-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Equities Bid, USD Nudges Higher

- U.S. Tsy futures cheapened marginally overnight, with cash Tsy markets closed owing to the observance of a Japanese national holiday.

- Elsewhere, the USD sits atop the G10 FX performance table, although the broader DXY hasn't got anywhere near fully paring its post-CPI losses, while the major Asia-Pac equity indices moved higher.

- Today's data highlights include weekly jobless claims & monthly PPI out of the U.S., with further Fedspeak due from San Francisco Fed President Daly ('24 voter).

US TSYS: Futures Cheapen Marginally In Asia With Cash Closed

TYU2 deals around the midpoint of its 0-10+ Asia-Pac range, last -0-02 at 119-22 on below par volume of ~35K. Note that activity in the Tsy space has been limited by the closure of the cash Tsy markets owing to the observance of a Japanese national holiday. Cash markets will open at 07:00 London time.

- Most of the Asia-Pac session provided little to really counter the cheapening impulse that was observed in the second half of Wednesday’s NY session, after the bulk of the CPI-related gains reversed (the curve twist steepened on Wednesday come the close of play) on hawkish Fedspeak from ’22 non-voters Kashkari & Evans and the latest article from WSJ Fed whisperer Timiraos.

- E-minis traded through their respective Wednesday highs after the NASDAQ 100 closed in technical bull market territory, with the 3 major contracts off best levels of the session but last printing ~0.3% above their respective settlement levels.

- Futures found a bit of a base in Asia dealing, then received the most marginal of boosts as an FT interview with San Francisco Fed President Daly (’24 voter) reiterated her baseline view surrounding the likelihood of the need for a 50bp hike come the end of the September FOMC meeting.

- The space looked through the latest round of localized COVID restrictions in China.

- Looking ahead, PPI and weekly jobless claims data, 30-Year Tsy supply and another address from Daly headline on Thursday.

AUSSIE BONDS: Cheaper, But Off Lows

ACGBs are off cheapest levels of the day, tracking a similar move in U.S. Tsy futures, with major Aussie bond future contracts operating a little above two-week lows made earlier. There was little by way of major macro headline drivers during the session, with focus centred around recent, hawkish Fedspeak, and a region-wide bid in major Asia-Pac equity indices.

- Cash ACGBs run 2.5-6.0bp cheaper across the curve, bear steepening. YM is -3.5, a shade below its overnight trough, while XM is -4.5, comfortably below its own overnight lows. Bills run 2 ticks richer to 7 ticks cheaper through the reds.

- Melbourne Institute consumer inflation expectations for August moderated to 5.9% from 6.3% in July. While the result sees inflation expectations continuing a pullback from the 6.7% print witnessed in June (highest since Jun ‘08), a reminder that the RBA has emphasised that it is cognisant of the psychology surrounding inflation, having already signalled the need for further monetary tightening at coming meetings amidst expected labour market strength and forecasts for CPI to hit 7.75% by end-’22.

- Friday will see A$700mn of ACGB Sep-2026 supply, followed by the release of the AOFM’s weekly issuance slate

FOREX: Greenback Finds Poise, Japanese Holiday Limits Activity

The greenback found poise after Wednesday's slump caused by below-forecast U.S. CPI data, as Fed officials warned against excessive optimism on that front and signalled their intention to continue raising interest rates into next year. The BBDXY index edged higher but then halved gains as the session progressed. The U.S. dollar occupies the top spot in G10 currency scoreboard, although it outperforms by very narrow ranges.

- USD/JPY added ~20 pips, flirting with the Y133.00 mark through the session. Liquidity was thinned out due to a public holiday in Japan. Risk reversals crept higher, albeit 1-year skews struggled to return above par.

- The Aussie dollar was the worst G10 performer even as U.S. e-mini futures advanced, signalling continuation of positive sentiment. From a cross-asset perspective, iron ore traded on a firmer footing but gold softened.

- Today's data highlights include weekly jobless claims & monthly PPI out of the U.S.

USD: Moving Average Momentum Leaning Against The USD

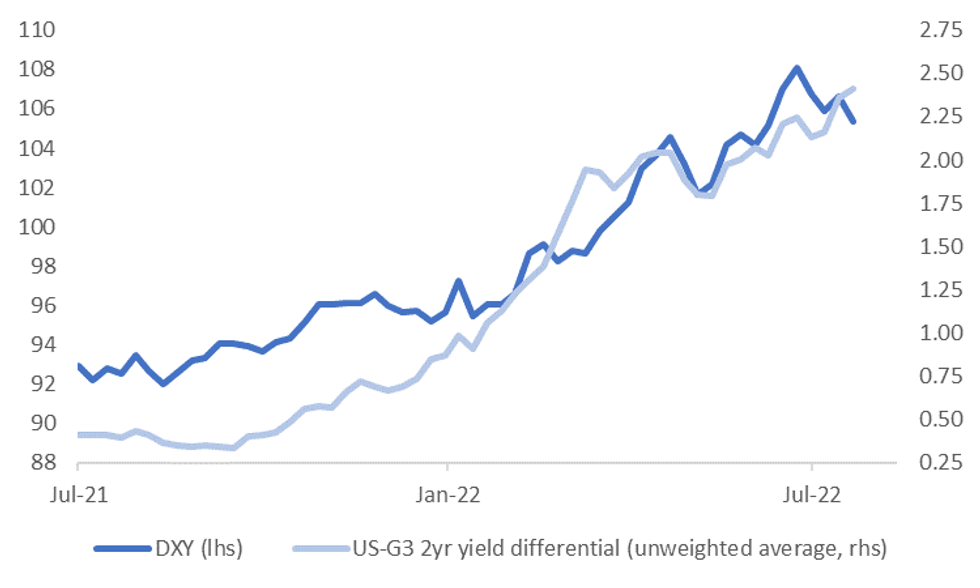

We noted yesterday, prior to the US CPI print, there was a modest wedge between DXY performance and the 2yr interest differential with other major economies. The first chart below updates the picture, which shows the divergence has widened a touch. The USD is modestly firmer through today's session, with the DXY up around 0.15%, but this has not been enough to shift the wedge.

Fig 1: DXY & Yield Differential Wedge Persisting

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

- The hawkish Fed rhetoric from regional Fed presidents post the CPI print helped stabilize yield sentiment.

- Correlations between daily DXY shifts and yield momentum changes aren't that high. Other factors can clearly influence FX market trends over such timeframes. However, longer window rates of change (like a few weeks or a month) have higher correlations and are more stable.

- Hence if we see yield momentum to continue to move in favour of the USD, we might expect the DXY to play catch up at some stage if 2022 trends hold.

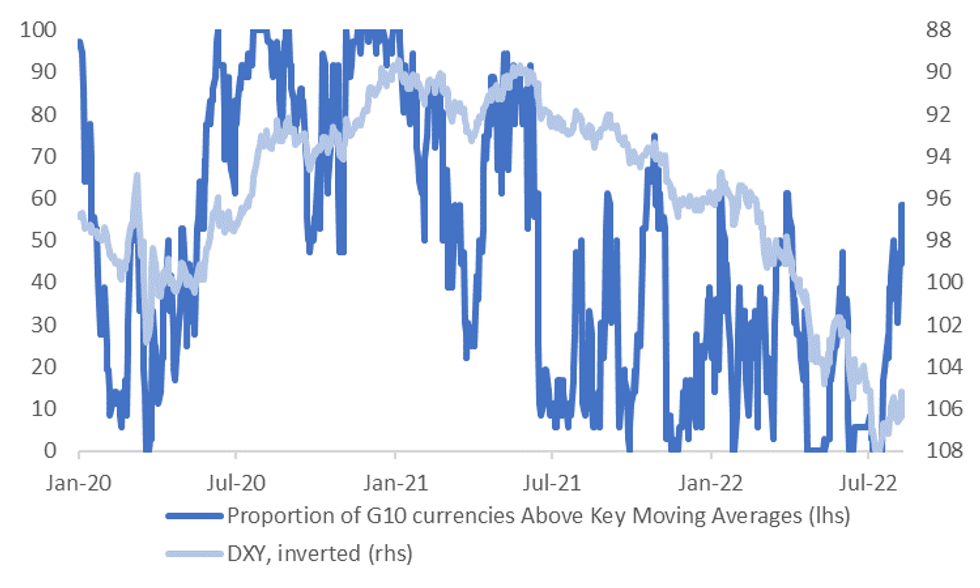

- Interestingly though, momentum in FX markets suggests risks are skewed the other way. The second chart below plots the DXY, which is inverted on the chart, against a moving average MA diffusion index for the G10 currencies.

Fig 2: Moving Average Momentum Leaning Against the USD

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

- This metric is simply calculated by measuring the proportion of the major currencies (EUR, JPY, GBP, AUD, NZD, CAD, CHF, NOK & SEK) that are either above or below key MAs against the USD - we utilize 4, the 20, 50, 100 and 200 day.

- Currently, the major currencies are firmer than the USD in 21 out of 36 possible MAs. This proportion, at just over 58%, is around YTD highs for the metric.

- All the majors are above their respective 20 day MAs against the USD, 8 are above the 50 day, with only the EUR not exceeding this benchmark. 3 are above the 100 day ( CAD, CHF and NOK). CHF is the only major currency threatening its 200 day MA to the strong side.

FX OPTIONS: Expiries for Aug11 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0097-05(E1.8bln), $1.0125(E607mln), $1.0200(E700mln), $1.0235(E524mln), $1.0300(E581mln)

- USD/JPY: Y134.25($685mln), Y134.97-00($1.2bln), Y135.15-35($941mln)

- GBP/USD: $1.2000(Gbp552mln), $1.2150-65(Gbp1.1bln)

- EUR/GBP: Gbp0.8350(E780mln), Gbp0.8650(E716mln)

- AUD/USD: $0.6980-00(A$1.6bln)

- USD/CAD: C$1.3200($825mln)

- USD/CNY: Cny6.7000($1.2bln)

ASIA FX: Not Much Follow Through USD Weakness

Asian FX hasn't seen a great deal of follow momentum following the overnight weaker than expected US CPI reading. Some markets have seen solid spot gains, but this is largely catch up with overnight moves. NDF levels are mostly leaning towards a firmer USD versus NY closing levels.

- CNH: USD/CNH crept higher today. The pair is around +0.20% above NY closing levels. We pushed above the 6.7400 level before selling interest emerged, last tracking at 6.7385. Onshore equities are higher, although domestic covid cases continue to rise and further cities have been placed in lockdown.

- KRW: USD/KRW has rebounded, in line with the broader USD trend. Onshore equities are higher, but not outperforming overnight tech gains. The Kospi is currently +1.30%. USD/KRW 1 month is back to 1303, around +0.50% above NY closing levels.

- SGD: USD/SGD is back above 1.3700, around 1.3720 currently. GDP revisions for Q2 were disappointing, showing the economy contracted -0.2% in Q2, versus a market estimate of +0.2%. The Singapore authorities expect growth to be slightly positive in Q3 and Q4.

- INR: Spot USD/INR is weaker, down by -0.20% to be at 79.38. The 1 month NDF is back above 79.60, suggesting limited follow through USD selling since the NY close. Onshore equities are pushing higher, and equity inflow remains positive since the start of the week.

- IDR: Spot USD/IDR dropped to its lowest point since late June as the rupiah's traditional risk-sensitivity helps it become the second best performer in the Asia EM basket. Spot is sub 14800, -0.50% for the session. The 1 month NDF is steady though versus NY closing levels.

- THB: Spot USD/THB re-opened lower, playing catch up with overnight reaction to below-forecast U.S. CPI data and resultant greenback sales. The pair last deals at 35.372, -0.19 figs for the session, up from earlier lows sub 35.30. The Bank of Thailand raised the one-day bond repurchase rate by 25bp in its first hike since 2018. The decision was in line with our prediction and Bloomberg consensus forecast.

- PHP: USD/PHP is sub 55.50, but remains within recent ranges. Foreign investors were net sellers of Philippine stocks for the fourth consecutive day on Wednesday, but net daily equity outflows shrank to PHP119.4mn. OCTA Research group said that the current wave of COVID-19 infections in Metro Manila is expected to peak next week. Looking ahead, Bangko Sentral ng Pilipinas will deliver its monetary policy decision next Thursday.

EQUITIES: Higher In Asia; Tech Leads Gains

Virtually all Asia-Pac equity indices are higher at typing, with a tech-led lead from Wall St. seeing high-beta equities across the region lead the bid (also coming after the sector’s underperformance on Wednesday).

- The Hang Seng deals 1.8% firmer at typing on gains across every sector, with China-based tech names leading the way higher (HSTECH: +2.7%). The property (+1.0%) and finance (+1.0%) sub-indices lagged peer sectors but were bid as well, receiving support from fresh pledges by Chinese regulators to maintain stable property financing for commercial housing in H2 ‘22 and to ensure the delivery of new houses. A rebound in Longfor Group (+5.0%, 10th largest builder in China) also lifted sentiment in real estate equities, after the developer stated that all of its commercial paper due has been settled.

- The CSI300 sits 1.4% firmer, rising to one-week highs primarily on gains in the richly-valued consumer staples (+1.1%) and healthcare (+2.8%) sub-indices, while elsewhere, tech equities outperformed as well, with the ChiNext index trading 2.0% higher at writing.

- The ASX200 is 0.8% better off at typing, with gains in tech equities (S&P/ASX All Tech Index: +2.4%) offsetting losses observed in the utilities and energy sub-gauges. The materials sub-index (+1.4%) received a strong bid as well, with battery mineral (e.g. lithium) and coal miners contributing the most to gains.

- E-minis are 0.3-0.4% firmer apiece, building on Wednesday’s higher close, with S&P500 and NASDAQ 100 contracts sitting at fresh five-month highs at typing.

GOLD: Lower In Asia

Gold trades $5/oz softer to print $1,787/oz at typing, operating through Wednesday’s worst levels amidst a limited uptick in the USD (DXY). The move lower also comes as e-minis and cash equities region wide have caught a bid in the wake of Wednesday’s U.S. CPI print, pointing to pressure from broader appetite for risk.

- To recap Wednesday’s price action, the precious metal briefly recorded fresh five-week highs ($1,807.9/oz) after U.S. CPI printed below expectations across all major measures, before reversing course to close ~$2/oz softer amidst previously-flagged hawkish Fedspeak and a rebound in U.S. real yields.

- Sep FOMC dated OIS now price in ~60bp of tightening for that meeting, pointing to greater odds of a 50bp hike in Sep (as compared to odds for a 75bp hike), returning the FOMC rate hike premium to ranges observed before last Friday’s above-expectations NFP print (~59bp).

- From a technical perspective, previously outlined technical levels remain in play, with initial resistance located at $1,825.1/oz (Jun 30 high), and support seen at $1,762.8/oz (20-Day EMA).

OIL: Little Changed In Asia; Demand Outlook Receives Lift On U.S. Gasoline Drawdown

WTI and Brent are ~-$0.20 softer apiece, operating a little below their respective best levels on Wednesday. Both benchmarks have maintained relatively tight ~$6 trading ranges over the past week, with prevailing recession-related worry (and the corresponding decline in the energy demand outlook) continuing to weigh against well-documented concerns re: tightness in global crude supply.

- Looking at Wednesday's price action, major crude benchmarks rebounded from their CPI-induced lows after the release of weekly U.S. EIA data, hitting session highs just shy of Tuesday’s peaks in the process. While the release had pointed to a significantly-larger-than expected build in crude inventories (comfortably surpassing even last week’s ~4.5mn bbl build), gasoline stocks however saw a significantly larger-than-expected drawdown amidst a previously-flagged decline in gasoline prices, relieving worry from some quarters re: demand destruction.

- Gasoline stockpiles in the central East Coast of the U.S. are at their lowest levels since Nov ‘12, with analysts pointing to its potential impact on global prices given the status of the NY harbour as a location for physical deliveries.

- Up next, monthly outlook reports are due from both the International Energy Agency (IEA) and OPEC later on Thursday.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/08/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 11/08/2022 | 1230/0830 | *** |  | US | PPI |

| 11/08/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 11/08/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 11/08/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 11/08/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 11/08/2022 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 11/08/2022 | 1800/1400 | *** |  | MX | Mexico Interest Rate |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.