-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - Trump Warns BRICS Over Moving Away From USD

MNI BRIEF: Japan Q3 GDP To Be Slightly Revised Down

MNI EUROPEAN MARKETS ANALYSIS: Japan Pressured By JPY/YCC Trade Off

- The BoJ was pressured by the continued trade off that it faces re: the BoJ's JPY and a weaker JPY, with it moving further up the verbal intervention scale as the bank defended the upper boundary of its YCC settings.

- Pricing of Fed tightening was little changed in Asia after yesterday's aggressive move. OIS now prices 84bp of tightening for this month’s FOMC meeting, while terminal rate pricing sits around 4.30%, little changed from levels observed late yesterday.

- The PBoC deployed the firmest lean against further CNY weakness since at least '18.

- Inflation data from the UK and Sweden will cross the wires in European hours, before the release of U.S. PPI figures. Comments are due from ECB's Villeroy.

US TSYS: Two-Way Asia Session With Debate Surrounding Fed Hikes Dominating

Tsys moved away from cheaps during the second half of Asia-Pac trade after TYZ2 failed to consolidate below Tuesday’s low, despite a look through. Early Asia trade saw paper out to 5s register fresh cycle highs in yield terms.

- Cash Tsys sit 0.5-1.5bp cheaper, while TYZ2 is -0-01 at 114-29+, off lows of 114-21+, with volume running at ~117K, comfortably above the recent Asia average.

- Headline flow was dominated by Japanese authorities and the BoJ keeping JPY weakness and a rise in 10-Year JGB yields in check, with the regional reaction to Tuesday’s CPI print and related Fed repricing front and centre.

- OIS now prices 84bp of tightening for this month’s FOMC meeting, while terminal rate pricing sits around 4.30%, little changed from levels observed late yesterday.

- Nomura became the first name to call for a 100bp hike from the Fed later this month in the wake of the CPI data, with the repricing further aided by WSJ Fed whisper Timiraos writing that yesterday’s CPI print means that the Fed will hike “interest rates by at least 0.75ppt next week and raises the prospect of hefty increases continuing in coming months.”

- PPI & MBA mortgage apps data is due later today.

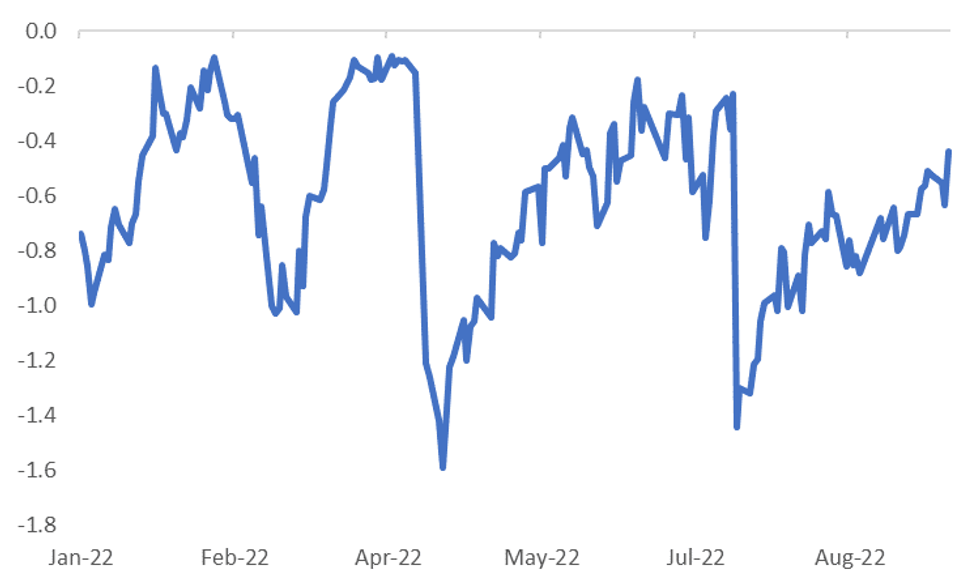

US TSYS/TIPS: Another Fresh Cycle High For Out Weighted U.S. Real Yield Monitor

No real surprise that the reaction to Tuesday’s CPI release and the subsequent repricing of Fed tightening expectations (which included a shift towards the potential for a 100bp hike in September and another fresh cycle high for terminal rate pricing) resulted in another cycle high for our weighted U.S. real yield monitor. That was before the cheapening observed in the wake of the CPI print facilitated solid demand at the latest 30-Year Tsy auction, which allowed the measure to retrace away from session highs ahead of the close.

Fig. 1: MNI Weighted U.S. Real Yield Monitor

AUSSIE BONDS: Cheapening Bias Maintained; Labour Market Data Up Next

Aussie bonds are off worst levels but have maintained the bulk of the cheapening derived from Tuesday’s U.S. CPI data, having tracked a pullback in U.S. Tsys from session cheaps, unwinding the early Sydney push lower.

- The repricing of Fed tightening expectations leaked through into AUD OIS, with ~39bp of tightening now priced for the RBA’s Oct meeting and a terminal rate of 3.75% priced (still well shy of the 4.50% that was priced back in June, given expectations for a slowing of the pace of tightening in the coming months).

- Cash ACGBs run 5.0-13.0bp cheaper across the curve, bear flattening.

- YM is -12.6 and XM is -9.7. The 3-/10-Year EFP box is flatter, with 3-Year EFP little changed and 10-Year EFP narrower, while Bills run 13 to 20 ticks cheaper through the reds.

- Thursday will see Australian labour market data and consumer inflation expectations cross.

AUSTRALIA DATA: Labour Market Likely Still Strong In August

The labour market is one of the key areas that the RBA is watching. On Thursday, the August labour force report is published. Bloomberg employment expectations are at +35k with the unemployment rate steady at 3.4%. If the data prints around these numbers, they are unlikely to change RBA thinking.

- Economists surveyed by Bloomberg all expect that there were more jobs in August in the range of 10k to 110k. They expect the unemployment rate to print at 3.2%-3.6%.

- The July drop of 40.9k had been impacted by winter illness, school holidays, and financial year reporting. A rebound in employment and the participation rate (to 66.6%) is expected, as these factors wane.

- Tuesday’s survey data suggested that the labour market has stabilised but remains strong. The employment component of the NAB business survey was a series high, apart from July, and consumers expected unemployment to fall further. Vacancies are still well above historical averages, suggesting that labour demand remains robust. These metrics all suggest that official labour market prints should remain solid for a number of months.

Source: MNI - Market News, Refinitiv

FOREX: Japanese Authorities Appear To Set Stage For FX Intervention As USD/JPY Approaches Y145

Japanese officials stepped up rhetoric surrounding sharp yen depreciation, which likely prevented USD/JPY from challenging recent cycle high/round figure of Y144.99/145.00 in early Tokyo trade. The pair ran as high as to Y144.96 before easing off on the back of jaw-boning by Japan's currency czar, while further comments from FinMin Suzuki helped keep the rate anchored below these psychological levels. The yen soared to fresh highs into the London morning on reports noting that the BoJ was conducting a rate check on FX, typically a move preceding an FX intervention.

- USD/JPY pulled back from session highs as Japan's FX chief Kanda said officials were watching "very sudden" FX moves and were ready to "respond appropriately without ruling out any options." Another leg lower came as e-mini futures turned red (they are back in positive territory at typing), but the pair clawed back losses over the Tokyo fix. Recovery lost momentum shortly thereafter, with USD/JPY extending losses as FinMin Suzuki refused to rule out an intervention in FX markets. As we were approaching the London morning, the Nikkei & Jiji both reported that the BoJ called traders asking for a rate check.

- U.S. Tsy yields retraced their initial upticks, opening some more space for USD/JPY to move lower. The greenback sits at the bottom of the G10 pile, while the BBDXY index showed high correlation with USD/JPY moves.

- Commodity-tied currencies traded on a softer footing as the commodity complex remained fragile, with the BCOM index losing ground.

- South Korean officials followed in the footsteps of Japanese colleagues, vowing to closely monitor FX markets, as spot USD/KRW jumped the most since Jun to print fresh cyclical highs.

- Consumer inflation data from the UK and Sweden will cross the wires in European hours, before the release of U.S. PPI figures. Comments are due from ECB's Villeroy.

STIR: Japanese FSA Flags Concerns Re: USD Funding Of Japanese Bank Ops

A BBG piece notes that “Japanese banks’ success in taking on Wall Street to offer loans in the U.S. is drawing regulatory attention as the cost of USD funding rises.”

- Japanese banks have been looking to combat the impact of low interest rates and limited demand in domestic loan markets. Fed tightening is putting these banks at a disadvantage when compared to their U.S. counterparts, as the BoJ is maintaining its ultra-easy stance, creating USD funding headwinds.

- A deputy director-general at Japan’s FSA told BBG that “we need not only to watch the volume and costs of funding, but also to monitor and discuss their business model.”

- The same official noted that “I don’t know whether the non-investment grade sector will be hit this time or not. But it’s a fact that they are vulnerable, and we will monitor closely.” This comes at a time when the Japanese megabanks have expanded into such business lines as they look to lift profits.

- A reminder that this interview comes just ahead of the time that the 3-month JPY/USD x-ccy basis metric will start to capture year-end turn dynamics. The 6-month x-ccy basis metric moved at the end of June (when it captured year-end turn) and hasn’t got close a full retrace.

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

FX OPTIONS: Expiries for Sep14 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9920(E543mln), $1.0000(E1.7bln)

- USD/JPY: Y144.49-70($541mln)

- GBP/USD: $1.1500-15(Gbp760mln)

- AUD/USD: $0.6800-13(A$503mln)

- USD/CAD: C$1.1325-35($535mln)

- USD/CNY: Cny6.8500($729mln)

ASIA FX: Firmer JPY Aids Asian FX

Parts of Asian FX have rallied this afternoon, buoyed by firmer JPY levels, while UST yields edging away from earlier highs has helped at the margin as well. USD/CNH is back below 6.9700, while USD/KRW is around1390. There has been less follow through elsewhere though.

- For USD/CNH we had a fresh record in the CNY fixing relative to expectations. This did little to support CNH initially, but a firmer onshore spot open helped, while the stronger JPY has been the main driver this afternoon. Tomorrow the 1 yr MLF rate announcement is due. No change is expected to the 2.75% rate.

- Spot USD/KRW leapt early, but didn't break above 1395. Officials stated they will pull out 'all measures' to curb depreciation pressures. Some support is evident for spot around 1390.

- USD/IDR is away from highs for the session, last at 14913, still +0.40% above yesterday's closing levels. The 1 month NDF is well below overnight highs though close to 15000 (last at 14933). Indonesia's monthly trade figures will be published tomorrow. Trade surplus is expected to have moderated to $4.019bn in Aug from $4.220bn recorded in Jul.

- USD/IDR is away from highs for the session, last at 14913, still +0.40% above yesterday's closing levels. The 1 month NDF is well below overnight highs though close to 15000 (last at 14933). Indonesia's monthly trade figures will be published tomorrow. Trade surplus is expected to have moderated to $4.019bn in Aug from $4.220bn recorded in Jul.

- USD/PHP is at 57.125 currently, down from intra-day highs of 57.265. Philippine overseas cash remittances are expected to cross the wires in the coming day.

- USD/THB is over 1% higher to 36.65. The Cabinet approved touted relief measures for energy users during its weekly meeting Tuesday amid fears that inflation may remain higher for longer. Ministers also gave a nod to the planned minimum wage increases. The Thai top court will rule the PM's term limit case by September 30.

SGD: Jobs Data Should Give MAS Comfort

Q2 jobs growth in Singapore was reportedly +66.5k, above the +42k reported for Q1. Importantly total employment is now very close to pre-pandemic levels. This should give the MAS some comfort the domestic economy remains on a reasonable footing.

- The non-resident sector remains a laggard form a jobs standpoint, but that should improve as Singapore has eased restrictions further and is actively encouraging non-residents back into the local jobs market. Job vacancies edged down to 126.1k in the second quarter, but is still close to historical highs.

- There is still a risk the MAS needs to tighten further at the October policy meeting. The August CPI data is due next Friday (23rdof September), which will be key. Ahead of then, August export data prints this Friday.

- The SGD NEER has been trending higher this month, up a further 0.4% according to Goldman Sachs estimates. Relative to the top-end of the band, we are still below 2022 highs, see the chart below, but up from August lows.

- Given broad based USD strength, playing SGD FX on crosses is likely to remain the preferred play.

Fig 1: Goldman Sachs SGD NEER Estimate - Deviation From The Top-End Of The Policy Band

Source: Goldman Sachs/MNI - Market News/Bloomberg

Source: Goldman Sachs/MNI - Market News/Bloomberg

EQUITIES: Following Wall St. Lower; Hang Seng Approaches Six-Month Lows

Virtually all Asia-Pac equity index benchmarks are in the red at typing. Tech and high-beta equities across the region broadly underperformed, reflecting Tuesday’s tech-led sell-off on Wall St.

- The Nikkei 225 trades 2.2% lower, with IT stocks and large-caps Fast Retailing (-2.8%) & Softbank Group (-3.5%) underperforming, unwinding the bulk of their gains observed in the sessions prior to Tuesday’s CPI print. The broader TOPIX fared a little better, dealing 1.6% softer at writing.

- The CSI300 sits 1.2% worse off, with the high-beta consumer staples and healthcare sub-indices contributing the most to drag. Chinese tech struggled, with the ChiNext dealing 2.0% weaker at writing.

- The Hang Seng (-2.6%) brings up the rear amongst regional peers and operates just above six-month lows made last Thursday, having reversed the bid observed after the long weekend.

- The ASX200 deals 2.5% softer at writing, with losses observed across virtually all constituents. The major miners and “Big 4” banks lead the way lower, with the latter group sitting 2.2-3.7% worse off apiece.

- E-minis deal 0.1-0.2% firmer apiece, holding the bulk of their losses observed on Tuesday at writing (having closed between ~4.0-5.5% lower).

GOLD: Steadying Around $1,700/oz; Post-CPI Dollar Strength In Focus

Gold sits little changed to print $1,702/oz at writing, struggling to make meaningful headway above neutral levels in Asia-Pac dealing amidst an uptick in nominal U.S. Tsy yields, while the USD (DXY) sits just shy of its best levels made on Tuesday.

- To recap, gold closed ~$22 softer on Tuesday, inversely tracking a rise in U.S. real yields and a bid in the Dollar, as the DXY surged to just below the 110.0 mark following the above-expectations U.S. CPI print.

- Tuesday’s decline also more than unwound gold’s pre-CPI rally, sending the precious metal back into negative territory for September (and on track for a sixth consecutive lower monthly close).

- Looking to technical levels, initial support is seen at $1,681.0 (21 Jul low and bear trigger), while initial resistance is located at ~$1,735.1 (Sep 12 high).

- Looking ahead, attention will turn to next week’s FOMC, with Sep FOMC dated OIS now pricing in ~84bp of tightening (compared to ~71bp pre-CPI), reflecting a rise in expectations for a 100bp rate hike at that meeting.

OIL: Off Tuesday’s Low On Potential U.S. SPR Refill; EIA Inventories Eyed

- To recap, both benchmarks closed between $0.50-1.00 softer apiece on Tuesday, after BBG source reports of plans to restock the U.S. SPR helped to partly unwind losses observed after the above-expectations CPI print on Tuesday.

- Looking ahead, the IEA’s monthly oil report and U.S. EIA inventory data are due later on Wednesday.

- OPEC maintained their oil demand forecasts for ‘22 and ‘23 in their monthly oil report on Tuesday, citing strong growth in “major consuming countries”.

- A note that recent, well-documented volatility in oil continues to limit market participation, with aggregate open interest in crude futures last week noted to have hit its lowest level since 2015 (with similar trends observed in other commodity markets as well).

- The latest round of U.S. API data saw reports point to a large build in crude stockpiles, an increase in distillate and Cushing hub stocks, and drawdown in gasoline inventories.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/09/2022 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 14/09/2022 | 0600/0700 | *** |  | UK | Producer Prices |

| 14/09/2022 | 0600/0800 | *** |  | SE | Inflation report |

| 14/09/2022 | 0830/0930 | * |  | UK | ONS House Price Index |

| 14/09/2022 | 0900/1100 | ** |  | EU | industrial production |

| 14/09/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 14/09/2022 | 1100/1300 |  | EU | ECB Chief Economist Lane MMCG Opening Remarks | |

| 14/09/2022 | 1230/0830 | *** |  | US | PPI |

| 14/09/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 14/09/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 15/09/2022 | 2245/1045 | *** |  | NZ | GDP |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.