-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Reaction To BoE Gilt Purchases Eyed

EXECUTIVE SUMMARY

- FED MUST PRESS ON DESPITE GLOBAL MARKET VOLATILITY, EVANS SAYS (BBG)

- YELLEN TELLS WHITE HOUSE SHE’LL STAY AS TREASURY CHIEF PAST MIDTERMS (BBG)

- BANK OF ENGLAND DOES NOT ACCEPT SOME OFFERS IN FIRST BOND BUYBACK (RTRS)

- US IS INCREASINGLY WORRIED ABOUT UK TURMOIL, WORKING WITH IMF (BBG)

- ECB’S KAZAKS SAYS NEXT HIKE MUST BE BIG, SMALLER STEPS TO FOLLOW (BBG)

- EU TELLS COUNTRIES GAS PRICE CAP WOULD COME WITH RISKS (RTRS)

- EU TO PUT PRICE CAP ON RUSSIAN OIL IN NEW SANCTIONS PACKAGE (FT)

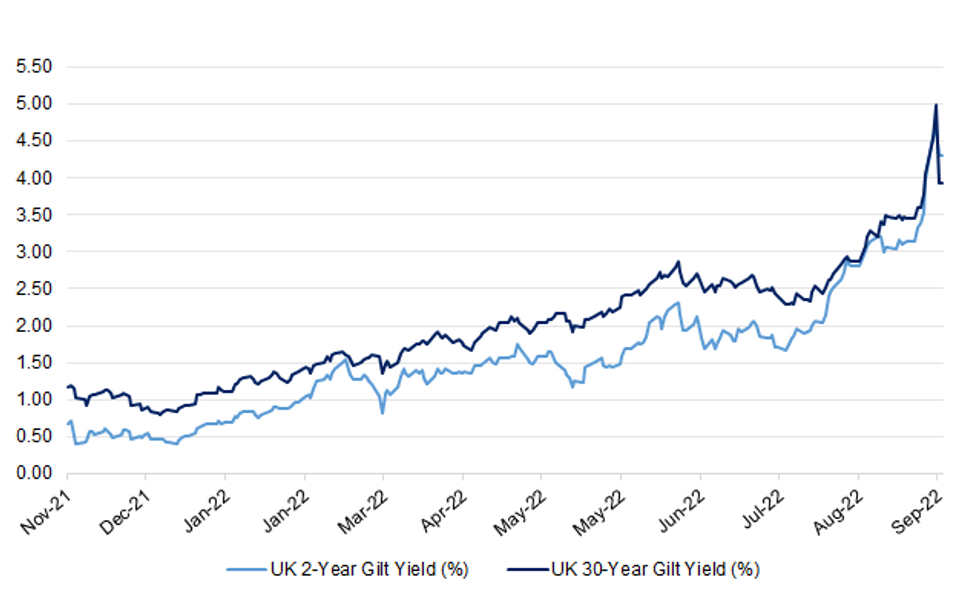

Fig. 1: UK 2- & 30-Year Gilt Yields (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BOE: The Bank of England said it had received 2.587 billion pounds' ($2.78 billion) worth of offers in its first bond buy-back operation aimed at reducing strains in the gilt market, and it had accepted only 1.025 billion pounds' worth. "The Bank has exercised its discretion not to allocate some offers in today's operation. This is in line with the terms set out in the Market Notice," it said. (RTRS)

BOE: The Bank of England's dramatic intervention today was in response to a "run dynamic" emerging in the British pensions system which could have resulted in the collapse of a swathe of institutions within hours, Sky News understands. (Sky)

FISCAL: UK Chancellor of the Exchequer Kwasi Kwarteng faces calls from members of the ruling Conservative Party to reverse a package of planned tax cuts that sparked days of turmoil in financial markets. (BBG)

FISCAL: Liz Truss is facing growing pressure from jittery Conservative MPs to sack Kwasi Kwarteng or face a mutiny after the Bank of England’s emergency intervention to address the turmoil in the financial markets. (Guardian)

FISCAL: The government will not abandon its mini-budget despite the Bank of England having to step in amid market turmoil, a Treasury minister has said. (BBC)

FISCAL: Liz Truss's cabinet is to be asked to find "efficiency savings" in Whitehall budgets, Sky News understands, putting huge pressure on frontline services. (Sky)

FISCAL: The Biden administration is alarmed over the market turmoil triggered by the new UK government’s economic program and is seeking ways to encourage Prime Minister Liz Truss’s team to dial back its dramatic tax cuts. (BBG)

PROPERTY: Lenders pulled a record number of mortgages in a single day on Wednesday, more than double the previous record set in the depths of the pandemic. (Sky)

M&A: The stock market and sterling may have steadied yesterday, but executives in City boardrooms and lawyers specialising in mergers and acquisitions were bracing nonetheless for a fresh wave of takeover bids from overseas. (The Times)

EUROPE

ECB: The European Central Bank should raise interest rates by another 75 basis points when it next sets policy in October, with steps likely to get smaller after that, according to Governing Council member Martins Kazaks. (BBG)

GERMANY: Lacklustre consumer sentiment will tip Germany into recession, Germany's four leading economics research institutes will say in their autumn forecast on Thursday. (RTRS)

FRANCE: French President Emmanuel Macron will press ahead with reforming the country's unwieldy pension system and his government will draft legislation by Christmas, a source present at a dinner where Macron briefed ruling party lawmakers said on Thursday. (RTRS)

ITALY: Mario Draghi's outgoing Italian government on Wednesday slashed next year's economic growth forecast to 0.6% due to sky-high energy costs but said strong revenues would still ensure an improvement in public finances. (RTRS)

ITALY: Caretaker Italian Prime Minister Mario Draghi is resisting attempts by the incoming right-wing coalition to make significant changes to the 2023 budget, but if necessary could ask for an extension of the Oct 15 deadline to submit a draft of the spending plans to the European Commission, finance ministry sources told MNI. (MNI)

U.S.

FED: The Federal Reserve must keep pushing interest rates higher to contain inflation despite rising volatility in global financial markets, Chicago Fed President Charles Evans said. (BBG)

FISCAL: Janet Yellen, eager to see through crucial projects, has told White House officials she’s prepared to remain Treasury secretary well after the midterm elections, according to people familiar with the discussions. (BBG)

OTHER

JAPAN: Japanese Prime Minister Fumio Kishida is set to announce a target of inbound tourism spending of more than 5 trillion yen ($34.65 billion) a year in a policy speech at the opening of parliament next week, Jiji news agency reported on Thursday. (RTRS)

JAPAN: Japanese Prime Minister Fumio Kishida plans to pledge to take “unprecedented and direct” steps to ease the burden of rising electricity costs on households and businesses, Nikkei reports, citing a draft of his policy speech. (BBG)

RBNZ: New Zealand's central bank on Thursday proposed changes to the means by which banks should apply risk weighting to their exposures under capital adequacy rules. (RTRS)

TURKEY: Turkish President Tayyip Erdogan on Wednesday said he hopes the central bank's monetary policy committee will deliver another cut to its policy rate next month and bring it down to single digits by year-end. (RTRS)

MEXICO: Mexico’s government spending cut kept the country’s debt from reaching 58% of the GDP, Finance Minister Rogelio Ramirez De la O said to senators at a briefing on Wednesday. (BBG)

BRAZIL: Petrobras is set to present its new strategic plan for the coming years in November, an executive for Brazil's state-run company said on Wednesday, hinting it should be "consistent" with the current focus on offshore oil formation known as pre-salt. (RTRS)

RUSSIA: The United States will in coming days impose economic costs on Moscow over "sham" referendums held by Russia in occupied regions of Ukraine, the State Department said on Wednesday, as Biden administration officials look to the finance and energy sectors for future sanctions action. (RTRS)

RUSSIA: An upcoming vote for leadership of a little-known United Nations agency that develops global standards for mobile phones, internet connectivity and satellite technology could impact the future of the internet. (BBG)

RUSSIA: The Russian government has proposed more than $60 billion in tax increases for the oil and gas industry in 2023-2025, the biggest such rises in the country's history, as it seeks to plug its budget gap, according to a document published on Wednesday. (RTRS)

RUSSIA: Russia's gross domestic product (GDP) fell 4.1% in August in year-on-year terms, after a decrease of 4.3% in the previous month, the economy ministry said on Wednesday. The ministry added that Russia's GDP had slipped 1.5% year-on-year in the first eight months of 2022. (RTRS)

RUSSIA: Weekly consumer prices in Russia rose for the first time since May, data published on Wednesday showed, less than two weeks after the central bank hinted at the end to its monetary easing cycle and following weeks of declining retail prices. (RTRS)

SOUTH AFRICA: The South African Reserve Bank’s immediate priority is to guide inflation back toward the middle of its 3%-6% target, but its longer-term goal is to reduce the target and allow for lower interest rates, central bank Governor Lesetja Kganyago said. (BBG)

WORLD BANK: World Bank President David Malpass on Wednesday warned that it could take years for global energy production to diversify away from Russia after its invasion of Ukraine, prolonging the risk of stagflation, or a period of low growth and high inflation. (RTRS)

ENERGY: The European Commission has warned EU countries that a broad cap on gas prices could be complex to launch and pose risks to energy security, amid calls from countries for Brussels to step in to tame high fuel prices. (RTRS)

ENERGY: Despite concerns by U.S. allies that ruptures of the Nord Stream pipelines were deliberate acts, the United States believes it is too soon to conclude there was sabotage, a senior U.S. military official said on Wednesday. (RTRS)

ENERGY: Russia's FSB security service is investigating the damage sustained by the Nord Stream gas pipelines under the Baltic Sea as "international terrorism", the Interfax news agency cited the general prosecutor's office as saying on Wednesday. (RTRS)

OIL: The EU is to implement a price cap on Russian oil and widen the range of products covered by export bans as part of new measures designed to inflict more pain on the Kremlin for escalating the war in Ukraine. (FT)

OIL: Indian companies are still buying Russian oil using dollars after Dubai's Mashreq Bank declined to handle payments from at least two refiners in Emirati Dirhams as requested by the supplier, according to three sources familiar with the matter. (RTRS)

CHINA

YUAN: Chinese regulators called on market participants to safeguard foreign exchange market stability and curb any significant movements in the yuan, the Securities Times reported citing a statement on the central bank website following a meeting of the China FX Market Self-Regulatory Framework. (MNI)

PBOC: The People’s Bank of China has launched a relending facility worth more than CNY200 billion to help manufacturers and SMEs upgrade their equipment, the China Securities Journal reported citing a statement on PBOC website. (MNI)

ECONOMY: Both central and local governments should fully implement policies in Q4 to support the timely recovery of the economy, CCTV News reported citing Premier Li Keqiang speaking at a work meeting to stabilise growth. (MNI)

FISCAL: China's finance ministry plans to issue about 2.5 trillion yuan ($347.4 billion) in government bonds in the fourth quarter, two sources with direct knowledge of the matter told Reuters on Thursday. (RTRS)

INFLATION: China’s economic planning agency criticized some unidentified social media for fabricating and spreading information on the rise in hog prices, according to a statement from the NDRC. (BBG)

CHINA MARKETS

PBOC NET INJECTS CNY180 BILLION VIA OMOS THURSDAY

The People's Bank of China (PBOC) on Thursday injected CNY105 billion via 7-day reverse repos and CNY77 billion via 14-day reverse repos with the rates unchanged at 2.00% and 2.15%, respectively. The operations have led to a net injection of CNY180 billion after offsetting the maturity of CNY2 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity stable at quarter-end, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0425% at 09:35 am local time from the close of 1.6717% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 47 on Wednesday vs 50 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 7.1102 THURS VS 7.1107 WEDS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1102 on Thursday, compared with 7.1107 set on Wednesday.

OVERNIGHT DATA

AUSTRALIA AUG CPI +6.8% Y/Y; JUL +7.0%

AUSTRALIA AUG UNDERLYING CPI +6.2% Y/Y; JUL +5.5%

NEW ZEALAND SEP ANZ BUSINESS CONFIDENCE -36.7; AUG -47.8

NEW ZEALAND SEP ANZ BUSINESS ACTIVTY OUTLOOK -1.8; AUG -4.0

The key themes of the September survey were:

- Activity measures generally lifted modestly, including business confidence, own activity, capacity utilisation, investment intentions and commercial construction intentions. The exceptions were export intentions and residential construction intentions.

- Inflation pressures remain intense and are easing only very slowly. Pricing intentions eased 2 points to a net 68% of firms intending to raise their prices in the next three months. This is still more than three times the 1992-2020 average.

- Inflation expectations eased only slightly, and at 6% are still three times the inflation target midpoint.

- Agriculture firms went against the flow and were more worried this month. Looking at global developments, this is understandable. (ANZ)

SOUTH KOREA OCT MANUFACTURING CONFIDENCE 75; SEP 82

SOUTH KOREA OCT NON-MANUFACTURING CONFIDENCE 81; SEP 82

MARKETS

SNAPSHOT: Reaction To BoE Gilt Purchases Eyed

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 262.63 points at 26437.39

- ASX 200 up 124.473 points at 6586.5

- Shanghai Comp. up 17.38 points at 3062.578

- JGB 10-Yr future up 29 ticks at 148.27, yield up 0.7bp at 0.254%

- Aussie 10-Yr future up 19 ticks at 96.06, yield down 19bp at 3.905%

- U.S. 10-Yr future down 0-15 at 112-12+, yield up 3.63bp at 3.7675%

- WTI crude down $0.47 at $81.68, Gold down $10.75 at $1649.3

- USD/JPY up 33 pips at Y144.49

- FED MUST PRESS ON DESPITE GLOBAL MARKET VOLATILITY, EVANS SAYS (BBG)

- YELLEN TELLS WHITE HOUSE SHE’LL STAY AS TREASURY CHIEF PAST MIDTERMS (BBG)

- BANK OF ENGLAND DOES NOT ACCEPT SOME OFFERS IN FIRST BOND BUYBACK (RTRS)

- US IS INCREASINGLY WORRIED ABOUT UK TURMOIL, WORKING WITH IMF (BBG)

- ECB’S KAZAKS SAYS NEXT HIKE MUST BE BIG, SMALLER STEPS TO FOLLOW (BBG)

- EU TELLS COUNTRIES GAS PRICE CAP WOULD COME WITH RISKS (RTRS)

- EU TO PUT PRICE CAP ON RUSSIAN OIL IN NEW SANCTIONS PACKAGE (FT)

US TSYS: Asia Fades Some Of Wednesday’s Rally

Cash Tsys run 1-4bp cheaper across the curve, with the belly leading the weakness and the wings lagging the wider move, as Asia fades some of Wednesday’s BoE-driven rally. TYZ2 last prints just off the base of its 0-09+ range, -0-15+ at 112-12, on healthy enough volume of ~100K.

- An early uptick in Chinese equities (which faded as property names struggled) helped apply some pressure lighter in the session.

- For 10s, the triple top resistance zone in yields (just above 4.00%), drawn off the YtD & ‘09/’10 highs, continues to provide the most meaningful technical area of note.

- Yesterday’s move pulled the 5-/30-Year curve away from cycle flats, but it still sits around -25bp.

- Gilt market moves in lieu of the BoE’s first round of emergency purchases will likely set the tone in London hours, with regional and national German CPI also due (note that NRW state CPI has not crossed yet, despite it usually being published at ~05:30 London).

- NY hours see the final Q2 GDP print, weekly jobless claims and another round of Fedspeak, with Messrs Bullard, Mester & Daly all set to appear. Expect them to stick to the hawkish script.

JGBS: Flattening Holds, Futures Off Best Levels

Thursday’s Tokyo session has been a bit of a catch-up exercise for JGBs.

- That leaves the major cash benchmarks running little changed to 9bp richer, as the curve flattens in lieu of Wednesday’s BoE action.

- Note that 10s haven’t really moved away from the upper limit of the BoJ’s permitted trading band, with participants seemingly willing to keep the pressure on the BAnk.

- Futures have faded a touch in the afternoon, but are still +23 on the day.

- MoF data revealed that last week saw international investors lodge the largest round of net weekly sales of Japanese bonds since mid-June, building on the theme of recent times i.e. offshore participants driving the challenge of the BoJ.

- The latest 2-Year JGB auction went well. Takedown was likely aided by the recent move to multi-month cheaps in outright terms, international investor demand stemming from FX-hedged yield pickup and the BoE’s well-documented Wednesday action, which has allowed core global FI markets to stabilise, for now.

- There hasn’t been much in the way of meaningful domestic news flow, outside of continued speculation surrounding potential forms of support for households re: energy prices and schemes to generate inbound tourism for Japan.

- Looking ahead, labour market data, industrial production, retail sales and the latest round of BoJ Rinban operations headline domestically on Friday.

AUSSIE BONDS: Overnight Gains Held, No Impact From New Monthly CPI Reading

Aussie bond futures stuck within the upper end of their respective overnight ranges during Sydney hours, with XM failing to force a break through its overnight peak on a re-test, while YM fell short of challenging its own post-Sydney high.

- Participants shrugged off the domestic monthly CPI print, even with underlying inflation clearing the 6.0% Y/Y level in August (the RBA currently looks for underlying inflation to hit 6.0% in Q422), while the headline print eased a touch, back to 6.8 Y/Y vs. the 7.0% seen in July.

- Elsewhere, we also saw a 2.1% fall in the job vacancies print (which is measured in Q/Q terms), accompanied by an upward revision to the prior print.

- YM +14.0 & XM +19.0 last, back from their respective session highs, with the major cash ACGB benchmarks running 11-19bp richer on the session. 10s outperformed all day as the space played catch up to Wednesday’s BoE-driven bid in futures/wider core global FI markets.

- Bills run 2-16bp richer through the reds.

- Friday will see A$700mn of ACGB Nov-28 auctioned by the AOFM, as well as the release of the AOFM’s weekly issuance slate and private sector credit data.

NZGBS: Off Best Levels But Still Firmer At The Close

Intermediates led the catch-up rally on Thursday, as NZGBs drew support from Wednesday’s BoE-inspired price action in core global FI markets. That left the major NZGB benchmarks 11-14bp richer across the curve.

- The space moved away from best levels of the session into the weekly round of NZGB supply (which included Apr-27, May-32 & May-41 paper). The auctions ultimately passed smoothly enough, allowing fresh richening into the bell, albeit not enough for the space to force a retest of the day’s richest levels.

- The latest ANZ business survey saw an uptick for both the confidence (back to near enough flat) and conditions (which remains deep in negative territory) metrics, with the inflationary measures remaining “intense,” while there was only a “slight easing” in inflation expectations.

- ANZ consumer confidence and building permits data round off this week’s domestic data releases on Friday.

- Next week’s RBNZ monetary policy decision provides the major upcoming domestic risk event, with a touch above 50bp of tightening still priced and a terminal rate of just over 4.80% priced in, which is ultimately little changed on the day.

EQUITIES: Relief Rally In APAC

Major regional indices are all in the green, as markets have risen in sympathy with the US gains overnight. Gains have ranged from 0.30% to more than 2%. US futures have fluctuated today, but have edged back towards positive territory this afternoon. Eminis were last around 3735, up from the 3718 low earlier in the session.

- China stocks continue to exhibit a low beta to broader global moves. At this stage, the Shanghai Composite index is up 0.27%, although the property sub-index is lagging, down a further 1.1% today. We highlighted woes for developer CIFI Holdings yesterday.

- The HSI has fared better, up +1.25%, albeit away from earlier highs. HSI Tech gains are around the same (+1.2%).

- The Kospi (+1.30%) and TWSE (+0.65%) are firmer as well, support from the official sector helping. South Korea stated late yesterday it was reactivating the stock stabilization fund and may ban short sales. In Taiwan, the Labor Pension Fund pledged to buy up to $70bn TWD of local equities before year end.

- The ASX200 has outperformed, up around 2%, with financial and resource names leading the rebound.

OIL: Supply Outlook Coming Back Into Focus

Brent crude is just below $89/bbl currently, modestly off NY highs, unwinding only 0.4% of the +3.5% rally yesterday. We haven't been able to sustain earlier gains beyond $89.50/bb. WTI is close to $82/bbl, displaying a similar trajectory.

- Crude is still moving with broader risk appetite to some degree. Today's rebound in the USD has no doubt weighed on sentiment.

- Still, the supply backdrop is likely to remain the main driver of sentiment as we push into next week. The energy conflict in the EU is unlikely to improve in the near term, which should continue to see some spill over to oil prices.

- Next week's OPEC+ meeting (October 5th) could deliver fresh production cuts as well. A number of sell-side analysts are suggesting as much.

- Overnight, we also had a surprise drawdown in both US crude and gasoline inventories, which suggests the demand backdrop is not as soft as feared.

- Tomorrow China PMIs print, which will also be eyed to gauge China's recovery/commodity demand outlook.

GOLD: Consolidates After Rebounding To Weekly High

Gold is down from overnight highs, last tracking close to $1654. This is around 0.35% down from NY closing levels. This comes after yesterday’s near 2% gain.

- There appears to be some support for the precious metal ahead of $1650. Note there were a number of highs just below this point at the start of the week as well. Below that we could also see buying interest emerge in the low $1640 region.

- On the topside, overnight highs came in just under $1663. Beyond that is numerous highs closer to $1680 from earlier in September.

- Gold continues to follow broader USD gyrations for the most part. The move lower today has coincided with the DYX back above 113, while a slight recover in UST yields has also likely weighed at the margin.

FOREX: Risk-Off Flows Restart After Wednesday's Pause

Early Asia-Pac trade saw a reversal of Wednesday's risk rebound amid suspected profit taking by regional players. With the BoE's bond-buying intervention already in the books, concerns over the UK government's fiscal plans and the prospect of further aggressive Fed tightening resurfaced. The re-established negative risk tone remained firm through the session, with wires carrying little to alter that trend.

- The greenback outperformed all its G10 peers, with upticks in U.S. Tsy yields facilitating this dynamic. E-minis operated in the red, generating demand for safe haven currencies, with JPY and CHF strengthening alongside USD as a result.

- USD/JPY added ~30 pips, even as one-month option skews dropped. Slight widening in U.S./Japan 10-year yield spread helped push the rate higher.

- Cable gave away nearly 100 pips as the sterling came under renewed pressure linked to Chancellor Kwarteng's sweeping tax reduction plans.

- USD/CNH advanced, then caught a breather as the PBOC pushed its fixing error back out to -729 pips, but promptly resumed gains. The rate's upswing was capped at the CNH7.2 mark.

- Yuan weakness created unfavourable backdrop for the Antipodeans, with the kiwi pacing losses in G10 FX space. The uptick in AUD/NZD was out of sync with the move lower in AU/NZ 2-year swap spread.

- On the global data docket we have U.S. initial jobless claims and third reading of Q2 GDP, German consumer inflation figures and Canadian GDP. Another hefty round of central bank rhetoric is inbound, with Fed, ECB, BoE and Riksbank members due to speak.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 29/09/2022 | 0700/0900 |  | EU | ECB Panetta Intro at ECOFIN Hearing | |

| 29/09/2022 | 0700/0900 | *** |  | ES | HICP (p) |

| 29/09/2022 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 29/09/2022 | 0800/1000 |  | EU | ECB de Guindos Speech at BIS/Bank of Lithuania | |

| 29/09/2022 | 0800/1000 |  | IT | PPI | |

| 29/09/2022 | 0815/1015 |  | EU | ECB Elderson Speech at Nederlandsche Bank & OMFIF | |

| 29/09/2022 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 29/09/2022 | 0830/0930 | ** |  | UK | BOE M4 |

| 29/09/2022 | 0900/1100 | ** |  | EU | Economic Sentiment Indicator |

| 29/09/2022 | 0900/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 29/09/2022 | 0900/1100 | * |  | EU | Business Climate Indicator |

| 29/09/2022 | 0900/1100 | *** |  | DE | Saxony CPI |

| 29/09/2022 | 0930/1130 |  | EU | ECB de Guindos Opens ECB Research Workshop | |

| 29/09/2022 | 1130/1230 |  | UK | BOE Ramsden Panels Lithuania CB/BIS Conference | |

| 29/09/2022 | 1200/1400 | *** |  | DE | HICP (p) |

| 29/09/2022 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 29/09/2022 | 1230/0830 | * |  | CA | Payroll employment |

| 29/09/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 29/09/2022 | 1230/0830 | *** |  | US | GDP (3rd) |

| 29/09/2022 | 1330/0930 |  | US | St. Louis Fed's James Bullard | |

| 29/09/2022 | 1400/1000 | ** |  | US | WASDE Weekly Import/Export |

| 29/09/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 29/09/2022 | 1500/1600 |  | UK | BOE Tenreyro Panellist at Centre for Economic Policy Research | |

| 29/09/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 29/09/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 29/09/2022 | 1700/1300 |  | US | Cleveland Fed's Loretta Mester | |

| 29/09/2022 | 1700/1900 |  | EU | ECB Lane Panels ECB/Cleveland Fed Conference | |

| 29/09/2022 | 1800/1400 | *** |  | MX | Mexico Interest Rate |

| 29/09/2022 | 2045/1645 |  | US | San Francisco Fed's Mary Daly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.