-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: The Fed Needs To See More

EXECUTIVE SUMMARY

- FED'S KASHKARI: MORE RATE HIKES AHEAD, AND POSSIBLE RECESSION (RTRS)

- FED TO RAISE INTEREST RATES TO 4% NEXT YEAR, EVANS SAYS (RTRS)

- FED’S DALY: IT IS TOO EARLY TO ‘DECLARE VICTORY’ ON INFLATION FIGHT (FT)

- FED LIKELY TO WANT FURTHER EVIDENCE OF INFLATION SLOWDOWN (WSJ)

- BOE'S PILL SAYS RATE HIKES WON'T FEED THROUGH UNTIL LATE 2023 (RTRS)

- U.S. RETHINKS STEPS ON CHINA TARIFFS IN WAKE OF TAIWAN RESPONSE (RTRS SOURCES)

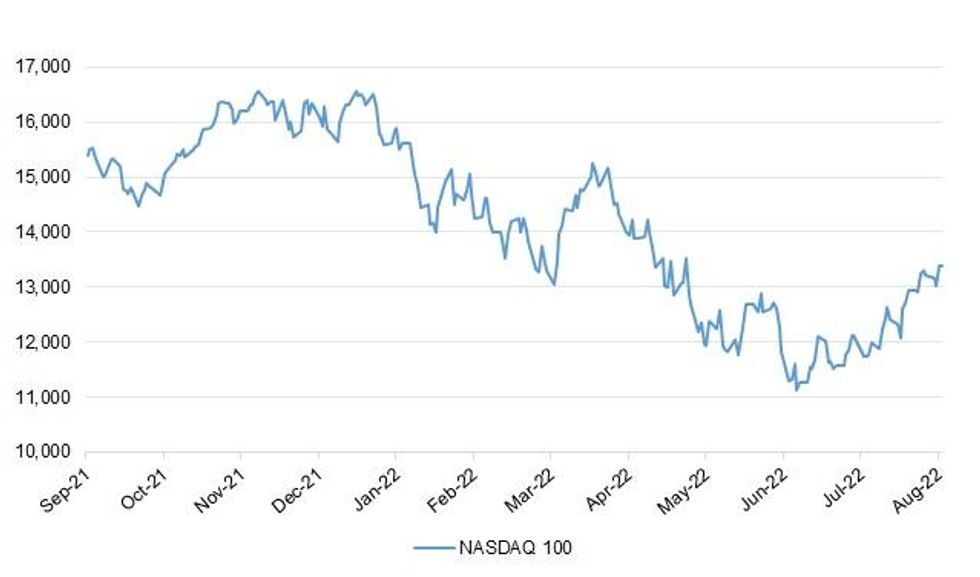

Fig. 1: NASDAQ 100

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS/FISCAL: Liz Truss signalled last night that she would hand government cash to the poorest to help with energy bills as the Treasury confirmed that it was working on options for a new prime minister to ease the cost of living crisis. Benefits increases, cash payments, scrapping VAT on energy, tax cuts and even freezing the energy price cap completely are all being looked by officials as Nadhim Zahawi, the chancellor, aims to give Boris Johnson’s successor a “suite of options” that can be implemented immediately. (The Times)

BOE: Britain will only feel the full impact of higher interest rates in late 2023 and there is unlikely to be any return of quantitative easing for at least a few years, Bank of England chief economist Huw Pill said on Wednesday. Pill also defended the BoE's exclusive power to set interest rates, which was questioned recently by supporters of British prime ministerial front-runner Liz Truss, who has promised to review the BoE's mandate. (RTRS)

U.S.

FED: In an interview with the Financial Times, Mary Daly, president of the San Francisco branch of the Fed, did not rule out a third consecutive 0.75 percentage point rate rise at the central bank’s next policy meeting in September, although she signalled her initial support for the Fed to slow the pace of its interest rate increases. (FT)

FED: Minneapolis Federal Reserve Bank President Neel Kashkari on Wednesday said he is sticking to his view that the U.S. central bank will need to raise its policy rate another 1.5 percentage points this year and more in 2023, even if that causes a recession. (RTRS)

FED: Wednesday's consumer price index report showing U.S. inflation didn't accelerate in July was the first "positive" reading on price pressures since the Federal Reserve began tightening policy, Chicago Fed President Charles Evans said, even as he signaled he believes the Fed has plenty more work to do. With consumer prices unchanged last month compared to June, but up 8.5% from a year earlier, inflation is still "unacceptably" high, and the Fed will likely need to lift its policy rate, currently in the 2.25%-2.5% range, to 3.25%-3.5% this year and to 3.75%-4% by the end of next year, Evans said. (RTRS)

FED: A slowdown in inflation last month, following recent indications of a robust labor market, complicates the Federal Reserve’s decision on how much to raise interest rates next month. (WSJ)

FISCAL: U.S. House Speaker Nancy Pelosi said on Wednesday the House of Representatives would pass the Inflation Reduction Act on Friday. In a letter to Democratic colleagues, Pelosi called the $430 billion climate, tax and healthcare bill approved by the Senate over the weekend "life-changing legislation." (RTRS)

FISCAL: The federal deficit narrowed by 30% in July compared with a year earlier, as the government reported a $211 billion monthly gap between revenue and spending. (WSJ)

OTHER

GLOBAL TRADE: The United Nations expects a "big uptick" in ships wanting to export Ukraine grain through the Black Sea after transit procedures were agreed and a goal of 2-5 million tonnes a month is "achievable," a senior U.N. official said on Wednesday. (RTRS)

U.S./CHINA: China's war games around Taiwan have led Biden administration officials to recalibrate their thinking on whether to scrap some tariffs or potentially impose others on Beijing, setting those options aside for now, according to sources familiar with the deliberations. President Joe Biden has not made a decision on the issue, officials said. His team has been wrestling for months with various ways to ease the costs of duties imposed on Chinese imports during predecessor Donald Trump's tenure, as it tries to tamp down skyrocketing inflation. (RTRS)

U.S./CHINA/TAIWAN: House of Representatives Speaker Nancy Pelosi said on Wednesday the United States could not allow China to normalize the new level of pressure on Taiwan it asserted with days of military drills following her visit to the Chinese-claimed island. "We went there to praise Taiwan. We went there to show our friendship, to say China cannot isolate Taiwan," Pelosi said. (b)

CHINA/TAIWAN: Taiwan rejects the "one country, two systems" model proposed by Beijing in a white paper published this week, the self-ruled island's foreign ministry said on Thursday. Only Taiwan's people can decide its future, ministry spokeswoman Joanne Ou told a news conference in Taipei, the capital. (RTRS)

MEXICO: The Bank of Mexico needs to continue hiking its benchmark interest rate, the bank's deputy governor Jonathan Heath told local newspaper Expansion in an interview published on Wednesday. The hikes need to happen in order to not have a "neutral posture" considering stubbornly high inflation, Heath said a day before the bank's next monetary policy decision. (RTRS)

BRAZIL: Brazil's President Jair Bolsonaro did not mention privatizing state-controlled oil company Petrobras in his re-election plan released on Wednesday that promises to continue pursuing policies that reduce the size of the state. (RTRS)

RUSSIA: Ukraine will respond to the Russian shelling of a town and needs to consider how to inflict as much damage on Russia as possible to end the war quickly, President Volodymyr Zelenskiy said on Wednesday. (RTRS)

RUSSIA: Annual inflation in Russia slowed further in July, driven by a month-on-month decline in consumer prices amid sluggish demand, data showed on Wednesday, giving the central bank an argument to continue cutting interest rates. (RTRS)

CHINA

YUAN: China should further improve the quotation mechanism of the central parity rate of the yuan, and vigorously develop its FX market by enriching trading products, expanding trading entities and relaxing trading restrictions, the Securities Daily reported, citing Guan Tao, a former FX official and now chief economist of BOC Securities. Further relaxation of the exchange rate fluctuation limit may be considered after the economic recovery stabilizes, though it is also necessary to retain the autonomy of exchange rate management and hold sufficient FX reserves, the newspaper said, citing Wang Youxin, senior researcher at Bank of China Research Institute. (MNI)

CORONAVIRUS: Covid-19 cases in China surged to a three-month high, with almost half of the 1,993 infections reported for Wednesday coming from Hainan island where tourists had thronged in search of respite. Sanya, a beach resort town in Hainan, saw infections triple in a day to 1,254 for Wednesday It’s the first time the daily number of cases in any Chinese province or city has exceeded 1,000 since May, when an outbreak shut down Shanghai for two months. (BBG)

CORONAVIRUS: The eastern Chinese export hub Yiwu in Zhejiang province imposed a three day lockdown starting on Thursday to contain a recent COVID-19 outbreak, the city government said on Thursday. Yiwu is a major manufacturing export hub in eastern China and home to 1.9 million people. (RTRS)

PROPERTY: China’s financial regulators will maintain stable property financing to better support commercial housing demand in the second half of this year, according to a front-page report on the official Economic Daily. (BBG)

CHINA MARKETS

PBOC INJECTS CNY2 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY2 billion via 7-day reverse repos with the rate unchanged at 2.1% on Thursday. This keeps the liquidity unchanged after offsetting the maturity of CNY2 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.5791% at 9:50 am local time from the close of 1.3721% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 43 on Wednesday vs 48 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7324 THU VS 6.7612

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.7324 on Thursday, compared with 6.7612 set on Wednesday.

OVERNIGHT DATA

AUSTRALIA AUG MELBOURNE INSTITUTE CONSUMER INFLATION EXPECTATIONS +5.9%; JUL +6.3%

NEW ZEALAND JUL REINZ HOUSE SALES -36.7% Y/Y; JUN -38.1%

NEW ZEALAND JUN NET MIGRATION -896; MAY -853

SOUTH KOREA JUN L MONEY SUPPLY SA -0.2% M/M; MAY +1.0%

SOUTH KOREA JUN M2 MONEY SUPPLY SA +0.3% M/M; MAY +0.8%

UK JUL RICS HOUSE PRICE BALANCE 63%; MEDIAN 60%; JUN 65%

MARKETS

SNAPSHOT: The Fed Needs To See More

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 is closed

- ASX 200 up 61.226 points at 7053.90

- Shanghai Comp. up 38 points at 3268.02

- JGBs are closed

- Aussie 10-Yr future down 5.5 ticks at 96.68, yield up 5.1bp at 3.295%

- U.S. 10-Yr future -0-02 at 119-22, cash Tsys are closed

- WTI crude down $0.33 at $91.6, Gold down $7.48 at $1784.91

- USD/JPY up 28 pips at Y133.17

- FED'S KASHKARI: MORE RATE HIKES AHEAD, AND POSSIBLE RECESSION (RTRS)

- FED TO RAISE INTEREST RATES TO 4% NEXT YEAR, EVANS SAYS (RTRS)

- FED’S DALY: IT IS TOO EARLY TO ‘DECLARE VICTORY’ ON INFLATION FIGHT (FT)

- FED LIKELY TO WANT FURTHER EVIDENCE OF INFLATION SLOWDOWN (WSJ)

- BOE'S PILL SAYS RATE HIKES WON'T FEED THROUGH UNTIL LATE 2023 (RTRS)

- U.S. RETHINKS STEPS ON CHINA TARIFFS IN WAKE OF TAIWAN RESPONSE (RTRS SOURCES)

US TSYS: Futures Cheapen Marginally In Asia With Cash Closed

TYU2 deals around the midpoint of its 0-10+ Asia-Pac range, last -0-02 at 119-22 on below par volume of ~35K. Note that activity in the Tsy space has been limited by the closure of the cash Tsy markets owing to the observance of a Japanese national holiday. Cash markets will open at 07:00 London time.

- Most of the Asia-Pac session provided little to really counter the cheapening impulse that was observed in the second half of Wednesday’s NY session, after the bulk of the CPI-related gains reversed (the curve twist steepened on Wednesday come the close of play) on hawkish Fedspeak from ’22 non-voters Kashkari & Evans and the latest article from WSJ Fed whisperer Timiraos ( https://www.wsj.com/articles/fed-likely-to-want-further-evidence-of-inflation-slowdown-11660153057?mod=Searchresults_pos1&page=1 ).

- E-minis traded through their respective Wednesday highs after the NASDAQ 100 closed in technical bull market territory, with the 3 major contracts off best levels of the session but last printing ~0.3% above their respective settlement levels.

- Futures found a bit of a base in Asia dealing, then received the most marginal of boosts as an FT interview with San Francisco Fed President Daly (’24 voter) reiterated her baseline view surrounding the likelihood of the need for a 50bp hike come the end of the September FOMC meeting.

- The space looked through the latest round of localized COVID restrictions in China.

- Looking ahead, PPI and weekly jobless claims data, 30-Year Tsy supply and another address from Daly headline on Thursday.

AUSSIE BONDS: Cheaper, But Off Lows

ACGBs are off cheapest levels of the day, tracking a similar move in U.S. Tsy futures, with major Aussie bond future contracts operating a little above two-week lows made earlier. There was little by way of major macro headline drivers during the session, with focus centred around recent, hawkish Fedspeak, and a region-wide bid in major Asia-Pac equity indices.

- Cash ACGBs run 2.5-6.0bp cheaper across the curve, bear steepening. YM is -3.5, a shade below its overnight trough, while XM is -4.5, comfortably below its own overnight lows. Bills run 2 ticks richer to 7 ticks cheaper through the reds.

- Melbourne Institute consumer inflation expectations for August moderated to 5.9% from 6.3% in July. While the result sees inflation expectations continuing a pullback from the 6.7% print witnessed in June (highest since Jun ‘08), a reminder that the RBA has emphasised that it is cognisant of the psychology surrounding inflation, having already signalled the need for further monetary tightening at coming meetings amidst expected labour market strength and forecasts for CPI to hit 7.75% by end-’22.

- Friday will see A$700mn of ACGB Sep-2026 supply, followed by the release of the AOFM’s weekly issuance slate

EQUITIES: Higher In Asia; Tech Leads Gains

Virtually all Asia-Pac equity indices are higher at typing, with a tech-led lead from Wall St. seeing high-beta equities across the region lead the bid (also coming after the sector’s underperformance on Wednesday).

- The Hang Seng deals 1.8% firmer at typing on gains across every sector, with China-based tech names leading the way higher (HSTECH: +2.7%). The property (+1.0%) and finance (+1.0%) sub-indices lagged peer sectors but were bid as well, receiving support from fresh pledges by Chinese regulators to maintain stable property financing for commercial housing in H2 ‘22 and to ensure the delivery of new houses. A rebound in Longfor Group (+5.0%, 10th largest builder in China) also lifted sentiment in real estate equities, after the developer stated that all of its commercial paper due has been settled.

- The CSI300 sits 1.4% firmer, rising to one-week highs primarily on gains in the richly-valued consumer staples (+1.1%) and healthcare (+2.8%) sub-indices, while elsewhere, tech equities outperformed as well, with the ChiNext index trading 2.0% higher at writing.

- The ASX200 is 0.8% better off at typing, with gains in tech equities (S&P/ASX All Tech Index: +2.4%) offsetting losses observed in the utilities and energy sub-gauges. The materials sub-index (+1.4%) received a strong bid as well, with battery mineral (e.g. lithium) and coal miners contributing the most to gains.

- E-minis are 0.3-0.4% firmer apiece, building on Wednesday’s higher close, with S&P500 and NASDAQ 100 contracts sitting at fresh five-month highs at typing.

OIL: Little Changed In Asia; Demand Outlook Receives Lift On U.S. Gasoline Drawdown

WTI and Brent are ~-$0.20 softer apiece, operating a little below their respective best levels on Wednesday. Both benchmarks have maintained relatively tight ~$6 trading ranges over the past week, with prevailing recession-related worry (and the corresponding decline in the energy demand outlook) continuing to weigh against well-documented concerns re: tightness in global crude supply.

- Looking at Wednesday's price action, major crude benchmarks rebounded from their CPI-induced lows after the release of weekly U.S. EIA data, hitting session highs just shy of Tuesday’s peaks in the process. While the release had pointed to a significantly-larger-than expected build in crude inventories (comfortably surpassing even last week’s ~4.5mn bbl build), gasoline stocks however saw a significantly larger-than-expected drawdown amidst a previously-flagged decline in gasoline prices, relieving worry from some quarters re: demand destruction.

- Gasoline stockpiles in the central East Coast of the U.S. are at their lowest levels since Nov ‘12, with analysts pointing to its potential impact on global prices given the status of the NY harbour as a location for physical deliveries.

- Up next, monthly outlook reports are due from both the International Energy Agency (IEA) and OPEC later on Thursday.

GOLD: Lower In Asia

Gold trades $5/oz softer to print $1,787/oz at typing, operating through Wednesday’s worst levels amidst a limited uptick in the USD (DXY). The move lower also comes as e-minis and cash equities region wide have caught a bid in the wake of Wednesday’s U.S. CPI print, pointing to pressure from broader appetite for risk.

- To recap Wednesday’s price action, the precious metal briefly recorded fresh five-week highs ($1,807.9/oz) after U.S. CPI printed below expectations across all major measures, before reversing course to close ~$2/oz softer amidst previously-flagged hawkish Fedspeak and a rebound in U.S. real yields.

- Sep FOMC dated OIS now price in ~60bp of tightening for that meeting, pointing to greater odds of a 50bp hike in Sep (as compared to odds for a 75bp hike), returning the FOMC rate hike premium to ranges observed before last Friday’s above-expectations NFP print (~59bp).

- From a technical perspective, previously outlined technical levels remain in play, with initial resistance located at $1,825.1/oz (Jun 30 high), and support seen at $1,762.8/oz (20-Day EMA).

FOREX: Greenback Finds Poise, Japanese Holiday Limits Activity

The greenback found poise after Wednesday's slump caused by below-forecast U.S. CPI data, as Fed officials warned against excessive optimism on that front and signalled their intention to continue raising interest rates into next year. The BBDXY index edged higher but then halved gains as the session progressed. The U.S. dollar occupies the top spot in G10 currency scoreboard, although it outperforms by very narrow ranges.

- USD/JPY added ~20 pips, flirting with the Y133.00 mark through the session. Liquidity was thinned out due to a public holiday in Japan. Risk reversals crept higher, albeit 1-year skews struggled to return above par.

- The Aussie dollar was the worst G10 performer even as U.S. e-mini futures advanced, signalling continuation of positive sentiment. From a cross-asset perspective, iron ore traded on a firmer footing but gold softened.

- Today's data highlights include weekly jobless claims & monthly PPI out of the U.S.

FX OPTIONS: Expiries for Aug11 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0097-05(E1.8bln), $1.0125(E607mln), $1.0200(E700mln), $1.0235(E524mln), $1.0300(E581mln)

- USD/JPY: Y134.25($685mln), Y134.97-00($1.2bln), Y135.15-35($941mln)

- GBP/USD: $1.2000(Gbp552mln), $1.2150-65(Gbp1.1bln)

- EUR/GBP: Gbp0.8350(E780mln), Gbp0.8650(E716mln)

- AUD/USD: $0.6980-00(A$1.6bln)

- USD/CAD: C$1.3200($825mln)

- USD/CNY: Cny6.7000($1.2bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/08/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 11/08/2022 | 1230/0830 | *** |  | US | PPI |

| 11/08/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 11/08/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 11/08/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 11/08/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 11/08/2022 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 11/08/2022 | 1800/1400 | *** |  | MX | Mexico Interest Rate |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.