading push higher to 7 (prev. 2) and conditions move higher to 20 (from 14). When it came to the write up the survey collators noted “a marked rally in the face of headwinds from inflation and rising interest rates, as well as a deteriorating global economic outlook.” The rise in labour costs accelerated further in July, with NAB suggesting that “overall, the survey suggests that despite global and domestic economic headwinds, demand has remained strong - and inflationary pressure continues to build suggesting that inflation is yet to peak.”

- The space then regained some poise, with a lack of meaningful RBA repricing evident post-data, owing to the fact that much of the inflationary and wage rhetoric fell in line with existing RBA thinking.

- Note we also saw a couple of soft rounds of domestic consumer confidence data.

- YM last deals +3.5 on the day, with XM +5.5. Cash ACGB trade sees the major benchmarks running 3-7bp richer on the day, with the broader bull flattening still intact. Bills sit 1-4bp richer through the reds.

- Looking ahead, A$800mn of ACGB Nov-31 supply headlines Wednesday’s domestic docket.

AUSSIE BONDS: I/L Aug-40 Auction Results

The AOFM sells A$100mn of the 1.25% 21 Aug 2040 I/L Bond, issue #CAIN413:

- Average Yield: 1.2380% (prev. 0.8269%)

- High Yield: 1.2500% (prev. 0.8400%)

- Bid/Cover: 3.70x (prev. 3.6000x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield: 100.0% (prev. 40.0%)

- Bidders 38 (prev. 39), successful 3 (prev. 21), allocated in full 3 (prev. 18)

EQUITIES: Japan Underperforms, While Hong Kong Leads The Way

Asia-Pac equities lacked a coherent direction on Tuesday. The Nikkei 225 was the underperformer when it came to the major regional benchmarks, shedding the best part of 1%, with the communications and IT sectors leading the weakness after Tokyo Electron provided a disappointing earnings report. At the other end of the spectrum, the Hang Seng outperformed, adding 1%, with a Hong Kong city official flagging a desire to move to a zero-quarantine status for international travellers by November and the potential for a waiving of the double stamp duty covering home purchases on the part of mainland Chinese buyer supporting the broader index. Elsewhere, the benchmark Chinese CSI 300 and U.S. e-mini futures (all +0.2% at typing) struggled for meaningful direction, with focus remaining on questions surrounding the height/length of the current Fed tightening cycle, the COVID situation in China and ongoing tensions re: Taiwan, which proved to be limiting factors

OIL: At The Top End Of Recent Ranges

Oil prices have been range bound today, with Brent crude dips back $96/bbl supported, but unable to make a push towards $97/bbl. We are just off NY closing levels for both Brent and WTI. We currently sit at the upper end of the range for the past few sessions though, with dips sub $94/bbl supported for Brent. WTI is just under $90.50/bbl currently, behaving in a similar fashion.

- The near term focus will be on the US Energy Information Association, which will release a report later today on the short term outlook. This will be followed by OPEC and IEA reports on Thursday.

- US gasoline demand is generally lagging 2021 summer trends, even as pump prices continue to trend down, which are now their lowest level in 5 months.

- Another focus point is that the degree of tightness in oil markets continues to moderate, at least looking at the prompt spread (the difference between the two nearest contracts for Brent). We are now back to +$1.53/bbl, which is fresh lows back to mid-May. This measure got close to +$3.40/bbl in early July.

- Finally, talks have concluded in Vienna on reviving the US-Iran nuclear deal. Both sides now have a few weeks to decide whether or not to re-enter the deal, which could see the return of Iranian oil flows.

GOLD: Close To 50-Day MA, US CPI In Focus

Gold has drifted lower, meeting resistance above $1790, last tracking at $1786. This is below the 50-day MA, which comes in at $1786.7, which continues to be a near term resistance point. Having said that, gold is holding most of its overnight gains, we are comfortably +$10 above lows from yesterday.

- Gold got a boost from weaker USD sentiment overnight, as the DXY corrected lower. US real yields edged down overnight as well, back to +29bps. Today nominal US yields have been fairly steady.

- Tomorrow's US CPI print shapes up as a key event risk for the precious metal this week. Recent upside surprises in inflation have coincided with sharp downside moves in gold.

- Such event risk may keep us range bound to a degree in terms of spot prices.

- The position slate is arguably cleaner compared to earlier in the year. CFTC positioning has only nudged back into a net long, after dipping into negative territory in late July. Still, ETF positioning in gold continues to trend lower.

FOREX: Tight Ranges

Volatility across G10 FX space was subdued in Asia as participants continued to assess Fed rate-hike outlook in the interim between the release of the expectation-beating NFP report last Friday and the upcoming U.S. CPI data due Wednesday. The BBDXY index mostly held below neutral levels.

- USD/JPY traded on a marginally softer footing, with 1-month risk reversal oscillating near two-month highs printed on Monday.

- The Aussie dollar paced losses as participants parsed high-frequency local data. Consumer confidence deteriorated in August, even as business sentiment rebounded in July.

- The global economic docket is very light through the rest of the day.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/08/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 09/08/2022 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 09/08/2022 | 1230/0830 | ** |  | US | Preliminary Non-Farm Productivity |

| 09/08/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 09/08/2022 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 09/08/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 09/08/2022 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.