-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: FX Coils, Tsys Nudge A Touch Firmer

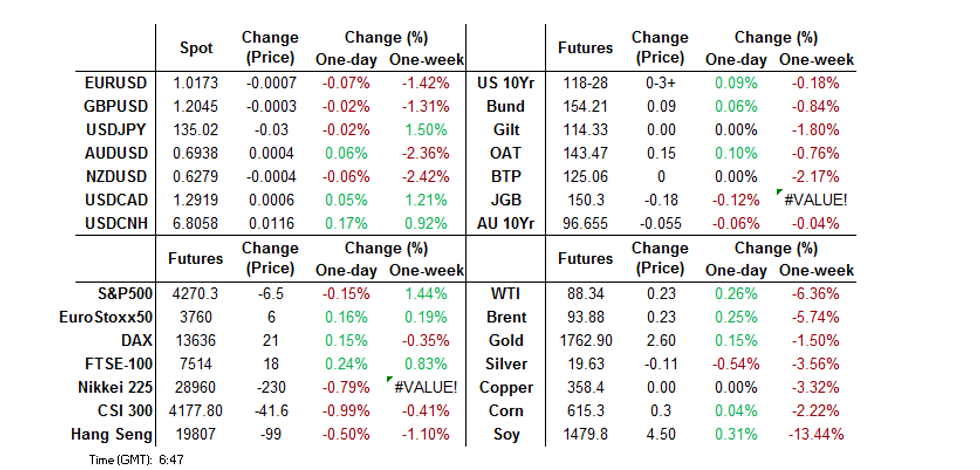

- Tsys firmed a touch overnight, with Sino-U.S. worries back at the fore on confirmation that the U.S. & Taiwan will enter formal trade discussions. The major G10 FX pairs were little changed on the day.

- Australia experienced an unexpected fall in headline employment figures, although various technicalities and caveats likely explained most of the variation.

- Looking ahead, the Norges Bank decision is in focus, after the July CPI print tilted the balance of risks to another 50bps rate rise. The U.S. Philly Fed Manufacturing reading, jobless claims data and existing home sales are the data points of note, with comments from Fed’s George and Kashkari also due.

US TSYS: Tsys Firm A Little In Asia

The combination of confirmation of the impending onset of formal U.S.-Taiwan trade talks and U.S. warnings re: China’s ambitions surrounding Taiwan supported Tsys during Asia-Pac dealing, leaving TYU2 +0-07 at 118-31+ into London hours, 0-02 off the peak of its 0-12 range, although summer seasonality continues to limit participation, with only ~74K lots changing hands thus far. Wider cash Tsy trade has seen the major benchmarks richen by 2.5-3.5bp across the curve, with the belly leading the bid, after that particular zone drove the weakness observed on Wednesday.

- Note that 2s have reversed all of the cheapening observed into Wednesday’s NY morning and now sit little changed over the past 24 hours after participants focused on some of the more dovish verses in July’s FOMC meeting minutes ahead of yesterday’s NY close.

- A cloudy Australian market report also helped the bid, although the move linked to that was very limited in nature, and mostly unwound, with Tsys already bid before that release and various technicalities seemingly distorting the dataset.

- Looking ahead, existing home sales, weekly jobless claims and the latest Philly Fed survey are due in NY hours. Thursday will also bring the latest round of 30-Year TIPS supply and Fedspeak from George & Kashkari.

JGBS: Little Changed On The Day

JGB futures are -10 ahead of the Tokyo close and haven’t ever threatened neutral levels. Meanwhile the wider JGB curve sees the major benchmarks running 0.5bp cheaper to 0.5bp richer on the day, with the early and post-20-Year auction rounds of strength in the super-long end fading.

- The modest, early bid in JGB futures faded a little as we moved into the Tokyo lunch break, with futures -15 at the lunch bell. This may have been influenced by the super-long end of the cash JGB curve pulling back from firmest levels of the day in setup for this afternoon’s 20-Year JGB supply.

- In terms of specifics, the 20-Year JGB auction was absorbed smoothly enough, with the low price printing comfortably above wider expectations, while the price tail narrowed when compared to the previous auction. On the other hand, the cover ratio painted a slightly weaker picture of demand, moderating to 3.28x from the previous auction’s 3.63x, a little below the six-auction average of 3.37x. As highlighted in our preview, the richening observed in 20s away from cycle cheaps as well as its richening on the 10-/20-/30-Year butterfly since June, likely provided headwinds for demand. Still, the auction priced well, likely aided by the continued home bias for Japanese investors, amidst elevated FX-hedging costs and continued market volatility. These factors probably meant that demand from life insurers for super-long JGBs remained evident, in line with their previously outlined investment intentions.

- Domestic headline flow was on the light side, with little in the way of clear catalyst evident for the super-long ends movement away from the afternoon’s richest levels.

- A quick reminder that the latest batch of weekly international security flow data out of Japan revealed foreign investors recorded net buying of Japanese bonds for the third straight week (and also for the seventh time in eight weeks, largely representing short covering after the ultimately failed challenge of the BoJ's YCC parameters in June).

- Looking ahead, national CPI data headlines the domestic docket on Friday.

AUSSIE BONDS: Cheaper, But Off Lows

Aussie bonds are off their extremes, back from session highs made after the surprise decline in headline employment figures within July’s domestic labour market report (-40.9K vs. BBG median +25.0K), but sitting comfortably cheaper on the day, with ACGBs unable to unwind the cheapening impetus derived from Wednesday’s weakness in wider core FI markets. ACGBs run 3.0-4.5bp cheaper across the curve, with 12s leading the way lower. YM is -3.5, operating around the middle of its range after a brief blip above its overnight high, while XM is -4.5, once again around the middle of its range. EFPs are mixed, with the 3-/10-Year box twist steepening, while Bills run flat to 7 ticks cheaper through the reds.

- Looking into the details, the labour market report contained several caveats (i.e. floods, school holidays, and COVID infections) as explanations for the miss in headline employment numbers, as well as sample rotation, helping to pull ACGBs back from their initial knee-jerk move higher.

- Friday will see A$700mn of ACGB Nov-27 supply before the release of the AOFM’s weekly issuance slate, while no economic data releases of note are scheduled.

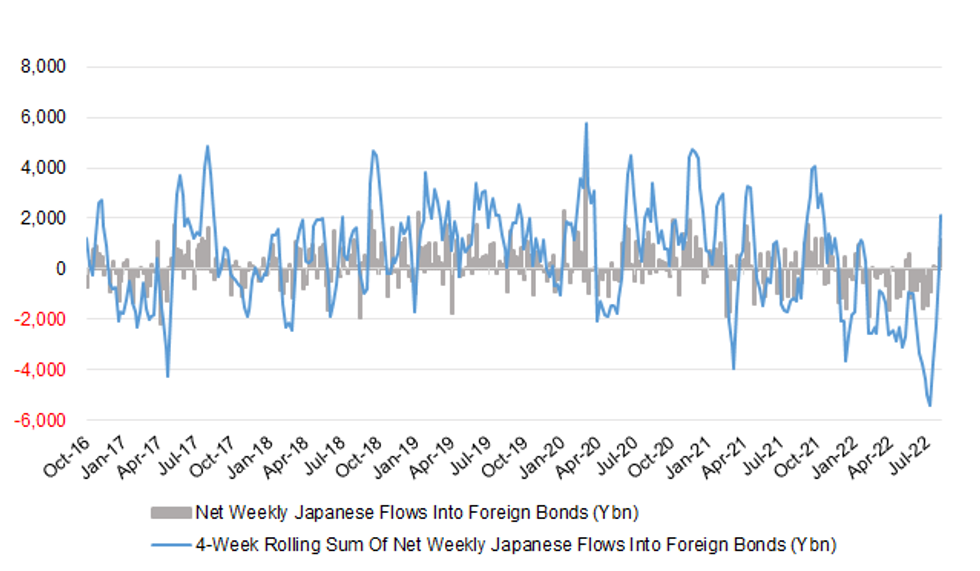

JAPAN: Japan Lodges Most Notable Round Of Offshore Bond Purchases Since November

Weekly international security flow data out of Japan revealed that Japanese investors lodged a fourth consecutive week of net purchases of foreign bonds last week, with the net amount representing the largest round of net buying seen since November. Weekly net buying topped the Y1tn mark for the first time in calendar ’22 in the process.

- The remaining 3 major flow metrics saw moderations in net flows and no change in direction, with Japanese investors net selling foreign equities for a second straight week, foreign investors net buying Japanese bonds for the third straight week (and also for the seventh time in eight weeks, largely representing short covering after the ultimately failed challenge of the BoJ's YCC parameters in June), while foreign investors were small net buyers of Japanese equities for a second consecutive week.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 1152.4 | 829.9 | 2132.1 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -234.8 | -1036.2 | -685.1 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 231.3 | 1017.4 | 2523.0 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 45.5 | 61.0 | 283.2 |

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

FOREX: USD Firmer Across The Board

The USD has pushed higher through the afternoon session. To be sure, gains have been fairly modest overall, but have been broad based. The DXY is back to 106.75, close to 0.20% above NY closing levels. This week the DXY has run out of momentum on moves into the 106.80/90 range.

- There doesn't appear to be a strong cross-asset driver of positive USD momentum. Regional equities in Asia Pac are in the red for the most part, particularly the key indices. US futures are modestly lower as well (-0.10%-0.15%).

- Still, dips in USD/JPY have been supported, with the pair getting to a low of 134.70/75 before rebounding. We are now back at 135.10. EUR/USD has drifted lower, back below 1.0170 now.

- The dip in AUD/USD was minimal following the weaker than expected July jobs report, but given the caveats placed on the print by the ABS, this is arguably not surprising. Still AUD/USD has faltered through the afternoon session to sub 0.6920. We remain above overnight lows (close to 0.6910) for now. NZD/USD has moved in line with the AUD mostly. The Kiwi is down at 0.6270.

- Firmer USD levels have also been evident across the USD/Asia complex. In particular, USD/CNH has rebounded, +0.20/0.25%, to be back close to the 6.8100 level.

- Looking ahead, the Norges bank decision at 0900BST is in focus, where the most recent July CPI print tilts the balance of risks to another 50bps rate rise.

- Philly Fed Manufacturing, jobless claims and existing home sales are the US data points of note with potential comments from Fed’s George and Kashkari to watch out for.

FX OPTIONS: Expiries for Aug18 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0147-57(E1.5bln), $1.0175($802mln), $1.0200-05(E1.0bln), $1.0215-30(E2.1bln), $1.0240-50(E1.0bln), $1.0290-00($786mln)

- USD/JPY: Y132.00($1.4bln), Y133.85-00($1.2bln), Y134.50-60($1.0bln), Y137.60-80($796mln)

- AUD/USD: $0.6975(A$822mln)

- USD/CNY: Cny6.80($611mln)

NORGES BANK: MNI Norges Bank Preview - August 2022: July CPI Tilts Balance to 50bps

EXECUTIVE SUMMARY:

- July CPI tilts balance of risks to another 50bps rate rise this month

- Bank looks to head off the highest inflation rate in 25 years

- No new rate path projections or economic forecasts due

July’s inflation release saw a broad-based rise in prices, with food prices a particular hotspot having lurched higher by 7.6% on the month. Nonetheless, the bank’s attention will have been on the CPI-ATE measure, which ticked up to 4.5% on the year, a series high on records going back to 1996.

This exceeded sell-side forecasts as well as the projections made by the bank in their June Monetary Policy Report. They had pencilled in CPI-ATE rising to 4.20% in Q1 next year, before drifting lower across the forecast horizon. It is now clear that these projections will require a hasty upgrade at the September forecasting round.

ASIA FX: USD Dominates

USD/Asia pairs are higher across the board today. Notably, USD/CNH has rebounded, pushing back to 6.8100. The won has also weakened to multi-week lows (1320). INR and IDR are also off, while PHP is steady as the market awaits a the BSP meeting outcome (50bps hike expected).

- CNH: USD/CNH has rebounded today. Currently sitting close to 6.8100, +0.20% on NY closing levels. Much like yesterday's session, where the dip in USD/CNH was difficult to explain from a cross asset perspective, the same applies today in terms of the bounce. Onshore equities are weaker, as is the case for much of the rest of the region. Local yields have ticked lower, but not as large as US moves. If USD/CNH keeps extending up, the focus will be highs from Monday's session, close to 6.8200.

- KRW: The won has slumped today, falling past 1320 in USD/KRW terms, before steadying. Onshore equities are lower by 0.35%. Broader risk appetite is weaker. We will also keep an eye out for South Korean rhetoric around FX levels.

- INR: Spot USD/INR has rebounded, back to 79.67, +0.30% on yesterday's closing levels. The 1 month NDF is around 79.90, close to the 80.00 level, so RBI intervention could be a risk. The domestic equity rally has stalled, at least in the first bit of onshore trade today. Local bourses are off by 0.2%.

- PHP: The PHP is relatively steady, with USD/PHP finding selling interest above 55.90. Hence the peso has outperformed the rest of the Asia complex today. The market awaits the BSP decision ,due out soon. The consensus is for a 50bps hike, in line with our expectation.

- IDR: USD/IDR has continued to climb today. The pair is up a further 0.50% in spot terms to 14841, while the 50-day MA comes in at 14878. Risk aversion creeping back into regional equities is not helping, even if Indonesian stocks are flat on the day. The BI Governor also came across the wires with dovish comments, stating the central bank is no rush to raise rates, and that rates don't need to be raised with the removal of energy subsidies. Note the next decision from the BI is on Tuesday the 23rd of August.

EQUITIES: Lower In Asia After FOMC Minutes

Virtually all regional equity indices are lower at typing, tracking a negative lead from Wall St. as participants in Asia react to the release of the July FOMC minutes, with recession-related worry taking focus. Semiconductor stocks struggled after U.S. chipmaker Analog Devices (-5.0%) warned of demand headwinds (joining recent warnings from the likes of Nvidia, Intel and Micron), with favoured names such as Taiwan’s TSMC Corp. shedding 1.3% at writing.

- The Hang Seng sits 0.6% worse off at writing, on track for a third consecutive lower daily close on weakness in the finance (-1.4%) and property (-0.6%) sub-indices. The underperformance in the latter duo comes after Chinese developer Country Garden (-5.2%) reported preliminary earnings, warning that H1 earnings could decline by as much as 70%.

- The CSI300 trades 0.9% lower at writing, with losses observed across much of the indice’s constituents. The richly-valued consumer staples (-1.9%) and healthcare (-1.6%) sub-indices lead the way lower, with real estate equities struggling as well (CSI300 Real Estate Index: -1.7%).

- The Nikkei deals 0.9% weaker, shedding practically all of Wednesday’s gains at writing. Favoured names such as Fast Retailing (-1.6%) Fanuc Corp (-1.6%) lead the way lower, with losses observed in >80% of the index’s constituents.

- E-minis sit a little below neutral levels at writing after a fairly directionless Asian session, operating towards the lower end of their respective ranges established on Wednesday.

GOLD: A Little Off Two-Week Lows

Gold deals ~$3/oz firmer at typing to print ~$1,765/oz, a little below session highs, but continuing to edge away from Wednesday’s worst levels at typing.

- An earlier blip higher in the precious metal was facilitated by initial worry from some quarters re: geopolitical risks after news that formal U.S.-Taiwan bilateral trade negotiations will begin later this year, with the event ultimately providing little by way of meaningful direction for the space.

- To recap Wednesday’s price action, the precious metal hit fresh two-week lows ($1,759.8/oz) on an uptick in the USD (DXY) and U.S. real yields, with a minor bid from the market’s dovish interpretation to the latest FOMC minutes evaporating, seeing gold close ~$14/oz weaker for a third straight lower daily close.

- Measures of investor interest remains weak, with known ETF holdings of gold compiled by BBG declining for a fourth consecutive session on Wednesday, while the SPDR Gold Trust’s (GLD) holdings of gold has fallen to its lowest level in seven months.

- From a technical perspective, gold maintains a firmer tone after the breach of trendline resistance at $1,794.6/oz previously. However, a stronger reversal amidst recent moves lower may threaten the bullish theme, with initial support at $1,754.4/oz (Aug 3 low, key short-term support) in focus. On the upside, initial resistance is seen at $1,807.9/oz (Aug 10 high and bull trigger).

OIL: Little Changed In Asia

WTI and Brent are $0.10 firmer apiece, operating comfortably within Wednesday’s trading range at typing. Both benchmarks sit a short distance away from recent multi-month lows amidst headwinds from worry re: economic slowdowns, adding to pressure from improvements in the outlook for supply.

- WTI and Brent closed ~$1 higher apiece on Wednesday, ultimately halting a three-session streak of losses after the release of the EIA’s weekly inventory data. The release was headlined by a significantly larger-than-expected drawdown in crude stockpiles mainly due to record-high U.S. crude exports, while gasoline inventories saw a larger-than-expected decline as well, alleviating prevailing worry re: domestic demand destruction. Small builds were observed in distillate and Cushing Hub stocks.

- Looking to crude supply matters, RTRS sources have pointed to Russian crude production rising despite Western sanctions earlier this year, with Moscow reportedly raising output and export forecasts through to ‘25. Elsewhere, Saudi oil output and exports for June were reported to have increased as well, with crude output hitting the highest levels observed since Apr ‘20.

- The prompt spreads for WTI and Brent remain a little off their respective multi-month lows, printing ~$0.40 and ~$0.60 respectively, pointing to a moderation in worry re: tightness in global crude supplies from their extremes witnessed in earlier months.

- Turning to Iran, unresolved issues surrounding ongoing negotiations re: a U.S.-Iran nuclear deal remain at the fore, with Tehran reportedly requesting the addition of additional articles to the EU’s “final draft”.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/08/2022 | 0600/0800 | ** |  | NO | Norway GDP |

| 18/08/2022 | 0800/1000 | *** |  | NO | Norges Bank Rate Decision |

| 18/08/2022 | 0900/1100 | *** |  | EU | HICP (f) |

| 18/08/2022 | 0900/1100 | ** |  | EU | Construction Production |

| 18/08/2022 | 1100/0700 | * |  | TR | Turkey Benchmark Rate |

| 18/08/2022 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 18/08/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 18/08/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 18/08/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 18/08/2022 | 1400/1000 | *** |  | US | NAR existing home sales |

| 18/08/2022 | 1400/1000 | * |  | US | Services Revenues |

| 18/08/2022 | 1400/1000 | ** |  | US | leading indicators |

| 18/08/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 18/08/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 18/08/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 18/08/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 30 Year Bond |

| 18/08/2022 | 1715/1915 |  | EU | ECB Schnabel Presentation at IHK Reception | |

| 18/08/2022 | 1720/1320 |  | US | Kansas City Fed's Esther George | |

| 18/08/2022 | 1745/1345 |  | US | Minneapolis Fed's Neel Kashkari |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.